0000883107 False 0000883107 2023-11-13 2023-11-13 iso4217:USD xbrli:shares iso4217:USD xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 13, 2023

_______________________________

NANOPHASE TECHNOLOGIES CORPORATION

(Exact name of registrant as specified in its charter)

_______________________________

| Delaware | 000-22333 | 36-3687863 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

1319 Marquette Drive

Romeoville, Illinois 60446

(Address of Principal Executive Offices) (Zip Code)

(630) 771-6708

(Registrant's telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| N/A | N/A | N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 13, 2023, the Registrant issued a press release, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | NANOPHASE TECHNOLOGIES CORPORATION |

| | | |

| | | |

| Date: November 13, 2023 | By: | /s/ Jess Jankowski |

| | | Jess Jankowski |

| | | Chief Executive Officer |

| | | |

EXHIBIT 99.1

Nanophase Reports Third Quarter Results, New Financing Package

— Closed on $3.2 Million Financing

— Delivered $29.3 Million in nine-month revenue

— Won 2023 BeautyMatter NEXT Award

— Named as finalist for 22nd annual Chicago Innovation Awards and 2024 Cosmetics & Toiletries Allē Awards

ROMEOVILLE, Ill., Nov. 13, 2023 (GLOBE NEWSWIRE) -- Nanophase Technologies Corporation (OTCQB: NANX), a leader in minerals-based and scientifically-driven health care solutions across beauty and life science categories — with innovations that protect skin from environmental aggressors and aid in medical diagnostics — today announced financial results for the third quarter ended September 30, 2023.

Jess Jankowski, President and Chief Executive Officer, commented: “We’ve had our ups and downs in the third quarter, but critically, we’ve positioned ourselves for success as we look to a strong year for Solésence in 2024. We were plagued by supply chain issues this past quarter, which set us back in terms of our ability to get Solésence product shipped. Given our reliance on working capital financing, this had a cascading effect causing us to focus more on cash management than manufacturing improvement. Given the turn of events in Q3, we no longer expect to achieve modest profitability for 2023.

“In November, we concluded a $3.2 million financing which we believe will allow us to achieve a solid footing in Operations during Q4 and continue to support Solésence growth into 2024.”

Kevin Cureton, Chief Operating Officer, commented: “During Q3 we continued to make planned improvements to our production capabilities. In November, we were thrilled to bring on a Purchasing Manager with broad industry experience, whom we expect, along with our new senior manufacturing leader, will help us to finally achieve the world standard results in our Operations group to match the innovation leadership we continue to be rewarded for in our Solésence product lines.”

2023 Q2 Financial Information

Operational Highlights

Solésence Beauty Science Wins 2nd Major Beauty Industry Award in 2023

- In October, Solésence won the BeautyMatter NEXT Award for Best Contract Manufacturer. This award recognizes companies that provide services related to the production, formulation, and filling of beauty and wellness products. The BeautyMatter NEXT Awards aim to raise the bar and define the future of beauty. Solésence was selected from 400+ entries for over 50 awards across 7 categories. In July, Solésence won Best Formulation at Cosmopack North America for the second year in a row.

Operational Highlights (continued)

- In October, Harrison King was promoted to VP of Operations, and will now lead supply chain in addition to his existing leadership of manufacturing.

- In November, Solésence Kleair™ was chosen as a finalist for the 22nd annual Chicago Innovation Awards.

- Also in November, Solésence market-ready product Soft Glow 50+ featuring Kleair™ was nominated as a finalist for the 2024 Cosmetics & Toiletries Allē Awards in the Finished Formulas – Prestige Category.

- Also in November, a New Purchasing Manager joined the Manufacturing team.

Financial Highlights

- Negotiated $2.0M bridge loan to support rights offering to allow pro-rata participation by all stockholders.

- Expansion of revolving credit facility by $1.2M.

- Revenue for the nine months ended September 30, 2023 was $29.3 million, vs. $29.1 million for the same period in 2022.

- Q3 2023 Revenue was down due to supply chain issues which we expect to resolve in Q4.

“We had $19 million in open P.O.s and shipped orders combined leaving September, roughly half of which reflects potential Q4 volume. We expect more orders in Q4 to further enhance 2024 volume. Our expectations for margin and profitability improvement during the current quarter leading into 2024 are high. We’ve seen productivity improvements over the past few months that we expect will deliver significant value in 2024 as we move to a more robust and controllable production model,” said Jankowski.

Conference Call

Nanophase will host its Third Quarter Conference Call on Tuesday, November 14th, 2023, at 10:00 a.m. CST, 11:00 a.m. EST, to discuss its financial results and provide a business and financial update. On the call will be Jess Jankowski, the Company’s President & CEO, joined by Kevin Cureton, the Company’s Chief Operating Officer.

Participant Registration:

https://register.vevent.com/register/BI94a18ef178ea4a21a030ea0d6d4351a6

To receive the dial-in number, as well as your personalized PIN, you must register at the above link. Once registered, you will also have the option to have the system dial-out to you once the conference call has begun. If you forget your PIN prior to the conference call, you can simply re-register.

The process for accessing the webcast as listen-only remains the same. The same link can be used after the call to access the replay. A Telco replay is no longer available.

Listen-Only Webcast & Replay:

https://edge.media-server.com/mmc/p/62t64a8r

Please connect to the conference at least five minutes before the call is scheduled to begin.

The call may also be accessed through the company’s website, at www.nanophase.com, by clicking on Investor Relations, Investor News, and the links in this conference call announcement release.

FINANCIAL RESULTS AND NON-GAAP INFORMATION

Use of Non-GAAP Financial Information

Nanophase believes that the presentation of results excluding certain items, such as non-cash equity compensation charges, provides meaningful supplemental information to both management and investors, facilitating the evaluation of performance across reporting periods. The Company uses these non-GAAP measures for internal planning and reporting purposes. These non-GAAP measures are not in accordance with, or an alternative for, Generally Accepted Accounting Principles (“GAAP”) and may be different from non-GAAP measures used by other companies. The presentation of this additional information is not meant to be considered in isolation or as a substitute for net income or net income per share prepared in accordance with GAAP.

About Nanophase Technologies

Nanophase Technologies Corporation (OTCQB: NANX), www.nanophase.com, is a leading innovator in minerals-based and scientifically driven healthcare solutions across beauty and life science categories, as well as other legacy advanced materials applications. Leveraging a platform of integrated, patented, and proprietary technologies, the Company creates products with unique performance, enhancing consumers' health and well-being. We deliver commercial quantity and quality engineered materials both as ingredients and as part of fully formulated products in a variety of formats.

About Solésence Beauty Science

Solésence, www.solesence.com, a wholly owned subsidiary of Nanophase Technologies, is changing the face of skin health with patented, mineral-based technology that is embraced by leading performance-driven and clean beauty brands alike. Our patented products for brands transform the way mineral actives look, feel and function — enabling textures never-before-seen in the mineral space and inclusivity never-before-seen in the sun care space. Solésence’s innovative formulations offer best-in-class UV protection, unparalleled free radical prevention to protect against pollution, and enhanced antioxidant performance.

Forward-Looking Statements

This press release contains words such as “expects,” “shall,” “will,” “believes,” and similar expressions that are intended to identify forward-looking statements within the meaning of the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. Such statements in this announcement are made based on the Company’s current beliefs, known events and circumstances at the time of publication, and as such, are subject in the future to unforeseen risks and uncertainties that could cause the Company’s results of operations, performance, and achievements to differ materially from current expectations expressed in, or implied by, these forward-looking statements. These risks and uncertainties include, without limitation, the following: a decision by a customer to cancel a purchase order or supply agreement in light of the Company’s dependence on a limited number of key customers; uncertain demand for, and acceptance of, the Company’s engineered materials, ingredients, and fully formulated products; the Company’s manufacturing capacity and product mix flexibility in light of customer demand; the Company’s limited marketing experience; changes in development and distribution relationships; the impact of competitive products and technologies; the Company’s dependence on patents and protection of proprietary information; the resolution of litigation in which the Company may become involved; the impact of any potential new government regulations that could be difficult to respond to or too costly to comply with while remaining financially viable; the ability of the Company to maintain an appropriate electronic trading venue; and other factors described in the Company’s Form 10-K filed March 31, 2022. In addition, the Company’s forward-looking statements could be affected by general industry and market conditions and growth rates. Except as required by federal securities laws, the Company undertakes no obligation to update or revise these forward-looking statements to reflect new events, uncertainties, or other contingencies.

Investor Relations Contact: Phone: (630) 771-6736

| NANOPHASE TECHNOLOGIES CORPORATION |

| | | | | | |

| CONSOLIDATED BALANCE SHEETS |

| (Unaudited Consolidated Condensed) |

| | | | (in thousands except share and per share data) |

| | | |

| | | | September 30, | | December 31, |

| | | | | 2023 | | | | 2022 | |

| ASSETS | (Unaudited) | | |

| | | | | | |

| Current assets: | | | |

| | Cash | $ | 1,188 | | | $ | 2,186 | |

| | Trade accounts receivable, less allowance for doubtful accounts of $270 | | | |

| | | for September 30, 2022 and $139 for December 31, 2021 | | 3,199 | | | | 4,734 | |

| | Inventories, net | | 10,123 | | | | 8,839 | |

| | Prepaid expenses and other current assets | | 1,040 | | | | 866 | |

| | | Total current assets | | 15,550 | | | | 16,625 | |

| | | | | | |

| | Equipment and leasehold improvements, net | | 8,607 | | | | 7,949 | |

| | Operating leases, right of use | | 8,187 | | | | 8,978 | |

| | Other assets, net | | 3 | | | | 6 | |

| | Total assets | $ | 32,347 | | | $ | 33,558 | |

| | | | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| Current liabilities: | | | |

| | Line of credit, related party | | 6,338 | | | | 7,282 | |

| | Accounts payable | | 6,270 | | | | 6,363 | |

| | Current portion of operating lease obligations | | 1,303 | | | | - | |

| | Current portion of deferred revenue | | 2,619 | | | | 2,167 | |

| | Accrued expenses | | 1,130 | | | | 1,023 | |

| | | Total current liabilities | | 17,660 | | | | 16,835 | |

| | | | | | |

| | Long-term portion of operating lease obligations | | 9,475 | | | | 9,823 | |

| | Long-term debt, related party | | 1,000 | | | | 1,000 | |

| | Long-term portion of deferred revenue | | 45 | | | | 21 | |

| | Asset retirement obligation | | 236 | | | | 230 | |

| | | Total long-term liabilities | | 10,756 | | | | 11,074 | |

| | | | | | |

| Stockholders' equity: | | | |

| | Preferred stock, $.01 par value, 24,088 shares authorized and | | | |

| | | no shares issued and outstanding | | - | | | | - | |

| | Common stock, $.01 par value, 60,000,000 shares authorized; | | | |

| | | 49,627,254 and 49,320,680 shares issued and outstanding on September 30, 2023 | | | |

| | | and December 31, 2022, respectively | | 496 | | | | 493 | |

| | Additional paid-in capital | | 105,970 | | | | 105,226 | |

| | Accumulated deficit | | (102,535 | ) | | | (100,070 | ) |

| | | Total stockholders' equity | | 3,931 | | | | 5,649 | |

| | Total liabilities and shareholders' equity | $ | 32,347 | | | $ | 33,558 | |

| | | | | | |

| NANOPHASE TECHNOLOGIES CORPORATION |

| | | | | | | | | | | | |

| CONSOLIDATED STATEMENTS OF OPERATIONS |

| (Unaudited Consolidated Condensed) |

| (in thousands except share and per share data) |

| | | | | | Three months ended | | Nine months ended |

| | | | | | September 30, | | September 30, |

| | | | | | | 2023 | | | | 2022 | | | | 2023 | | | | 2022 | |

| Revenue: | | | | | | | | | |

| | Product revenue | | $ | 7,746 | | | $ | 9,673 | | | $ | 28,925 | | | $ | 28,515 | |

| | Other revenue | | | 212 | | | | 5 | | | | 361 | | | | 541 | |

| | | Net revenue | | | 7,958 | | | | 9,678 | | | | 29,286 | | | | 29,056 | |

| | | | | | | | | | | | |

| Operating expense: | | | | | | | | |

| | Cost of revenue | | | 6,428 | | | | 7,185 | | | | 21,932 | | | | 21,659 | |

| | | Gross profit | | | 1,530 | | | | 2,493 | | | | 7,354 | | | | 7,397 | |

| | | | | | | | | | | | |

| | Research and development expense | | | 1,057 | | | | 848 | | | | 3,052 | | | | 2,310 | |

| | Selling, general and administrative expense | | | 1,695 | | | | 2,279 | | | | 5,951 | | | | 5,493 | |

| Income from operations | | | (1,222 | ) | | | (634 | ) | | | (1,649 | ) | | | (406 | ) |

| Interest income | | | - | | | | - | | | | - | | | | - | |

| Interest expense | | | 214 | | | | 116 | | | | 613 | | | | 232 | |

| Other income, net | | | - | | | | - | | | | - | | | | - | |

| Income before provision for income taxes | | | (1,436 | ) | | | (750 | ) | | | (2,262 | ) | | | (638 | ) |

| Provision for income taxes | | | - | | | | - | | | | - | | | | - | |

| Net income | | $ | (1,436 | ) | | $ | (750 | ) | | $ | (2,262 | ) | | $ | (638 | ) |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Net income per share-basic | | $ | (0.03 | ) | | $ | (0.02 | ) | | $ | (0.05 | ) | | $ | (0.01 | ) |

| | | | | | | | | | | | |

| Weighted average number of common shares outstanding - basic | | | 49,598,591 | | | | 49,174,673 | | | | 49,532,395 | | | | 49,068,709 | |

| | | | | | | | | | | | |

| Net income per share-diluted | | $ | (0.03 | ) | | $ | (0.02 | ) | | $ | (0.05 | ) | | $ | (0.01 | ) |

| | | | | | | | | | | | |

| Weighted average number of common shares outstanding - diluted | | 49,598,581 | | | | 49,174,673 | | | | 49,532,395 | | | | 49,068,709 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| NANOPHASE TECHNOLOGIES CORPORATION |

| | | | | | | | | | | | |

| CONSOLIDATED STATEMENTS OF OPERATIONS - EXPANDED SCHEDULE |

| (Unaudited Consolidated Condensed) |

| (in thousands except share and per share data) |

| | | | | | Three months ended | | Nine months ended |

| | | | | | September 30, | | September 30, |

| | | | | | | 2023 | | | | 2022 | | | | 2022 | | | | 2022 | |

| Revenue: | | | | | | | | | |

| | Product revenue | | $ | 7,746 | | | $ | 9,673 | | | $ | 28,925 | | | $ | 28,515 | |

| | Other revenue | | | 212 | | | | 5 | | | | 361 | | | | 541 | |

| | | Net revenue | | | 7,958 | | | | 9,678 | | | | 29,286 | | | | 29,056 | |

| | | | | | | | | | | | |

| Operating expense: | | | | | | | | |

| | Cost of revenue detail: | | | | | | | | |

| | Depreciation | | | 159 | | | | 126 | | | | 481 | | | | 365 | |

| | Non-Cash equity compensation | | | 27 | | | | 22 | | | | 85 | | | | 71 | |

| | Other costs of revenue | | | 6,242 | | | | 7,037 | | | | 21,366 | | | | 21,223 | |

| | | Cost of revenue | | | 6,428 | | | | 7,185 | | | | 21,932 | | | | 21,659 | |

| | | | Gross profit | | | 1,530 | | | | 2,493 | | | | 7,354 | | | | 7,397 | |

| | | | | | | | | | | | |

| | Research and development expense detail: | | | | | | | | |

| | Depreciation | | | 7 | | | | 9 | | | | 21 | | | | 26 | |

| | Non-Cash equity compensation | | | 47 | | | | 38 | | | | 136 | | | | 121 | |

| | Other research and development expense | | | 1,003 | | | | 801 | | | | 2,895 | | | | 2,163 | |

| | | Research and development expense | | | 1,057 | | | | 848 | | | | 3,052 | | | | 2,310 | |

| | | | | | | | | | | | |

| | Selling, general and administrative expense detail: | | | | | | | | |

| | Depreciation and amortization | | | 8 | | | | 8 | | | | 22 | | | | 22 | |

| | Non-Cash equity compensation | | | 136 | | | | 90 | | | | 374 | | | | 261 | |

| | Other selling, general and administrative expense | | | 1,551 | | | | 2,181 | | | | 5,555 | | | | 5,210 | |

| | | Selling, general and administrative expense | | | 1,695 | | | | 2,279 | | | | 5,951 | | | | 5,493 | |

| Income from operations | | | (1,222 | ) | | | (634 | ) | | | (1,649 | ) | | | (406 | ) |

| Interest expense | | | 214 | | | | 116 | | | | 613 | | | | 232 | |

| Other income, net | | | - | | | | - | | | | - | | | | - | |

| Income before provision for income taxes | | | (1,436 | ) | | | (750 | ) | | | (2,262 | ) | | | (638 | ) |

| Provision for income taxes | | | - | | | | - | | | | - | | | | - | |

| Net income | | $ | (1,436 | ) | | $ | (750 | ) | | $ | (2,262 | ) | | $ | (638 | ) |

| | | | | | | | | | | | |

| Non-GAAP Disclosure (see note regarding Non-GAAP disclosures): | | | | | | | |

| | Addback Interest, net | | | 214 | | | | 116 | | | | 613 | | | | 232 | |

| | Addback Depreciation/Amortization | | | 174 | | | | 143 | | | | 524 | | | | 413 | |

| | Addback Non-Cash Equity Compensation | | | 210 | | | | 150 | | | | 595 | | | | 453 | |

| | Subtract Non-Cash Other Income | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | |

| | Adjusted EBITDA | | $ | (838 | ) | | $ | (341 | ) | | $ | (530 | ) | | $ | 460 | |

| | | | | | | | | | | | |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

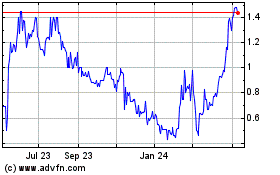

Nanophase Technologies (QB) (USOTC:NANX)

Historical Stock Chart

From Mar 2024 to Apr 2024

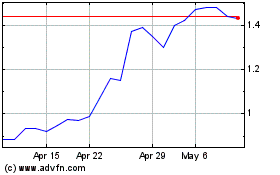

Nanophase Technologies (QB) (USOTC:NANX)

Historical Stock Chart

From Apr 2023 to Apr 2024