false

0001320760

0001320760

2023-11-13

2023-11-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

November 13, 2023

Date of Report (Date of earliest event reported)

TSS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

000-33627

|

20-2027651

|

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number)

|

(I.R.S. Employer

Identification No.)

|

| |

|

|

|

110 E. Old Settlers Road

|

|

|

|

Round Rock, Texas

|

|

78664

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(512) 310-1000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address, and former fiscal year, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of this Act: None.

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02.

|

Results of Operations and Financial Condition.

|

On Monday, November 13, 2023, TSS, Inc. (the “Company”), issued a press release reporting certain financial results of the Company for the three and nine months ended September 30, 2023. A copy of the press release is being furnished herewith as Exhibit 99.1.

The Company’s press release contains non-GAAP financial measures. Pursuant to the requirements of Regulation G, the Company has provided reconciliations within the press release of the non-GAAP financial measures to the most directly comparable GAAP financial measures. Disclosure regarding definitions of these measures used by the Company and why the Company’s management believes the measures provide useful information to investors is also included in the press release.

The Company will conduct a conference call to discuss its financial results on Monday, November 13, 2023, at 4:30 p.m. Eastern Time.

The information in this Report, including Exhibit 99.1 attached hereto, is furnished pursuant to Item 2.02 of this Current Report on Form 8-K. Such information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

This report may contain “forward-looking statements” – that is, statements related to future – not past – events, plans, and prospects. In this context, forward-looking statements may address matters such as our expected future business and financial performance, and often contain words such as “guidance,” “prospects,” “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “should,” or “will.” Forward-looking statements by their nature address matters that are, to different degrees, uncertain. Particular uncertainties that could adversely or positively affect the Company's future results include: we may not have sufficient resources to fund our business and may need to issue debt or equity to obtain additional funding; our reliance on a significant portion of our revenues from a limited number of customers and our ability to diversify our customer base; risks relating to operating in a highly competitive industry; risks relating to supply chain challenges; risk related to changes in labor market conditions; risks related to the implementation of a new enterprise resource IT system; risk related to the development of our procurement and reseller services business; risks relating to rapid technological, structural, and competitive changes affecting the industries we serve; risks involved in properly managing complex projects; risks relating to the possible cancellation of customer contracts on short notice; risks relating our ability to continue to implement our strategy, including having sufficient financial resources to carry out that strategy; uncertainty related to current economic conditions including the impact of the COVID-19 pandemic and the related impact on demand for our services; and other risks and uncertainties disclosed in our filings with the Securities and Exchange Commission, including the Annual Report on Form 10-K for the fiscal year ended December 31, 2022. These uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

| |

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

S I G N A T U R E S

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

TSS, INC.

|

| |

|

|

| |

|

|

| |

By:

|

/s/ John Penver

|

| |

|

John Penver

|

| |

|

Chief Financial Officer

|

Date: November 13, 2023

Exhibit 99.1

TSS, INC. REPORTS THIRD QUARTER 2023 RESULTS

ROUND ROCK, TX – November 13, 2023 – TSS, Inc. (Other OTC: TSSI), a data center facilities and technology integration services company, reported results for its third quarter ended September 30, 2023.

“We continued to produce strong financial results during the third quarter as we improved efficiency through operational investments. We are beginning to see the benefits of our expanded sales initiatives as we integrate hardware and software technologies into useable solutions that enable data centers and the Internet to function,” said Darryll E. Dewan, President and CEO of TSS. “We continue to invest in our foundation and plan that will benefit our growth and financial performance going forward. We will continuously improve the solutions and services we provide to the market.”

Third Quarter Highlights (unaudited):

| |

●

|

Third quarter 2023 revenue of $8.9 million compared with $8.1 million in the third quarter of 2022. Reseller revenues were $5.4 million in the third quarter of 2023 compared to $3.1 million in the third quarter of 2022.

|

| |

●

|

Gross margin of 32% in the third quarter of 2023 compared with 34% in the third quarter of 2022.

|

| |

●

|

Operating income of $715,000 in the third quarter of 2023 compared to operating income of $871,000 in the third quarter of 2022.

|

| |

●

|

Net income of $209,000 or $0.01 per share in the third quarter of 2023 compared to net income of $605,000 or $0.03 per share in the third quarter of 2022.

|

| |

●

|

Adjusted EBITDA of $940,000 in the third quarter of 2023 compared with Adjusted EBITDA of $1,043,000 in the third quarter of 2022.

|

Year-to-date Highlights (unaudited):

| |

●

|

2023 revenue of $30.0 million compared with $19.7 million in 2022. Reseller revenues were $17.7 million in 2023 compared to $5.6 million in 2022.

|

| |

●

|

Gross margin of 26% in 2023 compared with 36% in 2022.

|

| |

●

|

Operating income of $1,025,000 in 2023 compared to operating income of $1,637,000 in 2022.

|

| |

●

|

Net loss of $262,000 or $(0.01) per share in 2023 compared to net income of $1,068,000 or $0.05 per share in 2022.

|

| |

●

|

Adjusted EBITDA of $1,727,000 in 2023 compared with Adjusted EBITDA of $2,202,000 in 2022.

|

“We have balanced achieving positive results with funding strategic investments in our sales and operations staff that will benefit us and drive growth in future periods,” added Dewan. “Looking forward, we are in the process of expanding our direct selling capabilities and improving communication to the market and our customers so that we can capture more of the transformation and growth in the IT market that is being driven by AI, cyber-security, data analytics, and other emerging technologies. We are also looking at expanding the range of services we provide to the IT market and believe both initiatives will drive continued revenue growth in 2023 and into next year. We anticipate finishing the year strongly as we build a pipeline for additional growth next year.”

Quarterly Conference Call Details

The Company has scheduled a conference call to discuss the third quarter 2023 financial results for Monday, November 13, 2023, at 4:30 PM Eastern. To participate on the conference call, please dial 1-888-596-4144 toll free from the U.S., or 1-646-968-2525 for international callers. The event ID number is 3667493. Investors may also access a live audio web cast of this conference call under the “events” tab on the investor relations section of the Company's website at www.tssiusa.com.

An audio replay of the conference call will be available approximately four hours after the conclusion of the call and will be made available until December 14, 2023. The audio replay can be accessed at the following url: EVENT | ECHO PLAYBACK (registrations.events)

The conference ID to access the digital playback is 3667493. Additionally, a replay of the webcast will be available on the Company’s website approximately two hours after the conclusion of the call and will remain available for 30 calendar days.

About Non-GAAP Financial Measures

Adjusted EBITDA is a supplemental financial measure not defined under Generally Accepted Accounting Principles (GAAP). We define Adjusted EBITDA as net income (loss) before interest expense, income taxes, depreciation and amortization, impairment loss on goodwill and other intangibles, stock-based compensation, provision for bad debts and certain extraordinary items, including CEO transition costs. We present Adjusted EBITDA because we believe this supplemental measure of operating performance is helpful in comparing our operating results across reporting periods on a consistent basis by excluding items that may, or could, have a disproportionate positive or negative impact on our results of operations in any particular period. We also use Adjusted EBITDA as a factor in evaluating the performance of certain management personnel when determining incentive compensation.

Adjusted EBITDA may not be comparable to similarly titled measures reported by other companies. Adjusted EBITDA, while providing useful information, should not be considered in isolation or as an alternative to net income or cash flows as determined under GAAP. Consistent with Regulation G under the U.S. federal securities laws, Adjusted EBITDA has been reconciled to the nearest GAAP measure, and this reconciliation is located under the heading “Adjusted EBITDA Reconciliation” following the Consolidated Statements of Operations included in this press release.

About TSS, Inc.

TSS is a trusted single source provider of mission-critical planning, design, system integration, deployment, maintenance and evolution of data centers facilities and information infrastructure. TSS specializes in customizable end to end solutions powered by industry experts and innovative services that include technology consulting, engineering, design, construction, operations, facilities management, technology system installation and integration, as well as maintenance for traditional and modular data centers. For more information, visit www.tssiusa.com or call 888-321-4877.

Forward Looking Statements

This press release may contain “forward-looking statements” -- that is, statements related to future -- not past -- events, plans, and prospects. In this context, forward-looking statements may address matters such as our expected future business and financial performance, and often contain words such as “guidance,” “prospects,” “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “should,” or “will.” Forward-looking statements by their nature address matters that are, to different degrees, uncertain. Particular uncertainties that could adversely or positively affect the Company's future results include: we may not have sufficient resources to fund our business and may need to issue debt or equity to obtain additional funding; our reliance on a significant portion of our revenues from a limited number of customers and our ability to diversify our customer base; risks relating to operating in a highly competitive industry; risks relating to supply chain challenges; risk related to changes in labor market conditions; risks related to the implementation of a new enterprise resource IT system; risk related to the development of our procurement and reseller services business; risks relating to rapid technological, structural, and competitive changes affecting the industries we serve; risks involved in properly managing complex projects; risks relating to the possible cancellation of customer contracts on short notice; risks relating our ability to continue to implement our strategy, including having sufficient financial resources to carry out that strategy; uncertainty related to current economic conditions including the impact of the COVID-19 pandemic and the related impact on demand for our services; and other risks and uncertainties disclosed in our filings with the Securities and Exchange Commission, including the Annual Report on Form 10-K for the fiscal year ended December 31, 2022. These uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements.

Company Contact:

TSS, Inc.

John Penver, CFO

Phone: (512) 310-1000

TSS, Inc.

Consolidated Balance Sheets

(In thousands except par values)

| |

|

September 30,

|

|

|

December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

| |

|

(unaudited)

|

|

|

|

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Current Assets

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

28,703 |

|

|

$ |

20,397 |

|

|

Contract and other receivables, net

|

|

|

6,311 |

|

|

|

2,745 |

|

|

Costs and estimated earnings in excess of billings on uncompleted contracts

|

|

|

610 |

|

|

|

231 |

|

|

Inventories, net

|

|

|

2,131 |

|

|

|

862 |

|

|

Prepaid expenses and other current assets

|

|

|

335 |

|

|

|

175 |

|

|

Total current assets

|

|

|

38,090 |

|

|

|

24,410 |

|

|

Property and equipment, net

|

|

|

657 |

|

|

|

587 |

|

|

Lease right-of-use assets

|

|

|

4,231 |

|

|

|

4,717 |

|

|

Goodwill

|

|

|

780 |

|

|

|

780 |

|

|

Intangible assets, net

|

|

|

- |

|

|

|

35 |

|

|

Other assets

|

|

|

839 |

|

|

|

877 |

|

|

Total assets

|

|

$ |

44,597 |

|

|

$ |

31,406 |

|

|

Liabilities and Stockholders’ Equity

|

|

|

|

|

|

|

|

|

|

Current Liabilities

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses

|

|

$ |

22,256 |

|

|

$ |

21,616 |

|

|

Deferred revenues

|

|

|

14,768 |

|

|

|

2,080 |

|

|

Current portion of lease liabilities

|

|

|

673 |

|

|

|

467 |

|

|

Total current liabilities

|

|

|

36,563 |

|

|

|

24,163 |

|

|

Non-current portion of lease liabilities

|

|

|

3,808 |

|

|

|

4,309 |

|

|

Total liabilities

|

|

|

41,505 |

|

|

|

28,472 |

|

|

Stockholders’ Equity

|

|

|

|

|

|

|

|

|

|

Preferred stock- $.0001 par value; 1,000 shares authorized at September 30, 2023 and December 31, 2022; none issued

|

|

|

- |

|

|

|

- |

|

|

Common stock- $.0001 par value, 49,000 shares authorized at September 30, 2023 and December 31, 2022: 23,473 and 23,197 shares issued at September 30, 2023 and December 31, 2022, respectively

|

|

|

2 |

|

|

|

2 |

|

|

Additional paid-in capital

|

|

|

71,975 |

|

|

|

71,522 |

|

|

Treasury stock 1,744 and 1,657 shares at cost at September 30, 2023 and December 31, 2022, respectively

|

|

|

(2,238 |

) |

|

|

(2,205 |

) |

|

Accumulated deficit

|

|

|

(66,647 |

) |

|

|

(66,385 |

) |

|

Total stockholders' equity

|

|

|

3,092 |

|

|

|

2,934 |

|

|

Total liabilities and stockholders’ equity

|

|

$ |

44,597 |

|

|

$ |

31,406 |

|

TSS, Inc.

Condensed Consolidated Statements of Operations

(In thousands except per-share values, unaudited)

| |

|

Three Months Ended

September 30,

|

|

|

Nine Months Ended

September 30,

|

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022

|

|

|

Results of Operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$ |

8,880 |

|

|

$ |

8,077 |

|

|

$ |

29,991 |

|

|

$ |

19,690 |

|

|

Cost of revenue

|

|

|

6,050 |

|

|

|

5,312 |

|

|

|

16,203 |

|

|

|

7,335 |

|

|

Gross profit

|

|

|

2,830 |

|

|

|

2,765 |

|

|

|

7,738 |

|

|

|

7,043 |

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative

|

|

|

2,043 |

|

|

|

1,826 |

|

|

|

6,464 |

|

|

|

5,158 |

|

|

Depreciation and amortization

|

|

|

72 |

|

|

|

68 |

|

|

|

249 |

|

|

|

248 |

|

|

Total operating costs

|

|

|

2,115 |

|

|

|

1,894 |

|

|

|

6,713 |

|

|

|

5,406 |

|

|

Operating income (loss)

|

|

|

715 |

|

|

|

871 |

|

|

|

1,025 |

|

|

|

1,637 |

|

|

Interest expense, net

|

|

|

(482 |

) |

|

|

(255 |

) |

|

|

(1,242 |

) |

|

|

(537 |

) |

|

Income (loss) before income taxes

|

|

|

233 |

|

|

|

616 |

|

|

|

(217 |

) |

|

|

1,100 |

|

|

Income tax expense

|

|

|

24 |

|

|

|

11 |

|

|

|

45 |

|

|

|

32 |

|

|

Net income (loss)

|

|

$ |

209 |

|

|

$ |

605 |

|

|

$ |

(262 |

) |

|

$ |

1,068 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic net income (loss) per share

|

|

$ |

0.01 |

|

|

$ |

0.03 |

|

|

$ |

(0.01 |

) |

|

$ |

0.05 |

|

|

Diluted net income (loss) per share

|

|

$ |

0.01 |

|

|

$ |

0.03 |

|

|

$ |

(0.01 |

) |

|

$ |

0.05 |

|

TSS, Inc.

Adjusted EBITDA Reconciliation

(In thousands, unaudited)

| |

|

Three Months Ended

September 30,

|

|

|

Nine Months Ended

September 30,

|

|

| |

|

2023 |

|

|

2022 |

|

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$ |

209 |

|

|

$ |

605 |

|

|

$ |

(262 |

) |

|

$ |

1,068 |

|

|

Interest expense (income), net

|

|

|

482 |

|

|

|

255 |

|

|

|

1,242 |

|

|

|

537 |

|

|

Depreciation and amortization

|

|

|

72 |

|

|

|

68 |

|

|

|

249 |

|

|

|

248 |

|

|

Income tax expense

|

|

|

24 |

|

|

|

11 |

|

|

|

45 |

|

|

|

32 |

|

|

EBITDA profit (loss)

|

|

$ |

787 |

|

|

|

939 |

|

|

$ |

1,274 |

|

|

$ |

1,885 |

|

|

Stock based compensation

|

|

|

153 |

|

|

|

104 |

|

|

|

453 |

|

|

|

317 |

|

|

Adjusted EBITDA profit (loss)

|

|

$ |

940 |

|

|

$ |

1,043 |

|

|

$ |

1,727 |

|

|

$ |

2,202 |

|

v3.23.3

Document And Entity Information

|

Nov. 13, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

TSS, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 13, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

000-33627

|

| Entity, Tax Identification Number |

20-2027651

|

| Entity, Address, Address Line One |

110 E. Old Settlers Road

|

| Entity, Address, City or Town |

Round Rock

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

78664

|

| City Area Code |

512

|

| Local Phone Number |

310-1000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001320760

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

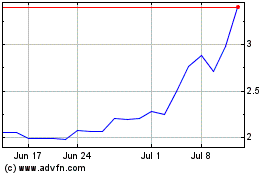

TSS (QB) (USOTC:TSSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

TSS (QB) (USOTC:TSSI)

Historical Stock Chart

From Apr 2023 to Apr 2024