0001282631

false

NETLIST INC

0001282631

2023-10-31

2023-10-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or

15(d) of the Securities Exchange Act of 1934

October 31, 2023

Date of Report (Date of earliest event

reported):

NETLIST, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-33170 |

|

95-4812784 |

| (State or other jurisdiction of

|

|

(Commission |

|

(IRS Employer |

| incorporation) |

|

File Number) |

|

Identification Number) |

111 Academy, Suite 100

Irvine, California 92617

(Address of principal executive offices)

(949) 435-0025

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425

under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12

under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant

to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant

to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common stock, par value $0.001 per share |

|

NLST |

|

None |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Item 2.02. Results of Operations and Financial Condition.

On October 31, 2023, Netlist, Inc. (the

“Company”) issued a press release announcing the Company’s financial results for the third quarter ended September 30,

2023. A copy of the press release is attached hereto as Exhibit 99.1.

The information in this Current Report on Form 8-K,

including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of

1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended,

or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

NETLIST, INC. |

| |

|

| |

|

| Date: October 31, 2023 |

By: |

/s/ Gail M. Sasaki |

| |

|

Gail M. Sasaki |

| |

|

Executive Vice President and Chief Financial Officer |

Exhibit 99.1

Netlist Reports Third Quarter 2023 Results

IRVINE, CALIFORNIA, October 31, 2023 - Netlist, Inc.

(OTCQB: NLST) today reported financial results for the third quarter ended September 30, 2023.

“Product revenue in the third quarter improved 67% on a

sequential basis, as the memory market has begun to recover,” said Chief Executive Officer, C.K. Hong. “The transition

to new DDR5 based servers and high bandwidth memory for AI are creating huge demand for products that require Netlist’s

technology. The efforts to defend and fairly license our intellectual property continue and we look forward to the upcoming patent

infringement trial in January against Micron. Additionally, the recent split ruling from the U.S. Court of Appeals on the Samsung

contract remanded the case back to the district court. Netlist looks forward to having an opportunity to bring forth all the

evidence supporting its position.”

Net sales for the third quarter ended September 30, 2023 were

$16.7 million, compared to net sales of $34.4 million for the third quarter ended October 1, 2022. Gross profit for the third quarter

ended September 30, 2023 was $0.4 million, compared to a gross profit of $2.2 million for the third quarter ended October 1,

2022.

Net sales for the nine months ended September 30, 2023 were $35.8

million, compared to net sales of $140.0 million for the nine months ended October 1, 2022. Gross profit for the nine months ended

September 30, 2023 was $1.2 million, compared to a gross profit of $10.3 million for the nine months ended October 1, 2022.

Net loss for the third quarter ended September 30, 2023 was ($17.3)

million, or ($0.07) per share, compared to a net loss in the prior year period of ($9.6) million, or ($0.04) per share. These results

include stock-based compensation expense of $1.1 million and $0.9 million for the quarters ended September 30, 2023 and October 1,

2022, respectively.

Net loss for the nine months ended September 30, 2023 was ($47.2)

million, or ($0.20) per share, compared to a net loss in the prior year period of ($20.4) million, or ($0.09) per share. These results

include stock-based compensation expense of $3.4 million and $2.4 million for the nine months ended September 30, 2023 and October 1,

2022, respectively.

As of September 30, 2023, cash, cash equivalents and restricted

cash was $50.6 million, total assets were $68.2 million, working capital was $34.5 million, and stockholders’ equity was $36.1

million.

Conference Call Information

C.K. Hong, Chief Executive Officer, and Gail Sasaki, Chief Financial

Officer, will host an investor conference call today, October 31, 2023 at 12:00 p.m. Eastern Time to review Netlist’s

results for the third quarter ended September 30, 2023. The live webcast and archived replay of the call can be accessed for 90

days in the Investors section of Netlist’s website at www.netlist.com.

About Netlist

Netlist is a leading innovator in memory and storage solutions, pushing

the boundaries of technology to deliver unparalleled performance and reliability. With a rich portfolio of patented technologies, Netlist

has consistently driven innovation in the field of cutting-edge enterprise memory and storage, empowering businesses and industries to

thrive in the digital age. To learn more about Netlist, please visit www.netlist.com.

Safe Harbor Statement

This news release contains

forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements

are statements other than historical facts and often address future events or Netlist's future performance. Forward-looking

statements contained in this news release include statements about Netlist's ability to execute on its strategic initiatives. All

forward-looking statements reflect management's present expectations regarding future events and are subject to known and unknown

risks, uncertainties and other factors that could cause actual results to differ materially from those expressed in or implied by

any forward-looking statements. These risks, uncertainties and other factors include, among others: risks that Samsung will appeal

the final judgment by the trial court, which could cause a lengthy delay in Netlist’s ability to collect the damage award or

overturn the verdict or reduce the damages award; risks that the Ninth Circuit ruling will adversely affect Netlist’s ability

to defend the final judgment on appeal; risks related to Netlist's plans for its intellectual property, including its strategies for

monetizing, licensing, expanding, and defending its patent portfolio; risks associated with patent infringement litigation initiated

by Netlist, or by others against Netlist, as well as the costs and unpredictability of any such litigation; risks associated with

Netlist's product sales, including the market and demand for products sold by Netlist and its ability to successfully develop and

launch new products that are attractive to the market; the success of product, joint development and licensing partnerships; the

competitive landscape of Netlist's industry; and general economic, political and market conditions, including quarantines, factory

slowdowns and/or shutdowns. The military conflict between Russia and Ukraine may increase the likelihood of supply interruptions.

All forward-looking statements reflect management's present assumptions, expectations and beliefs regarding future events and are

subject to known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those

expressed in or implied by any forward-looking statements. These and other risks and uncertainties are described in Netlist's annual

report on Form 10-K for its most recently completed fiscal year filed on February 28, 2023, and the other filings it makes

with the U.S. Securities and Exchange Commission from time to time, including any subsequently filed quarterly and current reports.

In light of these risks, uncertainties and other factors, these forward-looking statements should not be relied on as predictions of

future events. These forward-looking statements represent Netlist's assumptions, expectations and beliefs only as of the date they

are made, and except as required by law, Netlist undertakes no obligation to revise or update any forward-looking statements for any

reason.

(Tables Follow)

| For more information, please contact: |

|

| The Plunkett Group |

Netlist, Inc. |

| Mike Smargiassi |

Gail M. Sasaki |

| NLST@theplunkettgroup.com |

Chief Financial Officer |

| (212) 739-6729 |

(949) 435-0025 |

Netlist, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(in thousands)

| | |

(unaudited) | | |

| |

| | |

September 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 43,226 | | |

$ | 25,011 | |

| Restricted cash | |

| 7,350 | | |

| 18,600 | |

| Accounts receivable, net | |

| 4,544 | | |

| 8,242 | |

| Inventories | |

| 9,175 | | |

| 10,686 | |

| Prepaid expenses and

other current assets | |

| 738 | | |

| 1,308 | |

| Total current assets | |

| 65,033 | | |

| 63,847 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 846 | | |

| 1,138 | |

| Operating lease right-of-use assets | |

| 1,754 | | |

| 2,043 | |

| Other assets | |

| 549 | | |

| 295 | |

| Total assets | |

$ | 68,182 | | |

$ | 67,323 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 27,360 | | |

$ | 28,468 | |

| Revolving line of credit | |

| — | | |

| 4,935 | |

| Accrued payroll and related liabilities | |

| 1,401 | | |

| 1,588 | |

| Accrued expenses and other current liabilities | |

| 1,777 | | |

| 2,635 | |

| Long-term debt due

within one year | |

| — | | |

| 447 | |

| Total current liabilities | |

| 30,538 | | |

| 38,073 | |

| Operating lease liabilities | |

| 1,350 | | |

| 1,744 | |

| Other liabilities | |

| 211 | | |

| 270 | |

| Total liabilities | |

| 32,099 | | |

| 40,087 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders' equity: | |

| | | |

| | |

| Preferred stock | |

| — | | |

| — | |

| Common stock | |

| 254 | | |

| 233 | |

| Additional paid-in capital | |

| 306,409 | | |

| 250,428 | |

| Accumulated deficit | |

| (270,580 | ) | |

| (223,425 | ) |

| Total stockholders'

equity | |

| 36,083 | | |

| 27,236 | |

| Total liabilities

and stockholders' equity | |

$ | 68,182 | | |

$ | 67,323 | |

Netlist, Inc. and Subsidiaries

Condensed Consolidated Statements

of Operations (Unaudited)

(in thousands, except per share amounts)

| | |

Three Months

Ended | | |

Nine Months

Ended | |

| | |

September 30, | | |

October 1, | | |

September 30, | | |

October 1, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Net sales | |

$ | 16,725 | | |

$ | 34,424 | | |

$ | 35,772 | | |

$ | 139,982 | |

| Cost of sales(1) | |

| 16,285 | | |

| 32,244 | | |

| 34,533 | | |

| 129,691 | |

| Gross profit | |

| 440 | | |

| 2,180 | | |

| 1,239 | | |

| 10,291 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development(1) | |

| 2,268 | | |

| 2,550 | | |

| 6,824 | | |

| 7,679 | |

| Intellectual property legal fees | |

| 12,891 | | |

| 5,577 | | |

| 32,908 | | |

| 11,716 | |

| Selling, general

and administrative(1) | |

| 3,160 | | |

| 3,767 | | |

| 9,515 | | |

| 11,429 | |

| Total operating

expenses | |

| 18,319 | | |

| 11,894 | | |

| 49,247 | | |

| 30,824 | |

| Operating loss | |

| (17,879 | ) | |

| (9,714 | ) | |

| (48,008 | ) | |

| (20,533 | ) |

| Other income, net: | |

| | | |

| | | |

| | | |

| | |

| Interest income, net | |

| 507 | | |

| 34 | | |

| 840 | | |

| 38 | |

| Other income,

net | |

| 33 | | |

| 82 | | |

| 14 | | |

| 74 | |

| Total other income,

net | |

| 540 | | |

| 116 | | |

| 854 | | |

| 112 | |

| Loss before provision for income taxes | |

| (17,339 | ) | |

| (9,598 | ) | |

| (47,154 | ) | |

| (20,421 | ) |

| Provision for income taxes | |

| — | | |

| — | | |

| 1 | | |

| 1 | |

| Net loss | |

$ | (17,339 | ) | |

$ | (9,598 | ) | |

$ | (47,155 | ) | |

$ | (20,422 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss per common share: | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

$ | (0.07 | ) | |

$ | (0.04 | ) | |

$ | (0.20 | ) | |

$ | (0.09 | ) |

| Weighted-average common shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

| 247,420 | | |

| 231,739 | | |

| 240,974 | | |

| 231,194 | |

| (1) Amounts include stock-based compensation

expense as follows: | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of sales | |

$ | 19 | | |

$ | 22 | | |

$ | 90 | | |

$ | 41 | |

| Research and development | |

| 231 | | |

| 283 | | |

| 691 | | |

| 674 | |

| Selling, general and administrative | |

| 895 | | |

| 587 | | |

| 2,637 | | |

| 1,649 | |

| Total stock-based

compensation | |

$ | 1,145 | | |

$ | 892 | | |

$ | 3,418 | | |

$ | 2,364 | |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

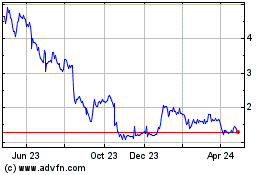

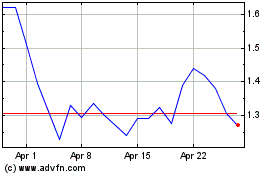

Netlist (QB) (USOTC:NLST)

Historical Stock Chart

From Mar 2024 to Apr 2024

Netlist (QB) (USOTC:NLST)

Historical Stock Chart

From Apr 2023 to Apr 2024