0000731802false00007318022023-11-082023-11-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report Pursuant to Section 13 or

15(d) of the Securities Exchange Act of 1934

November 8, 2023

Date of Report (Date of earliest event reported)

ATMOS ENERGY CORPORATION

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| Texas | and | Virginia | 1-10042 | 75-1743247 |

| --------------------------------- | ------------------------ | ---------------------- |

| (State or Other Jurisdiction | (Commission File | (I.R.S. Employer |

| of Incorporation) | Number) | Identification No.) |

| | | | | | | | |

| 1800 Three Lincoln Centre | |

| 5430 LBJ Freeway | |

| Dallas | Texas | 75240 |

| ---------------------------------------------------- | ----------------- |

| (Address of Principal Executive Offices) | (Zip Code) |

(972) 934-9227

------------------------------

(Registrant's Telephone Number, Including Area Code)

Not Applicable

---------------------------

(Former Name or Former Address, if Changed Since Last Report)

| | | | | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common stock | No Par Value | ATO | New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On Wednesday, November 8, 2023, Atmos Energy Corporation (the “Company”) issued a news release in which it reported the Company’s financial results for the fourth quarter and full 2023 fiscal year, which ended September 30, 2023, and that certain of its officers would discuss such financial results in a conference call on Thursday, November 9, 2023 at 10 a.m. Eastern Time. In the release, the Company also announced that the call would be webcast live and that slides for the webcast would be available on its website for all interested parties.

A copy of the news release is furnished as Exhibit 99.1. The information furnished in this Item 2.02 and in Exhibit 99.1 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section, nor shall such information be deemed to be incorporated by reference into any of the Company’s filings under the Securities Act of 1933 or the Securities Exchange Act of 1934.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits | | | | | | | | | | | | | | |

| | | | |

| | Exhibit Number | Description |

| | 99.1 | | |

| | 101.INS | | XBRL Instance Document - the Instance Document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document.

|

| | 101.SCH | | Inline XBRL Taxonomy Extension Schema |

| | 101.CAL | | Inline XBRL Taxonomy Extension Calculation Linkbase |

| | 101.DEF | | Inline XBRL Taxonomy Extension Definition Linkbase |

| | 101.LAB | | Inline XBRL Taxonomy Extension Labels Linkbase |

| | 101.PRE | | Inline XBRL Taxonomy Extension Presentation Linkbase |

| | 104 | | Cover Page Interactive Data File - the cover page interactive data file does not appear in the interactive data file because its XBRL tags are embedded within the Inline XBRL document

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | ATMOS ENERGY CORPORATION |

| | (Registrant) |

| | |

| | |

| DATE: | November 8, 2023 | By: /s/ CHRISTOPHER T. FORSYTHE |

| | Christopher T. Forsythe |

| | Senior Vice President and |

| | Chief Financial Officer |

| | |

| | |

Exhibit 99.1

Analysts and Media Contact:

Dan Meziere (972) 855-3729

Atmos Energy Corporation Reports Earnings for Fiscal 2023;

Initiates Fiscal 2024 Guidance; Raises Dividend

DALLAS (November 8, 2023) - Atmos Energy Corporation (NYSE: ATO) today reported consolidated results for its fourth fiscal quarter and year ended September 30, 2023.

Highlights

•Earnings per diluted share was $6.10 for the year ended September 30, 2023; $0.80 per diluted share for the fourth fiscal quarter.

•Consolidated net income was $885.9 million for the year ended September 30, 2023; $118.5 million for the fourth fiscal quarter.

•Capital expenditures totaled $2.8 billion for the year ended September 30, 2023, with approximately 85 percent of capital spending related to system safety and reliability investments.

Outlook

•Earnings per diluted share for fiscal 2024 is expected to be in the range of $6.45 to $6.65 per diluted share.

•Capital expenditures are expected to approximate $2.9 billion in fiscal 2024.

•The company's Board of Directors has declared a quarterly dividend of $0.805 per common share. The indicated annual dividend for fiscal 2024 is $3.22, which represents an 8.8% increase over fiscal 2023.

"Fiscal 2023 marks the 40th anniversary of Atmos Energy as well as the 12th year of executing our proven strategy of operating safely and reliably while we modernize our natural gas distribution, transmission, and storage systems," said Kevin Akers, president and chief executive officer of Atmos Energy Corporation. "This strategy, along with our employees' continued focus on our vision to be the safest provider of natural gas service continues to benefit our customers, our communities, and position us to continue delivering annual earnings per share growth in the six to eight percent range,” Akers concluded.

Results for the Fiscal Year Ended September 30, 2023

Consolidated operating income increased $146.1 million to $1.1 billion for the year ended September 30, 2023, compared to $921.0 million in the prior year, primarily due to rate outcomes in both segments, increased weather and consumption and customer growth in our distribution segment and increased through system revenues in our pipeline and storage segment that were partially offset by increased operation and maintenance expense and higher depreciation and property tax expenses due to increased capital investments.

Distribution operating income increased $88.1 million to $692.6 million for the year ended September 30, 2023, compared with $604.5 million in the prior year, primarily due to a net $166.4 million increase in rates, an $18.4 million increase in customer growth, including industrial load, and an $11.7 million increase in consumption, partially offset by a $65.4 million increase in depreciation and property tax expenses and a $46.7 million increase in operation and maintenance expense driven primarily by line locates and other pipeline system maintenance activities and increased administrative costs.

Pipeline and storage operating income increased $58.1 million to $374.5 million for the year ended September 30, 2023, compared with $316.4 million in the prior year. Key operating drivers for this segment include an $87.3 million increase from our GRIP filings approved in fiscal 2022 and 2023 and a $5.2 million increase in through system revenues, partially offset by a $24.5 million increase in depreciation and property tax expenses and a $7.9 million increase in operation and maintenance expense driven primarily by pipeline inspection activities and employee-related costs.

Capital expenditures increased $361.6 million to $2.8 billion for the year ended September 30, 2023, compared with $2.4 billion in the prior year, due to increased system modernization and expansion spending.

For the year ended September 30, 2023, the company generated operating cash flow of $3.5 billion, compared to $977.6 million in the prior year. The year-over-year increase primarily reflects the receipt of $2.02 billion from the Texas Natural Gas Securitization Finance Corporation in March 2023 related to gas costs incurred during Winter Storm Uri.

Our equity capitalization ratio at September 30, 2023 increased to 61.5%, from 53.6% at September 30, 2022, due to the repayment at maturity of $2.2 billion of Winter Storm Uri financing and $806.9 million in equity issuances under our forward equity agreements, partially offset by the issuance of $500 million of 5.75% senior notes and $300 million of 5.45% senior notes in October 2022. Excluding the $2.2 billion of incremental financing issued to pay for the purchased gas costs incurred during Winter Storm Uri, our equity capitalization ratio was 61.3% at September 30, 2022.

Results for the Three Months Ended September 30, 2023

Consolidated operating income increased $48.7 million to $154.1 million for the three months ended September 30, 2023, from $105.4 million in the prior-year quarter. Rate case outcomes in both segments and customer growth in our distribution segment and timing of pipeline maintenance activities were partially offset by higher depreciation and property tax expenses due to increased capital investments.

Distribution operating income increased $17.2 million to $53.9 million for the three months ended September 30, 2023, compared with $36.7 million in the prior-year quarter. The main drivers for the current quarter include a net $27.6 million increase in rates and a $3.8 million increase due to net customer growth, partially offset by a $14.8 million increase in depreciation and property tax expenses.

Pipeline and storage operating income increased $31.5 million to $100.2 million for the three months ended September 30, 2023, compared with $68.7 million in the prior-year quarter. The current quarter activity is primarily attributable to a $22.7 million increase in rates, due to the GRIP filings approved in May 2022 and May 2023 and a $14.3 million decrease in operations and maintenance expense due to timing of pipeline maintenance activities, which were partially offset by a $7.5 million increase in depreciation and property tax expenses.

Conference Call to be Webcast November 9, 2023

Atmos Energy will host a conference call with financial analysts to discuss the fiscal 2023 fourth quarter financial results on Thursday, November 9, 2023, at 10:00 a.m. Eastern Time. The domestic telephone number is 888-350-3846 and the international telephone number is 646-960-0251. The conference ID is 9958104. Kevin Akers, President and Chief Executive Officer, and Chris Forsythe, Senior Vice President and Chief Financial Officer, will participate in the conference call. The conference call will be webcast live on the Atmos Energy website at www.atmosenergy.com. A playback of the call will be available on the website later that day.

Forward-Looking Statements

The matters discussed in this news release may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than statements of historical fact included in this news release are forward-looking statements made in good faith by the company and are intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. When used in this news release or any of the company’s other documents or oral presentations, the words “anticipate”, “believe”, “estimate”, “expect”, “forecast”, “goal”, “intend”, “objective”, “plan”, “projection”, “seek”, “strategy” or similar words are intended to identify forward-looking statements. Such forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those discussed in this release, including the risks relating to regulatory trends and decisions, the company’s ability to continue to access the credit and capital markets, and the other factors discussed in the company’s reports filed with the Securities and Exchange Commission. These risks and uncertainties include the following: federal, state and local regulatory and political trends and decisions, including the impact of rate proceedings before various state regulatory commissions; increased federal regulatory oversight and potential penalties; possible increased federal, state and local regulation of the safety of our operations; possible significant costs and liabilities resulting from pipeline integrity and other similar programs and related repairs; the inherent hazards and risks involved in distributing, transporting and storing natural gas; the availability and accessibility of contracted gas supplies, interstate pipeline and/or storage services; increased competition from energy suppliers and alternative forms of energy; failure to attract and retain a qualified workforce; natural disasters, terrorist activities or other events and other risks and uncertainties discussed herein, all of which are difficult to predict and many of which are beyond our control; increased dependence on technology that may hinder the Company's business if such technologies fail; the threat of cyber-attacks or acts of cyber-

terrorism that could disrupt our business operations and information technology systems or result in the loss or exposure of confidential or sensitive customer, employee or Company information; the impact of new cybersecurity compliance requirements; adverse weather conditions; the impact of greenhouse gas emissions or other legislation or regulations intended to address climate change; the impact of climate change; the capital-intensive nature of our business; our ability to continue to access the credit and capital markets to execute our business strategy; market risks beyond our control affecting our risk management activities, including commodity price volatility, counterparty performance or creditworthiness and interest rate risk; the concentration of our operations in Texas; the impact of adverse economic conditions on our customers; changes in the availability and price of natural gas; and increased costs of providing health care benefits, along with pension and postretirement health care benefits and increased funding requirements.

Accordingly, while we believe these forward-looking statements to be reasonable, there can be no assurance that they will approximate actual experience or that the expectations derived from them will be realized. Further, the company undertakes no obligation to update or revise any of our forward-looking statements whether as a result of new information, future events or otherwise.

About Atmos Energy

Atmos Energy Corporation, an S&P 500 company headquartered in Dallas, is the country’s largest natural gas-only distributor. We safely deliver reliable, efficient and abundant natural gas to over 3.3 million distribution customers in over 1,400 communities across eight states located primarily in the South. As part of our vision to be the safest provider of natural gas services, we are modernizing our business and infrastructure while continuing to invest in safety, innovation, environmental sustainability and our communities. Atmos Energy manages proprietary pipeline and storage assets, including one of the largest intrastate natural gas pipeline systems in Texas. Find us online at http://www.atmosenergy.com, Facebook, Twitter, Instagram and YouTube.

This news release should be read in conjunction with the attached unaudited financial information.

Atmos Energy Corporation

Financial Highlights (Unaudited)

| | | | | | | | | | | | | | |

| | | | |

| Statements of Income | | Year Ended September 30 |

| (000s except per share) | | 2023 | | 2022 |

| Operating revenues | | | | |

Distribution segment | | $ | 4,099,690 | | | $ | 4,035,194 | |

Pipeline and storage segment | | 785,174 | | | 693,660 | |

Intersegment eliminations | | (609,507) | | | (527,192) | |

| | 4,275,357 | | | 4,201,662 | |

| Purchased gas cost | | | | |

Distribution segment | | 2,061,920 | | | 2,210,302 | |

Pipeline and storage segment | | (1,220) | | | (1,583) | |

Intersegment eliminations | | (608,527) | | | (526,063) | |

| | 1,452,173 | | | 1,682,656 | |

| | | | |

| Operation and maintenance expense | | 764,906 | | | 710,161 | |

| Depreciation and amortization | | 604,327 | | | 535,655 | |

| Taxes, other than income | | 386,804 | | | 352,208 | |

| | | | |

| Operating income | | 1,067,147 | | | 920,982 | |

| Other non-operating income | | 69,775 | | | 33,737 | |

| Interest charges | | 137,281 | | | 102,811 | |

| Income before income taxes | | 999,641 | | | 851,908 | |

| Income tax expense | | 113,779 | | | 77,510 | |

| Net income | | $ | 885,862 | | | $ | 774,398 | |

| | | | |

| | | | |

| Basic net income per share | | $ | 6.10 | | | $ | 5.61 | |

| Diluted net income per share | | $ | 6.10 | | | $ | 5.60 | |

| | | | |

| | | | |

| | | | |

| Cash dividends per share | | $ | 2.96 | | | $ | 2.72 | |

| Basic weighted average shares outstanding | | 145,121 | | | 137,830 | |

| Diluted weighted average shares outstanding | | 145,166 | | | 138,096 | |

| | | | | | | | | | | | | | |

| | | | |

| | | Year Ended September 30 |

| Summary Net Income by Segment (000s) | | 2023 | | 2022 |

| Distribution | | $ | 580,397 | | | $ | 521,977 | |

| Pipeline and storage | | 305,465 | | | 252,421 | |

| | | | |

| | | | |

| Net income | | $ | 885,862 | | | $ | 774,398 | |

Atmos Energy Corporation

Financial Highlights, continued (Unaudited)

| | | | | | | | | | | | | | |

| | | | |

| Statements of Income | | Three Months Ended September 30 |

| (000s except per share) | | 2023 | | 2022 |

| Operating revenues | | | | |

Distribution segment | | $ | 542,987 | | | $ | 678,915 | |

Pipeline and storage segment | | 205,896 | | | 183,583 | |

Intersegment eliminations | | (161,241) | | | (139,870) | |

| | 587,642 | | | 722,628 | |

| Purchased gas cost | | | | |

Distribution segment | | 164,934 | | | 329,090 | |

Pipeline and storage segment | | (789) | | | 1,492 | |

Intersegment eliminations | | (160,982) | | | (139,626) | |

| | 3,163 | | | 190,956 | |

| | | | |

| Operation and maintenance expense | | 190,125 | | | 205,374 | |

| Depreciation and amortization | | 159,264 | | | 140,194 | |

| Taxes, other than income | | 81,020 | | | 80,702 | |

| | | | |

| Operating income | | 154,070 | | | 105,402 | |

| Other non-operating income | | 15,008 | | | 6,559 | |

| Interest charges | | 31,817 | | | 27,842 | |

| Income before income taxes | | 137,261 | | | 84,119 | |

| Income tax expense | | 18,737 | | | 12,476 | |

| | | | |

| | | | |

| | | | |

| Net income | | $ | 118,524 | | | $ | 71,643 | |

| | | | |

| | | | |

| | | | |

| Basic net income per share | | $ | 0.80 | | | $ | 0.51 | |

| Diluted net income per share | | $ | 0.80 | | | $ | 0.51 | |

| Cash dividends per share | | $ | 0.74 | | | $ | 0.68 | |

| Basic weighted average shares outstanding | | 148,671 | | | 140,924 | |

| Diluted weighted average shares outstanding | | 148,672 | | | 141,220 | |

| | | | | | | | | | | | | | |

| | | | |

| | | Three Months Ended September 30 |

| Summary Net Income by Segment (000s) | | 2023 | | 2022 |

| Distribution | | $ | 37,816 | | | $ | 16,154 | |

| Pipeline and storage | | 80,708 | | | 55,489 | |

| Net income | | $ | 118,524 | | | $ | 71,643 | |

Atmos Energy Corporation

Financial Highlights, continued (Unaudited)

| | | | | | | | | | | | | | |

| Condensed Balance Sheets | | September 30, | | September 30, |

| (000s) | | 2023 | | 2022 |

| Net property, plant and equipment | | $ | 19,606,583 | | | $ | 17,240,239 | |

| Cash and cash equivalents | | 15,404 | | | 51,554 | |

| Restricted cash and cash equivalents | | 3,844 | | | — | |

| Cash and cash equivalents and restricted cash and cash equivalents | | 19,248 | | | 51,554 | |

| Accounts receivable, net | | 328,654 | | | 363,708 | |

| Gas stored underground | | 245,830 | | | 357,941 | |

| | | | |

| Other current assets | | 292,036 | | | 2,274,490 | |

| Total current assets | | 885,768 | | | 3,047,693 | |

| Securitized intangible asset, net | | 92,202 | | | — | |

| Goodwill | | 731,257 | | | 731,257 | |

| | | | |

| Deferred charges and other assets | | 1,201,158 | | | 1,173,800 | |

| | $ | 22,516,968 | | | $ | 22,192,989 | |

| | | | |

| Shareholders' equity | | $ | 10,870,064 | | | $ | 9,419,091 | |

| Long-term debt, net | | 6,554,133 | | | 5,760,647 | |

| Securitized long-term debt | | 85,078 | | | — | |

| Total capitalization | | 17,509,275 | | | 15,179,738 | |

| Accounts payable and accrued liabilities | | 336,083 | | | 496,019 | |

| | | | |

| Other current liabilities | | 763,086 | | | 720,157 | |

| Short-term debt | | 241,933 | | | 184,967 | |

| Current maturities of long-term debt | | 1,568 | | | 2,201,457 | |

| Current maturities of securitized long-term debt | | 9,922 | | | — | |

| Total current liabilities | | 1,352,592 | | | 3,602,600 | |

| Deferred income taxes | | 2,304,974 | | | 1,999,505 | |

| Regulatory excess deferred taxes | | 253,212 | | | 385,213 | |

| | | | |

| Deferred credits and other liabilities | | 1,096,915 | | | 1,025,933 | |

| | $ | 22,516,968 | | | $ | 22,192,989 | |

Atmos Energy Corporation

Financial Highlights, continued (Unaudited)

| | | | | | | | | | | | | | |

| Condensed Statements of Cash Flows | | Year Ended September 30 |

| (000s) | | 2023 | | 2022 |

| Cash flows from operating activities | | | | |

| Net income | | $ | 885,862 | | | $ | 774,398 | |

| | | | |

| Depreciation and amortization | | 604,327 | | | 535,655 | |

| Deferred income taxes | | 108,215 | | | 53,651 | |

| | | | |

| | | | |

| | | | |

| Other | | (50,793) | | | (22,356) | |

| Change in Winter Storm Uri current regulatory asset | | 2,021,889 | | | — | |

| | | | |

| Changes in other assets and liabilities | | (109,757) | | | (363,764) | |

| Net cash provided by operating activities | | 3,459,743 | | | 977,584 | |

| Cash flows from investing activities | | | | |

| Capital expenditures | | (2,805,973) | | | (2,444,420) | |

| | | | |

| | | | |

| Debt and equity securities activities, net | | (8,315) | | | 4,173 | |

| | | | |

| | | | |

| | | | |

| | | | |

| Other, net | | 19,008 | | | 10,289 | |

| Net cash used in investing activities | | (2,795,280) | | | (2,429,958) | |

| Cash flows from financing activities | | | | |

| Net increase in short-term debt | | 56,966 | | | 184,967 | |

| Proceeds from issuance of long-term debt, net of premium/discount | | 797,258 | | | 798,802 | |

| Proceeds from issuance of securitized debt by AEK | | 95,000 | | | — | |

| Net proceeds from equity issuances | | 806,949 | | | 776,805 | |

| Issuance of common stock through stock purchase and employee retirement plans | | 15,395 | | | 15,403 | |

| Settlement of interest rate swaps | | 171,145 | | | 197,073 | |

| Proceeds from term loan | | 2,020,000 | | | — | |

| Repayment of term loan | | (2,020,000) | | | — | |

| Repayment of long-term debt | | (2,200,000) | | | (200,000) | |

| | | | |

| Cash dividends paid | | (430,345) | | | (375,914) | |

| Debt issuance costs | | (7,864) | | | (8,196) | |

| Securitized debt issuance costs | | (1,273) | | | — | |

| Other | | — | | | (1,735) | |

| | | | |

| | | | |

| Net cash provided by (used in) financing activities | | (696,769) | | | 1,387,205 | |

| Net decrease in cash and cash equivalents and restricted cash and cash equivalents | | (32,306) | | | (65,169) | |

| Cash and cash equivalents and restricted cash and cash equivalents at beginning of period | | 51,554 | | | 116,723 | |

| Cash and cash equivalents and restricted cash and cash equivalents at end of period | | $ | 19,248 | | | $ | 51,554 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30 | | Year Ended September 30 |

| Statistics | | 2023 | | 2022 | | 2023 | | 2022 |

Consolidated distribution throughput (MMcf as metered) | | 65,853 | | | 68,221 | | | 442,911 | | | 444,975 | |

Consolidated pipeline and storage transportation volumes (MMcf) | | 195,493 | | | 168,604 | | | 635,508 | | | 580,488 | |

| | | | | | | | |

| Distribution meters in service | | 3,486,384 | | | 3,442,224 | | | 3,486,384 | | | 3,442,224 | |

| Distribution average cost of gas | | $ | 5.39 | | | $ | 9.26 | | | $ | 7.11 | | | $ | 7.56 | |

| | | | | | | | |

###

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

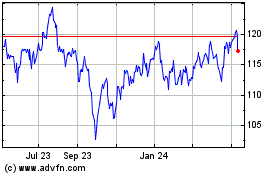

Atmos Energy (NYSE:ATO)

Historical Stock Chart

From Mar 2024 to Apr 2024

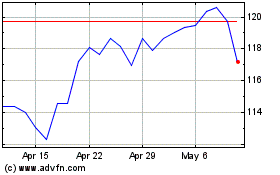

Atmos Energy (NYSE:ATO)

Historical Stock Chart

From Apr 2023 to Apr 2024