0001637207false00016372072023-11-072023-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

November 7, 2023

Date of Report (Date of earliest event reported)

Planet Fitness, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | | |

| Delaware | | 001-37534 | | 38-3942097 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

4 Liberty Lane West

Hampton, NH 03842

(Address of principal executive offices)

(Zip Code)

Registrant’s telephone number, including area code: (603) 750-0001

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Exchange act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

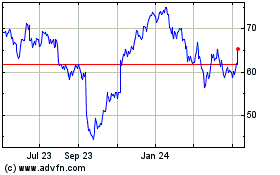

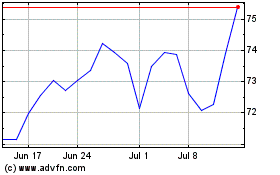

| Class A common stock, $0.0001 Par Value | PLNT | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On November 7, 2023, Planet Fitness, Inc. (the “Company”) issued a press release announcing its financial results for the quarter ended September 30, 2023. A copy of this press release is being furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference into this Item 2.02.

| | | | | |

| Item 7.01 | Regulation FD Disclosure |

Beginning on November 7, 2023, the Company intends to use the presentations furnished herewith (the "Presentations"), or portions thereof, in one or more meetings with investors and analysts. The Presentations will also be available online at https://investor.planetfitness.com, beginning November 7, 2023. Information appearing on https://investor.planetfitness.com is not a part of, and is not incorporated by reference in, this Current Report on Form 8-K. Copies of the Presentations are furnished as Exhibit 99.2 and 99.3 and are incorporated by reference into this Item 7.01.

In accordance with General Instruction B.2 of Form 8-K, the information in Items 2.02, 7.01 and 9.01 of this Current Report on Form 8-K, including Exhibits 99.1, 99.2 and 99.3, shall not be deemed “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section, nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

| | | | | | | | |

| | | |

| Exhibit No. | | Description |

| | |

| 99.1 | | |

| 99.2 | | |

| 99.3 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | | |

| PLANET FITNESS, INC. |

| | |

| By: | | /s/ Thomas Fitzgerald |

Name:

Title: | | Thomas Fitzgerald

Chief Financial Officer |

Dated: November 7, 2023

Exhibit 99.1

Planet Fitness, Inc. Announces Third Quarter 2023 Results

System-wide same store sales increased 8.4%

Ended third quarter with total membership of more than 18.5 million

Opened 26 new Planet Fitness stores bringing total to 2,498

Updates 2023 outlook

Hampton, NH, November 7, 2023 - Today, Planet Fitness, Inc. (NYSE:PLNT) reported financial results for its third quarter ended September 30, 2023.

“I’m honored to serve as interim CEO of such a truly unique brand with a strong track record of growth as we enter the next chapter of the Planet Fitness journey. As a Board member, and a Planet Fitness franchisee, I know firsthand the power of this brand, the strength of our team, and our commitment to a welcoming, non-intimidating culture, all of which uniquely position us to continue to lead the industry. My priorities are to lead the team as we execute on the current strategy with a focus on enhancing returns on stores as well as assisting the Board with the search for a permanent CEO,” said Governor Craig Benson, interim Chief Executive Officer. “We ended the third quarter with more than 18.5 million members, drove 8.4 percent system-wide same store sales growth primarily from an increase in members, and grew our store count to nearly 2,500 locations globally. With our industry-leading results, we’re adjusting our store-level return model to further improve the attractiveness of opening and operating Planet Fitness stores in a new macro-environment. The changes include decreasing certain capital investments by extending the timing for replacing equipment and completing remodels, to set us and our franchisees up for continued long-term sustainable growth.”

Third Quarter Fiscal 2023 results

•Total revenue increased from the prior year period by 13.6% to $277.6 million.

•System-wide same store sales increased by 8.4%.

•System-wide sales increased $124.8 million to $1,092.9 million, from $968.1 million in the prior year period.

•Net income attributable to Planet Fitness, Inc. was $39.1 million, or $0.46 per diluted share, compared to $26.9 million, or $0.32 per diluted share, in the prior year period.

•Net income increased $10.6 million to $41.3 million, compared to $30.7 million in the prior year period.

•Adjusted net income(1) increased $13.6 million to $51.8 million, or $0.59 per diluted share, compared to $38.2 million, or $0.42 per diluted share, in the prior year period.

•Adjusted EBITDA(1) increased $18.0 million to $111.9 million from $93.9 million in the prior year period.

•26 new Planet Fitness stores were opened during the period, including 2 corporate-owned and 24 franchisee-owned stores, bringing system-wide total stores to 2,498 as of September 30, 2023.

•Cash, cash equivalents and marketable securities of $474.1 million, which includes cash and cash equivalents of $309.0 million, marketable securities of $118.7 million and restricted cash of $46.4 million.

(1) Adjusted net income and Adjusted EBITDA are non-GAAP measures. For reconciliations of Adjusted EBITDA and Adjusted net income to U.S. GAAP (“GAAP”) net income see “Non-GAAP Financial Measures” accompanying this press release.

Operating Results for the Third Quarter Ended September 30, 2023

For the third quarter 2023, total revenue increased $33.2 million or 13.6% to $277.6 million from $244.4 million in the prior year period, which included the impact of the system-wide same store sales growth of 8.4%. By segment:

•Franchise segment revenue increased $17.4 million or 21.6% to $98.2 million from $80.7 million in the prior year period. The increase in franchise segment revenue for the third quarter of 2023 was primarily due to an $8.0 million increase in franchise royalty revenue, a $3.5 million increase in franchise and other fees, a $3.0 million increase in National Advertising Fund (“NAF”) revenue, a $1.5 million increase in equipment placement revenue and $1.3 million of revenue associated with the sale of HVAC units to franchisees. Of the $8.0 million increase in franchise royalty revenue, $4.4 million was attributable to a franchisee-owned same store sales increase of 8.2%, $1.7 million was from higher royalties on annual fees and $1.6 million was attributable to new stores opened since July 1, 2022;

•Corporate-owned stores segment revenue increased $11.9 million or 11.8% to $113.2 million from $101.3 million in the prior year period. Of the increase, $6.8 million was from the corporate-owned store same store sales increase of

10.1%, and $5.1 million was from new store openings since July 1, 2022 and the April 2023 acquisition of 4 stores in Florida; and

•Equipment segment revenue increased $3.8 million or 6.1% to $66.1 million from $62.3 million in the prior year period, driven by $5.6 million of higher equipment sales to existing franchisee-owned stores in the three months ended September 30, 2023. We had equipment sales to 22 and 27 new franchisee-owned stores in the three months ended September 30, 2023 and September 30, 2022, respectively.

For the third quarter of 2023, net income attributable to Planet Fitness, Inc. was $39.1 million, or $0.46 per diluted share, compared to $26.9 million, or $0.32 per diluted share, in the prior year period. Net income was $41.3 million in the third quarter of 2023 compared to $30.7 million in the prior year period. Adjusted net income increased $13.6 million to $51.8 million, or $0.59 per diluted share, from $38.2 million, or $0.42 per diluted share, in the prior year period. Adjusted net income has been adjusted to reflect a normalized federal income tax rate of 25.9% for both the current and prior year period, and excludes certain non-cash and other items that we do not consider in the evaluation of ongoing operational performance (see “Non-GAAP Financial Measures”).

Adjusted EBITDA, which is defined as net income before interest, taxes, depreciation and amortization, adjusted for the impact of certain non-cash and other items that we do not consider in the evaluation of ongoing operational performance (see “Non-GAAP Financial Measures”), increased $18.0 million to $111.9 million from $93.9 million in the prior year period.

Segment EBITDA represents our Total Segment EBITDA broken down by the Company’s reportable segments. Total Segment EBITDA is equal to EBITDA, which is defined as net income before interest, taxes, depreciation and amortization (see “Non-GAAP Financial Measures”).

•Franchise segment EBITDA increased $14.1 million to $67.6 million. The increase in franchise segment EBITDA for the third quarter of 2023 was primarily attributable to the franchise revenue increases as described above of $17.4 million, partially offset by $1.3 million of higher cost of goods sold from HVAC units sold to franchisees, $0.8 million of higher selling, general, and administrative expenses, and higher national advertising fund expenses of $0.6 million;

•Corporate-owned stores segment EBITDA increased $3.8 million to $44.3 million. Of the increase, $3.9 million was attributable to the stores included in the same store sales base and $2.2 million was from new store openings since July 1, 2022 and the April 2023 acquisition of 4 stores in Florida, partially offset by $1.0 million of higher corporate store selling, general, and administrative expenses in the three months ended September 30, 2023 and by a $1.3 million gain in the prior year related to the sale of corporate-owned stores; and

•Equipment segment EBITDA increased by $0.6 million to $16.4 million, primarily driven by higher equipment sales to existing franchisee-owned stores in the three months ended September 30, 2023 compared to the three months ended September 30, 2022, as described above.

2023 Outlook

For the year ending December 31, 2023, the Company is updating or reiterating the following expectations as compared to the Company’s 2022 results, which assumes there are no material new supply chain disruptions:

•It now expects new equipment placements of between approximately 130 and 140 in franchisee-owned locations (previously it expected approximately 140)

•It now expects system-wide new store openings of between approximately 150 and 160 locations (previously it expected approximately 160)

•It continues to expect system-wide same store sales in the high single-digit percentage range

The following are 2023 growth expectations over the Company’s 2022 results:

•It now expects revenue to increase approximately 14% (previously it expected approximately 12%)

•It now expects Adjusted EBITDA to increase approximately 18% (previously it expected approximately 17%)

•It now expects Adjusted net income to increase approximately 33% (previously it expected approximately 30%)

•It now expects Adjusted earnings per share to increase approximately 35% (previously it expected approximately 34%), based on Adjusted diluted shares outstanding of approximately 89 million, inclusive of the nearly 1.7 million shares repurchased through September 30, 2023

The Company continues to expect 2023 net interest expense to be in the low $70 million range, capital expenditures to increase approximately 40%, and depreciation and amortization to increase in the high-teens percentage range.

Presentation of Financial Measures

Planet Fitness, Inc. (the “Company”) was formed in March 2015 for the purpose of facilitating the initial public offering (the “IPO”) and related recapitalization transactions that occurred in August 2015, and in order to carry on the business of Pla-Fit Holdings, LLC (“Pla-Fit Holdings”) and its subsidiaries. As the sole managing member of Pla-Fit Holdings, the Company operates and controls all of the business and affairs of Pla-Fit Holdings, and through Pla-Fit Holdings, conducts its business. As a result, the Company consolidates Pla-Fit Holdings’ financial results and reports a non-controlling interest related to the portion of Pla-Fit Holdings not owned by the Company.

The financial information presented in this press release includes non-GAAP financial measures such as EBITDA, Segment EBITDA, Adjusted EBITDA, Adjusted net income and Adjusted net income per share, diluted, to provide measures that we believe are useful to investors in evaluating the Company’s performance. These non-GAAP financial measures are supplemental measures of the Company’s performance that are neither required by, nor presented in accordance with GAAP. These financial measures should not be considered in isolation or as substitutes for GAAP financial measures such as net income or any other performance measures derived in accordance with GAAP. In addition, in the future, the Company may incur expenses or charges such as those added back to calculate Adjusted EBITDA, Adjusted net income and Adjusted net income per share, diluted. The Company’s presentation of Adjusted EBITDA, Adjusted net income and Adjusted net income per share, diluted, should not be construed as an inference that the Company’s future results will be unaffected by similar amounts or other unusual or nonrecurring items. See the tables at the end of this press release for a reconciliation of EBITDA, Adjusted EBITDA, Total Segment EBITDA, Adjusted net income, and Adjusted net income per share, diluted, to their most directly comparable GAAP financial measure.

The non-GAAP financial measures used in our full-year outlook will differ from net income and net income per share, diluted, determined in accordance with GAAP in ways similar to those described in the reconciliations at the end of this press release. We do not provide guidance for net income or net income per share, diluted, determined in accordance with GAAP or a reconciliation of guidance for Adjusted net income or Adjusted net income per share, diluted, to the most directly comparable GAAP measure because we are not able to predict with reasonable certainty the amount or nature of all items that will be included in our net income and net income per share, diluted, for the year ending December 31, 2023. These items are uncertain, depend on many factors and could have a material impact on our net income and net income per share, diluted, for the year ending December 31, 2023, and therefore cannot be made available without unreasonable effort.

Same store sales refers to year-over-year sales comparisons for the same store sales base of both corporate-owned and franchisee-owned stores, which is calculated for a given period by including only sales from stores that had sales in the comparable months of both years. We define the same store sales base to include those stores that have been open and for which monthly membership dues have been billed for longer than 12 months. We measure same store sales based solely upon monthly dues billed to members of our corporate-owned and franchisee-owned stores.

Investor Conference Call

The Company will hold a conference call at 8:00 AM (ET) on November 7, 2023 to discuss the news announced in this press release. A live webcast of the conference call will be accessible at www.planetfitness.com via the “Investor Relations” link. The webcast will be archived on the website for one year.

About Planet Fitness

Founded in 1992 in Dover, NH, Planet Fitness is one of the largest and fastest-growing franchisors and operators of fitness centers in the world by number of members and locations. As of September 30, 2023, Planet Fitness had more than 18.5 million members and 2,498 stores in 50 states, the District of Columbia, Puerto Rico, Canada, Panama, Mexico and Australia. The Company’s mission is to enhance people’s lives by providing a high-quality fitness experience in a welcoming, non-intimidating environment, which we call the Judgement Free Zone®. More than 90% of Planet Fitness stores are owned and operated by independent business men and women.

Investor Contact:

Stacey Caravella

investor@planetfitness.com

603-750-4674

Media Contacts:

McCall Gosselin, Planet Fitness

mccall.gosselin@pfhq.com

603-957-4650

Brittany Fraser, ICR

brittany.fraser@icrinc.com

917-658-8750

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the federal securities laws, which involve risks and uncertainties. Forward-looking statements include the Company’s statements with respect to expected future performance presented under the heading “2023 Outlook,” those attributed to the Company’s Interim Chief Executive Officer in this press release, the Company’s expected membership growth, share repurchases, and other statements, estimates and projections that do not relate solely to historical facts. Forward-looking statements can be identified by words such as "believe," “expect,” “goal,” “plan,” “will,” “prospects,” “future,” “strategy” and similar references to future periods, although not all forward-looking statements include these identifying words. Forward-looking statements are not assurances of future performance. Instead, they are based only on the Company’s current beliefs, expectations and assumptions regarding the future of the business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the Company’s control. Actual results and financial condition may differ materially from those indicated in the forward-looking statements. Important factors that could cause our actual results to differ materially include competition in the fitness industry, the Company’s and franchisees’ ability to attract and retain members, the Company's and franchisees' ability to identify and secure suitable sites for new franchise stores, changes in consumer demand, changes in equipment costs, the Company’s ability to expand into new markets domestically and internationally, operating costs for the Company and franchisees generally, availability and cost of capital for franchisees, acquisition activity, developments and changes in laws and regulations, our substantial increased indebtedness as a result of our refinancing and securitization transactions and our ability to incur additional indebtedness or refinance that indebtedness in the future, our future financial performance and our ability to pay principal and interest on our indebtedness, our corporate structure and tax receivable agreements, failures, interruptions or security breaches of the Company's information systems or technology, our ability to successfully identify and engage a highly qualified permanent CEO, general economic conditions and the other factors described in the Company’s annual report on Form 10-K for the year ended December 31, 2022, and the Company’s other filings with the Securities and Exchange Commission. In light of the significant risks and uncertainties inherent in forward-looking statements, investors should not place undue reliance on forward-looking statements, which reflect the Company’s views only as of the date of this press release. Except as required by law, neither the Company nor any of its affiliates or representatives undertake any obligation to provide additional information or to correct or update any information set forth in this release, whether as a result of new information, future developments or otherwise.

Planet Fitness, Inc. and subsidiaries

Condensed Consolidated Statements of Operations (Unaudited)

(Amounts in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the three months ended

September 30, | | For the nine months ended

September 30, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue: | | | | | | | | |

| Franchise | | $ | 80,587 | | | $ | 66,168 | | | $ | 237,313 | | | $ | 200,243 | |

| | | | | | | | |

| National advertising fund revenue | | 17,578 | | | 14,578 | | | 52,378 | | | 43,130 | |

| Corporate-owned stores | | 113,245 | | | 101,330 | | | 332,885 | | | 278,940 | |

| Equipment | | 66,141 | | | 62,310 | | | 163,664 | | | 133,191 | |

| Total revenue | | 277,551 | | | 244,386 | | | 786,240 | | | 655,504 | |

| Operating costs and expenses: | | | | | | | | |

| Cost of revenue | | 53,751 | | | 48,531 | | | 132,561 | | | 103,436 | |

| Store operations | | 63,120 | | | 57,892 | | | 188,011 | | | 161,789 | |

| Selling, general and administrative | | 33,290 | | | 27,148 | | | 93,705 | | | 86,176 | |

| National advertising fund expense | | 17,618 | | | 17,009 | | | 52,496 | | | 50,445 | |

| Depreciation and amortization | | 37,477 | | | 32,572 | | | 110,254 | | | 90,427 | |

| Other (gains) losses, net | | (56) | | | (700) | | | 7,705 | | | (2,452) | |

| Total operating costs and expenses | | 205,200 | | | 182,452 | | | 584,732 | | | 489,821 | |

| Income from operations | | 72,351 | | | 61,934 | | | 201,508 | | | 165,683 | |

| Other expense, net: | | | | | | | | |

| Interest income | | 4,245 | | | 1,561 | | | 12,339 | | | 2,244 | |

| Interest expense | | (21,704) | | | (21,917) | | | (64,771) | | | (66,527) | |

| Other income, net | | 148 | | | 4,762 | | | 631 | | | 9,000 | |

| Total other expense, net | | (17,311) | | | (15,594) | | | (51,801) | | | (55,283) | |

| Income before income taxes | | 55,040 | | | 46,340 | | | 149,707 | | | 110,400 | |

| Equity losses of unconsolidated entities, net of tax | | (242) | | | (2) | | | (580) | | | (334) | |

| Provision for income taxes | | 13,474 | | | 15,661 | | | 38,855 | | | 35,942 | |

| Net income | | 41,324 | | | 30,677 | | | 110,272 | | | 74,124 | |

| Less net income attributable to non-controlling interests | | 2,190 | | | 3,764 | | | 7,299 | | | 8,405 | |

| Net income attributable to Planet Fitness, Inc. | | $ | 39,134 | | | $ | 26,913 | | | $ | 102,973 | | | $ | 65,719 | |

| Net income per share of Class A common stock: | | | | | | | | |

| Basic | | $ | 0.46 | | | $ | 0.32 | | | $ | 1.22 | | | $ | 0.78 | |

| Diluted | | $ | 0.46 | | | $ | 0.32 | | | $ | 1.21 | | | $ | 0.78 | |

| Weighted-average shares of Class A common stock outstanding: | | | | | | | | |

| Basic | | 84,610 | | | 84,156 | | | 84,558 | | | 84,377 | |

| Diluted | | 84,886 | | | 84,547 | | | 84,870 | | | 84,798 | |

Planet Fitness, Inc. and subsidiaries

Condensed Consolidated Balance Sheets (Unaudited)

(Amounts in thousands, except per share amounts)

| | | | | | | | | | | | | | |

| | | September 30, 2023 | | December 31, 2022 |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 308,970 | | | $ | 409,840 | |

| Restricted cash | | 46,381 | | | 62,659 | |

| Short-term marketable securities | | 108,460 | | | — | |

Accounts receivable, net of allowances for uncollectible amounts of $0 and $0 as of

September 30, 2023 and December 31, 2022, respectively | | 36,362 | | | 46,242 | |

| | | | |

| Inventory | | 7,536 | | | 5,266 | |

| | | | |

| | | | |

| Prepaid expenses | | 18,073 | | | 11,078 | |

| Other receivables | | 8,678 | | | 14,975 | |

| Income tax receivables | | 5,659 | | | 5,471 | |

| Total current assets | | 540,119 | | | 555,531 | |

| Long-term marketable securities | | 10,252 | | | — | |

Property and equipment, net of accumulated depreciation of $296,677 and $227,869 as of

September 30, 2023 and December 31, 2022, respectively | | 366,780 | | | 348,820 | |

Investments, net of allowances for expected credit losses of $14,951 and $14,957

as of September 30, 2023 and December 31, 2022, respectively | | 46,037 | | | 25,122 | |

| Right-of-use assets, net | | 381,819 | | | 346,937 | |

| Intangible assets, net | | 385,462 | | | 417,067 | |

| Goodwill | | 717,502 | | | 702,690 | |

| Deferred income taxes | | 492,965 | | | 454,565 | |

| Other assets, net | | 3,911 | | | 3,857 | |

| Total assets | | $ | 2,944,847 | | | $ | 2,854,589 | |

| Liabilities and stockholders' deficit | | | | |

| Current liabilities: | | | | |

| Current maturities of long-term debt | | $ | 20,750 | | | $ | 20,750 | |

| | | | |

| Accounts payable | | 28,364 | | | 20,578 | |

| Accrued expenses | | 56,430 | | | 66,993 | |

| Equipment deposits | | 13,933 | | | 8,443 | |

| Restricted liabilities – national advertising fund | | 805 | | | — | |

| Deferred revenue, current | | 64,352 | | | 53,759 | |

| Payable pursuant to tax benefit arrangements, current | | 38,193 | | | 31,940 | |

| Other current liabilities | | 50,019 | | | 42,067 | |

| Total current liabilities | | 272,846 | | | 244,530 | |

| Long-term debt, net of current maturities | | 1,966,682 | | | 1,978,131 | |

| | | | |

| Lease liabilities, net of current portion | | 379,810 | | | 341,843 | |

| Deferred revenue, net of current portion | | 32,670 | | | 33,152 | |

| Deferred tax liabilities | | 1,397 | | | 1,471 | |

| Payable pursuant to tax benefit arrangements, net of current portion | | 451,569 | | | 462,525 | |

| Other liabilities | | 4,803 | | | 4,498 | |

| Total noncurrent liabilities | | 2,836,931 | | | 2,821,620 | |

| Stockholders' equity (deficit): | | | | |

Class A common stock, $.0001 par value - 300,000 authorized, 85,410 and 83,430 shares issued and

outstanding as of September 30, 2023 and December 31, 2022, respectively | | 9 | | | 8 | |

Class B common stock, $.0001 par value - 100,000 authorized, 2,733 and 6,146 shares issued and

outstanding as of September 30, 2023 and December 31, 2022, respectively | | — | | | 1 | |

| Accumulated other comprehensive loss | | (684) | | | (448) | |

| Additional paid in capital | | 570,397 | | | 505,144 | |

| Accumulated deficit | | (726,800) | | | (703,717) | |

| Total stockholders' deficit attributable to Planet Fitness, Inc. | | (157,078) | | | (199,012) | |

| Non-controlling interests | | (7,852) | | | (12,549) | |

| Total stockholders' deficit | | (164,930) | | | (211,561) | |

| Total liabilities and stockholders' deficit | | $ | 2,944,847 | | | $ | 2,854,589 | |

Planet Fitness, Inc. and subsidiaries

Condensed Consolidated Statements of Cash Flows (Unaudited)

(Amounts in thousands, except per share amounts)

| | | | | | | | | | | | | | |

| | | For the nine months ended September 30, |

| | | 2023 | | 2022 |

| Cash flows from operating activities: | | | | |

| Net income | | $ | 110,272 | | | $ | 74,124 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Depreciation and amortization | | 110,254 | | | 90,427 | |

| Amortization of deferred financing costs | | 4,114 | | | 4,129 | |

| Write-off of deferred financing costs | | — | | | 1,583 | |

| | | | |

| Accretion of marketable securities discount | | (2,224) | | | — | |

| Dividends accrued on investment | | (1,490) | | | (1,391) | |

| Deferred tax expense | | 34,884 | | | 35,026 | |

| | | | |

| Equity losses of unconsolidated entities, net of tax | | 580 | | | 334 | |

| Gain on adjustment of allowance for credit losses on held-to-maturity investment | | (6) | | | (1,572) | |

| Gain on re-measurement of tax benefit arrangement | | — | | | (8,381) | |

| | | | |

| Loss on reacquired franchise rights | | 110 | | | 1,160 | |

| | | | |

| Gain on sale of corporate-owned stores | | — | | | (1,324) | |

| Equity-based compensation | | 6,326 | | | 6,942 | |

| Other | | 133 | | | 267 | |

| Changes in operating assets and liabilities, excluding effects of acquisitions: | | | | |

| Accounts receivable | | 10,086 | | | (7,477) | |

| Inventory | | (2,270) | | | (3,071) | |

| Other assets and other current assets | | (1,722) | | | (567) | |

| Restricted liabilities (assets) - national advertising fund | | 805 | | | (1,773) | |

| Accounts payable and accrued expenses | | (7,488) | | | (22,521) | |

| Other liabilities and other current liabilities | | 6,855 | | | 1,728 | |

| Income taxes | | (104) | | | (2,111) | |

| Payable pursuant to tax benefit arrangements | | (21,780) | | | (14,211) | |

| Equipment deposits | | 5,495 | | | 26,049 | |

| Deferred revenue | | 9,428 | | | 11,506 | |

| Leases | | 4,662 | | | 1,550 | |

| Net cash provided by operating activities | | 266,920 | | | 190,426 | |

| Cash flows from investing activities: | | | | |

| Additions to property and equipment | | (84,636) | | | (65,138) | |

| Acquisition of franchisees, net of cash acquired | | (26,264) | | | (424,940) | |

| Proceeds from sale of corporate-owned stores | | — | | | 20,820 | |

| Proceeds from sale of property and equipment | | 2 | | | 60 | |

| Purchases of marketable securities | | (155,007) | | | — | |

| Maturities of marketable securities | | 37,990 | | | — | |

| Other investments | | (20,000) | | | — | |

| Net cash used in investing activities | | (247,915) | | | (469,198) | |

| Cash flows from financing activities: | | | | |

| Principal payments on capital lease obligations | | (152) | | | (207) | |

| Proceeds from issuance of long-term debt | | — | | | 900,000 | |

| Proceeds from issuance of Variable Funding Notes | | — | | | 75,000 | |

| Repayment of long-term debt and Variable Funding Notes | | (15,563) | | | (719,625) | |

| Payment of financing and other debt-related costs | | — | | | (15,951) | |

| | | | |

| Proceeds from issuance of Class A common stock | | 8,575 | | | 779 | |

| Repurchase and retirement of Class A common stock | | (125,030) | | | (94,314) | |

| | | | |

| Distributions paid to members of Pla-Fit Holdings | | (4,216) | | | (2,945) | |

| Net cash (used in) provided by financing activities | | (136,386) | | | 142,737 | |

| Effects of exchange rate changes on cash and cash equivalents | | 233 | | | (729) | |

| Net decrease in cash, cash equivalents and restricted cash | | (117,148) | | | (136,764) | |

| Cash, cash equivalents and restricted cash, beginning of period | | 472,499 | | | 603,941 | |

| Cash, cash equivalents and restricted cash, end of period | | $ | 355,351 | | | $ | 467,177 | |

| Supplemental cash flow information: | | | | |

| Net cash paid for income taxes | | $ | 4,394 | | | $ | 3,072 | |

| Cash paid for interest | | $ | 60,964 | | | $ | 60,535 | |

| Non-cash investing & financing activities: | | | | |

| Non-cash additions to property and equipment | | $ | 20,590 | | | $ | 11,566 | |

| Accrued taxes on share repurchases | | $ | 1,048 | | | $ | — | |

| Fair value of common stock issued as consideration for acquisition | | $ | — | | | $ | 393,730 | |

Planet Fitness, Inc. and subsidiaries

Non-GAAP Financial Measures (Unaudited)

(Amounts in thousands, except per share amounts)

To supplement its consolidated financial statements, which are prepared and presented in accordance with GAAP, the Company uses the following non-GAAP financial measures: EBITDA, Total Segment EBITDA, Adjusted EBITDA, Adjusted net income and Adjusted net income per share, diluted (collectively, the “non-GAAP financial measures”). The Company believes that these non-GAAP financial measures, when used in conjunction with GAAP financial measures, are useful to investors in evaluating our operating performance. These non-GAAP financial measures presented in this release are supplemental measures of the Company’s performance that are neither required by, nor presented in accordance with GAAP. These financial measures should not be considered in isolation or as substitutes for GAAP financial measures such as net income or any other performance measures derived in accordance with GAAP. In addition, in the future, the Company may incur expenses or charges such as those added back to calculate Adjusted EBITDA, Adjusted net income and Adjusted net income per share, diluted. The Company’s presentation of Adjusted EBITDA, Adjusted net income, and Adjusted net income per share, diluted, should not be construed as an inference that the Company’s future results will be unaffected by unusual or nonrecurring items.

EBITDA, Segment EBITDA and Adjusted EBITDA

We refer to EBITDA and Adjusted EBITDA as we use these measures to evaluate our operating performance and we believe these measures provide useful information to investors in evaluating our performance. We have also disclosed Segment EBITDA as an important financial metric utilized by the Company to evaluate performance and allocate resources to segments in accordance with ASC 280, Segment Reporting. We define EBITDA as net income before interest, taxes, depreciation and amortization. Segment EBITDA sums to Total Segment EBITDA which is equal to the Non-GAAP financial metric EBITDA. We believe that EBITDA, which eliminates the impact of certain expenses that we do not believe reflect our underlying business performance, provides useful information to investors to assess the performance of our segments as well as the business as a whole. Our board of directors also uses EBITDA as a key metric to assess the performance of management. We define Adjusted EBITDA as net income before interest, taxes, depreciation and amortization, adjusted for the impact of certain additional non-cash and other items that we do not consider in our evaluation of ongoing performance of the Company’s core operations. These items include certain purchase accounting adjustments, stock offering-related costs, acquisition transaction costs, and certain other charges and gains. We believe that Adjusted EBITDA is an appropriate measure of operating performance in addition to EBITDA because it eliminates the impact of other items that we believe reduce the comparability of our underlying core business performance from period to period and is therefore useful to our investors in comparing the core performance of our business from period to period.

Planet Fitness, Inc. and subsidiaries

Non-GAAP Financial Measures (Unaudited)

(Amounts in thousands, except per share amounts)

A reconciliation of Adjusted EBITDA to net income, the most directly comparable GAAP measure, is set forth below.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three months ended September 30, | | Nine months ended September 30, |

| (in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

| Net income | | $ | 41,324 | | | $ | 30,677 | | | $ | 110,272 | | | $ | 74,124 | |

| Interest income | | (4,245) | | | (1,561) | | | (12,339) | | | (2,244) | |

Interest expense(1) | | 21,704 | | | 21,917 | | | 64,771 | | | 66,527 | |

| Provision for income taxes | | 13,474 | | | 15,661 | | | 38,855 | | | 35,942 | |

| Depreciation and amortization | | 37,477 | | | 32,572 | | | 110,254 | | | 90,427 | |

| EBITDA | | $ | 109,734 | | | $ | 99,266 | | | $ | 311,813 | | | $ | 264,776 | |

Purchase accounting adjustments-revenue(2) | | 45 | | | 84 | | | 378 | | | 213 | |

Purchase accounting adjustments-rent(3) | | 173 | | | 109 | | | 461 | | | 328 | |

Loss on reacquired franchise rights(4) | | — | | | — | | | 110 | | | 1,160 | |

Gain on settlement of preexisting contract with acquiree(5) | | — | | | — | | | — | | | (2,059) | |

Transaction fees and acquisition-related costs(6) | | — | | | 396 | | | 394 | | | 5,344 | |

(Gain) loss on adjustment of allowance for credit losses on held-to-maturity investments(7) | | (101) | | | 273 | | | (6) | | | (1,572) | |

Dividend income on held-to-maturity investments(8) | | (511) | | | (477) | | | (1,490) | | | (1,391) | |

| | | | | | | | |

Legal matters(9) | | — | | | 238 | | | 6,250 | | | 1,189 | |

Tax benefit arrangement remeasurement(10) | | — | | | (4,510) | | | — | | | (8,381) | |

Gain on sale of corporate-owned stores(11) | | — | | | (1,324) | | | — | | | (1,324) | |

Executive transition costs(12) | | 2,502 | | | — | | | 3,722 | | | — | |

Other(13) | | 50 | | | (153) | | | (590) | | | 1,447 | |

| Adjusted EBITDA | | $ | 111,892 | | | $ | 93,902 | | | $ | 321,042 | | | $ | 259,730 | |

(1)Includes a $1,583 loss on extinguishment of debt in the nine months ended September 30, 2022.

(2)Represents the impact of revenue-related purchase accounting adjustments associated with the acquisition of Pla-Fit Holdings on November 8, 2012 by TSG (the “2012 Acquisition”). At the time of the 2012 Acquisition, the Company maintained a deferred revenue account, which consisted of deferred area development agreement fees, deferred franchise fees, and deferred enrollment fees that the Company billed and collected up-front but recognizes for GAAP purposes at a later date. In connection with the 2012 Acquisition, it was determined that the carrying amount of deferred revenue was greater than the fair value assessed in accordance with ASC 805—Business Combinations, which resulted in a write-down of the carrying value of the deferred revenue balance upon application of acquisition push-down accounting under ASC 805. These amounts represent the additional revenue that would have been recognized in these periods if the write-down to deferred revenue had not occurred in connection with the application of acquisition pushdown accounting.

(3)Represents the impact of rent-related purchase accounting adjustments. In accordance with guidance in ASC 805 – Business Combinations, in connection with the 2012 Acquisition, the Company’s deferred rent liability was required to be written off as of the acquisition date and rent was recorded on a straight-line basis from the acquisition date through the end of the lease term. This resulted in higher overall recorded rent expense each period than would have otherwise been recorded had the deferred rent liability not been written off as a result of the acquisition push down accounting applied in accordance with ASC 805. Adjustments of $41, $45, $123, and $135 in the three and nine months ended September 30, 2023 and 2022, respectively, reflect the difference between the higher rent expense recorded in accordance with GAAP since the acquisition and the rent expense that would have been recorded had the 2012 Acquisition not occurred. Adjustments of $138, $65, $338, and $194 in the three and nine months ended September 30, 2023 and 2022, respectively, are due to the amortization of favorable and unfavorable leases. All of the rent related purchase accounting adjustments are adjustments to rent expense which is included in store operations on our consolidated statements of operations.

(4)Represents the impact of a non-cash loss recorded in accordance with ASC 805 – Business Combinations related to our acquisition of franchisee-owned stores. The loss recorded under GAAP represents the difference between the fair value and the contractual terms of the reacquired franchise rights and is included in other losses (gains), net on our consolidated statement of operations.

Planet Fitness, Inc. and subsidiaries

Non-GAAP Financial Measures (Unaudited)

(Amounts in thousands, except per share amounts)

(5)Represents a gain on settlement of deferred revenue from existing contracts with acquired franchisee-stores recorded in accordance with ASC 805 – Business Combinations, and is included in other losses (gains), net on our consolidated statement of operations.

(6)Represents transaction fees and acquisition-related costs incurred in connection with our acquisition of franchisee-owned stores.

(7)Represents a (gain) loss on the adjustment of the allowance for credit losses on the Company’s held-to-maturity investments.

(8)Represents dividend income on held-to-maturity investments.

(9)Represents costs associated with legal matters in which the Company is a defendant. In connection with the summary of terms for a settlement agreement that was agreed to between the Company and a franchisee in Mexico (the “Preliminary Settlement Agreement”), the Company recorded an estimated liability for the legal settlement of $8,550 as of December 31, 2022, inclusive of estimated future legal fees. During the second quarter of 2023, the Company revised its estimate of the legal settlement and recorded an increase to the liability of $6,250 during the nine months ended September 30, 2023 to $14,500, net of legal fees paid. In the three and nine months ended September 30, 2022, the amounts represent a reserve against an indemnification receivable related to a legal matter.

(10)Represents gains related to the adjustment of our tax benefit arrangements primarily due to changes in our deferred state tax rate.

(11)Represents a gain on the sale of corporate-owned stores.

(12)Represents certain severance and related expenses in the three and nine months ended September 30, 2023 recorded in connection with the departure of the Chief Executive Officer and in the nine months ended September 30, 2023, also includes severance expenses recorded in connection with the elimination of the President and Chief Operating Officer position.

(13)Represents certain other charges and gains that we do not believe reflect our underlying business performance.

A reconciliation of Segment EBITDA to Total Segment EBITDA is set forth below.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three months ended September 30, | | Nine months ended September 30, |

| (in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

| Segment EBITDA | | | | | | | | |

| Franchise | | $ | 67,583 | | | $ | 53,475 | | | $ | 198,418 | | | $ | 167,910 | |

| Corporate-owned stores | | 44,264 | | | 40,446 | | | 126,499 | | | 103,287 | |

| Equipment | | 16,434 | | | 15,803 | | | 39,134 | | | 34,638 | |

| Corporate and other | | (18,547) | | | (10,458) | | | (52,238) | | | (41,059) | |

Total Segment EBITDA(1) | | $ | 109,734 | | | $ | 99,266 | | | $ | 311,813 | | | $ | 264,776 | |

(1) Total Segment EBITDA is equal to EBITDA.

Planet Fitness, Inc. and subsidiaries

Non-GAAP Financial Measures (Unaudited)

(Amounts in thousands, except per share amounts)

Adjusted Net Income and Adjusted Net Income per Diluted Share

Our presentation of Adjusted net income and Adjusted net income per share, diluted, assumes that all net income is attributable to Planet Fitness, Inc., which assumes the full exchange of all outstanding Holdings Units for shares of Class A common stock of Planet Fitness, Inc., adjusted for certain non-recurring items that we do not believe directly reflect our core operations. Adjusted net income per share, diluted, is calculated by dividing Adjusted net income by the total shares of Class A common stock outstanding plus any dilutive options and restricted stock units as calculated in accordance with GAAP and assuming the full exchange of all outstanding Holdings Units and corresponding Class B common stock as of the beginning of each period presented. Adjusted net income and Adjusted net income per share, diluted, are supplemental measures of operating performance that do not represent, and should not be considered, alternatives to net income and earnings per share, as calculated in accordance with GAAP. We believe Adjusted net income and Adjusted net income per share, diluted, supplement GAAP measures and enable us to more effectively evaluate our performance period-over-period. A reconciliation of Adjusted net income to net income, the most directly comparable GAAP measure, and the computation of Adjusted net income per share, diluted, are set forth below.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three months ended September 30, | | Nine months ended September 30, |

| (in thousands, except per share amounts) | | 2023 | | 2022 | | 2023 | | 2022 |

| Net income | | $ | 41,324 | | | $ | 30,677 | | | $ | 110,272 | | | $ | 74,124 | |

| Provision for income taxes, as reported | | 13,474 | | | 15,661 | | | 38,855 | | | 35,942 | |

Purchase accounting adjustments-revenue(1) | | 45 | | | 84 | | | 378 | | | 213 | |

Purchase accounting adjustments-rent(2) | | 173 | | | 109 | | | 461 | | | 328 | |

Loss on reacquired franchise rights(3) | | — | | | — | | | 110 | | | 1,160 | |

Gain on settlement of preexisting contract with acquiree(4) | | — | | | — | | | — | | | (2,059) | |

Transaction fees and acquisition-related costs(5) | | — | | | 396 | | | 394 | | | 5,344 | |

Loss on extinguishment of debt(6) | | — | | | — | | | — | | | 1,583 | |

(Gain) loss on adjustment of allowance for credit losses on held-to-maturity investments(7) | | (101) | | | 273 | | | (6) | | | (1,572) | |

Dividend income on held-to-maturity investments(8) | | (511) | | | (477) | | | (1,490) | | | (1,391) | |

| | | | | | | | |

Legal matters(9) | | — | | | 238 | | | 6,250 | | | 1,189 | |

Tax benefit arrangement remeasurement(10) | | — | | | (4,510) | | | — | | | (8,381) | |

Gain on sale of corporate-owned stores(11) | | — | | | (1,324) | | | — | | | (1,324) | |

Executive transition costs(12) | | 2,502 | | | — | | | 3,722 | | | — | |

Other(13) | | 50 | | | (153) | | | (590) | | | 1,447 | |

Purchase accounting amortization(14) | | 12,954 | | | 10,611 | | | 38,485 | | | 29,644 | |

| Adjusted income before income taxes | | $ | 69,910 | | | $ | 51,585 | | | $ | 196,841 | | | $ | 136,247 | |

Adjusted income tax expense(15) | | 18,107 | | | 13,361 | | | 50,982 | | | 35,288 | |

Adjusted net income(16) | | $ | 51,803 | | | $ | 38,224 | | | $ | 145,859 | | | $ | 100,959 | |

| | | | | | | | |

| Adjusted net income per share, diluted | | $ | 0.59 | | | $ | 0.42 | | | $ | 1.64 | | | $ | 1.11 | |

| | | | | | | | |

| Adjusted weighted-average shares outstanding | | 88,420 | | | 90,692 | | | 89,107 | | | 90,571 | |

(1)Represents the impact of revenue-related purchase accounting adjustments associated with the 2012 Acquisition. At the time of the 2012 Acquisition, the Company maintained a deferred revenue account, which consisted of deferred area development agreement fees, deferred franchise fees, and deferred enrollment fees that the Company billed and collected up-front but recognizes for GAAP purposes at a later date. In connection with the 2012 Acquisition, it was determined that the carrying amount of deferred revenue was greater than the fair value assessed in accordance with ASC 805 – Business Combinations, which resulted in a write-down of the carrying value of the deferred revenue balance upon application of acquisition push-down accounting under ASC 805. These amounts represent the additional revenue that would have been recognized in these periods if the write-down to deferred revenue had not occurred in connection with the application of acquisition pushdown accounting.

Planet Fitness, Inc. and subsidiaries

Non-GAAP Financial Measures (Unaudited)

(Amounts in thousands, except per share amounts)

(2)Represents the impact of rent-related purchase accounting adjustments. In accordance with guidance in ASC 805 – Business Combinations, in connection with the 2012 Acquisition, the Company’s deferred rent liability was required to be written off as of the acquisition date and rent was recorded on a straight-line basis from the acquisition date through the end of the lease term. This resulted in higher overall recorded rent expense each period than would have otherwise been recorded had the deferred rent liability not been written off as a result of the acquisition push down accounting applied in accordance with ASC 805. Adjustments of $41, $45, $123, and $135 in the three and nine months ended September 30, 2023 and 2022, respectively, reflect the difference between the higher rent expense recorded in accordance with GAAP since the acquisition and the rent expense that would have been recorded had the 2012 Acquisition not occurred. Adjustments of $138, $65, $338, and $194 in the three and nine months ended September 30, 2023 and 2022, respectively, are due to the amortization of favorable and unfavorable leases. All of the rent related purchase accounting adjustments are adjustments to rent expense which is included in store operations on our consolidated statements of operations.

(3)Represents the impact of a non-cash loss recorded in accordance with ASC 805 – Business Combinations related to our acquisition of franchisee-owned stores. The loss recorded under GAAP represents the difference between the fair value and the contractual terms of the reacquired franchise rights and is included in other losses (gains), net on our consolidated statement of operations.

(4)Represents a gain on settlement of deferred revenue from existing contracts with acquired franchisee-stores recorded in accordance with ASC 805 – Business Combinations, and is included in other losses (gains), net on our consolidated statement of operations.

(5)Represents transaction fees and acquisition-related costs incurred in connection with our acquisition of franchisee-owned stores.

(6)Represents a loss on extinguishment of debt in the nine months ended September 30, 2022.

(7)Represents a (gain) loss on the adjustment of the allowance for credit losses on the Company’s held-to-maturity investments.

(8)Represents dividend income on held-to-maturity investments.

(9)Represents costs associated with legal matters in which the Company is a defendant. In connection with the summary of terms for a settlement agreement that was agreed to between the Company and a franchisee in Mexico (the “Preliminary Settlement Agreement”), the Company recorded an estimated liability for the legal settlement of $8,550 as of December 31, 2022, inclusive of estimated future legal fees. During the second quarter of 2023, the Company revised its estimate of the legal settlement and recorded an increase to the liability of $6,250 during the nine months ended September 30, 2023 to $14,500, net of legal fees paid. In the three and nine months ended September 30, 2022, the amounts represent a reserve against an indemnification receivable related to a legal matter.

(10)Represents gains related to the adjustment of our tax benefit arrangements primarily due to changes in our deferred state tax rate.

(11)Represents a gain on the sale of corporate-owned stores.

(12)Represents certain severance and related expenses in the three and nine months ended September 30, 2023 recorded in connection with the departure of the Chief Executive Officer and in the nine months ended September 30, 2023, also includes severance expenses recorded in connection with the elimination of the President and Chief Operating Officer position.

(13)Represents certain other charges and gains that we do not believe reflect our underlying business performance.

(14)Includes $3,096, $3,096, $9,288 and 9,288 of amortization of intangible assets, for the three and nine months ended September 30, 2023 and 2022, recorded in connection with the 2012 Acquisition, and $9,858, $7,515, $29,197 and $20,357 of amortization of intangible assets for the three and nine months ended September 30, 2023 and 2022, respectively, recorded in connection with historical acquisitions of franchisee-owned stores. The adjustment represents the amount of actual non-cash amortization expense recorded, in accordance with GAAP, in each period.

(15)Represents corporate income taxes at an assumed blended tax rate of 25.9% for both the three and nine months ended September 30, 2023 and 2022, applied to adjusted income before income taxes.

(16)Assumes the full exchange of all outstanding Holdings Units and corresponding shares of Class B common stock for shares of Class A common stock of Planet Fitness, Inc.

Planet Fitness, Inc. and subsidiaries

Non-GAAP Financial Measures (Unaudited)

(Amounts in thousands, except per share amounts)

A reconciliation of net income per share, diluted, to Adjusted net income per share, diluted is set forth below for the three and nine months ended September 30, 2023 and 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the three months ended

September 30, 2023 | | For the three months ended

September 30, 2022 |

| (in thousands, except per share amounts) | | Net income | | Weighted Average Shares | | Net income per share, diluted | | Net income | | Weighted Average Shares | | Net income per share, diluted |

Net income attributable to Planet Fitness, Inc.(1) | | $ | 39,134 | | | 84,886 | | | $ | 0.46 | | | $ | 26,913 | | | 84,547 | | | $ | 0.32 | |

Assumed exchange of shares(2) | | 2,190 | | | 3,534 | | | | | 3,764 | | | 6,145 | | | |

| Net income | | 41,324 | | | | | | | 30,677 | | | | | |

Adjustments to arrive at adjusted income before income taxes(3) | | 28,586 | | | | | | | 20,908 | | | | | |

| Adjusted income before income taxes | | 69,910 | | | | | | | 51,585 | | | | | |

Adjusted income tax expense(4) | | 18,107 | | | | | | | 13,361 | | | | | |

| Adjusted net income | | $ | 51,803 | | | 88,420 | | | $ | 0.59 | | | $ | 38,224 | | | 90,692 | | | $ | 0.42 | |

(1)Represents net income attributable to Planet Fitness, Inc. and the associated weighted average shares, diluted, of Class A common stock outstanding.

(2)Assumes the full exchange of all outstanding Holdings Units and corresponding shares of Class B common stock for shares of Class A common stock of Planet Fitness, Inc. Also assumes the addition of net income attributable to non-controlling interests corresponding with the assumed exchange of Holdings Units and Class B common shares for shares of Class A common stock.

(3)Represents the total impact of all adjustments identified in the adjusted net income table above to arrive at adjusted income before income taxes.

(4)Represents corporate income taxes at an assumed blended tax rate of 25.9% for both the three months ended September 30, 2023 and 2022, applied to adjusted income before income taxes.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the nine months ended

September 30, 2023 | | For the nine months ended

September 30, 2022 |

| (in thousands, except per share amounts) | | Net income | | Weighted Average Shares | | Net income per share, diluted | | Net income | | Weighted Average Shares | | Net income per share, diluted |

Net income attributable to Planet Fitness, Inc.(1) | | $ | 102,973 | | | 84,870 | | | $ | 1.21 | | | $ | 65,719 | | | 84,798 | | | $ | 0.78 | |

Assumed exchange of shares(2) | | 7,299 | | | 4,237 | | | | | 8,405 | | | 5,773 | | | |

| Net income | | 110,272 | | | | | | | 74,124 | | | | | |

Adjustments to arrive at adjusted income before income taxes(3) | | 86,569 | | | | | | | 62,123 | | | | | |

| Adjusted income before income taxes | | 196,841 | | | | | | | 136,247 | | | | | |

Adjusted income tax expense(4) | | 50,982 | | | | | | | 35,288 | | | | | |

| Adjusted net income | | $ | 145,859 | | | 89,107 | | | $ | 1.64 | | | $ | 100,959 | | | 90,571 | | | $ | 1.11 | |

(1)Represents net income attributable to Planet Fitness, Inc. and the associated weighted average shares, diluted of Class A common stock outstanding.

(2)Assumes the full exchange of all outstanding Holdings Units and corresponding shares of Class B common stock for shares of Class A common stock of Planet Fitness, Inc. Also assumes the addition of net income attributable to non-controlling interests corresponding with the assumed exchange of Holdings Units and Class B common shares for shares of Class A common stock.

(3)Represents the total impact of all adjustments identified in the adjusted net income table above to arrive at adjusted income before income taxes.

(4)Represents corporate income taxes at an assumed blended tax rate of 25.9% for both the nine months ended September 30, 2023 and 2022, applied to adjusted income before income taxes.

Investor Presentation November 2023 1

The financial information presented in this presentation includes non-GAAP financial measures such as EBITDA, Segment EBITDA, Adjusted EBITDA, and Adjusted earnings per share to provide measures that we believe are useful to investors in evaluating the Company’s performance. These non-GAAP financial measures are supplemental measures of the Company’s performance that are neither required by, nor presented in accordance with GAAP. These financial measures should not be considered in isolation or as substitutes for GAAP financial measures such as net income or any other performance measures derived in accordance with GAAP. In addition, in the future, the Company may incur expenses or charges such as those added back to calculate these non-GAAP measures. The Company’s presentation of these non-GAAP measures should not be construed as an inference that the Company’s future results will be unaffected by similar amounts or other unusual or nonrecurring items. Same store sales refers to year-over-year sales comparisons for the same store sales base of both corporate-owned and franchisee-owned stores, which is calculated for a given period by including only sales from stores that had sales in the comparable months of both years. We define the same store sales base to include those stores that have been open and for which monthly membership dues have been billed for longer than 12 months. We measure same store sales based solely upon monthly dues billed to members of our corporate-owned and franchisee-owned stores. The non-GAAP financial measures used in our long-term growth targets will differ from their most directly comparable GAAP measures in ways similar to those in reconciliations the Company has previously provided in its disclosure with the Securities and Exchange Commission (SEC). We do not provide a reconciliation of growth targets for Adjusted EBITDA or Adjusted earnings per share to the most directly comparable GAAP measure because we are not able to predict with reasonable certainty the amount or nature of all items that will be included for the applicable period. Accordingly, a reconciliation of the Company’s growth targets for these non-GAAP measures to the most directly comparable GAAP measure cannot be made available without unreasonable effort. These items are uncertain, depend on many factors and could have a material impact on our Adjusted EBITDA and Adjusted earnings per share for the applicable period. This presentation contains “forward-looking statements” within the meaning of the federal securities laws, which involve risks and uncertainties. Forward-looking statements include the Company’s statements with respect to expected future performance presented under the heading “Financial Overview”, including with respect to the Company’s growth opportunities, ability to create long-term value for our shareholders, long-term store and member growth, and other statements, estimates and projections that do not relate solely to historical facts. Forward-looking statements can be identified by words such as “believe,” “expect,” “goal,” “plan,” “will,” “prospects,” “future,” “strategy,” “projected” and similar references to future periods, although not all forward-looking statements include these identifying words. Forward-looking statements are not assurances of future performance. Instead, they are based only on the Company’s current beliefs, expectations and assumptions regarding the future of the business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the Company’s control. Actual results and financial condition may differ materially from those indicated in the forward-looking statements. Important factors that could cause our actual results to differ materially include competition in the fitness industry, the Company’s and franchisees’ ability to attract and retain members, the Company's and franchisees' ability to identify and secure suitable sites for new franchise stores, changes in consumer demand, changes in equipment costs, the Company’s ability to expand into new markets domestically and internationally, operating costs for the Company and franchisees generally, availability and cost of capital for franchisees, acquisition activity, developments and changes in laws and regulations, our substantial increased indebtedness as a result of our refinancing and securitization transactions and our ability to incur additional indebtedness or refinance that indebtedness in the future, our future financial performance and our ability to pay principal and interest on our indebtedness, our corporate structure and tax receivable agreements, failures, interruptions or security breaches of the Company's information systems or technology, our ability to successfully identify and engage a highly-qualified permanent CEO, general economic conditions and the other factors described in the Company’s annual report on Form 10-K for the year ended December 31, 2022, and the Company’s other filings with the Securities and Exchange Commission. In light of the significant risks and uncertainties inherent in forward-looking statements, investors should not place undue reliance on forward-looking statements, which reflect the Company’s views only as of the date of this press release. Except as required by law, neither the Company nor any of its affiliates or representatives undertake any obligation to provide additional information or to correct or update any information set forth in this release, whether as a result of new information, future developments or otherwise. Presentation of Financial Measures & Forward-Looking Statements 2

Planet Fitness at a Glance Enhancing people’s lives by providing a high-quality fitness experience in a welcoming, non- intimidating environment, which we call the Judgement Free Zone® More than 2,4002 Stores Worldwide Corporate HQ Hampton, NH NYSE: PLNT 2015 IPO $4.8 Billion1 Market Cap $272M $379M $228M $879M 2022 Revenue By Segment3 Franchise Corporate-owned Stores Equipment $217M $142M $59M $367M 2022 Total Segment EBITDA4 Franchise Corporate-owned Stores Equipment 1. As of 11/2/2023 2. As of 12/31/2022 3. Excludes NAF revenue 4. Offset by Corporate and other 3 63 13 14 6 United States Canada Australia Mexico Panama 2,410 Stores In 5 Countries2 2,314

Q3 2023 Results 4 2,498 stores 18.5M+ members 8% Systemwide Same Store Sales Increase 13.6% revenue growth 19% Adj. EBITDA growth 40.3% Adj. EBITDA margin 40% Adj. EPS growth

Why Invest in Planet Fitness? Industry Leader Largest fitness franchise by number of members and locations Growing & Successful Business Model Supporting increased consumer prioritization of health wellness, especially among Gen-Z Historical Financial Performance Strong track record of consistent positive system-wide same store sales growth Disciplined Capital Allocation Prioritizing high-return investments while also remaining asset-light Experienced Management Team Significant experience in building successful franchise model businesses 5

30 years of consistent, reliable growth 2022 17 million members2021 15 million members2019 2,000th store opens2017 10.5 million members2015 1,000th store opens IPO 2013 5 million members2012 TSG Consumer Partners buys PF 500th store opens 2011 First ever National advertising campaign “Lift Things Up” 2009 2 million members 2008 1 million members2006 100th store 2005 PF Black Card® introduced2003 First franchise store opens & unit expansion accelerates 1999 Pizza 1998 Judgement Free Zone® unveiled 1996 Tootsie Rolls 1992 Planet Fitness opens in New Hampshire 6

DIFFERENTIATED MODEL Disruptive Brand 80% unserved Judgement Free Great Value Streamlined Operating Model Re-equip schedules Unique royalty stream Disciplined Franchise Model 7

12.8M NEW MEMBERS Total U.S. gym membership growth 2011-2019 11.1M NEW MEMBERS FROM PLNT 2011-2019 Grew industry by going after 80% of U.S. population that doesn’t belong to a gym 87% & 13%OF INDUSTRY MEMBER GROWTH DROVE OF INDUSTRY UNIT GROWTH 8Source: IHRSA

Broad demographic appeal Source: 2019 Civis analytics survey data SLIGHT SKEW TO FEMALE >50% of members are female COMPELLING VALUE 26% of members have incomes under $50K 21% of members have incomes over $100K ALL AGES 13+ CAN JOIN 48% of members are under 35 15% of members are over 55 9

Significant size and scale advantage 10 Store & Membership Marketing • 60% greater by store count than next 17 High Value Low Price competitors combined1 • Nearly 8x the membership of next largest competitor1 • More than $1B spent on marketing systemwide since 2015 IPO • Spent over $240M in systemwide marketing in 2022; more than 10x the combined spend of next 15 largest gym concept peers2 • #1 in aided/unaided brand awareness3 1. As of 12/31/2022 2. Next 15 largest gym concept peers as tracked by Kantar and Pathmatic 3. PF Brand Health, Magid Research, Winter 2023

Confidence in long-term membership growth driven by historic ability to gain greater share of each successive generational group and consumer prioritization of overall health and wellness GEN X MILLENNIAL GEN Z (15+) BOOMER+ GEN X MILLENNIAL GEN Z (15+) BOOMER+ GENERATIONAL MIX* 2019 14.4M MEMBERS 2023 Q3 18.5M+ MEMBERS 3.4% Penetration 6.0% Penetration 8.0% Penetration 5.1% Penetration 19% 28% 41% 12% 3.5% Penetration 6.0% Penetration 9.2% Penetration 9.2% Penetration 14% 23% 38% 25% *Through Q3 2023 11

REFER A FRIEND EASY DIGITAL UPGRADES DIGITAL JOINS AND INCREASED CONVERSION PERKS AND REWARDS WORKOUTS AND GUIDANCE REDUCING MEMBERSHIP FRICTION PROSPECTING VIA APP BIG PARTNERSHIPS FITNESS TRACKING HIGHER DUES LONGER TENURE MEMBERSHIP GROWTH BETTER BLACK CARD VALUE Digital flywheel unlocks even more value for members and supports retention 12

Our Business

Long track record of strong SSS growth primarily driven by member growth 53 straight quarters of positive SSS AVERAGE: 12% 18%Annual SSS 23%22% 13% 3% 8% 8% 11% 7% 8% 10% 10% 8% NA NA 11% 14 AVERAGE: 10% 9 straight quarters of positive SSS -5% 10% 25% 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Our Three Segments Franchise Growing locations and members by leveraging well-capitalized entrepreneurs with local market expertise Corporate-Owned Corporate-owned locations that represent a growing business with stable profitability Equipment High-quality, Planet Fitness-branded equipment sold at a fixed cadence with attractive pricing to our franchisees 15

Franchise • Franchise model designed to be streamlined and easy- to-operate, with efficient staffing and minimal inventory • Supported by an active, engaged franchise operations and training system • Dedicated marketing team that provides guidance, tracking, measurement, and advice on best practices • Recurring revenue consists of: • Royalties • Monthly dues • Annual fees $223 $162 $238 $272 2019 2020 2021 2022 Revenue ($M)2 $192 $115 $194 $217 2019 2020 2021 2022 EBITDA ($M) 16 2,176 Franchised Locations1 5 Countries 90%+ Recurring Revenue in ‘22 1. As of 12/31/2022 2. Excludes NAF revenue

Corporate-Owned Stores • Diversified corporate store geographic footprint in Northeast and Southeast markets with runway for future store development. • Target ownership of 10% of system to retain asset-light business model, an important part of shareholder value proposition. $160 $117 $167 $379 2019 2020 2021 2022 Revenue ($M) $66 $24 $49 $142 2019 2020 2021 2022 EBITDA ($M) 17 234 Corporate Owned Stores1 95%+ Recurring Revenue in ‘22 1. As of 12/31/2022

Equipment • Franchisees obligated to: • Purchase new store equipment from PLNT1 • Replace cardio equipment every 5 years and strength equipment every 7 years • Provides high visibility into revenue generation • Leverage our scale for competitive pricing and to secure extended warranties from suppliers • Offer equipment at more attractive pricing than franchisees could otherwise secure $251 $83 $129 $228 2019 2020 2021 2022 Revenue ($M) $60 $13 $28 $59 2019 2020 2021 2022 EBITDA ($M) 18 New Store Equipment Purchases Predictable Replacement Revenue 1. The limited number of International franchisees purchase directly from our vendors for which we earn a commission.

Financial Overview 19

Strong flow-through on incremental revenue growth compared to QSR COMPARISON OF MATURE UNIT ECONOMICS ILLUSTRATIVE FLOW-THROUGH OF INCREMENTAL REVENUE 46% 27% 14% 56% 40% 17% 4-wall EBITDA Variable Costs Fixed Costs Illustrative QSR Concept ~2.5x $0 $200 $400 $600 $800 $1,000 10% 20% 30% 40% 50% 4 -W A LL E B IT D A C H A N G E AUV GROWTH QSR needs to drive 2xs AUV growth to achieve same 4-Wall EBITDA improvement Illustrative QSR Concept Source: Company filings, pre-pandemic returns Note: Illustrative QSR concept reflects 2/3 variable and 1/3 fixed costs. 20

Prioritizing high-return investments and committed to asset-light model 21 Capital Investments Share Repurchases • New stores • Remodels • Re-equip existing stores • Technology • Annual repurchase minimum of ~1M shares • Option to increase where appropriate

2023 Outlook • New equipment placements of between approximately 130 and 140 in franchise-owned locations • System-wide new store openings of between approximately 150 and 160 locations • System wide same store sales in the high single-digit percentage range 1. Based on adjusted diluted shares outstanding of approximately 89.5 million, inclusive of one million shares repurchased 2. Driven by additional stores in our corporate-owned portfolio 3. Driven by the increase in capital expenditures and a full-year of Sunshine in our results over 2022 4. Over 2022 results for metrics included in the outlook with expected growth targets REVENUE ADJ. EBITDA ADJ. NET INCOME ADJ. EPS1 NET INTEREST EXPENSE CAPITAL EXPENDITURES2 D&A3 ~14% Growth4 ~18% growth ~33% growth ~35% growth ~$70 million ~40% growth High-teens% growth 22

Management Team Craig Benson Interim Chief Executive Officer Paul Barber Chief Information Officer Bill Bode Division President, U.S. Franchise Tom Fitzgerald Chief Financial Officer Kathy Gentilozzi Chief People Officer Sherrill Kaplan Chief Digital Officer Jamie Medeiros Chief Brand Officer Jennifer Simmons Division President, Corporate Clubs McCall Gosselin SVP Communications & Corporate Social Responsibility Brian O'Donnell SVP, Chief Accounting Officer Justin Vartanian General Counsel & SVP, Internal Division 23

PF Purpose: Our commitment to ESG

PF Purpose ACCESS We increase access to fitness for all through affordable memberships, nonintimidating environment, and investment in community partners and programs. INCLUSION We create, promote and reward inclusive clubs, cultures and communities SUSTAINABILITY We strive to leave a positive impact on the world by actively contributing to a healthier planet 25 We are guided by our purpose to create a more judgement free planet where health and wellness is within reach for all.

Enhancing Lives and Creating a Healthier World 26 Environmental Committed to working with franchisees and partners to make environmentally sustainable decisions by reducing our environmental impact to ensure future generations have access to a healthy planet. Social Committed to increasing access to fitness, ensuring a safe environment for members and team members, creating opportunities for youth to build healthy habits and relationships, and fostering inclusive cultures in our clubs, communities and workplace. Governance Designed to drive sound company oversight, ensure leadership accountability, engender and maintain stakeholder trust, and demonstrate our commitment to our mission to create a healthier world, while driving long-term, sustainable value creation.

Appendix

Income Statement 28

Balance Sheet 29

Cash Flow Statement 30

Non-GAAP Financial Measures 31

Non-GAAP Financial Measures (contd.) 32

Contact Investor Relations: Stacey Caravella investor@planetfitness.com

1

This presentation contains “forward-looking statements” within the meaning of the federal securities laws, which involve risks and uncertainties. Forward-looking statements include the Company’s statements under the heading “Future Growth Model” as well as other statements by members of the Company’s management team in this presentation, including with respect to the Company’s growth opportunities, ability to create long-term value for our shareholders, long-term store and member growth, and other statements, estimates and projections that do not relate solely to historical facts. Forward-looking statements can be identified by words such as "believe," “expect,” “goal,” “plan,” “will,” “prospects,” “future,” “strategy,” “projected,” “target” and similar references to future periods, although not all forward-looking statements include these identifying words. Forward-looking statements are not assurances of future performance. Instead, they are based only on the Company’s current beliefs, expectations and assumptions regarding the future of the business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the Company’s control. Actual results and financial condition may differ materially from those indicated in the forward-looking statements. Important factors that could cause our actual results to differ materially include competition in the fitness industry, the Company’s and franchisees’ ability to attract and retain members, the Company's and franchisees' ability to identify and secure suitable sites for new franchise stores, changes in consumer demand, changes in equipment costs, the Company’s ability to expand into new markets domestically and internationally, operating costs for the Company and franchisees generally, availability and cost of capital for franchisees, acquisition activity, developments and changes in laws and regulations, our substantial increased indebtedness as a result of our refinancing and securitization transactions and our ability to incur additional indebtedness or refinance that indebtedness in the future, our future financial performance and our ability to pay principal and interest on our indebtedness, our corporate structure and tax receivable agreements, failures, interruptions or security breaches of the Company's information systems or technology, our ability to successfully identify and engage a highly- qualified permanent CEO, general economic conditions and the other factors described in the Company’s annual report on Form 10-K for the year ended December 31, 2022, and the Company’s other filings with the Securities and Exchange Commission. In light of the significant risks and uncertainties inherent in forward-looking statements, investors should not place undue reliance on forward-looking statements, which reflect the Company’s views only as of the date of this press release. Except as required by law, neither the Company nor any of its affiliates or representatives undertake any obligation to provide additional information or to correct or update any information set forth in this release, whether as a result of new information, future developments or otherwise. Forward-Looking Statements 2

New Growth Model

External pressures on store returns 4 Cost to build a new Planet Fitness club and interest rates have increased significantly since 2019 Slower ramps for cohort of clubs built from 2019 to 2022 due to COVID; drag on franchisee portfolio economics Increasing store operating expense (payroll, utilities, etc.)