UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

October 25, 2023

(Commission File Number: 001-15128)

United Microelectronics Corporation

(Translation of registrant’s name into English)

No. 3 Li-Hsin 2nd Road

Hsinchu Science Park

Hsinchu, Taiwan, R.O.C.

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101 (b) (1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101 (b) (7):

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

|

|

United Microelectronics Corporation |

|

|

|

By: |

Chitung Liu |

Name: |

Chitung Liu |

Title: |

CFO |

Date: October 25, 2023

2

EXHIBIT INDEX

3

www.umc.com

www.umc.com

Exhibit

Exhibit Description

99.1 Announcement on 2023/10/11: UMC will convene Q3 2023 Investor Conference

99.2 Announcement on 2023/10/25: Announcement of board meeting approved the consolidated financial statements for the third quarter of 2023

99.3 Announcement on 2023/10/25: The board meeting approved capital budget execution

99.4 Announcement on 2023/10/25: The Board of Directors Approved the Cancellation of Restricted Shares to Employees Stock Awards

99.5 Announcement on 2023/10/25: The Board of Directors resolved to release the managerial officer from non-competition restrictions

99.6 Announcement on 2023/10/25: UMC announced its operating results for the third quarter of 2023

99.7 Announcement on 2023/10/06: September Revenue

99.8 Announcement on 2023/10/10: the trading and pledge of UMC common shares by directors, executive officers and 10% shareholders of UMC

Exhibit 99.1

UMC will convene Q3 2023 Investor Conference

1. Date of institutional investor conference: 2023/10/25

2. Time of institutional investor conference: 17:00

3. Location of institutional investor conference: Online teleconference

4. Outline of institutional investor conference:

UMC Q3 2023 Financial and Operating Results

5. Any other matters that need to be specified: None

Exhibit 99.2

Announcement of board meeting approved the consolidated financial statements for the third quarter of 2023

1. Date of submission to the board of directors or approval by the board of directors: 2023/10/25

2. Date of approval by the audit committee: 2023/10/25

3. Start and end dates of financial reports or annual self-assessed financial information of the reporting period (XXXX/XX/XX~XXXX/XX/XX): 2023/01/01~2023/09/30

4. Operating revenue accumulated from 1/1 to end of the period (thousand NTD): 167,574,722

5. Gross profit (loss) from operations accumulated from 1/1 to end of the period (thousand NTD): 59,937,544

6. Net operating income (loss) accumulated from 1/1 to end of the period (thousand NTD): 45,467,335

7. Profit (loss) before tax accumulated from 1/1 to end of the period (thousand NTD): 56,262,347

8. Profit (loss) accumulated from 1/1 to end of the period (thousand NTD): 48,247,012

9. Profit (loss) during the period attributable to owners of parent accumulated from 1/1 to end of the period (thousand NTD): 47,794,836

10. Basic earnings (loss) per share accumulated from 1/1 to end of the period (NTD): 3.87

11. Total assets end of the period (thousand NTD): 547,270,956

12. Total liabilities end of the period (thousand NTD): 197,254,767

13. Equity attributable to owners of parent end of the period (thousand NTD): 349,677,213

14. Any other matters that need to be specified: NA

Exhibit 99.3

The board meeting approved capital budget execution

1. Date of the resolution of the board of directors or shareholders meeting: 2023/10/25

2. Content of the investment plan: capital budget execution

3. Projected monetary amount of the investment: NT$ 1,297 million

4. Projected date of the investment: by capital budget plan

5. Source of capital funds: working capital

6. Specific purpose: capacity deployment

7. Any other matters that need to be specified: none

Exhibit 99.4

The Board of Directors Approved the Cancellation of Restricted Shares to Employees Stock Awards

1. Date of the board of directors’ resolution: 2023/10/25

2. Reason for capital reduction: The Restricted shares to employees will be returned to the Company and cancelled due to non-fulfillment of the vesting conditions.

3. Amount of capital reduction: NT$445,810

4. Cancelled shares: 44,581 shares

5. Capital reduction percentage: 0.0004%

6. Share capital after capital reduction: NT$125,030,946,600

7. Scheduled date of the shareholders meeting: N/A

8. Estimated no. of listed common shares after issuance of new shares upon capital reduction: N/A

9. Estimated ratio of listed common shares after issuance of new shares upon capital reduction to outstanding common shares: N/A

10. Please explain any countermeasures for lower circulation in shareholding if the aforesaid estimated no. of listed common shares upon capital reduction does not reach 60 million and the percentage does not reach 25%: N/A

11. The record date for capital reduction: 2023/10/25

12. Any other matters that need to be specified: None

Exhibit 99.5

The Board of Directors resolved to release the managerial officer from non-competition restrictions

1. Date of the board of directors’ resolution: 2023/10/25

2. Name and title of the managerial officer with permission to engage in competitive conduct:

(1) C C Hsu, Vice President

(2) M C Lai, Vice President

(3) Francia, Hsu, Vice President

3. Items of competitive conduct in which the officer is permitted to engage:

(1) C C Hsu, Vice President

To act as the director of HeJian Technology (Suzhou) Co., Ltd.

(2) M C Lai, Vice President

To act as the director of United Semiconductor (Xiamen) Co., Ltd.

(3) Francia, Hsu, Vice President

To act as the director of United Semiconductor (Xiamen) Co., Ltd. and HeJian Technology (Suzhou) Co., Ltd.

4. Period of permission to engage in the competitive conduct: Employment period

5. Circumstances of the resolution (please describe the results of voting in accordance with Article 32 of the Company Act): Approved

6. If the permitted competitive conduct belongs to the operator of a mainland China area enterprise, the name and title of the managerial officer (if it is not the operator of a mainland China area enterprise, please enter “N/A” below):

(1) C C Hsu, Vice President

(2) M C Lai, Vice President

(3) Francia, Hsu, Vice President

7. Company name of the mainland China area enterprise and the officer’s position in the enterprise:

(1) C C Hsu, Vice President

To act as the director of HeJian Technology (Suzhou) Co., Ltd.

(2) M C Lai, Vice President

To act as the director of United Semiconductor (Xiamen) Co., Ltd.

(3) Francia, Hsu, Vice President

To act as the director of United Semiconductor (Xiamen) Co., Ltd. and HeJian Technology (Suzhou) Co., Ltd.

8. Address of the mainland China area enterprise:

(1) HeJian Technology (Suzhou) Co., Ltd.:

No.333, Xinghua St., Suzhou Industrial Park, Suzhou

(2) United Semiconductor (Xiamen) Co., Ltd.:

No.899, Wan Jia Chun Road, Xiang’an District, Xiamen

9. Operations of the mainland China area enterprise:

(1) HeJian Technology (Suzhou) Co., Ltd.:

Sales and manufacturing of integrated circuits

(2) United Semiconductor (Xiamen) Co., Ltd.:

Sales and manufacturing of integrated circuits

10. Impact on the company’s finance and business: None

11. If the managerial officer has invested in the mainland China area enterprise, the monetary amount of the investment and the officer’s shareholding ratio: None

12. Any other matters that need to be specified: None

Exhibit 99.6

UMC announced its operating results for the third quarter of 2023

1. Date of occurrence of the event: 2023/10/25

2. Company name: UNITED MICROELECTRONICS CORPORATION

3. Relationship to the Company (please enter “head office” or “subsidiaries”): head office

4. Reciprocal shareholding ratios: N/A

5. Cause of occurrence:

UMC Reports Third Quarter 2023 Results

12A P6 production ramp lifts 22/28nm revenue contribution to 32%

2023 Year to Date EPS totaled NT$3.87

Third Quarter 2023 Overview:

‧Revenue: NT$57.07 billion (US$1.77 billion)

‧Gross margin: 35.9%; Operating margin: 26.8%

‧Revenue from 22/28nm: 32%

‧Capacity utilization rate: 67%

‧Net income attributable to shareholders of the parent: NT$15.97 billion (US$495 million)

‧Earnings per share: NT$1.29; earnings per ADS: US$0.200

Taipei, Taiwan, ROC – October 25, 2023 – United Microelectronics Corporation (NYSE: UMC; TWSE: 2303) (“UMC” or “The Company”), a leading global semiconductor foundry, today announced its consolidated operating results for the third quarter of 2023.

Third quarter consolidated revenue was NT$57.07 billion, increasing 1.4% QoQ from NT$56.30 billion in 2Q23. Compared to a year ago, 3Q23 revenue declined 24.3% YoY from NT$75.39 billion in 3Q22. Consolidated gross margin for 3Q23 was 35.9%. Net income attributable to the shareholders of the parent was NT$15.97 billion, with earnings per ordinary share of NT$1.29.

Jason Wang, co-president of UMC, said, “During the third quarter, despite a 2.3% decrease in wafer shipments, quarterly revenue and gross margin remained firm QoQ which primarily attributed to the demand strength in computing and communication segments, continuous product mix enhancement as well as favorable currency movement. From end markets perspective, strength in computing applications were propelled by LCD controller, WiFi, codec and touch IC controllers while shipments in communication segments increased due to demand for RF front end IC and networking chips. Looking back at 2023, although foundry industry experienced a significant decline in market demand, UMC maintained solid structural profitability supported by firmness in blended ASP due to continuous product mix optimization efforts and the increasing contribution from specialty technologies. As UMC continues to introduce new specialty technologies to solidify our differentiation, we will strengthen the competitiveness of our customers and enhance their respective market position.”

Co-president Wang said, “For the fourth quarter, with the recent rush orders from PC and smartphones, we expect demand has gradually stabilized. However, customers still employ a cautious and conservative approach in maintaining lean inventory levels while automotive business conditions appear challenging. For 2024, we anticipate the production ramp of our 12A Phase 6 fab will further enhance revenue contribution from 22/28nm continuing the robust business traction for UMC. In addition, through our technology leadership, we will ramp up our offering on 22nm derivative products which will further our specialty technology product pipeline.”

Co-president Wang continued, “Talent is UMC's most important and highly valued asset. We respect the uniqueness of every employee and are committed to creating a diverse, equal, and inclusive workplace environment. Receiving the ‘HR Asia’ award for the ‘Best Employer in Asia’ in July is a recognition of our years of effort. Our goal is to create a culture of diversity and inclusivity in our workplace that enables employees to leverage their strengths, thereby playing a pivotal role in the Company's sustained growth and enduring success.”

Fourth Quarter 2023 Outlook & Guidance

‧Wafer Shipments: Will decline by approximately 5%

‧ASP in USD: Will remain flat

‧Gross Profit Margin: Will be in the low-30% range

‧Capacity Utilization: low-60% range

‧2023 CAPEX: US$3.0 billion

6. Countermeasures: N/A

7. Any other matters that need to be specified (the information disclosure also meets the requirements of Article 7, subparagraph 9 of the Securities and Exchange Act Enforcement Rules, which brings forth a significant impact on shareholders rights or the price of the securities on public companies.): N/A

Exhibit 99.7

United Microelectronics Corporation

October 6, 2023

This is to report the changes or status of 1) Sales volume, 2) Funds lent to other parties, 3) Endorsements and guarantees, and 4) Financial derivative transactions for the period of September 2023.

1)Sales volume (NT$ Thousand)

|

|

|

|

|

|

Period |

Items |

2023 |

2022 |

Changes |

% |

September |

Net sales |

19,052,938 |

25,218,828 |

(6,165,890) |

(24.45%) |

Year-to-Date |

Net sales |

167,574,722 |

210,869,549 |

(43,294,827) |

(20.53%) |

2)Funds lent to other parties (NT$ Thousand): None

3)Endorsements and guarantees (NT$ Thousand)

|

|

|

|

Balance as of period end |

This Month (actual amount provided) |

Last Month (actual amount provided) |

Limit of lending |

UMC |

10,557,950 |

10,440,105 |

146,945,338 |

Note: On February 22, 2017, March 7, 2018, October 24, 2018, July 24,2019, December 18, 2019, July 29, 2020, October 29, 2020, December 16, 2020, July 28, 2021, October 27, 2021, December 15, 2021, April 27, 2022, October 26, 2022, December 14, 2022, April 26, 2023 and July 26, 2023, the board of directors resolved to provide endorsement to USC(Xiamen)’s syndicated loan from banks for the amount up to CNY¥ 2,405 million. |

4)Financial derivatives transactions:

a Not under hedging accounting: NT$ thousand

UMC

|

|

|

|

|

Financial instruments |

Option |

Forwards |

IRS |

|

Put |

Call |

|

|

Deposit Paid |

0 |

0 |

0 |

0 |

Royalty Income (Paid) |

0 |

0 |

0 |

0 |

Unwritten-off Trading |

|

|

|

|

Contracts |

0 |

0 |

0 |

0 |

Fair Value |

0 |

0 |

0 |

0 |

Net profit (loss) from Fair Value |

0 |

0 |

0 |

0 |

Written-off Trading |

|

|

|

|

Contracts |

0 |

0 |

360,448 |

0 |

Realized profit (loss) |

0 |

0 |

(6,640) |

0 |

Exhibit 99.8

United Microelectronics Corporation

For the month of September, 2023

This is to report 1) the trading of directors, executive officers and 10% shareholders of United Microelectronics Corporation (“UMC”) (NYSE: UMC); 2) the pledge and clear of pledge of UMC common shares by directors, executive officers and 10% shareholders of UMC;

1)The trading of directors, executive officers and 10% shareholders

|

|

|

|

|

Title |

Name |

Number of shares as of August 31, 2023 |

Number of shares as of September 30, 2023 |

Changes |

Chairman President President Executive Vice President Senior Vice President Senior Vice President Senior Vice President Vice President Vice President Vice President Vice President Vice President Vice President Vice President Vice President Vice President Vice President Vice President Vice President Vice President Vice President |

Stan Hung SC Chien Jason Wang Ming Hsu Oliver Chang Chitung Liu Lucas S Chang TS Wu C C Hsu M C Lai S F Tzou Osbert Cheng G C Hung Steven Hsu Jerry CJ Hu Y S Shen Steven S Liu SR Sheu Francia Hsu Mindy Lin Eric Chen |

52,601,452 12,594,648 22,015,000 4,393,000 2,240,589 3,250,217 1,150,000 2,265,809 3,141,068 3,215,863 1,374,108 1,349,000 1,029,791 1,104,000 2,124,000 1,539,000 2,790,000 2,507,892 1,466,000 1,933,925 1,069,000 |

55,901,452 15,894,648 25,315,000 6,538,000 3,890,589 4,900,217 2,470,000 3,354,809 4,230,068 4,304,863 1,869,108 1,943,000 2,118,791 1,698,000 3,213,000 2,628,000 3,780,000 3,596,892 2,555,000 2,428,925 2,158,000 |

3,300,000 3,300,000 3,300,000 2,145,000 1,650,000 1,650,000 1,320,000 1,089,000 1,089,000 1,089,000 495,000 594,000 1,089,000 594,000 1,089,000 1,089,000 990,000 1,089,000 1,089,000 495,000 1,089,000 |

2)The pledge and clear of pledge of UMC common shares by directors, executive officers and 10% shareholders:

|

|

|

|

|

Title |

Name |

Number of shares as of August 31, 2023 |

Number of shares as of September 31, 2023 |

Changes |

Vice President |

M C Lai |

3,215,000 |

4,304,000 |

1,089,000 |

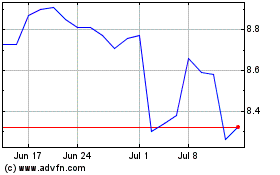

United Microelectronics (NYSE:UMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

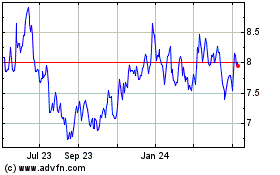

United Microelectronics (NYSE:UMC)

Historical Stock Chart

From Apr 2023 to Apr 2024