As filed with the Securities and Exchange Commission on November 7, 2023

Securities Act Registration No. 333-_________

===================================================================================

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Nelnet, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Nebraska | | 84-0748903 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

121 South 13th Street, Suite 100

Lincoln, Nebraska 68508

(Address of Principal Executive Offices) (Zip Code)

Nelnet, Inc. Directors Stock Compensation Plan

(Full title of the plan)

James D. Kruger

Chief Financial Officer

Nelnet, Inc.

121 South 13th Street, Suite 100

Lincoln, Nebraska 68508

(Name and address of agent for service)

(402) 458-2370

(Telephone number, including area code, of agent for service)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [X] Accelerated filer [ ]

Non-accelerated filer [ ] Smaller reporting company [ ]

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. [ ]

EXPLANATORY NOTE

This Registration Statement on Form S-8 is being filed by Nelnet, Inc. (the “Company” or the “registrant”) pursuant to General Instruction E. to Form S-8 for the purpose of registering an additional 200,000 shares (the “Additional Shares”) of the Company’s Class A Common Stock, par value $0.01 per share (the “Class A Common Stock”), issuable under the Nelnet, Inc. Directors Stock Compensation Plan (the “Plan”) pursuant to an amendment to the Plan approved by the Company’s shareholders on May 18, 2023 (the “Amendment”). In addition, the Amendment: (i) provides an increased annual per-director share award limit under the Plan from $300,000 to $500,000; (ii) allows Board members who are also employees of the Company to be eligible to participate in the Plan and elect to receive their annual retainer fees in shares of stock instead of cash; and (iii) makes certain other technical and administrative amendments to the Plan. The Additional Shares are additional securities of the same class as other securities for which the following Registration Statements on Form S-8 are effective: (i) a Registration Statement on Form S-8 (File No. 333-112374) filed by the Company on January 30, 2004 to register 2,100,000 shares of Class A Common Stock, including 100,000 shares of Class A Common Stock issuable under the Plan; (ii) a Registration Statement on Form S-8 (File No. 333-151991) filed by the Company on June 27, 2008 to register an additional 300,000 shares of Class A Common Stock issuable under the Plan; and (iii) a Registration Statement on Form S-8 (File No. 333-151991) filed by the Company on March 7, 2019 to register an additional 100,000 shares of Class A Common Stock issuable under the Plan. In accordance with General Instruction E. to Form S-8, the contents of those earlier registration statements are incorporated by reference into this registration statement, to the extent not otherwise amended or superseded by the contents of this registration statement. Part II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents filed by the Company with the U.S. Securities and Exchange Commission (“Commission”) are incorporated by reference in this registration statement:

(a)The Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (the “Annual Report”), filed with the Commission on February 28, 2023; and (b)The Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2023, as filed with the Commission on May 8, 2023; (c)The Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2023, as filed with the Commission on August 7, 2023; (d)The Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, as filed with the Commission on November 7, 2023;

(e)The Company’s Current Reports on Form 8-K filed with the Commission on February 2, 2023, March 23, 2023, March 30, 2023, April 25, 2023, and May 22, 2023 (and as amended on June 21, 2023). (f)The description of the Company’s Class A Common Stock contained in Exhibit 4.1 to the Annual Report and any amendment or report filed for the purpose of updating such description. All documents filed by the Company subsequent to the date of this registration statement pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934 (other than the portions of those documents furnished or otherwise not deemed to be filed) prior to the filing of a post-effective amendment hereto which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference in this registration statement and to be a part hereof from the date of the filing of such documents.

Any statement contained herein or in a document incorporated or deemed to be incorporated by reference in this registration statement shall be deemed to be modified or superseded for purposes of this registration statement to the extent that a statement contained herein (or in any subsequently filed document which also is or is deemed to be incorporated by reference herein) modifies and supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this registration statement.

Item 5. Interests of Named Experts and Counsel.

William J. Munn, who has given an opinion with respect to the securities to which this registration statement relates, is an employee and an officer (Corporate Secretary, Chief Governance Officer, and General Counsel) of the Company. Mr. Munn beneficially owned a total of 17,085 shares of the Company’s Class A Common Stock as of the date of the filing of this registration statement and participates in various employee benefit plans of the Company but is not eligible to participate in the Plan.

Item 6. Indemnification of Directors and Officers.

The Company is a Nebraska corporation. Under Sections 21-2,112 and 21-2,116(c) of the Nebraska Model Business Corporation Act (the “NMBCA”), a Nebraska corporation shall indemnify its directors and officers who are wholly successful, on the merits or otherwise, in the defense of any proceeding to which such person was a party because he or she was a director or officer of the corporation against expenses incurred by such person in connection with the proceeding. Sections 21-2,114 and 21-2,116(c) of the NMBCA allow a director or officer to apply for the court to order indemnification or advance of expenses of such person if the court determines, in view of all the relevant circumstances, that it is fair and reasonable to order indemnification.

Under Section 21-2,111 of the NMBCA, a Nebraska corporation may indemnify an individual who is a party to a proceeding (defined as any threatened, pending, or completed action, suit, or proceeding, whether civil, criminal, administrative, arbitrative, or investigative and whether formal or informal) because the individual is a director against liability (defined as the obligation to pay a judgment, settlement, penalty, fine, including an excise tax assessed with respect to an employee benefit plan, or reasonable expenses incurred with respect to a proceeding) incurred in the proceeding if (1)(i) the director conducted himself or herself in good faith; and (ii) reasonably believed (a) in the case of conduct in an official capacity, that his or her conduct was in the best interests of the corporation; and (b) in all other cases, that the director’s conduct was at least not opposed to the best interests of the corporation; and (iii) in the case of any criminal proceeding, the director had no reasonable cause to believe his or her conduct was unlawful; or (2) the director engaged in conduct for which broader indemnification is provided for under the articles of incorporation, as authorized by Section 21-220(b)(5) of the NMBCA (such broader indemnification is provided for under the Company’s Third Amended and Restated Articles of Incorporation (the “Articles of Incorporation”), as discussed below). However, unless ordered by a court, a Nebraska corporation may not indemnify a director (1) in connection with a proceeding by or in the right of the corporation, except for expenses incurred in connection with the proceeding if it is determined that the director has met the relevant standard of conduct discussed above; or (2) in connection with any proceeding with respect to conduct for which the director was adjudged liable on the basis of receiving a financial benefit to which he or she was not entitled, whether or not involving action in the director’s official capacity. Under Section 21-2,113 of the NMBCA, a Nebraska corporation generally may, before final disposition of a proceeding, advance funds to pay for or reimburse expenses incurred in connection with the proceeding by an individual who is a party to the proceeding because that individual is a director if the director delivers to the corporation a signed written undertaking of the director to repay any funds advanced if it is ultimately determined under the NMBCA that the director is not entitled to indemnification.

Under Section 21-2,116 of the NMBCA, a Nebraska corporation may generally indemnify and advance expenses to an officer of the corporation who is a party to a proceeding because he or she is an officer of the corporation (i) to the same extent as a director; and (ii) if he or she is an officer but not a director, to such further extent as may be provided by the articles of incorporation, the bylaws, a resolution of the board of directors, or contract, except for (a) liability in connection with a proceeding by or in the right of the corporation other than for expenses incurred in connection with the proceeding; or (b) liability arising out of conduct that constitutes (1)

receipt by the officer of a financial benefit to which he or she is not entitled; (2) an intentional infliction of harm on the corporation or the shareholders; or (3) an intentional violation of criminal law.

Article VIII of the Company’s Articles of Incorporation provides that, to the fullest extent permitted by the NMBCA (including the broader indemnification authorized by Section 21-220(b)(5) of the NMBCA, as discussed below), the Company shall indemnify and hold harmless and advance expenses (as defined in Section 21-214 of the NMBCA) to any person (an “indemnitee”) who was, is, or is threatened to be made a party or is otherwise involved in any proceeding (as defined in Subsection (6) of Section 21-2,110 of the NMBCA) by reason of the fact that the indemnitee, or a person for whom the indemnitee is the legal representative, is or was a director or officer of the Company, against all liability (as defined in Subsection (3) of Section 21,2110 of the NMBCA) and loss suffered and expenses actually and reasonably incurred by the indemnitee in connection with such proceeding.

Article VIII of the Company’s Articles of Incorporation also provides that the Company may purchase and maintain insurance on behalf of any person who is or was a director or officer of the Company against any liability asserted against or incurred by such person in such capacity or arising out of such person’s status as such, whether or not the Company would have the power to indemnify or advance expenses to him or her against such liability under the provisions of Article VIII of the Company’s Articles of Incorporation or the NMBCA. The Company maintains insurance for the benefit of its directors and officers, insuring such persons against liability that may be incurred by them in their capacity as directors and officers of the Company.

As permitted by Section 21-220(b)(4) of the NMBCA, Article VII of the Company’s Articles of Incorporation provides that a director of the Company shall have no personal liability to the Company or its shareholders for money damages for any action taken, or any failure to take any action, as a director of the Company, except liability for (i) the amount of a financial benefit received by a director to which the director is not entitled; (ii) an intentional infliction of harm on the Company or the shareholders; (iii) a violation of Section 21-2,104 of the NMBCA relating to unlawful distributions from a corporation; or (iv) an intentional violation of criminal law. In addition, under Section 21-220(b)(5) of the NMBCA, a Nebraska corporation’s articles of incorporation may contain a provision permitting or making obligatory indemnification of a director for liability, as defined in Section 21-2,110(3) of the NMBCA, to any person for any action taken, or any failure to take any action, as a director, except liability for (i) receipt of a financial benefit to which the director is not entitled; (ii) an intentional infliction of harm on the corporation or its shareholders; (iii) a violation of Section 21-2,104 of the NMBCA relating to unlawful distributions from a corporation; or (iv) an intentional violation of criminal law. As indicated above, Article VIII of the Company’s Articles of Incorporation provides that, to the fullest extent permitted by the NMBCA (including the broader indemnification authorized by Section 21-220(b)(5) of the NMBCA), the Company shall indemnify a director of the Company against liability.

The discussion above is only a general summary of certain provisions of the NMBCA and the Company’s Articles of Incorporation and is qualified in its entirety by reference to the complete text of the provisions of the NMBCA and the Company’s Articles of Incorporation referred to above.

Item 8. Exhibits.

The following exhibits are furnished as part of this registration statement:

| | | | | |

| Exhibit No. | Description |

| |

| 4.1 | |

| |

| 4.2 | |

| |

| 4.3 | |

| |

| 5.1* | |

| |

| 23.1* | |

| |

| 23.2* | |

| |

| 24.1* | |

| |

| 107* | |

* Filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Lincoln, State of Nebraska, on November 7, 2023.

NELNET, INC.

By: /s/ JEFFREY R.NOORDHOEK

Jeffrey R. Noordhoek

Chief Executive Officer

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below hereby authorizes, constitutes and appoints Jeffrey R. Noordhoek and James D. Kruger his or her true and lawful attorney-in-fact and agent with full power of substitution and resubstitution, and each with full power to act alone, for the undersigned and in his or her own name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments and other amendments thereto) to this Registration Statement on Form S-8 and to file the same, with all exhibits thereto and other documents in connection therewith, with the United States Securities and Exchange Commission, granting unto each said attorney-in-fact and agent full power and authority to do and perform each and every act and thing as the undersigned could do in person, hereby ratifying and confirming all that each said attorney-in-fact and agent, or his substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

| | | | | | | | | | | | | | |

| Signature | | Title | | Date |

| | | | |

| /s/ JEFFREY R. NOORDHOEK | | Chief Executive Officer (Principal Executive Officer) | | November 7, 2023 |

| Jeffrey R. Noordhoek | | | |

| | | | |

| /s/ JAMES D. KRUGER | | Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer) | | November 7, 2023 |

| James D. Kruger | | | |

| | | | |

| /s/ MICHAEL S. DUNLAP | | Executive Chairman | | November 7, 2023 |

| Michael S. Dunlap | | | | |

| | | | |

| /s/ PREETA D. BANSAL | | Director | | November 7, 2023 |

| Preeta D. Bansal | | | |

| | | | |

| /s/ MATTHEW W. DUNLAP | | Director | | November 7, 2023 |

| Matthew W. Dunlap | | | |

| | | | |

| /s/ KATHLEEN A. FARRELL | | Director | | November 7, 2023 |

| Kathleen A. Farrell | | | |

| | | | |

| /s/ DAVID S. GRAFF | | Director | | November 7, 2023 |

| David S. Graff | | | | |

| | | | |

| /s/ THOMAS E. HENNING | | Director | | November 7, 2023 |

| Thomas E. Henning | | | | |

| | | | |

| /s/ ADAM K. PETERSON | | Director | | November 7, 2023 |

| Adam K. Peterson | | | | |

| | | | |

| /s/ KIMBERLY K. RATH | | Director | | November 7, 2023 |

| Kimberly K. Rath | | | |

| | | | |

| /s/ JONA M. VAN DEUN | | Director | | November 7, 2023 |

| Jona M. Van Deun | | | | |

CALCULATION OF FILING FEE TABLES

S-8

(Form Type)

Nelnet, Inc.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

| | | | | | | | | | | | | | | | | | | | | | | |

Security Type | Security Class Title | Fee Calculation Rule | Amount to be Registered(1) | Proposed Maximum Offering Price Per Unit(2) | Proposed Maximum Aggregate Offering Price(2) | Fee Rate | Amount of Registration Fee |

| Equity | Class A Common Stock,

par value $0.01 per share

(“Class A Common Stock”) | Other(2) | 200,000 shares | $84.73(2) | $16,946,000(2) | $147.60 per $1,000,000 | $2,501.23 |

| Total Offering Amounts | | $16,946,000(2) | | $2,501.23 |

| Total Fee Offsets | | | | — |

| Net Fee Due | | | | $2,501.23 |

(1) Represents shares of the Nelnet, Inc. Class A Common Stock authorized to be issued under the Nelnet, Inc. Directors Stock Compensation Plan (the “Plan”). Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement shall also be deemed to cover any additional shares of Class A Common Stock which become issuable under the plan to prevent dilution resulting from any stock splits, stock dividends, recapitalizations, or similar transaction.

(2) Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(c) and Rule 457(h) under the Securities Act based on a price of $84.73 per share of the Class A Common Stock, which is the average of the high and low prices per share of the Class A Common Stock as reported on the New York Stock Exchange on November 1, 2023.

November 7, 2023

Nelnet, Inc.

121 South 13th Street, Suite 100

Lincoln, Nebraska 68508

Re: Registration Statement on Form S-8 for Additional Shares of Class A Common Stock Issuable Under the Nelnet, Inc. Directors Stock Compensation Plan

Ladies and Gentlemen:

I am General Counsel of Nelnet, Inc., a Nebraska corporation (the “Company”), and I have acted as counsel in connection with the Registration Statement on Form S-8 (the “Registration Statement”) with respect to the registration under the Securities Act of 1933, as amended (the “Securities Act”), of a total of 200,000 additional shares (the “Shares”) of the Company’s Class A Common Stock, par value $0.01 per share (the “Class A Common Stock”), issuable from time to time pursuant to awards granted under the Nelnet, Inc. Directors Stock Compensation Plan, as amended (the “Plan”).

In connection therewith, I, or attorneys under my direction, have examined, and relied upon the accuracy of factual matters contained in the Plan and such other agreements, documents, certificates, corporate records and instruments as I have deemed necessary for the purposes of the opinion expressed below. In my examination of such documents, I have assumed the genuineness of all signatures, the legal capacity of all natural persons, the accuracy and completeness of all documents, the authenticity of all original documents, and the conformity to authentic original documents of all copies of documents. In rendering this opinion, I have assumed that, at the time of the issuance of the Shares, the Shares will continue to be duly and validly authorized on the dates that the Shares are issued to participants pursuant to the terms of the Plan, and upon the issuance of any of the Shares, the total number of shares of Class A Common Stock issued and outstanding, after giving effect to such issuance of such Shares, will not exceed the total number of shares of Class A Common Stock that the Company is then authorized to issue under its articles of incorporation, as amended.

Based upon, subject to, and limited by the foregoing, I am of the opinion that the Shares, when issued pursuant to awards granted in accordance with the terms of the Plan and in the manner contemplated by the Plan, will be legally issued, fully paid and non-assessable, provided that the consideration for the Shares is at least equal to the stated par value thereof.

This opinion is limited to the matters expressly stated herein. No implied opinion may be inferred to extend this opinion beyond the matters expressly stated herein. I am a member of the bar of the State of Nebraska, and in rendering the opinion set forth above, I express no opinion as to the laws of any jurisdiction other than the Model Business Corporation Act of the State of Nebraska and the federal laws of the United States of America. I do not undertake to advise you of any changes in the opinion expressed herein resulting from changes in law, changes in facts or any other matters that might occur or be brought to my attention after the date hereof.

I hereby consent to the filing of this opinion as an exhibit to the Registration Statement. In giving such consent, I do not thereby admit that I am in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Securities and Exchange Commission thereunder.

Very truly yours,

/s/ WILLIAM J. MUNN

William J. Munn

General Counsel

| | |

121 S. 13th Street | Suite 100 | Lincoln, NE 68508 | p 402.458.2370 | Nelnet.com |

KPMG LLP Suite 300 1212 N. 96th Street Omaha, NE 68114-2274 Suite 1120 1248 O Street Lincoln, NE 68508-1493 KPMG LLP, a Delaware limited liability partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. Consent of Independent Registered Public Accounting Firm We consent to the use of our reports dated February 28, 2023, with respect to the consolidated financial statements of Nelnet, Inc., and the effectiveness of internal control over financial reporting, incorporated herein by reference. /s/ KPMG LLP Lincoln, Nebraska November 7, 2023

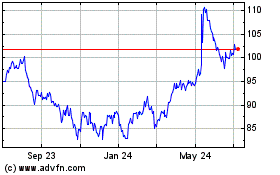

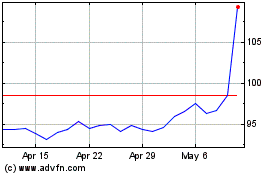

Nelnet (NYSE:NNI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nelnet (NYSE:NNI)

Historical Stock Chart

From Apr 2023 to Apr 2024