FALSE000073101200007310122023-10-252023-10-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 25, 2023

HEALTHCARE SERVICES GROUP, INC.

(Exact name of registrant as specified in its charter)

Commission File Number: 0-12015

| | | | | |

| Pennsylvania | 23-2018365 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification number) |

3220 Tillman Drive, Suite 300, Bensalem, Pennsylvania

(Address of principal executive office)

19020

(Zip Code)

Registrant's telephone number, including area code: 215-639-4274

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

( ☐ ) Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

( ☐ ) Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

( ☐ ) Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

( ☐ ) Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | HCSG | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On October 25, 2023, Healthcare Services Group, Inc. (the "Company") issued a press release (the "Press Release") announcing its earnings for the three months ended September 30, 2023. A copy of the Press Release is being furnished hereto as Exhibit 99.1 and is hereby incorporated by reference to this Current Report.

The information furnished herein, including Exhibit 99.1 shall not be deemed "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

( a ) Not applicable

( b ) Not applicable

( c ) Not applicable

( d ) Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 104 | | Cover page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | HEALTHCARE SERVICES GROUP, INC. |

| Date: October 25, 2023 | By: | /s/ Andrew M. Brophy |

| | Name: Andrew M. Brophy

Title: Vice President, Controller & Principal Accounting Officer |

HCSG Reports Q3 2023 Results; Raises Cash Flow Expectations

•Revenue of $411.4 million; adjusted revenue(1) of $424.0 million, in line with expectations.

•Net income and diluted EPS of ($5.5) million and ($0.07); adjusted net income(1) and adjusted diluted EPS(1) of $12.5 million and $0.17, a 13.7% and 13.3% increase, respectively, over Q3 2022.

•Adjusted EBITDA(1) of $23.2 million, a 10.2% increase over Q3 2022.

•Cash flow from operations of $2.9 million; adjusted cash flow from operations(1) of $18.0 million, a 208.9% increase over Q3 2022.

•Raises expectations for second half of 2023 cash flow from operations from a range of $20.0 million to $30.0 million, to $35.0 million to $45.0 million.

BENSALEM, PA – (BUSINESS WIRE)-- Healthcare Services Group, Inc. (NASDAQ:HCSG) today reported results for the three months ended September 30, 2023.

Ted Wahl, Chief Executive Officer, stated, “We entered the second half of the year with three clear priorities and made substantial progress on all three during the quarter. The first was continuing to manage adjusted costs of services at 86%, which we did. The second was collecting what we bill, building on the strong momentum that we gained in May and June. In Q3 we delivered our strongest cash collections of the year, collecting over 98% of what we billed, with the modest shortfall primarily related to the timing of new business adds during the quarter. The third priority was executing on our organic growth strategy. Adjusted revenue for the quarter was up sequentially, our sales pipeline is growing, and our recruiting and management development efforts are ramping up as we ready ourselves for growth. We look forward to ending the year on a strong note and expect these positive operating, cash collection, and new business trends to continue into 2024.”

Mr. Wahl continued, “We also had two long-term clients initiate restructurings during the quarter. And while the resulting non-cash charges created some noise in Q3 revenue and earnings, I believe that, longer term, these restructuring actions will result in stronger, healthier clients with significant opportunities for future growth. The other positive takeaway is that with the impact of these two legacy issues behind us and the operating landscape continuing to improve, our visibility to deliver consistent results only increases.”

Mr. Wahl concluded, “As we look toward 2024, industry fundamentals continue to improve, and a stabilizing labor market and select state-based reimbursement increases have contributed to the gradual but steady occupancy recovery. On the regulatory front, there remains uncertainty as to what a final minimum staffing rule may look like. We remain hopeful that CMS will fully consider the impact on operators before finalizing a rule, and if one is ultimately implemented, have confidence in our customers’ ability to manage any such rule.”

Third Quarter Highlights

| | | | | | | | | | | | | | | | | |

| | GAAP | | Adjusted(1) | | | |

| Revenue | | $411.4 | | $424.0 | | | |

| Costs of services | | $377.6 | | $366.2 | | | |

| Selling, general and administrative | | $39.0 | | $40.3 | | | |

| Diluted (loss) earnings per share | | $(0.07) | | $0.17 | | | |

| Cash flows provided by operations | | $2.9 | | $18.0 | | | |

•Revenue was $411.4 million; adjusted revenue was $424.0 million, in line with the Company’s expectations of $420.0 million to $430.0 million. The Company estimates Q4 revenue in the range of $420.0 million to $430.0 million.

•Housekeeping & laundry and dining & nutrition segment revenues were $190.9 million and $220.5 million, respectively; adjusted housekeeping & laundry and dining & nutrition segment revenues were $194.6 million and $229.4 million, respectively.

◦Housekeeping & laundry and dining & nutrition segment margins were 5.4% and 0.9%, respectively; adjusted housekeeping & laundry and dining & nutrition segment margins were 7.2% and 4.7%, respectively.

•Costs of services was $377.6 million; adjusted costs of services was $366.2 million, or 86.4%, in line with the Company’s target of 86%. The Company’s goal is to continue to manage adjusted costs of services in the 86% range.

•SG&A was $39.0 million; adjusted SG&A was $40.3 million or 9.5%, within the Company’s targeted range of 8.5% to 9.5%. The Company expects to continue to manage adjusted SG&A within its targeted range.

•Diluted EPS was ($0.07) per share; adjusted diluted EPS was $0.17 per share, an increase of 13.3% over Q3 2022.

Balance Sheet and Liquidity

The Company’s primary sources of liquidity are cash and cash equivalents, its revolving credit facility, and cash flow from operating activities. As of the end of the third quarter, the Company had a current ratio of 2.8 to 1, cash and marketable securities of $121.3 million, and a $500.0 million credit facility, which expires in November 2027. Additionally, Q3 cash flow and adjusted cash flow from operations were $2.9 million and $18.0 million, respectively. The Company raised its expectations for the second half of 2023 cash flow from operations from a range of $20.0 to $30.0 million, to $35.0 to $45.0 million.

The Company has repurchased over 0.5 million shares, or $6.2 million, of its common stock during 2023, including over 0.3 million shares or $4.0 million of its common stock during the third quarter. The Company has 7.0 million shares remaining under its outstanding share repurchase authorization.

Conference Call and Upcoming Events

The Company will host a conference call on Wednesday, October 25, 2023, at 8:30 a.m. Eastern Time to discuss its results for the three months ended September 30, 2023. The call may be accessed via phone at 1 (888) 330-3451, Conference ID: 4431380. The call will be simultaneously webcast under the “Events & Presentations” section of the Investor Relations page on the Company’s website, www.hcsg.com. A replay of the webcast will also be available on the website for one year following the date of the earnings call.

(1) Adjusted results are non-GAAP financial measures and exclude the impact of certain items. See the tables within "Reconciliations of Non-GAAP Financial Measures" for more information.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This release and any schedules incorporated by reference into it may contain forward-looking statements within the meaning of federal securities laws, which are not historical facts but rather are based on current expectations, estimates and projections about our business and industry, and our beliefs and assumptions. Words such as “believes,” “anticipates,” “plans,” “expects,” “estimates,” “will,” “goal,” and similar expressions are intended to identify forward-looking statements. The inclusion of forward-looking statements should not be regarded as a representation by us that any of our plans will be achieved. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Such forward-looking information is also subject to various risks and uncertainties. Such risks and uncertainties include, but are not limited to, risks arising from our providing services to the healthcare industry and primarily providers of long-term care; the impact of and future effects of the COVID-19 pandemic or other potential pandemics; having a significant portion of our consolidated revenues contributed by one customer during the nine months ended September 30, 2023; credit and collection risks associated with the healthcare industry; the impact of bank failures; our claims experience related to workers’ compensation and general liability insurance (including any litigation claims, enforcement actions, regulatory actions and investigations arising from personal injury and loss of life related to COVID-19); the effects of changes in, or interpretations of laws and regulations governing the healthcare industry, our workforce and services provided, including state and local regulations pertaining to the taxability of our services and other labor-related matters such as minimum wage increases; the Company's expectations with respect to selling, general, and administrative expense; and the risk factors described in Part I of our Form 10-K for the fiscal year ended December 31, 2022 under “Government Regulation of Customers,” “Service Agreements and Collections,” and “Competition” and under Item 1A. “Risk Factors” in such Form 10-K.

These factors, in addition to delays in payments from customers and/or customers in bankruptcy, have resulted in, and could continue to result in, significant additional bad debts in the near future. Additionally, our operating results would be adversely affected by continued inflation particularly if increases in the costs of labor and labor-related costs, materials, supplies and equipment used in performing services (including the impact of potential tariffs and COVID-19) cannot be passed on to our customers.

In addition, we believe that to improve our financial performance we must continue to obtain service agreements with new customers, retain and provide new services to existing customers, achieve modest price increases on current service agreements with existing customers and/or maintain internal cost reduction strategies at our various operational levels. Furthermore, we believe that our ability to sustain the internal development of managerial personnel is an important factor impacting future operating results and the successful execution of our projected growth strategies. There can be no assurance that we will be successful in that regard.

USE OF NON-GAAP FINANCIAL INFORMATION

To supplement HCSG’s consolidated financial information, which are prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”), the Company believes that certain non-GAAP financial measures are useful in evaluating operating performance and comparing such performance to other companies.

The Company is presenting adjusted revenues, adjusted segment revenues, adjusted segment margins, adjusted costs of services provided, adjusted selling, general and administrative expense, adjusted net income, adjusted diluted earnings per share, adjusted cash flows provided by (used in) operations, earnings before interest, taxes, depreciation and amortization ("EBITDA"), and EBITDA excluding items impacting comparability ("Adjusted EBITDA"). We cannot provide a reconciliation of forward-looking non-GAAP measures to GAAP due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation. The presentation of non-GAAP financial measures is not meant to be considered in isolation or as a substitute for financial statements prepared in accordance with GAAP.

| | | | | | | | |

| Company Contacts: |

| | |

| Theodore Wahl | | Matthew J. McKee |

| President and Chief Executive Officer | | Chief Communications Officer |

| | |

| 215-639-4274 |

| investor-relations@hcsgcorp.com |

HEALTHCARE SERVICES GROUP, INC.

CONSOLIDATED STATEMENTS OF INCOME (LOSS)

(Unaudited)

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended | | For the Nine Months Ended | |

| | September 30, | | September 30, | | | |

| | 2023 | | 2022 | | 2023 | | 2022 | | | |

| Revenue | | $ | 411,388 | | | $ | 414,488 | | | $ | 1,247,549 | | | $ | 1,266,156 | | | | |

| Operating costs and expenses: | | | | | | | | | | | |

| Costs of services | | 377,554 | | | 376,894 | | | 1,106,260 | | | 1,129,526 | | | | |

| Selling, general and administrative | | 39,047 | | | 35,803 | | | 120,523 | | | 100,820 | | | | |

| (Loss) income from operations | | (5,213) | | | 1,791 | | | 20,766 | | | 35,810 | | | | |

| Other (expense) income, net | | (1,738) | | | (798) | | | 1,249 | | | (10,786) | | | | |

| (Loss) income before income taxes | | (6,951) | | | 993 | | | 22,015 | | | 25,024 | | | | |

| | | | | | | | | | | |

| Income tax (benefit) provision | | (1,457) | | | 671 | | | 6,227 | | | 6,553 | | | | |

| Net (loss) income | | $ | (5,494) | | | $ | 322 | | | $ | 15,788 | | | $ | 18,471 | | | | |

| | | | | | | | | | | |

| Basic (loss) earnings per common share | | $ | (0.07) | | | $ | 0.00 | | | $ | 0.21 | | | $ | 0.25 | | | | |

| | | | | | | | | | | |

| Diluted (loss) earnings per common share | | $ | (0.07) | | | $ | 0.00 | | | $ | 0.21 | | | $ | 0.25 | | | | |

| | | | | | | | | | | |

| Basic weighted average number of common shares outstanding | | 74,364 | | | 74,340 | | | 74,446 | | | 74,334 | | | | |

| | | | | | | | | | | |

| Diluted weighted average number of common shares outstanding | | 74,364 | | | 74,348 | | | 74,446 | | | 74,346 | | | | |

HEALTHCARE SERVICES GROUP, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(in thousands)

| | | | | | | | | | | |

| September 30, 2023 | | December 31, 2022 |

| Cash and cash equivalents | $ | 31,313 | | | $ | 26,279 | |

| Marketable securities, at fair value | 90,004 | | | 95,200 | |

| Accounts and notes receivable, net | 367,807 | | | 336,777 | |

| Other current assets | 44,239 | | | 50,376 | |

| Total current assets | 533,363 | | | 508,632 | |

| | | |

| Property and equipment, net | 29,145 | | | 22,975 | |

| Notes receivable — long-term, net | 28,770 | | | 32,609 | |

| Goodwill | 75,529 | | | 75,529 | |

| Other intangible assets, net | 12,799 | | | 15,946 | |

| Deferred compensation funding | 36,408 | | | 33,493 | |

| Other assets | 34,702 | | | 29,150 | |

| Total assets | $ | 750,716 | | | $ | 718,334 | |

| | | |

| Accrued insurance claims — current | $ | 25,160 | | | $ | 23,166 | |

| Other current liabilities | 162,614 | | | 155,453 | |

| Total current liabilities | 187,774 | | | 178,619 | |

| | | |

| Accrued insurance claims — long-term | 69,755 | | | 65,541 | |

| Deferred compensation liability — long-term | 36,686 | | | 33,764 | |

| Lease liability — long-term | 11,645 | | | 8,097 | |

| Other long term liabilities | 3,123 | | | 6,141 | |

| Stockholders' equity | 441,733 | | | 426,172 | |

| Total liabilities and stockholders' equity | $ | 750,716 | | | $ | 718,334 | |

HEALTHCARE SERVICES GROUP, INC.

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of GAAP revenue to adjusted revenue (in thousands) | | For the Three Months Ended | | For the Nine Months Ended |

| September 30, | | September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| GAAP revenue | | $ | 411,388 | | | $ | 414,488 | | | $ | 1,247,549 | | | $ | 1,266,156 | |

Client restructurings(1) | | 12,629 | | | 10,000 | | | 12,629 | | | 10,000 | |

| Adjusted revenue | | $ | 424,017 | | | $ | 424,488 | | | $ | 1,260,178 | | | $ | 1,276,156 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of GAAP costs of services to adjusted costs of services (in thousands) | | For the Three Months Ended | | For the Nine Months Ended | |

| September 30, | | September 30, |

| 2023 | | 2022 | | 2023 | | 2022 | | | |

| GAAP costs of services | | $ | 377,554 | | | $ | 376,894 | | | $ | 1,106,260 | | | $ | 1,129,526 | | | | |

Client restructurings(1) | | 9,093 | | | — | | | 9,093 | | | — | | | | |

Bad debt expense adjustments(2) | | 2,308 | | | 4,586 | | | 14,722 | | | 18,092 | | | | |

| Adjusted costs of services | | $ | 366,153 | | | $ | 372,308 | | | $ | 1,082,445 | | | $ | 1,111,434 | | | | |

| Adjusted costs of services as a percentage of Adjusted revenues | | 86.4 | % | | 87.7 | % | | 85.9 | % | | 87.1 | % | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of GAAP selling, general and administrative ("SG&A") to adjusted SG&A (in thousands) | | For the Three Months Ended | | For the Nine Months Ended | |

| September 30, | | September 30, |

| 2023 | | 2022 | | 2023 | | 2022 | | | |

| GAAP SG&A | | $ | 39,047 | | | $ | 35,803 | | | $ | 120,523 | | | $ | 100,820 | | | | |

(Gain)/loss on deferred compensation in SG&A(3) | | (1,242) | | | (1,160) | | | 2,629 | | | (11,324) | | | | |

| Adjusted SG&A | | $ | 40,289 | | | $ | 36,963 | | | $ | 117,894 | | | $ | 112,144 | | | | |

| Adjusted SG&A as a percentage of adjusted revenues | | 9.5 | % | | 8.7 | % | | 9.4 | % | | 8.8 | % | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of GAAP net (loss) income to adjusted net income (in thousands) and (loss) earnings per share to adjusted diluted earnings per share | | For the Three Months Ended | | For the Nine Months Ended | |

| September 30, | | September 30, |

| 2023 | | 2022 | | 2023 | | 2022 | | | |

| GAAP net (loss) income | | $ | (5,494) | | | $ | 322 | | | $ | 15,788 | | | $ | 18,471 | | | | |

| (Gain)/loss on deferred compensation, net | | (15) | | | (335) | | | 67 | | | 121 | | | | |

Bad debt expense adjustments(2) | | 2,308 | | | 4,586 | | | 14,722 | | | 18,092 | | | | |

Client restructurings(1) | | 21,722 | | | 10,000 | | | 21,722 | | | 10,000 | | | | |

Tax effect of adjustments(4) | | (6,004) | | | (3,563) | | | (9,128) | | | (7,053) | | | | |

| Adjusted net income | | $ | 12,517 | | | $ | 11,010 | | | $ | 43,171 | | | $ | 39,631 | | | | |

| Adjusted net income as a percentage of adjusted revenues | | 3.0 | % | | 2.6 | % | | 3.4 | % | | 3.1 | % | | | |

| GAAP diluted earnings per share | | $ | (0.07) | | | $ | 0.00 | | | $ | 0.21 | | | $ | 0.25 | | | | |

| Adjusted diluted earnings per share | | $ | 0.17 | | | $ | 0.15 | | | $ | 0.58 | | | $ | 0.53 | | | | |

| Weighted-average shares outstanding - diluted | | 74,364 | | | 74,348 | | | 74,446 | | | 74,346 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of GAAP net (loss) income to EBITDA and adjusted EBITDA (in thousands) | | For the Three Months Ended | | For the Nine Months Ended | |

| September 30, | | September 30, |

| 2023 | | 2022 | | 2023 | | 2022 | | | |

| GAAP net (loss) income | | $ | (5,494) | | | $ | 322 | | | $ | 15,788 | | | $ | 18,471 | | | | |

| Income tax (benefit) provision | | (1,457) | | | 671 | | | 6,227 | | | 6,553 | | | | |

| Interest, net | | 529 | | | (353) | | | 1,119 | | | (1,386) | | | | |

Depreciation and amortization(5) | | 3,250 | | | 3,795 | | | 10,565 | | | 11,560 | | | | |

| EBITDA | | $ | (3,172) | | | $ | 4,435 | | | $ | 33,699 | | | $ | 35,198 | | | | |

| Share-based compensation | | 2,384 | | | 2,388 | | | 6,793 | | | 7,156 | | | | |

| Gain/loss on deferred compensation, net | | (15) | | | (335) | | | 67 | | | 121 | | | | |

| | | | | | | | | | | |

Bad debt expense adjustments(2) | | 2,308 | | | 4,586 | | | 14,722 | | | 18,092 | | | | |

Client restructurings(1) | | 21,722 | | | 10,000 | | | 21,722 | | | 10,000 | | | | |

| Adjusted EBITDA | | $ | 23,227 | | | $ | 21,074 | | | $ | 77,003 | | | $ | 70,567 | | | | |

| Adjusted EBITDA as a percentage of adjusted revenue | | 5.5 | % | | 5.0 | % | | 6.1 | % | | 5.5 | % | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of GAAP cash flows provided by (used in) operations to adjusted cash flows provided by (used in) operations (in thousands) | | For the Three Months Ended | | For the Nine Months Ended | |

| September 30, | | September 30, |

| 2023 | | 2022 | | 2023 | | 2022 | | | |

| GAAP cash flows provided by (used in) operations | | $ | 2,939 | | | $ | (9,896) | | | $ | (5,947) | | | $ | (31,060) | | | | |

Accrued payroll(6) | | 15,039 | | | 15,717 | | | 17,377 | | | 21,240 | | | | |

| Adjusted cash flows provided by (used in) operations | | $ | 17,978 | | | $ | 5,821 | | | $ | 11,430 | | | $ | (9,820) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of GAAP segment margins to adjusted segment revenue and segment margins (in thousands) | | For the Three Months Ended | | For the Nine Months Ended |

| September 30, | | September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| GAAP revenue - housekeeping | | $ | 190,920 | | | $ | 196,941 | | | $ | 575,256 | | | $ | 597,710 | |

Client restructurings(1) - housekeeping | | 3,716 | | | 2,289 | | | 3,716 | | | 2,289 | |

| Adjusted revenue - housekeeping | | $ | 194,636 | | | $ | 199,230 | | | $ | 578,972 | | | $ | 599,999 | |

| | | | | | | | |

| GAAP revenue - dietary | | $ | 220,468 | | | $ | 217,547 | | | $ | 672,293 | | | $ | 668,446 | |

Client restructurings(1) - dietary | | 8,913 | | | 7,711 | | | 8,913 | | | 7,711 | |

| Adjusted revenue - dietary | | $ | 229,381 | | | $ | 225,258 | | | $ | 681,206 | | | $ | 676,157 | |

| | | | | | | | |

| Segment margins: | | | | | | | | |

| GAAP housekeeping | | 5.4 | % | | 8.9 | % | | 8.2 | % | | 9.3 | % |

| GAAP dietary | | 0.9 | % | | (0.2) | % | | 4.3 | % | | 2.9 | % |

| Adjusted housekeeping | | 7.2 | % | | 10.0 | % | | 8.8 | % | | 9.7 | % |

| Adjusted dietary | | 4.7 | % | | 3.3 | % | | 5.6 | % | | 4.0 | % |

(1) Client restructurings include changes to contracts with existing customers for which the Company has either recorded a reduction to revenue or an increase to bad debt expense due to clients entering bankruptcy, receivership, or out-of-court workouts.

(2) The bad debt expense adjustment reflects the difference between GAAP bad debt expense (CECL) and historical write-offs as a percentage of adjusted revenues, both of which are based on the same seven year look-back period.

(3) Represents the changes in fair market value on deferred compensation investments. The impact of offsetting investment portfolio gains are included in the “Other (expense) income, net” caption on the Consolidated Statements on Income (Loss).

(4) The tax impact of adjustments is calculated using a 25% effective tax rate.

(5) Includes right-of-use asset depreciation of $1.8 million and $4.6 million for the three and nine months ended September 30, 2023, respectively, and $1.5 million and $4.6 million for the three and nine months ended September 30, 2022, respectively.

(6) The accrued payroll adjustment reflects changes in accrued payroll for the three and nine months ended September 30, 2023 and 2022. The Company processes payroll on set weekly and bi-weekly schedules, and the timing of payments may result in operating cash flow increases or decreases which are not indicative of the Company’s quarterly cash flow performance.

v3.23.3

Document

|

Oct. 25, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 25, 2023

|

| Entity Registrant Name |

HEALTHCARE SERVICES GROUP, INC.

|

| Entity File Number |

0-12015

|

| Entity Incorporation, State or Country Code |

PA

|

| Entity Tax Identification Number |

23-2018365

|

| Entity Address, Address Line One |

3220 Tillman Drive

|

| Entity Address, Address Line Two |

Suite 300

|

| Entity Address, City or Town |

Bensalem

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19020

|

| City Area Code |

215

|

| Local Phone Number |

639-4274

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

HCSG

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0000731012

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

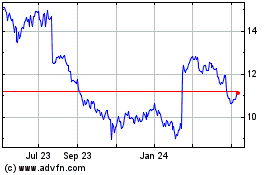

Healthcare Services (NASDAQ:HCSG)

Historical Stock Chart

From Mar 2024 to Apr 2024

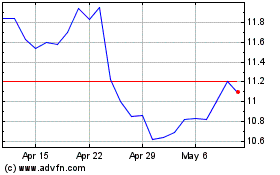

Healthcare Services (NASDAQ:HCSG)

Historical Stock Chart

From Apr 2023 to Apr 2024