0001275158false00012751582023-11-092023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15 (d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): November 9, 2023

NOODLES & COMPANY

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | |

| Delaware | 001-35987 | 84-1303469 |

| (State or Other Jurisdiction of | (Commission File Number) | (I.R.S. Employer |

| Incorporation) | | Identification No.) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 520 Zang Street, Suite D | | | | | | | | | | | | | | | |

| | | Broomfield, | CO | | | | | | | | | | | | | | | 80021 |

| | | (Address of principal executive offices) | | | | | | | | | | | | | | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (720) 214-1900

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common stock | NDLS | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors of Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On November 9, 2023, the Board of Directors (the “Board”) of Noodles & Company (the “Company”) appointed Drew Madsen, 67, as the Company’s interim Chief Executive Officer, effective immediately. Mr. Madsen has served as a member of the Board since September 2017 and will continue to serve as a member of the Board while he is the interim Chief Executive Officer. The Board will conduct a comprehensive search process to identify a permanent Chief Executive Officer with the assistance of an executive search firm.

In connection with his appointment as interim Chief Executive Officer, the Company entered into an offer letter with Mr. Madsen, dated November 9, 2023 (the “Offer Letter”). Mr. Madsen will serve as interim Chief Executive Officer until the earlier of the one-year anniversary of his appointment as interim Chief Executive Officer or the date a permanent Chief Executive Officer commences employment with the Company. For his role as interim Chief Executive Officer, Mr. Madsen will receive the following compensation and benefits: (i) an annual base salary of $669,500 and (ii) a grant of restricted stock units pursuant to the Company’s 2023 Stock Incentive Plan (the “2023 Plan”) with respect to 100,000 shares of the Company’s common stock, which units will vest upon the earlier of the date a permanent Chief Executive Officer commences employment with the Company or a change in control (as defined in the 2023 Plan). In addition, commencing on May 1, 2024, Mr. Madsen is entitled to receive a grant of restricted stock units pursuant to the 2023 Plan with respect to 10,000 shares of the Company’s common stock on the first day of each month on which he continues to serve as interim Chief Executive Officer, which units will vest upon the earlier of the date a permanent Chief Executive Officer commences employment with the Company or a change in control (as defined in the 2023 Plan). Mr. Madsen is further entitled to the standard benefits available to the Company’s executives generally, including health insurance, life and disability coverage and the option to participate in the Company’s 401(k) Savings Plan. Mr. Madsen will not receive compensation paid to members of the Board while serving as Chief Executive Officer (but shall receive a prorated director equity grant for the year in which he returns to serving solely as a member of the Board).

Biographical and other information about Mr. Madsen required by Item 5.02(c) of Form 8-K is included in the Company’s proxy statement on Schedule 14A for its 2023 annual stockholders’ meeting filed with the SEC on March 31, 2023, and is incorporated herein by reference. There were no arrangements or understandings between Mr. Madsen and any other person pursuant to which Mr. Madsen was selected as an officer. There are no family relationships between Mr. Madsen and any director or executive officer of the Company required to be disclosed under Item 401(d) of Regulation S-K, and he does not have any direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Dave Boennighausen ceased serving as Chief Executive Officer of the Company, effective November 9, 2023. Subject to Mr. Boennighausen’s timely execution of a release agreement (and non-revocation in the time provided to do so), which includes a release of claims against the Company and its affiliates, Mr. Boennighausen will be entitled to receive the payments and benefits associated with a termination without Cause, as such term is defined in Mr. Boennighausen’s Employment Agreement, dated October 27, 2020, by and between the Company and Mr. Boennighausen, which was originally filed as Exhibit 10.1 attached to the Company’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission (“SEC”) on October 29, 2020. In accordance with Mr. Boennighausen’s Employment Agreement, Mr. Boennighausen has resigned from all other positions with the Company and its affiliates, including as a member of the Board.

Item 7.01. Regulation FD Disclosure.

On November 10, 2023, the Company issued a press release announcing the termination of Mr. Boennighausen and appointment of Mr. Madsen as interim Chief Executive Officer.

A copy of the Company’s press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference. The information contained in this Item 7.01 is being furnished, not filed, for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | | | | |

Exhibit No. | | Description |

| 10.1* | | | |

| 10.2* | | | |

| 99.1 | | | |

| 104 | | Cover Page Interactive Data File. The cover page XBRL tags are embedded within the Inline XBRL document. | |

*Indicates management contract or compensatory plan or arrangement.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | Noodles & Company |

| | |

| By: | /s/ MIKE HYNES |

| Name: | Mike Hynes |

| Title: | Chief Financial Officer |

DATED: November 13, 2023

Exhibit 10.1

November 9, 2023

Drew Madsen via email

Dear Drew:

We are pleased that you have agreed to serve as the interim Chief Executive Officer of Noodles & Company (the “Company”) while the Company’s board of directors (the “Board”) seeks a permanent Chief Executive Officer. This letter does not impact your continued service as a member of the Board.

1. Position and Term. While serving as Chief Executive Officer, you will report to the Board. You will serve as Chief Executive Officer until the earlier of (x) the date a permanent Chief Executive Officer commences employment with the Company and (y) the 12-month anniversary of the date of this letter (the “Term”), unless earlier terminated by you or the Company with thirty (30) days’ advance written notice. You will be an at-will employee of the Company during the Term. For the avoidance of doubt, (i) your title and position shall revert to solely serving as a member of the Board upon the end of the Term, and shall remain on the Board until your resignation, death or removal (subject to your continued election to the Board by our shareholders), and (ii) you will not receive compensation paid to members of the Board while serving as Chief Executive Officer (but shall receive a prorated director equity grant for the year in which you return to serving solely as a member of the Board).

2. Compensation for Serving as CEO.

a. For your service as Chief Executive Officer during the Term, you shall be paid a base salary at the rate of $669,500 per annum in accordance with the Company’s standard payroll procedures.

b. In addition, effective as of the date hereof, you will be granted 100,000 restricted stock units pursuant to our 2023 Stock Incentive Plan (the “2023 Plan”). In addition, commencing on May 1, 2024, you will receive a grant of 10,000 restricted stock units under the 2023 Plan on the first day of each month on which you continue to serve as Chief Executive Officer. Subject to your continued employment, the awards will vest upon the earlier of the date a permanent Chief Executive Officer commences employment with the Company or a change in control (as defined in the 2023 Plan).

3. Employee Benefits. During the Term, you will be eligible to participate in the Company’s standard employee benefit plans in accordance with the terms of such plans as they may be amended from time-to-time.

4. Reimbursement of Expenses. The Company will reimburse the reasonable travel and other expenses you incur in performing your role as Chief Executive Officer during the Term, upon your submission of appropriate documentation pursuant to the Company’s policies in effect from time to time. In addition, during the Term, the Company will provide you with or reimburse you for the reasonable cost of temporary housing near the Company’s corporate headquarters.

5. Covenants.

a. Confidential Information. You agree that you shall not, at any time during the Term or thereafter, disclose to another, or use for any purpose other than performing your duties and

responsibilities under this letter, any Confidential Information. For purposes of this letter, Confidential Information includes all trade secrets and confidential information of the Company and its affiliates and subsidiaries including, but not limited to, the Company’s unique business methods, processes, operating techniques and “know-how” (all of which have been developed by the Company or its affiliates and subsidiaries through substantial effort and investment), profit and loss results, market and supplier strategies, customer identity and needs, information pertaining to employee effectiveness and compensation, inventory strategy, product costs, gross margins, and other information relating to the affairs of the Company and its affiliates and subsidiaries that you shall have acquired during your employment with the Company.

b. Non-Solicitation of Employees. You agree that, during the Term and for a period of two (2) years thereafter, for any reason whether voluntarily or involuntarily, you will not, directly or indirectly, whether as an associate, agent, employee, consultant, independent contractor, owner, partner or otherwise, (i) solicit for yourself or others, or advise or recommend to any other person that that person solicit, divert, accept, or conduct securities sales transactions from or on behalf of any customer of the Company, for the purpose of obtaining the business of that customer, in competition with the Company; or (ii) employ, solicit for employment, or advise or recommend to any other person that that person solicit for employment or employ in competition with the Company, any person employed by the Company. For purposes of this paragraph “in competition with the Company” means working for yourself, another entity, or a customer of the Company, whether as an associate, agent, employee, broker, consultant, independent contractor, owner, partner or otherwise, performing security sales transactions or other services that the Company provides during or as of the end of the Term.

6. Tax Withholding. All amounts payable to you by the Company are subject to all applicable tax withholdings.

7. Indemnification. Subject to applicable law, you will be provided indemnification to the maximum extent permitted by the Company’s Certificate of Incorporation or Bylaws, including, if applicable, any directors’ and officers’ insurance policies, with such indemnification to be on terms determined by the Board or any of its committees, but on terms no less favorable than provided to any other Company executive officer or director.

8. Entire Agreement/Governing Law. This letter supersedes and replaces any prior agreements, representations or understandings (whether written, oral, implied or otherwise) between you and the Company, and constitutes the complete agreement between you and the Company regarding your position as Chief Executive Officer. This letter may not be amended or modified, except by an express written agreement signed by both you and the Chair of the Board. This letter shall be construed, interpreted and governed by the law of the State of Delaware, without giving effect to principles regarding conflict of laws. Sections 5 and 7 hereof shall survive the termination of this letter agreement for any reason.

9. Counterparts. This letter may be executed in counterparts, and each counterpart will have the same force and effect as an original and will constitute an effective, binding agreement on the part of each of the undersigned.

10. Headings. Headings in this letter are for reference only and shall not be deemed to have any substantive effect.

We are thrilled to have you in a leadership role during this exciting time for the Company. Please confirm your agreement to the terms specified in this letter by signing below.

Sincerely,

| | | | | | | | |

| | |

| | |

| By: | /s/ Melissa Heidman |

| | Name: Melissa M. Heidman |

| | Title: Executive Vice President, Gen. Counsel and Secretary |

| | |

| AGREED AND ACKNOWLEDGED: |

| | |

| /s/ Drew Madsen |

| DREW MADSEN |

| | |

| | |

Exhibit 10.2

RESTRICTED STOCK UNIT AGREEMENT

This RESTRICTED STOCK UNIT AGREEMENT (this "Agreement") is made as of November 9, 2023 (the "Effective Date") by and between Noodles & Company, a Delaware corporation (the "Company"), and Drew Madsen (the "Participant").

RECITALS

A. The Company has adopted the Noodles & Company 2023 Stock Incentive Plan (the "Plan"), a copy of which is attached hereto as Exhibit 1.

B. The Company desires to grant the Participant the right to a proprietary interest in the Company to encourage the Participant's contribution to the success and progress of the Company.

C. In accordance with the Plan, the Administrator (as defined in the Plan) has granted to the Participant restricted stock units with respect to 100,000 shares of Class A Common Stock of the Company, par value $0.01 per share ("Shares"), subject to the terms and conditions of the Plan and this Agreement.

AGREEMENTS

NOW, THEREFORE, in consideration of the mutual terms, conditions and other covenants and agreements set forth herein, the parties hereto hereby agree as follows:

1. Definitions. Capitalized terms used herein shall have the following meanings, and capitalized terms not otherwise defined herein shall have the meaning specified in the Plan:

"Agreement" has the meaning set forth in the Preamble.

"Business Day" means a day other than Saturday, Sunday or any day on which banks located in the State of New York are authorized or obligated to close.

"Company" has the meaning set forth in the Preamble.

"Competing Business" has the meaning set forth in Section 23(a).

"Confidential Information" has the meaning set forth in Section 23(b).

"Disability" has the meaning ascribed to such term in the Plan.

"Effective Date" has the meaning set forth in the Preamble.

"Employer" means the Company and/or any of its subsidiaries with which the Participant is employed.

"Participant" has the meaning set forth in the Preamble.

"Person" means and includes an individual, a partnership, a corporation, a limited liability company, a trust, a joint venture, an unincorporated organization and any governmental or regulatory body or agency or other authority.

"Plan" has the meaning set forth in the Recitals.

"RSUs" has the meaning set forth in Section 2.

"Shares" has the meaning set forth in the Recitals.

"Termination Date" means the date on which the Participant experiences a Termination of Employment (as defined in the Plan).

"Third Party Information" has the meaning set forth in Section 23(b).

"Withholding Obligation" means the amount determined in the Administrator's sole discretion to be the minimum sufficient to satisfy all federal, state, local and other withholding tax obligations that the Administrator determines may arise with respect to the issuance of Shares or payment of income earned in respect of any RSUs.

2. Grant of RSUs. The Company grants to the Participant restricted stock units (the "RSUs") with respect to 100,000 Shares.

3. Vesting.

(a) The RSUs shall vest upon the earlier of the date a permanent Chief Executive Officer commences employment with the Company or a Change in Control, subject to the Participant’s continued employment with the Employer through the date thereof.

(b) In addition, the Administrator may, at any time in its sole discretion, accelerate the vesting of all or any portion of the RSUs.

4. Settlement.

(a) Unless deferred by the Participant to the extent permitted by the Board, the RSUs shall be settled promptly following their vesting pursuant to Section 3(a) by the Company delivering to the Participant one Share for each RSU that has vested. Unless deferred by the Participant, in no event shall such settlement occur later than the same date of the year following the year in which the RSUs vest.

(b) The unvested RSUs shall immediately expire on the Termination Date.

5. Nontransferability of the RSUs. Except as permitted by the Administrator or as permitted under the Plan, the Participant may not assign or transfer the RSUs to anyone other than by will or the laws of descent and distribution. The Company may cancel the Participant's RSUs if the Participant attempts to assign or transfer them in a manner inconsistent with this Section 5.

6. Adjustments.

(a) In the event that any dividend or other distribution (whether in the form of cash, Shares, other securities or other property, but excluding regular, quarterly and other periodic cash dividends), stock split or a combination or consolidation of the outstanding Shares into a lesser number of shares, is declared with respect to the Shares, then the RSUs shall be subject to adjustment as provided in Section 12(a) of the Plan.

(b) In connection with a Change in Control, the Administrator may provide for any adjustment or action specified in Section 12(b) of the Plan.

7. Restrictions on Resales of Shares. The Company may impose such restrictions, conditions or limitations as it determines appropriate as to the timing and manner of any resales by the Participant or other subsequent transfers by the Participant of any Shares issued as a result of the settlement of the RSUs, including without limitation (a) restrictions under an insider trading policy,(b) restrictions designed to delay and/or coordinate the timing and manner of sales by Participant and other grantees and (c) restrictions as to the use of a specified brokerage firm for such resales or other transfers.

8. No Interest in Shares Subject to RSUs. Neither the Participant (individually or as a member of a group) nor any beneficiary or other Person claiming under or through the Participant shall have any right, title, interest, or privilege in or to any Shares allocated or reserved for the purpose of the Plan or subject to this Agreement except as to such Shares, if any, as shall have been issued to such Person following vesting of the RSUs.

9. Plan Controls. The RSUs hereby granted are subject to, and the Company and the Participant agree to be bound by, all of the terms and conditions of the Plan as the same may be amended from time to time in accordance with the terms thereof; provided, however, that no such amendment shall be effective as to the RSUs without the Participant's consent insofar as it adversely affects the Participant's material rights under this Agreement, which consent will not be unreasonably withheld by the Participant.

10. Not an Employment Contract. Nothing in the Plan, this Agreement or any other instrument executed pursuant hereto or thereto shall confer upon the Participant any right to continue in the employ of the Employer or any affiliate thereof or shall affect the right of the Employer to terminate the employment of the Participant at any time with or without cause (unless otherwise set forth in an employment agreement between the Company and the Participant).

11. Governing Law. This Agreement, and any disputes or controversies arising hereunder, shall be construed and enforced in accordance with and governed by the internal laws of the State of Delaware other than principles of law that would apply the law of another jurisdiction.

12. Taxes. The Administrator may, in its sole discretion, make such provisions and take such steps as it may deem necessary or appropriate to satisfy the Withholding Obligations with respect to the issuance of Shares, including deducting the amount of any such Withholding Obligations from any other amount then or thereafter payable to the Participant, requiring the Participant to pay to the Company the amount of such Withholding Obligations or to execute such documents as the Administrator deems necessary or desirable to enable it to satisfy the Withholding Obligations, or any other means provided in the Plan; provided, however, that, the Participant may satisfy any Withholding Obligations by (i) directing the Company to withhold that number of Shares with an aggregate fair market value equal to the amount of the Withholding Obligations or (ii) delivering to the Company such number of previously held Shares that have been owned by the Participant with an aggregate fair market value equal to the amount of the Withholding Obligations.

13. Notices. All notices, requests, demands and other communications called for or contemplated hereunder shall be in writing and shall be deemed to have been given when delivered to the party to whom addressed or when sent by telecopy (if promptly confirmed by registered or certified mail, return receipt requested, prepaid and addressed) to the parties, their successors in interest, or their assignees at the following addresses, or at such other addresses as the parties may designate by written notice in the manner aforesaid:

If to the Company to:

Noodles & Company

520 Zang Street, Suite D

Broomfield, CO 80021

Email: Benefits@Noodles.com

Attention: General Counsel

If to the Participant to the address set forth below the Participant's signature below.

All such notices, requests and other communications will (i) if delivered personally to the address as provided in this Section 13, be deemed given upon delivery,(ii) if delivered by facsimile transmission to the facsimile number as provided for in this Section 13,be deemed given upon facsimile confirmation,(iii) if delivered by mail in the manner described above to the address as provided for in this Section 13,be deemed given on the earlier of the third Business Day following mailing or upon receipt, and (iv) if delivered by overnight courier to the address as provided in this Section 13,be deemed given on the earlier of the first Business Day following the date sent by such overnight courier or upon receipt (in each case regardless of whether such notice, request or other communication is received by any other Person to whom a copy of such notice is to be delivered pursuant to this Section 13). Any party from time to time may change its address, facsimile number or other information for the purpose of notices to that party by giving notice specifying such change to the other parties hereto.

Either party may, by notice given to the other party in accordance with this Section 13, designate another address or Person for receipt of notices hereunder.

14. Amendments and Waivers. This Agreement shall not be changed, altered, modified or amended, except by a written agreement signed by both parties hereto. The failure of any party to insist in any one instance or more upon strict performance of any of the terms and conditions hereof, or to exercise any right or privilege herein conferred, shall not be construed as a waiver of such terms, conditions, rights or privileges, but same shall continue to remain in full force and effect. Any waiver by any party of any violation of, breach of or default under any provision of this Agreement by the other party shall not be construed as, or constitute, a continuing waiver of such provision, or waiver of any other violation of, breach of or default under any other provision of this Agreement. Any waiver by any party of any provision hereof shall be effective only by a writing signed by the party to be charged.

15. Entire Agreement. This Agreement, together with the Plan, sets forth the entire agreement and understanding between the parties hereto as to the subject matter hereof and thereof and supersedes all prior oral and written and all contemporaneous oral discussions, agreements and understandings of any kind or nature, regarding the subject matter hereof and thereof between the parties hereto.

16. Separability. If any term or provision of this Agreement shall to any extent be invalid, illegal or incapable of being enforced by any rule of law, or public policy, all other conditions and provisions of this Agreement nevertheless shall remain in full force and effect so long as the economic or legal substance of the transactions contemplated hereby is not affected in any manner adverse to any party. Upon such determination that any term or provision is invalid, illegal or incapable of being enforced, the invalid or unenforceable provisions, to the extent permitted by law, shall be deemed amended and given such interpretation so as to effect the original intent of the parties as closely as possible in an acceptable manner to the end that transactions contemplated hereby are fulfilled to the maximum extent possible.

17. Headings; Construction. Headings in this Agreement are for reference purposes only and shall not be deemed to have any substantive effect. The words "include," "includes" and "including" when used herein shall be deemed in each case to be followed by the words "without limitation."

18. Counterparts. This Agreement may be executed in multiple counterparts, each of which shall be deemed an original, and all of which together shall constitute one and the same instrument.

19. Further Assurances. The Participant shall cooperate and take such action as may be reasonably requested by the Company in order to carry out the provisions and purposes of this Agreement.

20. Remedies. In the event of a breach by any party to this Agreement of its obligations under this Agreement, any party injured by such breach, in addition to being entitled to exercise all rights granted by law, including recovery of damages, shall be entitled to specific performance of its rights under this Agreement. The parties agree that the provisions of this Agreement shall be specifically enforceable, it being agreed by the parties that the remedy at law, including monetary damages, for breach of any such provision will be inadequate compensation for any loss and that any defense in any action for specific performance that a remedy at law would be adequate is hereby waived.

21. Electronic Delivery. By executing the Agreement, the Participant hereby consents to the delivery of information (including, without limitation, information required to be delivered to the Participant pursuant to applicable securities laws) regarding the Company and the subsidiaries, the Plan, the RSUs and the Shares via Company web site or other electronic delivery.

22. Binding Effect. This Agreement shall inure to the benefit of and be binding upon the parties hereto and their respective permitted successors and assigns, including any Permitted Transferees.

23. Participant Covenants.

(a) Covenant not to Compete. While employed by the Company or a subsidiary and for six (6) months thereafter, the Participant shall not, directly or indirectly, own any interest in, manage, control, participate in, consult with, render services for, or be employed in an executive, managerial or administrative capacity by any entity engaged in the fast or quick-casual restaurant business in North America that derives 20% or more of its revenues from the sale of noodles or pasta dishes (a "Competing Business"). Nothing herein shall prohibit the Participant from being a passive owner of not more than 5% of the outstanding stock of any class of a corporation which is publicly traded, so long as the Participant has no active participation in the business of such corporation.

(b) Non-Solicitation. While employed by the Company or a subsidiary and for six (6) months thereafter, other than in the course of performing his or her duties, the Participant shall not, directly or indirectly through another Person, induce or attempt to induce any employee of the Company or any of its subsidiaries (other than restaurant-level employees who are not managers) to leave the employ of the Company or such subsidiary, or in any way interfere with the relationship between the Company or any of its subsidiaries and any such employee.

(c) Confidentiality. The Participant acknowledges that the confidential business information generated by the Company and its subsidiaries, whether such information is written, oral or graphic, including, but not limited to, financial plans and records, marketing plans, business strategies and relationships with third parties, present and proposed products, present and proposed patent applications, trade secrets, information regarding customers and suppliers, strategic planning and systems and contractual terms obtained by the Participant while employed by the Company and its subsidiaries concerning the business or affairs of the Company or any subsidiary of the Company (collectively, the "Confidential Information") is the property of the Company or such subsidiary. The Participant agrees that he or she shall not disclose to any Person or use for the Participant's own purposes any Confidential Information or any confidential or proprietary information of other Persons in the possession of the Company and its subsidiaries ("Third Party Information"),without the prior written consent of the Board, unless and to the extent that (i) the Confidential Information or Third Party Information becomes generally known to and available for use by the public, other than as a result of the Participant's acts or omissions or (ii) the disclosure of such Confidential Information is required by law, in which case the Participant shall give notice to and the opportunity to the Company to comment on the form of the disclosure and only the portion of Confidential Information that is required to be disclosed by law shall be disclosed. The Participant shall deliver to the Company on the date of his or her termination of employment, or at any other time the Company may request, all memoranda, notes, plans, records, reports, computer files, disks and tapes, printouts and software and other documents and data (and copies thereof) embodying or relating to Third Party Information, Confidential Information, or the business of the Company or any of its subsidiaries which he or she may then possess or have under his or her control.

(d) Specific Performance. The Participant recognizes and agrees that a violation by him or her of his or her obligations under this Section 23 may cause irreparable harm to the Company that would be difficult to quantify and that money damages may be inadequate. As such, the Participant agrees that the Company shall have the right to seek injunctive relief (in addition to, and not in lieu of any other right or remedy that may be available to it) to prevent or restrain any such alleged violation without the necessity of posting a bond or other security and without the necessity of proving actual damages. However, the foregoing shall not prevent the Participant from contesting the Company's request for the issuance of any such injunction on the grounds that no violation or threatened violation of this Section 23 has occurred and that the Company has not suffered irreparable harm. If a court of competent jurisdiction determines that the Participant has violated the obligations of any covenant for a particular duration, then the Participant agrees that such covenant will be extended by that duration.

(e) Scope and Duration of Restrictions. The Participant expressly agrees that the character, duration and geographical scope of the restrictions imposed under this Section 23 are reasonable

in light of the circumstances as they exist at the date upon which this Agreement has been executed. However, should a determination nonetheless be made by a court of competent jurisdiction at a later date that the character, duration or geographical scope of any of the covenants contained herein is unreasonable in light of the circumstances as they then exist, then it is the intention of both the Participant and the Company that such covenant shall be construed by the court in such a manner as to impose only those restrictions on the conduct of the Participant which are reasonable in light of the circumstances as they then exist and necessary to assure the Company of the intended benefit of such covenant.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the Effective Date.

| | | | | | | | |

| THE COMPANY: |

| NOODLES & COMPANY |

| By: | |

| | Name: |

| | Title: |

| | |

| PARTICIPANT: |

| | |

| |

| Name: Drew Madsen |

| Address: ____________________________________ |

| ____________________________________ |

| ____________________________________ |

| Tel: _________________________________ |

Exhibit 99.1

Noodles & Company Announces CEO Transition

Board Director and Industry Vet Drew Madsen Appointed as Interim CEO; Dave Boennighausen Departs the Company

•Drew Madsen is appointed Interim CEO effective immediately; is a Board Director at Noodles, and a seasoned leader with deep experience in the restaurant industry

•Board announces search for new permanent CEO

•Dave Boenninghausen to depart the Company as CEO effective immediately

BROOMFIELD, Colo., November 10, 2023 (GLOBE NEWSWIRE) - Noodles & Company (NASDAQ: NDLS), today announced that the Board has appointed Noodles Board member Drew Madsen to serve as interim CEO effective immediately. Concurrently, the Board has initiated a comprehensive search for a new permanent CEO to lead the Company into its next phase of growth. Madsen’s appointment follows the decision by the Board to transition to new leadership, resulting in Dave Boennighausen’s departure as the Company's CEO.

Mr. Madsen brings a wealth of experience in the restaurant industry to the role of interim CEO. In his recent operating roles, Mr. Madsen was President and Chief Operating Officer at some of the most successful and well-respected businesses in the restaurant industry. Most recently, Mr. Madsen was President of Panera Bread. During his tenure at Panera, Mr. Madsen led the company to industry leadership in clean food, digital sales, and home delivery, combined with significantly improved operations execution and aggressive cost reduction.

Mr. Madsen’s professional experience prior to Panera includes fifteen years at Darden. Mr. Madsen was President & Chief Operating Officer for nearly ten years. During his tenure, he helped establish Darden as a successful multi-brand operator in full service dining. In addition, Darden was the first restaurant company to be recognized by Fortune as one of the “100 Best Companies to Work For,” achieving that distinction for three consecutive years.

Mr. Madsen has served on the Noodles board since 2017. For nearly ten years, Mr. Madsen was a board member at Darden Restaurants. He previously served as an independent director on the board of Talbots Inc., the specialty retailer of women’s fashion.

Jeff Jones, Noodles & Company Board Chairman, commented on the interim CEO appointment, stating, "We are very excited to have Drew step into the interim CEO role and remain on our Board. He is a seasoned executive with a deep understanding of our Company's operations and strategy, and has a successful track record as a leader in the restaurant industry. We have full confidence in his ability to guide the company effectively during this time as we focus on key strategic initiatives to drive top line growth and bottom line results and significantly enhance stockholder value."

Mr. Madsen also expressed his commitment to the company during this interim period, saying, "I am honored to take on this role and work with our dedicated employees, partners, and stakeholders while we search for a permanent leader. As interim CEO, I will focus the Noodles team on delivering exceptional experiences to our customers, and effectively implementing the initiatives that drive business growth."

Mr. Jones expressed his gratitude for Mr. Boennighausen's contributions to the Company: "On behalf of the Board, we thank Dave for his leadership and dedication to Noodles. He led the Noodles team and navigated the Company through a period of rapid change and market disruption, including during the pandemic. His passion for the Noodles brand is undeniable, he has our full respect, and we wish him all the best in his future endeavors.”

About Noodles & Company

Since 1995, Noodles & Company has been serving guests Uncommon Goodness and noodles your way, with noodles and flavors you know and love as well as new ones you’re about to discover. From indulgent Wisconsin Mac & Cheese to better-for-you Zoodles, Noodles serves a world of flavor in every bowl. Made up of more than 450 restaurants and 8,000 passionate team members, Noodles is dedicated to nourishing and inspiring every guest who walks through the door. To learn more or find the location nearest you, visit www.noodles.com.

Forward-Looking Statements

In addition to historical information, this press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. In some cases, you can identify forward-looking statements by terms such as “may,” “might,” “will,” “objective,” “intend,” “should,” “could,” “can,” “would,” “expect,” “believe,” “design,” “estimate,” “predict,” “potential,” “plan” or the negative of these terms and similar expressions intended to identify forward-looking statements. These statements reflect our current views with respect to future events and are based on currently available operating, financial and competitive information. Examples of forward-looking statements include all matters that are not historical facts, such as statements regarding Mr. Madsen’s intended goals for the Company. Our actual results may differ materially from those anticipated in these forward-looking statements due to reasons including, but not limited to, our ability to sustain our overall growth, including our digital sales growth; and our ability to achieve and maintain increases in comparable restaurant sales and to successfully execute our business strategy, including new restaurant initiatives, such as digital menu boards, and operational strategies to improve the performance of our restaurant portfolio. For additional information on these and other factors that could affect the Company’s forward-looking statements, see the Company’s risk factors, as they may be amended from time to time, set forth in its filings with the SEC, included in our most recently filed Annual Report on Form 10-K, and, from time to time, in our subsequently filed Quarterly Reports on Form 10-Q. The Company disclaims and does not undertake any obligation to update or revise any forward-looking statement in this press release, except as may be required by applicable law or regulation.

Contacts:

Investor Relations

investorrelations@noodles.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

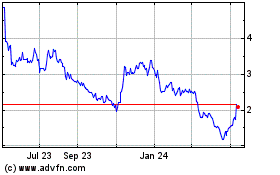

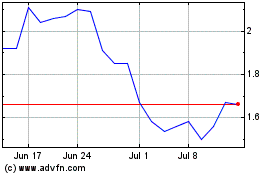

Noodles (NASDAQ:NDLS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Noodles (NASDAQ:NDLS)

Historical Stock Chart

From Apr 2023 to Apr 2024