0001070050

false

0001070050

2023-10-26

2023-10-26

0001070050

APCX:CommonStockParValue0.001PerShareMember

2023-10-26

2023-10-26

0001070050

APCX:WarrantsEachWholeWarrantExercisableForOneShareOfCommonStockAtExercisePriceOf5.19Member

2023-10-26

2023-10-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 26, 2023

AppTech

Payments Corp.

(Exact

name of registrant as specified in its charter)

Delaware

(State

or other jurisdiction of incorporation)

| 000-27569 |

|

66-0847995 |

| (Commission

File Number) |

|

(IRS

Employer Identification No.) |

5876

Owens Ave, Suite

100

Carlsbad,

California 92008

(Address

of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code (760)

707-5959

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| |

☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on Which Registered |

| Common

stock, par value $0.001 per share |

|

APCX |

|

Nasdaq

Capital Market |

| Warrants,

each whole warrant exercisable for one share of common stock at an exercise price of $4.15 |

|

APCXW |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.01 Completion of Acquisition or Disposition

of Assets.

As disclosed on the Form 8-K filed with the Securities

and Exchange Commission (the “Commission”) on October 16, 2023 by AppTech Payments Corp. (the “Company”), on

October 13, 2023, the Company entered into a Membership Interest Purchase Agreement (the “Purchase Agreement”) with Alliance

Partners, LLC, a Nevada limited liability company (“Alliance Partners”), and Chris Leyva (the “Seller”), pursuant

to which the Company agreed, upon the terms and subject to the conditions of the Purchase Agreement, to purchase all of the Seller’s

interest in, to and under the membership interests of Alliance Partners (the “Transaction”). As consideration for the purchase

of the membership interests of Alliance Partners, the Company has agreed to pay the Seller a total consideration of $2,000,000 in cash

and assume the obligations and liabilities of Alliance Partners, subject to the satisfaction of certain customary closing conditions.

The Company closed the Transaction on October 26,

2023 (the “Closing Date”). Pursuant to the terms of the Purchase Agreement, the Company paid $500,000 to the Seller. Subsequent

to the Closing Date, on or before January 7, 2024, the Company shall pay $750,000 to the Seller, and on or before April 7, 2024, the Company

shall pay $750,000 to the Seller.

Forward-Looking Statements /Safe Harbor Statements

This Current Report on Form

8-K includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities

Litigation Reform Act of 1995. Certain of these forward-looking statements can be identified by the use of words such as “believes,”

“expects,” “anticipates,” “intends,” “plans,” “estimates,” “assumes,”

“may,” “should,” “will,” “would,” “will be” “seeks,” or other

similar expressions. These forward-looking statements include, but are not limited to, statements whether or not the Transaction will

be completed, the satisfaction of customary closing conditions related to the Transaction, and the timing of, and expectations in relation

to, any of the foregoing matters. These statements are based on current expectations on the date of this Current Report on Form 8-K and

involve a number of risks and uncertainties that may cause actual results to differ significantly. Actual events and circumstances are

difficult or impossible to predict and will differ from assumptions, and such differences may be material. Many actual events and circumstances

are beyond the control of the Company. The Company does not assume any obligation to update or revise any such forward-looking statements,

whether as the result of new developments or otherwise. Readers are cautioned not to put undue reliance on forward-looking statements.

Item 7.01 Regulation FD Disclosure.

A copy of the Company’s

press release announcing the closing of the Transaction is attached as Exhibit 99.1 to this Form 8-K.

Item 9.01. Exhibits.

* Previously filed.

** Furnished pursuant to Item 7.01 as part of this Current Report on

Form 8-K and not to be deemed “filed” pursuant to Section 18 of the Securities Exchange Act of 1934 or otherwise subject to

the liabilities of that section.

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, as amended, the Company has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

APPTECH

PAYMENTS CORP. |

| |

|

|

| Date:

October 27, 2023 |

By: |

/s/

Luke D’Angelo |

| |

|

Luke

D’Angelo |

| |

|

Chief

Executive Officer |

Exhibit 99.1

AppTech Payments

Corp. Completes Acquisition of FinZeo

Carlsbad, Calif. – October 27, 2023 -

AppTech Payments Corp. (NASDAQ: APCX), a pioneering Fintech company powering frictionless commerce between business to business and

business to consumer, today announced that it completed its acquisition of Alliance Partners, LLC, owners of FinZeo, a software development

company centered around the movement of money, nationally and globally.

FinZeo was founded in 2018 and is dedicated to delivering innovative

payment and banking technology solutions for businesses of all sizes. By integrating the FinZeo platform, AppTech believes it can augment

its technology offerings, furnishing users with cutting-edge tools accessible via online portals or through an API.

“This acquisition aligns seamlessly with

AppTech's strategic initiatives, marking our steadfast commitment to investing in innovation and technology. We are resolute in our mission

to foster revenue synergy and provide specialty payments for businesses and partners, while continuing to lead the way in the ever-evolving

Fintech landscape,” said Luke D’Angelo, Chairman & CEO of AppTech Payments Corp. “With FinZeo fully integrated into

our Commerse™ product suite, we trust the market will be highly receptive to our comprehensive PaaS and BaaS solutions. We welcome

the FinZeo team to our company and look forward to executing on our commercialization strategy to ultimately generate value for our shareholders.”

Finzeo’s API enables AppTech to optimize integration with software

providers and Independent Software Vendors (ISVs), facilitating rapid technology implementation. The onboarding process for ISVs will

be streamlined with the support of video tutorials, a dedicated customer center, and a sandbox API environment. With the assimilation

of FinZeo, AppTech advances into a Payment Facilitator (PayFac), propelling the company’s aggregation model.

To learn more about FinZeo, please visit www.finzeo.com.

About AppTech Payments Corp

AppTech Payments Corp. (NASDAQ: APCX) provides

digital financial services for corporations, small and midsized enterprises (“SMEs”) and consumers through the Company’s

scalable cloud-based platform architecture and infrastructure, coupled with our commerce experiences development and delivery model. AppTech

maintains exclusive licensing and partnership agreements in addition to a full suite of patented technology capabilities. For more information,

please visit www.apptechcorp.com.

Forward-Looking Statements

This press release contains forward-looking statements

that are inherently subject to risks and uncertainties. Any statements contained in this document that are not historical facts are forward-looking

statements as defined in the U.S. Private Securities Litigation Reform Act of 1995. Words such as "anticipate, believe, estimate,

expect, forecast, intend, may, plan, project, predict, should, will" and similar expressions as they relate to AppTech are intended

to identify such forward-looking statements. These risks and uncertainties include, but are not limited to, general economic and business

conditions, effects of continued geopolitical unrest and regional conflicts, competition, changes in methods of marketing, delays in manufacturing

or distribution, changes in customer order patterns, changes in customer offering mix, and various other factors beyond the Company's

control. Actual events or results may differ materially from those described in this press release due to any of these factors. AppTech

is under no obligation to update or alter its forward-looking statements, whether as a result of new information, future events, or otherwise.

Investor Relations Contact

Michael Kim/Brooks Hamilton

737-289-0835

APCX@mzgroup.us

AppTech Payments Corp.

760-707-5959

info@apptechcorp.com

v3.23.3

Cover

|

Oct. 26, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 26, 2023

|

| Entity File Number |

000-27569

|

| Entity Registrant Name |

AppTech

Payments Corp.

|

| Entity Central Index Key |

0001070050

|

| Entity Tax Identification Number |

66-0847995

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

5876

Owens Ave

|

| Entity Address, Address Line Two |

Suite

100

|

| Entity Address, City or Town |

Carlsbad

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92008

|

| City Area Code |

760

|

| Local Phone Number |

707-5959

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common stock, par value $0.001 per share |

|

| Title of 12(b) Security |

Common

stock, par value $0.001 per share

|

| Trading Symbol |

APCX

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each whole warrant exercisable for one share of common stock at an exercise price of $5.19 |

|

| Title of 12(b) Security |

Warrants,

each whole warrant exercisable for one share of common stock at an exercise price of $4.15

|

| Trading Symbol |

APCXW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=APCX_CommonStockParValue0.001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=APCX_WarrantsEachWholeWarrantExercisableForOneShareOfCommonStockAtExercisePriceOf5.19Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

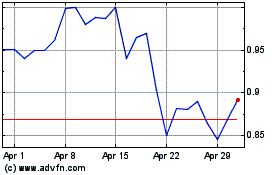

AppTech Payments (NASDAQ:APCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

AppTech Payments (NASDAQ:APCX)

Historical Stock Chart

From Apr 2023 to Apr 2024