As filed with the Securities and Exchange Commission on October 19, 2023

Registration No. 333-_______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER SECURITIES ACT OF 1933

MILESTONE SCIENTIFIC INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

13-3545623

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

incorporation or organization)

|

Identification No.)

|

425 Eagle Rock Avenue, Suite 403

Roseland, New Jersey 07068

(973) 535-2717

(Address, including zip code, and telephone number, including

area code, of Registrant’s principal executive offices)

Arjan Haverhals

Chief Executive Officer

Milestone Scientific Inc.

425 Eagle Rock Ave, Suite 403

Roseland, New Jersey 07068

(973) 535-2717

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copy To:

Lawrence M. Bell, Esq.

Golenbock Eiseman Assor Bell & Peskoe LLP

711 Third Avenue

New York, New York 10017

(212) 907-7300

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☑

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to general Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the commission pursuant to Rule 462(e) under the Securities Act, check the following box, ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

Accelerated filer ☐ |

Non-accelerated filer ☐ |

| Smaller reporting company ☑ |

|

Emerging growth company ☐ |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED OCTOBER 19, 2023

PROSPECTUS

$45,000,000

MILESTONE SCIENTIFIC INC.

Common Stock

Preferred Stock

Warrants

Subscription Rights

Units

This prospectus relates to common stock, preferred stock, warrants, subscription rights and units that we may sell from time to time in one or more offerings up to a total public offering price of $45,000,000 on terms to be determined at the time of sale. We will provide specific terms of these securities in supplements to this prospectus. You should read this prospectus and any supplement carefully before you invest. This prospectus may not be used to offer and sell securities unless accompanied by a prospectus supplement for those securities.

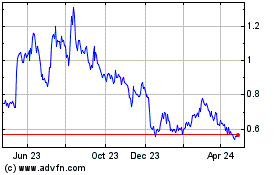

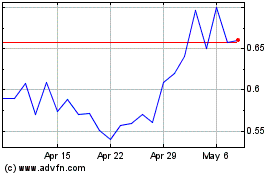

Our common stock is listed on the NYSE American under the symbol “MLSS”. On October 18, 2023, the closing price of our common stock on the NYSE American was $0.90 per share.

These securities may be sold directly by us, through dealers or agents designated from time to time, to or through underwriters or through a combination of these methods. See “Plan of Distribution” in this prospectus. We may also describe the plan of distribution for any particular offering of these securities in any applicable prospectus supplement. If any agents, underwriters or dealers are involved in the sale of any securities in respect of which this prospectus is being delivered, we will disclose their names and the nature of our arrangements with them in a prospectus supplement. The net proceeds we expect to receive from any such sale will also be included in a prospectus supplement.

Investing in our securities involves certain risks. See “Risk Factors” beginning on page 3 of this prospectus and in any prospectus supplement before you make your investment decision.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is __________, 2023.

Table of Contents

| |

Page

|

| |

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

1

|

| |

|

|

FORWARD-LOOKING STATEMENTS

|

2

|

| |

|

|

PROSPECTUS SUMMARY

|

2

|

| |

|

|

RISK FACTORS

|

3

|

| |

|

|

THE BUSINESS

|

3

|

| |

|

|

USE OF PROCEEDS

|

5

|

| |

|

|

DESCRIPTION OF COMMON STOCK WE MAY OFFER

|

5

|

| |

|

|

DESCRIPTION OF PREFERRED STOCK WE MAY OFFER

|

6

|

| |

|

|

DESCRIPTION OF WARRANTS OR SUBSCRIPTION RIGHTS WE MAY OFFER

|

8

|

| |

|

|

DESCRIPTION OF UNITS WE MAY OFFER

|

9

|

| |

|

|

PLAN OF DISTRIBUTION

|

9

|

| |

|

|

LEGAL MATTERS

|

11

|

| |

|

|

EXPERTS

|

12

|

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and special reports, proxy statements and other information with the Securities and Exchange Commission (the “SEC”). You can inspect and copy these reports, proxy statement and other information at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D. C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the Public Reference Room. The SEC also maintains a web site that contains reports, proxy and information statements and other information regarding issuers, such as Milestone Scientific Inc. (www.sec.gov). Our web site is located at www.milestonescientific.com. The information contained on our web site is not part of this prospectus.

This prospectus “incorporates by reference” certain information that we have filed with the SEC under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). This means we are disclosing important information to you by referring you to those documents. We incorporate by reference the documents listed below and any future filings made by us with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act until the offering is terminated:

| |

●

|

Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed on March 30, 2023, including the Definitive Proxy Statement of Schedule14A, filed on May 1, 2023;

|

| |

●

|

Quarterly Reports on Form 10-Q for the fiscal quarter ended March 31, 2023, filed on May 10, 2023, and for the fiscal quarter ended June 30, 2023, filed on August 14, 2023;

|

| |

●

|

Current Reports on Form 8-K, filed on January 5, 2023, February 6, 2023, June 30, 2023, July 13, 2023, August 24, 2023 and September 12, 2023; and

|

| |

●

|

The description of Milestone’s Common Stock contained in Exhibit 4.6 to its Annual Report on Form 10-K filed with the SEC on March 31, 2022, including any further amendment or report filed hereafter for the purpose of updating such description.

|

You should rely only on the information incorporated by reference or provided in this prospectus. We have authorized no one to provide you with different information. You should not assume that the information in this prospectus is accurate as of any date other than the date on the front of this document. All documents that we file pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus or after the date of the registration statement of which this prospectus forms a part and prior to the termination of the offering will be deemed to be incorporated in this prospectus by reference and will be a part of this prospectus from the date of the filing of the document. Any statement contained in a document incorporated or deemed to be incorporated by reference in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or in any other subsequently filed document which also is or is deemed to be incorporated by reference in this prospectus modifies or supersedes that statement. Any statement that is modified or superseded will not constitute a part of this prospectus, except as modified or superseded.

We will provide, upon written or oral request, without charge to you, including any beneficial owner to whom this prospectus is delivered, a copy of any or all of the documents incorporated herein by reference other than the exhibits to those documents, unless the exhibits are specifically incorporated by reference into the information that this prospectus incorporates. You should direct a request for copies to us at Attention: Controller, Keisha Harcum, Milestone Scientific Inc., 425 Eagle Rock Avenue, Suite 403, Roseland, New Jersey 07068, or you may call us at (973) 535-2717.

FORWARD-LOOKING STATEMENTS

Certain information set forth in this prospectus or incorporated by reference in this prospectus are “forward-looking statements” (within the meaning of the Private Securities Litigation Reform Act of 1995) regarding the plans and objectives of management for future operations. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance, or achievements of Milestone Scientific to be materially different from any future results, performance, or achievements expressed or implied by such forward-looking statements. The forward-looking statements included herein are based on current expectations that involve numerous risks and uncertainties. Milestone Scientific’s plans and objectives are based, in part, on assumptions involving the continued expansion of its business. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of Milestone Scientific. Although Milestone Scientific believes that its assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate. Considering the significant uncertainties inherent in the forward-looking statements included herein, our history of operating losses that are expected to continue, requiring additional funding which we may be unable to raise capital when needed (which may force us to delay, curtail or eliminate commercialization efforts of our CompuFlo Epidural Computer Controlled Anesthesia System), the early stage operations of and relatively lack of acceptance of our medical products, relying exclusively on two third parties to manufacture our products, changes to our distribution arrangements exposes us to risks of interruption of marketing efforts and building new marketing channels, changes in our informal manufacturing arrangements made by the manufacturer of our products and disruptions at the manufacturing facility of our manufacturers, including shortages of or delays in obtaining chips and other components, exposes us to risks that may harm our business, raising additional funds by issuing securities or through licensing or lending arrangements may cause dilution to our existing stockholders, restrict our operations or require us to relinquish proprietary rights, if physicians do not accept nor use our CompuFlo Epidural Computer Controlled Anesthesia System, our ability to generate revenue from sales will be materially impaired, exposure to the risks inherent in international sales and operations, including China, and developments by competitors may render our products or technologies obsolete or non-competitive, the inclusion of such information should not be regarded as a representation by Milestone Scientific or any other person that the objectives and plans of Milestone Scientific will be achieved. Prospective investors are cautioned that any forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties and the actual results may differ materially from those included within the forward-looking statements as a result of various factors. Milestone Scientific undertakes no obligation to revise or update publicly any forward-looking statements for any reason.

PROSPECTUS SUMMARY

This prospectus is part of a registration statement on Form S-3 that we filed with the SEC utilizing a “shelf” registration process. Under this shelf process, we may from time to time, sell any combination of securities described in this prospectus in one or more offerings. This prospectus provides you with a general description of the securities we may offer. Each time we sell securities, we will provide a prospectus supplement that will contain specific information about the terms of the securities being offered and risk factors specific to that offering.

We may add or modify in a prospectus supplement any of the information contained in this prospectus or in the documents that we have incorporated into this prospectus by reference. If there is any inconsistency between the information in this prospectus and a prospectus supplement, you should rely on the information in the prospectus supplement. You should read both this prospectus and any applicable prospectus supplement together with additional information described above under the heading “Where You Can Find More Information.”

When acquiring any securities discussed in this prospectus, you should rely on the information provided in this prospectus and the prospectus supplement, including the information incorporated by reference. Neither we, nor any underwriters or agents, have authorized anyone to provide you with different information. We are not offering the securities in any state where such an offer is prohibited. You should not assume that the information in this prospectus, any prospectus supplement, or any document incorporated by reference, is truthful or complete at any date other than the date mentioned on the cover page of those documents. You should also carefully review the section entitled “Risk Factors”, which highlights certain risks associated with an investment in our securities, to determine whether an investment in our securities is appropriate for you.

All references in this report to “Milestone Scientific,” “us,” “our,” “we,” the “Company” or “Milestone” refer to Milestone Scientific Inc. and its consolidated subsidiaries, Wand Dental, Inc. and Milestone Medical Inc., unless the context otherwise indicates. Milestone Scientific is the owner of the following registered U.S. trademarks: CompuDent®; CompuMed®; CompuFlo®; DPS Dynamic Pressure Sensing technology®; Milestone Scientific®; CathCheck®; the Milestone logo®; SafetyWand®; STA Single Tooth Anesthesia System®; and The Wand®.

RISK FACTORS

Investing in our securities involves a high degree of risk. You should carefully consider those risk factors described in our Annual Report on Form 10-K for our fiscal year ended December 31, 2022 (together with any material changes thereto contained in subsequently filed Quarterly Reports on Form 10-Q) and those contained in our other filings with the SEC, which are incorporated by reference in this prospectus and any accompanying prospectus supplement and all other information contained in this prospectus and in any supplementary prospectus relating to the offering of any of our securities before purchasing any of our securities. Some statements in this prospectus, constitute forward-looking statements. Please refer to the section entitled “Forward-Looking Statements.”

The prospectus supplement applicable to each type or series of securities we offer may contain a discussion of risks applicable to the particular types of securities that we are offering under that prospectus supplement. Prior to making a decision about investing in our securities, you should carefully consider the specific factors discussed under the caption “Risk Factors” in the applicable prospectus supplement, together with all of the other information contained in the prospectus supplement or appearing or incorporated by reference in this prospectus. These risks could materially affect our business, results of operations or financial condition and cause the value of our securities to decline. You could lose all or part of your investment.

THE BUSINESS

Overview

Milestone Scientific is a biomedical technology company that patents, designs, develops and commercializes innovative diagnostic and therapeutic injection technologies and devices for medical and dental use. Since our inception, we have engaged in pioneering proprietary, innovative, computer-controlled injection technologies, and solutions for the medical and dental markets. We believe our technologies are proven and well established.

We have focused our resources on redefining the worldwide standard of care for injection techniques by making the experience more comfortable for the patient by reducing the anxiety and stress of receiving injections from the healthcare provider. Our computer-controlled injection devices make injections precise, efficient, and virtually painless.

Milestone Scientific has developed a proprietary, revolutionary, computer-controlled anesthetic delivery device, our DPS Dynamic Pressure Sensing Technology® System, to meet the needs of various subcutaneous drug delivery injections and fluid aspiration – enabling healthcare practitioners to achieve multiple unique benefits that cannot currently be accomplished with the 160-year-old manual syringe. Our proprietary DPS Dynamic Pressure Sensing technology is our technology platform that advances the development of next-generation devices. It regulates flow rate and monitoring pressure from the tip of the needle, through platform extensions for local anesthesia for subcutaneous drug delivery, used in various dental and medical injections. It has specific medical applications for epidural space identification in regional anesthesia procedures.

Our device, using The Wand®, a single use disposable handpiece, is marketed in dentistry under the trademark CompuDent®, and STA Single Tooth Anesthesia System® and is suitable for all dental procedures that require local anesthetic. The dental devices currently are sold in the United States, Canada and in over 41 other countries. Milestone Scientific also has 510(k) marketing clearance from the U.S. Food and Drug Administration (FDA) on the CompuFlo® Epidural Computer Controlled Anesthesia System in the lumbar, thoracic and cervical thoracic junction of the spine region. In addition, Milestone Scientific has obtained CE mark approval and can be marketed and sold in most European countries.

Our recent receipt of chronology-Specific CPT Code for the Company's technology by the American Medical Association marks an important milestone, that could increase the potential number of anesthesia pain management clinics adopting the CompuFlo instrument. A CPT code expands the potential for reimbursement of epidural procedures in pain management utilizing the CompuFlo Epidural System., which should help accelerate the commercial roll-out of CompuFlo in the U.S

Milestone Scientific and its subsidiaries currently hold over 245 U.S. and foreign patents, and many patents pending and patent applications. The Company’s patents and patent applications relate to drug delivery methodologies, Peripheral Nerve Block, drug flow rate measurement, pressure/force computer-controlled drug delivery with exit pressure, dynamic pressure sensing, automated rate control, automated charging, drug profiles, audible and visual pressure/force feedback, tissue identification, identification of a target region drug delivery injection unit, drug drive unit for anesthetic, handpiece, and injection device.

Milestone Scientific remains focused on advancing efforts to achieve the following three primary objectives:

● Establishing Milestone’s DPS Dynamic Pressure Sensing technology platform as the standard-of-care in painless and precise drug delivery, providing for the first time, objective visual and audible in-tissue pressure feedback, and continuing to expand platform applications;

● Following obtaining successful FDA clearance of our first medical device, Milestone Scientific is transitioning from a research and development organization to a commercially focused medical device company; and

● Expanding our global footprint of our CompuFlo Epidural and CathCheck System by utilizing a targeted field sales force and partnering with distribution companies worldwide.

Building on the success of our proprietary, core technology platform for dental injections, and desiring to pursue other growth opportunities, we have recently begun to expand the uses and applications of our proprietary, patented technologies to achieve greater operational efficiencies, enhanced patient safety and therapeutic adherence, patient satisfaction, and improved quality of care across a broad range of medical specialties.

We intend to continue to expand the uses and applications of our DPS Dynamic Pressure Sensing technology. We believe that we and our technology solutions are recognized by key opinion leaders (i.e., academics, anesthesiologists and practicing dentists whose opinions are widely respected), industry experts and medical and dental practitioners as a leader in the emerging, computer-controlled injection industry.

Corporate Information

We were organized in August 1989 under the laws of the State of Delaware. Our common stock was initially listed on the NYSE American on June 1, 2015 and trades under the symbol “MLSS”. Our principal executive office is located at 425 Eagle Rock Ave, Suite 403, Roseland, New Jersey 07068 and our telephone number is (973) 535-2717. Our web address is www.milestonescientific.com. Information contained on or accessed through our website is not part of this prospectus.

USE OF PROCEEDS

Unless otherwise indicated in the prospectus supplement, the net proceeds from the sale of securities offered by this prospectus will be used for general corporate purposes and working capital requirements. We may also use a portion of the net proceeds for licensing or acquiring intellectual property or technologies to incorporate into our products and product candidates or our research and development programs, the development and finalization of the next generation dental instrument, preparation for market readiness once health care insurance providers approve reimbursement payment, capital expenditures, to fund possible investments in and acquisitions of complementary businesses or partnerships. We have not determined the amounts we plan to spend on the areas listed above or the timing of these expenditures, and we have no current plans with respect to acquisitions as of the date of this prospectus. As a result, unless otherwise indicated in the prospectus supplement, our management will have broad discretion to allocate the net proceeds of the offerings. Pending their ultimate use, we intend to invest the net proceeds in a variety of securities, including commercial paper, government and non-government debt securities and/or money market funds that invest in such securities.

DESCRIPTION OF COMMON STOCK WE MAY OFFER

The following description of our common stock is only a summary. This description and the description contained in any prospectus supplement is subject to, and qualified in its entirety by reference to, our restated certificate of incorporation and bylaws, each as amended, each of which has previously been filed with the SEC and the Delaware General Corporation Law (“DCGL”).

Common Stock

Our authorized capital stock includes 100,000,000 shares of common stock, par value $0.001 per share. As of October 17, 2023, there are 71,368,468 shares of common stock issued, of which 71,335,135 were outstanding and 33,333 shares were held in the treasury.

Subject to preferences that may apply to preferred shares outstanding at the time, the holders of outstanding common stock are entitled to receive dividends out of assets legally available therefor at such times and in such amounts as the Board of Directors may from time to time determine. Each stockholder is entitled to one vote for each share of common stock held on all matters submitted to a vote of stockholders. Directors are elected by plurality vote. Therefore, the holders of a majority of the common stock voted can elect all of the directors then standing for election. The common stock is not entitled to preemptive rights and are not subject to conversion. If we are liquidated or dissolved or our business is otherwise wound up, the holders of common stock would be entitled to share ratably in the distribution of all of our assets remaining available for distribution after satisfaction of all our liabilities and the payment of the liquidation preference of any outstanding preferred shares. Each outstanding share of common stock is, and all shares of common stock to be outstanding upon completion of any offering under the registration statement of which this prospectus forms a part, will be, fully paid and non-assessable.

Authorized but Unissued Common Stock

The DCGL does not require stockholder approval for any issuance of authorized shares, except in certain limited circumstances. However, the listing requirements of the NYSE American, which would apply for so long as our common stock is listed on the NYSE American, require stockholder approval of certain issuances (other than a public offering) equal to or exceeding 20% of the then outstanding voting power or then outstanding number of shares of common stock, as well as for certain issuances of stock in compensatory transactions. These additional shares may be used for a variety of corporate purposes, including future public offerings, to raise additional capital or to facilitate acquisitions. One of the effects of the existence of unissued and unreserved shares of common stock may be to enable our Board of Directors to sell shares to persons friendly to current management, for such consideration, in form and amount, as is acceptable to the Board, which issuance could render more difficult or discourage an attempt to obtain control of us by means of a merger, tender offer, proxy contest or otherwise, and thereby protect the continuity of our management and possibly deprive stockholders of opportunities to sell their common stock at prices higher than prevailing market prices.

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is Continental Stock Transfer & Trust Company, 1 State Street, 30th Floor, New York, NY 10004.

DESCRIPTION OF PREFERRED STOCK WE MAY OFFER

The following description of the terms of our preferred stock is only a summary. This description and the description contained in any prospectus supplement is subject to, and qualified in its entirety by reference to, our restated certificate of incorporation and bylaws, each as amended, each of which has previously been filed with the SEC. In addition, the specific terms of any series of preferred shares will be described in the applicable prospectus supplement and certificate of designation amending the certificate of incorporation.

Preferred Stock

We are authorized to issue “blank check” preferred stock, which may be issued in one or more series upon authorization of our Board of Directors. Our Board of Directors is authorized to fix the designations, powers, rights and preferences, and the qualifications, limitations, and restrictions thereof to the fullest extent permitted by our certificate of incorporation and the laws of the State of Delaware, including, without limitation, voting rights, dividend rights, dissolution rights, conversion rights, exchange rights and redemption rights. The authorized shares of our preferred stock are available for issuance without further action by our stockholders, unless such action is required by applicable law or the rules of any stock exchange on which our securities may be listed. If the approval of our stockholders is not required for the issuance of shares of our preferred stock, our Board of Directors may determine not to seek stockholder approval. The specific terms of any series of preferred stock offered pursuant to this prospectus will be described in the prospectus supplement relating to that series of preferred stock.

A series of our preferred stock could, depending on the terms of such series, impede the completion of a merger, tender offer or other takeover attempt. Our Board of Directors will make any determination to issue preferred shares based upon its judgment as to the best interests of our stockholders. Our directors, in so acting, could issue preferred stock having terms that could discourage an acquisition attempt through which an acquirer may be able to change the composition of our Board of Directors, including a tender offer or other transaction that some, or a majority, of our stockholders might believe to be in their best interests or in which stockholders might receive a premium for their stock over the then-current market price of the stock.

The preferred stock may have some or all of the terms described below, with will be described in the prospectus supplement relating to the particular series of preferred stock being issued and sold under the prospectus supplement. You should read the prospectus supplement relating to the particular series of preferred stock being offered for specific terms, including:

| |

•

|

the designation and stated value per share of the preferred stock and the number of shares offered;

|

| |

•

|

the amount of liquidation preference per share and the ranking as to the right to receive a liquidation payment;

|

| |

•

|

the price at which the preferred stock will be issued;

|

| |

•

|

the dividend rate, or method of calculation of dividends, the dates on which dividends will be payable, whether dividends will be cumulative or noncumulative and, if cumulative, the dates from which dividends will commence to accumulate, the ranking as to right to receive dividend;

|

| |

•

|

any redemption or sinking fund provisions;

|

| |

•

|

if other than the currency of the United States, the currency or currencies including composite currencies in which the preferred stock is denominated and/or in which payments will or may be payable;

|

| |

•

|

any conversion provisions; and

|

| |

•

|

any other rights, preferences, privileges, limitations and restrictions on the preferred stock.

|

Rank. The preferred stock may rank:

| |

•

|

senior to our common stock and to all equity securities ranking junior to such preferred stock with respect to dividend rights or rights upon our liquidation, dissolution or winding up of our affairs;

|

| |

•

|

on a parity with all equity securities issued by us, the terms of which specifically provide that such equity securities rank on a parity with the preferred stock with respect to dividend rights or rights upon our liquidation, dissolution or winding up of our affairs; or

|

| |

•

|

junior to all equity securities issued by us, the terms of which specifically provide that such equity securities rank senior to the preferred stock with respect to dividend rights or rights upon our liquidation, dissolution or winding up of our affairs.

|

Dividends. Holders of the preferred stock of each series may be entitled to receive, when, as and if declared by our Board of Directors, cash dividends at such rates and on such dates described in the prospectus supplement. Different series of preferred stock may be entitled to dividends at different rates or based on different methods of calculation. The dividend rate may be fixed or variable or both. Dividends on any series of preferred stock may be cumulative or noncumulative. If our Board of Directors does not declare a dividend payable on a dividend payment date on any series of noncumulative preferred stock, then the holders of that noncumulative preferred stock will have no right to receive a dividend for that dividend payment date, and we will have no obligation to pay the dividend accrued for that period, whether or not dividends on that series are declared payable on any future dividend payment dates. Dividends on any series of cumulative preferred stock will accrue from the date we initially issue shares of such series or such other date specified in the applicable prospectus supplement.

No dividends may be declared or paid or funds set apart for the payment of any dividends on any parity securities unless full dividends have been paid or set apart for payment on the preferred stock. If full dividends are not paid, the preferred stock will share dividends pro rata with the parity securities.

No dividends may be declared or paid or funds set apart for the payment of dividends on any junior securities unless full dividends for all dividend periods terminating on or prior to the date of the declaration or payment will have been paid or declared and a sum sufficient for the payment set apart for payment on the preferred stock.

Liquidation Preference. Upon any voluntary or involuntary liquidation, dissolution or winding up of our affairs, then, before we make any distribution or payment to the holders of any common stock or any other class or series of our capital stock ranking junior to the preferred stock in the distribution of assets, the holders of each series of preferred stock shall be entitled to receive out of assets legally available for distribution to stockholders, liquidating distributions in the amount of the liquidation preference per share. Such dividends may not include any accumulation in respect of unpaid noncumulative dividends for prior dividend periods. Unless otherwise specified in terms of the series of preferred stock, after payment of the full amount of their liquidating distributions, the holders of preferred stock will have no right or claim to any of our remaining assets. Upon a voluntary or involuntary liquidation, dissolution or winding up, if our available assets are insufficient to pay the amount of the liquidating distributions on all outstanding preferred stock and the corresponding amounts payable on all other classes or series of our capital stock ranking on parity with the preferred stock and all other such classes or series of shares of capital stock ranking on parity with the preferred stock in the distribution of assets, then the holders of the preferred stock and all other such classes or series of capital stock ranking on parity with the preferred stock will share ratably in any such distribution of assets in proportion to the full liquidating distributions to which they would otherwise be entitled.

Upon any such liquidation, dissolution or winding up and if we have made liquidating distributions in full to all holders of preferred stock, we will distribute our remaining assets among the holders of any other classes or

series of capital stock ranking junior to the preferred stock according to their respective rights and preferences and, in each case, according to their respective number of shares.

Redemption. If so provided in the terms of the preferred stock, the preferred stock may be subject to mandatory redemption or redemption at our option, as a whole or in part, in each case upon the terms, at the times and at the redemption prices set forth in such prospectus supplement. A series of preferred stock that is subject to mandatory redemption will have specified the number of shares of preferred stock that shall be redeemed and the terms of the redemption, including the dates of redemption, price to be paid upon redemption, and the accrued and unpaid dividends to the date of redemption. We may pay the redemption price in cash or other property. If fewer than all of the outstanding shares of preferred stock of any series are to be redeemed, we may determine the number of shares to be redeemed pro rata from the holders of record of such shares in proportion to the number of such shares held or for which redemption is requested by such holder or by any other equitable manner that we determine. Such determination will reflect adjustments to avoid redemption of fractional shares.

Voting Rights. Holders of preferred stock may have voting rights as determined by the Board of Directors, and will have voting rights as required by law.

Conversion Rights. The terms and conditions, if any, upon which any series of preferred stock may be convertible into shares of our common stock will be set forth in the terms of the preferred stock series. Such terms may include the number of shares of common stock into which the shares of preferred stock are convertible, the conversion price, rate or manner of calculation thereof, the conversion period, provisions as to whether conversion will be at our option or at the option of the holders of the preferred stock, the events requiring an adjustment of the conversion price and provisions affecting conversion in the event of the redemption.

Transfer Agent and Registrar. The transfer agent and registrar for the preferred stock will be set forth in the applicable prospectus supplement.

No Other Rights. The shares of a new series of preferred stock will not have any preferences, voting powers or relative, participating, optional or other special rights except:

| |

●

|

as discussed above or in the prospectus supplement;

|

| |

●

|

as provided in our certificate of incorporation and in the certificate of designations; and

|

| |

●

|

as otherwise required by law.

|

DESCRIPTION OF WARRANTS OR SUBSCRIPTION RIGHTS WE MAY OFFER

The following description of warrants and subscription rights is only a summary. This description is subject to, and qualified in its entirety by reference to, the provisions of the applicable warrant or subscription agreement.

We may issue warrants or other forms of subscription rights for the purchase of shares of common stock, preferred stock or units. Warrants may be issued independently or together with preferred stock, common stock or units and may be attached to or separate from any offered securities. Any issuance of warrants or subscription rights will be governed by the terms of the applicable form of security and any related agreement, which we will file as an exhibit to our registration statement at or before the time we issue any warrants.

The particular terms of any issue of warrants or subscription right will be described in the prospectus supplement relating to the issue. Those terms may include:

| |

●

|

the title of the security;

|

| |

●

|

the aggregate number of the security;

|

| |

●

|

the price or prices at which the security will be issued;

|

| |

●

|

the currency or currencies (including composite currencies) in which the price of the security may be paid;

|

| |

●

|

the terms of the securities purchasable upon exercise of the warrants or subscription right and the procedures and conditions relating to the exercise of the securities;

|

| |

●

|

the price at which the securities purchasable upon exercise of the warrants or subscription rights may be purchased;

|

| |

●

|

the date on which the right to exercise the securities will commence and the date on which such right shall expire;

|

| |

●

|

any provisions for adjustment of the number or amount and exercise price of securities receivable upon exercise of the securities;

|

| |

●

|

if applicable, the minimum or maximum amount of the securities that may be exercised at any one time;

|

| |

●

|

if applicable, the designation and terms of the securities with which the securities are issued and the number of the warrants or subscription rights issued with each such security;

|

| |

●

|

if applicable, the date on and after which any related securities will be separately transferable;

|

| |

●

|

information with respect to book-entry procedures, if any; and

|

| |

●

|

any other terms, including terms, procedures and limitations relating to the exchange or exercise of the warrants or subscription rights.

|

The prospectus supplement relating to any warrants or subscription rights to purchase equity securities may also include, if applicable, a discussion of certain U.S. federal income tax and ERISA considerations.

After the close of business on the expiration date, unexercised warrants or subscription rights will become void. We will specify the place or places where, and the manner in which, the securities may be exercised in the applicable prospectus supplement.

Prior to the exercise of any warrants or subscription rights to purchase preferred stock, common stock or units, holders of the warrants will not have any of the rights of holders of the preferred stock, common stock or units purchasable upon exercise.

DESCRIPTION OF UNITS WE MAY OFFER

We may issue units consisting of a combination of two or more of any offered securities, at a single price or at a separate price for each security included in the unit. The securities offered may be issued separately or may be evidenced by a separate unit certificate, which may or may not trade separately. The terms and conditions governing the issuance of any units, including the form and content of any certificate evidencing the units, will be described in detail in the prospectus supplement to be filed in connection with the offering of such units.

PLAN OF DISTRIBUTION

We may sell the securities offered through this prospectus (1) to or through underwriters or dealers, (2) directly to purchasers, including our affiliates, (3) through agents, or (4) through a combination of any these methods. The securities may be distributed at a fixed price or prices, which may be changed, market prices prevailing at the time of sale, prices related to the prevailing market prices, or negotiated prices. The prospectus supplement will include the following information:

| |

●

|

the terms of the offering;

|

| |

●

|

the names of any underwriters or agents;

|

| |

●

|

the name or names of any managing underwriter or underwriters;

|

| |

●

|

the purchase price of the securities;

|

| |

●

|

the net proceeds from the sale of the securities;

|

| |

●

|

any delayed delivery arrangements;

|

| |

●

|

any underwriting discounts, commissions and other items constituting underwriters’ compensation;

|

| |

●

|

any initial public offering price;

|

| |

●

|

any discounts or concessions allowed or reallowed or paid to dealers; and

|

| |

●

|

any commissions paid to agents.

|

Sale through underwriters or dealers

If underwriters are used in the sale, the underwriters will acquire the securities for their own account, including through underwriting, purchase, security lending or repurchase agreements with us. The underwriters may resell the securities from time to time in one or more transactions, including negotiated transactions. Underwriters may sell the securities in order to facilitate transactions in any of our other securities (described in this prospectus or otherwise), including other public or private transactions and short sales. Underwriters may offer securities to the public either through underwriting syndicates represented by one or more managing underwriters or directly by one or more firms acting as underwriters. Unless otherwise indicated in the prospectus supplement, the obligations of the underwriters to purchase the securities will be subject to certain conditions, and the underwriters will be obligated to purchase all the offered securities if they purchase any of them. The underwriters may change from time to time any initial public offering price and any discounts or concessions allowed or reallowed or paid to dealers.

If dealers are used in the sale of securities offered through this prospectus, we will sell the securities to them as principals. They may then resell those securities to the public at varying prices determined by the dealers at the time of resale. The prospectus supplement will include the names of the dealers and the terms of the transaction.

Direct sales and sales through agents

We may sell the securities offered through this prospectus directly to investors. In this case, no underwriters or agents would be involved. Securities may also be sold through agents designated from time to time. The prospectus supplement will name any agent involved in the offer or sale of the offered securities and will describe any commissions payable to the agent. Unless otherwise indicated in the prospectus supplement, any agent will agree to use its reasonable best efforts to solicit purchases for the period of its appointment.

We may sell the securities directly to institutional investors or others who may be deemed to be underwriters within the meaning of the Securities Act with respect to any sale of those securities. The terms of any such sales will be described in the prospectus supplement.

Underwriter, dealer or agent discounts and commissions

Underwriters, dealers or agents may receive compensation in the form of discounts, concessions or commissions from us or our purchasers as their agents in connection with the sale of securities. These underwriters, dealers or agents may be considered to be underwriters under the Securities Act. As a result, discounts, commissions, or profits on resale received by the underwriters, dealers or agents may be treated as underwriting discounts and commissions. Each prospectus supplement will identify any such underwriter, dealer or agent, and describe any compensation received by them from us. Any public offering price of the securities being sold and any discounts or concessions allowed or reallowed or paid to dealers may be changed from time to time.

Delayed delivery contracts

If the prospectus supplement indicates, we may authorize agents, underwriters or dealers to solicit offers from certain types of institutions to purchase securities at the public offering price under delayed delivery contracts. These contracts would provide for payment and delivery on a specified date in the future. The contracts would be subject only to those conditions described in the prospectus supplement. The applicable prospectus supplement will describe the commission payable for solicitation of those contracts.

Market making, stabilization and other transactions

Unless the applicable prospectus supplement states otherwise, each series of offered securities will be a new issue and will have no established trading market. We may elect to list any series of offered securities on an exchange. Any underwriters that we use in the sale of offered securities may make a market in such securities, but may discontinue such market making at any time without notice. Therefore, we cannot assure you that the securities will have a liquid trading market.

Any underwriter may also engage in stabilizing transactions, syndicate covering transactions and penalty bids in accordance with Regulation M under the Exchange Act. Stabilizing transactions involve bids to purchase the underlying security in the open market for the purpose of pegging, fixing or maintaining the price of the securities. Syndicate covering transactions involve purchases of the securities in the open market after the distribution has been completed in order to cover syndicate short positions.

Penalty bids permit the underwriters to reclaim a selling concession from a syndicate member when the securities originally sold by the syndicate member are purchased in a syndicate covering transaction to cover syndicate short positions. Stabilizing transactions, syndicate covering transactions and penalty bids may cause the price of the securities to be higher than it would be in the absence of the transactions. The underwriters may, if they commence these transactions, discontinue them at any time.

Derivative transactions and hedging

The underwriters or other agents may engage in derivative transactions involving the securities. These derivatives may consist of short sale transactions and other hedging activities. The underwriters or agents may acquire a long or short position in the securities, hold or resell securities acquired and purchase options or futures on the securities and other derivative instruments with returns linked to or related to changes in the price of the securities. In order to facilitate these derivative transactions, we may enter into security lending or repurchase agreements with the underwriters or agents. The underwriters or agents may effect the derivative transactions through sales of the securities to the public, including short sales, or by lending the securities in order to facilitate short sale transactions by others. The underwriters or agents may also use the securities purchased or borrowed from us or others (or, in the case of derivatives, securities received from us in settlement of those derivatives) to directly or indirectly settle sales of the securities or close out any related open borrowings of the securities.

General information

Agents, underwriters, and dealers may be entitled, under agreements entered into with us, to indemnification by us against certain liabilities, including liabilities under the Securities Act.

LEGAL MATTERS

The validity of the securities being offered hereby has been passed upon by Golenbock Eiseman Assor Bell & Peskoe LLP, New York, New York.

EXPERTS

The financial statements as of and for the year ended December 31, 2022 incorporated by reference in this registration statement have been audited by Marcum LLP, an independent registered public accounting firm, as stated in their report. Such financial statements are incorporated by reference in reliance upon the report of such firm given upon their authority as experts in accounting and auditing.

The financial statements as of and for the year ended December 31, 2021 incorporated by reference in this registration statement have been audited by Friedman LLP, an independent registered public accounting firm, as stated in their report. Such financial statements are incorporated by reference in reliance upon the report of such firm given upon their authority as experts in accounting and auditing.

Part II

Information Not Required in the Prospectus

Item 14. Other Expenses of Issuance and Distribution

The following is statement of the estimated expenses of the Company in connection with the issuance and delivery of the securities being registered hereby, other than underwriting discounts and commissions:

|

Securities and Exchange Commission registration fee

|

|

$ |

6,642.00 |

|

|

Accounting fees and expenses*

|

|

|

125,000.00 |

|

|

Legal fees and expenses*

|

|

|

100,000.00 |

|

|

Printing expenses*

|

|

|

25,000.00 |

|

|

Transfer Agent Fees and Expenses*

|

|

|

15,000.00 |

|

|

Miscellaneous*

|

|

|

10,000.00 |

|

|

Total

|

|

281,642.00

|

|

|

*

|

These fees will be dependent on the types of securities offered and number of offerings and, therefore, cannot be fully determined at this time and may vary significantly from the estimates.

|

Item 15. Indemnification of Directors and Officers

Our certificate of incorporation provides that a director will not be personally liable to us or to our stockholders for monetary damages for breach of the fiduciary duty of care as a director, including breaches which constitute gross negligence. This provision does not eliminate or limit the liability of a director:

| |

•

|

for breach of his or her duty of loyalty to us or to our stockholders;

|

| |

•

|

for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law;

|

| |

•

|

under Section 174 of the DGCL (relating to unlawful payments or dividends or unlawful stock repurchases or redemptions);

|

| |

•

|

for any improper benefit; or

|

| |

•

|

for breaches of a director's responsibilities under the federal securities laws.

|

Our certificate of incorporation also provides that we indemnify and hold harmless each of our directors and officers to the fullest extent authorized by the DGCL, against all expense, liability and loss (including attorney's fees, judgments, fines, ERISA excise taxes or penalties and amounts paid or to be paid in settlement) reasonably incurred or suffered by such person in connection therewith.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of Milestone Scientific, pursuant to the forgoing provisions or otherwise, we have been informed that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

Item 16. Exhibits

The following exhibits are filed herewith or incorporated by reference herein:

|

*

|

To be filed by amendment or as an exhibit to a report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, and incorporated herein by reference.

|

|

**

|

Filed herewith.

|

Item 17. Undertakings

| (a) |

(1)

|

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

| |

(2)

|

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

|

| |

(3)

|

That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

|

| |

(i)

|

If the registrant is relying on Rule 430B,

|

| |

(A)

|

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

|

| |

(B)

|

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to the effective date; or

|

| |

(ii)

|

If the registrant is subject to Rule 430C, each prospectus filed pursuant to Rule 424(b) as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used after effectiveness. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of first use.

|

| |

(4)

|

That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer and sell such securities to such purchaser:

|

| |

(i)

|

Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

|

| |

(ii)

|

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

|

| |

(iii)

|

The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

|

| |

(iv)

|

Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

|

|

(b)

|

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

(c)

|

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding), is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue.

|

|

(d)

|

The undersigned registrant hereby undertakes that:

|

| |

(1)

|

For purposes of determining any liability under the Securities Act of 1933, the information omitted from the form of prospectus filed as part of this registration statement in reliance upon Rule 430A and contained in a form of prospectus filed by the registrant pursuant to Rule 424(b)(1) or (4) or 497(h) under the Securities Act shall be deemed to be part of this registration statement as of the time it was declared effective.

|

| |

(2)

|

For the purpose of determining any liability under the Securities Act of 1933, each post-effective amendment that contains a form of prospectus shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

(e)

|

The undersigned registrant hereby undertakes to file an application for the purpose of determining the eligibility of the trustee to act under subsection (a) of Section 310 of the Trust Indenture Act in accordance with the rules and regulations prescribed by the SEC under Section 305(b)(2) of the Trust Indenture Act.

|

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Roseland, State of New Jersey, on October 19, 2023.

| |

MILESTONE SCIENTIFIC INC.

|

| |

|

| |

By:

|

/S/ Arjan Haverhals

|

| |

|

Arjan Haverhals,

|

| |

|

Chief Executive Officer

|

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS that each individual whose signature appears below constitutes and appoints Arjan Haverhals and Neal Goldman, and each of them, his or her true and lawful attorneys-in-fact and agents with full power of substitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this Registration Statement, and to sign any registration statement for the same offering covered by the Registration Statement that is to be effective upon filing pursuant to Rule 462(b) promulgated under the Securities Act, and all post-effective amendments thereto, and to file the same, with all exhibits thereto and all documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents or any of them, or his or their substitute or substitutes, may lawfully do or cause to be done or by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the dates stated.

|

Signature

|

Title

|

Date

|

|

/S/Arjan Haverhals

Arjan Haverhals

|

Chief Executive Officer (Principal Executive Officer and Acting Chief Accounting Officer) and Director

|

October 19, 2023

|

| |

|

|

|

/S/ Neal Goldman

Neal Goldman

|

Chairman of the Board

|

October 19, 2023

|

| |

|

|

|

/S/Leonard Osser

Leonard Osser

|

Vice Chairman of the Board

|

October 19, 2023

|

| |

|

|

|

/S/ Gian Domenico Trombetta

Gian Domenico Trombetta

|

Director

|

October 19, 2023

|

| |

|

|

|

/S/ Michael McGeehan

Michael McGeehan

|

Director

|

October 19, 2023

|

| |

|

|

|

/S/ Benedetta Casamento

Benedetta Casamento

|

Director

|

October 19, 2023

|

| |

|

|

|

/S/ Dr. Didier Demesmin

Dr. Didier Demesmin

|

Director

|

October 19, 2023

|

Exhibit 5.1

Golenbock Eiseman Assor Bell & Peskoe LLP

711 Third Avenue

New York, New York 10017

Milestone Scientific Inc.

425 Eagle Rock Avenue, Suite 403

Roseland, New Jersey 070689

Ladies and Gentlemen:

We have acted as counsel to Milestone Scientific Inc., a Delaware corporation (the “Company”), in connection with its filing on the date hereof of a Registration Statement on Form S-3 (the “Registration Statement”) under the Securities Act of 1933, as amended (the “Act”), with the Securities and Exchange Commission (the “Commission”).

The Registration Statement relates to the proposed issuance and sale, from time to time, pursuant to Rule 415 under the Act, as set forth in the Registration Statement, the prospectus contained therein (the “Prospectus”) and the supplements to the prospectus referred to therein (each a “Prospectus Supplement”), of up to an aggregate offering price of $45,000,000, or the equivalent thereof, of shares of the Company’s common stock, $0.001 par value per share (the “Common Stock”), shares of the Company’s preferred stock, $0.001 par value per share (the “Preferred Stock”), warrants or other forms of subscription rights to purchase any of the securities described above (the “Rights”), and units consisting of any combination of Common Stock, Preferred Stock or Rights (the “Units”, and together with the Common Stock, the Preferred Stock and the Rights, the “Securities”)

The Securities are to be sold from time to time as set forth in the Registration Statement, the Prospectus contained therein and the Prospectus Supplements. The preferences, limitations and relative rights of shares of any series of Preferred Stock will be set forth in a Certificate of Designation (a “Certificate of Designation”). The Rights are to be issued pursuant to an appropriate agreement or rights certificate (“Rights Agreement”), which will be incorporated by reference into the Registration Statement when the Rights are issued. The Units are to be issued pursuant to a unit agreement (the “Unit Agreement”), which will be incorporated by reference into the Registration Statement when Units are issued. The Securities are to be sold pursuant to a purchase, underwriting or similar agreement in substantially the form to be filed under a Current Report on Form 8-K.

We have examined instruments, documents, certificates and records that we have deemed relevant and necessary for the basis of our opinions hereinafter expressed. In such examination, we have assumed: (i) the authenticity of original documents and the genuineness of all signatures; (ii) the conformity to the originals of all documents submitted to us as copies; (iii) the truth, accuracy and completeness of the information, representations and warranties contained in the instruments, documents, certificates and records we have reviewed; (iv) that the Registration Statement, and any amendments thereto (including post-effective amendments), will have become effective under the Act; (v) that a Prospectus Supplement will have been filed with the Commission describing the Securities offered thereby; (vi) that all Securities will be issued and sold in compliance with applicable U.S. federal and state securities laws and in the manner stated in the Registration Statement and the applicable Prospectus Supplement; (vii) that a definitive purchase, underwriting or similar agreement with respect to any Securities offered will have been duly authorized and validly executed and delivered by the Company and the other parties thereto; (viii) that any Securities issuable by the Company and issuable upon conversion, exchange, redemption or exercise of any Securities being offered will be duly authorized, created and, if appropriate, reserved for issuance upon such conversion, exchange, redemption or exercise; (ix) with respect to shares of Common Stock or Preferred Stock offered, that there will be sufficient shares of Common Stock or Preferred Stock authorized under the Company’s organizational documents that are not otherwise reserved for issuance; (x) with respect to shares of Preferred Stock, the Certificate of Designation will set forth the terms thereof and be filed with the Secretary of State of Delaware prior to their issuance; (xi) with respect to the Rights and Units, the Company will have entered into a form of agreement for each of the Rights and Units as authorized by the Board of Directors; and (xii) the legal capacity of all natural persons. As to any facts material to the opinions expressed herein that were not independently established or verified, we have relied upon oral or written statements and representations of officers and other representatives of the Company.

Subject to the foregoing and the other matters set forth herein, it is our opinion that, as of the date hereof:

1. With respect to shares of Common Stock, when both: (a) the Board of Directors of the Company or a duly constituted and acting committee thereof (such Board of Directors or committee being hereinafter referred to as the “Board”) has taken all necessary corporate action to approve the issuance and the terms of the offering of the shares of Common Stock and related matters; and (b) certificates representing the shares of Common Stock have been duly executed, countersigned, registered and delivered either (i) in accordance with the applicable definitive purchase, underwriting or similar agreement approved by the Board, or upon the exercise of Rights to purchase Common Stock, upon payment of the consideration therefor (not less than the par value of the Common Stock) provided for therein or (ii) upon conversion or exercise of any other Security, in accordance with the terms of such Security or the instrument governing such Security providing for such conversion or exercise as approved by the Board, for the consideration approved by the Board, then the shares of Common Stock will be validly issued, fully paid and non-assessable.

2. With respect to any particular series of shares of Preferred Stock, when both: (a) the Board has taken all necessary corporate action to approve the issuance and terms of the shares of Preferred Stock, the terms of the offering thereof, and related matters, including the adoption of a Certificate of Designation relating to such Preferred Stock conforming to the Delaware General Corporation Law (the “DGCL”) and the filing of the Certificate of Designation with the Secretary of State of the State of Delaware; and (b) certificates representing the shares of Preferred Stock have been duly executed, countersigned, registered and delivered either (i) in accordance with the applicable definitive purchase, underwriting or similar agreement approved by the Board, or upon the exercise of Rights to purchase Preferred Stock, upon payment of the consideration therefor (not less than the par value of the Preferred Stock) provided for therein or (ii) upon conversion or exercise of such Security or the instrument governing such Security providing for such conversion or exercise as approved by the Board, for the consideration approved by the Board, then the shares of Preferred Stock will be validly issued, fully paid and non-assessable.

3. With respect to the Rights, when both: (a) the Board has taken all necessary corporate action to approve the issuance and terms of the Rights, the Rights Agreement and related matters; and (b) the Rights Agreement has been duly executed and delivered against payment therefor, pursuant to the applicable definitive purchase, underwriting, warrant, subscription or similar agreement that has been duly authorized, executed and delivered by the Company and a warrant/rights agent, if any, and the certificates for the Rights have been duly executed and delivered by the Company and such warrant/rights agent, if any, then the Rights will be validly issued and will constitute valid and binding obligations of the Company, enforceable against the Company in accordance with their terms.

4. With respect to the Units, when both: (a) the Board has taken all necessary corporate action to approve the issuance and terms of the Units, Unit Agreement, and related matters; and (b) and the underlying Securities that are components of the Units, in accordance with the applicable Unit Agreement, have been duly authorized, executed and delivered by the Company against payment therefor, pursuant to the applicable definitive purchase, underwriting, Unit Agreement or similar agreement that has been duly authorized, executed and delivered by the Company and a unit agent, if any, and the certificates for the Units have been duly executed and delivered by the Company and such unit agent, if any, then the Units will be validly issued and will constitute valid and binding obligations of the Company, enforceable against the Company in accordance with their terms.

Attorneys at our firm are admitted to the practice of law in the State of New York, and we express no opinion as to the laws of any other jurisdiction, other than the Federal laws of the United States of America and the DGCL. We are not licensed to practice law in the State of Delaware and, accordingly, our opinions as to the DGCL are based solely on a review of the official statutes of the state of Delaware and the applicable provisions of the Delaware Constitution and the reported judicial decisions interpreting such statutes and provisions.

We hereby consent to the use of this opinion as an exhibit to the Registration Statement, to the use of our firm name as your counsel, and to all references made to us in the Registration Statement and in the Prospectus forming a part thereof. In giving this consent, we do not hereby admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act of 1933, as amended, or the rules and regulations promulgated thereunder.

| |

Very truly yours,

/s/ Golenbock Eiseman Assor Bell & Peskoe LLP

|

Exhibit 23.1

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM’S CONSENT