Polestar Automotive Holding UK PLC (Nasdaq: PSNY), the Swedish

electric performance car brand, today presents a strengthened

business plan which targets an accelerated margin improvement and a

reduction of the Company’s total funding need to the point of cash

flow break-even in 2025.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20231108523637/en/

Polestar 2, Polestar 3, Polestar 4,

Polestar 5 (Photo: Business Wire)

In light of a fast-changing operating environment, Polestar has

introduced a strengthened business plan that reorients a path to

profitability by prioritising margin progression over volume. For

the fiscal year 2025, Polestar is targeting a gross margin in the

high teens with a total annual volume of approximately

155,000-165,000 cars. This is expected to be achieved through a

richer product mix, with four models in production, reduced cost

structure and refocused approach to key markets including a new

joint venture in China and measures to improve profitability in the

US business. Polestar has already implemented cost reduction

measures announced earlier this year around headcount reductions

and continues to advance active cost management efforts.

Thomas Ingenlath, Polestar CEO, says: “By having taken the

necessary steps to re-work our business plan, we are reducing costs

and improving efficiencies to create a more resilient and

profitable Polestar – and reducing our funding need at the same

time.

“Achieving cash flow break-even already in 2025 will show the

strength of our asset-light business model. Margin over volume is

our way forward, supported by a gorgeous line-up of four exclusive

performance cars.”

Showing their continued commitment to Polestar, Geely Holding

and Volvo Cars have provided additional liquidity to the Company.

Pursuant to an amendment to its existing shareholder term loan,

Volvo Cars has extended the maturity of its outstanding term loan

by over three years to June 2027, and provided an aggregate of $200

million in additional loan capacity with the same maturity date,

bringing the total investment to $1 billion. In addition, Geely

Sweden Automotive Investment AB (an affiliate of Geely Holding) is

making available a $250 million term loan on substantially the same

terms as Volvo Cars, including the maturity in June 2027.

Both loans have an optional equity conversion feature.

Based on the reduced funding need from a strengthened business

plan and new and existing financing and liquidity support from

Geely Holding and Volvo Cars, Polestar expects it will require

external funding of approximately $1.3 billion until achieving cash

flow break-even, targeted in 2025.

Working alongside its major shareholders, Polestar is

well-progressed on a holistic financing plan to provide the

remainder of funding required, including additional debt and

equity.

Polestar management will hold a live audio webcast today, 8

November 2023 at 14:00 PT (17:00 ET or 23:00 CET). The live audio

webcast will be available at

https://investors.polestar.com/events/event-details/q323-results-webcast

Following the completion of the call, a replay will be available

at https://investors.polestar.com/.

Note: Polestar Day, a technology and innovation event, takes

place in Los Angeles on 9 November. The keynote presentations and

technology deep dive highlights will be made available on the

investor relations website in the coming days.

About Polestar

Polestar (Nasdaq: PSNY) is the Swedish electric performance car

brand determined to improve society by using design and technology

to accelerate the shift to sustainable mobility. Headquartered in

Gothenburg, Sweden, its cars are available online in 27 markets

globally across North America, Europe and Asia Pacific. The company

plans to create a truly climate-neutral production car, without

offsetting, by 2030.

Polestar 2 launched in 2019 as the electric performance fastback

with avant-garde Scandinavian design and up to 350 kW. Polestar 3

launched in late 2022 as the SUV for the electric age – a large

high-performance SUV that delivers sports car dynamics with a low

stance and spacious interior. Polestar plans to release three more

electric performance vehicles through to 2026.

Forward-Looking Statements

Certain statements in this press release (“Press Release”) may

be considered “forward-looking statements” as defined in the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements generally relate to future events or the future

financial or operating performance of Polestar including the number

of vehicle deliveries and gross margin. For example, projections of

revenue, volumes, margins, cash flow break-even and other financial

or operating metrics and statements regarding expectations of

future needs for funding and plans related thereto are

forward-looking statements. In some cases, you can identify

forward-looking statements by terminology such as “may”, “should”,

“expect”, “intend”, “will”, “estimate”, “anticipate”, “believe”,

“predict”, “potential”, “forecast”, “plan”, “seek”, “future”,

“propose” or “continue”, or the negatives of these terms or

variations of them or similar terminology. Such forward-looking

statements are subject to risks, uncertainties, and other factors

which could cause actual results to differ materially from those

expressed or implied by such forward looking statements.

These forward-looking statements are based upon estimates and

assumptions that, while considered reasonable by Polestar and its

management, as the case may be, are inherently uncertain. Factors

that may cause actual results to differ materially from current

expectations include, but are not limited to: (1) Polestar’s

ability to maintain agreements or partnerships with its strategic

partners, such as Volvo Cars, Geely or Xingji Meizu Group, and to

develop new agreements or partnerships; (2) Polestar’s ability to

maintain relationships with its existing suppliers, source new

suppliers for its critical components and enter into longer term

supply contracts and complete building out its supply chain, while

effectively managing the risks due to such relationships; (3)

Polestar’s reliance on its partnerships with vehicle charging

networks to provide charging solutions for its vehicles and its

reliance on strategic partners for servicing its vehicles and their

integrated software; (4) Polestar’s reliance on its partners, some

of which may have limited experience with electric vehicles, to

manufacture vehicles at a high volume or develop devices, products,

apps or operating systems for Polestar, and to allocate sufficient

production capacity or resources to Polestar in order for Polestar

to be able to increase its vehicle production capacities and

product offerings; (5) the ability of Polestar to grow and manage

growth profitably including expectations of growth and financial

performance by generating expected revenues at expected selling

prices, maintain relationships with customers and retain its

management and key employees; (6) Polestar’s estimates of expenses,

profitability, gross margin, cash flow, and cash reserves; (7)

increases in costs, disruption of supply or shortage of materials,

in particular for lithium-ion cells or semiconductors; (8) the

possibility that Polestar may be adversely affected by other

economic, business, and/or competitive factors; (9) the effects of

competition and the high barriers to entry in the automotive

industry, and the pace and depth of electric vehicle adoption

generally on Polestar’s future business; (10) changes in regulatory

requirements, governmental incentives and fuel and energy prices;

(11) the outcome of any legal proceedings that may be instituted

against Polestar or others, adverse results from litigation,

governmental investigations or audits, or tax-related proceedings

or audits; (12) the ability to meet stock exchange listing

standards; (13) changes in applicable laws or regulations or

governmental incentive programs; (14) Polestar’s ability to

establish its brand and capture additional market share, (15) the

risks associated with negative press or reputational harm,

including from lithium-ion battery cells catching fire or venting

smoke; (65) delays in the design, development, manufacture, launch

and financing of Polestar’s vehicles and other product offerings,

and Polestar’s reliance on a limited number of vehicle models to

generate revenues; (16) Polestar’s ability to continuously and

rapidly innovate, develop and market new products; (17) risks

related to future market adoption of Polestar’s offerings; (18)

risks related to Polestar’s distribution model; (19) the impact of

the global COVID-19 pandemic, inflation, interest rate changes, the

ongoing conflict between Ukraine and Russia and in Israel and the

Gaza Strip, supply chain disruptions, fuel and energy prices and

logistical constraints on Polestar, Polestar’s projected results of

operations, financial performance or other financial and

operational metrics, or on any of the foregoing risks; (20)

Polestar’s ability to forecast demand for its vehicles; (21)

Polestar’s ability to raise additional funding; (22) Polestar’s

ability to successfully execute cost-cutting activities and

strategic efficiency initiatives; (and (23) other risks and

uncertainties set forth in the sections entitled “Risk Factors” and

“Cautionary Note Regarding Forward-Looking Statements” in

Polestar’s Form 20-F, and other documents filed, or to be filed,

with the SEC by Polestar. There may be additional risks that

Polestar presently does not know or that Polestar currently

believes are immaterial that could also cause actual results to

differ from those contained in the forward-looking statements.

Nothing in this Press Release should be regarded as a

representation by any person that the forward-looking statements

set forth herein will be achieved or that any of the contemplated

results of such forward-looking statements will be achieved. You

should not place undue reliance on forward-looking statements,

which speak only as of the date they are made. Polestar assumes no

obligation to update these forward-looking statements, even if new

information becomes available in the future, except as may be

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231108523637/en/

Bojana Flint Head of Investor Relations

bojana.flint@polestar.com Theo Kjellberg Head of Corporate PR

theo.kjellberg@polestar.com Tanya Ridd Global Head of

Communications & PR tanya.ridd@polestar.com

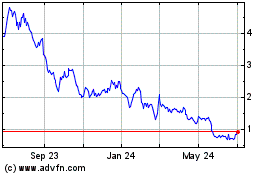

Polestar Automotive Hold... (NASDAQ:PSNY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Polestar Automotive Hold... (NASDAQ:PSNY)

Historical Stock Chart

From Apr 2023 to Apr 2024