0001760689FALSE00017606892023-11-092023-11-090001760689us-gaap:CommonStockMember2023-11-092023-11-090001760689us-gaap:WarrantMember2023-11-092023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 9, 2023

Microvast Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-38826 | | 83-2530757 |

(State or other jurisdiction

of incorporation) | | (Commission File Number) | | (IRS. Employer

Identification No.) |

12603 Southwest Freeway, Suite 300

Stafford, Texas 77477

(Address of principal executive offices, including zip code)

281-491-9505

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.0001 per share | | MVST | | The NASDAQ Stock Market LLC |

| Redeemable warrants, exercisable for shares of common stock at an exercise price of $11.50 per share | | MVSTW | | The NASDAQ Stock Market LLC |

Item 2.02 Results of Operations and Financial Condition.

On November 9, 2023, Microvast Holdings, Inc. (the “Company”) issued a press release announcing its unaudited condensed consolidated financial results for the period ended September 30, 2023. In addition, the Company posted an accompanying slideshow presentation to its website summarizing its results for the same period. The full text of the press release is furnished as Exhibit 99.1 and the slideshow presentation is furnished as Exhibit 99.2 to this Current Report on Form 8-K. Exhibits 99.1 and 99.2 are hereby incorporated into this Item 2.02 by reference.

The information furnished in this Current Report on Form 8-K and Exhibits 99.1 and 99.2 attached hereto shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Date: November 9, 2023 | MICROVAST HOLDINGS, INC. |

| |

| By: | /s/ Craig Webster |

| Name: | Craig Webster |

| Title: | Chief Financial Officer |

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits

| | | | | | | | |

Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

Exhibit 99.1

Microvast Reports Third Quarter 2023 Financial Results

•Revenue increased 107.5% year over year to $80.1 million

•Achieved record backlog of $678.7 million, up 382.7% year over year

•Gross margin increased from 5.2% to 22.3%, a 17.1 percentage point improvement year over year

STAFFORD, Texas, USA, November 9, 2023 — Microvast Holdings, Inc. (NASDAQ: MVST) (“Microvast” or the “Company”), a technology innovator that designs, develops and manufactures lithium-ion battery solutions, today announced unaudited condensed consolidated financial results for the third quarter ended September 30, 2023 (“Q3 2023”).

“In the third quarter, we achieved excellent year over year revenue growth, led by increased deliveries of our 53.5Ah cell from our new Huzhou 3.1 line to our OEM customers.” said Yang Wu, Microvast’s Founder, Chairman, and Chief Executive Officer. “Operations at our expanded facility in Huzhou, China have exceeded target yields on high levels of utilization, and our target is to have over 90% utilization by the end of the fourth quarter. Completion of the Phase 1A line in Clarksville, Tennessee is a key operational focus with an accelerated ramp up plan allowing for delivery of qualified products from early Q2 next year.”

“This was a really solid quarter. We delivered our revenues at an adjusted gross margin of 24.2%. These gross margin levels are in the territory of the scaled global battery manufacturers with whom we compete.” said Craig Webster, Microvast’s Chief Financial Officer. “The successful conclusion of the Phase 3.1 investment is an incredible milestone for the year, and positions us very nicely for Q4 and our plans of another high growth year in 2024.”

Results for Q3 2023

•Revenue of $80.1 million, compared to $38.6 million in Q3 2022, an increase of 107.5%

•Backlog as of September 30, 2023 was $678.7 million, representing a growth of 382.7% compared to $140.6 million in backlog as of September 30, 2022

•Gross margin increased to 22.3% from gross margin of 5.2% in Q3 2022; Non-GAAP adjusted gross margin increased to 24.2%, up from 10.2% in Q3 2022

•Operating expenses of $44.7 million, compared to $39.6 million in Q3 2022; Adjusted operating expenses of $30.3 million, compared to $22.3 million in Q3 2022

•Net loss of $26.2 million, compared to net loss of $36.5 million in Q3 2022; Non-GAAP adjusted net loss of $10.3 million, compared to non-GAAP adjusted net loss of $17.4 million in Q3 2022

•Net loss per share of $0.08 compared to net loss per share of $0.12 in Q3 2022; Non-GAAP adjusted net loss per share of $0.03, compared to non-GAAP adjusted net loss per share of $0.06 in Q3 2022

•Adjusted EBITDA of $(5.3) million in Q3 2023, compared to Adjusted EBITDA of $(12.6) million in Q3 2022

•Capital expenditures of $59.9 million, compared to $16.8 million in Q3 2022, and primarily driven by capacity expansion at our Clarksville, Tennessee facility

•Cash, cash equivalents, restricted cash and short-term investments of $114.7 million as of September 30, 2023, compared to $327.7 million as of December 31, 2022, and $415.7 million as of September 30, 2022; decrease largely due to significant capital expenditure towards PP&E in the U.S. and Huzhou, China

Results for Nine Months Ended September 30, 2023 (“YTD 2023”)

•Revenue of $202.0 million, compared to $139.7 million in the nine months ended September 30, 2022 (“YTD 2022”), an increase of 44.6%

•Gross margin increased to 16.9% from gross margin of 4.9% in YTD 2022; Non-GAAP adjusted gross margin increased to 19.2%, up from 9.0% in YTD 2022

•Operating expenses of $119.9 million, compared to $133.4 million in YTD 2022; Adjusted operating expenses of $72.8 million, compared to $75.1 million in YTD 2022

•Net loss of $81.8 million, compared to net loss of $124.5 million in YTD 2022; Non-GAAP adjusted net loss of $30.2 million, compared to non-GAAP adjusted net loss of $61.4 million in YTD 2022

•Net loss per share of $0.26 compared to net loss per share of $0.41 in YTD 2022; Non-GAAP adjusted net loss per share of $0.09, compared to non-GAAP adjusted net loss per share of $0.20 in YTD 2022

•Adjusted EBITDA of $(17.0) million in YTD 2023, compared to Adjusted EBITDA of $(44.9) million in YTD 2022

•Capital expenditures of $153.6 million, compared to $84.7 million in YTD 2022, and were driven by investments in manufacturing capacity expansions in Huzhou, China and Clarksville, Tennessee

Please refer to the tables at the end of this press release for reconciliations of gross profit to non-GAAP adjusted gross profit, and net loss to non-GAAP adjusted net loss and non-GAAP adjusted EBITDA.

2023 Outlook

•For the remainder of 2023, the Company anticipates adding major projects to its record backlog of $678.7 million, with continued growth in orders

•The Company expects revenue to be in the range of $90 million to $100 million in Q4 2023, and $292 million to $302 million for the full year 2023 compared to $204 million in revenue for full year 2022

•Continued ramp up of qualified product deliveries to customers of 53.5Ah cells from Huzhou, China to meet strong demand from our OEM customers

•Work towards completion of construction and equipment installation in Clarksville, Tennessee to begin ramp up in Q1 2024 and delivering qualified products into Q2 2024

•Begin incremental investment program for the Phase 3.2 additional capacity expansion with new flexible automated production line in Huzhou, China to meet growing demand

Webcast Information

Company management will host a conference call and webcast to discuss the Company’s financial results on November 9, 2023, at 4:00 p.m. Central Time, to discuss the Company's financial results. The live webcast and accompanying slide presentation will be accessible from the Events & Presentations section of Microvast’s investor relations website (https://ir.microvast.com/events-presentations/events). A replay will be available following the conclusion of the event. Investment community professionals interested in participating in the Q&A session may join the call by dialing +1 (877) 407-9208.

About Microvast

Microvast is a global leader in providing battery technologies for electric vehicles and energy storage solutions. With a legacy of over 17 years, Microvast has consistently delivered cutting-edge battery systems that empower a cleaner and more sustainable future. The company's innovative approach and dedication to excellence have positioned it as a trusted partner for customers around the world. Microvast was founded in 2006 and is headquartered in Stafford, Texas.

For more information, please visit www.microvast.com or follow us on LinkedIn or Twitter (@microvast).

Contact:

Investor Relations

ir@microvast.com

Cautionary Statement Regarding Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about future financial and operating results, our objectives, expectations and intentions with respect to future operations, products and services; and other statements identified by words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “objective,” “plan,” “project,” “predict,” “outlook” “should,” “will,” “would,” or the negative of these terms, or other comparable terminology intended to identify statements about the future. These forward-looking statements include, but are not limited to, statements regarding our industry and market sizes, and future opportunities for us. Such forward-looking statements are based upon the current beliefs and expectations of management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are difficult to predict and generally beyond our control. Actual results and the timing of events may differ materially from the results anticipated in these forward-looking statements.

Many factors could cause actual results and the timing of events to differ materially from the anticipated results or other expectations expressed in the forward-looking statements, including, among others: (1) changes in the highly competitive market in which we compete, including with respect to our competitive landscape, technology evolution or regulatory changes; (2) risk that we may not be able to execute our growth strategies or achieve profitability; (3) risks of operations in China; (4) the impact of inflation and rising interest rates; (5) changes in availability and price of raw

materials; (6) changes in the markets that we target; (7) heightened awareness of environmental issues and concern about global warming and climate change; (8) risk that we are unable to secure or protect our intellectual property; (9) risk that our customers or third-party suppliers are unable to meet their obligations fully or in a timely manner; (10) risk that our customers will adjust, cancel or suspend their orders for our products; (11) risk that we will need to raise additional capital to execute our business plan, which may not be available on acceptable terms or at all; (12) risk of product liability or regulatory lawsuits or proceedings relating to our products or services; (13) risk of any cyber security threat or event and the effectiveness of our information technology systems to detect and defend against cyber attacks; (14) economic, financial and other impacts of the coronavirus (“COVID-19”) pandemic, including global supply chain disruptions; and (15) the ongoing conflicts between Russia and Ukraine and Israel and Hamas, acts of terrorism, other catastrophic events and any restrictive actions that have been or may be taken by the U.S. and/or other countries in response thereto, such as sanctions or export controls. Microvast’s annual, quarterly and other filings with the U.S. Securities and Exchange Commission identify, address and discuss these and other factors in the sections entitled “Risk Factors.”

Actual results, performance or achievements may differ materially, and potentially adversely, from any forward-looking statements and the assumptions on which those forward-looking statements are based. There can be no assurance that the data contained herein is reflective of future performance to any degree. You are cautioned not to place undue reliance on forward-looking statements as a predictor of future performance as forward-looking statements are based on estimates and assumptions that are inherently subject to various significant risks, uncertainties and other factors, many of which are beyond our control. All information set forth herein speaks only as of the date hereof, and we disclaim any intention or obligation to update any forward-looking statements as a result of developments occurring after the date hereof except as may be required under applicable securities laws. Forecasts and estimates regarding our industry and end markets are based on sources we believe to be reliable, however, there can be no assurance these forecasts and estimates will prove accurate in whole or in part.

Non-GAAP Financial Measures

To provide investors with additional information regarding our financial results, Microvast has disclosed in this earnings release non-GAAP financial measures, including non-GAAP adjusted gross profit (loss), non-GAAP adjusted EBITDA and non-GAAP adjusted net loss, which are non-GAAP financial measures as defined under the rules of the SEC. These are intended as supplemental measures of our financial performance that are not required by, or presented in accordance with U.S. generally accepted accounting principles (“GAAP”).

Reconciliations to the most comparable GAAP measures, gross profit and net income (loss), are contained in tabular form in the unaudited financial statements below. Non-GAAP adjusted gross profit is GAAP gross profit as adjusted for non-cash stock-based compensation expense included in cost of revenues. Non-GAAP adjusted net loss is GAAP net loss as adjusted for non-cash stock-based compensation expense and change in valuation of warrant liabilities. Non-GAAP adjusted net loss per common share is GAAP net loss per common share as adjusted for non-cash stock-based compensation expense and change in valuation of warrant liabilities per common share. Non-GAAP adjusted EBITDA is defined as net loss excluding depreciation and amortization, non-cash settled share-based compensation expense, interest expense, interest income, changes in fair value of our warrant liability and income tax expense or benefit.

We use non-GAAP adjusted gross profit, non-GAAP adjusted EBITDA and non-GAAP adjusted net loss for financial and operational decision-making and as a means to evaluate period-to-period comparisons. We consider them to be important measures because they help illustrate underlying trends in our business and our historical operating performance on a more consistent basis. We

believe that these non-GAAP financial measures, when taken together with their most directly comparable GAAP measures, gross profit and net income (loss), provide meaningful supplemental information regarding our performance by excluding certain items that may not be indicative of our recurring core business operating results.

We believe that both management and investors benefit from referring to these non-GAAP financial measures in assessing our performance and when planning, forecasting, and analyzing future periods. These non-GAAP financial measures also facilitate management’s internal comparisons to our historical performance. We believe these non-GAAP financial measures are useful to investors both because (1) they allow for greater transparency with respect to key metrics used by management in its financial and operational decision-making and (2) they are used by our institutional investors and the analyst community to help them analyze the health of our business. Accordingly, we believe that these non-GAAP financial measures provide useful information to investors and others in understanding and evaluating our operating results in the same manner as our management team and board of directors.

Non-GAAP financial measures have limitations as an analytical tool, and you should not consider them in isolation, or as a substitute for, financial information prepared in accordance with GAAP. For example, our calculation of non-GAAP adjusted EBITDA may differ from similarly titled non-GAAP measures, if any, reported by our peer companies, or our peer companies may use other measures to calculate their financial performance, and therefore our use of non-GAAP adjusted EBITDA may not be directly comparable to similarly titled measures of other companies. The principal limitation of non-GAAP adjusted EBITDA is that it excludes significant expenses and income that are required by GAAP to be recorded in our financial statements. In addition, it is subject to inherent limitations as it reflects the exercise of judgments by management about which expense and income are excluded or included in determining this non-GAAP financial measure. In order to compensate for these limitations, management presents non-GAAP financial measures in connection with GAAP results. In addition, such financial information is unaudited and does not conform to SEC Regulation S-X and as a result, such information may be presented differently in our future filings with the SEC. For example, with respect to the warrant liability resulting from the merger, we now exclude changes in fair value from net loss in our non-GAAP adjusted EBITDA and non-GAAP adjusted net loss calculation, which had not been done in prior periods.

MICROVAST HOLDINGS, INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands of U.S. dollars, except share and per share data, or as otherwise noted)

| | | | | | | | | | | |

| December 31,

2022 | | September 30,

2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 231,420 | | | $ | 67,398 | |

| Restricted cash, current | 70,732 | | | 21,803 | |

| Short-term investments | 25,070 | | | 25,496 | |

| Accounts receivable (net of allowance for credit losses of $4,407 and $3,242 as of December 31, 2022 and September 30, 2023, respectively) | 119,304 | | | 116,300 | |

| Notes receivable | 2,196 | | | 20,161 | |

| Inventories, net | 84,252 | | | 126,913 | |

| Prepaid expenses and other current assets | 12,093 | | | 25,840 | |

| Total Current Assets | 545,067 | | | 403,911 | |

| Restricted cash, non-current | 465 | | | 11 | |

| Property, plant and equipment, net | 335,140 | | | 549,544 | |

| Land use rights, net | 12,639 | | | 11,734 | |

| Acquired intangible assets, net | 1,636 | | | 3,210 | |

| Operating lease right-of-use assets | 16,368 | | | 19,612 | |

| Other non-current assets | 73,642 | | | 28,540 | |

| Total Assets | $ | 984,957 | | | $ | 1,016,562 | |

| | | |

| Liabilities | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 44,985 | | | $ | 95,294 | |

| Advance from customers | 54,207 | | | 54,482 | |

| Accrued expenses and other current liabilities | 66,720 | | | 121,816 | |

| Income tax payables | 658 | | | 652 | |

| Short-term bank borrowings | 17,398 | | | 24,818 | |

| Notes payable | 68,441 | | | 39,329 | |

| Total Current Liabilities | 252,409 | | | 336,391 | |

| Long-term bonds payable | 43,888 | | | 43,888 | |

| Long-term bank borrowings | 28,997 | | | 30,839 | |

| Warrant liability | 126 | | | 151 | |

| Share-based compensation liability | 131 | | | 187 | |

| Operating lease liabilities | 14,347 | | | 16,951 | |

| Other non-current liabilities | 32,082 | | | 20,817 | |

| Total Liabilities | $ | 371,980 | | | $ | 449,224 | |

| | | |

| Shareholders’ Equity | | | |

| Common Stock (par value of US$0.0001 per share, 750,000,000 and 750,000,000 shares authorized as of December 31, 2022 and September 30, 2023; 309,316,011 and 316,534,825 shares issued, and 307,628,511 and 314,847,325 shares outstanding as of December 31, 2022 and September 30, 2023) | $ | 31 | | | $ | 32 | |

| Additional paid-in capital | 1,416,160 | | | 1,468,173 | |

| Statutory reserves | 6,032 | | | 6,032 | |

| Accumulated deficit | (791,165) | | | (872,965) | |

| Accumulated other comprehensive loss | (18,081) | | | (35,925) | |

| Total Microvast Holding, Inc. shareholders’ equity | 612,977 | | | 565,347 | |

| Noncontrolling interests | $ | — | | | $ | 1,991 | |

| Total Equity | $ | 612,977 | | | $ | 567,338 | |

| Total Liabilities and Equity | $ | 984,957 | | | $ | 1,016,562 | |

MICROVAST HOLDINGS, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands of U.S. dollars, except share and per share data, or as otherwise noted)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2022 | | 2023 | | 2022 | | 2023 |

| Revenues | $ | 38,616 | | | $ | 80,116 | | | $ | 139,698 | | | $ | 202,042 | |

| Cost of revenues | (36,623) | | | (62,232) | | | (132,851) | | | (167,839) | |

| Gross profit | 1,993 | | | 17,884 | | | 6,847 | | | 34,203 | |

| Operating expenses: | | | | | | | |

| General and administrative expenses | (22,585) | | | (25,402) | | | (83,021) | | | (69,347) | |

| Research and development expenses | (11,457) | | | (13,241) | | | (33,010) | | | (33,609) | |

| Selling and marketing expenses | (5,561) | | | (6,031) | | | (17,369) | | | (16,916) | |

| Total operating expenses | (39,603) | | | (44,674) | | | (133,400) | | | (119,872) | |

| Subsidy income | 520 | | | 442 | | | 1,233 | | | 1,156 | |

| Loss from operations | (37,090) | | | (26,348) | | | (125,320) | | | (84,513) | |

| Other income and expenses: | | | | | | | |

| Interest income | 870 | | | 582 | | | 1,604 | | | 3,481 | |

| Interest expense | (774) | | | (491) | | | (2,465) | | | (1,437) | |

| Changes in fair value of warrant liability | 101 | | | (42) | | | 921 | | | (25) | |

| Other income, net | 349 | | | 127 | | | 758 | | | 673 | |

| Loss before provision for income taxes | (36,544) | | | (26,172) | | | (124,502) | | | (81,821) | |

| Income tax expense | — | | | — | | | — | | | — | |

| Net loss | $ | (36,544) | | | $ | (26,172) | | | $ | (124,502) | | | $ | (81,821) | |

| Less: net loss attributable to noncontrolling interests | — | | | (42) | | | — | | | (21) | |

| Net loss attributable to Microvast Holdings, Inc.'s shareholders | $ | (36,544) | | | $ | (26,130) | | | $ | (124,502) | | | $ | (81,800) | |

| Net loss per common share | | | | | | | |

| Basic and diluted | $ | (0.12) | | | $ | (0.08) | | | $ | (0.41) | | | $ | (0.26) | |

| Weighted average shares used in calculating net loss per share of common stock | | | | | | | |

| Basic and diluted | 305,977,372 | | | 313,108,457 | | | 301,821,464 | | | 309,541,499 | |

MICROVAST HOLDINGS, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands of U.S. dollars, except share and per share data, or as otherwise noted)

| | | | | | | | | | | |

| Nine Months Ended

September 30, |

| 2022 | | 2023 |

| Cash flows from operating activities | | | |

| Net loss | $ | (124,502) | | | $ | (81,821) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Loss on disposal of property, plant and equipment | 11 | | | 832 | |

| Depreciation of property, plant and equipment | 15,161 | | | 14,643 | |

| Amortization of land use right and intangible assets | 420 | | | 593 | |

| Noncash lease expenses | 1,662 | | | 2,108 | |

| Share-based compensation | 72,925 | | | 51,641 | |

| Changes in fair value of warrant liability | (921) | | | 25 | |

| Allowance/(reversal) of credit losses | 337 | | | (1,038) | |

| Provision for obsolete inventories | 3,148 | | | 928 | |

| Impairment loss from property, plant and equipment | 1,546 | | | 473 | |

| Product warranty | 8,263 | | | 9,017 | |

| Changes in operating assets and liabilities: | | | |

| Notes receivable | 1,386 | | | (22,372) | |

| Accounts receivable | (5,024) | | | (911) | |

| Inventories | (39,517) | | | (54,473) | |

| Prepaid expenses and other current assets | (3,764) | | | (12,666) | |

| Amounts due from/to related parties | 85 | | | — | |

| Operating lease right-of-use assets | (19,284) | | | (5,588) | |

| Other non-current assets | 216 | | | (653) | |

| Notes payable | 19,942 | | | (26,070) | |

| Accounts payable | (529) | | | 53,400 | |

| Advance from customers | 5,608 | | | 515 | |

| Accrued expenses and other liabilities | (12,203) | | | (1,374) | |

| Operating lease liabilities | 15,389 | | | 2,760 | |

| Other non-current liabilities | 1,050 | | | (319) | |

| Net cash used in operating activities | (58,595) | | | (70,350) | |

| | | |

| Cash flows from investing activities | | | |

| Purchases of property, plant and equipment | (84,722) | | | (153,574) | |

| Proceeds on disposal of property, plant and equipment | 3 | | | 879 | |

| Purchase of short-term investments | — | | | (425) | |

| Net cash used in investing activities | (84,719) | | | (153,120) | |

| | | |

| Cash flows from financing activities | | | |

| Proceeds from borrowings | 58,708 | | | 18,439 | |

| Repayment of bank borrowings | (24,482) | | | (6,286) | |

| Net cash generated from financing activities | 34,226 | | | 12,153 | |

| Effect of exchange rate changes | (11,322) | | | (2,088) | |

| Decrease in cash, cash equivalents and restricted cash | (120,410) | | | (213,405) | |

| Cash, cash equivalents and restricted cash at beginning of the period | 536,109 | | | 302,617 | |

| Cash, cash equivalents and restricted cash at end of the period | $ | 415,699 | | | $ | 89,212 | |

MICROVAST HOLDINGS, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS-Continued

(In thousands of U.S. dollars, except share and per share data, or as otherwise noted)

| | | | | | | | | | | |

| Nine Months Ended

September 30, |

| 2022 | | 2023 |

| Reconciliation to amounts on consolidated balance sheets | | | |

| Cash and cash equivalents | $ | 295,816 | | | $ | 67,398 | |

| Restricted cash | 119,883 | | | 21,814 | |

| Total cash, cash equivalents and restricted cash | $ | 415,699 | | | $ | 89,212 | |

MICROVAST HOLDINGS, INC.

RECONCILIATION OF GROSS PROFIT TO ADJUSTED GROSS PROFIT

(Unaudited, in thousands of U.S. dollars)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2022 | | 2023 | | 2022 | | 2023 |

| Revenues | $ | 38,616 | | | $ | 80,116 | | | $ | 139,698 | | | $ | 202,042 | |

| Cost of revenues | (36,623) | | | (62,232) | | | (132,851) | | | (167,839) | |

| Gross profit (GAAP) | $ | 1,993 | | | $ | 17,884 | | | $ | 6,847 | | | $ | 34,203 | |

| Gross margin | 5.2 | % | | 22.3 | % | | 4.9 | % | | 16.9 | % |

| | | | | | | |

| Non-cash settled share-based compensation (included in cost of revenues) | 1,964 | | | 1,530 | | | 5,745 | | | 4,559 | |

| Adjusted gross profit (non-GAAP) | $ | 3,957 | | | $ | 19,414 | | | $ | 12,592 | | | $ | 38,762 | |

| Adjusted gross margin (non-GAAP) | 10.2 | % | | 24.2 | % | | 9.0 | % | | 19.2 | % |

MICROVAST HOLDINGS, INC.

RECONCILIATION OF NET LOSS TO ADJUSTED NET LOSS

(In thousands of U.S. dollars, except per share data, or as otherwise noted)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2022 | | 2023 | | 2022 | | 2023 |

| Net loss (GAAP) | $ | (36,544) | | | $ | (26,172) | | | $ | (124,502) | | | $ | (81,821) | |

Changes in fair value of warrant liability* | (101) | | | 42 | | | (921) | | | 25 | |

| Non-cash settled share-based compensation* | 19,259 | | | 15,862 | | | 64,039 | | | 51,602 | |

| Adjusted Net Loss (non-GAAP) | $ | (17,386) | | | $ | (10,268) | | | $ | (61,384) | | | $ | (30,194) | |

*The tax effect of the adjustments was nil.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2022 | | 2023 | | 2022 | | 2023 |

| Net loss per common share-Basic and diluted (GAAP) | $ | (0.12) | | | $ | (0.08) | | | $ | (0.41) | | | $ | (0.26) | |

| Changes in fair value of warranty liability per common share | — | | | — | | | — | | | — | |

| Non-cash settled share-based compensation per common share | 0.06 | | | 0.05 | | | 0.21 | | | 0.17 | |

| Adjusted net loss per common share-Basic and diluted (non-GAAP) | $ | (0.06) | | | $ | (0.03) | | | $ | (0.20) | | | $ | (0.09) | |

MICROVAST HOLDINGS, INC.

RECONCILIATION OF NET LOSS TO EBITDA AND ADJUSTED EBITDA

(Unaudited, in thousands of U.S. dollars)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2022 | | 2023 | | 2022 | | 2023 |

| Net loss (GAAP) | $ | (36,544) | | | $ | (26,172) | | | $ | (124,502) | | | $ | (81,821) | |

| Interest expense (income), net | (96) | | | (91) | | | 861 | | | (2,044) | |

| Income tax expense | — | | | — | | | — | | | — | |

| Depreciation and amortization | 4,921 | | | 5,040 | | | 15,581 | | | 15,236 | |

| EBITDA (non-GAAP) | $ | (31,719) | | | $ | (21,223) | | | $ | (108,060) | | | $ | (68,629) | |

| Changes in fair value of warrant liability | (101) | | | 42 | | | (921) | | | 25 | |

| Non-cash settled share-based compensation | 19,259 | | | 15,862 | | | 64,039 | | | 51,602 | |

| Adjusted EBITDA (non-GAAP) | $ | (12,561) | | | $ | (5,319) | | | $ | (44,942) | | | $ | (17,002) | |

Q 3 2 0 2 3

Forward-Looking Statements This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about future financial and operating results, our plans, objectives, expectations and intentions with respect to future operations, products and services; and other statements identified by words such as “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimated,” “believe,” “intend,” “plan,” “projection,” “guidance,” “outlook” or words of similar meaning. Such forward-looking statements are based upon the current beliefs and expectations of our management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are difficult to predict and generally beyond our control. Actual results, performance or achievements may differ materially, and potentially adversely, from any projections and forward-looking statements and the assumptions on which those forward-looking statements are based. All information set forth herein speaks only as of the date hereof and we disclaim any intention or obligation to update any forward-looking statements as a result of developments occurring after the date of this communication. Forecasts and estimates regarding Microvast’s industry and end markets are based on sources we believe to be reliable, however there can be no assurance these forecasts and estimates will prove accurate in whole or in part. Microvast’s annual, quarterly and other filings with the U.S. Securities and Exchange Commission identify, address and discuss these and other factors in the sections entitled “Risk Factors.” Non-GAAP Financial Measures This presentation contains adjusted gross profit, adjusted operating loss and adjusted net loss, which are non-GAAP financial measures. Adjusted gross profit is GAAP gross profit as adjusted for non-cash stock-based compensation expense included in cost of revenues. Adjusted operating loss is GAAP operating loss as adjusted for non-cash stock-based compensation expense included in cost of revenues and operating expense . Adjusted net loss is GAAP net loss as adjusted for non-cash stock-based compensation expense and change in on valuation of warrant liabilities and convertible notes. In addition to Microvast's results determined in accordance with GAAP, Microvast's management uses these non-GAAP financial metrics to evaluate the company’s ongoing operations and for internal planning and forecasting purposes. We believe that this non-GAAP financial information, when taken collectively, may be helpful to investors in assessing Microvast's operating performance. We believe that the use of these non-GAAP metrics provides an additional tool for investors to use in evaluating ongoing operating results and trends because it eliminates the effect of financing, non-recurring items, capital expenditures, and non-cash expenses. In addition, our presentation of adjusted gross profit, adjusted operating loss and adjusted net loss should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. Our computation of non-GAAP financial metrics may not be comparable to other similarly titled measures computed by other companies because not all companies calculate these measures in the same fashion. Because of these limitations, these non-GAAP financial metrics should not be considered in isolation or as a substitute for performance measures calculated in accordance with GAAP. We compensate for these limitations by relying primarily on our GAAP results and using non-GAAP financial metrics on a supplemental basis. Investors should review the reconciliations in this presentation and not rely on any single financial measure to evaluate our business. Disclaimer

Q 3 H I G H L I G H T S

4 Overview Steady Growth, Strong Positioning Huzhou 3.1 driven by ESS business in the U.S. and strong CV demand in EMEA & APAC107% increase YoY Q3 Revenue Q3 Backlog Clarksville, TN Q 3 2 0 2 3 53.5Ah With U.S. and Europe leading markets Backlog Share Exceeding yield targets Utilization ramping on schedule Delivering qualified products Construction phase nearing completion ~30% of equipment on site, installation in Q4 Deliver qualified 53.5Ah cells from early Q2 +14 percentage points YoY Adj. GM

5 53.5Ah Product Wins Huzhou Phase 3.1 – Commercialization Exceeding Targets 2GWh Production Capacity: Huzhou 3.1 producing at ~70% utilization. Targeting >90% utilization by YE2023. 53.5Ah Yield: Currently surpassing ramped production yield targets. Continuing efforts and improvements to push above target. Qualified Deliveries: Delivering qualified products to customers that meet or exceed performance specifications. Q 3 2 0 2 3 Superior Energy Density Industry-Leading Commercialized Chemistries Long Cycle Life

6 Huzhou Capacity – Phase 3.2 Incremental Investment & Substantial Capacity Increase Q 3 2 0 2 3 ~$35M CAPEX Investment Bolster nameplate capacity with additional equipment $250M Anticipated additional annual revenue potential 1GWh Capacity Expansion 48Ah & 53.5Ah automated flex production line Huzhou Phase 3 – Sized for 12GWh Capacity Funding in Place: Availability period on existing $111M facility extended to June 2024 with ~$70M available to fund expansion, attractive interest rates of ~4.8%. 2024 High Growth Year: Supports expected high growth in both commercial vehicle and energy storage segments. Flex line will also produce 48Ah cell (high power) for hydrogen fuel- cell OEMs. Gross Margin Expansion: Immediately accretive as we see >20% gross margins (and improving) from the existing Phase 3.1 line.

7 Clarksville Phase 1A Status Update Summary Q 3 2 0 2 3 SOP: • SOP target of Q1 2024 to allow for an accelerated post-installation ramp-up schedule. • Factory acceptance tests on parts of the line were extended to incorporate modifications via experience from our Huzhou 3.1 automated line. 2024 Targets: + Deliver qualified 53.5Ah cells from early Q2 + Generate S45X IRA credits from Q2 onwards + Achieve target production yields in Q2 + Provide domestic content to our customers Construction Update: • Nearing completion of construction phase • Majority of the building is under joint occupancy • Minor works will be completed in Q4 Equipment Progress: • ~30% of our production equipment is on site • Majority of the remaining equipment has shipped

8 Continued Upward Trajectory – Q3 Revenue Customer project delays High interest rate environment Visa entry into U.S. for personnel to support our installation and commissioning $80.1M Revenue 107% YoY Revenue Growth in Q3 Q3 KEY STATSCHALLENGES Received 280+ unit E-Bus order from JBM under the General Purchase Agreement Delivered 80+ E-Buses to South Korean market through collaboration with leading Asian bus OEM Acquired 300+ unit order from long-term CV partner for deployment in the U.S. market in 2024 HIGHLIGHTS $67.5M Order Intake $678.7M Sales Backlog Q 3 2 0 2 3

9 OEM Vehicle Battery Type Highlights Major Project Developments Global Commercial Vehicle Market Q 3 2 0 2 3 HpCO-53.5Ah Gen 4 pack Prototype order in progress Otokar Bus e-Kent HpCO-53.5Ah Gen 4 pack Order for 300+ vehicles received LCV platform 80+ units delivered in South Korea E-bus HpCO-53.5Ah Gen 4 pack MpCO-21Ah Gen 3 pack 100 MWh delivered in Q3 Another 280+ units ordered E-bus

10 Q4 Major Projects Expected Growing EMEA Business Across Vehicle Segments Nomination letter signed MV-C Gen 4 with HpCO-53.5Ah Expected revenue: Up to $230M (2024-2027) Key Facts: + PR campaign initiated + Supply contract anticipated close in Q4 Leading EMEA Bus OEM Leading EMEA Truck OEM Nomination letter received for medium-duty truck MV-I Gen 2 pack with HpCO-53.5Ah Expected revenue: Up to $160M (2025-2027) Key Facts: + Development costs paid + Compliant with ECE r100.3 and safety requirements Q 4 2 0 2 3 O U T L O O K

Q 3 F I N A N C I A L S

12 Q3 2023 P&L ($ in thousands) Nine-Months Ended Sept. 30Three-Months Ended Sept. 30 GAAP Income Statement YoY (%)20232022YoY (%)20232022 45%202,042139,698107%80,11638,616Revenue 26%(167,839)(132,851)70%(62,232)(36,623)Cost of revenues 400%34,2036,847797%17,8841,993Gross Profit 245%16.9%4.9%333%22.3%5.2%Gross Margin -16%(69,347)(83,021)12%(25,402)(22,585)General and administrative expenses 2%(33,609)(33,010)16%(13,241)(11,457)Research and development expenses -3%(16,916)(17,369)8%(6,031)(5,561)Selling and marketing expenses -10%(119,872)(133,400)13%(44,674)(39,603)Operating expense -6%1,1561,233-15%442520Subsidy Income -33%(84,513)(125,320)-29%(26,348)(37,090)Operating loss -103%(25)921-142%(42)101Change in fair value of warrant liability 2738%2,717(103)-51%218445Others -34%(81,821)(124,502)-28%(26,172)(36,544)Loss before income tax ----Income tax -34%(81,821)(124,502)-28%(26,172)(36,544)Net loss (21)-(42)-Less: net income attributable to noncontrolling interests -34%(81,800)(124,502)-28%(26,130)(36,544)Net loss attributable shareholders

13 Cost of Sales AdjustmentsNine-Months Ended Sept. 30Three-Months Ended Sept. 30 Nine-Months Ended Sept. 30Three-Months Ended Sept. 302023202220232022 2023202220232022202,042139,69880,11638,616Revenue 4,5595,7451,5301,964Non-Cash Settled SBC(163,280)(127,106)(60,702)(34,659)Adjusted Cost of sales (non-GAAP) 38,76212,59219,4143,957Adjusted gross (loss) / profit (non-GAAP) 19.2%9.0%24.2%10.2%Adjusted gross margin (non-GAAP) Operating Expense Adjustments Nine-Months Ended Sept. 30Three-Months Ended Sept. 30(72,829)(75,106)(30,342)(22,308)Adjusted Operating Expense 2023202220232022(32,911)(61,281)(10,486)(17,831)Adjusted Operating Loss (non-GAAP) 47,04358,29414,33217,295Non-Cash Settled SBC (30,194)(61,384)(10,268)(17,386)Adjusted Net Loss (non-GAAP) Net Loss Adjustments Nine-Months Ended Sept. 30Three-Months Ended Sept. 30 2023202220232022 25(921)42(101)Fair Value Changes Q3 2023 Adjusted Financials – Non-GAAP ($ in thousands)

14 Q3 2023 Revenue by Region ($ in thousands) Three-Months Ended Sept. 30 Revenue by region YoY %20232022 233%24,6117,394APAC (Excluding China) 37%36,28926,542China 455%19,0343,432EMEA -85%1821,248USA 107%80,11638,616Total Nine-Months Ended Sept. 30 Revenue by region YoY %20232022 2%46,28045,420APAC (Excluding China) 43%115,02380,326China 249%38,55611,062EMEA -24%2,1832,890USA 45%202,042139,698Total Q3 9-Months

15 Q3 2023 Financial Highlights 24.2% Adj. Gross Margin +14 percentage points YoY $59.9M Total Capex >70% to capacity expansions Expanded gross margins from increased utilization & yield, changes in product mix, and raw material prices Expansion CAPEX of $42.5M for 4GWh capacity additions of HpCO-53.5Ah, expected to add ~$1B new revenue potential going into 2024 U.S. manufacturing footprint is expanding; growing asset base to support ESS and CV business lines and remains unlevered Record backlog of $678.7M – underpins high growth forecast, HpCO-53.5Ah cell rapid adoption across CV and ESS $678.7M Backlog Position >84% 53.5Ah share

16 Financial Resilience Debt maturity schedule requires minimal cash flow – $5.0M to be repaid in 4Q23 and total to be retired by YE25 is $40.2M. All current debt relates to our Huzhou operations and is non-recourse to our U.S. holding structure and operations. ~$70M drawdown available to support Huzhou growth and expansion. Have additional ~$22M credit line. No current leverage on U.S. business – Project financing in progress to support Clarksville. Low debt levels, combined with revenues showing strong multi-year growth, provide a solid financial foundation for our business. Current debt profile helps us maintain resilience in future macro-economic uncertainties. No material near-term refinancings anticipated We expect to be cashflow positive prior to 2027 bond maturation Current facilities on low interest rates of 3.0 – 4.8% (~56% of debt is fixed rate) $- $5 $10 $15 $20 $25 $30 $35 $40 $45 $50 20 23 20 24 20 25 20 26 20 27 M ill io n U SD Debt Maturation Profile Bank Borrowing Bond

O U T L O O K

18 Q4 2023 Guidance 20-25% Adj. Gross Margin up >3x YoY >90% Huzhou 3.1 Utilization Anticipate gross margin expansion as Huzhou Phase 3.1 ramps towards nameplate capacity and deliveries of 53.5Ah increase Backlog going into 2024 situates us for another high growth year with continued margin improvement Expected initial deliveries of ME-4300 ESS containers to customer sites from our Windsor facility Solid revenue growth YoY although impacted by slight push out of customer delivery schedules $90-100M 47% revenue growth YoY at midpoint

19 NEW 2GWh Huzhou cell, module, and pack facility delivering qualified production and exceeding targets NEW 2GWh U.S. cell, module, and pack facility in Clarksville, TN trial production target in 1Q24 Management believes path to profitability is within the next 2-3 years. Strong Backlog & Technology Supports Multi-Year High Growth Phase Clarksville, TN location benefits from IRA at $45/kWh for domestic battery cells & modules 2GWh = $80M Annual IRA potential EXIT 1Q24 NEW CAPACITY 4GWh = $1B Expected annual revenue potential And 10M sqm. pilot line for polyaramid separator $292-302M FY23 revenue guidance 2023 Outlook =+ Supported by ESS business in the U.S. and strong CV demand in EMEA & APAC $678.7M Q3 Backlog backlog due to superior technical performance >84% 53.5Ah Backlog Share 43-48% FY23 revenue growth YoY We anticipate new major CV and ESS projects supported by sales pipeline in Q4

v3.23.3

Cover

|

Nov. 09, 2023 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 09, 2023

|

| Entity Registrant Name |

Microvast Holdings, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38826

|

| Entity Tax Identification Number |

83-2530757

|

| Entity Address, Address Line One |

12603 Southwest Freeway

|

| Entity Address, Address Line Two |

Suite 300

|

| Entity Address, City or Town |

Stafford

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77477

|

| City Area Code |

281

|

| Local Phone Number |

491-9505

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001760689

|

| Amendment Flag |

false

|

| Common Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

MVST

|

| Security Exchange Name |

NASDAQ

|

| Warrant |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Redeemable warrants, exercisable for shares of common stock at an exercise price of $11.50 per share

|

| Trading Symbol |

MVSTW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

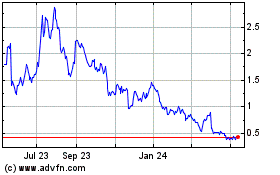

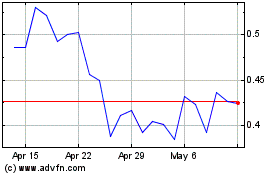

Microvast (NASDAQ:MVST)

Historical Stock Chart

From Mar 2024 to Apr 2024

Microvast (NASDAQ:MVST)

Historical Stock Chart

From Apr 2023 to Apr 2024