0001490281False00014902812023-11-072023-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 7, 2023

Commission File Number: 1-35335 | | | | | | | | | | | | | | |

| Groupon, Inc. |

| (Exact name of registrant as specified in its charter) |

| | | | |

| Delaware | | 27-0903295 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | | |

| 600 W Chicago Avenue | | 60654 |

| Suite 400 | | (Zip Code) |

| Chicago | | |

| Illinois | | (312) | 334-1579 |

| (Address of principal executive offices) | | (Registrant's telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.0001 per share | | GRPN | | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 406 of the Securities Act of 1933 (230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (240.12b-2 of this chapter)

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On November 7, 2023, Groupon, Inc. (the “Company”) entered into an amendment to its Existing Credit Agreement (as defined below) to provide for additional flexibility in connection with the Company’s $80.0 million fully backstopped rights offering (the “Rights Offering”), as described below. Specifically, the Company entered into a Fifth Amendment (the “Amendment”) to the Second Amended and Restated Credit Agreement, dated as of May 14, 2019 (as amended by the First Amendment, dated as of July 17, 2020, the Second Amendment, dated as of March 22, 2021, the Third Amendment, dated as of September 28, 2022 and the Fourth Amendment, dated as of March 13, 2023, collectively, the “Existing Credit Agreement”) with JPMorgan Chase Bank, N.A., as Administrative Agent, and the other lenders party to that Existing Credit Agreement.

The Amendment effects certain modifications to the definition of the term “Change in Control” contained in the Existing Credit Agreement and adds the term “Disqualified Equity Interest” to the Existing Credit Agreement, among other changes.

In addition, the Amendment modifies the restricted payment covenant to permit the Company to declare and pay dividends with respect to its Equity Interests (other than Disqualified Equity Interests) payable solely in additional shares of its Equity Interests (other than Disqualified Equity Interests).

The foregoing description of the Amendment does not purport to be complete and is subject to and qualified in its entirety by reference to the Amendment, a copy of which is attached to this Current Report as Exhibit 10.1 and is incorporated by reference herein.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The disclosure set forth above in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item 8.01. Other Events.

On November 9, 2023, the Company issued a press release announcing the approval by the Board of Directors (the “Board”) of the Rights Offering to all holders of record of the Company’s common stock, par value $0.0001 (“Common Stock”) as of 5:00 p.m., New York City time, on November 20, 2023 (the “Record Date”). The Rights Offering will be made through the distribution to all holders of record of Common Stock as of the Record Date of non-transferable basic subscription rights to purchase shares of Common Stock at a subscription price of $11.30 per share and otherwise on such terms and subject to such conditions as may be required to comply with any applicable Nasdaq Global Select Market stock exchange rules and regulations.

The Company expects to receive gross proceeds of $80.0 million, less expenses related to the Rights Offering. The Company intends to use the proceeds from the Rights Offering for general corporate purposes, which may include the repayment of debt.

The Rights Offering is currently expected to commence promptly after the Record Date and expire at 5:00 p.m., New York City time, on January 17, 2024 (the “Expiration Date”).

The Rights Offering is fully backstopped by Pale Fire Capital SICAV a.s. (the “Backstop Party”), an entity affiliated with Dusan Senkypl, the Company’s Interim Chief Executive Officer and a member of the Board, and Jan Barta, a member of the Board. The Backstop Party has committed to (i) fully exercise its basic subscription rights prior to the Expiration Date and (ii) fully purchase any and all unsubscribed shares in the Rights Offering following the Expiration Date at a price of $11.30 per share and on the same terms and conditions as other rights holders.

The Rights Offering will be made pursuant to the Company’s existing effective shelf registration statement on Form S-3 (Reg. No. 333-273533) on file with the Securities and Exchange Commission (the “SEC”) and a prospectus supplement (and the accompanying base prospectus) to be filed with the SEC prior to the commencement of the Rights Offering. The Company reserves the right to extend, amend or terminate the planned Rights Offering, subject to certain conditions, at any time.

The Rights Offering will include an over-subscription privilege to permit each rights holder that exercises its basic subscription rights in full to purchase additional shares of Common Stock (if any) that remain unsubscribed on the Expiration Date. The availability of the over-subscription privilege will be subject to certain terms and restrictions to be set forth in the prospectus supplement. If the aggregate subscriptions (basic subscriptions plus over-subscriptions) exceed the number of shares of Common Stock offered in the Rights Offering, then the aggregate

over-subscription amount will be pro-rated among the holders exercising their respective over-subscription privileges based on the basic subscription amounts of such holders.

A copy of the press release related to the Rights Offering is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Forward Looking Statements

This Current Report on Form 8-K includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding the Company’s future results of operations and financial position, business strategy and plans and the Company’s objectives for future operations and future liquidity. The words "may," "will," "should," "could," "expect," "anticipate," "believe," "estimate," "intend," "continue" and other similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on current expectations and projections about future events and financial trends that we believe may affect the Company’s financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs, including, without limitation, the Company’s expectations regarding the proposed Rights Offering, including the size, timing, price, and use of proceeds. These forward-looking statements involve risks and uncertainties that could cause the Company’s actual results to differ materially from those expressed or implied in the Company’s forward-looking statements. Factors that may cause such differences include prevailing market conditions, the Company’s ability to launch the Rights Offering as expected, whether holders of record will exercise their rights to purchase Common Stock and the amount subscribed, and whether the Company will be able to successfully complete the Rights Offering, in addition to (without limitation), the Company’s ability to execute, and achieve the expected benefits of, the Company’s go-forward strategy; execution of the Company’s business and marketing strategies; volatility in the Company’s operating results; challenges arising from the Company’s international operations, including fluctuations in currency exchange rates, legal and regulatory developments in the jurisdictions in which the Company operates and geopolitical instability resulting from the conflicts in Ukraine and the Middle East; global economic uncertainty, including as a result of inflationary pressures, ongoing impacts from the COVID-19 pandemic and labor and supply chain challenges; retaining and adding high quality merchants and third- party business partners; retaining existing customers and adding new customers; competing successfully in the Company’s industry; providing a strong mobile experience for the Company’s customers; managing refund risks; retaining and attracting members of the Company’s executive and management teams and other qualified employees and personnel; customer and merchant fraud; payment-related risks; the Company’s reliance on email, internet search engines and mobile application marketplaces to drive traffic to the Company’s marketplace; cybersecurity breaches; maintaining and improving the Company’s information technology infrastructure; reliance on cloud-based computing platforms; completing and realizing the anticipated benefits from acquisitions, dispositions, joint ventures and strategic investments; lack of control over minority investments; managing inventory and order fulfillment risks; claims related to product and service offerings; protecting the Company’s intellectual property; maintaining a strong brand; the impact of future and pending litigation; compliance with domestic and foreign laws and regulations, including the CARD Act, GDPR, CPRA, other privacy-related laws and regulations of the Internet and e-commerce; classification of the Company’s independent contractors, agency workers or employees; the Company’s ability to remediate its material weakness over internal control over financial reporting; risks relating to information or content published or made available on the Company’s websites or service offerings we make available; exposure to greater than anticipated tax liabilities; adoption of tax laws; the Company’s ability to use its tax attributes; impacts if we become subject to the Bank Secrecy Act or other anti-money laundering or money transmission laws or regulations; the Company’s ability to raise capital if necessary; the Company’s ability to continue as a going concern; risks related to the Company’s access to capital and outstanding indebtedness, including the Company’s convertible senior notes; the Company’s common stock, including volatility in the Company’s stock price; the Company’s ability to realize the anticipated benefits from the capped call transactions relating to the Company’s 1.125% Convertible Senior Notes due 2026; difficulties, delays or the Company’s inability to successfully complete all or part of the announced restructuring actions or to realize the operating efficiencies and other benefits of such restructuring actions; higher than anticipated restructuring charges or changes in the timing of such restructuring charges; and those risks and other factors discussed in Part I, Item 1A. Risk Factors of the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 and Part II, Item 1A. Risk Factors of the Company’s Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023, June 30, 2023, and September 30, 2023, and the Company’s other filings with the Securities and Exchange Commission (the "SEC"), copies of which may be obtained by visiting the company's Investor Relations web site at investor.groupon.com or the SEC's web site at www.sec.gov. Groupon's actual results could differ materially from those predicted or implied and reported results should not be considered an indication of future performance.

You should not rely upon forward-looking statements as predictions of future events. Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, it cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking

statements will be achieved or occur. Moreover, neither the Company nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. The forward-looking statements reflect the Company’s expectations as of November 9, 2023. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this release to conform these statements to actual results or to changes in the Company’s expectations.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | | | | | | | |

| (d) | Exhibits: | |

| | Exhibit No. | | Description |

| 10.1 | | Fifth Amendment, dated as of November 7, 2023, among the Company, the subsidiaries of the Company party thereto, JPMorgan Chase Bank, N.A., as Administrative Agent, and the lenders party thereto, to the Second Amended and Restated Credit Agreement, dated as of May 14, 2019 (and as amended by the First Amendment, dated as of July 17, 2020, the Second Amendment, dated as of March 22, 2021, the Third Amendment, dated as of September 28, 2022 and the Fourth Amendment, dated as of March 14, 2023), among the Company, JPMorgan Chase Bank, N.A., as Administrative Agent, and the lenders party thereto. |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| | GROUPON, INC. |

| Date: November 9, 2023 | |

| | By: /s/ Jiri Ponrt Name: Jiri Ponrt Title: Chief Financial Officer |

FIFTH AMENDMENT TO SECOND AMENDED AND RESTATED CREDIT AGREEMENT

THIS FIFTH AMENDMENT TO SECOND AMENDED AND RESTATED CREDIT AGREEMENT (this “Amendment”), dated as of November 7, 2023 is among GROUPON, INC., as Borrower (the “Borrower”), the other Loan Parties party hereto, the Lenders party hereto, and JPMORGAN CHASE BANK, NATIONAL ASSOCIATION, as Administrative Agent (the “Administrative Agent”).

RECITALS:

WHEREAS, the Borrower, the Administrative Agent, and the Lenders party thereto are party to that certain Second Amended and Restated Credit Agreement dated as of May 14, 2019 (as amended by the First Amendment, dated as of July 17, 2020, the Second Amendment, dated as of March 22, 2021, the Third Amendment, dated as of September 28, 2022 and the Fourth Amendment, dated as of March 13, 2023, the “Credit Agreement”, and as further amended by this Amendment, the “Amended Credit Agreement”); and

WHEREAS, (i) the Borrower has requested certain amendments be made to the Credit Agreement and (ii) the Lenders party hereto (which, for the avoidance of doubt, constitute the Required Lenders under the Credit Agreement) are willing to amend the Credit Agreement pursuant to Section 9.02 thereof on the terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the premises herein contained and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

SECTION 1 DEFINITIONS. Capitalized terms used but not defined herein shall have the meanings specified in the Amended Credit Agreement.

SECTION 2 AMENDMENT. Subject to the satisfaction of the conditions precedent set forth in Section 3 hereof the Credit Agreement (including the schedules thereto) is amended as follows:

2.1Section 1.01 of the Credit Agreement is amended to amend the definition of “Change in Control” in its entirety to read as follows:

“Change in Control” means (a) the acquisition of ownership, directly or indirectly, beneficially or of record, by any Person or group (within the meaning of the Securities Exchange Act of 1934 and the rules of the Securities and Exchange Commission thereunder as in effect on the date hereof) other than (i) the Permitted Holders or (ii) PFC in connection with the underwriting of a rights offering of the Borrower, of Equity Interests representing more than 35% of the aggregate ordinary voting power represented by the issued and outstanding common stock of the Borrower; provided that PFC shall not own more than 50% of the aggregate ordinary voting power represented by the issued and outstanding common stock of the Borrower; or (b) occupation of a majority of the seats (other than vacant seats) on the board of directors of the Borrower by Persons who were neither (i) nominated or approved by the board of directors of the Borrower nor (ii) appointed by directors so nominated or approved.

2.2Section 1.01 of the Credit Agreement is amended to add the following definitions in the appropriate alphabetical order:

“PFC” means Pale Fire Capital SE and/or its affiliates (collectively with funds, partnerships or other investment vehicles managed, advised or controlled with any such entity).

“Disqualified Equity Interest” means any Equity Interest that, by its terms (or by the terms of any security into which it is convertible or for which it is exchangeable), or upon the happening of any event, (a) matures (excluding any maturity as the result of an optional redemption by the issuer thereof, provided that any such optional redemption payment shall be subordinated to the prior payment in full of the Secured Obligations) or is mandatorily redeemable (other than solely for Equity Interests that are not Disqualified Equity Interests), pursuant to a sinking fund obligation or otherwise (except as a result of a Change in Control so long as any rights of the holders thereof upon such event shall be subject to the prior payment in full of the Secured Obligations and the termination of the Commitments), or is redeemable at the option of the holder thereof (other than solely for Equity Interests that are not Disqualified Equity Interests), in whole or in part, or requires the payment of any cash dividend or any other scheduled payment constituting a return of capital, in each case at any time on or prior to the first anniversary of the latest Maturity Date in effect at the time such Equity Interest is issued, or (b) is convertible into or exchangeable (other than at the sole option of the issuer thereof, provided that any such conversion or exchange shall be subordinated to the prior payment in full of the Secured Obligations) for (i) debt securities or (ii) any Equity Interest referred to in clause (a) above, in each case at any time prior to the first anniversary of the Maturity Date in effect at the time such Equity Interest is issued.

2.3Section 6.06(a) of the Credit Agreement is hereby amended in its entirety to read as follows:

(a) the Borrower may declare and pay dividends with respect to its Equity Interests (other than Disqualified Equity Interests) payable solely in additional shares of its Equity Interests (other than Disqualified Equity Interests);

SECTION 3 EFFECTIVENESS.

This Amendment shall become effective on the date (the “Fifth Amendment Effective Date”) on which each of the following conditions are satisfied:

a.The Administrative Agent (or its counsel) shall have received a counterpart of this Amendment signed on behalf of the Loan Parties party hereto, the Administrative Agent and the Required Lenders.

b.The Administrative Agent shall have received all reasonable and documented fees and expenses of the Administrative Agent, in connection herewith, required to be paid or reimbursed under Section 9.03 of the Amended Credit Agreement (including attorney’s fees), in each case, for which invoices have been presented at least one (1) Business Day prior to the Fifth Amendment Effective Date.

SECTION 4 REPRESENTATIONS AND WARRANTIES. After giving effect to this Amendment, the following statements by the Borrower shall be true and correct (and the Borrower, by its execution of this Amendment, hereby represents and warrants to the Administrative Agent and the Lenders that such statements shall be true and correct as at such times):

a.the representations and warranties of the Loan Parties set forth in the Loan Documents shall be true and correct in all material respects with the same effect as though made on and as of the date hereof (it being understood and agreed that any representation or warranty

which by its terms is made as of a specified date shall be required to be true and correct in all material respects only as of such specified date, and that any representation or warranty which is subject to any materiality qualifier shall be required to be true and correct in all respects);

b.no Default shall have occurred and be continuing;

c.the execution and delivery of this Amendment and performance of the Amended Credit Agreement by the Borrower have been duly authorized by all necessary corporate and, if required, stockholder action;

d.this Amendment has been duly executed and delivered by the Borrower and constitutes a legal, valid and binding obligation of the Borrower, enforceable in accordance with its terms, subject to applicable bankruptcy, insolvency, reorganization, moratorium or other laws affecting creditors’ rights generally and subject to general principles of equity, regardless of whether considered in a proceeding in equity or at law; and

e.the execution and delivery of this Amendment and performance of the Amended Credit Agreement by the Borrower (i) does not require any consent or approval of, registration or filing with, or any other action by, any Governmental Authority, except such as have been obtained or made and are in full force and effect, and (ii) will not violate any applicable law or regulation or the charter, by-laws or other organizational documents of the Borrower or any of its Restricted Subsidiaries or any order of any Governmental Authority

SECTION 5 MISCELLANEOUS.

5.1Ratifications. The terms and provisions set forth in this Amendment shall modify and supersede all inconsistent terms and provisions set forth in the Credit Agreement and except as expressly modified and superseded by this Amendment, the terms and provisions of the Credit Agreement and the other Loan Documents are ratified and confirmed and shall continue in full force and effect. The Borrower (on behalf of itself, GI Luxembourg S.á R.L. and Groupon Holdings B.V), each undersigned Loan Party, the Administrative Agent and the Lenders agree that the Amended Credit Agreement and the other Loan Documents shall continue to be legal, valid, binding and enforceable in accordance with its terms (subject to applicable bankruptcy, insolvency, reorganization, moratorium or other laws affecting creditors’ rights generally and subject to general principles of equity, regardless of whether considered in a proceeding in equity or at law). For all matters arising prior to the effective date of this Amendment, the Credit Agreement (as unmodified by this Amendment) shall control.

5.2Entire Agreement. This Amendment and the Amended Credit Agreement, together with the Loan Documents (collectively, the “Relevant Documents”), set forth the entire understanding and agreement of the parties hereto in relation to the subject matter hereof and supersedes any prior negotiations and agreements among the parties relating to such subject matter. No promise, condition, representation or warranty, express or implied, not set forth in the Relevant Documents shall bind any party hereto, and no such party has relied on any such promise, condition, representation or warranty. Each of the parties hereto acknowledges that, except as otherwise expressly stated in the Relevant Documents, no representations, warranties or commitments, express or implied, have been made by any party to the other in relation to the subject matter hereof or thereof. None of the terms or conditions of this Amendment may be changed, modified, waived or canceled orally or otherwise, except in writing.

5.3Counterparts. This Amendment may be executed in any number of counterparts, each of which shall be deemed an original as against any party whose signature appears thereon, and all of which shall together constitute one and the same instrument. Delivery of an executed counterpart of a signature page of this Amendment by telecopy, facsimile or other electronic transmission (including .PDF) shall be effective as delivery of a manually executed counterpart of this Amendment.

5.4Governing Law. This Amendment shall be construed in accordance with and governed by the law of the State of New York.

5.5Incorporation of Credit Agreement Provisions. The provisions of Section 9.07 (Severability) and Section 9.10 (Waiver of Jury Trial) of the Credit Agreement are incorporated by reference as if fully set forth herein, mutatis mutandis.

5.6References. All references in any of the Loan Documents to the “Agreement” or the “Credit Agreement” shall mean the Credit Agreement or Amended Credit Agreement, as applicable.

5.7Headings. The headings, captions, and arrangements used in this Amendment are for convenience only and shall not affect the interpretation of this Amendment.

5.8Successors and Assigns. This Amendment is binding upon and shall inure to the benefit of the Administrative Agent, the Lenders, the Borrower, and their respective successors and assigns as provided in the Amended Credit Agreement.

5.9Loan Document. The execution, delivery and effectiveness of this Amendment shall not, except as expressly provided herein, operate as a waiver of any right, power or remedy of any Lender or the Administrative Agent under any of the Loan Documents, nor constitute a waiver of any provision of any of the Loan Documents. This Amendment shall for all purposes constitute a Loan Document.

[Signature Pages Follow]

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed by their respective authorized officers as of the day and year first above written.

| | | | | | | | |

| GROUPON, INC. |

| |

| |

| |

| By: | /s/ Jiri Ponrt |

| | Name: Jiri Ponrt

Title: Chief Financial Officer |

| | | | | | | | |

| GROUPON GOODS, INC. |

| |

| |

| |

| By: | /s/ Reggie Zeigler |

| | Name: Reggie Zeigler

Title: Vice President - Tax |

| | | | | | | | |

| GI INTERNATIONAL HOLDINGS, INC. |

| |

| |

| |

| By: | /s/ Reggie Zeigler |

| | Name: Reggie Zeigler

Title: Vice President - Tax |

| | | | | | | | |

| GROUPON MERCHANT SERVICES, LLC |

| |

| |

| |

| By: | /s/ Jiri Ponrt |

| | Name: Jiri Ponrt

Title: Chief Financial Officer |

| | | | | | | | |

| LIVINGSOCIAL, LLC |

| |

| |

| |

| By: | /s/ Jiri Ponrt |

| | Name: Jiri Ponrt

Title: Chief Financial Officer |

[Signature Page to Fifth Amendment to Credit Agreement]

| | | | | | | | |

| GROUPON INTERNATIONAL LIMITED |

| |

| |

| |

| By: | /s/ Jiri Ponrt |

| | Name: Jiri Ponrt

Title: Chief Financial Officer |

| | | | | | | | |

| GROUPON GETAWAYS, INC. |

| |

| |

| |

| By: | /s/ Reggie Zeigler |

| | Name: Reggie Zeigler

Title: Vice President - Tax |

[Signature Page to Fifth Amendment to Credit Agreement]

| | | | | | | | |

| JPMORGAN CHASE BANK, N.A., individually and as Administrative Agent |

| |

| |

| |

| By: | /s/ Christine Lathrop |

| | Name: Christine Lathrop

Title: Executive Director |

[Signature Page to Fifth Amendment to Credit Agreement]

| | | | | | | | |

| BARCLAYS BANK PLC, as a Lender |

| |

| |

| |

| By: | /s/ Patty M. Galitis |

| | Name: Patty M. Galitis

Title: Authorized Signatory |

[Signature Page to Fifth Amendment to Credit Agreement]

758075521 14452363

| | | | | | | | |

| BANK OF AMERICA, N.A., as a Lender |

| |

| |

| |

| By: | /s/ Philip Raby |

| | Name: Philip Raby

Title: Senior Vice President |

| | | | | | | | |

| BANK OF AMERICA, N.A. (acting through its Canada branch), as a Lender |

| |

| |

| |

| By: | /s/ Medina Sales de Andrade |

| | Name: Medina Sales de Andrade

Title: Vice President |

[Signature Page to Fifth Amendment to Credit Agreement]

| | | | | | | | |

| CITIZENS BANK, N.A., as a Lender |

| |

| |

| |

| By: | /s/ Marla Merritt |

| | Name: Marla Merritt

Title: Vice President |

[Signature Page to Fifth Amendment to Credit Agreement]

| | | | | | | | |

| FIRST-CITIZENS BANK & TRUST COMPANY (successor by purchase to the Federal Deposit Insurance Corporation as Receiver for Silicon Valley Bridge Bank, N.A. (as successor to Silicon Valley Bank)), as a Lender |

| |

| |

| |

| By: | /s/ Zach Norris |

| | Name: Zach Norris

Title: Manager Director |

[Signature Page to Fifth Amendment to Credit Agreement]

| | | | | | | | |

| WELLS FARGO BANK, NATIONAL ASSOCIATION, as a Lender |

| |

| |

| |

| By: | /s/ Patrick McGovern |

| | Name: Patrick McGovern

Title: Senior Vice President |

[Signature Page to Fifth Amendment to Credit Agreement]

Groupon Announces $80.0 Million Fully Backstopped Rights Offering for Common Stock

CHICAGO – November 9, 2023 - Groupon, Inc. (NASDAQ: GRPN) (the “Company”) announced today that the Company’s Board of Directors (the “Board”) has approved an $80.0 million fully backstopped rights offering (the “Rights Offering”) available to all holders of record of the Company’s common stock, par value $0.0001 (“Common Stock”), as of 5:00 p.m., New York City time, on November 20, 2023 (the “Record Date”).

The Rights Offering will be made through the distribution to all holders of record of Common Stock as of the Record Date of non-transferable basic subscription rights to purchase shares of Common Stock at a subscription price of $11.30 per share and otherwise on such terms and subject to such conditions as may be required to comply with any applicable Nasdaq Global Select Market stock exchange rules and regulations. The Company expects to receive gross proceeds of $80.0 million, less expenses related to the Rights Offering. The Rights Offering is currently expected to commence promptly after the Record Date and expire at 5:00 p.m., New York City time, on January 17, 2024 (the “Expiration Date”).

The Rights Offering is fully backstopped by Pale Fire Capital SICAV a.s. (the “Backstop Party”), an entity affiliated with Dusan Senkypl, the Company’s Interim Chief Executive Officer and a member of the Board, and Jan Barta, a member of the Board. The Backstop Party has committed to (i) fully exercise its basic subscription rights prior to the Expiration Date and (ii) fully purchase any and all unsubscribed shares in the Rights Offering following the Expiration Date at a price of $11.30 per share and on the same terms and conditions as other rights holders.

The Company intends to use the proceeds from the Rights Offering for general corporate purposes, which may include the repayment of debt.

The Rights Offering will be made pursuant to the Company’s existing effective shelf registration statement on Form S-3 (Reg. No. 333-273533) on file with the Securities and Exchange Commission (the “SEC”) and a prospectus supplement (and the accompanying base prospectus) to be filed with the SEC prior to the commencement of the Rights Offering. The Company reserves the right to extend, amend or terminate the planned Rights Offering, subject to certain conditions, at any time.

The Rights Offering will include an over-subscription privilege to permit each rights holder that exercises its basic subscription rights in full to purchase additional shares of Common Stock (if any) that remain unsubscribed on the Expiration Date. The availability of the over-subscription privilege will be subject to certain terms and restrictions to be set forth in the prospectus supplement. If the aggregate subscriptions (basic subscriptions plus over-subscriptions) exceed the number of shares of Common Stock offered in the Rights Offering, then the aggregate over-subscription amount will be pro-rated among the holders exercising their respective over-subscription privileges based on the basic subscription amounts of such holders.

The information herein is not complete and is subject to change. This press release does not constitute an offer to sell or the solicitation of an offer to buy any of the basic subscription rights, Common Stock or any other securities, nor will there be any sale of the basic subscription rights, Common Stock or any other securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or other jurisdiction. This document is not an offering, which can only be made by the prospectus supplement (and the accompanying base prospectus), which will contain information about the Company and the Rights Offering, and should be read carefully before investing. For any questions or further information about the Rights Offering, or to obtain a copy of the prospectus supplement (and the accompanying base prospectus), when available, please contact Kroll Issuer Services (US), which will be acting as the information agent for the Rights Offering, at (844) 369-8502 (Toll-Free) or (646) 651-1193 (International), or via email at groupon@is.kroll.com.

About Groupon

Groupon (www.groupon.com) (NASDAQ: GRPN) is a trusted local marketplace where consumers go to buy services and experiences that make life more interesting and deliver boundless value. To find out more about Groupon, please visit press.groupon.com.

Contacts:

Investor Relations:

ir@groupon.com

Public Relations:

Emma Coleman

press@groupon.com

Note on Forward-Looking Statements

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding the Company’s future results of operations and financial position, business strategy and plans and the Company’s objectives for future operations and future liquidity. The words "may," "will," "should," "could," "expect," "anticipate," "believe," "estimate," "intend," "continue" and other similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on current expectations and projections about future events and financial trends that we believe may affect the Company’s financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs, including, without limitation, the Company’s expectations regarding the proposed Rights Offering, including the size, timing, price, and use of proceeds. These forward-looking statements involve risks and uncertainties that could cause the Company’s actual results to differ materially from those expressed or implied in the Company’s forward-looking statements. Factors that may cause such differences include prevailing market conditions, the Company’s ability to launch the Rights Offering as expected, whether holders of record will exercise their rights to purchase Common Stock and the amount subscribed, and whether the Company will be able to successfully complete the Rights Offering, in addition to (without limitation), the Company’s ability to execute, and achieve the expected benefits of, the Company’s go-forward strategy; execution of the Company’s business and marketing strategies; volatility in the Company’s operating results; challenges arising from the Company’s international operations, including fluctuations in currency exchange rates, legal and regulatory developments in the jurisdictions in which the Company operates and geopolitical instability resulting from the conflicts in Ukraine and the Middle East; global economic uncertainty, including as a result of inflationary pressures, ongoing impacts from the COVID-19 pandemic and labor and supply chain challenges; retaining and adding high quality merchants and third- party business partners; retaining existing customers and adding new customers; competing successfully in the Company’s industry; providing a strong mobile experience for the Company’s customers; managing refund risks; retaining and attracting members of the Company’s executive and management teams and other qualified employees and personnel; customer and merchant fraud; payment-related risks; the Company’s reliance on email, internet search engines and mobile application marketplaces to drive traffic to the Company’s marketplace; cybersecurity breaches; maintaining and improving the Company’s information technology infrastructure; reliance on cloud-based computing platforms; completing and realizing the anticipated benefits from acquisitions, dispositions, joint ventures and strategic investments; lack of control over minority investments; managing inventory and order fulfillment risks; claims related to product and service offerings; protecting the Company’s intellectual property; maintaining a strong brand; the impact of future and pending litigation; compliance with domestic and foreign laws and regulations, including the CARD Act, GDPR, CPRA, other privacy-related laws and regulations of the Internet and e-commerce; classification of the Company’s independent contractors, agency workers or employees; the Company’s ability to remediate its material weakness over internal control over financial reporting; risks relating to information or content published or made available on the Company’s websites or service offerings we make available; exposure to greater than anticipated tax liabilities; adoption of tax laws; the Company’s ability to use its tax attributes; impacts if we become subject to the Bank Secrecy Act or other anti-money laundering or money transmission laws or regulations; the Company’s ability to raise capital if necessary; the Company’s ability to continue as a going concern; risks related to the Company’s

access to capital and outstanding indebtedness, including the Company’s convertible senior notes; the Company’s common stock, including volatility in the Company’s stock price; the Company’s ability to realize the anticipated benefits from the capped call transactions relating to the Company’s 1.125% Convertible Senior Notes due 2026; difficulties, delays or the Company’s inability to successfully complete all or part of the announced restructuring actions or to realize the operating efficiencies and other benefits of such restructuring actions; higher than anticipated restructuring charges or changes in the timing of such restructuring charges; and those risks and other factors discussed in Part I, Item 1A. Risk Factors of the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 and Part II, Item 1A. Risk Factors of the Company’s Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023, June 30, 2023, and September 30, 2023, and the Company’s other filings with the Securities and Exchange Commission (the "SEC"), copies of which may be obtained by visiting the company's Investor Relations web site at investor.groupon.com or the SEC's web site at www.sec.gov. Groupon's actual results could differ materially from those predicted or implied and reported results should not be considered an indication of future performance.

You should not rely upon forward-looking statements as predictions of future events. Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, it cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. Moreover, neither the Company nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. The forward-looking statements reflect the Company’s expectations as of November 9, 2023. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this release to conform these statements to actual results or to changes in the Company’s expectations.

v3.23.3

Cover

|

Nov. 07, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 07, 2023

|

| Entity File Number |

1-35335

|

| Entity Registrant Name |

Groupon, Inc.

|

| Entity Tax Identification Number |

27-0903295

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Postal Zip Code |

60654

|

| Entity Address, Address Line One |

600 W Chicago Avenue

|

| Entity Address, Address Line Two |

Suite 400

|

| Entity Address, City or Town |

Chicago

|

| City Area Code |

(312)

|

| Entity Address, State or Province |

IL

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

GRPN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001490281

|

| Amendment Flag |

false

|

| Extension |

334-1579

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

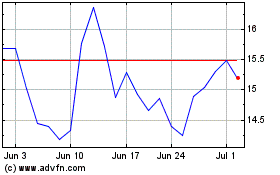

Groupon (NASDAQ:GRPN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Groupon (NASDAQ:GRPN)

Historical Stock Chart

From Apr 2023 to Apr 2024