____________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

FORM 6-K

__________________________________

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of November 2023

Commission File Number: 001-15102

__________________________________

Embraer S.A.

__________________________________

Avenida Dra. Ruth Cardoso,

8501,

30th floor (part), Pinheiros,

São Paulo, SP, 05425-070, Brazil

(Address of principal executive offices)

__________________________________

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x

Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

HIGHLIGHTS

| · | Embraer delivered 43 jets in the third quarter, of which 15 commercial aircraft and 28

executive jets (19 light and 9 mid-size). The total number of deliveries represent an increase of 30% compared to 3Q22 and an increase

of 33% Year to Date (YTD) from 105 versus 79 aircraft. |

| · | Revenues reached US$ 1,284 million in the quarter (38% higher than 3Q22 and equal to 2Q23).

YTD revenues represent an increase of 29% compared to the same period last year. All Business Units had higher revenues and volumes Year

over Year (YoY) and YTD, with the main highlight being Commercial Aviation representing a strong growth of 68% YoY and 52% YTD. |

| · | Adjusted EBIT of 7.8% compared to 5.4% in 3Q22 due to higher volumes in all business

units. |

| · | Firm order backlog ended 3Q23 at US$ 17.8 billion, the highest level in one year, driven

by higher sales in Commercial Aviation. Commercial Aviation backlog rose from US$ 8 billion to US$ 8.6 billion compared

to 2Q23, with 42 aircraft sold in 2023. Services & Support reached US$ 2.8 billion in the quarter, the highest volume ever

recorded in the business unit. Executive Aviation strong backlog at US$ 4.3 billion highlights its sustained demand backlog. |

| · | Adjusted Free Cash Flow w/o EVE (FCF) in 3Q23 of US$ 44.0 million pointing to a strong cash generation

in the 4Q23 due to higher deliveries. |

| · | Successful conclusion of Liability Management, extending the average loan maturity to 4.8 years. |

| · | Operational and financial guidance for 2023 remains unchanged. |

Main

financial indicators[1]

2 Adjusted Net Income (loss)

is a non-GAAP measure, calculated by adding Net Income attributable to Embraer Shareholders plus Deferred income tax and social contribution

for the period, in addition to adjusting for non-recurring items. Under IFRS for Embraer’s Income Tax benefits (expenses) the Company

is required to record taxes resulting from unrealized gains or losses due to the impact of changes in the Real to US Dollar exchange

rate over non-monetary assets (primarily Inventory, Intangibles, and PP&E). The taxes resulting from gains or losses over non-monetary

assets are considered deferred taxes and are presented in the consolidated Cash Flow statement, under Deferred income tax and social contribution.

Adjusted Net Income (loss) also excludes the net after-tax special items.

| | |

| 1 |

São

Paulo, Brazil, November 6, 2023 - (B3: EMBR3, NYSE: ERJ). The Company's operating and financial

information is presented, except where otherwise stated, on a consolidated basis in United States dollars (US$) in accordance with IFRS.

The financial data presented in this document as of and for the quarters ended September 30, 2023 (3Q23), September 30, 2022 (3Q22), and

June 30, 2023 (2Q23), are derived from the unaudited financial statements, except annual financial data and where otherwise stated.

REVENUE

and gross margin

Consolidated revenue of US$ 1,284 million in 3Q23

represented an increase of 38% YoY mainly explained by Commercial Aviation with 68% increase, while Defense rose by 40%, 25% for Executive

and 24% for Services.

Comparing January to September of 2022 to the same

period of 2023, total revenue rose 29%. Commercial Aviation represented the most expressive increase with 52% variance, followed by Executive

Aviation with 28%, Services & Support and Defense with 16% and 15%, respectively.

| Q | Commercial Aviation reported revenue growth of 68% YoY to US$ 424.9 million due to the higher

number of deliveries, with reported gross margin increase from 5.4% in 3Q22 to 6.5% in 3Q23. |

| Q | Executive Aviation revenues were US$ 339.9 million, 25% higher than 3Q22 with an increase

in volumes and deliveries mix. As a result, gross margin increased from 19.7% to 21.8% YoY. |

| Q | Defense & Security revenue of US$ 133.1 million, 40% higher YoY. Reported gross margin

of 16.1% in 3Q22 versus 26.0% in 3Q23 due to baseline adjustments of current contracts and physical progress, according to its percentage

of completion evolution. |

| Q | Services & Support revenue of US$ 365.8 million, registering growth for 2 quarters in

a row, representing a YoY increase of 24%. Reported gross margin of 24.9% lower than 31.0% reported in 3Q22 due to different mix of services. |

| | |

| 2 |

ADJUSTED

EBIT

In

3Q23, the Company’s reported results are summarized in the table below.

Excluding the above special items, 3Q23

Adjusted EBIT was US$ 100.1 million and Adjusted EBIT margin was 7.8%. On a YoY basis, 3Q Adjusted EBIT increased due to higher volumes

in Commercial and Executive Aviation and better performance on Defense. Adjusted EBIT is trending to a strong performance in 4Q23 due

to higher level of deliveries.

net

income (Loss)

Net income (loss) attributable to Embraer shareholders

and income (loss) per ADS for 3Q23 were US$ 61.0 million and US$ 0.3322 per share, respectively, compared to US$ (30.2) million in net

loss attributable to Embraer shareholders and US$ (0.1644) in income per ADS in 3Q22. Excluding extraordinary effects, adjusted net income

was US$ 32.9 million compared to US$ 24.5 million in 3Q22 representing an increase of 34% YoY. In the 3Q, costs related to the development

of EVE began to be capitalized as intangible assets as the program reached sufficient maturity.

¹ADJUSTED

NET INCOME – US$ Million

¹ Adjusted Net Income (loss) is a non-GAAP measure, calculated by adding Net

Income attributable to Embraer Shareholders plus Deferred income tax and social contribution for the period, in addition to adjusting

for non-recurring items. Under IFRS for Embraer’s Income Tax benefits (expenses) the Company is required to record taxes resulting

from unrealized gains or losses due to the impact of changes in the Real to US Dollar exchange rate over non-monetary assets (primarily

Inventory, Intangibles, and PP&E). The taxes resulting from gains or losses over non-monetary assets are considered deferred taxes

and are presented in the consolidated Cash Flow statement, under Deferred income tax and social contribution. Adjusted Net Income (loss)

also excludes the net after-tax special items.

| | |

| 3 |

DEBT & LIABILITY

MANAGEMENT

The company concluded a successful Liability management,

(which placed the company in a position without any main liability until mid-2027) extending the average loan maturity to 4.8 years. The

cost of Dollar-denominated loans was 6.33% p.a., while the cost of Brazilian Real denominated loans was 10.85% p.a. in 3Q23.

Embraer ended the quarter with a net debt position

of US$ 1,357.3 million (without EVE), compared to US$ 1,604.8 million YoY and US$ 1,459.4 million QoQ.

|

¹EVE’s Cash = Cash and cash equivalents

plus financial investments and intercompany loan receivable

2Maturities = Do not consider

accrued interest and deferred costs

*All numbers from EVE are IFRS |

| | |

| 4 |

FREE CASH FLOW

Adjusted free cash flow for the third quarter

2023 was US$ 44.0 million pointing to a positive trend for 2023, even with higher inventories due to larger deliveries in the 4Q.

CAPEX

Net

additions to total PP&E for 3Q23 were US$ 55.2 million, versus US$ 33.3 million in net additions reported in 3Q22. Of the total 3Q23

additions to PP&E, CAPEX amounted to US$ 30.2 million, and additions of pool program spare parts represented US$ 28.3 million of the

additions, partially offset by US$ (3.3) million of proceeds from the sale of PP&E. The increase in PP&E in 3Q23 versus 2Q23 is

related to expansion in services training and maintenance. In 3Q23, costs related to the development of EVE began to be capitalized as

intangible assets as the program reached sufficient maturity.

| | |

| 5 |

WORKING

CAPITAL

Inventories

of work-in-progress had a slight increase compared to the previous quarter to attend to the greater number of deliveries in 4Q23, while

FCF was positive in the quarter.

Total Backlog

Firm order backlog ended 3Q23 at US$ 17.8 billion,

a US$ 500 million increase versus the second quarter. This volume represents the highest level of the company’s backlog in one year,

driven by higher sales in Commercial Aviation while Defense and Executive Aviation remained stable. Services reached US$ 2.8 billion in

the quarter, the highest backlog volume ever recorded in the business unit.

Embraer delivered 43 jets in 3Q23, an increase

of 30% compared to 3Q22, when 33 aircraft were delivered. In Commercial Aviation deliveries boosted from 10 to 15, an increase of 50%

YoY. In Executive Aviation, the numbers were also positive: 28 executive jets delivered (19 light jets and 9 medium) representing a growth

of 22% YoY.

During the year, the company accumulated a total

of 105 aircraft delivered (39 commercial and 66 executive), an increase of 33% compared to the same period last year, when 79 jets were

delivered (27 commercial and 52 executive). For the second consecutive quarter, Embraer showed double-digit growth in deliveries: in 2Q23,

the company's deliveries grew 47% compared to 2Q22.

| | |

| 6 |

Commercial

Aviation

In

3Q23, Embraer delivered 15 commercial jets, as shown below:

Embraer's E195-E2 jet, the largest in the E-Jet

family, received Type Certification from the Civil Aviation Administration of China (CAAC). This will allow the company to penetrate the

Chinese market with the aircraft and explore its opportunities, complementing COMAC’s ARJ21 and C919 already manufactured in the

country.

SkyWest ordered 19 new E175 jets for operation

in the United Airlines network, adding to the 90 E175 jets that SkyWest is already operating with the airline. The 70-seat aircraft will

be delivered in a three-class configuration. This deal is part of the Q3 backlog and deliveries will begin Q4 2024.

Air Peace, West Africa's largest airline, announced

a firm order for five Embraer E175 jets. Deliveries of the new 88-seat jets are scheduled to take place from 2024. The E175 will complement

the Nigerian company's fleet, which already operates the E195-E2.

Embraer announced in September the signing of a

Memorandum of Understanding (MoU) with American Airlines, for the United States airline to join the Energy Project Advisory Group. With

the MoU signed with Embraer, the companies will work together to define and establish real-world requirements for sustainable, emission-free

and commercially viable aviation.

Executive Jets

Executive aviation delivered 19 light and 9 mid-size

jets, totaling 28 aircraft in 3Q23, an increase of 22% compared to the same period in 2022.

The business unit continues its sales momentum

with sustained demand across its entire product portfolio and strong customer acceptance in both retail and fleet markets. In August,

the Phenom 300E became the most-flown business jet in the United States (Source: Federal Aviation Administration).

At NBAA Embraer announced the Phenom 100EX, the

company’s newest evolution delivers superior cabin comfort, operational versatility and safety enhanced pilot-centric avionics to

offer the ultimate flying experience.

In addition, autothrottle feature was announced

for the Phenom 300E, and in line with Embraer’s commitment to a more sustainable future, Embraer announced in October that it has

successfully tested the Phenom 300E and Praetor 600 on 100% neat sustainable aviation fuel (SAF). The tests, with one engine running

on 100% SAF, were performed at Embraer’s Melbourne facility and provided significant insight into systems’ performance when

utilizing blends up to 100% SAF, which was provided by World Fuel.

| | |

| 7 |

Defense

& security

Three more European countries, Czech Republic,

Austria and Netherlands have now selected the C-390 Millennium , further consolidating our multi-mission platform as a preferred solution

in NATO countries and allies. Negotiations have not yet been incorporated into Embraer Defense & Security's backlog, which represents

a significant potential for the coming quarters.

In September, the KC-390 Millennium, has completed

10,000 flight hours operating under the Brazilian Air Force (FAB). The current fleet of six aircraft already in operation, from a total

of 19 ordered by the Brazilian Air Force, has been demonstrating operational availability at 80%, and mission completion rate above 99%.

Embraer and the Brazilian Army have successfully

completed the first test of the M200 Vigilante radar, including the deployment of the equipment on the KC-390 Millenium aircraft from

the Brazilian Air Force (FAB).

SERVICES &

SUPPORT

Embraer had an extension of Integrated Logistical

Support (ILS) contract for Brazilian Air Force fleet of 24 ERJ-135, Legacy 600 and AEW. Embraer has also signed a contract with Affinity

SOIU/AUVP for 35 months of engineering analysis of the aircraft utilization of the Phenom 100.

Executive Jet Services in partnership with FlightSafety,

deployed the third full-flight simulator for the Praetors, based in Orlando, Florida.

New or renewed contracts were signed in Pool Program with

Marathon Airlines (Greece), Sky High (Dominican Republic), Royal Jordanian Airlines (Jordan) and Scoot (Singapore), the last two to be

included in Embraer’s future backlog.

| | |

| 8 |

| | |

| 9 |

| | |

| 10 |

| | |

| 11 |

| | |

| 12 |

Reconciliation

OF IFRS and “NON-GAAP” information

We define Free cash flow

as operating cash flow less Additions to property, plant and equipment, Additions to intangible assets, Financial investments and Other

assets. Free cash flow is not an accounting measure under IFRS. Free cash flow is presented because it is used internally as a measure

for evaluating certain aspects of our business. The Company also believes that some investors find it to be a useful tool for measuring

Embraer's cash position. Free cash flow should not be considered as a measure of the Company's liquidity or as a measure of its cash flow

as reported under IFRS. In addition, Free cash flow should not be interpreted as a measure of residual cash flow available to the Company

for discretionary expenditures, since the Company may have mandatory debt service requirements or other nondiscretionary expenditures

that are not deducted from this measure. Other companies in the industry may calculate Free cash flow differently from Embraer for purposes

of their earnings releases, thus limiting its usefulness for comparing Embraer to other companies in the industry.

EBITDA LTM represents earnings before

interest, taxation, depreciation, and amortization accumulated over a period of the last 12 months. It is not a financial measure of the

Company’s financial performance under IFRS. EBIT as mentioned in this press release refers to earnings before interest and taxes,

and for purposes of reporting is the same as that reported on the Income Statement as Operating Profit before Financial Income.

EBIT and EBITDA are presented

because they are used internally as measures to evaluate certain aspects of the business. The Company also believes that some investors

find them to be useful tools for measuring a Company’s financial performance. EBIT and EBITDA should not be considered as alternatives

to, in isolation from, or as substitutes for, analysis of the Company’s financial condition or results of operations, as reported

under IFRS. Other companies in the industry may calculate EBIT and EBITDA differently from Embraer for the purposes of their earnings

releases, limiting EBIT and EBITDA’s usefulness as comparative measures.

Adjusted

EBIT and Adjusted EBITDA are non-GAAP measures, and both exclude the impact of several non-recurring items, as described in the tables

below.

| | |

| 13 |

Adjusted

Net Income is a non-GAAP measure, calculated by adding Net Income attributable to Embraer Shareholders plus Deferred Income tax and

social contribution for the period, as well as removing the impact of non-recurring items. Furthermore, under IFRS for purposes of calculating

Embraer’s Income Tax benefits (expenses), the Company is required to record taxes resulting from gains or losses due to the impact

of the changes in the Real to the US Dollar exchange rate over non-monetary assets (primarily Inventories, Intangibles, and PP&E).

It is important to note that taxes resulting from gains or losses over non-monetary assets are considered deferred taxes and are accounted

for in the Company’s consolidated Cash Flow statement, under Deferred income tax and social contribution.

Ratios

based on “NON-GAAP” information

| (i) | Total debt represents short and long-term loans and financing INCLUDING EVE (USD billion). |

| (ii) | Net debt represents cash and cash equivalents, plus financial investments, minus short and long-term loans

and financing. |

| (iii) | Net debt w/o EVE represents cash and cash equivalents, plus financial investments and intercompany loan

receivable, minus short and long-term loans, less EVE's Net debt. |

| (iv) | Total capitalization represents short and long-term loans and financing, plus shareholders equity (USD

billion). |

| (v) | Financial expense (gross) includes only interest and commissions on loans. |

| (vi) | The table at the end of this release sets forth the reconciliation of Net income to EBITDA, calculated

on the basis of financial information prepared with IFRS data, for the indicated periods (USD million). |

| (vii) | Interest expense (gross) includes only interest and commissions on loans, which are included in Interest

income (expense), net presented in the Company’s consolidated Income Statement (USD million). |

| (viii) | The table at the end of this release sets forth the reconciliation of Net income to Adjusted EBITDA, calculated

on the basis of financial information prepared with IFRS data, for the indicated periods (USD million). |

| | |

| 14 |

Investor

Relations

Leonardo Shinohara, Patricia

Mc Knight, Viviane Pinheiro, Eliane Fanis and Marcelo Cuperman.

(+55 11) 3040-6874

investor.relations@embraer.com.br

ri.embraer.com.br

CONFERENCE

CALL INFORMATION

Embraer

will host a conference call to present its 3Q23 Results on:

Monday, Nov 6, 2023

ENGLISH: 08:00

AM (NY Time) / 10:00 AM (SP Time).

Click here to access the webcast link https://choruscall.com.br/embraer/3q23.htm

[choruscall.com.br]

To participate by phone call:

U.S.: Dial in +1 412 717-9627 or Toll

Free: +1 844 204-8942

Brazil: +55 11 3181-8565 or +55 11 4090-1621

UK: +44 20 3795 9972

Web Phone: https://hdbr.choruscall.com/?passcode=6879074&h=true&info=company&r=true

[hdbr.choruscall.com]

PORTUGUESE: 07:00

AM (NY Time) / 09:00 AM (SP Time).

Click here to access the webcast link https://choruscall.com.br/embraer/3t23.htm

[choruscall.com.br]

To participate by phone call:

U.S.: Dial in +1 412 717-9627 or Toll

Free: +1 844 204-8942

Brazil: +55 11 3181-8565 or +55 11 4090-1621

UK: +44 20 3795 9972

Web Phone: https://hdbr.choruscall.com/?passcode=6879074&h=true&info=company&r=true

[hdbr.choruscall.com]

We recommend you join 15 minutes

in advance.

ABOUT

EMBRAER

A global aerospace company headquartered

in Brazil, Embraer has businesses in Commercial and Executive Aviation, Defense & Security and Agricultural Aviation. The company

designs, develops, manufactures and markets aircraft and systems, providing after-sales service and support to customers.

Since it was founded in 1969, Embraer

has delivered more than 8,000 aircraft. On average, every 10 seconds an aircraft manufactured by Embraer takes off somewhere in the world,

transporting more than 145 million passengers a year.

Embraer is the main manufacturer of

commercial jets with up to 150 seats and the main exporter of high value-added goods in Brazil. The company maintains industrial units,

offices, service centers and parts distribution, among other activities, in the Americas, Africa, Asia and Europe.

This document may contain projections,

statements and estimates regarding circumstances or events yet to take place. Those projections and estimates are based largely on current

expectations, forecasts of future events and financial trends that affect Embraer’s businesses. Those estimates are subject to risks,

uncertainties and suppositions that include, among others: general economic, political and trade conditions in Brazil and in those markets

where Embraer does business; expectations of industry trends; the Company’s investment plans; its capacity to develop and deliver

products on the dates previously agreed upon, and existing and future governmental regulations. The words “believe”, “may”,

“is able”, “will be able”, “intend”, “continue”, “anticipate”, “expect”

and other similar terms are intended to identify potentialities. Embraer does not undertake any obligation to publish updates nor to revise

any estimates due to new information, future events or any other facts. In view of the inherent risks and uncertainties, such estimates,

events and circumstances may not take place. The actual results may therefore differ substantially from those previously published as

Embraer expectations.

This document contains non-gaap financial

information, to facilitate investors to reconcile Eve's financial information in GAAP standards to Embraer`s IFRS.

| | |

| 15 |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: November 6, 2023

| |

|

|

|

|

| Embraer S.A. |

| |

|

| By: |

|

/s/ Antonio Carlos Garcia |

| |

|

Name: |

|

Antonio Carlos Garcia |

| |

|

Title: |

|

Executive Vice President of Finance and Investor Relations |

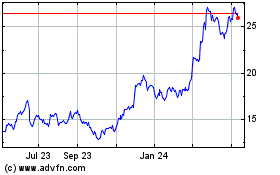

Embraer (NYSE:ERJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

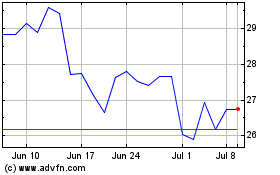

Embraer (NYSE:ERJ)

Historical Stock Chart

From Apr 2023 to Apr 2024