UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 6, 2023

Galaxy Gaming, Inc.

(Exact Name of Registrant as Specified in Its Charter)

Nevada

(State or Other Jurisdiction of Incorporation)

|

|

000-30653 |

20-8143439 |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

6480 Cameron Street Suite 305

Las Vegas, Nevada 89118

(Address of principal executive offices)

(702) 939-3254

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report

_______________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230 425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of Each Class |

Trading Symbol |

Name of Exchange on Which Registered |

Common Stock |

GLXZ |

OTCQB marketplace |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

|

Item 1.01 |

Entry into a Material Definitive Agreement |

On November 6, 2023, Galaxy Gaming, Inc. (the “Company”), entered into an Employment Agreement, effective November 13, 2023 between the Company and Matt Reback, the Company’s newly hired President and Chief Executive Officer. The Agreement, among other things (i) sets the term for the period from November 13, 2023, through November 13, 2026; (ii) provides for base compensation of $350,000 per year; (iii) provides for bonuses and a minimum guaranteed bonus for 2024; (iv) provides for other benefits for Mr. Reback; and, (v) provides for a grant of base options to purchase 400,000 shares of Employer’s restricted common stock with a strike price equal to the price per share of Employer’s common stock as reported on OTC Markets on the date such option is granted, which option will vest as follows: (a) as to the first 100,000 shares of stock, on November 13, 2024, (b) as to the next 100,000 shares of stock, on November 13, 2025, (c) as to the next 100,000 shares of stock, on November 13, 2026, and (d) as to the next 100,000 shares of stock, on November 13, 2027 all pursuant to the terms of a Stock Option Grant Agreement by and between Employer and Employee; and, (vi) provides for Employee to be eligible to earn certain additional Long-Term Incentive Stock Grants based on achievement of certain business performance criteria as established by the Board. The Long-Term Incentive Stock Grants shall be broken down into three segments including Personal Performance Targets, Business Target I and Business Target II.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On November 6, 2023, the Company and Matt Reback, the Company’s President and Chief Executive Officer, effective November 13, 2023, entered into an Employment Agreement in the manner described in Item 1.01. The terms and conditions of the agreement are described under Item 1.01.

(c) Election of Officer

On and as of November 6, 2023, the Board of Directors of Galaxy Gaming, Inc., a Nevada corporation (the “Company”), appointed Mr. Matt Reback as President and Chief Executive Officer. Mr. Reback will join Galaxy on November 13, 2023. The Company intends to work through a brief transition with Mr. Todd Cravens, the current President and Chief Executive Officer, and expects Harry Hagerty to serve as an interim President and Chief Executive Officer should such a need arise.

Item 8.01 Other Events

On November 6, 2023, the Company issued a press release announcing the election of Mr. Reback as President and Chief Executive Officer, the transition with current President and Chief Executive Officer, Mr. Cravens, and the appointment of Mr. Hagerty as an interim President and Chief Executive Officer should the need arise.

Item 9.01. Exhibits.

d) Exhibits

Signature Page Follows

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: November 6, 2023

|

|

|

|

GALAXY GAMING, INC. |

|

|

|

|

By: |

/s/ Harry C. Hagerty |

|

|

Harry C. Hagerty |

|

|

Chief Financial Officer |

EMPLOYMENT AGREEMENT

THIS EMPLOYMENT AGREEMENT (this “Agreement”) by and between GALAXY GAMING, INC., a Nevada corporation (“Employer”), and Matt Reback (“Employee” and, together with Employer, the “Parties”) is entered into on November 6, 2023, and made effective for all purposes as of November 13, 2023 (the “Effective Date”).

A. Employer operates in the highly competitive business of designing, developing, manufacturing, marketing and acquiring proprietary casino table games and associated technology, platforms and systems (the “Business”) for the casino gaming industry in the United States, Canada and worldwide (the “Industry”) and provides such Services (the “Services”) to casinos, other gaming venues and in the internet gaming channel.

B. Employer desires to employ Employee and Employee desires to be employed by Employer, in such capacity, and under the terms and restrictions as set forth herein.

C. As a result of such employment, Employee will have access to Confidential Information and Trade Secrets (as defined herein). Employee will gain the ability to influence the goodwill of Employer with Partners (as defined herein) necessary to the success of the Business. Employee recognizes the Confidential Information and Trade Secrets and Partner relationships and goodwill are assets deserving of protection as provided for in the restrictive covenants contained in this Agreement.

NOW, THEREFORE, for and in consideration of Employee’s employment with Employer on the terms and conditions set forth herein, and the promises, mutual covenants, and agreements hereinafter contained and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Employer and Employee, intending to be legally bound, hereby agree and covenant as follows:

(a)Term. Subject to the terms and conditions of this Agreement, Employer agrees to employ Employee, and Employee agrees to be employed by Employer as of the Effective Date pursuant to the terms herein until November 13, 2026.

(b)Position; Duties. During the period of Employee’s employment hereunder, Employee agrees to serve Employer, and Employer shall employ Employee, in the position listed on Exhibit A, or in such other capacity or capacities as may be determined from time to time by Employer. Employee acknowledges that Employee shall be deemed an officer of the Company and will require him to complete obligations and maintain requirements consistent with the position. During the period of Employee’s employment with Employer, Employee shall, in good faith, devote solely Employee’s full time, attention, skills and efforts to the business and affairs of Employer. Employee’s duties shall be performed under the direction and supervision of the Board of Directors (hereinafter the “Board”) of the Company. The foregoing shall not be construed as prohibiting Employee from serving on corporate, civic or charitable boards or committees or making personal investments, so long as such activities are approved in advance by the Board (such approval to not be unreasonably withheld) and do not materially interfere with the performance of Employee’s obligations to Employer as set forth in this Agreement or as may be determined by Employer from time to time.

(c)Compensation; Benefits. For all services rendered by Employee under this Agreement, Employee shall be compensated as set forth in Exhibit A. Employer may withhold from any amounts payable under this Agreement such federal, state and local taxes required to be withheld pursuant to any applicable law or regulation.

(d)Survival of Employee’s Obligations After Termination. Upon the effective date of the termination of Employee’s employment with Employer under this Agreement, regardless the date, cause or manner of such termination (the “Termination Date”), Employee’s obligations set forth in Sections 3, 4 and 5, below, shall survive and remain in full force and effect to the extent provided in those Sections.

2.Termination of Employment.

(a)Termination by Employer for Cause. Employer may terminate Employee’s employment under this Agreement for “Cause” (as hereinafter defined) or otherwise at will at any time immediately upon written notice, or where applicable, upon Employee’s failure to cure the breach as provided below, whereupon notwithstanding any other provision herein, Employer shall have no further obligation hereunder to Employee, except for payment of amounts of Base Salary accrued through the Termination Date. For purposes of this Agreement, “Cause” shall mean: (i) the continued failure by Employee to substantially perform his duties with Employer, (ii) the engaging by Employee in fraud, deceit or gross misconduct injurious to Employer, (iii) the Employee fails to cooperate in providing information to the Company Compliance Officer, fails to comply with the applicable laws, regulations and policies in jurisdictions where Company business is conducted and/or the good faith and commercially reasonable determination by the Board of Directors that Employee’s continued employment by Employer is likely to have a materially adverse effect on the licensing or regulatory status of Employer with any gaming or other regulatory agency, or (iv) Employee’s material breach of Section 1, 3, 4 or 5 of this Agreement; provided, with respect to any breach curable by Employee, as determined by Employer in good faith, Employer has provided Employee written notice of the material breach and Employee has not cured such breach, as determined by Employer in good faith, within fifteen (15) days following the date Employer provides such notice.

(b)Termination as a Result of Employee’s Death or Disability. Employee’s employment hereunder shall terminate automatically upon Employee’s death and may be terminated by Employer upon Employee’s Disability (as hereinafter defined). If Employee’s employment hereunder is terminated by reason of Employee’s Disability or death, Employee’s (or Employee’s estate’s) right to benefits under this Agreement will terminate as of the date of such termination and all of Employer’s obligations hereunder shall immediately cease and terminate, except that Employee or Employee’s estate, as the case may be, will be entitled to receive accrued Base Salary and benefits through the Termination Date. As used herein, “Disability” shall have the meaning set forth in any long-term disability plan in which Employee participates, and in the absence thereof shall mean the determination in good faith by Employer’s Board of Directors (or comparable governing body) that, due to physical or mental illness, Employee shall have failed to perform his duties on a full-time basis hereunder for one hundred eighty (180) consecutive days and shall not have returned to the performance of his duties hereunder on a full-time basis before the end of such period, and if Disability has occurred termination shall occur within thirty (30) days after written notice of termination is given (which notice may be given before the end of the one hundred eighty (180) day period described above so as to cause termination of employment to occur as early as the last day of such period).

- 2 -

Final

(c)Termination by Employee for Good Reason or by Employer other than as a Result of Employee’s Death or Disability or other than for Cause; Change of Control.

(i) Employee may terminate Employee’s employment hereunder for “Good Reason” (as hereinafter defined), if Good Reason exists, upon at least thirty (30) days’ prior written notice to Employer, and Employer may terminate Employee’s employment hereunder for any reason or for no reason, other than as a result of Employee’s death or Disability or for Cause, upon at least thirty (30) days’ prior written notice to Employee, in each case with the consequences set forth in this Section 2(c).

(ii) If Employee’s employment is terminated by Employee for Good Reason or by Employer for any reason other than Employee’s death or Disability or other than for Cause, subject to Employee entering into and not revoking a release of claims in favor of Employer and its affiliates pursuant to Section 2(e) below and Employee fully complying with the covenants set forth in Sections 3, 4 and 5, Employee shall be entitled to the following benefits:

(A) Cash severance payments equal in the aggregate to twelve (12) months of Employee’s annual Base Salary at the time of termination, payable in accordance with Employer’s customary payroll practices as in effect from time to time.

(B) Continuation of Employee’s medical and health insurance benefits for a period equal to the lesser of (i) twelve (12) months or (ii) the period ending on the date Employee first becomes entitled to medical and health insurance benefits under any plan maintained by any person for whom Employee provides services as an employee or otherwise.

(C) In addition, solely if Employee is terminated without Cause following a “Change of Control” (as defined below), Employee shall be entitled to: (i) cash severance payments equal in the aggregate to twelve (12) months of Employee’s annual Base Salary at the time of termination, payable in accordance with Employer’s customary payroll practices as in effect from time to time;(ii) any unvested Base stock options granted to Employee pursuant to this Agreement shall accelerate and immediately vest; provided, however, that the acceleration and immediate vesting described herein shall not occur in any event with respect to the shares underlying that certain option; and (iii) certain shares of Company stock provided as part of Employee’s Long-Term Incentive Stock Grant (details provided within Section 5.2 of Exhibit A to the Agreement).

(iii) For purposes of this Agreement, “Good Reason” shall mean: (A) a material reduction (without Employee’s express written consent) in Employee’s Base Salary, unless the reduction is made as part of, and is generally consistent with, a general reduction of executive salaries; or (B) Employer’s material breach (without Employee’s express written consent) of Section 1 of this Agreement; provided, that Employee has provided Employer written notice of the material breach and Employer has not cured such breach within thirty (30) days following the date Employee provides such notice. If Employer thereafter intentionally repeats the breach it previously cured, such breach shall no longer be deemed curable.

(iv) For purposes of this Agreement, “Change of Control” shall mean (a) the sale, conveyance or other disposition of all or substantially all of Employer’s assets as an entirety or substantially as an entirety to any “person” (as such term is used in Section 13(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)), entity or “group” of persons (as defined in Section 13(d) of the Exchange Act) acting in concert; (b) any “person” becoming the “beneficial owner” (as defined in Rule 13d-3 under the Exchange Act), directly or indirectly, of securities of Employer representing 50% or more of the total voting power represented by Employer’s then-outstanding voting securities; or (c) a merger or consolidation of Employer with any other

- 3 -

Final

corporation or other entity, other than a merger or consolidation that would result in the voting securities of Employer outstanding immediately prior thereto continuing to represent (either by remaining outstanding or by being converted into voting securities of the surviving entity or its controlling entity) at least 50% of the total voting power represented by the voting securities of Employer, or such surviving entity (or its controlling entity), outstanding immediately after such merger or consolidation, as applicable. Employer and Employee acknowledge and agree that pursuant to subsection (b) of this section 2(c)(iv) above, a conveyance by a party owning 50% or more of the total voting power represented by Employer’s then-outstanding voting securities (the “Majority Owner”) to one or more entities controlled by or under common control with such Majority Owner, or conveyances between any such entities controlled by or under common control with such Majority Owner, shall not be deemed to be a Change of Control unless or until the Majority Owner ceases to own, directly or indirectly, 50% or more of the total voting power represented by Employer’s then-outstanding voting securities.

(d)Termination by Employee other than for Good Reason. Employee may terminate his employment with Employer other than for Good Reason upon sixty (60) days’ written notice to Employer, after which Employer shall have no further obligation hereunder to Employee, except for payment of amounts of Base Salary and other benefits accrued through the Termination Date. If Employee so notifies Employer of such termination, Employer shall have the right to accelerate the effective date of such termination to any date after Employer’s receipt of such notice, but such acceleration will not be deemed to constitute a termination of Employee’s employment by Employer without Cause, and the consequences of such termination will continue to be governed by this subsection (d).

(e)Waiver and Release. In consideration for and as a condition to the payments and benefits provided and to be provided under this Agreement, Employee agrees that Employee will, within thirty (30) days after the Termination Date, deliver to Employer a fully executed release agreement substantially in a form then used by and agreeable to Employer and which shall fully and irrevocably release and discharge Employer and its directors, officers, managers, members, shareholders and employees from any and all claims, charges, complaints, liabilities of any kind, known or unknown, owed to Employee, other than any rights Employee may have under the terms of this Agreement that survive such termination of employment and other than any vested rights of Employee under any of Employer’s employee benefit plans or programs that, by their terms, survive or are unaffected by such termination of employment.

(f)Regulatory Licensing and Suitability. Employee is entering this Agreement with the full knowledge that, as the Chief Executive Officer, he will be subjected to a substantial requirement to undergo certain industry standard investigations, certifications, registrations and other similarly described mandates of regulatory bodies around the globe regarding his personal background (hereinafter “Regulatory Approvals”). During his employment, such costs of Regulatory Approvals shall be borne by the Company. Regulatory Approval investigations are generally viewed as intrusive and can include the provision of material personal documentation, disclosure and interviews which can include what most individuals deem as highly sensitive and private. Employee is representing in the execution of this Agreement he is not aware of any current matter that could present a material impediment to him securing and maintaining any and all such Regulatory Approvals. Employee agrees he will use good faith efforts to fully participate and provide timely responses to requests for information and interviews as may be required by the Company’s regulators. A failure on the part of the Employee to fully and timely participate in the process to secure and maintain all required Regulatory Approvals shall be deemed a basis for a termination for Good Reason.

3.Protection of Confidential Information.

(a)Employee expressly recognizes and acknowledges that in connection with Employee’s employment with Employer, Employee will be given access to certain highly sensitive confidential and

- 4 -

Final

proprietary information belonging to Employer or other parties who may have furnished such information under obligations of confidentiality, relating to and used in the Business or the provision of Services (collectively, “Confidential Information”). Employee expressly recognizes and acknowledges that, unless otherwise generally available to the public, Confidential Information shall include, but not be limited to, the following categories of information and material, regardless of how such information or material may exist from time to time and whether in electronic, print, or other form, including all copies, notes, or other reproductions or replicas thereof, which constitute valuable, special, and unique assets of Employer or its affiliates that have been developed or acquired through substantial investments of time, money, and resources, and regardless of whether such information is marked as “confidential”:

(i)any and all information relating to the operation of the Business or the provision of Services, methods of operation, technology, or marketing, including, but not limited to, business plans, processes, strategic plans, forecasts, financial information or data, marketing information or data, research and development, business account lists, customer lists (including customer names and contact information), customer information (including customer preferences, pricing, buying habits and needs and the methods of fulfilling those needs), employee lists (including skills, ability and compensation of employees other than Employee), vendor or supplier lists, licensor or licensee lists, contractor lists, records relating to any intellectual property owned by, controlled, or maintained by Employer related to the operation of the Business or provision of Services, and any and all other records pertaining to the operation of the Business or provision of Services which Employer may, from time to time, designate as confidential or proprietary or that Employee reasonably knows should be treated or has been treated by Employer or its affiliates as confidential or proprietary and is related to the operation of the Business or provision of Services;

(ii) any and all information of a technical or proprietary nature developed by or acquired by Employer or made available to Employer and its employees, or any licensor, licensee, customer, utility, supplier, vendor, employee, contractor, sub-contractor, government agency, or municipality affiliated with Employer, on a confidential basis or protected basis and related to the Businesses or provision of Services, including but not limited to any scientific or technical analyses, ideas, concepts, designs, specifications, requirements, prototypes, techniques, technical data or know-how, formulae, methods, discoveries, improvements, equipment, research and development, and inventions related to the Business or provision of Services; and

(iii) excludes information (A) which is in the public domain through no unauthorized act or omission of Employee or (B) which becomes available to Employee on a non-confidential basis from a source other than Employer or its affiliates without breach of such source’s confidentiality or non-disclosure obligations to Employer or any of its affiliates.

(b)Employee agrees that Employee shall not disclose any Confidential Information to any third-party not employed by or otherwise expressly associated or affiliated with Employer for any reason or purpose whatsoever and will not use such Confidential Information except on behalf of Employer at any time during Employee’s employment with Employer, or at any time within two years after the Termination Date. Employee further agrees to promptly surrender to Employer upon request during Employee’s employment with Employer and immediately upon the Termination Date, all Confidential Information and any other property of any kind, existing in any tangible, print or electronic form in Employee’s possession or under Employee’s control, including all passwords used by Employee to access facilities, networks, or phone systems of Employer. Employee further agrees he will not retain any copies of all Confidential Information in any form unless authorized specifically in writing by Employer. Employee also expressly agrees that immediately upon the Termination Date, Employee shall cease using any secure website or web portals, e-mail system, or phone system or voicemail service of Employer.

- 5 -

Final

(c)In addition, during Employee’s employment with Employer and at all times after the Termination Date, Employee shall not directly or indirectly disclose any Trade Secret (defined below) to any third-party, and shall not use any Trade Secret, directly or indirectly, for Employee or for others, without the prior written consent of Employer. For purposes of this Agreement, the term “Trade Secret” means any item of Confidential Information that constitutes a trade secret of Employer or any of the Affiliated Entities under the common law or statutory law of the state of Nevada. The Parties acknowledge and agree this Agreement is not intended to, and does not, alter either Employer’s rights or Employee’s obligations under any state or federal statutory or common law regarding trade secrets and unfair trade practices.

(d)It is acknowledged and agree any breach or threatened breach of the provisions of this Section 3 would cause irreparable injury to Employer and money damages would not provide an adequate remedy to Employer. In the event of a breach or threatened breach by Employee of this Section 3, Employer shall be entitled to an injunction restraining Employee from disclosing any Confidential Information or Trade Secrets, and, further, from accepting any employment with or rendering any services to any such third-party to whom any Confidential Information or Trade Secret has been disclosed or is threatened to be disclosed by Employee.

(e)Nothing contained in this Section 3 shall be construed as prohibiting Employer from pursuing any other equitable or legal remedies for any such breach or threatened breach, including recovery from Employee of any monetary damages Employer may suffer by reason of any such breach or threatened breach.

4.Restrictive Covenants. Employee and Employer understand and agree the purpose of this Section 4 is solely to protect Employer’s legitimate business interests, including, but not limited to Confidential Information and Trade Secrets, Partner relationships and goodwill, and Employer’s competitive advantage within the Industry in the operation of the Businesses or provision of Services. This Section 4 is not intended to impair, nor will it impair, Employee’s ability or right to work or earn a living. Employee and Employer further understand and agree this Section 4 represents an important element of this Agreement, and is a material inducement to Employer entering into this Agreement, without which Employer would not have entered into this Agreement.

(a) Covenant Not to Compete. Employee acknowledges that Employee’s duties as an employee and member of Employer’s Leadership Team will entail involvement with the entire range of Employer’s operations across the Industry, and Employee’s extensive familiarity with Employer’s provision of Services, Confidential Information and Trade Secrets justifies a restriction applicable across the entire geographic footprint in which Employer provides Services. To the fullest extent permitted by any applicable state law, and unless Employee is terminated as a result of a reduction in force or Change of Control by the Company, Employee agrees during Employee’s continuous employment with Employer, and for the period of twelve (12) months immediately following the Termination Date, Employee shall not, without the prior written consent of Employer, directly or indirectly, obtain or hold a Competitive Position with a Competitor in the Restricted Territory, as these terms are defined herein.

(i) For purposes of this Agreement, a “Competitive Position” means any employment with or service to be performed (whether as owner, member, manager, lender, partner, shareholder, consultant, agent, employee, co-venturer, or otherwise) for a Competitor in which Employee (A) will use or disclose or could reasonably be expected to use or disclose any Confidential Information or Trade Secrets for the purpose of providing, or attempting to provide, such Competitor with a competitive advantage in the Industry or (B) will hold a position, will have duties, or will perform or be expected to perform services for such Competitor, that is or are the same as or substantially

- 6 -

Final

similar to the position held by Employee with Employer or those duties or services actually performed by Employee for Employer in connection with the provision of Services by Employer, or (C) will otherwise engage in the Businesses, or market, sell or provide Services in competition with Employer.

(ii) For purposes of this Agreement, “Competitor” means any third-party (A) whose business is the same as or substantially similar to the Business or major segment thereof, or (B) who owns or operates, or is preparing to own or operate a subsidiary, affiliate, or business line or business segment whose business is or is expected to be the same as or substantially similar to the Business or major segment thereof.

(iii) For purposes of this Agreement, “Restricted Territory” means anywhere in the world wherein the company’s products, technology or intellectual property are in commerce.

Employee shall be deemed to be in a Competitive Position with a Competitor in the Restricted Territory if Employee obtains or holds a Competitive Position with a Competitor that conducts its business within the Restricted Territory (and Employee’s responsibilities relate to that Competitor’s business in the Restricted Territory), even if Employee’s residence or principal place of work (other than as permitted by applicable law) is not within the Restricted Territory.

Notwithstanding the foregoing, Employee may, as a passive investor, own capital stock of a publicly held corporation, which is actively traded in the over-the-counter market or is listed and traded on a national securities exchange, which constitutes or is affiliated with a Competitor, so long as Employee’s ownership is not in excess of five percent (5%) of the total outstanding capital stock of the Competitor.

(iv) For the purposes of this Section 5 “Change of Control” means the sale of all or substantially all the assets of the Company; any merger, consolidation or acquisition of the Company with, by or into another corporation, entity or person; or any change in the ownership of more than fifty percent (50%) of the voting capital stock of the Company, in one or more related transactions or any change in the majority of the members of the board of directors that was in place at the Effective Date of this Agreement.

(b) Non-Solicitation / No Interference Provisions.

(i) Business Partners. Employee understands and agrees the relationship between Employer and each of its licensors, licensees, suppliers, vendors, contractors, subcontractors, consultants, customers, and prospective customers related to the Business or the provision of Services (the “Partners”) constitutes a valuable asset of Employer, and may not be misappropriated for Employee’s own use or benefit or for the use or benefit of any other third-party. Accordingly, Employee hereby agrees during Employee’s employment by Employer and for the period of twenty-four (24) months immediately after the Termination Date, Employee shall not, without the prior written consent of Employer, directly or indirectly, on Employee’s own behalf or on behalf of any other third-party:

(A) call-on, solicit, divert, take away or attempt to call-on, solicit, divert, or take away any of the Partners (1) with whom or with which Employee had communications on Employer’s behalf about the Partner’s existing or potential business relationship with Employer with respect to the Business or provision of Services; (2) whose business dealings with Employer are or were managed or supervised by Employee as part of his duties for Employer; or (3) about

- 7 -

Final

whom or about which Employee obtained Confidential Information or Trade Secrets solely as a result of Employee’s employment with Employer; or

(B) interfere or engage in any conduct that would otherwise have the effect of interfering, in any manner with the business relationship between Employer and any of the Partners, including, but not limited to, urging or inducing, or attempting to urge or induce, any Partner to terminate its relationship with Employer or to cancel, withdraw, reduce, limit, or modify in any manner such Partner’s business or relationship with Employer.

(ii) Employees. Employee understands and agrees the relationship between Employer and each of its employees constitutes a valuable asset of Employer and such assets may not be converted to Employee’s own use or benefit or for the use or benefit of any other third-party. Accordingly, Employee hereby agrees that during Employee’s employment with Employer and for the period of twenty-four (24) months immediately after the Termination Date, Employee shall not, without Employer’s prior written consent, directly or indirectly, solicit or recruit for employment; attempt to solicit or recruit for employment; or attempt to hire or accept as an employee, consultant, contractor, or otherwise, any employee of Employer engaged in the Business or provision of Services; or unlawfully urge, encourage, induce, or attempt to urge, encourage, or induce any employee of Employer engaged in the Business or provision of Services to terminate his or her employment with Employer.

(c) Post-Termination Covenants by Employee.

(i) Upon the termination of Employee’s employment hereunder, regardless of (A) the date, cause, or manner of the termination of Employee’s employment with Employer, (B) whether such termination occurs with or without Cause or is a result of Employee’s resignation, or (C) whether Employer provides severance benefits to Employee under this Agreement, Employee shall resign and does resign from all positions as an employee and officer of Employer and from any other positions with Employer, with such resignations to be effective upon the Termination Date.

(ii) From and after the Termination Date, Employee agrees not to make any statements to Employer’s employees, customers, vendors, or suppliers or to any public or media source, whether written or oral, regarding Employee’s employment hereunder or termination from Employer’s employment, except as may be approved in writing by an executive officer of Employer in advance. Employee further agrees not to make any statement (including to any media source, or to Employer’s suppliers, customers or employees) or take any action that would disrupt, impair, embarrass, harm or affect adversely Employer or any of the employees, officers, directors, or customers of Employer or place Employer or such individuals in any negative light.

(iii) From and after the Termination Date, Employee agrees to cooperate with and provide assistance to Employer and its legal counsel in connection with any litigation (including arbitration or administrative hearings) or investigation affecting Employer, in which, in the reasonable judgment of Employer’s counsel, Employee’s assistance or cooperation is needed. Employee shall, when requested by Employer, provide truthful testimony or other assistance and shall travel at Employer’s request in order to fulfill this obligation. In connection with such litigation or investigation, Employer shall attempt to accommodate Employee’s schedule, shall reimburse Employee (unless prohibited by law) for any actual loss of wages in connection therewith, shall provide Employee with reasonable notice in advance of the times in which Employee’s cooperation or assistance is needed, and shall reimburse Employee for any reasonable expenses incurred in connection with such matters.

- 8 -

Final

(d) Enforcement of Restrictive Covenants. Notwithstanding any other provision of this Agreement, in the event of Employee’s actual or threatened breach of any provision of this Section 4, Employer shall be entitled to an injunction restraining Employee from such breach or threatened breach, without the requirement of posting any bond or the necessity of proof of actual damage, it being agreed that any breach or threatened breach of these restrictive covenants would cause immediate and irreparable injury to Employer and that money damages would not provide an adequate remedy to Employer. Nothing herein shall be construed as prohibiting Employer from pursuing any other equitable or legal remedies for such breach or threatened breach, including the recovery of monetary damages from Employee. The period of any restriction set forth in this Section 4 shall be extended by any period of time that Employee is or has been found to be in breach of any provision in this Section 4.

(e) Employee Acknowledgement. Employee acknowledges and agrees:

(i)the restrictive covenants contained in this Agreement constitute material inducement to Employer entering into this Agreement and agreeing to employ Employee on the terms and conditions stated herein;

(a) the restrictive covenants contained in this Agreement are reasonable in time, territory, and scope, and in all other respects;

(b)should any part or provision of any covenant be held invalid, void, or unenforceable in any court of competent jurisdiction, such invalidity, voidness, or unenforceability shall not render invalid, void, or unenforceable any other part or provision of this Agreement; and

(c)if any portion of the foregoing provisions is found to be invalid or unenforceable by a court of competent jurisdiction because its duration, territory, definition of activities, or definition of information covered is considered to be invalid or unreasonable in scope, the invalid or unreasonable terms shall be redefined to carry out Employer’s and Employee’s intent in agreeing to these restrictive covenants.

These restrictive covenants shall be construed as agreements independent of any other provision in this Agreement and the existence of any claim or cause of action of Employee against Employer, whether predicated on this Agreement or otherwise, shall not constitute a defense to the enforcement by Employer of these restrictive covenants.

5.Employer’s Rights to Inventions and Other Intellectual Property.

(a) Employee hereby assigns to Employer all of Employee’s rights, title, and interest (including, but not limited to all patent, trademarks, copyright, and trade secret rights) in and to all Work Product (as defined below) prepared or developed by Employee, made or conceived in whole or in part by Employee within the scope of Employee’s employment by Employer, or that involve the use of Confidential Information or Trade Secrets within six (6) months thereafter. Employee further acknowledges and agrees all copyrightable Work Product prepared by Employee within the scope of Employee’s employment by Employer are “works made for hire” and, consequently, Employer owns all copyrights thereto.

(b) Employee represents and warrants to Employer all work Employee performs for or has performed for Employer, and all Work Product Employee produces, which includes, but is not limited to, software, copyrights, trademarks, domain names, domain name registrations, documentation, memoranda, ideas, designs, inventions, processes, new developments or improvements, and algorithms (“Work Product”), will not knowingly infringe upon or violate any patent, copyright, trade secret, or other property

- 9 -

Final

right of Employee’s former employers or of any other third party. Employee will not disclose to Employer, or use in any of Employee’s Work Product, any confidential or proprietary information belonging to others, unless both the owner thereof and Employer have consented.

(c) Notwithstanding the other provisions of this Section 5, Employee shall not be required to assign, transfer, or convey to Employer any of the rights, title, and interest Employee may have in any Work Product Employee invents, discovers, originates, makes, or conceives during Employee’s employment by Employer if and only if (i) no equipment, supplies, facilities, Confidential Information, or Trade Secrets are used in the creation of the Work Product, (ii) the Work Product was developed entirely on Employee’s own time, (iii) the Work Product does not relate directly to the Business or to Employer’s actual or demonstrably anticipated research or development, and (iv) the Work Product does not result in any way from any work performed by Employee for Employer.

6.Dispute Resolution/Jury Trial Waiver. All disputes and controversies arising out of or in connection with this Agreement, Employee’s employment with the Employer, or the transactions contemplated hereby shall be resolved exclusively by the state and federal courts located in the County of Clark, in the State of Nevada, and each party hereto irrevocably submits to the jurisdiction of said courts and agrees that venue shall lie exclusively with such courts. Each party hereby irrevocably waives, to the fullest extent permitted by applicable law, any objection which such party may raise now, or hereafter have, to the laying of the venue of any such suit, action or proceeding brought in such a court and any claim that any such suit, action or proceeding brought in such a court has been brought in an inconvenient forum. Each party agrees, to the fullest extent permitted by applicable law, a final judgment in any such suit, action, or proceeding brought in such a court shall be conclusive and binding upon such party, and may be enforced in any court of the jurisdiction in which such party is or may be subject by a suit upon such judgment. In any adversarial proceedings between the parties arising out of this Agreement, the prevailing party will be entitled to recover from the other party, in addition to any other relief awarded, all expenses that the prevailing party incurs in those proceedings, including attorneys’ fees and expenses. For purposes of the foregoing, (i) “prevailing party” means (A) in the case of the party initiating the enforcement of rights or remedies, that it was awarded relief on substantially all of its claims, and (B) in the case of the party defending against such enforcement, that it successfully defended substantially all of the claims made against it, and (ii) if no party is a “prevailing party” within the meaning of the foregoing, then no party will be entitled to recover its costs and expenses (including attorney’s fees and disbursements) from any other party. EACH PARTY HERETO KNOWINGLY, VOLUNTARILY, AND INTENTIONALLY WAIVES ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY WITH RESPECT TO ANY LITIGATION BETWEEN THE PARTIES TO THIS AGREEMENT AND THE PARTIES HERETO EXPRESSLY CONSENT TO A NON-JURY TRIAL IN THE EVENT OF ANY OF THE FOREGOING.

7.No Conflict. Employee represents and warrants Employee is not subject to any agreement, instrument, order, judgment or decree of any kind, or any other restrictive agreement of any character, which would prevent Employee from entering into this Agreement or would conflict with the performance of Employee’s duties pursuant to this Agreement. Employee represents and warrants Employee will not engage in any activity, which would conflict with the performance of Employee’s duties pursuant to this Agreement.

8.Notices. Any notice, requests, demands and other communications to be given to a party in connection with this Agreement shall be in writing addressed to such party in person or at such party’s “Notice Address,” which shall initially be as set forth below:

- 10 -

Final

If to Employer:

GALAXY GAMING, INC.

6480 Cameron Street, Suite 305

Las Vegas, Nevada 89118

Attn: Board of Directors

with a copy to (which shall not constitute notice):

LATHAM & WATKINS

650 Town Center Drive, 20th Floor

Costa Mesa, California 92626

Attn: Michael Treska

If to Employee: Matt Reback

208 Inman Lane NE

Atlanta, GA 30307

A party’s Notice Address may be changed or supplemented from time to time by such party by notice thereof to the other party as herein provided. Any such notice shall be deemed effectively given to and received by a party on the first to occur of (a) the date on which such notice is actually delivered (whether by mail, courier, hand delivery, electronic or facsimile transmission or otherwise) to such party’s Notice Address and addressed to such party, if such delivery occurs on a business day, or if such delivery occurs on a day which is not a business day, then on the next business day after the date of such delivery, (b) upon personal delivery to the party to be notified, or (c) the date on which such notice is actually received by such party (or, in the case of a party that is not an individual, actually received by the individual designated in the Notice Address of such party). For purposes of the preceding sentence, a “business day” is any day other than a Saturday, Sunday or U.S. federal public legal holiday.

(a)Waiver of Breach. The waiver by either Party of a breach or violation of any provision of this Agreement shall not operate as, or be construed to be, a waiver of any subsequent breach of the same or other provision hereof. The failure of either Party to insist, in any one or more instances, upon performance of any of the terms, conditions, or restrictive covenants contained in this Agreement shall not be construed as a waiver or a relinquishment of any right granted hereunder or of the future performance of any such term or condition, but the obligations of each Party with respect thereto shall continue in full force and effect.

(b)Severability. Any provision of this Agreement determined to be invalid or unenforceable by any court of competent jurisdiction will not affect the validity or enforceability of (i) any other provision hereof or (ii) the invalid or unenforceable provision in any other situation or in any other jurisdiction. Any provision of this Agreement held invalid or unenforceable only in part or degree will remain in full force and effect to the extent not held invalid or unenforceable.

(c)Assignability. Except as otherwise provided herein, this Agreement shall inure to the benefit of and shall be binding upon Employee, his or her executor, administrators, heirs, and personal representatives and upon Employer and its successors and assigns. The rights, obligations, and duties of Employee hereunder may be assigned by Employer to any successor or assign of Employer, and such successor or assign is expressly authorized to enforce all the terms and provisions of this Agreement, including without limitation the terms and provisions of Sections 3, 4 and 5 hereof. Employee’s obligations under this Agreement shall not be assignable by Employee.

- 11 -

Final

(d)Choice of Law. This Agreement shall be governed by the laws of the State of Nevada without regard to its choice of law rules.

(e)Amendments; Entire Agreement. This Agreement (i) constitutes the entire agreement between the Parties with respect to the subject matter of this Agreement and (ii) supersedes all prior and contemporaneous agreements (whether written or oral and whether express or implied) between the Parties to the extent related to the subject matter of this Agreement. No amendment of any provision of this Agreement will be valid unless the amendment is in writing and signed by Employer and Employee. Without limiting the generality of the foregoing, the obligations under this Agreement with respect to any termination of employment of Employee, for whatever reason, supersede any severance or related obligations of Employer in any policy, plan or practice of Employer or any agreement between Employee and Employer. Further, this Agreement shall not affect, or be affected by, any indemnification agreement between the Parties.

(f)Headings. Section headings in this Agreement are included herein for convenience of reference only and shall not constitute a part of this Agreement for any other purpose.

(g)Counterparts. This Agreement may be executed by the Parties in multiple counterparts and shall be effective as of the Effective Date when each party shall have executed and delivered a counterpart hereof, whether or not the same counterpart is executed and delivered by each Party. When so executed and delivered, each such counterpart shall be deemed an original and all such counterparts shall be deemed one and the same document. Transmission of images of signed signature pages by facsimile, e-mail or other electronic means shall have the same effect as the delivery in person of manually signed documents.

(h)Compliance with Section 409A. This Agreement is intended to comply with Section 409A of Internal Revenue Code of 1986, as amended (“Section 409A”), to the extent applicable. Notwithstanding any provision herein to the contrary, this Agreement shall be interpreted, operated and administered consistent with this intent. Each separate installment under this Agreement shall be treated as a separate payment for purposes of determining whether such payment is subject to or exempt from compliance with the requirements of Section 409A. In addition, in the event that Employee is a “specified employee” within the meaning of Section 409A (as determined in accordance with the methodology established by Employer as in effect on the date of termination of Employee’s employment hereunder), any payment or benefits hereunder that are nonqualified deferred compensation subject to the requirements of Section 409A shall be provided to Employee no earlier than six (6) months after the date of Employee’s “separation from service” within the meaning of Section 409A.

[signatures follow on next page]

- 12 -

Final

IN WITNESS WHEREOF, Employer has caused this Employment Agreement to be executed by its duly authorized officer, and Employee has hereunto signed this Agreement, as of the Effective Date.

“Employer”:

GALAXY GAMING, INC.

By:

Name: Harry Hagerty

Title: Chief Financial Officer

“Employee”:

Matt Reback

Matt Reback, an Individual

[Galaxy Gaming, Inc. Employment Agreement Signature Page]

EXHIBIT A

Employee: Matt Reback

Effective Date of Employment: November 13, 2023

Position: President and Chief Executive Officer

Compensation and Benefits:

1.Base Salary. Employer will pay to Employee beginning on the first regular payroll cycle following November 13, 2023 a base salary at an annual rate of $350,000 (as adjusted, the “Base Salary”), payable in accordance with Employer’s customary payroll practices as in effect from time to time. Any increase in the Employee’s Base Salary shall be at the sole discretion of the Board of Directors.

2.Bonuses; Additional Compensation. In addition to those set forth in this Exhibit A, Employee may be eligible to receive bonuses and to participate in incentive compensation plans of Employer in accordance with any plan or decision the Board, or any committee or other person authorized by the Board, may in its sole discretion determine from time to time.

3.Reimbursement of Expenses. Employee shall be paid or reimbursed by Employer, in accordance with and subject to Employer’s general expense reimbursement policies and practices and Employer’s receipt of evidence of such expenses reasonably satisfactory to Employer, for all reasonable travel and other business expenses incurred by Employee in performing his obligations under this Agreement. Employee will be reimbursed for any ordinary and customary documented expenses associated with his relocation from Atlanta, Georgia to Las Vegas, Nevada including, but not limited to, an allowance of monthly short-term home rental costs for a period not to exceed four months from his first date of employment. The short-term home rental costs shall not exceed $4100.00 per month.

4.Benefits. Employee shall be eligible to participate in Employer’s medical and dental insurance programs, 401(k), and other employee benefit or welfare plan, program, or arrangement that Employer has or may from time to time establish or sponsor for the benefit of Employer’s employees, upon Employee meeting any qualifications for participation in such plan(s), program(s), or arrangement(s).

5.Incentive Compensation.

5.1. Employee shall be eligible to the following bonus/incentive compensation, subject in the case of any bonus to the prior approval of Employer’s Board and subject to the Galaxy Gaming Inc. 2014 Equity Incentive Plan, as amended:

5.1.1 Management Bonus. Provided the Board of Directors determines certain Employer metrics have been met, Employee shall be eligible to receive an annual discretionary bonus of up to fifty percent (50%) of the Base Salary (the “Management Bonus”). Nothing herein shall limit the Management Bonus to fifty percent (50%) of the Base Salary if the target/“on plan” performance objectives referenced below are exceeded, as specified in the Board determined and approved Management Bonus program. The Management Bonus shall be determined as follows: (i) twenty percent (20%) of each annual bonus (if earned) will be based on Employee’s individual performance; and (ii) eighty percent (80%) of each annual bonus (if earned) will be based on corporate performance objectives, each as determined in the sole and absolute discretion by Employer’s Board. If a determination is made by the Board to pay the Management Bonus, it will be paid upon satisfactory filing of the Company’s Annual

[Galaxy Gaming, Inc. Exhibit A to Employment Agreement]

Form 10-K of the year following the fiscal year in which such bonus may have been earned. The determination by the Board to pay a Management Bonus will be uniform among similarly situated employees of the Employer without bias to Employee. For the purposes of clarity, all Management Bonuses require continued employment by the Employee at the date of payment. Any deviation, modification or deviation to this employment requirement shall be at the sole and absolute discretion of the Board.

5.1.2. 2024 Minimum Bonus Guaranty. As an incentive to accept employment with Employer, and, notwithstanding the Management Bonus term above, Employer agrees it will pay a bonus to Employee in the amount of not less than $80,000.00 for the 2024 calendar year (on its regularly scheduled plan for annual bonus payments) to be known as the “2024 Minimum Guarantee.” This minimum guarantee shall be payable with the limitation that the Company’s common bonus threshold must be achieved at 80% of plan. If 80% of the annual bonus target is not achieved at the conclusion of the 2024 calendar year, the payment of the Minimum Guarantee to the Employee shall be at the sole and absolute discretion of the Board of Directors.

5.1.3. Base Stock Option Grant. In consideration of making the covenants to not compete set forth in Section 4(a) of this Agreement, Employee shall, upon execution of this Agreement, be granted an option to purchase up to 400,000 shares of Employer’s restricted common stock with a strike price equal to the price per share of Employer’s common stock as reported on OTC Markets on the date such option is granted, which option will vest as follows: (i) as to the first 100,000 shares of stock, on November 13, 2024, (ii) as to the next 100,000 shares of stock, on November 13, 2025, (iii) as to the next 100,000 shares of stock, on November 13, 2026, and (iv) as to the next 100,000 shares of stock, on November 13, 2027 all pursuant to the terms of a Stock Option Grant Agreement by and between Employer and Employee.

5.1.4. Termination Prior to Twelve (12) Month Tenure Ending. As an incentive to accept employment with the Company, in the event Employer terminates Employee within the first 12 months of his employment without good cause, the Company agrees it shall allow the first 100,000 base stock options granted above to vest.

5.2. Long-Term Incentive Stock Grant. In addition to the Base Stock Option Grant above and in consideration of the covenants of the Agreement, including without limitation the covenant not to compete set forth in Section 4(a) of this Agreement, Employee shall be eligible to earn certain additional Long-Term Incentive Stock Grants based on achievement of certain business performance criteria as established by the Board. The Long-Term Incentive Stock Grants shall be broken down into three segments including Personal Performance Targets, Business Target I and Business Target II. The relative distribution of the three criteria shall be twenty per cent (20%) against the achievement of the Employee’s Personal Performance Targets, thirty percent (30%) against the achievement of Business Target I and 50% against Business Target II. For the purposes of clarity, each of the criteria can be separately achieved (or not) and minimum thresholds shall be established by the Board of Directors for each segment, in its sole discretion, exercised reasonably and in good faith.

Each year the Board shall establish and provide to the Employee the specific personal and business performance targets for calendar years 2024, 2025 and 2026 (the “Targets”). The Targets, if achieved, will provide Employee the opportunity to be granted a total of 70,000 shares of stock for calendar year 2024, 100,000 shares of stock for calendar year 2025, and 130,000 shares of stock for calendar year 2026.

Unless specifically authorized by the Board of Directors, any of the shares of stock earned by the Employee relating to the Long-Term Incentive shall be granted/delivered within five (5) days of the

[Galaxy Gaming, Inc. Exhibit A to Employment Agreement]

Final

filing of the Company’s Annual Form 10-K. By way of example, assuming the Employee has earned his annual Long-Term Incentive, he would be provided the stock grant for calendar year 2024, five days following the March 31, 2025, Form 10-K filing deadline.

Should a “Change of Control” event (provided in Section 2(c)(iv) of this Agreement) take place and Employee is not retained or is not provided the continuing opportunity to earn his Long-Term Incentive Grant (under the terms established by the Board for any given calendar year prior to the Change of Control), Employee shall be provided the benefit of vesting his Long Term Incentive Target shares under the following terms:

(i) if the Change of Control event takes place in calendar year 2024, Employee shall be entitled to acceleration of vesting of all of his targeted 2024 Long Term Target incentive shares;

ii) if a Change of Control event takes place in calendar year 2025, Employee shall be entitled to: a) any 2024 incentive shares "earned" in the performance of his duties (as provided herein); plus b) an amount of 2025 incentive shares, as determined at the discretion of the Board of Directors, but in any event the number of target 2025 incentive shares subject to acceleration shall not be less than 75,000; and

iii) if a Change of Control event takes place in calendar year 2026 Employee shall be entitled to: a) any 2025 incentive shares "earned" in the performance of his duties (as provided herein); plus b) an amount of incentive shares as determined at the discretion of the Board of Directors, but in any event the number of target 2026 incentive shares subject to acceleration shall not be less than 75,000 shares.

[Galaxy Gaming, Inc. Exhibit A to Employment Agreement]

Final

PRESS/MEDIA RELEASE

Galaxy Gaming Announces Leadership Change

LAS VEGAS, November 6, 2023 (GLOBE NEWSWIRE) -- Galaxy Gaming, Inc. (OTCQB: GLXZ) (“Galaxy” or the “Company”), a developer and distributor of casino table games and enhanced systems for land-based casinos and iGaming, announced today that its Board of Directors has appointed a new President and Chief Executive Officer of the Company. The Company’s Board of Directors has appointed Matt Reback, who will join Galaxy on November 13, 2023.

“We are excited to welcome Matt as the Company’s new President and CEO. The Board carefully considered this change, examined multiple candidates, and ultimately believed it was the right decision to bring a new perspective into the Company as we embark on our next phase of growth,” stated Mark Lipparelli, Chairman of Galaxy’s Board of Directors. “Matt brings to Galaxy a combination of 20 years of leadership skills acquired in the gaming industry from both operator and technology companies. On a positive note, we are making this change with a solid foundation intact, and we are well-positioned going into the 2024 fiscal year.”

“I am looking forward to joining the Galaxy team and continuing what has been a great story in the gaming industry,” stated Matt Reback. “I intend to quickly get up to speed and make sure our 2023 year-end goals and 2024 plans remain on-track, while also taking a fresh look at our opportunities. There is a team of talented people at Galaxy who have demonstrated their ability to compete effectively against companies with more resources as well as their success forming strong industry partnerships. I expect that one of my goals with the Board will be to build on those successes.”

Prior to accepting this role, Mr. Reback served as the founder and President of Bravery Gaming. Prior thereto Mr. Reback held senior management positions in product management, sales, marketing and operations with AGS, Konami Gaming, Red Rock Casinos (formerly Station Casinos) and Caesars Entertainment. Mr. Reback is a graduate of UCLA and University of San Diego School of Law.

Lipparelli added, “We are appreciative of Todd Cravens’ material contributions to the development of Galaxy over the past six years, including navigating successfully the difficult pandemic period. We wish him well in his next endeavor.”

The Company intends to work through a brief transition with Mr. Cravens and expects Harry Hagerty to serve as an interim President and Chief Executive Officer should such a need arise.

The Company expects to release third quarter results on Monday, November 13. It currently expects to report Revenue of $6.1 million and Adjusted EBITDA of $1.5 million for the quarter and Revenue of $21.1 million and Adjusted EBITDA of $7.8 million for the nine months ended September 30, 2023. In the third quarter, revenues from perpetual license sales were approximately $1 million lower than in the first and second quarters of 2023. In the third quarter, the Company significantly increased its allowance for doubtful accounts, principally as a result of financial difficulties at a single customer, and it continued to incur significant legal expenses related to intellectual property registrations around the world. The Company expects to report that, at September 30, 2023, it had $58.7 million in debt and $15.9 million in cash and that it was in compliance with the covenants in its credit agreement. The Company expects to issue fourth quarter guidance of $7.0-$7.5 million in revenue and $2.8 million to $3.2 million in Adjusted EBITDA. Actual reported results may differ from the estimates made here, and it should be noted that these estimates do not include any expenses related to the CEO transition described earlier in this press release.

Forward-Looking Statements

This press release contains, and oral statements made from time to time by our representatives may contain, forward-looking statements based on management's current expectations and projections, which are intended to qualify for the safe harbor of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements identified by words such as "believe," "will," "may," "might," "likely," "expect," "anticipates," "intends," "plans," "seeks," "estimates," "believes," "continues," "projects" and similar references to future periods, or by the inclusion of forecasts or projections. All forward-looking statements are based on current expectations and projections of future events.

These forward-looking statements reflect the current views, models, and assumptions of Galaxy Gaming, and are subject to various risks and uncertainties that cannot be predicted or qualified and could cause actual results in Galaxy Gaming's performance to differ materially from those expressed or implied by such forward looking statements. These risks and uncertainties include, but are not limited to, the ability of Galaxy Gaming to enter and maintain strategic alliances, product placements or installations, in land based casinos or grow its iGaming business, garner new market share, secure licenses in new jurisdictions or maintain existing licenses, successfully develop or acquire and sell proprietary products, comply with regulations, have its games approved by relevant jurisdictions, and adapt to changes resulting from the COVID-19 pandemic and other factors. All forward-looking statements made herein are expressly qualified in their entirety by these cautionary statements and there can be no assurance that the actual results, events, or developments referenced herein will occur or be realized. Readers are cautioned that all forward-looking statements speak only to the facts and circumstances present as of the date of this press release. Galaxy Gaming expressly disclaims any obligation to update or revise any forward-looking statements, whether because of new information, future events or otherwise.

Certain statements in this release may constitute forward-looking statements, which involve a number of risks and uncertainties. Galaxy cautions readers that any forward-looking information is not a guarantee of future performance and that actual results could differ materially from those contained in the forward-looking information due to a number of factors, including those listed from time to time in reports that Galaxy files with the Securities and Exchange Commission.

About Galaxy Gaming

Headquartered in Las Vegas, Nevada, Galaxy Gaming (galaxygaming.com) develops and distributes innovative proprietary table games, state-of-the-art electronic wagering platforms and enhanced bonusing systems to land-based, riverboat, and cruise ship and casinos worldwide. In addition, through its wholly owned subsidiary, Progressive Games Partners LLC, Galaxy licenses proprietary table games content to the online gaming industry. Connect with Galaxy on Facebook, YouTube and Twitter.

Non-GAAP Financial Information

Adjusted EBITDA includes adjustments to net loss/income to exclude interest, taxes, depreciation, amortization, share based compensation, gain/loss on extinguishment of debt, foreign currency exchange gains/losses, change in estimated fair value of interest rate swap liability and severance and other expenses related to litigation. Adjusted EBITDA is not a measure of performance defined in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”). However, Adjusted EBITDA is used by management to evaluate our operating performance. Management believes that disclosure of Adjusted EBITDA allows investors, regulators, and other stakeholders to view our operations in the way management does. Adjusted EBITDA should not be considered as an alternative to net income or to net cash provided by operating activities as a measure of operating results or of liquidity. Finally, Adjusted EBITDA may not be comparable to similarly titled measures used by other companies.

Contact:

Media: Phylicia Middleton (702) 936-5216

Investors: Harry Hagerty (702) 938-1740

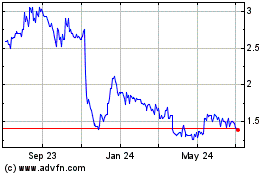

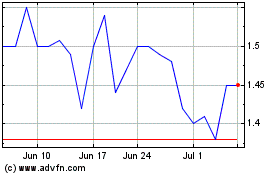

Galaxy Gaming (QB) (USOTC:GLXZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Galaxy Gaming (QB) (USOTC:GLXZ)

Historical Stock Chart

From Apr 2023 to Apr 2024