false

0001411685

0001411685

2023-11-09

2023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) of the SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 9, 2023

Vistagen Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

000-54014

|

20-5093315

|

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification Number)

|

|

343 Allerton Ave.

South San Francisco, California 94080

|

|

(Address of principal executive offices)

|

(650) 577-3600

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

VTGN

|

Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2)

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Item 2.02 Results of Operations and Financial Condition.

On November 9, 2023, Vistagen Therapeutics, Inc. (the “Company”) issued a press release to announce the Company’s financial results for its fiscal year 2024 second quarter ended September 30, 2023. A copy of the press release is attached to this Current Report on Form 8-K as Exhibit 99.1.

Disclaimer.

The information in this Current Report on Form 8-K, including the information set forth in Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall Exhibit 99.1 filed herewith be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits Index

|

Exhibit No.

|

|

Description

|

| |

|

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

Vistagen Therapeutics, Inc.

|

|

|

|

|

|

Date: November 9, 2023

|

By:

|

/s/ Shawn K. Singh

|

|

|

|

Shawn K. Singh

Chief Executive Officer

|

Exhibit 99.1

Vistagen Provides Corporate Update and Reports Fiscal 2024 Second Quarter Financial Results

| |

●

|

Fasedienol (PH94B) PALISADE Phase 3 Program for acute treatment of social anxiety disorder (SAD) advancing to build on recent positive PALISADE-2 Phase 3 results

|

| |

●

|

Preparations to initiate potential fasedienol NDA-enabling Phase 3 studies in 2024 underway

|

| |

●

|

Itruvone (PH10) staged for potential Phase 2B clinical development 2H 2024

|

| |

●

|

PH80 positive exploratory Phase 2A trial data reported in two separate women’s health indications – vasomotor symptoms (hot flashes) due to menopause and premenstrual dysphoric disorder (PMDD)

|

| |

●

|

$137.7 million in gross proceeds secured since the beginning of fiscal 2024 second quarter, including $100 million from an underwritten public offering of equity securities led by BVF Partners LP, with participation from Commodore Capital, Great Point Partners, Logos Capital, Nantahala Capital, Surveyor Capital (a Citadel company), TCGX, and additional institutional investors

|

| |

●

|

Strong financial position provides adequate cash runway to a potential fasedienol U.S. New Drug Application for acute treatment of SAD

|

SOUTH SAN FRANCISCO, Calif.--(BUSINESS WIRE)—November 9, 2023-- Vistagen (Nasdaq: VTGN), a late clinical-stage biopharmaceutical company aiming to transform the treatment landscape for individuals living with anxiety, depression, and other central nervous system (CNS) disorders, today provided a corporate update and reported financial results for its fiscal year 2024 second quarter ended September 30, 2023.

"Vistagen achieved multiple important milestones in recent months, significantly advancing our innovative pipeline, including positive Phase 3 results for fasedienol, our lead pherine nasal spray drug candidate,” said Shawn Singh, Chief Executive Officer. “With a fortified balance sheet, a robust pipeline of drug candidates differentiated from the current standards of care, and a clear path forward in our potential U.S. New Drug Application-enabling PALISADE Phase 3 Program for fasedienol in social anxiety disorder, we are confident in our potential to improve the lives of millions of individuals affected by SAD and other large market mental health and CNS disorders.”

Corporate Update and Pipeline Highlights

Fasedienol Nasal Spray – PALISADE Phase 3 Program

Positive results in August 2023 from PALISADE-2 Phase 3 study of fasedienol for the acute treatment of anxiety in adults with SAD advances the PALISADE Phase 3 development program and paves the way to initiate potential U.S. New Drug Application (NDA)-enabling studies in 2024.

| |

●

|

Primary endpoint met, with fasedienol demonstrating a statistically significant difference in average patient-reported Subjective Units of Distress Scale (SUDS) score during a public speaking challenge compared to placebo (p=0.015).

|

| |

●

|

Secondary endpoint met, demonstrating a statistically significant difference in the proportion of clinician-assessed responders between fasedienol and placebo as measured by the Clinical Global Impressions - Improvement (CGI-I) scale (p=0.033).

|

| |

●

|

Exploratory endpoint met, demonstrating a statistically significant difference in the proportion of patient-assessed responders between fasedienol and placebo as measured by the Patient Global Impression of Change (PGI-C) scale (p=0.003).

|

| |

●

|

Fasedienol was observed to be well-tolerated and demonstrated a favorable safety profile consistent with all prior trials.

|

| |

●

|

PALISADE Phase 3 Program studies to be initiated in 2024 are designed to build on the positive results observed from PALISADE-2 and enable a potential submission of a fasedienol U.S. NDA in SAD.

|

Preparing to initiate PALISADE-3 and PALISADE-4 Phase 3 studies.

To complement the positive top-line results from PALISADE-2, the Company is preparing to launch two similar Phase 3 clinical trials in 2024, PALISADE-3 in the first half of 2024 and PALISADE-4 in the second half of 2024. Like PALISADE-2, each study will be a randomized, double-blind, placebo-controlled, Phase 3 clinical trial designed to evaluate the efficacy, safety, and tolerability of the acute administration of fasedienol to relieve anxiety symptoms in adult patients with SAD after a single dose of fasedienol during a simulated, anxiety-provoking public speaking challenge in a clinical setting, as measured using the patient-reported SUDS as the primary efficacy endpoint.

Should it be successful, the Company believes its PALISADE Phase 3 Program may establish substantial evidence of fasedienol’s effectiveness, supporting a potential fasedienol NDA submission to the U.S. Food and Drug Administration (FDA) for the acute treatment of anxiety in adults with SAD in the first half of 2026.

The Company also plans to initiate a small (n= ca. 60) three-arm randomized, double-blind, placebo-controlled Phase 2B clinical trial designed to evaluate the efficacy, safety, and tolerability of a repeat dose of fasedienol (administered 10 minutes after an initial dose) to further relieve symptoms of acute anxiety in adult patients with SAD during a single simulated, anxiety-provoking public speaking challenge in a clinical setting.

The Company is preparing for the following milestones for fasedienol in SAD:

| |

●

|

Initiate PALISADE-3 Phase 3 study in the first half of 2024;

|

| |

●

|

Initiate PALISADE-4 Phase 3 study in the second half of 2024; and

|

| |

●

|

Initiate fasedienol Phase 2B repeat dose study in the second half of 2024.

|

Itruvone Nasal Spray

Itruvone staged for Phase 2B development as a monotherapy for major depressive disorder (MDD), by the Company or potentially with a strategic partner.

In June 2023, the Company completed a successful randomized, double-blind, placebo-controlled Phase 1 clinical trial to investigate the safety and tolerability of itruvone in healthy adult subjects. The trial was designed to confirm the favorable safety profile of itruvone established in three previous clinical trials conducted in Mexico, including a positive randomized, double-blind, placebo-controlled Phase 2A study of itruvone in MDD, and facilitate potential Phase 2B clinical development of itruvone in the U.S., either by Vistagen alone or potentially with a strategic development and commercialization partner, as a non-systemic monotherapy for MDD differentiated from all FDA-approved antidepressants.

The Company is preparing for the following milestone for itruvone in MDD:

| |

●

|

Initiate Phase 2B study in the second half of 2024.

|

PH80 Nasal Spray

Second positive exploratory Phase 2A trial of hormone-free PH80 nasal spray provides new optimism for the acute management of multiple indications in women’s healthcare with high unmet medical need.

In September 2023, the Company announced previously unreported data of a randomized, double-blind, placebo-controlled exploratory Phase 2A clinical study designed to explore the efficacy, safety, and tolerability of intranasal administration of PH80 for the acute management of premenstrual dysphoric disorder (PMDD) in subjects with a regular menstrual cycle and at least a one-year history of PMDD.

| |

●

|

PH80 demonstrated statistically and clinically significant improvement versus placebo in symptoms of PMDD using the subject-rated Penn Daily Symptom Report (DSR) as early as Day 4 and continuing to Day 6 (p=0.008).

|

| |

●

|

PH80 demonstrated statistically and clinically significant improvement versus placebo at Day 6 on the clinician-rated Premenstrual Tension Scale (PMTS) (p=0.006).

|

| |

●

|

PH80 was well-tolerated with no serious adverse events.

|

| |

●

|

Along with the positive results reported during the Company’s fiscal 2024 first quarter from a randomized, double-blind, placebo-controlled exploratory Phase 2A clinical study designed to explore the efficacy, safety, and tolerability of PH80 for the acute management of vasomotor symptoms (hot flashes) due to menopause, these PMDD data further support PH80’s potential as a differentiated, non-systemic, hormone-free treatment option for multiple indications in women’s healthcare with high unmet medical need.

|

The Company expects the following milestone for PH80:

| |

●

|

Finalize U.S. IND-enabling studies in the second half of 2024 to facilitate potential Phase 2B development in the U.S. for the acute treatment of vasomotor symptoms (hot flashes) due to menopause in the first half of 2025, potentially with a development and commercialization partner.

|

Corporate Update

$1.5 million payment received from Fuji Pharma for an exclusive negotiation agreement for a potential license to develop and commercialize hormone-free PH80 for vasomotor symptoms (hot flashes) due to menopause in Japan and potentially other indications.

In September 2023, Vistagen and Fuji Pharma entered into a time-limited (up to approximately eighteen months) agreement to negotiate exclusively with each other regarding a potential license to develop and commercialize PH80 in Japan, including for the acute treatment of moderate to severe vasomotor symptoms (hot flashes) due to menopause, PMDD, and potentially other indications. As consideration for this agreement, Fuji Pharma agreed to pay to Vistagen a cash fee of $1.5 million, which payment was received in November 2023.

Cindy Anderson appointed as Chief Financial Officer, succeeding Jerrold Dotson who retired after a distinguished decade-long career with the Company.

In August 2023, the Company announced the appointment of Cindy Anderson as Chief Financial Officer. Ms. Anderson brings almost two decades of financial and operating strength from her experiences in the biotechnology sector. She joins Vistagen from Alnylam Pharmaceuticals where she served as the Chief Accounting Officer, focused on strategic and financial operations. Vistagen would like to extend its gratitude to Mr. Dotson for his substantial contributions during his tenure with the Company.

Fiscal Year 2024 Second Quarter Financial Results

Research and development (R&D) expense: Research and development expense decreased by approximately $9.0 million, from $12.9 million to $3.9 million for the quarter ended September 30, 2022 and 2023, respectively. The decrease in R&D expense is primarily due to completing the initial studies in the Company’s PALISADE Phase 3 Program for fasedienol in SAD, as well as reduced nonclinical development, regulatory and outsourced manufacturing, and regulatory activities for fasedienol and itruvone.

General and administrative (G&A) expense: General and administrative expense decreased by approximately $0.5 million from $3.7 million for the quarter ended September 20, 2022, to $3.2 million for the quarter ended September 30, 2023, primarily due to decreased compensation, consulting, and professional services.

Net loss: Net loss attributable to common stockholders for the second quarter ended September 30, 2023 was approximately $6.6 million compared to a net loss of $17.5 million for September 30, 2022.

Cash position: At September 30, 2023, the Company had cash and cash equivalents of approximately $37.6 million. In addition, since September 30, 2023, the Company received approximately $93.5 million in net proceeds from an underwritten public offering of its equity securities and $1.5 million from Fuji Pharma for a time-limited exclusive negotiation agreement regarding a potential license to develop and commercialize PH80 in Japan.

Should its PALISADE Phase 3 Program be successful, the Company believes that the current cash position will be sufficient to fund its operations through its potential submission of a U.S. NDA for fasedienol for the acute treatment of anxiety in adults with SAD in the first half of 2026.

As of November 9, 2023, the Company had 27,023,038 shares of common stock outstanding.

Conference Call

Vistagen will host a conference call and live audio webcast this afternoon at 5:00 p.m. Eastern Time to provide a corporate update.

U.S. Dial-in (Toll-Free): 1-800-245-3047

International Dial-in Number (Toll): 1-203-518-9765

Conference ID: VISTAGEN

Webcast Link: https://viavid.webcasts.com/starthere.jsp?ei=1641124&tp_key=2213157260

A live audio conference call webcast will also be available via the above link. Participants should access this webcast site 10 minutes before the start of the call. In addition, a telephone playback of the call will be available after approximately 8:00 p.m. Eastern Time on Thursday, November 9, 2023. To listen to the replay, call toll-free 1-844-512-2921 within the United States or 1-412-317-6671 when calling internationally (toll). Please use the replay access ID number: 11153994.

About Vistagen

Vistagen (Nasdaq: VTGN) is a late clinical-stage biopharmaceutical company aiming to transform the treatment landscape for individuals living with anxiety, depression, and other CNS disorders. Vistagen is advancing therapeutics with the potential to be faster-acting, and with fewer side effects and safety concerns, than those currently available for the treatment of anxiety, depression, and multiple CNS disorders. Vistagen's pipeline contains six clinical-stage product candidates, including fasedienol (PH94B), itruvone (PH10), PH15, PH80, and PH284, each an investigational agent belonging to a new class of drugs known as pherines, as well as AV-101, which is an oral prodrug antagonist of the N-methyl-D-aspartate receptor (NMDAR). Pherines are neuroactive nasal sprays designed with an innovative and differentiated proposed mechanism of action (MOA) that activates chemosensory neurons in the nasal cavity and can beneficially impact key neural circuits in the brain without systemic absorption or direct activity on neurons in the brain. Vistagen is passionate about transforming mental health care and redefining what is possible in the treatment of anxiety, depression, and several other CNS disorders. Connect at www.Vistagen.com.

Forward-looking Statements

This press release contains certain forward-looking statements within the meaning of the federal securities laws. These forward-looking statements involve known and unknown risks that are difficult to predict and include all matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of words such as "may," "could," “expect,” “project,” “outlook,” “strategy,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “strive,” “goal,” “continue,” “likely,” “will,” “would” and variations of these terms and similar expressions, or the negative of these terms or similar expressions. Such forward-looking statements are necessarily based upon estimates and assumptions that, while considered reasonable by Vistagen and its management, are inherently uncertain. As with all pharmaceutical products, there are substantial risks and uncertainties in the process of development and commercialization and actual results or developments may differ materially from those projected or implied in these forward-looking statements. Among other things, there can be no guarantee that any of the Company’s drug candidates will successfully complete ongoing or, if initiated, future clinical trials, receive regulatory approval or be commercially successful, or that the Company will be able to successfully replicate the result of past studies of its product candidates, including fasedienol, itruvone, AV-101 and/or PH80. Other factors that may cause such a difference include, without limitation, risks and uncertainties relating to the Company’s submission of an U.S. NDA to the FDA for any product candidate, including fasedienol; the ability of any clinical trial information submitted by the Company to the FDA to support an U.S. NDA; risks and uncertainties related to the Company’s ability to secure successful strategic global and/or regional development and commercialization partnerships; other risks and uncertainties related to delays in launching, conducting and/or completing ongoing and planned clinical trials; the scope and enforceability of the Company’s patents, including patents related to the Company’s pherine drug candidates and AV-101; fluctuating costs of materials and other resources and services required to conduct the Company’s ongoing and/or planned clinical and non-clinical trials; market conditions; the impact of general economic, industry or political conditions in the United States or internationally; and other technical and unexpected hurdles in the development, manufacture and commercialization of the Company’s product candidates. These risks are more fully discussed in the section entitled "Risk Factors" in the Company’s most recent Annual Report on Form 10-K for the fiscal year ended March 31, 2023, and in the Company’s Quarterly Report on Form 10-Q for the period ended September 30, 2023, as well as discussions of potential risks, uncertainties, and other important factors in our other filings with the U.S. Securities and Exchange Commission (SEC). The Company’s SEC filings are available on the SEC’s website at www.sec.gov. You should not place undue reliance on these forward-looking statements, which apply only as of the date of this press release and should not be relied upon as representing the Company’s views as of any subsequent date. The Company explicitly disclaims any obligation to update any forward-looking statements other than as may be required by law. If the Company does update one or more forward-looking statements, no inference should be made that the Company will make additional updates with respect to those or other forward-looking statements.

|

VISTAGEN THERAPEUTICS, INC.

|

|

CONSOLIDATED BALANCE SHEETS

|

|

(Amounts in dollars, except share amounts)

|

| |

|

September 30,

|

|

|

March 31,

|

|

| |

|

2023

|

|

|

2023

|

|

| |

|

(Unaudited)

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

37,608,400 |

|

|

$ |

16,637,600 |

|

|

Prepaid expenses and other current assets

|

|

|

1,393,300 |

|

|

|

802,700 |

|

|

Deferred contract acquisition costs - current portion

|

|

|

74,500 |

|

|

|

67,100 |

|

|

Total current assets

|

|

|

39,076,200 |

|

|

|

17,507,400 |

|

|

Property and equipment, net

|

|

|

444,300 |

|

|

|

507,300 |

|

|

Right-of-use asset - operating lease

|

|

|

2,045,000 |

|

|

|

2,260,300 |

|

|

Deferred offering costs

|

|

|

362,000 |

|

|

|

495,700 |

|

|

Deferred contract acquisition costs - non-current portion

|

|

|

167,400 |

|

|

|

217,600 |

|

|

Security deposits

|

|

|

100,900 |

|

|

|

100,900 |

|

|

Total assets

|

|

$ |

42,195,800 |

|

|

$ |

21,089,200 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

1,305,000 |

|

|

$ |

2,473,100 |

|

|

Accrued expenses

|

|

|

292,600 |

|

|

|

787,400 |

|

|

Note payable

|

|

|

- |

|

|

|

105,300 |

|

|

Deferred revenue - current portion

|

|

|

793,000 |

|

|

|

714,300 |

|

|

Operating lease obligation - current portion

|

|

|

517,100 |

|

|

|

485,600 |

|

|

Financing lease obligation - current portion

|

|

|

1,800 |

|

|

|

1,700 |

|

|

Total current liabilities

|

|

|

2,909,500 |

|

|

|

4,567,400 |

|

| |

|

|

|

|

|

|

|

|

|

Non-current liabilities:

|

|

|

|

|

|

|

|

|

|

Deferred revenue - non-current portion

|

|

|

1,780,600 |

|

|

|

2,314,600 |

|

|

Operating lease obligation - non-current portion

|

|

|

1,854,000 |

|

|

|

2,119,800 |

|

|

Financing lease obligation - non-current portion

|

|

|

6,500 |

|

|

|

7,400 |

|

|

Total non-current liabilities

|

|

|

3,641,100 |

|

|

|

4,441,800 |

|

|

Total liabilities

|

|

|

6,550,600 |

|

|

|

9,009,200 |

|

| |

|

|

|

|

|

|

|

|

|

Commitments and contingencies (Note 9)

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock, $0.001 par value; 10,000,000 shares authorized at September 30, 2023 and March 31, 2023; no shares outstanding at September 30, 2023 and March 31, 2023

|

|

|

- |

|

|

|

- |

|

|

Common stock, $0.001 par value; 325,000,000 shares authorized at September 30, 2023 and March 31, 2023; 12,016,750 and 7,315,583 shares issued at September 30, 2023 and March 31, 2023, respectively

|

|

|

12,000 |

|

|

|

7,300 |

|

|

Additional paid-in capital

|

|

|

379,943,800 |

|

|

|

342,892,500 |

|

|

Treasury stock, at cost, 4,522 shares of common stock held at September 30, 2023 and March 31, 2023

|

|

|

(3,968,100 |

) |

|

|

(3,968,100 |

) |

|

Accumulated deficit

|

|

|

(340,342,500 |

) |

|

|

(326,851,700 |

) |

|

Total stockholders’ equity

|

|

|

35,645,200 |

|

|

|

12,080,000 |

|

|

Total liabilities and stockholders’ equity

|

|

$ |

42,195,800 |

|

|

$ |

21,089,200 |

|

|

References to common shares and per share amounts have been retroactively restated to reflect the Company’s 1-for-30 reverse stock split of its common stock effective on June 6, 2023.

|

|

VISTAGEN THERAPEUTICS

|

|

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

|

|

(Unaudited)

|

|

(Amounts in Dollars, except share amounts)

|

| |

|

Three Months Ended

|

|

|

Six Months Ended

|

|

| |

|

September 30,

|

|

|

September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sublicense revenue

|

|

$ |

277,700 |

|

|

$ |

(892,500 |

) |

|

$ |

455,300 |

|

|

$ |

(582,500 |

) |

|

Total revenues

|

|

|

277,700 |

|

|

|

(892,500 |

) |

|

|

455,300 |

|

|

|

(582,500 |

) |

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

|

3,850,600 |

|

|

|

12,894,500 |

|

|

|

8,047,800 |

|

|

|

28,185,800 |

|

|

General and administrative

|

|

|

3,207,300 |

|

|

|

3,702,300 |

|

|

|

6,185,500 |

|

|

|

8,494,100 |

|

|

Total operating expenses

|

|

|

7,057,900 |

|

|

|

16,596,800 |

|

|

|

14,233,300 |

|

|

|

36,679,900 |

|

|

Loss from operations

|

|

|

(6,780,200 |

) |

|

|

(17,489,300 |

) |

|

|

(13,778,000 |

) |

|

|

(37,262,400 |

) |

|

Other income, net:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income, net

|

|

|

192,500 |

|

|

|

6,100 |

|

|

|

289,700 |

|

|

|

8,400 |

|

|

Loss before income taxes

|

|

|

(6,587,700 |

) |

|

|

(17,483,200 |

) |

|

|

(13,488,300 |

) |

|

|

(37,254,000 |

) |

|

Income taxes

|

|

|

- |

|

|

|

- |

|

|

|

(2,500 |

) |

|

|

(5,500 |

) |

|

Net loss and comprehensive loss

|

|

$ |

(6,587,700 |

) |

|

$ |

(17,483,200 |

) |

|

$ |

(13,490,800 |

) |

|

$ |

(37,259,500 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net loss per common share

|

|

$ |

(0.66 |

) |

|

$ |

(2.54 |

) |

|

$ |

(1.55 |

) |

|

$ |

(5.41 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common share - basic and diluted

|

|

|

10,042,530 |

|

|

|

6,893,708 |

|

|

|

8,717,050 |

|

|

|

6,890,152 |

|

|

References to common shares and per share amounts have been retroactively restated to reflect the Company’s 1-for-30 reverse stock split of its common stock effective on June 6, 2023.

|

Investors:

Mark McPartland

Senior Vice President, Investor Relations

(650) 577-3606

markmcp@vistagen.com

Media:

Nate Hitchings

SKDK

nhitchings@skdknick.com

v3.23.3

Document And Entity Information

|

Nov. 09, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Vistagen Therapeutics, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 09, 2023

|

| Entity, Incorporation, State or Country Code |

NV

|

| Entity, File Number |

000-54014

|

| Entity, Tax Identification Number |

20-5093315

|

| Entity, Address, Address Line One |

343 Allerton Ave.

|

| Entity, Address, City or Town |

South San Francisco

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

94080

|

| City Area Code |

650

|

| Local Phone Number |

577-3600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

VTGN

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001411685

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

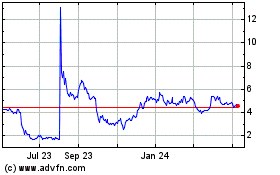

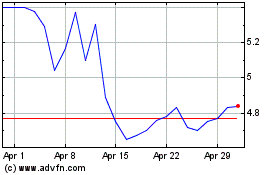

VistaGen Therapeutics (NASDAQ:VTGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

VistaGen Therapeutics (NASDAQ:VTGN)

Historical Stock Chart

From Apr 2023 to Apr 2024