UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Schedule

14C

Information

Statement Pursuant to Section 14(c) of the Securities Exchange Act of 1934

(Amendment

No.)

Check

the appropriate box:

| ☒ |

Preliminary

Information Statement |

| |

|

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| |

|

| ☐ |

Definitive

Information Statement |

SHARING

SERVICES GLOBAL CORPORATION

(Name

of Registrant as Specified In Its Charter)

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No

fee required |

| |

|

| ☐ |

Fee

paid previously with preliminary materials. |

| |

|

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) of Schedule 14A (17 CFR 240.14a-101) per Item 1 of this Schedule and Exchange

Act Rules 14c-5(g) and 0-11 |

Sharing

Services Global Corporation

5200

Tennyson Parkway, Suite 400, Plano, Texas 75024

NOTICE

OF ACTION BY WRITTEN CONSENT OF STOCKHOLDERS

NOTICE

IS HEREBY GIVEN that the holders of the majority of the voting power of the stockholders of Sharing Services Global Corporation,

a Nevada corporation (the “Company” “we”, “us,” or “our”), has approved the following

action without a meeting of stockholders in accordance with Section 78.320 of the Nevada Revised Statutes:

The

approval of an amendment to our articles of incorporation to effect a reverse stock split of our Class A Common Stock, par value $0.0001

per share (the “Common Stock”) by a ratio of not less than 700-for-1 and not more than 1,800-for-1, with the Board of Directors

(the “Board”) having the discretion as to the exact date and ratio of any reverse split to be set at a whole

number within the above range. The action will become effective on the 20th day after the Information Statement is mailed to our

stockholders and notification to and approval by the Financial Industry Regulatory Authority, Inc. of the same. This Information Statement

will serve as written notice to stockholders pursuant to the Nevada Revised Statutes.

The

enclosed Information Statement contains information pertaining to the matters acted upon.

WE

ARE NOT ASKING YOU FOR A PROXY, AND YOU ARE REQUESTED NOT TO SEND US A PROXY

| October

18, 2023 |

By:

|

Order

of the Board of Directors |

| |

|

|

| |

|

/s/ John

Thatch |

| |

|

John

Thatch |

| |

|

Chief

Executive Officer and Vice Chairman of the Board of Directors |

INFORMATION

STATEMENT

Action

by Written Consent of Stockholders

GENERAL

INFORMATION

WE

ARE NOT ASKING YOU FOR A PROXY, AND YOU ARE REQUESTED NOT TO SEND US A PROXY

This

Information Statement is being furnished in connection with the action by written consent of stockholders taken without a meeting of

a proposal to approve the actions described in this Information Statement. We are mailing this Information Statement to our stockholders

on or about ____, 2023.

What

action was taken by written consent?

We

obtained stockholder consent for the approval of an amendment to our articles of incorporation, to effect a reverse split within the

range of 700-to-1 to 1800-to-1, with the Board having the discretion as to the exact date and ratio of any reverse split to

be set at a whole number within the above range.

How

many shares of Common Stock, Series A Preferred Stock, Series C Preferred Stock and Series D Preferred Stock were outstanding

on September 26, 2023?

On

September 26, 2023, the date we received the consent of the holders of an aggregate 53.5% of the voting power of our stockholders,

there were 376,328,885 shares of Common Stock, 3,100,000 shares of Series A Preferred Stock outstanding, 3,220,000 shares

of Series C Preferred Stock outstanding and 26,000 shares of Series D Preferred Stock outstanding. 188,393,373 shares of Common

Stock provides Heng Fai Ambrose Chan with 49.2% of the total voting power of our stockholders and 16,472,660 shares

of Common Stock provides John “JT” Thatch with 4.3% of the total voting power of our stockholders.

What

vote was obtained to approve the amendment to the articles of incorporation described in this Information Statement?

We

obtained the approval of Heng Fai Ambrose Chan, who is the beneficial holder of 188,393,373 shares of Common Stock

and John “JT” Thatch who is holder of 16,472,660 shares of Common Stock.

Who

is paying the cost of this Information Statement?

We

will pay for preparing, printing and mailing this Information Statement. Arrangements may be made with banks, brokerage houses and other

institutions, nominees and fiduciaries, to forward the Definitive Information Statement to beneficial owners. We will, upon request,

reimburse those persons and entities for expenses incurred in forwarding the Definitive Information Statement to our stockholders.

AMENDMENT

TO THE ARTICLES OF INCORPORATION TO EFFECT THE REVERSE STOCK SPLIT

The

Board and the holders of a majority of the voting power of our shareholders have approved an amendment to our articles of incorporation

to effect a reverse split within the range of 700-to-1 to 1800-to-1, with the Board having the discretion as to the exact date and ratio

of any reverse split to be set at a whole number within the above range. The reverse split will become effective

upon the filing of the amendment to the articles of incorporation with the Secretary of State of the State of Nevada. We believe that

enabling our Board to set the ratio within the stated range will provide us with the flexibility to implement the reverse split in

a manner designed to maximize the anticipated benefits for our stockholders. We will file the amendment to our articles of incorporation

to effect the reverse stock split approximately (but not less than) 20 days after this Information Statement is mailed to stockholders

and notification to and approval by the Financial Industry Regulatory Authority, Inc. of the same.

As

a result of the reverse split, every share of outstanding Common Stock (the “Old Shares”) will become and be converted into

one share of common stock (the “New Shares”) within the range of 700-to-1 to 1800-to-1, with stockholders who would receive

a fractional share to receive such additional fractional share as will result in the holder having a whole number of shares.

As

a result of the reverse split, the number of shares of Common Stock issued and outstanding will decrease. Since additional fractional

shares may be issued in order to round up fractional shares, we do not know the exact number of New Shares that will be outstanding after

the reverse split.

Reasons

for the Reverse Stock Split

The

Company’s Common Stock is quoted on the OTCQB under the symbol “SHRG”. The shares of Common Stock of the Company have

traded at low prices for some time. The Company is effecting a reverse stock split solely for the purpose of enabling a future uplisting

of our Common Stock to a national securities exchange. In addition to increasing the market price of our Common Stock, the reverse stock

split would also reduce certain of our costs, as discussed below. Accordingly, for these and other reasons discussed below, we believe

that effecting the reverse stock split is in the Company’s and our Stockholders’ best interests.

Reducing

the number of outstanding shares of our Common Stock should, absent other factors, increase the per share market price of our Common

Stock, although we cannot provide any assurance that the post reverse stock split price would remain following the reverse stock split.

Reducing

the number of outstanding shares of our Common Stock through the reverse stock split is intended, absent other factors, to increase the

per share market price of our Common Stock. However, other factors, such as our financial results, market conditions and the market perception

of our business may adversely affect the market price of our Common Stock. As a result, there can be no assurance that the reverse stock

split, if completed, will result in the intended benefits described above, that the market price of our Common Stock will increase following

the reverse stock split or that the market price of our Common Stock will not decrease in the future. Additionally, we cannot assure

you that the market price per share of our Common Stock after a reverse stock split will increase in proportion to the reduction in the

number of shares of our Common Stock outstanding before the reverse stock split. Accordingly, the total market capitalization of our

Common Stock after the reverse stock split may be lower than the total market capitalization before the reverse stock split.

In

evaluating the reverse stock split, our Board also took into consideration negative factors associated with reverse stock splits. These

factors include the negative perception of reverse stock splits held by many investors, analysts and other stock market participants,

as well as the fact that the stock price of some companies that have effected reverse stock splits has subsequently declined back to

pre-reverse stock split levels. The Board, however, determined that these negative factors were outweighed by the potential benefits.

Potential

Effects of the Reverse Stock Split

The

immediate effect of a reverse stock split will be to reduce the number of shares of Common Stock outstanding, and to increase the trading

price of the Common Stock. However, the effect of any reverse stock split upon the market price of the Common Stock cannot be predicted,

and the history of reverse stock splits for companies in similar circumstances is varied. We cannot assure you that the trading price

of the Common Stock after the reverse stock split will rise in exact proportion to the reduction in the number of shares of the Common

Stock outstanding as a result of the reverse stock split. Also, as stated above, the Company cannot assure you that a reverse stock split

will lead to a sustained increase in the trading price of the Common Stock. The trading price of the Common Stock may change due to a

variety of other factors, including the Company’s operating results, other factors related to the Company’s business, and

general market conditions.

Effect

on Ownership by Individual Shareholders

The

New Shares issued pursuant to the reverse stock split will be fully paid and non-assessable. All New Shares will have the same voting

rights and other rights as the Old Shares. Our stockholders do not have preemptive rights to acquire additional shares of Common Stock.

The reverse stock split will not alter any shareholder’s percentage interest in our equity, except to the extent that the reverse

stock split results in any of our stockholders owning a fractional share, which will be rounded up to the next whole number of shares.

Effect

on Options, Warrants and other Securities

All

outstanding options, warrants, and other securities entitling their holders to purchase shares of Common Stock will be adjusted as a

result of the reverse stock split, as required by the terms of these securities. In particular, the conversion ratio for each instrument

will be reduced, and the exercise price, if applicable, will be increased, in accordance with the terms of each instrument within the

range of 700-to-1 to 1800-to-1.

Other

Effects on Outstanding Shares

As

stated above, the rights of the outstanding shares of Common Stock will remain the same after the reverse stock split.

The

reverse stock split may result in some shareholders owning “odd-lots” of less than 100 shares of Common Stock. Brokerage

commissions and other costs of transactions in odd-lots are generally higher than the costs of transactions in “round-lots”

of even multiples of 100 shares.

The

Company’s Common Stock is currently registered under Section 12(g) of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”). As a result, the Company is subject to the periodic reporting and other requirements of the Exchange Act. The reverse stock

split will not affect the registration of the Company’s Common Stock under the Exchange Act.

Authorized

Shares

The

reverse stock split will not change the number of authorized shares of the Company’s Common Stock under the Company’s articles

of incorporation. Because the number of issued and outstanding shares of Common Stock will decrease, the number of shares of Common Stock

remaining available for issuance will increase. Under our articles of incorporation, our Board has authorized the issuance of up to 1,990,000,000 shares

of Class A Common Stock and up to 10,000,000 shares of Class B Common Stock, each with a par value of $0.0001 per share. In addition,

our Board has authorized the issuance of up to 100,000,000 shares of Series A Convertible Preferred Stock, 10,000,000 shares of Series

B Convertible Preferred Stock,10,000,000 shares of Series C Convertible Preferred Stock and 26,000 shares of Series D Preferred Stock.

There are no shares of the Company’s Class B Common Stock or Series B Preferred Stock currently issued and outstanding. Our Series

D Preferred Stock does not contain voting rights. The Company does not currently have any plans, proposal or arrangement to issue any

of its authorized but unissued shares of Common Stock. However, it is possible that some of these additional shares could be used in

the future for various purposes without further stockholder approval, except as such approval may be required in particular cases by

our charter documents, applicable law or the rules of any stock exchange or other system on which our securities may then be listed.

These purposes may include: raising capital, providing equity incentives to employees, officers or directors, establishing strategic

relationships with other companies, and expanding the company’s business or product lines through the acquisition of other businesses

or products.

By

increasing the number of authorized but unissued shares of Common Stock, the reverse split could, under certain circumstances, have an

anti-takeover effect, although this is not the intent of the Board. For example, it may be possible for the Board to delay or impede

a takeover or transfer of control of the Company by causing such additional authorized but unissued shares to be issued to holders who

might side with the Board in opposing a takeover bid that the Board determines is not in the best interests of the Company or its stockholders.

The reverse split therefore may have the effect of discouraging unsolicited takeover attempts. By potentially discouraging initiation

of any such unsolicited takeover attempts the reverse split may limit the opportunity for the Company’s stockholders to dispose

of their shares at the higher price generally available in takeover attempts or that may be available under a merger proposal. The reverse

split may have the effect of permitting the Company’s current management, including the current Board, to retain its position,

and place it in a better position to resist changes that stockholders may wish to make if they are dissatisfied with the conduct of the

Company’s business. However, the Board is not aware of any attempt to take control of the Company and the Board has not approved

the reverse split with the intent that it be utilized as a type of anti-takeover device. The Company’s articles of incorporation

and by-laws do not have any anti-takeover provisions.

Fractional

Shares

The

Company will not issue fractional shares in connection with the reverse stock split. Instead, any fractional share resulting from the

reverse stock split will be rounded up to the nearest whole share.

Accounting

Consequences

The

par value of the Common Stock will remain unchanged at $0.0001 per share after the reverse stock split. Also, the capital account of

the Company will remain unchanged, and the Company does not anticipate that any other accounting consequences will arise as a result

of the reverse stock split.

Federal

Income Tax Consequences

We

believe that the United States federal income tax consequences of the reverse stock split to holders of Common Stock will be as follows:

(i)

Except as explained in (v) below with respect to fractional shares, no income gain or loss will be recognized by a shareholder on the

surrender of the current shares or receipt of the certificate representing new post-split shares.

(ii)

Except as explained in (v) below with respect to fractional shares, the tax basis of the New Shares will equal the tax basis of the Old

Shares exchanged therefore.

(iii)

Except as explained in (v) below, the holding period of the New Shares will include the holding period of the Old Shares if such Old

Shares were held as capital assets.

(iv)

The conversion of the Old Shares into the New Shares will produce no taxable income or gain or loss to us.

(v)

The federal income tax treatment of the receipt of the additional fractional interest by a shareholder is not clear and may result in

tax liability not material in amount in view of the low value of such fractional interest.

Our

opinion is not binding upon the Internal Revenue Service or the courts, and there can be no assurance that the Internal Revenue Service

or the courts will accept the positions expressed above.

THE

ABOVE IS A BRIEF SUMMARY OF THE EFFECT OF FEDERAL INCOME TAXATION UPON THE PARTICIPANTS AND THE COMPANY WITH RESPECT TO THE REVERSE STOCK

SPLIT, AND DOES NOT CONSTITUTE A TAX OPINION. THIS SUMMARY DOES NOT PURPORT TO BE COMPLETE AND DOES NOT ADDRESS THE FEDERAL INCOME TAX

CONSEQUENCES TO TAXPAYERS WITH SPECIAL TAX STATUS. IN ADDITION, THIS SUMMARY DOES NOT DISCUSS THE PROVISIONS OF THE INCOME TAX LAWS OF

ANY MUNICIPALITY, STATE OR FOREIGN COUNTRY IN WHICH THE STOCKHOLDER MAY RESIDE, AND DOES NOT DISCUSS ESTATE, GIFT OR OTHER TAX CONSEQUENCES

OTHER THAN INCOME TAX CONSEQUENCES. THE COMPANY ADVISES EACH PARTICIPANT TO CONSULT HIS OR HER OWN TAX ADVISOR REGARDING THE TAX CONSEQUENCES

OF THE REVERSE STOCK SPLIT AND FOR REFERENCE TO APPLICABLE PROVISIONS OF THE CODE.

Procedure

for Effecting the Reverse Stock Split and Exchange of Stock Certificates

The

reverse stock split will be implemented by filing an amendment to the Company’s articles of incorporation with the Secretary of

State of the State of Nevada. We will obtain a new CUSIP number for the new Common Stock effective at the time of the reverse split.

As

of the effective date of the reverse stock split, each certificate representing shares of Common Stock before the reverse stock split

will be deemed, for all corporate purposes, to evidence ownership of the reduced number of shares of Common Stock resulting from the

reverse stock split. All options, warrants, and other securities will also be automatically adjusted on the effective date.

The

Company anticipates that its transfer agent will act as the exchange agent for purposes of implementing the exchange of stock certificates.

As soon as practicable after the effective date, shareholders will be notified of the effectiveness of the reverse split. Shareholders

of record will receive a letter of transmittal requesting them to surrender their stock certificates for stock certificates reflecting

the adjusted number of shares as a result of the reverse stock split. Persons who hold their shares in brokerage accounts or “street

name” will not be required to take any further actions to effect the exchange of their certificates. Instead, the holder of the

certificate will be contacted.

No

new certificates will be issued to a shareholder until the shareholder has surrendered the shareholder’s outstanding certificate(s)

together with the properly completed and executed letter of transmittal to the exchange agent. Until surrender, each certificate representing

shares before the reverse stock split will continue to be valid and will represent the adjusted number of shares based on the exchange

ratio of the reverse stock split, rounded up to the nearest whole share. Shareholders should not destroy any stock certificate and should

not submit any certificates until they receive a letter of transmittal.

BENEFICIAL

OWNERSHIP OF SECURITIES AND SECURITY OWNERSHIP OF MANAGEMENT

As

of October 17, 2023, there were 376,328,885 shares of the Company’s Class A Common Stock; 3,100,000 shares of its Series

A Preferred Stock issued and outstanding; 3,220,000 shares of its Series C Preferred Stock issued and outstanding and 26,000

shares of its Series D Preferred Stock issued and outstanding, excluding shares that any named person has the right to acquire pursuant

to convertible instruments. Each outstanding share of Class A Common Stock; Series A Preferred Stock; and Series C Preferred Stock entitles

the holder to one (1) vote. In addition, each outstanding share of Series A Preferred Stock and Series C Preferred Stock is convertible

into one share of the Company’s Class A Common Stock. The outstanding shares of Series D Preferred Stock are non-convertible

to shares of Class A Common Stock and do not entitle the holder to voting rights.

Beneficial

ownership is determined in accordance with SEC rules and generally includes voting or investment power with respect to securities. For

purposes of this disclosure, a person or group of persons is deemed to have “beneficial ownership” of any shares of our Class

A Common Stock that such person or group of persons owns or has the right to acquire within 60 days of the date of this prospectus, except

as discussed below. For purposes of computing the percentage of the outstanding shares of our Class A Common Stock held by a named person,

any shares that such person has the right to acquire within 60 days of the date of this Proxy Statement are deemed to be outstanding,

but such shares are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person. For purposes

of computing the percentage of the outstanding shares of our Class A Common Stock held by all executive officers and/or directors as

a group (12 persons), any shares that such group of persons has the right to acquire within 60 days of the date of this Proxy Statement

are deemed to be outstanding, but such shares are not deemed to be outstanding for the purpose of computing the percentage ownership

of any other person. The inclusion herein of any shares listed as beneficially owned does not constitute an admission of beneficial ownership.

The

following table sets forth certain information regarding the ownership of our capital stock, as of October 17, 2023, by: (i) each

person known by us to be the beneficial owner of more than 5% of the outstanding shares of all voting classes of our stock, (ii) each

executive officer and director of the Company, and (iii) all our executive officers and/or directors as a group. The table reflects the

number of shares held, the percentage of ownership of each voting class held, and the percentage of ownership of all voting classes held

by each listed person or group of persons. No person beneficially owns more than 5% of the shares of our Series C Preferred Stock outstanding.

Unless otherwise noted, the address for the shareholders listed below is 5200 Tennyson Parkway, Suite 400, Plano, TX 75024.

| Title of Class | |

Name of Beneficial Owner [1] | |

Amount and Nature of Beneficial Ownership | | |

Percent of Class [2] | | |

Percent of All Voting Classes [3] | |

| Class A Common Stock | |

ALSET, Inc.

4800 Montgomery Lane, Suite 210

Bethesda, MD 20814 | |

| 125,624,528 | | |

| 33.4 | % | |

| 32.8 | % |

| | |

DSS, Inc.

275 Wiregrass Pkwy.

West Henrietta, NY 14586 | |

| 24,821,089 | | |

| 6.6 | % | |

| 6.5 | % |

| | |

Heng Fai Ambrose Chan [4] | |

| 188,393,373 | | |

| 50.1 | % | |

| 49.2 | % |

| | |

| |

| | | |

| | | |

| | |

| | |

John (“JT”) Thatch [5] | |

| 16,472,660 | | |

| 4.4 | % | |

| 4.3 | % |

| | |

| |

| | | |

| | | |

| | |

| | |

Robert H. Trapp | |

| - | | |

| - | | |

| - | |

| | |

| |

| | | |

| | | |

| | |

| | |

Anthony S. Chan | |

| - | | |

| - | | |

| - | |

| | |

| |

| | | |

| | | |

| | |

| | |

All Officers and/or Directors as a Group – 6 persons | |

| 223,429,793 | | |

| 54.5 | % | |

| 53.5 | % |

| | |

| |

| | | |

| | | |

| | |

| Series A Preferred Stock | |

Research & Referral BZ [6]

11 Hibiscus Street

Ladyville, Belize | |

| 2,900,000 | | |

| 93.5 | % | |

| 0.8 | % |

| | |

| |

| | | |

| | | |

| | |

| | |

All Officers and/or Directors as a Group - 6 persons | |

| - | | |

| - | | |

| - | |

| | |

| |

| | | |

| | | |

| | |

| Series C Preferred Stock | |

All Officers and/or Directors as a Group - 6 persons | |

| - | | |

| - | | |

| - | |

[1]

Each person named above may be deemed to be a “parent” and “promoter” of the Company, within the meaning of

such terms under the Securities Act of 1933, as amended, by virtue of their direct and indirect stock holdings.

[2]

Calculated based on the total shares of each respective class of voting equity securities issued and outstanding as of October 17,

2023, as follows: Class A Common Stock: 376,328,885 shares; Series A Preferred Stock: 3,100,000 shares; and Series C Preferred Stock:

3,220,000 shares.

[3]

Calculated based upon the aggregate Voting Power of all shares of all classes of stock held by the named person compared to the

aggregate Voting Power of all shares of all classes of voting securities issued and outstanding. Assuming the conversion of all

shares of all classes of convertible stock issued and outstanding, the total number of shares of our Common Stock outstanding and

entitled to vote would be 382,648,885 shares (with each share entitled to one vote).

[4]

Reflects shares held by Mr. Chan and shares held by: (a) ALSET, Inc. and its subsidiary, (b) DSS, Inc. and its subsidiaries, (c)

Global BioMedical Pte., Ltd., and (d) Heng Fai Holdings, Ltd., in the aggregate, over which Mr. Chan maintains voting control. Mr.

Chan is a director of ALSET, DSS, Global BioMedical, and Heng Fai Holdings.

[5]

Reflects 16,472,620 shares held by the Thatch Family

Trust, shares held by members of Mr. Thatch’s family, over which Mr. Thatch maintains

voting control.

[6]

Represents shares purportedly held by Research &

Referral BZ. As disclosed in prior Company filings, in the fiscal year 2019, the Company filed suit against Research & Referral BZ

and two other parties concerning breach of contract, fraud, and statutory fraud in a stock transaction, violations of state securities

laws and alter ego relating to a stock exchange/transfer transaction, involving the Company’s stock. In April 2020, the court issued

a Final Default Judgment in favor of the Company finding Research and Referral, BZ liable for the Company’s claims of fraud in

the inducement and statutory fraud in a stock transaction. Further, the court ordered that the stock transaction be rescinded, and the

Company’s stock be returned to the Company, and the matter has been dismissed with prejudice.

INTEREST

OF CERTAIN PERSONS IN OR OPPOSITION TO MATTERS TO BE ACTED UPON

No

person who has been a director or officer of the Company at any time since the beginning of the last fiscal year, nominee for election

as a director of the Company, nor associates of the foregoing persons have any substantial interest, direct or indirect, in proposed

amendment to the Company’s articles of incorporation which differs from that of other stockholders of the Company.

ADDITIONAL

AVAILABLE INFORMATION

We

are subject to the information and reporting requirements of the Securities Exchange Act of 1934, as amended, and in accordance with

such act we file periodic reports, documents and other information with the Securities and Exchange Commission relating to our business,

financial statements and other matters. We file annual, quarterly and special reports, along with other information with the SEC. Our

SEC filings are available to the public over the Internet at the SEC’s website at http://www.sec.gov.

| October 18, 2023 |

By:

|

Order

of the Board of Directors |

| |

|

|

| |

|

/s/ John

Thatch |

| |

|

John

Thatch |

| |

|

Chief

Executive Officer and Vice Chairman of the Board of Directors |

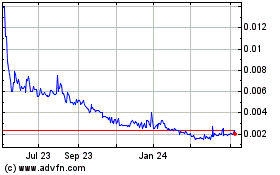

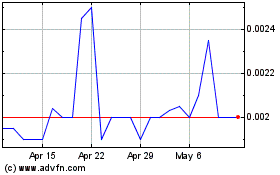

Sharing Services Global (PK) (USOTC:SHRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sharing Services Global (PK) (USOTC:SHRG)

Historical Stock Chart

From Apr 2023 to Apr 2024