Filed Pursuant to General Instruction II.L of Form F-10

File No. 333-272706

This prospectus supplement (the "Prospectus Supplement"), together with the short form base shelf prospectus dated August 17, 2023 to which it relates, as amended or supplemented (the "Base Shelf Prospectus"), and each document deemed to be incorporated by reference into this Prospectus Supplement and the Base Shelf Prospectus, as amended or supplemented (collectively, the "Prospectus"), constitutes a public offering of these securities only in those jurisdictions where they may be lawfully offered for sale and only by persons permitted to sell such securities. No securities regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise.

Information has been incorporated by reference in the Prospectus from documents filed with securities commissions or similar authorities in Canada. Copies of the documents incorporated herein by reference may be obtained on request without charge from the Secretary of Cybin Inc. at 100 King Street West, Suite 5600, Toronto, Ontario M5X 1C9, telephone 1-866-292-4601, and are also available electronically at www.sedarplus.ca and www.sec.gov/edgar.

PROSPECTUS SUPPLEMENT

TO THE SHORT FORM BASE SHELF PROSPECTUS DATED AUGUST 17, 2023

| New Issue |

November 10, 2023 |

CYBIN INC.

US$30,000,000

66,666,667 Units

____________________________________

Price: US$0.45 per Unit

____________________________________

Cybin Inc. (“Cybin” or the “Corporation”) is hereby qualifying the distribution (the “Offering”) of 66,666,667 units of the Corporation (the “Units”) at a price of US$0.45 per Unit (the “Offering Price”) for aggregate gross proceeds of US$30,000,000.15. Each Unit will be comprised of one Common Share (as defined herein) (each, a “Unit Share”) and one Common Share purchase warrant (each, a “Warrant”). Each Warrant shall be exercisable to acquire one Common Share (each, a “Warrant Share”), subject to adjustment in certain circumstances, at an exercise price of US$0.51 (the “Warrant Exercise Price”), at any time during the period beginning six (6) months from the date of closing of the Offering until 66 months from the closing of the Offering (the “Warrant Expiry Date”), subject to acceleration in certain circumstances. The Unit Shares and Warrants comprising the Units will be separated immediately upon closing of the Offering. This Prospectus Supplement together with the Base Shelf Prospectus qualifies the distribution of the Unit Shares and Warrants comprising the Units.

This Prospectus Supplement also qualifies for distribution in the United States, 66,666,667 Warrant Shares issuable from time to time on exercise of the Warrants issuable under this Prospectus Supplement, and such indeterminate number of additional Warrant Shares that may be issuable by reason of the anti-dilution provisions forming part of the terms and conditions of the Warrants

The Offering is being made in the Province of Ontario, and in the United States. The Units are being issued pursuant to an underwriting agreement dated November 10, 2023 (the “Underwriting Agreement”) between the Corporation and A.G.P./Alliance Global Partners as sole bookrunner and lead underwriter (the “Underwriter”), relating to the Units offered by this Prospectus Supplement and the accompanying Base Shelf Prospectus. The Units will be offered in Canada and the United States through the Underwriter either directly or through its respective U.S. or Canadian broker-dealer affiliates or agents. The Offering is being made concurrently in the United States under the terms of a registration statement filed under the United States Securities Act of 1933, as amended (the “Securities Act”) on Form F-10, as amended (File No. 333-272706) (the “Registration Statement”), of which this Prospectus Supplement forms a part, filed with the United States Securities and Exchange Commission (the “SEC”). The Units will be offered in the United States by the Underwriter under a prospectus supplement filed with the SEC, and in Canada by the Underwriter under this Prospectus Supplement. See “Plan of Distribution”.

| |

|

|

Price to the Public(1) |

|

|

Underwriter's Fee(2)(3) |

|

|

Net Proceeds to the

Corporation(3)(4) |

|

| Per Unit |

|

|

US$0.45 |

|

|

US$0.02295 |

|

|

US$0.42705 |

|

| Total |

|

|

US$30,000,000.15 |

|

|

US$1,529,999.98 |

|

|

US$28,470,000.17 |

|

Notes:

(1) The Offering Price was determined by arm's length negotiation between the Corporation and the Underwriter with reference to the then-current market price of the Common Shares (as defined below).

(2) The Corporation has agreed to pay the Underwriter a commission equal to 6.0% of the total gross proceeds of the Offering (the "Underwriter's Fee"). The Underwriter's Fee shall be reduced to 1.5% with respect to total gross proceeds received from the sale of Units to purchasers identified by the Corporation (the "President's List").

(3) Assumes a total of 13,333,335 Units, representing gross proceeds of US$6,000,000.75, are being purchased under the President's List.

(4) After deducting the Underwriter's Fee, but before deducting the expenses of the Offering (estimated to be approximately US$400,000, which together with the Underwriter's Fee, will be paid from the gross proceeds of the Offering).

The Underwriter, as principal, conditionally offers the Units in connection with the Offering, subject to prior sale, if, as and when issued by the Corporation and accepted by the Underwriter in accordance with the conditions contained in the Underwriting Agreement referred to under "Plan of Distribution" and subject to the passing upon of certain legal matters relating to the Offering on behalf of the Corporation by Aird & Berlis LLP with respect to Canadian legal matters and Dorsey & Whitney LLP with respect to United States legal matters, and on behalf of the Underwriter by Bennett Jones LLP with respect to certain Canadian legal matters, and by Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C. with respect to certain United States legal matters.

Subscriptions for the Units will be received subject to rejection or allotment in whole or in part and the Underwriter reserves the right to close the subscription books at any time without notice. Closing of the Offering is expected to occur on or about November 15, 2023, or such other date as the Corporation and the Underwriter may agree (the "Closing Date"), provided that the Units are to be taken up by the Underwriter on or before the date that is not later than 42 days after the date of this Prospectus Supplement. See "Plan of Distribution".

It is expected that the Unit Shares distributed under this Prospectus Supplement will be available for delivery in the book-based system of registration to be registered in the name of CDS Clearing and Depository Services Inc. ("CDS") or its nominee or The Depositary Trust Company ("DTC") and deposited with CDS or DTC on the Closing Date. Generally, a purchaser of Securities will receive only a customer confirmation from the Underwriter or other registered dealer who is a CDS participant (a "CDS Participant") through which the Unit Shares are purchased. For purchasers receiving Unit Shares through CDS's book-based system, CDS will record the CDS Participants who hold Unit Shares on behalf of owners who have purchased Unit Shares in accordance with the book-based system. Definitive certificates representing the Warrants will be available for delivery on the Closing Date.

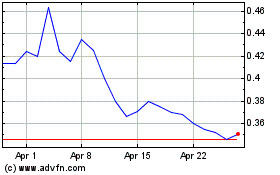

The common shares in the capital of the Corporation (the "Common Shares") are listed on the Neo Exchange Inc., now operating as Cboe Canada (the "NEO") under the trading symbol "CYBN", and in the United States on the NYSE American LLC (the "NYSE American") under the symbol "CYBN". On November 9, 2023, the last trading day prior to the announcement of the Offering, the closing prices of the Common Shares listed on the NEO and NYSE American were $0.70 and US$0.5054, respectively.

The Corporation has applied to list the Unit Shares offered by this Prospectus Supplement, and the Warrant Shares issuable upon exercise of the Warrants, as applicable on the NEO and the NYSE American, respectively. Listing will be subject to the Corporation fulfilling all of the listing requirements of the NEO and the NYSE American, as applicable. The Warrants will not be listed on the NEO or the NYSE American. There is currently no market through which the Warrants may be sold and purchasers may not be able to resell the Warrants purchased under this Prospectus Supplement. This may affect the pricing of the securities in the secondary market, the transparency and availability of trading prices, the liquidity of the securities, and the extent of issuer regulation. See "Risk Factors".

In connection with the Offering, the Underwriter may effect transactions that stabilize or maintain the market price of the Common Shares at levels other than those that may otherwise exist in the open market. Such transactions, if commenced, may be discontinued at any time. After the Underwriter has made reasonable efforts to sell all of the Units at the Offering Price, the Underwriter may subsequently reduce the selling price to investors from time to time in order to sell any of the Units remaining unsold. Any such reduction will not affect the proceeds received by the Corporation. See "Plan of Distribution".

Prospective investors should be aware that the acquisition of the Units, Unit Shares and Warrants (collectively, the "Securities") described herein may have tax consequences both in Canada and the United States. Such consequences, for investors who are resident in, or citizens of, the United States, may not be described fully in this Prospectus Supplement or the accompanying Prospectus, including the Canadian federal income tax consequences applicable to a foreign controlled Canadian corporation that acquires Securities pursuant to this Offering. Investors should read the tax discussion in this Prospectus Supplement and consult their own tax advisors with respect to their own particular circumstances. See "Certain Canadian Federal Income Tax Considerations", "Certain United States Federal Income Tax Considerations to U.S. Holders" and "Risk Factors".

An investment in the Securities is highly speculative and involves significant risks that investors should consider before purchasing such Securities. Investors should carefully review the "Risk Factors" section of this Prospectus Supplement, the Base Shelf Prospectus and the documents incorporated by reference herein and therein as well as the information under the heading "Cautionary Note Regarding Forward-Looking Information".

The Offering is being made by a Canadian issuer that is permitted, under a multijurisdictional disclosure system adopted by the United States and Canada ("MJDS"), to prepare this Prospectus Supplement in accordance with Canadian disclosure requirements. Prospective investors in the United States should be aware that such requirements are different from those of the United States. Financial statements included or incorporated by reference herein have been prepared in accordance with International Financial Reporting Standards, as issued by the International Accounting Standards Board, and may not be comparable to financial statements of United States companies, which are prepared under United States generally accepted accounting principles ("US GAAP"). Such financial statements are subject to the standards of the Public Company Accounting Oversight Board (United States) and the SEC independence standards.

The enforcement by investors of civil liabilities under the United States federal securities laws may be affected adversely by the fact that the Corporation is incorporated under the laws of Ontario, Canada, that the majority of its officers and directors are residents of Canada and that a substantial portion of the assets of the Corporation and said persons are located outside the United States. See "Enforceability of Civil Liabilities by U.S. Investors".

Douglas Drysdale, an officer of the Corporation, resides outside of Canada. He has appointed Maxims CS Inc., Suite 1800, 181 Bay Street, Toronto, Ontario, M5J 2T9, as agent for service of process in Ontario. Prospective purchasers are advised that it may not be possible for investors to enforce judgments obtained in Canada against any person or company that is incorporated, continued or otherwise organized under the laws of a foreign jurisdiction or resides outside of Canada, even if the party has appointed an agent for service of process.

The financial information of the Corporation incorporated by reference in the Prospectus is presented in Canadian dollars. Unless otherwise noted herein, all references to "US$" are to United States dollars and all references to "C$" or "$", are to Canadian dollars. See "Currency and Exchange Rate".

The Corporation's head and registered office is located at 100 King Street West, Suite 5600, Toronto, ON M5X 1C9.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR BY ANY STATE OR CANADIAN SECURITIES COMMISSION OR REGULATORY AUTHORITY, NOR HAS THE SEC OR ANY STATE OR CANADIAN SECURITIES COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS SUPPLEMENT OR THE ACCOMPANYING PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

Sole Book-Running Manager

A.G.P.

TABLE OF CONTENTS

Prospectus Supplement

Base Shelf Prospectus

ABOUT THIS PROSPECTUS

This document consists of two parts. The first part is this Prospectus Supplement, which describes certain terms of the Units that the Corporation is offering and also adds to and updates certain information contained in the Base Shelf Prospectus and the documents incorporated by reference therein. The second part, the Base Shelf Prospectus, gives more general information, some of which may not apply to the Units offered hereunder. Defined terms or abbreviations used in this Prospectus Supplement that are not defined herein have the meanings ascribed thereto in the Base Shelf Prospectus. Investors should rely only on the information contained or incorporated by reference in this Prospectus Supplement and the Base Shelf Prospectus. The Corporation has not, and the Underwriter has not, authorized anyone to provide investors with different or additional information. The Corporation is not, and the Underwriter is not, making an offer to sell Units in any jurisdiction where the offer or sale is not permitted. Investors should not assume that the information appearing in this Prospectus Supplement, the Base Shelf Prospectus or any documents incorporated by reference herein or therein, is accurate as of any date other than the date indicated in those documents, as the Corporation's business, operating results, financial condition and prospects may have changed since such date. Before an investment is made, an investor should carefully read this Prospectus Supplement, the accompanying Base Shelf Prospectus and all information incorporated by reference herein and therein. These documents contain information that should be considered when making an investment decision.

The Corporation filed the Base Shelf Prospectus with the securities commissions in all Canadian provinces and territories (the "Canadian Qualifying Jurisdictions") in order to qualify the offering of the securities described in the Base Shelf Prospectus in accordance with National Instrument 44-102 Shelf Distributions. The Ontario Securities Commission issued a receipt dated August 17, 2023 in respect of the final Base Shelf Prospectus as the principal regulatory authority under Multilateral Instrument 11-102 Passport System, and each of the other commissions in the Canadian Qualifying Jurisdictions is deemed to have issued a receipt under National Policy 11-202 Process for Prospectus Review in Multiple Jurisdictions.

The Base Shelf Prospectus also forms part of the Registration Statement on Form F-10 that the Corporation filed with the SEC on June 16, 2023, as amended August 17, 2023 under the Securities Act utilizing the MJDS. The Registration Statement became effective under the Securities Act on August 17, 2023. The Registration Statement incorporates the Base Shelf Prospectus with certain modifications and deletions permitted by Form F-10. This Prospectus Supplement is being filed by the Corporation, with certain modifications and deletions permitted by Form F-10, with the SEC in accordance with the instructions to Form F-10.

Unless otherwise indicated or the context otherwise requires, all references in this Prospectus Supplement to "Cybin" or the "Corporation", except as otherwise indicated or as the context otherwise indicates, mean Cybin Inc. and its subsidiaries and associated corporations.

This Prospectus Supplement is deemed to be incorporated by reference in the Base Shelf Prospectus solely for the purposes of the Offering. Other documents are also incorporated or deemed to be incorporated by reference in this Prospectus Supplement and in the Base Shelf Prospectus. See "Documents Incorporated by Reference".

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Certain statements contained in this Prospectus Supplement, and in certain documents incorporated by reference herein, constitute "forward-looking information" and "forward-looking statements," within the meaning of applicable securities laws. All statements other than statements of historical fact, including, without limitation, those regarding the Corporation's future financial position, business strategy, budgets, research and development, plans and objectives of management for future operations, and any statements preceded by, followed by or that include the words "expect," "likely", "may," "will," "should," "intend," or "anticipate," "potential," "proposed," "estimate" and other similar words, including negative and grammatical variations thereof, or statements that certain events or conditions "may" or "will" happen, or by discussions of strategy, are forward-looking statements.

These statements are not historical facts but instead represent only the Corporation's expectations, estimates and projections regarding future events. These statements are not guarantees of future performance and involve assumptions, risks and uncertainties that are difficult to predict. Therefore, actual results may differ materially from what is expressed, implied or forecasted in such forward-looking statements. Additional factors that could cause actual results, performance or achievements to differ materially include, but are not limited to, those discussed under "Risk Factors" in the Annual Information Form (as defined herein) and in this Prospectus Supplement and in other documents incorporated by reference herein. Management provides forward-looking statements because it believes they provide useful information to readers when considering their investment objectives and cautions readers that the information may not be appropriate for other purposes. Consequently, all of the forward-looking statements made in this Prospectus Supplement and in documents incorporated by reference herein are qualified by these cautionary statements and other cautionary statements or factors contained herein, and there can be no assurance that the actual results or developments will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, the Corporation. These forward-looking statements are made as of the date of this Prospectus Supplement and the Corporation assumes no obligation to update or revise them to reflect subsequent information, events or circumstances or otherwise, except as required by law.

The forward-looking statements in this Prospectus Supplement and in documents incorporated by reference herein are based on numerous assumptions regarding the Corporation's present and future business strategies and the environment in which the Corporation will operate in the future, including assumptions regarding business and operating strategies, and the Corporation's ability to operate on a profitable basis.

Some of the risks which could affect future results and could cause results to differ materially from those expressed in the forward-looking statements contained herein include: completion of the Offering and receipt of all regulatory and stock exchange approvals; listing of the Unit Shares and Warrant Shares issuable under the Offering; the net proceeds, if any, from sales under this Prospectus Supplement; the Corporation's use of proceeds and business objectives and milestones and the anticipated timing of execution, see "Use of Proceeds"; effects of the coronavirus "COVID-19"; limited operating history; achieving publicly announced milestones; speculative nature of investment risk; early stage of the industry and product development; regulatory risks and uncertainties; "foreign private issuer" status under U.S. securities laws; plans for growth; limited products; limited marketing and sales capabilities; no assurance of commercial success; no profits or significant revenues; reliance on third parties for clinical development activities; risks related to third party relationships; reliance on contract manufacturers; safety and efficacy of products; clinical testing and commercializing products; completion of clinical trials; commercial grade product manufacturing; nature of regulatory approvals; unfavourable publicity or consumer perception; social media; biotechnology and pharmaceutical market competition; reliance on key executives and scientists; employee misconduct; business expansion and growth; negative results of external clinical trials or studies; product liability; enforcing contracts; product recalls; distribution and supply chain interruption; difficulty to forecast; promoting the brand; product viability; success of quality control systems; reliance on key inputs; liability arising from fraudulent or illegal activity; operating risk and insurance coverage; costs of operating as public company; management of growth; conflicts of interest; foreign operations; cybersecurity and privacy risk; environmental regulation and risks; decriminalisation of psychedelics; forward-looking statements may prove to be inaccurate; effects of inflation; political and economic conditions; application and interpretation of tax laws; enforcement of civil liabilities; risks related to intellectual property: trademark protection; trade secrets; patent law reform; patent litigation and intellectual property; protection of intellectual property; third-party licences; financial and accounting risks: substantial number of authorized but unissued Common Shares; dilution; negative cash flow from operating activities; additional capital requirements; lack of significant product revenue; estimates or judgments relating to critical accounting policies; inadequate internal controls; risks related to the Common Shares: market for the Common Shares; significant sales of Common Shares; volatile market price for the Common Shares; tax issues; no dividends; risks related to the Offering: an investment in the Securities is highly speculative; completion of the Offering; negative operating cash flow and going concern; discretion in the use of proceeds; need for additional financing; potential dilution; trading market; significant sales of Common Shares; positive return not guaranteed; the Corporation's expectation that it will be a "passive foreign investment company"; and speculative nature of Warrants.

Although the forward-looking statements are based upon what management currently believes to be reasonable assumptions, the Corporation cannot assure prospective investors that actual results, performance or achievements will be consistent with these forward-looking statements. In particular, the Corporation has made assumptions regarding, among other things:

- substantial fluctuation of losses from quarter to quarter and year to year due to numerous external risk factors, and anticipation that the Corporation will continue to incur significant losses in the future;

- uncertainty as to the Corporation's ability to raise additional funding to support operations;

- the Corporation's ability to access additional funding;

- the fluctuation of foreign exchange rates;

- the duration of COVID-19 and the extent of its economic and social impact;

- the risks associated with the development of the Corporation's product candidates which are at early stages of development;

- reliance upon industry publications as the Corporation's primary sources for third-party industry data and forecasts;

- reliance on third parties to plan, conduct and monitor the Corporation's preclinical studies and clinical trials;

- reliance on third party contract manufacturers to deliver quality clinical and preclinical materials;

- the Corporation's product candidates may fail to demonstrate safety and efficacy to the satisfaction of regulatory authorities or may not otherwise produce positive results;

- risks related to filing investigational new drug applications to commence clinical trials and to continue clinical trials if approved;

- the risks of delays and inability to complete clinical trials due to difficulties enrolling patients;

- competition from other biotechnology and pharmaceutical companies;

- the Corporation's reliance on the capabilities and experience of the Corporation's key executives and scientists and the resulting loss of any of these individuals;

- the Corporation's ability to fully realize the benefits of acquisitions;

- the Corporation's ability to adequately protect the Corporation's intellectual property and trade secrets;

- the risk of patent-related or other litigation; and

- the risk of unforeseen changes to the laws or regulations in the United States, the United Kingdom, Canada, the Netherlands, Ireland and other jurisdictions in which the Corporation operates.

Drug development involves long lead times, is very expensive and involves many variables of uncertainty. Anticipated timelines regarding drug development are based on reasonable assumptions informed by current knowledge and information available to the Corporation. Every patient treated on future studies can change those assumptions either positively (to indicate a faster timeline to new drug applications and other approvals) or negatively (to indicate a slower timeline to new drug applications and other approvals). This Prospectus Supplement and the documents incorporated by reference herein contain certain forward-looking statements regarding anticipated or possible drug development timelines. Such statements are informed by, among other things, regulatory guidelines for developing a drug with safety studies, proof of concept studies, and pivotal studies for new drug application submission and approval, and assumes the success of implementation and results of such studies on timelines indicated as possible by such guidelines, other industry examples, and the Corporation's development efforts to date.

In addition to the factors set out above and those identified under the heading "Risk Factors" in the Annual Information Form and in this Prospectus Supplement, other factors not currently viewed as material could cause actual results to differ materially from those described in the forward-looking statements. Although the Corporation has attempted to identify important risks and factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors and risks that cause actions, events or results not to be anticipated, estimated or intended. Accordingly, readers should not place any undue reliance on forward-looking statements.

Many of these factors are beyond the Corporation's ability to control or predict. These factors are not intended to represent a complete list of the general or specific factors that may affect the Corporation. The Corporation may note additional factors elsewhere in this Prospectus Supplement and in any documents incorporated by reference herein. All forward-looking statements speak only as of the date made. All subsequent written and oral forward-looking statements attributable to the Corporation, or persons acting on the Corporation's behalf, are expressly qualified in their entirety by the cautionary statements. Except as required by law, the Corporation undertakes no obligation to update any forward-looking statement.

The forward-looking statements contained in this Prospectus Supplement and the documents incorporated by reference herein are expressly qualified in their entirety by the foregoing cautionary statement. Investors should read this entire Prospectus, including the Annual Information Form, the documents incorporated by reference herein, and each applicable Prospectus Supplement, and consult their own professional advisers to ascertain and assess the income tax and legal risks and other aspects associated with holding ssecurities of the Corporation.

DOCUMENTS INCORPORATED BY REFERENCE

This Prospectus Supplement is deemed to be incorporated by reference in the Base Shelf Prospectus solely for the purpose of the Offering.

As at the date hereof, the following documents of the Corporation filed with the securities commissions or similar authorities in Canada are incorporated by reference in this Prospectus Supplement:

1. annual information form of the Corporation dated June 27, 2023 (the "Annual Information Form") for the year ended March 31, 2023;

2. audited consolidated financial statements of the Corporation and the notes thereto as at and for the fiscal years ended March 31, 2023 and 2022, together with the auditor's report thereon;

3. management's discussion and analysis of the Corporation for the year ended March 31, 2023;

4. unaudited interim condensed consolidated financial statements of the Corporation and the notes thereto for the three months ended June 30, 2023 (the "Interim Financial Statements");

5. management's discussion and analysis of the Corporation for the three months ended June 30, 2023 (the "Interim MD&A");

6. management information circular of the Corporation dated September 13, 2023 relating to an annual and special meeting of shareholders of the Corporation held on October 12, 2023;

7. material change report dated May 31, 2023 relating to the sale of up to US$30,000,000 of Common Shares to Lincoln Park Capital Fund, LLC ("LPC") pursuant to the terms of the purchase agreement entered into between LPC and the Corporation on May 30, 2023 (the "Purchase Agreement");

8. material change report dated August 8, 2023 relating to the public offering (the "August 2023 Unit Offering") of 24,264,706 units of the Corporation (the "Units") at a price of US$0.34 per Unit for gross proceeds of US$8,250,000 pursuant to a prospectus supplement dated August 1, 2023 (the "August Supplement") to the Corporation's short form base shelf prospectus dated July 5, 2021;

9. material change report dated August 23, 2023 relating to the renewal of the Corporation's previously established at-the-market equity program (the "2023 ATM Program") that allows the Corporation to issue and sell up to US$35,000,000 of Common Shares to the public from time to time, pursuant to a prospectus supplement dated August 23, 2023 to the Base Shelf Prospectus;

10. material change report dated August 23, 2023 with respect to the requalification of the Purchase Agreement pursuant to a prospectus supplement dated August 23, 2023 to the Base Shelf Prospectus;

11. material change report dated September 7, 2023 with respect to the acquisition of Small Pharma Inc. ("Small Pharma") by the Corporation pursuant to the terms of a definitive agreement (the "Arrangement Agreement") under which the Corporation will acquire all of the issued and outstanding common shares of Small Pharma pursuant to a court-approved plan of arrangement (the "Arrangement");

12. material change report dated October 25, 2023 with respect the closing of the Arrangement with Small Pharma; and

13. business acquisition report dated October 27, 2023 relating to the Arrangement.

Any document of the type referred to in Section 11.1 of Form 44-101F1 - Short Form Prospectus Distributions filed by the Corporation with a securities commission or similar regulatory authority in Canada subsequent to the date of this Prospectus Supplement and prior to the termination of this distribution shall be deemed to be incorporated by reference in the Prospectus Supplement for the purposes of the Offering.

In addition, to the extent any such document is included in any report on Form 6-K furnished to the SEC or in any report on Form 40-F or 20-F, as applicable, (or any respective successor form) filed with the SEC subsequent to the date of this Prospectus Supplement, such document shall be deemed to be incorporated by reference as exhibits to the Registration Statement of which this Prospectus Supplement forms a part (in the case of any report on Form 6-K, if and to the extent expressly set forth in such report). In addition, any other report on Form 6-K and the exhibits thereto filed or furnished by the Corporation with the SEC, and any other reports filed, under the United States Securities Exchange Act of 1934, as amended (the "Exchange Act") from the date of this Prospectus Supplement shall be deemed to be incorporated by reference as exhibits to the Registration Statement of which this Prospectus Supplement forms a part, but only if and to the extent expressly so provided in any such report.

Copies of the documents incorporated by reference herein will be available electronically on the Corporation's SEDAR+ profile, which can be accessed at www.sedar.com, and from the Corporation's EDGAR profile at www.sec.gov/edgar. The Corporation's filings through SEDAR+ and EDGAR are not incorporated by reference in the Prospectus except as specifically set out herein.

Any statement contained in this Prospectus Supplement or in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for the purposes of the Offering to the extent that a statement contained herein or in any subsequently filed document which also is or is deemed to be incorporated by reference in this Prospectus Supplement or Base Shelf Prospectus modifies or supersedes that statement. Any statement so modified or superseded shall not constitute a part of this Prospectus Supplement except as so modified or superseded. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made.

DOCUMENTS FILED AS PART OF THE REGISTRATION STATEMENT

The following documents have been or will be filed with the SEC as part of Registration Statement: (i) the documents set out under the heading "Documents Incorporated by Reference" in this Prospectus Supplement and the Base Shelf Prospectus; (ii) the consents of the Corporation's auditor and legal counsels; (iii) powers of attorney from certain of the Corporation's directors and officers (included on the signature page of the Registration Statement); and (iv) the Underwriting Agreement described in this Prospectus Supplement.

CURRENCY AND EXCHANGE RATE INFORMATION

In this Prospectus Supplement, unless otherwise indicated, all dollar amounts and references to "US$" are to U.S. dollars and references to "C$" and "$" are to Canadian dollars. This Prospectus Supplement contains translations of some Canadian dollar amounts into U.S. dollars solely for convenience.

The following table sets forth, for the periods indicated, the high, low, average and period-end rates of exchange for US$1.00, expressed in Canadian dollars, posted by the Bank of Canada:

| |

|

Year Ended December 31, 2022 |

| Highest rate during the period |

|

C$1.3856 |

| Lowest rate during the period |

|

C$1.2540 |

| Average rate for the period |

|

C$1.3283 |

| Rate at the end of the period |

|

C$1.3544 |

On November 9, 2023, the daily average exchange rate posted by the Bank of Canada for conversion of U.S. dollars into Canadian dollars was US$1.00 = C$1.3781 (the "2023 Rate"). Unless otherwise indicated, currency translation in this Prospectus Supplement reflects the 2023 Rate.

THE CORPORATION

This summary does not contain all the information that may be important to an investor in deciding whether to invest in the Securities. An investor should read the entire Prospectus, including the section entitled "Risk Factors", the applicable Prospectus Supplement, and the documents incorporated by reference herein, including the Annual Information Form, before making such decision.

Summary of the Business

The Corporation is a clinical-stage biopharmaceutical company on a mission to create safe and effective psychedelic-based therapeutics to address the unmet need for new and innovative treatment options for people who suffer from mental health conditions. The Corporation's goal of revolutionizing mental healthcare is supported by a network of world-class partners and internationally recognized scientists aimed at progressing proprietary drug discovery platforms, innovative drug delivery systems, and novel formulation approaches and treatment regimens.1

The Corporation's research and development work focuses on a three-pillar strategy that leverages the Corporation's core competencies in preclinical innovation and clinical development. This strategy supports the creation of intellectual property focused on developing the Corporation's platform technology, the progression of clinical development programs including CYB003, a deuterated psilocybin analog, CYB004, a deuterated version of N, N-dimethyltryptamine, CYB005, phenethylamine derivatives, and an expansive list of preclinical molecules to facilitate future drug development opportunities.

1 This is a forward-looking statement that involves material assumptions by the Corporation. Drug development involves long lead times, is very expensive and involves many variables of uncertainty. Anticipated timelines regarding drug development are based on reasonable assumptions informed by current knowledge and information available to the Corporation. Such statements are informed by, among other things, regulatory guidelines for developing a drug with safety studies, proof of concept studies, and pivotal studies for new drug application submission and approval, and assumes the success of implementation and results of such studies on timelines indicated as possible by such guidelines, other industry examples, and the Corporation's development efforts to date.

On October 23, 2023, the Corporation completed the Arrangement pursuant to which Small Pharma became a wholly-owned subsidiary of the Corporation. Prior to the Arrangement, Small Pharma was a biotechnology company focused on developing short-duration psychedelic-assisted therapies for the treatment of mental health conditions. Small Pharma initiated programs across its "First-generation" and "Second-generation" psychedelics portfolio. First-generation psychedelics refer to the well-known classic psychedelics which includes psilocybin, dimethyltryptamine ("DMT"), and Lysergic acid diethylamide. Second-generation psychedelics refer to those that have been chemically modified with the aim to optimize their therapeutic benefit. Small Pharma focused on the development of its pharmaceutical psychedelic assets with the inclusion of supportive therapy, anticipating this treatment paradigm to be important for optimizing beneficial patient outcomes.

With a common goal to create novel, optimized psychedelic-based therapeutics, the combination of the Corporation and Small Pharma creates a leading international, clinical-stage company with potential to transform the treatment paradigm for mental health conditions. The companies' combined development portfolios are highly complementary and provide multiple opportunities to create operational and cost synergies.

As a result of the Arrangement, the Corporation now currently has 33 granted patents and over 170 pending patent applications.

Advancement of Mental Healthcare

The Corporation is conducting research and development of psychedelic therapeutics that aim to address unmet needs in the treatment of mental health conditions. This comprehensive development work is predicated on structural modifications of known tryptamine and phenethylamine derivatives to improve their pharmacokinetic properties while maintaining their respective pharmacology.

Across its extensive research and development programs, the Corporation is evaluating a wide array of novel, synthetic psychedelic active pharmaceutical ingredients intended to be delivered through innovative drug delivery systems including via inhalation, via intravenous, and intramuscular, or subcutaneous administration2.

The Corporation intends to apply for regulatory approval for therapies targeting indications such as major depressive disorder ("MDD"), alcohol use disorder, generalized anxiety disorder and potentially other various mental health conditions3. The Corporation is also developing compounds that may have the potential to address neuroinflammation4, central nervous system disorders, and psychiatric disorders5.

For additional information in respect of the Corporation and its operation, please see the Interim MD&A incorporated by reference into this Prospectus Supplement.

Recent Developments

Other than as set forth below and generally in this Prospectus Supplement, the Base Shelf Prospectus or the documents incorporated by reference herein, there have been no material developments in the business of the Corporation since August 11, 2023, the date of the Corporation's most recently issued Interim Financial Statements and Interim MD&A.

On August 15, 2023, the Corporation announced that the U.S. Patent and Trademark Office ("USPTO") had granted U.S. patent 11,724,985, to a deuterated psilocybin analog in the Corporation's CYB003 investigational drug program. The patent, which is expected to provide exclusivity until 2041, includes composition of matter claims to deuterated tryptamines in support of the Corporation's clinical-stage programs, CYB003, a proprietary deuterated psilocybin analog being developed for the potential treatment of MDD (the "Deuterated Psilocybin Analog Program"), and CYB004, a proprietary deuterated DMT (the "Deuterated Dimethyltryptamine Program"), in addition to other of the Corporation's preclinical programs.

On August 17, 2023, the Corporation announced that it had initiated preparations for good manufacturing practices production of a capsule formulation of CYB003 as part of its Deuterated Psilocybin Analog Program in development for the potential treatment of MDD.

On August 23, 2023, the Corporation announced the filing of a prospectus supplement under the Base Shelf Prospectus to renew its previously established the 2023 ATM Program that allows the Corporation to issue and sell up to US$35,000,000 of Common Shares from treasury to the public, from time to time. Distributions of Common Shares under the 2023 ATM Program will be made pursuant to the terms and conditions of an at-the-market equity distribution agreement (the "Distribution Agreement") dated August 23, 2023 among the Corporation, Cantor Fitzgerald Canada Corporation and Cantor Fitzgerald & Co. The 2023 ATM Program is effective until the earlier of the issuance and sale of all of the Common Shares issuable pursuant to the 2023 ATM Program and September 17, 2025, unless earlier terminated in accordance with the terms of the Distribution Agreement.

On August 23, 2023, the Corporation also announced the filing of a prospectus supplement under the Base Shelf Prospectus, requalifying the Corporation's Purchase Agreement on the same terms as those entered into on May 30, 2023 with LPC.

On September 5, 2023, the Corporation announced that the USPTO had granted U.S. patent 11,746,088, covering composition of matter for deuterated tryptamine compounds and pharmaceutical compositions thereof, with exclusivity until 2041. The newly granted U.S. patent covers deuterated 5-methoxy-dimethyltryptamine analogs in the Corporation's pre-clinical deuterated tryptamine portfolio and further strengthens the Corporation's leadership position in the development of potential best-in-class deuterated tryptamine-based therapeutics for the treatment of mental health conditions.

On September 21, 2023, the Corporation announced that it had completed enrollment in its Phase 2a study under its Deuterated Psilocybin Analog Program (CYB003). All participants in the final cohort received at least one dose (placebo or 16mg of CYB003) with several second doses already administered, and no serious adverse events observed in participants. To date, CYB003 has demonstrated a favorable safety and tolerability profile at all doses evaluated in the five completed cohorts (1mg, 3mg, 8mg, 10mg, and 12mg).

On September 26, 2023, the Corporation announced an agreement with Fluence, a leading continuing education organization in psychedelic therapy, to support the streamlining and scaling of the Corporation's EMBARK facilitator training program in preparation for a multi-site, global Phase 3 trial under its Deuterated Psilocybin Analog Program (CYB003). This streamlined model of psychedelic facilitation training, known as EMBARK for Clinical Trials, is designed for individuals with existing experience, knowledge, and skills in psychedelic facilitation. Under the terms of the agreement, Fluence will support the Corporation in the selection and training of facilitators for the planned Phase 3 trial. Fluence will also create supplemental video content and provide asynchronous and synchronous training in service of augmenting and verifying facilitator competencies.

On October 3, 2023, the Corporation announced that it had completed dosing in Cohort 6 of its Phase 2a study under its Deuterated Psilocybin Analog Program (CYB003). The following doses were evaluated in the six cohorts that comprised the Phase 2a study: 1mg, 3mg, 8mg, 10mg, 12mg, and 16mg. As of that date, CYB003 has been shown to be safe and tolerable at all doses evaluated with no serious adverse events or discontinuations due to adverse events having been observed in the final dose cohort.

On October 25, 2023, the Corporation announced that the USPTO had issued two patent grants that offer protection for its Deuterated Dimethyltryptamine Program (CYB004). The granted patents protecting the Corporation's Deuterated Dimethyltryptamine Program (CYB004) are (i) United States patent no. 11,771,681, which provides composition of matter protection for certain deuterated analogs of DMT, and (ii) United States patent no. 11,773,062, which provides protection for the medical use and the novel, efficient and scalable synthesis of certain analogs of DMT.

On October 26, 2023, the Corporation announced that the European Patent Office ("EP") had granted a patent protecting the Corporation's Deuterated Psilocybin Analog Program (CYB003) and Deuterated Dimethyltryptamine Program (CYB004). EP patent no. 4,031,529 provides composition of matter protection for certain deuterated tryptamine compounds, including deuterated psilocybin analogs within the Deuterated Psilocybin Analog Program (CYB003) and deuterated analogs of DMT within the Deuterated Dimethyltryptamine Program (CYB004), as well as their medical use.

On October 31, 2023, the Corporation announced Phase 2a interim results for its Deuterated Psilocybin Analog Program (CYB003), demonstrating a rapid, robust and statistically significant reduction in symptoms of depression three weeks following a single 12mg dose compared to placebo. At the 3-week primary efficacy endpoint, the reduction in MDD symptoms, defined as change from baseline in the Montgomery-Asberg Depression Rating Scale ("MADRS") total score, was superior in participants assigned to CYB003 compared to the participants who received placebo by 14.08 points (p=0.0005, Cohen's d=2.15).

On November 10, 2023, the Corporation issued a notice of suspension of the Purchase Agreement to LPC in the context of announcing the Offering. The Corporation sold a total of US$465,273 under the Purchase Agreement prior to the suspension of sales. No further Common Shares will be sold to LPC pursuant to the August Supplement or the Base Shelf Prospectus, unless such documents are amended to qualify further sales under the Purchase Agreement or sales under the Purchase Agreement are otherwise qualified and all necessary regulatory approvals are obtained.

Small Pharma Acquisition

On August 28, 2023, the Corporation entered into the Arrangement Agreement with Small Pharma pursuant to which the Corporation agreed to acquire all of the issued and outstanding shares of Small Pharma (each, a "Small Pharma Share") in an all-equity business combination transaction to be completed by way of a plan of arrangement under the Business Corporations Act (British Columbia).

On September 13, 2023, Small Pharma was granted an interim order (the "Interim Order") by the Supreme Court of British Columbia (the "Court") regarding the Arrangement. The Interim Order authorized Small Pharma to proceed with various matters relating to the Arrangement, including the holding of a special meeting of Small Pharma shareholders to consider and vote on the Arrangement. Completion of the Arrangement was conditional upon receipt of a final order by the Court. Small Pharma was granted a final order by the Court on October 17, 2023.

On September 21, 2023, the Corporation announced the date for its annual and special meeting of shareholders (the "Special Meeting") to be held on October 12, 2023 in connection with, among other things, the Arrangement. At the Special Meeting, shareholders of the Corporation passed an ordinary resolution approving the issuance by the Corporation of up to such number of Common Shares as may be required to be issued pursuant to the Arrangement in accordance with the terms of the Arrangement Agreement.

On October 23, 2023, the Corporation announced the completion of the Arrangement. As a result of the Arrangement, Small Pharma shareholders received 0.2409 of a Common Share in exchange for each Small Pharma Share held immediately prior to closing of the Arrangement. In aggregate, the Corporation issued 80,945,300 Common Shares pursuant to the Arrangement to former Small Pharma shareholders as consideration for their Small Pharma Shares. Small Pharma is now a wholly-owned subsidiary of the Corporation, and the Small Pharma Shares were delisted from the TSX Venture Exchange on October 25, 2023.

Effective October 23, 2023, in connection with the Arrangement, George Tziras, the former Chief Executive Officer of Small Pharma, was appointed to the Board of Directors and will also serve as the Corporation's Chief Business Officer.

Intercorporate Relationships

As at the date of this Prospectus Supplement, the Corporation's corporate structure includes the following material wholly-owned subsidiaries:

Note:

(1) The shareholders of Adelia Therapeutics Inc. ("Adelia") hold certain non-voting securities of Cybin U.S. issued in connection with the acquisition of Adelia on December 14, 2020 (the "Adelia Transaction"). For additional information in respect of the Adelia Transaction, please see the Annual Information Form incorporated by reference in this Prospectus Supplement.

DESCRIPTION OF SECURITIES BEING DISTRIBUTED

Units

The Offering consists of 66,666,667 Units at a price of US$0.45 per Unit. Each Unit will consist of one Unit Share and one Warrant. The Units Shares and Warrant Shares comprising the Units and Warrants, respectively, will have the same rights and entitlements as the Common Shares set forth below.

Common Shares

The Corporation is authorized to issue an unlimited number of Common Shares and an unlimited number of preferred shares. As at November 9, 2023, the Corporation had 339,242,044 Common Shares and nil preferred shares issued and outstanding.

Each Common Share entitles the holder thereof to one vote at meetings of shareholders of the Corporation other than meetings of the holders of another class of shares. Each holder of Common Shares is also entitled to receive dividends if, as and when declared by the board of directors of the Corporation. Holders of Common Shares are entitled to participate in any distribution of the Corporation's net assets upon liquidation, dissolution or winding-up on an equal basis per share. There are no pre-emptive, redemption, retraction, purchase or conversion rights attaching to the Common Shares.

Common Shares may be sold separately or together with certain other Securities under this Prospectus Supplement. Common Shares may also be issuable on conversion, exchange, exercise or maturity of certain other Securities qualified for issuance under this Prospectus Supplement.

Warrants

The Warrants will not be issued under a warrant indenture and will be represented and governed by the provisions of stand-alone warrant certificates. The following is a brief summary of the material terms of the Warrants. This summary does not purport to be complete and is qualified in all respects by the provisions contained in the form of certificate representing and governing the Warrants.

Each Warrant will entitle the holder thereof to acquire, subject to adjustment in certain circumstances, one Warrant Share at the Warrant Exercise Price at any time on or after the six (6) month anniversary of the Closing Date (the "Initial Exercise Date") until the Warrant Expiry Date. From the Initial Exercise Date until the Warrant Expiry Date, upon any consecutive twenty (20) day trading period that the Common Shares on the NYSE American (or such other principal exchange or market on which the Common Shares are listed and posted for trading) trade at a volume-weighted average price that is equal to or greater than US$1.50 per Common Share for each of such trading day with aggregate trading volume during the same period of at least 40 million Common Shares, the Corporation shall have the right, but not the obligation, to accelerate the Warrant Expiry Date of the Warrants to the date that is thirty (30) days following the delivery of a notice to the holders of the Warrants, pursuant to the terms of the Warrant Certificate.

Unless otherwise specified in the applicable Warrant, the holder will not have the right to exercise any portion of the Warrant if the holder (together with its affiliates) would beneficially own in excess of 4.99% of the number of Common Shares outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the Warrants. By written notice to the Corporation and subject to certain conditions, the holder may increase or decrease the foregoing percentage to any other percentage not in excess of 9.99%.

If at any time during the exercise period of the Warrant, a prospectus or registration statement covering the Warrant Shares issuable upon exercise of the Warrant that are the subject of such exercise notice is not available for the sale of such Warrant Shares, then in lieu of making the cash payment otherwise contemplated to be made to the Corporation upon such exercise in payment of the aggregate exercise price, the Warrant may be exercised by an election of the holder to receive upon such exercise the "net number" of Warrant Shares determined according to a formula set forth in the warrant certificate.

Subject to applicable laws, the Warrants may be transferred at the option of the holders upon surrender of the warrant certificates to the Corporation.

The Warrant Certificate provides for certain adjustments in the number of Warrant Shares issuable upon the exercise of the Warrants and/or the exercise price per Warrant Share upon the occurrence of certain events, including, but not limited to:

- stock dividends;

- subdivision of the Common Shars into a larger number of shares;

- combines (including by way of reverse stock split) outstanding Common Shares into a smaller number of shares;

- issues by reclassification of Common Shares any shares in the capital of the Company;

- subsequent rights offerings; and

- pro-rata distributions.

The Warrant Certificate provides for adjustments in the class and/or number of securities issuable upon exercise of the Warrants and/or exercise price per security in the event of the following events: (a) the Corporation, directly or indirectly, in one or more related transactions effects any merger or consolidation of the Corporation with or into another corporation or other entity, (b) the Corporation, directly or indirectly, effects any sale, lease, license, assignment, transfer, conveyance or other disposition of all or substantially all of its assets in one or a series of related transactions, (c) any, direct or indirect, purchase offer, tender offer or exchange offer (whether by the Corporation or another corporation or entity) is completed pursuant to which holders of Common Shares are permitted to sell, tender or exchange their shares for other securities, cash or property and has been accepted by the holders of 50% or more of the outstanding Common Shares, (d) the Corporation, directly or indirectly, in one or more related transactions effects any reclassification, reorganization or recapitalization of the Common Shares or any compulsory share exchange pursuant to which the Common Shares are effectively converted into or exchanged for other securities, cash or property, or (e) the Company, directly or indirectly, in one or more related transactions consummates a stock or share purchase agreement or other business combination (including, without limitation, a reorganization, recapitalization, spin-off, merger or scheme of arrangement) with another corporation or entity whereby such other corporation or entity or group acquires more than 50% of the outstanding Common Shares (not including any Common Shares held by the other corporation or entity making or party to, or associated or affiliated with the other corporation or entity making or party to, such stock or share purchase agreement or other business combination) (each, a "Fundamental Transaction"), in which case each holder of a Warrant which is thereafter exercised will receive, in lieu of Common Shares, the kind and number or amount of other securities or property which such holder would have been entitled to receive as a result of such event if such holder had exercised the Warrants prior to the event.

The Corporation also covenants in the Warrant Certificate that, during the period in which the Warrants are exercisable, it will give notice to holders of Warrants of certain stated events, including events that would result in an adjustment to the exercise price for the Warrants or the number of Warrant Shares issuable upon exercise of the Warrants, at least five (5) days prior to the record date or effective date, as the case may be, of such events.

No fractional Common Shares will be issuable to any holder of Warrants upon the exercise thereof. As to any fraction of a Common Share which the holder would otherwise be entitled to purchase upon such exercise, the Corporation shall, at its election, either pay a cash adjustment in respect of such fraction in an amount equal to such fraction multiplied by the Warrant Exercise Price or round up to the next whole Common Share. The holding of Warrants will not make the holder thereof a shareholder of the Corporation or entitle such holder to any right or interest in respect of the Warrants except as expressly provided in the Warrant Certificate. Holders of Warrants will not have any voting or pre-emptive rights or any other rights of a holder of Common Shares.

In no event may the exercise price of or the number of Warrant Shares subject to any Warrant be amended, nor may the right to exercise that Warrant be waived, without the written consent of the holder of that Warrant.

USE OF PROCEEDS

The net proceeds to the Corporation from the Offering (after deducting the Underwriter's Fee of US$1,529,999.98 and estimated expenses of this Offering of US$400,000) will be approximately US$28,070,000.17 (assuming a total of 13,333,335 Units are sold to purchasers on the President's List).

The Corporation intends to use the net proceeds from the Offering as follows:

| Proceeds |

|

Offering Amount |

|

| Offering |

|

US$30,000,000.15 |

|

| Underwriter's Fee(1) |

|

US$1,529,999.98 |

|

| Estimated expenses of the Offering |

|

US$400,000.00 |

|

| |

|

|

|

Net Proceeds

|

|

US$28,070,000.17 |

|

| |

|

|

|

| Use of Proceeds |

|

Offering Amount |

|

| Deuterated Psilocybin Analog Program(2) |

|

|

|

| |

Initiate a Phase 3 Study of CYB003 in MDD |

|

US$6,393,000 |

|

| Deuterated Dimethyltryptamine Program(3) |

|

|

|

| |

Initiate a Phase 2 Proof-Of-Concept Study |

|

US$597,000 |

|

| |

Initiate a Subcutaneous Formulation Study |

|

US$780,000 |

|

| Phenethylamine Derivatives Program |

|

- |

|

| Technology Programs |

|

- |

|

| Working Capital, and General Corporate Purposes(4) |

|

US$20,300,000.17 |

|

| Total |

|

US$28,070,000.17 |

|

Notes:

(1) Assuming US$6,000,000.75 of purchasers under the President's List.

(2) The Corporation's Phase 1/2a trial is a randomized, double-blind, placebo-controlled study evaluating CYB003, an orally delivered deuterated psilocybin analog that aims to address the limitations of oral psilocybin, in participants with moderate to severe MDD and in healthy volunteers. The study will investigate the safety, tolerability, pharmacokinetics ("PK") and pharmacodynamics ("PD"), and psychedelic effect of ascending oral doses of CYB003. The Corporation has engaged Clinilabs Drug Development Corporation, a full-service contract research organization with deep expertise in central nervous system drug development, to carry out the Phase 1/2a clinical trial of CYB003. As of October 3, 2023, the Corporation had completed dosing of Cohort 6, being the final cohort of its Phase 2a study of CYB003. On October 31, 2023, the Corporation announced Phase 2a interim results for CYB003, demonstrating a rapid, robust and statistically significant reduction in symptoms of depression three weeks following a single 12mg dose compared to placebo. The Corporation intends to provide the topline data readout from its Phase 1/2a study in Q4 2023 and complete the submission with the U.S. Food and Drug Administration (the "FDA") of CYB003 Phase 1/2a data for the end of Phase 2 meeting in Q4 2023.6 Following the completion of these milestones being met, the Corporation expects to spend approximately $8,810,193 (US$6,393,000) towards initiating a Phase 3 study of CYB003 in Q1 2024.

6 Anticipated timelines regarding drug development are based on reasonable assumptions informed by current knowledge and information available to the Company. Such statements are informed by, among other things, regulatory guidelines for developing a drug with safety studies, proof of concept studies, and pivotal studies for new drug application submission and approval, and assumes the success of implementation and results of such studies on timelines indicated as possible by such guidelines, other industry examples, and the Company's development efforts to date.

(3) The Corporation's Deuterated Dimethyltryptamine Program is focused on the development of CYB004, a deuterated version of N, N - DMT. The Phase 1 trial of CYB004-E is a three-part study evaluating the safety, PK and PD of escalating doses of DMT and CYB004 in healthy volunteers. The three-part study design was established in a protocol amendment to the initial study design, allowing the Corporation to commence first-in-human dosing of CYB004 sooner than initially planned. The study is expected to provide essential safety and dosing optimization data to inform the clinical path forward for CYB004. The CYB004-E study, acquired from Entheon Biomedical Corp., is being conducted at the Centre for Human Drug Research in the Netherlands and is one of the largest Phase 1 DMT clinical trials to date. Per the protocol amendment, Cybin established a three-part study to include Part A (IV DMT infusion), Part B (IV DMT bolus + infusion) and Part C (IV CYB004 bolus + infusion) in healthy volunteers. The Corporation was able to rely upon completed preclinical data to gain regulatory authorization to add CYB004 to the CYB004-E DMT study. On May 9, 2023, the Corporation announced that it had completed dosing for the last subject in Part B of the Phase 1 CYB004-E trial. On May 24, 2023, the Corporation announced that it had initiated first-in-human dosing of CYB004 in Part C of the Phase 1 CYB004-E trial. The Corporation intends to provide the topline data readout from the Phase 1 CYB004-E trial in Q4 2023 and complete the FDA Investigational New Drug submission in Q1 2024. 7 In addition, following the Arrangement, the Corporation intends to provide a data readout from the Phase 1 SPL028 study in Q4 2023. 8 Following the completion of these milestones, the Corporation expects to spend approximately $822,726 (US$597,000) towards initiating a Phase 2 proof-of-concept study in Q1 2024, approximately $1,074,918 (US$780,000) towards initiating subcutaneous formulation study in Q1 2024.

(4) Includes personnel costs, professional services, overhead expenses and general expenses to be incurred by the Corporation in the normal course of business. In addition, the Corporation intends to use a portion of these proceeds to continue funding both its Deuterated Psilocybin Analog and Deuterated Dimethyltryptamine programs. The allocation between these programs and specific milestones within the programs have not yet been determined.

The Corporation believes it is prudent, particularly at the Corporation's stage of development and the competitive industry landscape, to secure capital for general corporate and working capital purposes to ensure that the Corporation maintains sufficient liquidity and capital resources in the near to medium term. At any given time, the Corporation may be engaged in discussions and activities in respect of potential growth initiatives and other strategic opportunities that are complementary or accretive to the Corporation's business, which may include acquisitions or other investments. Some of the suppliers and services providers of the Corporation may be associated or affiliated with parties who have invested in the Corporation from time to time. As of the date of this Prospectus Supplement, the Corporation has not identified any specific investments or projects, nor any probable or significant acquisitions it wishes to undertake; however, it is important for the Corporation to have funds available to quickly and opportunistically pursue such opportunities as they arise. Given uncertain market conditions, the Corporation believes it is prudent to complete the Offering in order to further increase the Corporation's cash on hand.

The use of the net proceeds of the Offering is subject to change due to the influence of many evolving variables, including those as described under "Stage of Development of Principal Products" in the Annual Information Form and "Non-Revenue Generating Projects" in the Interim MD&A, any changes in legislation and regulations, applications for licenses and the receipt of required licenses, renewals and other regulatory approvals. As a result, the Corporation cannot provide definitive details with respect to timing or specific uses of the net proceeds of the Offering. Such decisions will depend on market and competitive factors, as described herein, as they evolve over time. See "Cautionary Statement Regarding Forward-Looking Statements" and "Risk Factors".

There may be circumstances where for sound business reasons, the Corporation reallocates the use of proceeds depending on the amount of proceeds raised, the time periods in which the proceeds are raised, developments in relation to potential growth initiatives and other strategic opportunities or unforeseen events, see "Risk Factors - Risks Related to the Offering - Discretion in the Use of Proceeds".

Since inception, the Corporation has financed its operations primarily from the issuance of equity and interest income on funds available for investment. To date, the Corporation has raised approximately C$156,500,000 in gross proceeds through private placement and prospectus offerings. The Corporation has experienced operating losses and cash outflows from operations since incorporation and will require ongoing financing to continue its research and development activates. As the Corporation has not yet achieved profitability, there are uncertainties regarding its ability to continue as a going concern. The Corporation has not earned any revenue or reached successful commercialization of any products. The Corporation's success is dependent upon the ability to finance its cash requirements to continue its activities. There is no assurance that additional capital or other types of financing will be available if needed or that these financings will be on terms at least as favourable to the Corporation as those previously obtained, or at all. To the extent that the Corporation has negative operating cash flows in future periods, it may need to deploy a portion of its existing working capital to fund such negative cash flows. The Corporation will be required to raise additional funds through the issuance of additional equity securities, through loan financing, or other means, such as through partnerships with other companies and research and development reimbursements. There is no assurance that additional capital or other types of financing will be available if needed or that these financings will be on terms at least as favourable to the Corporation as those previously obtained. See "Risk Factors - Risks Related to an Offering - Negative Operating Cash Flow and Going Concern".

8 See footnote 7. The Corporation is continuing to assess the SPL028 study and will provide further information and updates upon completion of the integration of Small Pharma's business following the Arrangement.

Until applied, the net proceeds will be held as cash balances in the Corporation's bank account or invested in certificates of deposit and other instruments issued by banks or obligations of or guaranteed by the Government of Canada or any province thereof in accordance with the Corporation's investment policies.

For detailed information in respect of the Corporation's business objectives and milestones, sources and use of capital, and the application of proceeds from prior offerings by the Corporation, prospective purchasers should carefully consider the information described in the Base Shelf Prospectus, Annual Information Form and the Interim MD&A, to which there has been no material changes since the date of the applicable document that have not otherwise been disclosed herein.

CONSOLIDATED CAPITALIZATION

There have been no material changes in the Corporation's share or loan capitalization on a consolidated basis since the date of the Interim Financial Statements, other than in connection with: (a) the issuance of 24,264,706 Units in connection with the August 2023 Unit Offering, with each Unit comprised of one Common Share and one Common Share purchase warrant; (b) the issuance of 80,945,300 Common Shares pursuant to the Arrangement to former Small Pharma shareholders as consideration for their Small Pharma Shares; and (c) the issuance of 25,607,238 Common Shares pursuant to the Corporation's at-the-market equity programs.

The following table sets forth the Corporation's cash, indebtedness and shareholders' equity as of June 30, 2023: (a) on an actual basis; and (b) after giving effect to the Offering. This table should be read in conjunction with the Interim Financial Statements and Interim MD&A.

| Description of Capital |

|

June 30, 2023 |

|

|

As at June 30, 2023, after

giving effect to the Offering(1) |

|

| Cash and Cash Equivalents(1) |

|

C$9,349,000 |

|

|

C$48,583,507(2) |

|

| Loans and Borrowings |

|

Nil |

|

|

Nil |

|

| Common Shares |

|

208,325,846 |

|

|

274,992,513(3) |

|

| Stock options |

|

40,980,425 |

|

|

40,980,425 |

|

| Compensation warrants |

|

868,740 |

|

|

868,740 |

|

| Common Share purchase warrants |

|

23,230,485 |

|

|

23,230,485(4) |

|

| Class B Shares (as defined below)(5) |

|

530,542.1 |

|

|

530,542.1 |

|

Notes:

(1) Proceeds from the Offering are before deducting expenses but are net proceeds after deducting the Underwriter's Fee (assuming a total of 13,333,335 Units are sold to purchasers on the President's List). Excludes Common Shares issued pursuant to the Arrangement and the Corporation's at-the-market equity programs.

(2) The proceeds from the Offering have been converted from USD to CAD based on the exchange rate posted by the Bank of Canada for November 9, 2023, being US$1.00 = C$1.3781.

(3) Since the date of the Interim Financial Statements, the Corporation has issued: (a) 24,264,706 Common Shares in connection with the August 2023 Unit Offering; (b) 80,945,300 Common Shares in connection with the Arrangement; and (c) 25,607,238 Common Shares in connection with the Corporation's at-the-market equity programs. As at the date hereof, the Corporation has 339,242,044 Common Shares issued and outstanding.

(4) In connection with the August 2023 Unit Offering, the Corporation issued 24,264,706 Common Share purchase warrants. As at the date hereof, the Corporation has 46,836,331 Common Share purchase warrants issued and outstanding.

(5) The Class B Shares are exchangeable for Common Shares on the basis of 10 Common Shares for each Class B Share, at the option of the holder thereof, subject to customary adjustments.

PLAN OF DISTRIBUTION

The Units will be offered in the Province of Ontario, and in the United States pursuant to the MJDS and, subject to applicable law and the Underwriting Agreement, certain jurisdictions outside of Canada and the United States. The Units will be offered in the United States by A.G.P./Alliance Global Partners under a prospectus supplement filed with the SEC, and in Canada by A.G.P. Canada Investments ULC under this Prospectus Supplement. Pursuant to the Underwriting Agreement, the Underwriter has agreed to purchase, as principal, subject to the terms and conditions contained in the Underwriting Agreement, up to 66,666,667 Units at a price of US$0.45 per Unit, for aggregate gross proceeds of US$30,000,000.15 payable in cash to the Corporation against delivery of the Units. The Offering Price has been determined by arm's length negotiation between the Corporation and the Underwriter, with reference to the prevailing market price of the Units. The obligations of the Underwriter under the Underwriting Agreement are several (and not joint or joint and several), are subject to certain closing conditions and may be terminated at their discretion on the basis of "material change out", "disaster out", "regulatory proceedings out", "breach of agreement out", and "market out" provisions in the Underwriting Agreement and may also be terminated upon the occurrence of certain other stated events.

Each Unit will consist of one Unit Share and one Warrant. Each Warrant will entitle the holder to acquire, subject to adjustment in certain circumstances, one Warrant Share at the Warrant Exercise Price at any time on or after the Initial Exercise Date until the Warrant Expiry Date, after which time the Warrants will be void and of no value. This Prospectus Supplement qualifies the distribution of the Unit Shares and the Warrants included in the Units.

The Warrants will be created and issued pursuant to the terms of a warrant certificate (the "Warrant Certificate"). The Warrant Certificate will contain provisions designed to protect holders of the Warrants against dilution upon the happening of certain events. See "Description of Securities Being Distributed".

In consideration for the services provided by the Underwriter in connection with the Offering, and pursuant to the terms of the Underwriting Agreement, the Corporation has agreed to pay the Underwriter the Underwriter's Fee equal to 6.0% of the gross proceeds from the Offering. The Underwriter's Fee shall be reduced to 1.5% of the gross proceeds from the Offering in respect of President's List purchasers.