0001337013false00013370132023-11-072023-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (date of earliest event reported): November 7, 2023

___________________________________

InfuSystem Holdings, Inc.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

Delaware (State or other jurisdiction of incorporation or organization) | 001-35020 (Commission File Number) | 20-3341405 (I.R.S. Employer Identification Number) |

| | |

3851 West Hamlin Road Rochester Hills, Michigan 48309 |

(Address of principal executive offices) (Zip Code) |

| | |

248 291-1210 |

(Registrant's telephone number, including area code) |

| | |

| Not Applicable | |

| (Former Name or Former Address, if Changed Since Last Report) |

___________________________________Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

| | |

Title of Each Class | Trading Symbol(s) | Name of Each Exchange on which Registered |

Common Stock, par value $.0001 per share | INFU | NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 - Results of Operations and Financial Condition

On November 7, 2023, InfuSystem Holdings, Inc. (the “Company”) issued a press release reporting its financial results for the third quarter of 2023. The press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information furnished in this Item 2.02 — “Results of Operations and Financial Condition” of this Current Report on Form 8-K and the press release attached hereto as Exhibit 99.1 shall not be deemed “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of such section, and shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

Item 9.01 - Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934 the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| INFUSYSTEM HOLDINGS, INC. |

| |

By: | /s/ Barry Steele |

| Barry Steele |

| Chief Financial Officer |

Dated: November 7, 2023

Exhibit 99.1

| | | | | |

| InfuSystem Holdings, Inc. 3851 W. Hamlin Road Rochester Hills, MI 48309 248-291-1210 |

| | | | | |

| CONTACT: | Joe Dorame, Joe Diaz & Robert Blum Lytham Partners, LLC 602-889-9700 |

InfuSystem Reports Third Quarter 2023 Financial Results

Record Net Revenues of $31.9 million Representing 17% Growth from the Prior Year

Operating Income Increased 80% - Net Income Increased 56% - Adjusted EBITDA Increased 11%

Raising Full Year 2023 Net Revenue Guidance

Rochester Hills, Michigan, November 7, 2023 – InfuSystem Holdings, Inc. (NYSE American: INFU) (“InfuSystem” or the “Company”), a leading national health care service provider, facilitating outpatient care for durable medical equipment manufacturers and health care providers, today reported financial results for the third quarter ended September 30, 2023.

2023 Third Quarter Overview:

•Net revenues totaled $31.9 million, an increase of 17% vs. prior year.

◦Patient Services (formerly Integrated Therapy Services ("ITS")) net revenue was $19.3 million, an increase of 11% vs. prior year.

◦Device Solutions (formerly Durable Medical Equipment Services ("DME Services")) net revenue was $12.6 million, an increase of 27% vs. prior year.

•Gross profit was $16.2 million, a slight increase vs. prior year.

•Gross margin was 50.9%, a decrease of 8.5% vs. prior year.

◦Patient Services gross margin was 61.4%, a decrease of 4.2% vs. prior year.

◦Device Solutions gross margin was 34.9%, a decrease of 13.7% vs. prior year.

•Net income increased $0.2 million, or 56%, to $0.7 million, or $0.03 per diluted share vs. prior year net income of $0.4 million, or $0.02 per diluted share.

•Adjusted earnings before interest, income taxes, depreciation, and amortization (“Adjusted EBITDA”) (non-GAAP) was $6.2 million, an increase of 11% vs. prior year.

Management Discussion

Richard DiIorio, Chief Executive Officer of InfuSystem, said, “We delivered another quarter of strong operating results with revenue and net income growth of 17% and 56%, respectively. The financial results of our third quarter represent the seventh consecutive quarter with record revenue, which we believe reflect the fundamental strength of our business. Our team continues to deliver sequential operational improvement with double-digit revenue growth for both Patient Services (formerly ITS), up 11%, and Device Solutions (formerly DME Services), up 27%. The positive results reflect our continued focus on execution of our strategic priorities, and I am proud of our team’s hard work.”

“With solid year-to-date performance, we are raising our full-year 2023 net revenue growth guidance to be greater than 11%, up from our previous estimate calling for an annual growth rate above 10%. Although we expect to conclude the year with record annual revenue, we also expect the fourth quarter to be slightly lower versus this year’s record third quarter. As we had previously anticipated, we have delivered a significant number of negative pressure wound therapy devices as part of a large lease agreement, which positively impacted the first three quarters of 2023, but will likely be much lower during the fourth

quarter of 2023. We believe that our commitment to helping people live longer and healthier lives and strengthening critical partnerships lays the groundwork for long-term success that will reward our shareholders.”

2023 Third Quarter Financial Review

Net revenues for the quarter ended September 30, 2023 were $31.9 million, an increase of $4.6 million, or 17.0%, compared to $27.3 million for the quarter ended September 30, 2022. The increase included higher net revenues for both the Patient Services and Device Solutions segments.

Patient Services net revenue of $19.3 million increased $1.9 million, or 11.0%, during the third quarter of 2023 compared to the prior year period. This increase was primarily attributable to additional treatment volume in the Oncology Business, revenue from sales-type leases of NPWT pumps, improved third party payer collections on billings and higher average prices. The largest net revenue improvement came from Wound Care, which increased by $1.1 million, or 693%, compared to the same prior year period, mainly due to increased sales of equipment on sales-type leases, partially offset by lower treatment volumes. Net revenue in the Oncology Business for the third quarter of 2023 increased by $0.8 million, or 5.2%, compared to the same prior year period.

Device Solutions net revenue of $12.6 million (exclusive of inter-segment revenues) increased $2.7 million, or 27.4%, during the third quarter of 2023 as compared to the prior year period. This increase included higher biomedical services revenue which increased by $2.6 million, or 150%. The increased biomedical revenue was mainly attributable to increased revenue from the master services agreement that we entered into with a leading global healthcare technology and diagnostic company in April 2022.

Gross profit for the third quarter of 2023 of $16.2 million increased slightly compared to the third quarter of 2022. The impact from the increase in net revenue was offset by a lower gross profit percentage of net revenue ("gross margin"). Gross margin was 50.9% during the third quarter of 2023 as compared to 59.5% during the prior year period, a decrease of 8.5%. Gross profit increased in the Patient Services segment but was lower in the Device Solutions segment. Gross margin decreased in both operating segments.

Patient Services gross profit was $11.8 million during the third quarter of 2023, representing an increase of $0.4 million compared to the prior year period. The increase reflected higher net revenue partially offset by lower gross margin, which decreased from the prior year by 4.2% to 61.4%. The decrease in gross margin reflected higher pump disposal expenses and an unfavorable product mix favoring lower margin revenues. These impacts were partially offset by improved coverage of fixed costs from higher net revenue. Pump disposal expenses, which include retirements of damaged pumps and reserves for missing pumps, increased by $0.2 million during the third quarter of 2023 compared to the prior year period. The unfavorable gross margin mix was mainly related to the increase in revenue related to NPWT equipment leases, which have a lower average gross margin than other Patient Services revenue categories.

Device Solutions gross profit during the third quarter of 2023 was $4.4 million, representing a decrease of $0.4 million, or 8.5%, compared to the prior year period. This decrease was due to a decrease in gross margin partially offset by higher net revenue. The Device Solutions gross margin was 34.9% during the current quarter, which was 13.7% lower than the prior year. This decrease was due to an increase in labor costs related to an increase in the number of biomedical technicians and other expenses associated with the rapid on-boarding of the master services agreement described above. Some of the additional labor costs include training activities and other labor expenses associated with building a larger team in order to have the capacity required to support much higher planned revenue volume. Over time, higher revenue levels are expected to absorb a portion of the increased labor costs and result in an improved gross margin. Other increased expenses associated with the on-boarding ramp, which include increased travel expenses and employee acquisitions costs, are expected to decrease in the future. We currently estimate that the additional expenses incurred during the third quarter of 2023 that will either be absorbed or reduced totaled approximately $1.2 million.

Selling and marketing expenses were $2.7 million for the third quarter of 2023, representing a decrease of $0.2 million, or 5.7%, compared to the prior year period. Selling and marketing expenses as a percentage of net revenues decreased to 8.5% compared to 10.6% in the prior year period. This decrease reflected a reduction in sales team members and improved coverage of fixed costs from higher net revenues.

General and administrative (“G&A”) expenses for the third quarter of 2023 were $11.7 million, a decrease of 0.2% from $11.8 million for the third quarter of 2022. G&A expenses as a percentage of net revenues for the third quarter of 2023 decreased to 36.8% compared to 43.1% for the prior year period, mainly reflecting improved net revenue leverage over fixed costs.

Net income for the third quarter of 2023 was $0.7 million, or $0.03 per diluted share, compared to net income of $0.4 million, or $0.02 per diluted share, for the third quarter of 2022.

Adjusted EBITDA, a non-GAAP measure, for the third quarter of 2023 was $6.2 million, or 19.5% of net revenue, and increased by $0.6 million, or 10.9%, compared to Adjusted EBITDA for the same prior year quarter of $5.6 million, or 20.5% of prior period net revenue.

Balance sheet, cash flows and liquidity

During the nine-month period ended September 30, 2023, operating cash flow decreased to $6.6 million, a $6.4 million or 49% decrease over operating cash flow during the same prior year nine-month period. The decrease reflected lower operating margins during the period, resulting from the additional biomedical labor expenses and higher working capital levels related to the increase in net revenues. Capital expenditures during the nine-month period of 2023 included purchases of medical devices totaling $8.5 million, which was $1.9 million, or 19%, lower than the amount purchased during the same prior year period.

On April 26, 2023, the Company amended its 2021 Credit Agreement, which, as amended, features a $75 million revolving line of credit, does not include any term indebtedness, and matures on April 26, 2028. On May 11, 2023, the Company entered into a rate swap agreement to fix the amount of interest expense for $20 million of the outstanding borrowings under the loans with a termination date matching the new credit agreement maturity date. Two interest rate swaps existing prior to the amendment date were settled. As of September 30, 2023, available liquidity for the Company totaled $41.8 million and consisted of $41.6 million in available borrowing capacity under the revolving line of credit plus cash and cash equivalents of $0.2 million. Net debt, a non-GAAP measure (calculated as total debt of $32.7 million less cash and cash equivalents of $0.2 million) as of September 30, 2023 was $32.5 million representing a decrease of $0.5 million compared to net debt of $33.0 million as of December 31, 2022 (calculated as total debt of $33.2 million less cash and cash equivalents of $0.2 million). Our ratio of Adjusted EBITDA to net debt (non-GAAP) for the last four quarters was 1.50 to 1.00 (calculated as net debt of $32.5 million divided by Adjusted EBITDA of $21.7 million).

Full Year 2023 Guidance

InfuSystem is raising its annual guidance for the full year 2023 with net revenue growth estimated to be above 11%, up from our previous estimate calling for an annual growth rate above 10%, and the Company is maintaining its guidance for Adjusted EBITDA margin (non-GAAP) to be between 17% and 18% for the year.

The full year 2023 guidance reflects management’s current expectation for operational performance, given the current market conditions. This includes our current estimate of net revenue growth and Adjusted EBITDA. The Company and its businesses are subject to certain risks, including those risk factors discussed in our most recent annual report on Form 10-K for the year ended December 31, 2022, filed on March 16, 2023. The financial guidance is subject to risks and uncertainties applicable to all forward-looking statements as described elsewhere in this press release.

Conference Call

The Company will conduct a conference call for all interested investors on Tuesday, November 7, 2023, at 9:00 a.m. Eastern Time to discuss its third quarter 2023 financial results. The call will include discussion of Company developments, forward-looking statements and other material information about business and financial matters.

To participate in this call, please dial (833) 366-1127 or (412) 902-6773, or listen via a live webcast, which is available in the Investors section of the Company’s website at https://ir.infusystem.com/. A replay of the call will be available by visiting https://ir.infusystem.com/ for the next 90 days or by calling (877) 344-7529 or (412) 317-0088, replay access code 1133909, through November 14, 2023.

Non-GAAP Measures

This press release contains information prepared in conformity with GAAP as well as non-GAAP financial information. Non-GAAP financial measures presented in this press release include EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, net debt and Adjusted EBITDA to net debt ratio. The Company believes that the non-GAAP financial measures presented in this press release provide useful information to the Company’s management, investors and other interested parties about the Company’s operating performance because they allow them to understand and compare the Company’s operating results during the current periods to the prior year periods in a more consistent manner. This non-GAAP information should be considered by the reader in addition to, but not instead of, the financial statements prepared in accordance with GAAP, and similarly titled

non-GAAP measures may be calculated differently by other companies. The Company calculates those non-GAAP measures by adjusting for non-recurring or non-core items that are not part of the normal course of business. A reconciliation of those measures to the most directly comparable GAAP measures is provided in the accompanying schedule, titled "GAAP to Non-GAAP Reconciliation" below. Future period non-GAAP guidance includes adjustments for items not indicative of our core operations, which may include, without limitation, items included in the accompanying schedule below. Such adjustments may be affected by changes in ongoing assumptions and judgments, as well as non-core, nonrecurring, unusual or unanticipated changes, expenses or gains or other items that may not directly correlate to the underlying performance of our business operations. The exact amounts of these adjustments are not currently determinable but may be significant. It is therefore not practicable to provide the comparable GAAP measures or reconcile this non-GAAP guidance to the most comparable GAAP measures and, therefore, such comparable GAAP measures and reconciliations are excluded from this release in reliance upon applicable SEC staff guidance.

About InfuSystem Holdings, Inc.

InfuSystem Holdings, Inc. (NYSE American: INFU), is a leading national health care service provider, facilitating outpatient care for durable medical equipment manufacturers and health care providers. INFU services are provided under a two-platform model. The first platform is Patient Services (formerly Integrated Therapy Services, or ITS), providing the last-mile solution for clinic-to-home healthcare where the continuing treatment involves complex durable medical equipment and services. The Patient Services segment is comprised of Oncology, Pain Management and Wound Therapy businesses. The second platform, Device Solutions (formerly Durable Medical Equipment Services, or DME Services), supports the Patient Services platform and leverages strong service orientation to win incremental business from its direct payer clients. The Device Solutions segment is comprised of direct payer rentals, pump and consumable sales, and biomedical services and repair. Headquartered in Rochester Hills, Michigan, the Company delivers local, field-based customer support and also operates Centers of Excellence in Michigan, Kansas, California, Massachusetts, Texas and Ontario, Canada.

Forward-Looking Statements

The financial results in this press release reflect preliminary results, which are not final until the Company’s quarterly report on Form 10-Q for the quarter year ended September 30, 2023 is filed. In addition, certain statements contained in this press release are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, such as statements relating to future actions, our share repurchase program and capital allocation strategy, business plans, strategic partnerships, growth initiatives, objectives and prospects, future operating or financial performance, guidance and expected new business relationships and the terms thereof (including estimated potential revenue under new or existing contracts). The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “goal,” “expect,” “strategy,” “future,” “likely,” variations of such words, and other similar expressions, as they relate to the Company, are intended to identify forward-looking statements. Forward-looking statements are subject to factors, risks and uncertainties that could cause actual results to differ materially, including, but not limited to, our ability to successfully execute on our growth initiatives and strategic partnerships, our ability to enter into definitive agreements for the new business relationships on expected terms or at all, our ability to generate estimated potential revenue amounts under new or existing contracts, the uncertain impact of the COVID-19 pandemic, our dependence on estimates of collectible revenue, potential litigation, changes in third-party reimbursement processes, changes in law, global financial conditions and recessionary risks, rising inflation and interest rates, supply chain disruptions, systemic pressures in the banking sector, including disruptions to credit markets, the Company's ability to remediate its previously disclosed material weaknesses in internal control over financial reporting, contributions from acquired businesses or new business lines, products or services and other risk factors disclosed in the Company’s most recent annual report on Form 10-K and, to the extent applicable, quarterly reports on Form 10-Q. Our strategic partnerships are subject to similar factors, risks and uncertainties. All forward-looking statements made in this press release speak only as of the date hereof. We do not undertake any obligation to update any forward-looking statements to reflect future events or circumstances, except as required by law.

Additional information about InfuSystem Holdings, Inc. is available at www.infusystem.com.

FINANCIAL TABLES FOLLOW

INFUSYSTEM HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in thousands, except share and per share data) | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| Net revenues | $ | 31,909 | | | $ | 27,279 | | | $ | 94,014 | | | $ | 81,084 | |

| Cost of revenues | 15,663 | | | 11,060 | | | 45,786 | | | 34,597 | |

| Gross profit | 16,246 | | | 16,219 | | | 48,228 | | | 46,487 | |

| | | | | | | |

| Selling, general and administrative expenses: | | | | | | | |

| Provision for doubtful accounts | (169) | | | (90) | | | (122) | | | (84) | |

| Amortization of intangibles | 248 | | | 704 | | | 743 | | | 2,125 | |

| Selling and marketing | 2,728 | | | 2,894 | | | 8,937 | | | 9,296 | |

| General and administrative | 11,742 | | | 11,768 | | | 35,832 | | | 34,525 | |

| | | | | | | |

| Total selling, general and administrative | 14,549 | | | 15,276 | | | 45,390 | | | 45,862 | |

| | | | | | | |

| Operating income | 1,697 | | | 943 | | | 2,838 | | | 625 | |

| Other expense: | | | | | | | |

| Interest expense | (563) | | | (385) | | | (1,667) | | | (976) | |

| Other expense | (14) | | | (11) | | | (47) | | | (69) | |

| | | | | | | |

| Income (loss) before income taxes | 1,120 | | | 547 | | | 1,124 | | | (420) | |

| (Provision for) benefit from income taxes | (431) | | | (104) | | | (324) | | | 331 | |

| Net income (loss) | $ | 689 | | | $ | 443 | | | $ | 800 | | | $ | (89) | |

| Net income (loss) per share: | | | | | | | |

| Basic | $ | 0.03 | | | $ | 0.02 | | | $ | 0.04 | | | $ | — | |

| Diluted | $ | 0.03 | | | $ | 0.02 | | | $ | 0.04 | | | $ | — | |

| Weighted average shares outstanding: | | | | | | | |

| Basic | 21,095,404 | | | 20,683,366 | | | 20,968,711 | | | 20,625,826 | |

| Diluted | 21,719,404 | | | 21,452,483 | | | 21,615,706 | | | 20,625,826 | |

INFUSYSTEM HOLDINGS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

SEGMENT REPORTING

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Better/ (Worse) |

| (in thousands) | | 2023 | | 2022 | |

| | | | | | |

| Net revenues: | | | | | | |

| Patient Services | | $ | 19,289 | | | $ | 17,375 | | | $ | 1,914 | |

| Device Solutions (inclusive of inter-segment revenues) | | 14,218 | | | 11,514 | | | 2,704 | |

| Less: elimination of inter-segment revenues | | (1,598) | | | (1,610) | | | 12 | |

| Total | | 31,909 | | | 27,279 | | | 4,630 | |

| Gross profit (inclusive of certain inter-segment allocations) (a): | | | | | | |

| Patient Services | | 11,837 | | | 11,400 | | | 437 | |

| Device Solutions | | 4,409 | | | 4,819 | | | (410) | |

| Total | | $ | 16,246 | | | $ | 16,219 | | | $ | 27 | |

(a)Inter-segment allocations are for cleaning and repair services performed on medical equipment.

| | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended

September 30, | | Better/ (Worse) |

| (in thousands) | | 2023 | | 2022 | |

| | | | | | |

| Net revenues: | | | | | | |

| Patient Services | | $ | 57,382 | | | $ | 51,260 | | | $ | 6,122 | |

| Device Solutions (inclusive of inter-segment revenues) | | 41,541 | | | 34,684 | | | 6,857 | |

| Less: elimination of inter-segment revenues | | (4,909) | | | (4,860) | | | (49) | |

| Total | | 94,014 | | | 81,084 | | | 12,930 | |

| Gross profit (inclusive of certain inter-segment allocations) (a): | | | | | | |

| Patient Services | | 35,223 | | | 32,251 | | | 2,972 | |

| Device Solutions | | 13,005 | | | 14,236 | | | (1,231) | |

| Total | | $ | 48,228 | | | $ | 46,487 | | | $ | 1,741 | |

(a)Inter-segment allocations are for cleaning and repair services performed on medical equipment.

INFUSYSTEM HOLDINGS, INC. AND SUBSIDIARIES

GAAP TO NON-GAAP RECONCILIATION

(UNAUDITED)

NET INCOME (LOSS) TO EBITDA, ADJUSTED EBITDA, NET INCOME (LOSS) MARGIN AND ADJUSTED EBITDA MARGIN:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | |

| GAAP net income (loss) | | $ | 689 | | | $ | 443 | | | $ | 800 | | | $ | (89) | |

| Adjustments: | | | | | | | | |

| Interest expense | | 563 | | | 385 | | | 1,667 | | | 976 | |

| Income tax provision (benefit) | | 431 | | | 104 | | | 324 | | | (331) | |

| Depreciation | | 2,820 | | | 2,736 | | | 8,621 | | | 8,131 | |

| Amortization | | 248 | | | 704 | | | 743 | | | 2,125 | |

| | | | | | | | |

| Non-GAAP EBITDA | | $ | 4,751 | | | $ | 4,372 | | | $ | 12,155 | | | $ | 10,812 | |

| | | | | | | | |

| Stock compensation costs | | 1,063 | | | 1,066 | | | 2,799 | | | 3,236 | |

| Medical equipment reserve and disposals (1) | | 307 | | | 85 | | | 1,073 | | | 976 | |

| | | | | | | | |

| SOX readiness costs | | — | | | — | | | — | | | 110 | |

| Management reorganization/transition costs | | — | | | 19 | | | 72 | | | 56 | |

| | | | | | | | |

| Certain other non-recurring costs | | 96 | | | 62 | | | 114 | | | 82 | |

| | | | | | | | |

| Non-GAAP Adjusted EBITDA | | $ | 6,217 | | | $ | 5,604 | | | $ | 16,213 | | | $ | 15,272 | |

| | | | | | | | |

| GAAP Net Revenues | | $ | 31,909 | | | $ | 27,279 | | | $ | 94,014 | | | $ | 81,084 | |

| Net Income (Loss) Margin (2) | | 2.2 | % | | 1.6 | % | | 0.9 | % | | (0.1) | % |

| Non-GAAP Adjusted EBITDA Margin (3) | | 19.5 | % | | 20.5 | % | | 17.2 | % | | 18.8 | % |

(1)Amounts represent a non-cash expense recorded to adjust the reserve for missing medical equipment and/or the disposal of medical equipment and is being added back due to its similarity to depreciation.

(2)Net Income (Loss) Margin is defined as GAAP Net Income (Loss) as a percentage of GAAP Net Revenues.

(3)Non-GAAP Adjusted EBITDA Margin is defined as Non-GAAP Adjusted EBITDA as a percentage of GAAP Net Revenues.

INFUSYSTEM HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

| | | | | | | | | | | | | | |

| | As of |

| (in thousands, except par value and share data) | | September 30,

2023 | | December 31,

2022 |

| | | | |

| ASSETS | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 161 | | | $ | 165 | |

| Accounts receivable, net | | 19,455 | | | 16,871 | |

| Inventories | | 6,091 | | | 4,821 | |

| Other current assets | | 4,012 | | | 2,922 | |

| | | | |

| Total current assets | | 29,719 | | | 24,779 | |

| Medical equipment for sale or rental | | 3,975 | | | 2,790 | |

| Medical equipment in rental service, net of accumulated depreciation | | 35,278 | | | 39,450 | |

| Property & equipment, net of accumulated depreciation | | 4,233 | | | 4,385 | |

| Goodwill | | 3,710 | | | 3,710 | |

| Intangible assets, net | | 7,694 | | | 8,436 | |

| Operating lease right of use assets | | 4,291 | | | 4,168 | |

| Deferred income taxes | | 9,245 | | | 9,625 | |

| Derivative financial instruments | | 2,165 | | | 1,965 | |

| Other assets | | 1,761 | | | 80 | |

| | | | |

| Total assets | | $ | 102,071 | | | $ | 99,388 | |

| | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 7,629 | | | $ | 8,341 | |

| Current portion of long-term debt | | — | | | — | |

| Other current liabilities | | 6,646 | | | 6,126 | |

| | | | |

| Total current liabilities | | 14,275 | | | 14,467 | |

| Long-term debt, net of current portion | | 32,655 | | | 33,157 | |

| | | | |

| Operating lease liabilities, net of current portion | | 3,672 | | | 3,761 | |

| | | | |

| Total liabilities | | 50,602 | | | 51,385 | |

| | | | |

| Stockholders’ equity: | | | | |

Preferred stock, $0.0001 par value: authorized 1,000,000 shares; none issued | | — | | | — | |

Common stock, $0.0001 par value: authorized 200,000,000 shares; 21,183,526 issued and outstanding as of September 30, 2023 and 20,781,977 issued and outstanding as of December 31, 2022 | | 2 | | | 2 | |

| Additional paid-in capital | | 108,530 | | | 105,856 | |

| Accumulated other comprehensive income | | 1,634 | | | 1,489 | |

| Retained deficit | | (58,697) | | | (59,344) | |

| | | | |

| Total stockholders’ equity | | 51,469 | | | 48,003 | |

| | | | |

| Total liabilities and stockholders’ equity | | $ | 102,071 | | | $ | 99,388 | |

INFUSYSTEM HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | | | | | | | | | | | | | |

| | Nine Months Ended September 30, |

| (in thousands) | | 2023 | | 2022 |

| | | | |

| OPERATING ACTIVITIES | | | | |

| Net income (loss) | | $ | 800 | | | $ | (89) | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | | |

| Provision for doubtful accounts | | (122) | | | (84) | |

| Depreciation | | 8,621 | | | 8,131 | |

| Loss on disposal of and reserve adjustments for medical equipment | | 1,278 | | | 1,450 | |

| Gain on sale of medical equipment | | (1,990) | | | (1,348) | |

| Amortization of intangible assets | | 743 | | | 2,125 | |

| Amortization of deferred debt issuance costs | | 99 | | | 55 | |

| Stock-based compensation | | 2,799 | | | 3,236 | |

| Deferred income taxes | | 325 | | | (331) | |

| Changes in assets - (increase)/decrease: | | | | |

| Accounts receivable | | (1,035) | | | (607) | |

| Inventories | | (1,270) | | | (922) | |

| Other current assets | | (1,090) | | | 224 | |

| Other assets | | (2,304) | | | (89) | |

| Changes in liabilities - (decrease)/increase: | | | | |

| Accounts payable and other liabilities | | (289) | | | 1,200 | |

| NET CASH PROVIDED BY OPERATING ACTIVITIES | | 6,565 | | | 12,951 | |

| | | | |

| INVESTING ACTIVITIES | | | | |

| | | | |

| Purchase of medical equipment | | (8,503) | | | (10,452) | |

| Purchase of property and equipment | | (616) | | | (571) | |

| Proceeds from sale of medical equipment, property and equipment | | 3,429 | | | 2,597 | |

| NET CASH USED IN INVESTING ACTIVITIES | | (5,690) | | | (8,426) | |

| | | | |

| FINANCING ACTIVITIES | | | | |

| Principal payments on long-term debt | | (43,160) | | | (31,089) | |

| Cash proceeds from long-term debt | | 42,788 | | | 32,398 | |

| Debt issuance costs | | (229) | | | — | |

| Cash payment of contingent consideration | | — | | | (750) | |

| Common stock repurchased as part of share repurchase program | | (153) | | | (5,359) | |

| Common stock repurchased to satisfy statutory withholding on employee stock-based compensation plans | | (1,157) | | | (698) | |

| Cash proceeds from stock plans | | 1,032 | | | 1,150 | |

| NET CASH USED IN FINANCING ACTIVITIES | | (879) | | | (4,348) | |

| | | | |

| Net change in cash and cash equivalents | | (4) | | | 177 | |

| Cash and cash equivalents, beginning of period | | 165 | | | 186 | |

| Cash and cash equivalents, end of period | | $ | 161 | | | $ | 363 | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

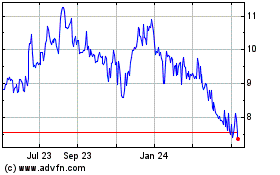

InfuSystems (AMEX:INFU)

Historical Stock Chart

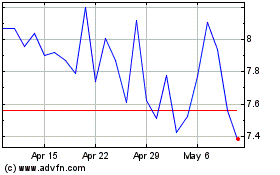

From Mar 2024 to Apr 2024

InfuSystems (AMEX:INFU)

Historical Stock Chart

From Apr 2023 to Apr 2024