0001390478FALSE00013904782023-11-092023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): November 9, 2023

SELLAS Life Sciences Group, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-33958 | | 20-8099512 |

| (State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | |

| | 7 Times Square, Suite 2503 New York, NY 10036 | | |

| | (Address of Principal Executive Offices) (Zip Code) | | |

| | | | |

Registrant’s telephone number, including area code: (646) 200-5278 |

| | | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | SLS | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 9, 2023, SELLAS Life Sciences Group, Inc. (“SELLAS”) issued a press release (the “Press Release”) announcing its financial results for the quarter ended September 30, 2023 and providing a corporate update.

A copy of the Press Release is furnished hereto as Exhibit 99.1 and is incorporated by reference herein. The information contained in this Item 2.02 and in the Press Release furnished as Exhibit 99.1 to this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this Item 2.02 and in the Press Release furnished as Exhibit 99.1 to this Current Report on Form 8-K shall not be incorporated by reference into any filing with the SEC made by SELLAS whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | SELLAS Life Sciences Group, Inc. |

| | | | |

| Date: | | November 9, 2023 | | | | By: | | /s/ Barbara A. Wood |

| | | | | | | Name: | Barbara A. Wood |

| | | | | | | Title: | Executive Vice President, General Counsel and Corporate Secretary |

Exhibit 99.1

SELLAS Life Sciences Provides Business Update and Reports Third Quarter 2023 Financial Results

- Phase 3 REGAL Trial of Galinpepimut-S (GPS) on Track to Complete Enrollment ex-China in November 2023 -

- Positive Initial Topline Phase 2a Data of SLS009 Reported with First Complete Response Achieved in Acute Myeloid Leukemia (AML) Patient Resistant to Venetoclax Combination Therapies -

- SLS009 Granted Orphan Drug Designation by U.S. Food & Drug Administration (FDA) for Treatment of AML -

- SLS009 Granted Fast Track Designation by FDA for Treatment of Relapsed/Refractory Peripheral T-cell Lymphomas (PTCL) -

- First Patient Dosed in Phase 1b/2 Trial of SLS009 in Relapsed/Refractory PTCL -

NEW YORK, November 9, 2023 (GLOBE NEWSWIRE) – SELLAS Life Sciences Group, Inc. (NASDAQ: SLS) (“SELLAS’’ or the “Company”), a late-stage clinical biopharmaceutical company focused on the development of novel therapies for a broad range of cancer indications, today provided a business update and reported its financial results for the quarter ended September 30, 2023.

“In the last several weeks, SELLAS has achieved several exciting milestones. We reported initial positive topline Phase 2a data at the 45 mg (safety) dose level demonstrating that SLS009 in combination with venetoclax and azacitidine (aza/ven) exhibited anti-leukemic effects with a favorable safety profile in AML patients resistant to venetoclax combination therapies. Importantly, as of the last follow-up, six of the seven patients enrolled to date were alive. The first patient enrolled in the study achieved a complete response and is in the sixth month of treatment and the second enrolled patient is in the fifth month of treatment, underscoring the potential benefit of adding CDK9 inhibition to the aza/ven regimen. We will share further topline data, including data of patients treated with the recommended Phase 2 dose level of 60 mg, by the end of the year. We also shared compelling topline results from the lymphoma group of patients in our Phase 1 trial of SLS009, showing anti-tumor activity and clinical responses with a tumor burden reduction of up to 68.9%,” said Angelos Stergiou, MD, ScD h.c., President and Chief Executive Officer of SELLAS. “SLS009 continues to emerge as a promising treatment for hematologic malignancies and we are pleased by the FDA’s recognition of its potential by the grant of Fast Track Designation for PTCL and Orphan Drug Designation for AML. These designations position us to expedite SLS009 clinical development with the goal of delivering this groundbreaking treatment to patients in need.”

Dr. Stergiou further stated “We are also on track to complete enrollment (other than 20-25 patients from China) of the Phase 3 registrational REGAL study of GPS in patients with AML this month and, while the interim and final analyses are event (death) driven and therefore not within our control, we expect interim data from the study by the end of this year or early next year based upon our assumptions in our statistical analysis plan. We also look forward to the upcoming meeting of the Independent Data Monitoring Committee for the REGAL study towards the end of the month. Last, but not least, we are planning to hold a corporate update call with

our shareholders in December to provide an update on the REGAL study and the SLS009 clinical programs as well as our projected outlook for 2024.”

Pipeline Update:

Galinpepimut-S (GPS): Wilms Tumor-1 (WT1) targeting immunotherapeutic

Phase 3 REGAL study in AML:

In August 2023, the Independent Data Monitoring Committee (IDMC) recommended that REGAL continue as planned, following a routine, prespecified risk-benefit assessment of unblinded data from the study. The next routine IDMC meeting is scheduled for the end of November 2023. The Company expects to complete enrollment in the REGAL study, other than the 20-25 patients to be enrolled in China, in November 2023 and anticipates that 3D Medicines Inc., its commercialization partner for GPS in Greater China, will begin enrolling patients in China in the fourth quarter of 2023, subject to any further delays as a result of supply chain or other operational reasons, which will trigger two development milestone payments totaling $13.0 million.

The interim analysis of the REGAL study is expected in late 2023 or early 2024; however, because these analyses are event-driven, they may occur at a different time than currently expected.

Phase 1/2 Study in combination with pembrolizumab (Keytruda®) in ovarian cancer:

Final data were presented in November 2023 at the International Gynecologic Cancer Society Annual 2023 Annual Global Meeting. The topline data showed clinical benefit of GPS and anti-PD-1 pembrolizumab combination therapy in WT1-positive relapsed or refractory platinum-resistant advanced metastatic ovarian cancer patients with a 50% disease control rate and a median overall survival benefit of 18.4 months as compared to 13.8 months with pembrolizumab monotherapy in a similar patient population shown in the KEYNOTE-028 study and historical values in comparable patients of 11-14 months with standard of care chemotherapy.

SLS009: highly selective CDK9 inhibitor

Phase 1 clinical trial in relapsed/refractory (r/r) hematological malignancies completed:

In September, the Company reported positive topline data from the cohort of patients with lymphomas from the Phase 1 dose escalation clinical trial of SLS009 showing that the study met all the primary and secondary endpoints supporting its advancement to Phase 2. The maximum tolerated dose was not reached. A dose-limiting toxicity occurred in one out of five patients in the lymphoma cohort treated at the 100 mg dose level. No dose-limiting toxicities were observed at any other dose level, and there were no unexpected toxicities across the study. Among 34 evaluable r/r lymphoma patients, five (14.7%) achieved a clinical response with a reduction in tumor burden of up to 68.9%. An additional seven patients (20.6%) achieved stable disease (SD) resulting in an overall disease control rate of 35.3%. In the subgroup of PTCL patients, four out of 11 (36.4%) evaluable patients achieved a clinical response. Additionally, one patient achieved a complete response (CR) in late October 2023, and remains on the trial after 16

weeks of treatment. The recommended Phase 2 dose for patients with lymphoma was established at 100 mg.

Phase 2a clinical trial in AML:

In October 2023, SELLAS announced positive, initial results from the Phase 2a study of SLS009 combination treatment with aza/ven in r/r AML patients who did not respond or stopped responding to venetoclax-based therapies. The Phase 2a clinical trial is an open-label, single-arm, multi-center study that is designed to evaluate safety, tolerability, and efficacy at two dose levels of SLS009. Six of the seven patients enrolled are still alive as of the latest follow-up, five remain on treatment and the first enrolled patientachieved a complete response and is in the sixth month of treatment while the second enrolled patient is in the fifth month of treatment. Anti-leukemic effects have been observed in all patients without any significant safety issues to date. Patients with AML who fail venetoclax-based therapies have limited treatment options and a poor prognosis with a median overall survival of approximately 2.5 months.

Phase 1b/2 clinical trial in r/r peripheral T-cell lymphomas:

The Company announced in October 2023 that the first patient was dosed in the Phase 1b/2 trial evaluating SLS009 in r/r PTCL. The open-label, single-arm trial will enroll up to 95 patients to evaluate safety and efficacy and, based on the results, may serve as a registrational study. This initial PTCL study is fully funded by GenFleet Therapeutics (Shanghai), Inc., and is being conducted in China.

Regulatory matters:

In October 2023, the FDA granted Orphan Drug Designation (ODD) for SLS009 for the treatment of AML.

In October 2023, the FDA granted Fast Track Designation to SLS009 for the treatment of r/r PTCL. The Fast Track Designation is intended to facilitate the development and review of drugs.

Financial Results for the Third Quarter 2023:

Research and Development Expenses: Research and development expenses for the third quarter of 2023 were $5.8 million, compared to $4.3 million for the same period in 2022. The increase was primarily due to an increase in clinical trial expenses related to the ongoing Phase 3 REGAL clinical trial of GPS in AML patients and the Phase 2a and Phase 1 clinical trials of SLS009 in hematological malignancies, an increase in manufacturing costs related to clinical drug supply purchases, and an increase in clinical and regulatory consulting. Research and development expenses were $18.9 million for the first nine months of 2023, compared to $14.4 million for the same period in 2022. The increase was primarily due to an increase in clinical trial expenses, an increase in clinical and regulatory consulting, and an increase in personnel related expenses due to increased headcount.

General and Administrative Expenses: General and administrative expenses for the third quarter of 2023 were $3.5 million, as compared to $2.9 million for the same period in 2022. The increase was primarily due to an increase in outside services and public company costs and an increase in legal and intellectual property fees. General and administrative expenses were $10.8 million for the first nine months of 2023, compared to $9.0 million for the same period in 2022.

The increase was primarily due to personnel-related expenses due to increased headcount, an increase in legal and intellectual property fees, and an increase in outside services and public company costs.

Acquired In-Process Research and Development: There was no acquired in-process research and development in the third quarter of 2023 or the third quarter of 2022. There was no acquired in-process research and development in the first nine months of 2023, compared to $10.0 million for the same period in 2022, resulting from the in-licensing of SLS009.

Net Loss: Net loss was $9.3 million for the third quarter of 2023, or a basic and diluted loss per share of $0.33, compared to a net loss of $7.0 million for the same period in 2022, or a basic and diluted loss per share of $0.34. Net loss was $29.2 million for the first nine months of 2023, or a basic and diluted loss per share of $1.09, compared to a net loss of $32.2 million for the same period in 2022, or a basic and diluted net loss per share of $1.70.

Cash Position: As of September 30, 2023, cash and cash equivalents totaled approximately $4.0 million. Following the end of the quarter, on November 2, 2023, the Company received gross proceeds of approximately $4.0 million from a registered direct offering at-the-market of shares of common stock, pre-funded warrants to acquire shares of common stock, and warrants to acquire shares of common stock with a single, healthcare-focused investor. Additionally, the Company is anticipating $13.0 million from 3D Medicines, Inc. upon patients enrolling China in the REGAL study which we expect to be triggered in the fourth quarter of 2023.

About SELLAS Life Sciences Group, Inc.

SELLAS is a late-stage clinical biopharmaceutical company focused on the development of novel therapeutics for a broad range of cancer indications. SELLAS’ lead product candidate, GPS, is licensed from Memorial Sloan Kettering Cancer Center and targets the WT1 protein, which is present in an array of tumor types. GPS has potential as a monotherapy and combination with other therapies to address a broad spectrum of hematologic malignancies and solid tumor indications. The Company is also developing SLS009 (formerly GFH009), a small molecule, highly selective CDK9 inhibitor, which is licensed from GenFleet Therapeutics (Shanghai), Inc., for all therapeutic and diagnostic uses in the world outside of Greater China. For more information on SELLAS, please visit www.sellaslifesciences.com.

Keytruda® is a registered trademark of Merck Sharp & Dohme LLC, a subsidiary of Merck & Co., Inc., Rahway, NJ, USA, and is not a trademark of SELLAS. The manufacturer of this brand is not affiliated with and do not endorse SELLAS or its products.

Forward-Looking Statements

This press release contains forward-looking statements. All statements other than statements of historical facts are “forward-looking statements,” including those relating to future events. In some cases, forward-looking statements can be identified by terminology such as “plan,” “expect,” “anticipate,” “may,” “might,” “will,” “should,” “project,” “believe,” “estimate,” “predict,” “potential,” “intend,” or “continue” and other words or terms of similar meaning. These statements include, without limitation, statements related to the GPS and SLS009 clinical development programs, including data therefrom, regulatory strategy and the timing of future milestones. These forward-looking statements are based on current plans, objectives,

estimates, expectations and intentions, and inherently involve significant risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation, risks and uncertainties with oncology product development and clinical success thereof, the uncertainty of regulatory approval, and other risks and uncertainties affecting SELLAS and its development programs as set forth under the caption “Risk Factors” in SELLAS’ Annual Report on Form 10-K filed on March 16, 2023 and in its other SEC filings. Other risks and uncertainties of which SELLAS is not currently aware may also affect SELLAS’ forward-looking statements and may cause actual results and the timing of events to differ materially from those anticipated. The forward-looking statements herein are made only as of the date hereof. SELLAS undertakes no obligation to update or supplement any forward-looking statements to reflect actual results, new information, future events, changes in its expectations or other circumstances that exist after the date as of which the forward-looking statements were made.

Investor Contact

Bruce Mackle

Managing Director

LifeSci Advisors, LLC

SELLAS@lifesciadvisors.com

SELLAS LIFE SCIENCES GROUP, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in thousands, except share and per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Licensing revenue | | $ | — | | | $ | — | | | $ | — | | | $ | 1,000 | |

| Operating expenses: | | | | | | | | |

| Cost of licensing revenue | | — | | | — | | | — | | | 100 | |

| Research and development | | 5,813 | | | 4,282 | | | 18,910 | | | 14,422 | |

| General and administrative | | 3,548 | | | 2,864 | | | 10,782 | | | 8,982 | |

| Acquired in-process research and development | | — | | | — | | | — | | | 10,000 | |

| Total operating expenses | | 9,361 | | | 7,146 | | | 29,692 | | | 33,504 | |

| Operating loss | | (9,361) | | | (7,146) | | | (29,692) | | | (32,504) | |

| Non-operating income: | | | | | | | | |

| Change in fair value of warrant liability | | — | | | 2 | | | 4 | | | 39 | |

| Change in fair value of contingent consideration | | — | | | 11 | | | — | | | 126 | |

| Interest income | | 94 | | | 111 | | | 484 | | | 159 | |

| Total non-operating income | | 94 | | | 124 | | | 488 | | | 324 | |

| Net loss | | $ | (9,267) | | | $ | (7,022) | | | $ | (29,204) | | | $ | (32,180) | |

| | | | | | | | |

| Per share information: | | | | | | | | |

| Net loss per common share, basic and diluted | | $ | (0.33) | | | $ | (0.34) | | | $ | (1.09) | | | $ | (1.70) | |

| Weighted-average common shares outstanding, basic and diluted | | 28,355,427 | | | 20,562,351 | | | 26,767,914 | | | 18,932,571 | |

SELLAS LIFE SCIENCES GROUP, INC.

CONSOLIDATED BALANCE SHEETS

(Amounts in thousands, except share and per share data)

(Unaudited)

| | | | | | | | | | | | | | |

| | September 30, 2023 | | December 31, 2022 |

| | |

| ASSETS | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 3,969 | | | $ | 17,125 | |

| Restricted cash and cash equivalents | | 100 | | | 100 | |

| Prepaid expenses and other current assets | | 1,134 | | | 531 | |

| Total current assets | | 5,203 | | | 17,756 | |

| Operating lease right-of-use assets | | 592 | | | 874 | |

| Goodwill | | 1,914 | | | 1,914 | |

| Deposits and other assets | | 377 | | | 399 | |

| Total assets | | $ | 8,086 | | | $ | 20,943 | |

| LIABILITIES AND STOCKHOLDERS’ (DEFICIT) EQUITY | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 4,340 | | | $ | 3,357 | |

| Accrued expenses and other current liabilities | | 6,929 | | | 6,286 | |

| Operating lease liabilities | | 466 | | | 372 | |

| Acquired in-process research and development payable | | — | | | 5,500 | |

| Total current liabilities | | 11,735 | | | 15,515 | |

| Operating lease liabilities, non-current | | 178 | | | 573 | |

| Warrant liability | | — | | | 4 | |

| Total liabilities | | 11,913 | | | 16,092 | |

| Commitments and contingencies | | | | |

| Stockholders’ (deficit) equity: | | | | |

| Preferred stock, $0.0001 par value; 5,000,000 shares authorized; Series A convertible preferred stock, 17,500 shares designated; no shares issued and outstanding at September 30, 2023 and December 31, 2022 | | — | | | — | |

| Common stock, $0.0001 par value; 350,000,000 shares authorized, 28,393,958 and 21,005,405 shares issued and outstanding at September 30, 2023 and December 31, 2022, respectively | | 3 | | | 2 | |

| Additional paid-in capital | | 205,278 | | | 184,753 | |

| Accumulated deficit | | (209,108) | | | (179,904) | |

| Total stockholders’ (deficit) equity | | (3,827) | | | 4,851 | |

| Total liabilities and stockholders’ (deficit) equity | | $ | 8,086 | | | $ | 20,943 | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

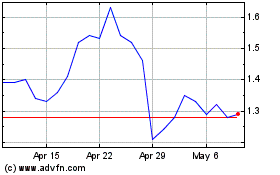

SELLAS Life Sciences (NASDAQ:SLS)

Historical Stock Chart

From Mar 2024 to Apr 2024

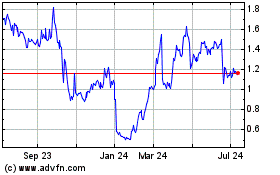

SELLAS Life Sciences (NASDAQ:SLS)

Historical Stock Chart

From Apr 2023 to Apr 2024