0001828105FALSE00018281052023-11-022023-11-020001828105us-gaap:CommonStockMember2023-11-022023-11-020001828105us-gaap:WarrantMember2023-11-022023-11-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 2, 2023

Hippo Holdings Inc.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39711 | | 32-0662604 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

150 Forest Avenue

Palo Alto, California 94301

650 294-8463

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| | ☐ | Written communications pursuant to Rule 425 under the Securities Act |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, $0.0001 par value per share | | HIPO | | New York Stock Exchange |

| Warrants to purchase common stock | | HIPO.WS | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On November 2, 2023, Hippo Holdings Inc. (the “Company”) issued a shareholder letter and press release announcing certain financial results for the quarter ended September 30, 2023. A copy of the shareholder letter and press release are furnished as Exhibit 99.1 and 99.2 to this report, respectively.

The Company is making reference to non-GAAP financial information in the shareholder letter, the press release and the related conference call. A reconciliation of these non-GAAP financial measures to their nearest GAAP equivalents is provided in the shareholder letter.

The information in Item 2.02 of this Current Report on Form 8-K, including Exhibits 99.1 and 99.2 to this Current Report on Form 8-K, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Section 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this Item 2.02 and in the accompanying Exhibits 99.1 and 99.2 shall not be incorporated by reference into any registration statement or other document filed by the Company with the Securities and Exchange Commission, whether made before or after the date of this Current Report, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference to this Item 2.02 and Exhibit 99.1 or Exhibit 99.2 in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

| | | | | |

| Exhibit Number | Exhibit Title or Description |

| |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: November 2, 2023

| | | | | | | | |

| HIPPO HOLDINGS, INC. |

| |

| By: | | /s/ STEWART ELLIS |

| | Stewart Ellis |

| | Chief Financial Officer |

LETTER TO SHAREHOLDERS Q3 2023

Letter to Shareholders | Q3 2023 2 KEY HIGHLIGHTS FROM Q3 Adjusted EBITDA, Our Best Yet • GAAP net loss attributable to Hippo of $53 million/adjusted EBITDA loss of $38 million • Expect to turn adjusted EBITDA positive before year-end 2024, earlier than previously projected Improving Core Gross Loss Ratio1 • Reported consolidated GLR of 59% with a core consolidated GLR of 53% • Hippo Homeowners Insurance Program (HHIP) core GLR: 69%, improved from 82% a year ago TGP Growth and Mix • TGP, up 38% YoY with IaaS and Services now representing 65% of Total TGP in Force • Insurance-as-a-Service (IaaS) TGP growth of 72% YoY • Services TGP growth of 32% YoY Expense Improvement • Operating expense, excluding loss and loss adjustment expense and an impairment and restructuring charge, declined to $72 million from $79 million a year ago Financial Strength • Cash and investments at $558 million at 9/30/23 • Spinnaker policyholder surplus of $182 million (1) Core Gross Loss Ratio defined as current accident year loss ratio excluding PCS-defined catastrophe losses Revenue +88% YoY Premium Retention2 +2pp 90% Q3 ‘22 Q3 ‘23 92% Total Generated Premium +38% YoY $162M $220M Q3 ‘22Q3 ‘21 Q3 ‘23 $304M $21M $31M Q3 ‘22Q3 ‘21 Q3 ‘23 $58M HHIP Core Gross Loss Ratio1 82% 69% Q3 ‘22 Q3 ‘23 -13pp YoY YoY (2) Hippo Consumer Blended Premiums

Letter to Shareholders | Q3 2023 3 Q3’23: POSITIONED FOR PROFITABILITY Dear Shareholders, Q3’23 was Hippo’s best quarter yet. The most predictable and profitable parts of Hippo, Services and Insurance-as-a-Service (IaaS) segments continued to drive our growth and now represent 65% of our premium-in-force, up from 52% a year ago. The actions we are taking in our homeowners insurance business to lower its volatility and improve its profitability are working. Our Q3’23 adjusted EBITDA loss was Hippo’s smallest as a public company and we are on pace to turn positive earlier than previously projected. After a challenging first half of 2023 for the US homeowners' insurance industry, Hippo has taken bold steps to position itself for future growth and profitability. In August, we temporarily paused the underwriting of most new business. We’re assessing our underwriting and risk appetite and only writing new business when we’re very confident in expected profitability and reduced volatility. For much of our renewal book, we’re raising rates, increasing deductibles and when necessary, non-renewing select policies. While we expect to see a decline in Hippo Homeowners Insurance Program's (HHIP) Total Generated Premium (TGP) in 2024, we expect that to be driven by a disproportionate decline in exposure and volatility and a significant improvement in underwriting profitability. We’ve already begun to see the benefit of actions taken in 2022 and early 2023 to improve our loss ratio, and we expect significant additional improvement to come. Our consolidated gross loss ratio in the quarter was 59%, a 51 percentage point improvement over the prior year quarter. And our net loss ratio improved even more significantly year over year, declining 112 percentage points to 111%. HHIP’s core gross loss ratio in the quarter, which excludes prior year reserve movements and PCS cats improved 13 percentage points to 69%, down from 82% in the prior year quarter. We had another outstanding quarter in our IaaS segment with positive adjusted operating income of $4 million and exceptional TGP growth of 72%. In a market with heightened concerns about credit risk exposure, Spinnaker continues to demonstrate strong risk management capabilities and underwriting controls while driving profitable growth. In our fee-based Services segment, the success of our builder agency business is providing

Letter to Shareholders | Q3 2023 4 a repeatable playbook for our entire Agency business. As HHIP’s risk appetite narrowed, our builder agency successfully placed business with third party carriers to keep the premium retention rate for the agency channel at 97% in the quarter. At First Connect, agency appointments are up 3X and we saw growth of more than 180% in our non-Hippo new business versus the prior year. As we have focused our underwriting footprint and intensified our emphasis on expense control, we are announcing a significant expense reduction initiative which we expect to take $50-$70 million out of our cost structure in 2024. We expect these savings, coupled with further loss ratio improvement and growth in our IaaS and Services segments, to result in positive adjusted EBITDA before year-end 2024, turning positive earlier than we previously projected. Finally, I extend our condolences to the many Israeli members of our Hippo family and our friends and partners impacted by the horrible events over the past several weeks. Thank you, Rick Richard McCathron President & CEO

Letter to Shareholders | Q3 2023 5 Q3 RESULTS Q3 Highlights Q3 FINANCIALS: KPIS, SEGMENT INFORMATION, AND NON-GAAP FINANCIALS Our Q3‘23 adjusted EBITDA loss of $38 million was our best yet as a public company and we expect even stronger results in the coming periods. These anticipated improvements will be driven by continued improvements to the HHIP loss ratio, significant operating expense savings, growth in our IaaS segment, which is already profitable, and growth in our Services business, which is closer to turning adjusted operating income positive in 2024. We now expect to be reporting positive adjusted EBITDA earlier than the end of 2024 while affirming our expectation of minimum cash and investments of at least $350 million. Total Generated Premium $304M +38% YoY Revenue $58M +88% YoY HHIP Core GLR, ex Cats of 6%1 69% -13pp YoY (1) Core Gross Loss Ratio defined as current accident year loss ratio excluding PCS-defined catastrophe losses 3 Premium Retention2 92% +2pp YoY Total Generated Premium In-Force $1,105M +49% YoY (2) Hippo Consumer Blended Premiums

Letter to Shareholders | Q3 2023 6 Total Generated Premium: Q3'23 Q3'22 %Change Services $121.6 $92.4 32% Insurance-as-a-service 141.8 82.6 72% Hippo Home Insurance Program 95.0 94.1 1% Eliminations (54.7) (49.2) Total $303.7 $219.9 38% Revenue: Q3'23 Q3'22 %Change Services $11.6 $9.5 22% Insurance-as-a-service 19.4 10.0 94% Hippo Home Insurance Program 28.9 16.3 77% Eliminations (2.2) (5.1) Total $57.7 $30.7 88% Adjusted Expenses: Q3'23 Q3'22 %Change Services $18.5 $23.8 (22%) Insurance-as-a-service 14.0 7.3 92% Hippo Home Insurance Program 56.7 55.3 3% Eliminations (1.6) (5.1) Total $87.6 $81.3 8% Services Non Controlling Interest $(2.8) $(1.7) 65% Adjusted Operating Income (Loss): Q3'23 Q3'22 %Change Services $(9.7) $(16.0) (39%) Insurance-as-a-service 3.6 2.0 80% Hippo Home Insurance Program (31.7) (40.8) (22%) Eliminations (0.6) — Total $(38.4) $(54.8) (30%) On a consolidated basis, year-over-year growth remained strong. TGP was up 38% to $304 million, driven primarily by our most profitable and most predictable segments, which now represent a significant majority of our total business. Revenue was up 88% over the prior year to $58 million primarily driven by growth in premiums earned and organic growth in both our IaaS and Services segments. Additionally, revenue has benefitted from an increase in investment income to $6 million from $3 million in the year- ago quarter as we have taken advantage of more attractive yields. Segment Information

Letter to Shareholders | Q3 2023 7 We will continue to push for growth in our profitable IaaS segment and view growth as an important lever to driving positive adjusted operating income in our Services segment. Our narrower risk appetite and focus on lowering our exposure to weather will result in lower TGP and disproportionately lower exposure and volatility in the HHIP segment in 2024. We’ve made great progress on operating expense control during the quarter. Excluding loss and LAE expense, consolidated expenses were $72 million in the quarter, down from $134 million a year ago ($79 million excluding an impairment and restructuring charge in Q3‘22). Reduced sales and marketing expenses were the major driver, down to $19 million from $29 million a year ago while tech and development costs were $12 million versus $15 million a year ago. These improvements were partially offset by an increase in Insurance Related Expenses to $20 million from $16 million a year ago. We also recently decided to take additional expense savings action including the difficult decision to make a staff reduction of up to 120 employees. We expect these actions to drive additional annualized savings between $50-70 million, partially beginning in Q4‘23. We ended the quarter in a strong financial position with cash and investments of $558 million, down from $565 million on June 30, 2023, as our Q3 adjusted EBITDA loss was partially offset by favorable changes in working capital. Services In our Services segment, our Q3 adjusted operating loss was $10 million, down from $16 million a year ago. Year-over-year growth remained strong with TGP up 32% to $122 million and revenue up 22% to $12 million. Hippo’s Agency continues to have tremendous success in the builder channel with volumes reaching another all-time high in the quarter despite the pressures on the broader housing market. Growth was driven by higher numbers of policies placed as well as higher premium per policy. Our third- party premium retention rate was 97% in the quarter. At First Connect, our digital marketplace for independent agents and carriers, we saw a year-over-year increase of more than 180% in non-Hippo new TGP during the quarter, despite challenging market conditions. By the

Letter to Shareholders | Q3 2023 8 end of this year, non-Hippo TGP will be triple the level it was at the end of 2021. We’ve been consistently adding to our portfolio of carriers to attract agency partners and in Q3, we hit a new record, with over 20,000 agency appointments granted, representing 3x growth from a year ago. As we look forward to 2024, we expect that continued revenue growth coupled with expense savings will turn our Services segment closer to positive operating income in the second half of 2024. Insurance-as-a-Service Adjusted operating income was steady at $4 million, up from $2 million in the year ago quarter. YoY TGP growth remains very strong at 72% and we see many opportunities for further growth in the market. Revenue grew 94% year over year. We continue to expand our Spinnaker platform while maintaining our high standards for due diligence, underwriting and expense discipline. Hippo Home Insurance Program HHIP’s adjusted operating loss of $32 million was HHIP’s best quarter since we began segment reporting. Underwriting and pricing actions taken in 2022 and 2023, continued expense control, and improved underwriting performance and improved reinsurance treaty terms all contributed. TGP at HHIP was $95 million, up 1% over the prior year quarter, as underwriting and pricing actions we took in 2022 and early 2023 resulted in higher rates that offset an intentional reduction in underlying policy count and exposure. We expect our recent actions to result in additional TGP declines in 2024. Our aim is to materially reduce our exposure to the hail and storm risks which have caused a disproportionate portion of our losses to date. Revenue of $29 million was up 77% over the prior year quarter largely reflecting the higher premium retention of our 2023 reinsurance treaty versus 2022’s treaty. In addition, we benefited from organic growth in TGP and higher investment income. HHIP’s gross loss ratio was 75%. Excluding PCS cats and prior year development, the core gross loss ratio was 69% versus 82% in the year-ago

Letter to Shareholders | Q3 2023 9 quarter. Our reserves for the large second quarter storm losses have been developing favorably but it’s still early. While we’re pleased with the loss ratio progress, we expect the more aggressive actions we’ve taken in recent months to drive even better results in the future results with significantly lower volatility. HHIP’s adjusted operating expenses, excluding Loss and LAE, were $26 million, down from $38 million in the prior year quarter. As a percent of TGP, these operating expenses were 27% versus 40% in the year ago quarter. While we are pleased with this improvement, we expect even more going forward, as a significant portion of our recent expense reduction actions were focused in this segment Guidance Summary • For the full year 2023, we now expect an adjusted EBITDA loss of $207- $212 million, compared to our previous range of $208-$218 million • 2023 revenue of $190-$195 million compared to our previous estimate of $178 million. Our 2023 TGP estimate remains $1.1 billion

Letter to Shareholders | Q3 2023 10 Non-GAAP financial measures This letter to shareholders includes the non-GAAP financial measure (including on a forward-looking basis) Adjusted EBITDA. Hippo defines Adjusted EBITDA, a non-GAAP financial measure, as net loss attributable to Hippo excluding interest expense, income tax expense, depreciation, amortization, stock-based compensation, net investment income, restructuring charges, impairment expense, other non-cash fair market value adjustments, and contingent consideration for one of our acquisitions and other transactions that we consider to be unique in nature. Hippo excludes these items from Adjusted EBITDA because it does not consider them to be directly attributable to its underlying operating performance. This non-GAAP measure is an addition, and not a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP and should not be considered as an alternative to net income, operating income or any other performance measures derived in accordance with GAAP. Reconciliations of non-GAAP measures to their most directly comparable GAAP counterparts are included in the Appendix to this presentation. Hippo believes that these non-GAAP measures of financial results (including on a forward-looking basis) provide useful supplemental information to investors about Hippo. Hippo’s management uses forward looking non-GAAP measures to evaluate Hippo’s projected financial and operating performance. However, there are a number of limitations related to the use of these non-GAAP measures and their nearest GAAP equivalents. For example other companies may calculate non-GAAP measures differently, or may use other measures to calculate their financial performance, and therefore Hippo’s non-GAAP measures may not be directly comparable to similarly titled measures of other companies. This letter to shareholders also includes certain projections of non-GAAP financial measures. Due to the high variability and difficulty in making accurate forecasts and projections of some of the information excluded from these projected measures, together with some of the excluded information not being ascertainable or accessible, Hippo is unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP financial measures without unreasonable effort. Consequently, no disclosure of estimated comparable GAAP measures is included and no reconciliation of the forward looking non-GAAP financial measures is included.

Letter to Shareholders | Q3 2023 11 This letter to shareholders also includes key operating and financial metrics including Total Generated Premium (“TGP”), Gross Loss Ratio and Net Loss Ratio. We define TGP as the aggregate written premium placed across all our business platforms for the period presented. We measure TGP as it reflects the volume of our business irrespective of choices related to how we structure our reinsurance treaties, the amount of risk we retain on our own balance sheet or the amount of business written in our capacity as an MGA, agency or as an insurance carrier/reinsurer. • We define Total Generated Premium in force as the aggregate annualized premium for all the policies in force as of the period end date. • We define Gross Loss Ratio expressed as a percentage, which is the ratio of the gross losses and loss adjustment expenses to the gross earned premium. • We define Core Gross Loss Ratio as current accident year loss ratio excluding PCS-defined catastrophe losses. • We define Net Loss Ratio expressed as a percentage, which is the ratio of the net losses and loss adjustment expenses to the net earned premium. Forward-looking statements safe harbor Certain statements included in this letter to shareholders that are not historical facts are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of financial results and other operating and performance metrics, our business strategy, our cost reduction efforts, the quality of our products and services, and the potential growth of our business, including our ability and timing to achieve profitability. These statements are based on the current expectations of Hippo’s management and are not predictions of actual performance. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions, and many actual events and circumstances are beyond the control of Hippo. These forward-looking

Letter to Shareholders | Q3 2023 12 statements are subject to a number of risks and uncertainties, including our ability to achieve or maintain profitability in the future; our ability to retain and expand our customer base and grow our business, including our builder network; our ability to manage growth effectively; risks relating to Hippo’s brand and brand reputation; denial of claims or our failure to accurately and timely pay claims; the effects of intense competition in the segments of the insurance industry in which we operate; the availability and adequacy of reinsurance, including at current coverage, limits or pricing; our ability to underwrite risks accurately and charge competitive yet profitable rates to our customers, and the sufficiency of the analytical models we use to assess and predict exposure to catastrophe losses; risks related to our proprietary technology and our digital platform; outages or interruptions or delays in services provided by our third party providers, including our data vendor; risks related to our intellectual property; the seasonal and cyclical nature of our business; the effects of severe weather events and other natural or man-made catastrophes, including the effects of climate change, global pandemics, and terrorism; continued disruptions from the COVID-19 pandemic; any overall decline in economic activity; the effects of existing or new legal or regulatory requirements on our business, including with respect to maintenance of risk-based capital and financial strength ratings, data privacy and cybersecurity, and the insurance industry generally; and other risks set forth in the sections entitled “Risk Factors” in our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward- looking statements. There may be additional risks that Hippo does not presently know, or that Hippo currently believes are immaterial, that could also cause actual results to differ from those contained in the forwardlooking statements. In addition, forward-looking statements reflect Hippo’s expectations, plans, or forecasts of future events and views as of the date of this letter to shareholders. Hippo anticipates that subsequent events and developments will cause Hippo’s assessments to change. However, while Hippo may elect to update these forward-looking statements at some point in the future, Hippo specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing Hippo’s assessments of any date subsequent to the date of this letter to shareholders. Accordingly, undue reliance should not be placed upon the forward-looking statements.

13Letter to Shareholders | Q3 2023 APPENDIX

Letter to Shareholders | Q3 2023 14 KEY OPERATING AND FINANCIAL METRICS (in millions, unaudited) Three Months Ended September 30 2023 2022 2023 2022 Total Generated Premium $303.7 $219.9 $866.3 $577.6 Total Revenue 57.7 30.7 145.2 83.9 Net Loss attributable to Hippo (53.1) (129.2) (230.8) (270.3) Adjusted EBITDA (38.4) (54.8) (178.3) (159.1) Gross Loss Ratio 59% 110% 81% 89% Net Loss Ratio 111% 223% 219% 245% Nine Months Ended September 30

Letter to Shareholders | Q3 2023 15 CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS (in millions, unaudited) 2023 2022 2023 2022 Revenue: Net earned premium $32.9 $10.7 $69.0 $30.9 Commission income, net 14.2 14.3 47.8 38.7 Service and fee income 4.9 3.2 11.9 10.3 Net investment income 5.7 2.5 16.5 4.0 Total revenue 57.7 30.7 145.2 83.9 Expenses: Losses and loss adjustment expenses 36.5 23.9 150.9 75.6 Insurance related expenses 20.3 15.6 54.8 46.2 Technology and development 11.9 14.8 36.6 46.0 Sales and marketing 18.9 29.4 63.9 73.7 General and administrative 20.7 19.0 62.0 53.7 Impairment and restructuring charges — 55.3 — 55.3 Interest and other (income) expense — (0.1) 0.5 (1.4) Total expenses 108.3 157.9 368.7 349.1 Loss before income taxes (50.6) (127.2) (223.5) (265.2) Income tax (benefit) expense (0.3) 0.3 0.2 0.8 Net loss (50.3) (127.5) (223.7) (266.0) Net income attributable to noncontrolling interests, net of tax 2.8 1.7 7.1 4.3 Net loss attributable to Hippo $(53.1) $(129.2) $(230.8) $(270.3) Other comprehensive income: Change in net unrealized gain or loss on investments, net of tax (0.7) (2.9) (0.1) (7.1) Comprehensive loss attributable to Hippo $(53.8) $(132.1) $(230.9) $(277.4) Per share data: Net loss attributable to Hippo - basic and diluted $(53.1) $(129.2) $(230.8) $(270.3) Weighted-average shares used in computing net loss per share attributable to Hippo - basic and diluted 23,729,570 22,839,916 23,440,555 22,651,026 Net loss per share attributable to Hippo - basic and diluted $(2.24) $(5.66) $(9.85) $(11.93) Three Months Ended September 30 Nine Months Ended September 30

Letter to Shareholders | Q3 2023 16 CONSOLIDATED BALANCE SHEETS (in millions) September 30, 2023 December 31, 2022 Assets Investments: Fixed maturities available-for-sale, at fair value $141.5 $121.1 Short-term investments, at fair value 188.5 324.8 Total investments 330.0 445.9 Cash and cash equivalents 228.4 194.5 Restricted cash 41.0 50.0 Accounts receivable, net of allowance 145.4 107.2 Reinsurance recoverable on paid and unpaid losses and LAE 297.3 286.3 Prepaid reinsurance premiums 375.5 309.9 Ceding commissions receivable 79.9 45.8 Capitalized internal use software 46.9 38.8 Intangible assets 23.6 26.9 Other assets 79.0 63.6 Total assets $1,647.0 $1,568.9 Liabilities and stockholders’ equity Liabilities: Loss and loss adjustment expense reserve 359.9 293.8 Unearned premiums 441.8 341.3 Reinsurance premiums payable 291.1 207.1 Provision for commission 18.0 5.0 Accrued expenses and other liabilities 124.9 128.2 Total liabilities 1,235.7 975.4 Commitments and contingencies Stockholders’ equity: Common stock — — Additional paid-in capital 1,606.1 1,558.0 Accumulated other comprehensive loss (7.1) (7.0) Accumulated deficit (1,192.0) (961.1) Total Hippo stockholders’ equity 407.0 589.9 Noncontrolling interest 4.3 3.6 Total stockholders’ equity 411.3 593.5 Total liabilities and stockholders' equity $1,647.0 $1,568.9 (Unaudited)

Letter to Shareholders | Q3 2023 17 2023 2022 Cash flows from operating activities: Net loss $(223.7) $(266.0) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation and amortization 14.4 11.2 Stock–based compensation expense 46.7 46.3 Change in fair value of warrant liability (0.2) (2.8) Change in fair value of contingent consideration liability 4.5 2.6 Impairment charges — 53.5 Other non-cash items (6.9) (0.3) Changes in assets and liabilities: Accounts receivable, net (38.2) (33.3) Reinsurance recoverable on paid and unpaid losses and LAE (11.0) (70.4) Ceding commissions receivable (34.2) (14.7) Prepaid reinsurance premiums (65.7) (70.0) Other assets 0.1 15.3 Provision for commission 13.0 1.1 Accrued expenses and other liabilities 6.6 15.5 Loss and loss adjustment expense reserves 66.1 60.7 Unearned premiums 100.6 63.4 Reinsurance premiums payable 84.0 56.5 Net cash used in operating activities (43.9) (131.4) Cash flows from investing activities: Capitalized internal use software costs (13.0) (11.4) Purchases of property and equipment (29.2) (4.8) Purchases of investments (290.7) (645.4) Maturities of investments 383.6 367.4 Sales of investments 29.8 5.5 Other (0.9) (2.0) Net cash provided by (used in) investing activities 79.6 (290.7) Cash flows from financing activities: Taxes paid related to net share settlement of equity awards (4.0) (3.5) Proceeds from issuances of common stock 2.4 3.4 Share repurchases under program (1.8) — Payments of contingent consideration (1.0) (0.4) Distributions to noncontrolling interests (6.5) (2.2) Other 0.1 (1.0) Net cash used in financing activities (10.8) (3.7) Net increase/(decrease) in cash, cash equivalents, and restricted cash 24.9 (425.8) Cash, cash equivalents, and restricted cash at the beginning of the period 244.5 818.7 Cash, cash equivalents, and restricted cash at the end of the period $269.4 $392.9 CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions, unaudited) Nine Months Ended September 30

Letter to Shareholders | Q3 2023 18 SUPPLEMENTAL FINANCIAL INFORMATION (in millions, unaudited) Total Generated Premium 2023 2022 2023 2022 Net loss attributable to Hippo $(53.1) $(129.2) $(230.8) $(270.3) Adjustments: Net investment income (5.7) (2.5) (16.5) (4.0) Depreciation and amortization 4.9 3.8 14.4 11.2 Stock-based compensation 14.0 17.0 46.8 46.3 Fair value adjustments (0.2) (0.2) (0.2) (2.8) Contingent consideration charge 0.8 0.2 4.5 2.6 Other one-off transactions 1.2 0.5 3.3 1.8 Income tax (benefit) expense (0.3) 0.3 0.2 0.8 Restructuring charges — 1.8 — 1.8 Goodwill impairment charge — 53.5 — 53.5 Adjusted EBITDA $(38.4) $(54.8) $(178.3) $(159.1) 2023 2022 Change 2023 2022 Change Gross Written Premium $229.5 $173.3 $56.2 $663.6 $452.2 $211.4 Gross Placed Premium 74.2 46.6 27.6 202.7 125.4 77.3 Total Generated Premium $303.7 $219.9 $83.8 $866.3 $577.6 $288.7 RECONCILIATION OF NON-GAAP FINANCIAL MEASURES TO THEIR MOST DIRECTLY COMPARABLE GAAP FINANCIAL MEASURES (in millions, unaudited) Three Months Ended September 30 Nine Months Ended September 30 Three Months Ended September 30 Nine Months Ended September 30

Letter to Shareholders | Q3 2023 19 Insurance Related Expenses Breakdown 2023 2022 2023 2022 PCS Losses 6% 45% 28% 29% Non-PCS Losses 53% 65% 53% 60% Gross Loss Ratio 59% 110% 81% 89% 2023 2022 2023 2022 Amortization of deferred direct acquisition costs, net $7.3 $1.9 $20.2 $13.6 Employee-related costs 3.0 3.4 9.4 9.3 Underwriting costs 2.5 1.9 6.5 6.0 Amortization of capitalized internal use software 3.4 2.4 9.4 6.3 Other 4.1 6.0 9.3 11.0 Total $20.3 $15.6 $54.8 $46.2 Gross and Net Loss Ratios 2023 2022 2023 2022 Gross Losses and LAE $124.6 $153.7 $450.9 $345.9 Gross Earned Premium 210.7 139.8 563.0 388.7 Gross Loss Ratio 59% 110% 81% 89% Net Losses and LAE $36.5 $23.9 $150.9 $75.6 Net Earned Premium 32.9 10.7 69.0 30.9 Net Loss Ratio 111% 223% 219% 245% Three Months Ended September 30 Nine Months Ended September 30 Three Months Ended September 30 Nine Months Ended September 30 Three Months Ended September 30 Nine Months Ended September 30 Gross Loss Ratio Breakdown

Letter to Shareholders | Q3 2023 20 Consolidated Gross Loss Ratio (GLR) HHIP Gross Loss Ratio (GLR) 2022 2023 Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Reported Consolidated GLR with ULAE 76% 78% 110% 42% 76% 76% 107% 59% Prior Accident Year (PAY) Action All PCS events (6%) (12%) (10%) (8%) (9%) (1%) (4%) 0% Non-PCS (13%) (10%) (8%) (2%) (8%) 0% (6%) 0% PAY Impact on GLR (19%) (22%) (18%) (10%) (17%) (1%) (10%) 0% PCS Cat Events Uri/Ian 0% 0% 52% (15%) 9% 0% (3%) 0% Other PCS 25% 33% 3% 13% 18% 26% 64% 6% PCS Impact on GLR 25% 33% 55% (2%) 27% 26% 61% 6% GLR excluding PAY and PCS Events 70% 67% 73% 54% 66% 51% 56% 53% 2022 2023 Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Reported HHIP GLR with ULAE 99% 95% 80% 59% 83% 101% 178% 75% Prior Accident Year (PAY) Action All PCS events (7%) (19%) (12%) (14%) (13%) 0% (2%) 0% Non-PCS (13%) (16%) (9%) (5%) (11%) (0%) (5%) 0% PAY Impact on GLR (20%) (35%) (21%) (19%) (24%) 0% (7%) 0% PCS Cat Events Uri/Ian 0% 0% 9% (3%) 1% 0% 0% 0% Other PCS 41% 55% 10% 22% 33% 41% 122% 6% PCS Impact on GLR 41% 55% 19% 19% 34% 41% 122% 6% HHIP GLR excluding PAY and PCS Events 78% 75% 82% 59% 73% 60% 63% 69%

Letter to Shareholders | Q3 2023 21 SEGMENTS (in millions, unaudited) Services Insurance- as-a-Service Hippo Home Insurance Program Intersegment Elimination1 Total Revenue: Net earned premium $ — $12.2 $20.7 $ — $32.9 Commission income, net 11.5 5.4 (0.5) (2.2) 14.2 Service and fee income 0.1 — 4.8 — 4.9 Net investment income — 1.8 3.9 — 5.7 Total Revenue 11.6 19.4 28.9 (2.2) 57.7 Adjusted Operating Expenses: Loss and loss adjustment expense — 5.2 31.0 — 36.2 Insurance related expense — 7.1 9.4 (0.7) 15.8 Sales and marketing 10.6 — 4.3 (0.9) 14.0 Technology and development 4.5 0.2 4.3 — 9.0 General and administrative 3.3 1.5 7.7 — 12.5 Other expenses 0.1 — — — 0.1 Total adjusted operating expenses 18.5 14.0 56.7 (1.6) 87.6 Less: Net investment income — (1.8) (3.9) — (5.7) Less: Noncontrolling interest (2.8) — — — (2.8) Adjusted operating income (loss) (9.7) 3.6 (31.7) (0.6) (38.4) Net investment income 5.7 Depreciation and amortization (4.9) Stock-based compensation (14.0) Fair value adjustments 0.2 Contingent consideration charge (0.8) Other one-off transactions (1.2) Income tax benefit (expense) 0.3 Net loss attributable to Hippo $(53.1) (1) Intersegment eliminations include commissions paid from Hippo Home Insurance Program for policies sold by the Company’s Services segment (revenue, cost, and other adjustments in respective business units eliminated as part of consolidation). Three Months Ended September 30, 2023

Letter to Shareholders | Q3 2023 22 Services Insurance- as-a-Service Hippo Home Insurance Program Intersegment Elimination1 Total Revenue: Net earned premium $ — $6.2 $4.5 $ — $10.7 Commission income, net 9.4 3.1 6.9 (5.1) 14.3 Service and fee income 0.1 — 3.1 — 3.2 Net investment income — 0.7 1.8 — 2.5 Total Revenue 9.5 10.0 16.3 (5.1) 30.7 Adjusted Operating Expenses: Loss and loss adjustment expense — 6.0 17.4 — 23.4 Insurance related expense — 0.2 16.7 (5.1) 11.8 Sales and marketing 19.8 — 4.1 — 23.9 Technology and development 1.8 — 7.6 — 9.4 General and administrative 2.2 1.1 9.5 — 12.8 Other expenses — — — — — Total adjusted operating expenses 23.8 7.3 55.3 (5.1) 81.3 Less: Net investment income — (0.7) (1.8) — (2.5) Less: Noncontrolling interest (1.7) — — — (1.7) Adjusted operating loss (16.0) 2.0 (40.8) — (54.8) Net investment income 2.5 Depreciation and amortization (3.8) Stock-based compensation (17.0) Fair value adjustments 0.2 Contingent consideration charge (0.2) Other one-off transactions (0.5) Income tax benefit (expense) (0.3) Restructuring charges (1.8) Goodwill impairment charge (53.5) Net loss attributable to Hippo (129.2) (1) Intersegment eliminations include commissions paid from Hippo Home Insurance Program for policies sold by the Company’s Services segment (revenue, cost, and other adjustments in respective business units eliminated as part of consolidation). Three Months Ended September 30, 2022

Letter to Shareholders | Q3 2023 23 Services Insurance- as-a-Service Hippo Home Insurance Program Intersegment Elimination1 Total Revenue: Net earned premium $ — $29.7 $39.3 $ — $69.0 Commission income, net 32.4 14.1 8.5 (7.2) 47.8 Service and fee income 0.4 — 11.5 — 11.9 Net investment income — 4.8 11.7 — 16.5 Total Revenue 32.8 48.6 71.0 (7.2) 145.2 Adjusted Operating Expenses: Loss and loss adjustment expense — 11.7 138.2 — 149.9 Insurance related expense — 16.0 27.9 (2.3) 41.6 Sales and marketing 33.9 — 14.4 (3.3) 45.0 Technology and development 12.3 0.5 13.6 — 26.4 General and administrative 9.3 4.1 23.1 — 36.5 Other expenses 0.5 — — — 0.5 Total adjusted operating expenses 56.0 32.3 217.2 (5.6) 299.9 Less: Net investment income — (4.8) (11.7) — (16.5) Less: Noncontrolling interest (7.1) — — — (7.1) Adjusted operating income (loss) (30.3) 11.5 (157.9) (1.6) (178.3) Net investment income 16.5 Depreciation and amortization (14.4) Stock-based compensation (46.8) Fair value adjustments 0.2 Contingent consideration charge (4.5) Other one-off transactions (3.3) Income tax benefit (expense) (0.2) Net loss attributable to Hippo $(230.8) Nine Months Ended September 30, 2023 (1) Intersegment eliminations include commissions paid from Hippo Home Insurance Program for policies sold by the Company’s Services segment (revenue, cost, and other adjustments in respective business units eliminated as part of consolidation).

Letter to Shareholders | Q3 2023 24 Services Insurance- as-a-Service Hippo Home Insurance Program Intersegment Elimination1 Total Revenue: Net earned premium $ — 15.6 15.3 $ — 30.9 Commission income, net 25.0 8.1 18.1 (12.5) 38.7 Service and fee income 0.8 — 9.5 — 10.3 Net investment income — 1.3 2.7 — 4.0 Total Revenue 25.8 25.0 45.6 (12.5) 83.9 Adjusted Operating Expenses: Loss and loss adjustment expense — 9.9 63.9 — 73.8 Insurance related expense — 6.5 41.9 (12.5) 35.9 Sales and marketing 44.5 0.2 13.8 — 58.5 Technology and development 5.3 — 23.1 — 28.4 General and administrative 6.8 3.3 27.5 — 37.6 Other expenses 0.5 — — — 0.5 Total adjusted operating expenses 57.1 19.9 170.2 (12.5) 234.7 Less: Net investment income — (1.3) (2.7) — (4.0) Less: Noncontrolling interest (4.3) — — — (4.3) Adjusted operating income (loss) (35.6) 3.8 (127.3) — (159.1) Net investment income 4.0 Depreciation and amortization (11.2) Stock-based compensation (46.3) Fair value adjustments 2.8 Contingent consideration charge (2.6) Other one-off transactions (1.8) Income tax benefit (expense) (0.8) Restructuring charges (1.8) Goodwill impairment charge (53.5) Net loss attributable to Hippo $(270.3) Nine Months Ended September 30, 2022 (1) Intersegment eliminations include commissions paid from Hippo Home Insurance Program for policies sold by the Company’s Services segment (revenue, cost, and other adjustments in respective business units eliminated as part of consolidation).

Hippo Reports Third Quarter 2023 Financial Results

PALO ALTO, Calif. November 02, 2023 – Hippo (NYSE: HIPO), the home insurance group focused on proactive home protection, today announced its consolidated financial results for the three months that ended September 30, 2023.

Complete financial results and full year guidance for 2023 can be found in the company's shareholder letter in the Investor Relations section of Hippo’s website at https://investors.hippo.com.

“The third quarter was our best as a public company yet, and we now expect to achieve EBITDA profitability before year-end 2024, earlier than previously projected” said Hippo President and CEO Rick McCathron. “It is a challenging time for the industry, but we have positioned ourselves for future growth in our Insurance-As-A-Service and fee-based segments and expected profitability in our risk-based segments. We are well positioned for when the market turns, as we continue protecting the joy of homeownership.”

Third Quarter Highlights

Adjusted EBITDA, Our Best Quarter Yet

•GAAP net loss attributable to Hippo of $53 million/adjusted EBITDA loss of $38 million

•Expect to turn adjusted EBITDA positive before year-end 2024, earlier than previously projected

Improving Core Gross Loss Ratio1

•Reported consolidated GLR for the quarter of 59% with a core consolidated GLR of 53%

•Hippo Homeowners Insurance Program (HHIP) core GLR for the quarter: 69%, improved from 82% a year ago

Outstanding TGP

•TGP up 38% YoY with Insurance-As-A-Service (IaaS) and Services now representing 65% of Total TGP in Force

•IaaS TGP growth of 72% YoY

•Services TGP growth of 32% YoY

Expense Improvement

•Operating expense, excluding loss and loss adjustment expense and an impairment and restructuring charge, declined to $72 million from $79 million a year ago

Financial Strength

•Cash and investments at $558 million at 9/30/23

•Spinnaker policyholder surplus of $182 million

1 Core Gross Loss Ratio defined as current accident year loss ratio excluding PCS-defined catastrophe losses

Conference Call and Webcast Information

Date: Thursday November 02, 2023

Time: 5:00 p.m. Eastern Time / 2:00 p.m. Pacific Time

Dial-in: 404 975 4839 (U.S.) / +1 646 904 5544 (International)

Conf ID: 930760

Webcast: https://events.q4inc.com/attendee/468482918

A replay of the webcast will be made available after the call in the investor relations section of the company’s website at https://investors.hippo.com/

Information about Key Operating Metrics/Non-GAAP Financial Measures

We define gross loss ratio expressed as a percentage, as the ratio of the gross losses and loss adjustment expenses, to the gross earned premium. We define TGP as the aggregate written premium placed across all of our business platforms for the period presented. We measure TGP as it reflects the volume of our business irrespective of choices related to how we structure our reinsurance treaties, the amount of risk we retain on our own balance sheet, or the amount of business written in our capacity as an MGA, agency, or as an insurance carrier/reinsurer. We define adjusted EBITDA, a Non-GAAP financial measure, as net loss attributable to Hippo excluding interest expense, income tax expense, depreciation, amortization, stock-based compensation, net investment income, restructuring charges, impairment expense, other non-cash fair market value adjustments, contingent consideration for one of our acquisitions, and other transactions that we consider to be unique in nature. We exclude these items from Adjusted EBITDA because we do not consider them to be directly attributable to our underlying operating performance. This Non-GAAP financial measure is in addition to, and not a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP and should not be considered as an alternative to net income, operating income or any other performance measures derived in accordance with GAAP. Reconciliations of this Non-GAAP financial measure to its most directly comparable GAAP counterpart is included in the shareholder letter referenced above. We believe that these non-GAAP measures of financial results provide useful supplemental information to investors about Hippo.

Forward-looking statements safe harbor

Certain statements included in this press release that are not historical facts are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of financial results and other operating and performance metrics, our business strategy, our cost reduction efforts, the quality of our products and services, and the potential growth of our business. These statements are based on the current expectations of Hippo’s management and are not predictions of actual performance. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions, and many actual events and circumstances are beyond the control of Hippo. These forward-looking statements are subject to a number of risks and uncertainties, including our ability to achieve or maintain profitability in the future; our ability to retain and expand our customer base and grow our business, including our builder network; our ability to manage growth effectively; risks relating to Hippo’s brand and brand reputation; denial of claims or our failure to accurately and timely pay claims; the effects of intense competition in the segments of the insurance industry in which we operate; the availability and adequacy of reinsurance, including at current coverage, limits or pricing; our ability to underwrite risks accurately and charge competitive yet profitable rates to our customers, and the sufficiency of the analytical models we use to assess and

predict exposure to catastrophe losses; risks related to our proprietary technology and our digital platform; outages or interruptions or delays in services provided by our third party providers, including our data vendor; risks related to our intellectual property; the seasonal and cyclical nature of our business; the effects of severe weather events and other natural or man-made catastrophes, including the effects of climate change, global pandemics, and terrorism; continued disruptions from the COVID-19 pandemic; any overall decline in economic activity; the effects of existing or new legal or regulatory requirements on our business, including with respect to maintenance of risk-based capital and financial strength ratings, data privacy and cybersecurity, and the insurance industry generally; and other risks set forth in the sections entitled “Risk Factors” in our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that Hippo does not presently know, or that Hippo currently believes are immaterial, that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Hippo’s expectations, plans, or forecasts of future events and views as of the date of this press release. Hippo anticipates that subsequent events and developments will cause Hippo’s assessments to change. However, while Hippo may elect to update these forward-looking statements at some point in the future, Hippo specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing Hippo’s assessments of any date subsequent to the date of this press release. Accordingly, undue reliance should not be placed upon the forward-looking statements.

About Hippo

Hippo is protecting the joy of homeownership, helping to safeguard customers’ most important financial asset by harnessing the power of real-time data, smart home technology, and a growing suite of home services to deliver proactive home protection.

Hippo Holdings Inc. operating subsidiaries include Hippo Insurance Services, Hippo Home Care, First Connect Insurance Services, Spinnaker Insurance Company, Spinnaker Specialty Insurance Company, and Mainsail Insurance Company. Hippo Insurance Services is a licensed property casualty insurance agent with products underwritten by various affiliated and unaffiliated insurance companies. For more information, including licensing details, visit http://www.hippo.com.

Contacts

Investors:

Cliff Gallant

Investors@hippo.com

Press:

Mark Olson

press@hippo.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

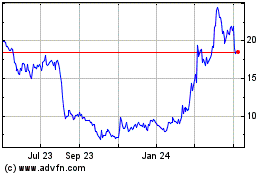

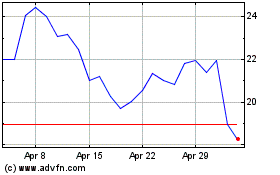

Hippo (NYSE:HIPO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hippo (NYSE:HIPO)

Historical Stock Chart

From Apr 2023 to Apr 2024