FALSE000160486800016048682023-11-082023-11-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): November 8, 2023

GROWGENERATION CORP.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| Colorado | | 333-207889 | | 46-5008129 |

(State or other Jurisdiction

of Incorporation) | | (Commission File Number) | | (I.R.S. Employer

Identification No.) |

5619 DTC Parkway, Suite 900

Greenwood Village, CO 80111

(Address of Principal Executive Offices)

Registrant’s telephone number, including area code: (800) 935-8420

N/A

(Former Address of Principal Executive Offices)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c)) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol | | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | | GRWG | | The NASDAQ Stock Market LLC |

Section 7 – Regulation FD

Item 7.01. Regulation FD Disclosure

On November 8, 2023, GrowGeneration Corp. published a press release regarding its financial results for the third quarter of 2023 and guidance for the remainder of 2023.

A copy of the press release is attached hereto as Exhibit 99.1. The information contained in this Current Report on Form 8-K (including the exhibit) is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as otherwise expressly stated in such filing.

Section 9 – Financial Statements and Exhibits

Item 9.01. Financial Statements and Exhibits

(c) Exhibits

| | | | | |

| Exhibit No. | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File, formatted XBRL Document |

| |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

Date: November 8, 2023 | GrowGeneration Corp. |

| | |

| | | |

| | By: | /s/ Darren Lampert |

| | Name: | Darren Lampert |

| | Title: | Chief Executive Officer |

GrowGeneration Reports Third Quarter 2023 Financial Results

Net Revenue of $55.7 million, Consistent with Expectations

Gross Profit Margin of 29.1% Represents 230 Basis Points Sequential Improvement Over Second Quarter 2023

Net Loss of $7.3 million and Non-GAAP Adjusted EBITDA(1) Loss of $0.9 million

DENVER, November 8, 2023 /PRNewswire/ -- GrowGeneration Corp. (NASDAQ: GRWG) (“GrowGen” or the “Company”), the largest chain of specialty hydroponic and organic garden centers in the United States with 50 stores across 18 states, today reported financial results for the third quarter ended September 30, 2023.

Third Quarter 2023 Highlights

•Net sales decreased 13% quarter-over-quarter to $55.7 million

•Comparable store sales decreased 14.4% to the prior year

•Gross profit margin of 29.1%, increase of 320 basis points to the prior year

•Net loss of $7.3 million, compared to a net loss of $7.2 million in the prior year

•Adjusted EBITDA(1) loss of $0.9 million, an improvement of $1.8 million to 2022

•Year-to-date cash flow provided by operations of $2.8 million

•Cash, cash equivalents, and marketable securities of $66.6 million

•Maintains full-year 2023 guidance for revenue to be $220 million to $225 million and Adjusted EBITDA(1) to be a loss of $4 million to $6 million

Darren Lampert, GrowGeneration’s Co-Founder and Chief Executive Officer, stated, “I am pleased with our third quarter results, which are broadly consistent with the expectations we communicated last quarter. Our continued focus on proprietary brands and distribution helped drive gross profit margin of 29.1%, representing a 230 basis point improvement over the second quarter. We have also reduced store operating expenses by over 12% and SG&A by nearly 14% year-over-year. As I have said before, we are constantly evaluating our network to enhance profitability and, as such, we consolidated 6 retail locations during the third quarter. Further in the fourth quarter, we expect to consolidate 6 additional locations where we identified cost rationalization opportunities through our ability to serve a similar customer base from a smaller

footprint. GrowGen ended the quarter with $66.6 million of cash and cash equivalents and generated nearly $3 million of operating cash flow year-to-date. We continue to make progress on our digital transformation efforts and we are excited about the potential of our new ERP system to enable further efficiencies in our supply chain and ultimately improve our end-to-end customer experience.”

Lampert continued, “We are bringing innovative new products to market and have seen success in growing our proprietary brand portfolio. We believe that our third quarter results represent progress towards the initiatives that we have been striving to achieve. Despite challenges within the industry, we remain focused on what we can control to position GrowGen to be more nimble, efficient, and better-positioned for profitable growth in 2024 and beyond.”

Third Quarter 2023 Consolidated Results

Revenues declined $15.2 million, or 21.4%, to $55.7 million for the quarter ended September 30, 2023, compared to $70.9 million for the quarter ended September 30, 2022. The decrease in net revenue was partially attributed to a decline in same-store sales of 14.4% at 55 retail locations. Overall retail sales were $41.4 million in the third quarter, compared to $47.9 million for the same period last year.

E-commerce revenue was $2.8 million in the third quarter, compared to $3.1 million for the same period last year.

Revenue from non-retail operations, including distributed brands and MMI, was $11.5 million in the third quarter of 2023, compared to $19.8 million in the same quarter last year. The year ago period in 2022 included a few large one-time transactions to account for the decrease.

Gross profit was $16.2 million for the third quarter of 2023, compared to $18.3 million for the third quarter of 2022. Gross profit margin was 29.1%, compared to 25.9% in the same quarter last year. The increase in gross margin in the third quarter of 2023 was due to increased private label sales growth, pricing expansion, and margin accretion from development of our distribution network and corresponding bulk-buy negotiations.

Store and other operating expenses in the third quarter of 2023 were $11.9 million, compared to $13.6 million in the prior year, a decrease of 12%.

Selling, general, and administrative expenses in the third quarter of 2023 were $7.6 million, compared to $8.8 million in the prior year, a decrease of 13.8%.

GAAP pre-tax net loss was $7.3 million for the third quarter of 2023, or a loss of $0.12 per diluted share, compared to $7.9 million in the third quarter of 2022, or a loss of $0.12 per diluted share.

Non-GAAP loss before interest, taxes, depreciation, amortization, share-based compensation, and other non-recurring charges (Adjusted EBITDA)(1) was $0.9 million in the third quarter of 2023, compared to a loss of $2.7 million in the same period last year.

Cash and short-term marketable securities as of September 30, 2023 were $66.6 million. Inventory as of September 30, 2023 was $76.0 million, and prepaid inventory and other current assets were $12.4 million.

Total current liabilities, including accounts payable, accrued payroll, and other liabilities, increased from $35.8 million at December 31, 2022 to $40.5 million at September 30, 2023.

Geographical Footprint

The Company’s operations span approximately 826,000 square feet of retail and warehouse space at 50 existing locations across 18 states.

Fiscal Year 2023 Financial Outlook(2)

Revenue guidance for full-year 2023 is unchanged to be between $220 million to $225 million.

Adjusted EBITDA(1) guidance for full-year 2023 is unchanged to be between a loss of $4 million to a loss of $6 million.

Footnotes

(1) Adjusted EBITDA represents earnings before income, taxes, depreciation, and amortization as adjusted for certain items as set forth in the reconciliation table of U.S. GAAP to non-GAAP information and is a measure calculated and presented on the basis of methodologies other than in accordance with GAAP. Please refer to the Use of Non-GAAP Financial Information herein for further discussion and reconciliation of this measure to GAAP measures.

(2) Sales and Adjusted EBITDA guidance metrics are inclusive of acquisitions and store openings completed in 2023 and 2022, but do not include any unannounced acquisitions.

Conference Call

The Company will host a conference call today, November 8, 2023, at 4:30PM Eastern Time. To participate in the call, please dial (888) 664-6392 (domestic) or (416) 764-8659 (international). The conference code is 71685189. This call is being webcast and can be accessed on the Investor Relations section of GrowGen's website at: https://ir.growgeneration.com.

A replay of the webcast will be available approximately two hours after the conclusion of the call and remain available for approximately 90 calendar days.

About GrowGeneration Corp:

GrowGeneration is a leading marketer and distributor of nutrients, growing media, lighting, benching and racking, environmental control systems, and other products for both indoor and outdoor hydroponic and organic gardening, including proprietary brands such as Charcoir, Drip Hydro, Power Si, MMI benching and racking, Ion lights, Durabreeze fans, and more. Incorporated in Colorado in 2014, GrowGeneration is the largest chain of specialty retail

hydroponic and organic garden centers in the United States. The Company also operates an online superstore for cultivators at growgeneration.com, as well as a wholesale business for resellers, HRG Distribution, and a benching, racking, and storage solutions business, Mobile Media.

Forward Looking Statements:

This press release may include predictions, estimates or other information that might be considered forward-looking within the meaning of applicable securities laws. While these forward-looking statements represent current judgments, they are subject to risks and uncertainties that could cause actual results to differ materially. You are cautioned not to place undue reliance on these forward-looking statements, which reflect opinions only as of the date of this release. Please keep in mind that the company does not have an obligation to revise or publicly release the results of any revision to these forward-looking statements in light of new information or future events. When used herein, words such as “look forward,” “expect,” “believe,” “continue,” “building,” or variations of such words and similar expressions are intended to identify forward-looking statements. Factors that could cause actual results to differ materially from those contemplated in any forward-looking statements made by us herein are often discussed in filings made with the United States Securities and Exchange Commission, available at: www.sec.gov, and on the company’s website, at: www.growgeneration.com.

Contacts:

ICR, Inc.

GrowGenIR@icrinc.com

GROWGENERATION CORP.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(in thousands, except shares and per share amounts)

| | | | | | | | | | | |

| | September 30,

2023 | | December 31,

2022 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 31,414 | | | $ | 40,054 | |

| Marketable securities | 35,203 | | | 31,852 | |

Accounts receivable, net of allowance for doubtful accounts of $1.1 million and $0.7 million at September 30, 2023 and December 31, 2022 | 8,351 | | | 8,336 | |

Notes receivable, current, net of allowance for doubtful accounts of $1.7 million and $1.3 million at September 30, 2023 and December 31, 2022 | — | | | 1,214 | |

| Inventory | 75,987 | | | 77,091 | |

| Prepaid income taxes | 477 | | | 5,679 | |

| Prepaids and other current assets | 12,383 | | | 6,455 | |

| Total current assets | 163,815 | | | 170,681 | |

| | | |

| Property and equipment, net | 28,946 | | | 28,669 | |

| Operating leases right-of-use assets | 42,316 | | | 46,433 | |

| Intangible assets, net | 24,466 | | | 30,878 | |

| Goodwill | 16,808 | | | 15,978 | |

| Other assets | 880 | | | 803 | |

| TOTAL ASSETS | $ | 277,231 | | | $ | 293,442 | |

| | | |

| LIABILITIES & STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 20,219 | | | $ | 15,728 | |

| Accrued liabilities | 3,413 | | | 1,535 | |

| Payroll and payroll tax liabilities | 2,027 | | | 4,671 | |

| Customer deposits | 4,926 | | | 4,338 | |

| Sales tax payable | 1,503 | | | 1,341 | |

| Current maturities of lease liability | 8,374 | | | 8,131 | |

| Current portion of long-term debt | — | | | 50 | |

| Total current liabilities | 40,462 | | | 35,794 | |

| Commitments and contingencies | | | |

| Operating lease liability, net of current maturities | 36,387 | | | 40,659 | |

| Other long-term liabilities | 317 | | | 593 | |

| Total liabilities | 77,166 | | | 77,046 | |

| | | |

| Stockholders’ equity: | | | |

Common stock; $0.001 par value; 100,000,000 shares authorized, 61,309,456 and 61,010,155 shares issued and outstanding as of September 30, 2023 and December 31, 2022 | 61 | | | 61 | |

| Additional paid-in capital | 372,789 | | | 369,938 | |

| Retained earnings | (172,785) | | | (153,603) | |

| Total stockholders’ equity | 200,065 | | | 216,396 | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 277,231 | | | $ | 293,442 | |

GROWGENERATION CORP.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended September 30, | | For the Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| Net sales | $ | 55,678 | | | $ | 70,850 | | | $ | 176,430 | | | $ | 223,710 | |

| Cost of sales (exclusive of depreciation and amortization shown below) | 39,490 | | | 52,516 | | | 126,816 | | | 163,009 | |

| Gross profit | 16,188 | | | 18,334 | | | 49,614 | | | 60,701 | |

| | | | | | | |

| Operating expenses: | | | | | | | |

| Store operations and other operational expenses | 11,930 | | | 13,585 | | | 37,165 | | | 41,884 | |

| Selling, general, and administrative | 7,582 | | | 8,796 | | | 21,923 | | | 28,164 | |

| Bad debt expense | 257 | | | 172 | | | 681 | | | 1,774 | |

| Depreciation and amortization | 4,721 | | | 3,875 | | | 12,477 | | | 13,164 | |

| Impairment loss | — | | | — | | | — | | | 127,831 | |

| Total operating expenses | 24,490 | | | 26,428 | | | 72,246 | | | 212,817 | |

| | | | | | | |

| Income from operations | (8,302) | | | (8,094) | | | (22,632) | | | (152,116) | |

| | | | | | | |

| Other income (expense): | | | | | | | |

| Other expense | 954 | | | 34 | | | 3,549 | | | 547 | |

| Interest income | — | | | 143 | | | — | | | 190 | |

| Interest expense | (1) | | | (3) | | | (6) | | | (16) | |

| Total non-operating income (expense), net | 953 | | | 174 | | | 3,543 | | | 721 | |

| | | | | | | |

| Net income (loss) before taxes | (7,349) | | | (7,920) | | | (19,089) | | | (151,395) | |

| | | | | | | |

| Provision (loss) for income taxes | — | | | 718 | | | (93) | | | 2,637 | |

| | | | | | | |

| Net income (loss) | $ | (7,349) | | | $ | (7,202) | | | $ | (19,182) | | | $ | (148,758) | |

| | | | | | | |

| Net income (loss) per share, basic | $ | (0.12) | | | $ | (0.12) | | | $ | (0.31) | | | $ | (2.45) | |

| Net income (loss) per share, diluted | $ | (0.12) | | | $ | (0.12) | | | $ | (0.31) | | | $ | (2.45) | |

| | | | | | | |

| Weighted average shares outstanding, basic | 61,272 | | | 60,855 | | | 61,127 | | | 60,771 | |

| Weighted average shares outstanding, diluted | 61,272 | | | 60,855 | | | 61,127 | | | 60,771 | |

Use of Non-GAAP Financial Information

The Company believes that the presentation of results excluding certain items in “Adjusted EBITDA,” such as non-cash equity compensation charges, provides meaningful supplemental information to both management and investors, facilitating the evaluation of performance across reporting periods. The Company uses these non-GAAP measures for internal planning and reporting purposes. These non-GAAP measures are not in accordance with, or an alternative for, generally accepted accounting principles and may be different from non-GAAP measures used by other companies. The presentation of this additional information is not meant to be considered in isolation or as a substitute for net income or net income per share prepared in accordance with generally accepted accounting principles.

Set forth below is a reconciliation of Adjusted EBITDA to net income (loss):

| | | | | | | | | | | |

| | For the Three Months Ended September 30, |

| | 2023 | | 2022 |

| | (000) | | (000) |

| Net income | $ | (7,349) | | | $ | (7,202) | |

| Income taxes | — | | | (718) | |

| Interest income | — | | | (143) | |

| Interest expense | 1 | | | 3 | |

| Depreciation and amortization | 4,721 | | | 3,875 | |

| EBITDA | $ | (2,627) | | | $ | (4,185) | |

| Share based compensation (option compensation, warrant compensation, stock issued for services) | 938 | | | 1,291 | |

| Impairment, restructuring, and other charges | 717 | | | — | |

| Fixed asset disposal | 64 | | | 165 | |

| Adjusted EBITDA | $ | (908) | | | $ | (2,729) | |

| | | |

| Adjusted EBITDA per share, basic | $ | (0.01) | | | $ | (0.04) | |

| Adjusted EBITDA per share, diluted | $ | (0.01) | | | $ | (0.04) | |

| | | | | | | | | | | |

| | For the Nine Months Ended September 30, |

| | 2023 | | 2022 |

| | (000) | | (000) |

| Net income | $ | (19,182) | | | $ | (148,758) | |

| Income taxes | 93 | | | (2,637) | |

| Interest income | — | | | (190) | |

| Interest expense | 6 | | | 16 | |

| Depreciation and amortization | 12,477 | | | 13,164 | |

| EBITDA | $ | (6,606) | | | $ | (138,405) | |

| Impairment, restructuring, and other charges | 2,215 | | | 127,831 | |

| Share based compensation (option compensation, warrant compensation, stock issued for services) | 2,452 | | | 3,980 | |

| Restructuring charges | 2,215 | | | — | |

| Fixed asset disposal | 85 | | | 81 | |

| Adjusted EBITDA | $ | (1,854) | | | $ | (6,513) | |

| | | |

| Adjusted EBITDA per share, basic | $ | (0.03) | | | $ | (0.11) | |

| Adjusted EBITDA per share, diluted | $ | (0.03) | | | $ | (0.11) | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

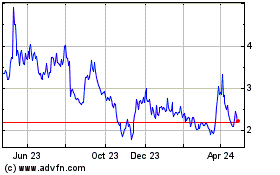

Growgeneration (NASDAQ:GRWG)

Historical Stock Chart

From Mar 2024 to Apr 2024

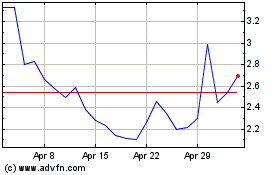

Growgeneration (NASDAQ:GRWG)

Historical Stock Chart

From Apr 2023 to Apr 2024