Filed Pursuant to Rule

424(b)(3)

Registration No. 333-273308

Marizyme,

Inc.

Up

to 915,071,257 Shares of Common Stock

This

prospectus relates to the offer and resale of up to 915,071,257 shares of common stock, par value $0.001 per share (“common

stock”), of Marizyme, Inc. that may be sold from time to time by the selling stockholders named in this prospectus, which consist

of:

| |

● |

13,971,324

shares of outstanding common stock held by existing

stockholders; |

| |

|

|

| |

● |

221,939,338 shares of common

stock issuable upon the conversion of the Company’s outstanding 10% Secured Convertible

Promissory Notes (the

“Convertible Notes”), assuming that all convertible debts and other liabilities

under the Convertible Notes are converted into shares of common stock, without

regard to any applicable limitations or restrictions; |

| |

|

|

| |

● |

380,986,336 shares of common

stock issuable upon the exercise of the Company’s outstanding Class C Common Stock

Purchase Warrants (the

“Class C Warrants”), without regard to any applicable limitations or restrictions; |

| |

|

|

| |

● |

66,159,434

shares

of common stock issuable upon the conversion of the Company’s outstanding 15% Original

Issue Discount Unsecured Subordinated Convertible Promissory Notes (the “OID Convertible

Notes”), assuming that the OID Convertible Notes are held until maturity and that all

convertible debts and other liabilities under the OID Convertible Notes are converted

into shares of common stock, without regard to any applicable limitations or restrictions; |

| |

|

|

| |

● |

84,546,202

shares

of common stock issuable upon the exercise of the Company’s outstanding Class E Common

Stock Purchase Warrants (the “Class E Warrants”), without regard to any applicable

limitations or restrictions; |

| |

|

|

| |

● |

80,796,202

shares

of common stock issuable upon the exercise of the Company’s outstanding Class F Common

Stock Purchase Warrants (the “Class F Warrants”), without regard to any

applicable limitations or restrictions; and |

| |

|

|

| |

● |

66,672,421 shares

of common stock issuable upon the exercise of the Company’s Placement Agent Warrants

(collectively, the “Placement Agent Warrants”), without regard to any

applicable limitations or restrictions. |

The

holders of the outstanding shares of common stock, the Convertible Notes, the Class C Warrants, the OID Convertible Notes, the Class

E Warrants, the Class F Warrants, and the Placement Agent Warrants that are identified in the “Selling Stockholders” section of this prospectus are each referred

to herein as a “selling stockholder” and collectively as the “selling stockholders”.

This

prospectus also covers any additional shares of common stock that may become issuable upon any anti-dilution adjustment pursuant to the

terms of the Convertible Notes, the Class C Warrants, the OID Convertible Notes, the Class E Warrants, the Class F Warrants, or the Placement

Agent Warrants issued to the selling stockholders by reason of stock splits, stock dividends, and other events described therein.

We

will not receive any proceeds from the resale of shares of common stock by the selling stockholders. Assuming the full exercise of the

Class C Warrants, the Class E Warrants, the Class F Warrants, and the Placement Agent Warrants for cash, we will receive gross proceeds

of approximately $70.4 million.

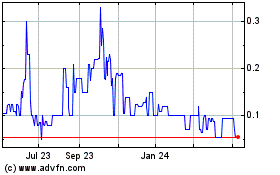

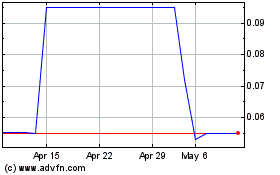

Currently,

a limited public market exists for our common stock. Our common stock is quoted for trading on the OTCQB tier of OTC Markets Group, Inc.

(“OTCQB”) under the symbol “MRZM”. On October 16, 2023, the last reported sale price of our common stock

on the OTCQB was $0.23 per share. We have applied to list our common stock under the symbol “MRZM” on the Nasdaq Capital

Market tier operated by The Nasdaq Stock Market LLC (“Nasdaq”). There can be no guarantee that we will successfully list

our common stock on the Nasdaq Capital Market. The registration of the selling stockholders’ resale of the Company’s common

stock as described in this prospectus is not conditioned upon our successful listing on the Nasdaq Capital Market.

Unlike

an initial public offering, the resale by the selling stockholders is not being underwritten by any investment bank. The selling stockholders

may or may not elect to sell, either prior to, in connection with, or at any point after a listing of our common stock on the Nasdaq

Capital Market, all or any portion of their shares of common stock covered by this prospectus. The selling stockholders may offer and

sell the common stock being offered by this prospectus from time to time in public or private transactions, or both. These sales will

occur at fixed prices, at market prices prevailing at the time of sale, at prices related to prevailing market prices, or at negotiated

prices. The selling stockholders may sell shares to or through underwriters, broker-dealers or agents, who may receive compensation in

the form of discounts, concessions or commissions from the selling stockholders, the purchasers of the shares, or both. Any participating

broker-dealers and any selling stockholders who are affiliates of broker-dealers may be deemed to be “underwriters” within

the meaning of the Securities Act of 1933, as amended (the “Securities Act”), and any commissions or discounts given to any

such broker-dealer or affiliates of a broker-dealer may be regarded as underwriting commissions or discounts under the Securities Act.

The selling stockholders have informed us that they do not have any agreement or understanding with any person

to distribute their common stock. See “Plan of Distribution” for a more complete description of the ways in which

the shares may be sold.

This offering will terminate on the earlier

of the date when all of the securities registered for offer and resale hereunder have been sold pursuant to this prospectus or one

year from the date the registration statement of which this

prospectus forms a part is declared effective, unless we terminate it earlier in accordance with the requirements of certain agreements with the selling stockholders. See “Plan of Distribution”.

Investing

in our shares of common stock involves a high degree of risk. See “Risk Factors” beginning on page 12 for a

discussion of information that should be considered in connection with an investment in our shares of common stock.

We

are a “smaller reporting company” under applicable federal securities laws and, as such, we have elected to comply with certain

reduced public company reporting requirements for this prospectus and future filings.

Neither

the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is October 17, 2023

TABLE

OF CONTENTS

This

prospectus describes the general manner in which the selling stockholders may offer from time to time up to 915,071,257 shares

of common stock. You should rely only on the information that we have provided or incorporated by reference in this prospectus, any applicable

prospectus supplement and any related free writing prospectus that we may authorize to be provided to you. We have not authorized anyone

to provide you with different information. No dealer, salesperson or other person is authorized to give any information or to represent

anything not contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus that we may authorize

to be provided to you. You must not rely on any unauthorized information or representation. This prospectus is an offer to sell only

the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should assume that

the information in this prospectus, any applicable prospectus supplement or any related free writing prospectus is accurate only as of

the date on the front of the document and that any information we have incorporated by reference is accurate only as of the date of the

document incorporated by reference, regardless of the time of delivery of this prospectus, any applicable prospectus supplement or any

related free writing prospectus, or any sale of a security.

If

necessary, the specific manner in which the shares of common stock may be offered and sold will be described in a supplement to this

prospectus, which supplement may also add, update or change any of the information contained in this prospectus. To the extent there

is a conflict between the information contained in this prospectus and any prospectus supplement, you should rely on the information

in such prospectus supplement, provided that if any statement in one of these documents is inconsistent with a statement in another document

having a later date — for example, a document incorporated by reference in this prospectus or any prospectus supplement —

the statement in the document having the later date modifies or supersedes the earlier statement.

Neither

the delivery of this prospectus nor any distribution of shares of common stock pursuant to this prospectus shall, under any circumstances,

create any implication that there has been no change in the information set forth or incorporated by reference into this prospectus or

in our affairs since the date of this prospectus. Our business, financial condition, results of operations and prospects may have changed

since such date.

TRADEMARKS,

TRADE NAMES AND SERVICE MARKS

We

use various trademarks, trade names and service marks in our business. For convenience or readability, we may not include the ℠,

® or ™ symbols, but such omission is not meant to indicate that we would not protect our intellectual

property rights to the fullest extent allowed by law. Any other trademarks, trade names or service marks referred to in this prospectus

are the property of their respective owners.

INDUSTRY

AND MARKET DATA

We

are responsible for the information contained in this prospectus. This prospectus includes industry and market data that we obtained

from periodic industry publications, third-party studies and surveys, filings of public companies in our industry and internal company

surveys. These sources generally state that the information they provide has been obtained from sources believed to be reliable, but

that the accuracy and completeness of the information are not guaranteed. The forecasts and projections are based on historical market

data, and there is no assurance that any of the forecasts or projected amounts will be achieved. Industry and market data could be wrong

because of the method by which sources obtained their data and because information cannot always be verified with complete certainty

due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations

and uncertainties. The market and industry data used in this prospectus involve risks and uncertainties that are subject to change based

on various factors, including the COVID-19 pandemic and those discussed in the section titled “Risk Factors.” These

and other factors could cause results to differ materially from those expressed in, or implied by, the estimates made by independent

parties and by us. Furthermore, we cannot assure you that a third party using different methods to assemble, analyze or compute industry

and market data would obtain the same results.

GLOSSARY

OF LIFE SCIENCE TERMS

The

following is a glossary of certain life science terms that are used in this prospectus.

| 510(k) Application |

|

A 510(k) application is a premarket submission made to FDA to demonstrate that the device to be marketed is as safe and effective as,

that is, substantially equivalent to, a legally marketed device. |

| |

|

|

| ACA |

|

The

Patient Protection and Affordable Care Act. |

| |

|

|

| Autologous |

|

In transplantation, referring

to transfer of an organ or other tissue from one location to another in the same person; or to blood or blood components that the

donor has previously donated and receives at a later time, usually perioperatively (i.e., around the time of surgery). |

| |

|

|

| Biofilm |

|

A collective of one or

more types of microorganisms that can grow on many different surfaces. |

| |

|

|

| Biomarker |

|

A broad subcategory of

medical signs – that is, objective indications of medical state observed from outside the patient – which can be measured

accurately and reproducibly. |

| |

|

|

| Cardiac Surgery |

|

A surgery on the heart

or great vessels performed by cardiac surgeons. |

| |

|

|

| CABG |

|

Coronary artery bypass

surgery, or CABG, also known as coronary artery bypass graft surgery, and colloquially heart bypass or bypass surgery, is a surgical

procedure to restore normal blood flow to an obstructed coronary artery. |

| |

|

|

| CE Marking |

|

The CE marking indicates

that the product may be sold freely in any part of the European Economic Area, regardless of its country of origin. |

| |

|

|

| cGCP |

|

Current Good Clinical Practices,

the standard required by the FDA for conducting clinical trials. |

| |

|

|

| cGMP |

|

Current Good Manufacturing

Processes, which are the standards mandated by the FDA to assure the proper design, monitoring and control of manufacturing processes

and facilities in connection with the production of pharmaceuticals. |

| |

|

|

| CKD |

|

Chronic kidney disease,

or CKD, means your kidneys are damaged and cannot filter blood the way they should. |

| |

|

|

| De Novo Process |

|

An FDA application process

for medical device marketing rights that was instituted by the FDA to address novel medical devices of low to moderate risk that

do not have a valid predicate device (that is, a similar device that has already been approved by the FDA for marketing in the U.S.). |

| |

|

|

| DuraGraft Registry |

|

Marizyme’s European

patient registry of subjects who have undergone CABG surgery utilizing DuraGraft. |

| |

|

|

| EDI |

|

Endothelial damage inhibitor. |

| |

|

|

| eGFR |

|

Estimated glomerular filtration

rate, a key measure of kidney function health and/or stage of kidney disease. |

| |

|

|

| Enzyme |

|

A type of protein that

regulates nearly all chemical reactions in cells. |

| |

|

|

| Fat Grafting |

|

A surgical process by which

fat is transferred from one area of the body to another area. |

| |

|

|

| FDA |

|

The U.S. Food and Drug

Administration. |

| |

|

|

| HHS |

|

The U.S. Department of

Health and Human Services. |

| |

|

|

| HIPAA |

|

The Health Insurance Portability

and Accountability Act of 1996, as amended. |

| |

|

|

| IRB |

|

Institutional Review Board,

tasked with reviewing clinical trial protocols and informed consent information for patients in clinical trials for the FDA. |

| |

|

|

| Ischemic Injury |

|

Injury caused by diminished

or absent blood flow. |

| |

|

|

| Organ |

|

Structure, such as the

heart, made up of different types of tissues that all work together. |

| |

|

|

| Registry |

|

A place to store detailed

information about people with a specific disease or condition, who provide the information on a voluntary basis. |

| |

|

|

| STS Registry |

|

The Society of Thoracis

Surgeons national database which collects data from more than 90% of U.S. based cardiac surgery centers. |

| |

|

|

| Vein |

|

Blood vessel that carries

blood back to the heart and has one-way valves that keep blood moving toward the heart. |

PROSPECTUS

SUMMARY

This

summary highlights selected information contained elsewhere in this prospectus. This summary is not complete and does not contain all

of the information that you should consider before deciding whether to invest in our securities. You should carefully read the entire

prospectus, including the risks associated with an investment in our company discussed in the “Risk Factors” section of this

prospectus, before making an investment decision. Some of the statements in this prospectus are forward-looking statements. See “Cautionary

Note Regarding Forward-Looking Statements.”

In

this prospectus, “we,” “us,” “our,” “our company,” “the Company,” “Marizyme”

and similar references refer to Marizyme, Inc., a Nevada corporation (“Marizyme, Inc.”), and its wholly-owned subsidiaries,

Somahlution, Inc., a Delaware corporation (“Somahlution, Inc.”), Somaceutica, Inc., a Florida corporation (“Somaceutica,

Inc.”), Marizyme Sciences, Inc., a Florida corporation (“Marizyme Sciences”), and My Health Logic Inc., a corporation

incorporated pursuant to the laws of the Province of Alberta, Canada (“My Health Logic”), and (ii) the term “common

stock” refers to the common stock, par value $0.001 per share, of Marizyme, Inc. The financial information included herein is presented

in United States dollars, or U.S. Dollars, the functional currency of our company.

Our

Company

Overview

We

are focused on commercializing or developing three medical technologies and related products – DuraGraft™,

MATLOC® and MAR-FG-001. DuraGraft is a first-in-class De Novo granted and CE marked intra-operative

vascular graft storage and flushing solution used during CABG surgeries. MATLOC is a point-of-care, lab-on-chip digital screening and

diagnostic device platform, initially being developed for quantitative chronic kidney disease, or CKD, assessment. MAR-FG-001 is a technology

in development for use in fat grafting procedures formulated as a tumescent solution base for protecting adipose tissue during adipose

tissue harvesting and storage. DuraGraft, MATLOC and MAR-FG-001 are expected to serve an unmet significant market need in several areas,

including, cardiac surgery, CKD assessment, and fat grafting.

Since October

2023, DuraGraft has been authorized for marketing by the U.S. Food and Drug Administration, or FDA, for use as an intra-operative

vascular conduit storage and flushing solution used during CABG surgeries in the United States, subject to applicable risks,

mitigation requirements, and control provisions. Since August 2014, DuraGraft has also had the CE marking required to be

sold in the EEA, and DuraGraft has therefore been assessed as meeting the EEA safety, health, and environmental protection

requirements.

We

intend to continue the advancement of our other

two primary product technologies, MATLOC and MAR-FG-001. Our MATLOC CKD point-of-care device is being developed toward a functional prototype,

mainly through the development of its lab-on-chip technology under a Sponsored Research Agreement, or SRA. An SRA is an agreement (which

may be classified as a grant, contract or cooperative agreement) under which one party (the “Sponsor”) provides funding to

a second party to support the performance of a specified research project or related activity. The Sponsor may be a foundation, government

agency, for-profit entity, research institute, or another university. We will also continue to ready MAR-FG-001 for viability for development

and manufacturing. We intend to fully develop and market MAR-FG-001 in the U.S. for fat grafting for procedures such as plastic and cosmetic

surgery.

In the near term, we expect to generate revenue

primarily from the sale of DuraGraft through the expansion of our international marketing efforts by our distribution partners in Europe

and in other countries that accept CE marking. We intend to commercialize DuraGraft in the U.S. primarily through

hospital integrated networks using our own direct sales force. We anticipate that once we commence marketing and sales operations

for DuraGraft in the U.S., we will be able to generate sustainable revenue growth, accelerate the development of a functional MATLOC

device prototype, and expedite the development of MAR-FG-001 into medical products.

Our

Corporate History and Structure

Marizyme,

Inc. is a Nevada corporation that was incorporated on March 20, 2007. From 2007 to early 2018, we operated under a number of different

names with different management teams and in different industries. We changed our name to Marizyme, Inc. on March 21, 2018, to reflect

our new life science focus, and at that time we also changed our common stock ticker symbol to “MRZM.”

In

September 2018, we acquired assets relating to Krillase®, a technology intended for the treatment of certain harmful

blockages, plaque and biofilms, from ACB Holding AB, Reg. No. 559119-5762, a company incorporated and organized under the laws of Sweden

(“ACB Holding”). In July 2020, we acquired from Somahlution, Inc., a Delaware corporation (“Somahlution, Inc.”),

Somahlution, LLC, a Delaware limited liability company (“Somahlution, LLC”), and Somaceutica LLC, a Delaware limited

liability company (“Somaceutica LLC”), which we refer to together as “Somahlution,” all of the assets of Somahlution,

including our DuraGraft-related assets, as well as the outstanding capital stock of Somahlution, Inc., which we refer to as the “Somahlution

Assets.” In December 2021, we acquired My Health Logic and assets relating to MATLOC®, a technology intended

for the screening of biomarkers relating to CKD, from Health Logic Interactive Inc. (“HLII”). In connection with the My Health

Logic acquisition, David Barthel, former chief executive officer of HLII and My Health Logic, became our Chief Executive Officer and

a member of our board of directors; George Kovalyov, previously the chief operating officer and a director of HLII, became our Chief

Financial Officer and Treasurer; and Harrison Ross, previously the Chief Financial Officer of HLII, became our Vice President of Finance.

The

Company previously planned to develop and commercialize FDA-approved products based on the Krillase assets. We suspended these plans

due to our determination to prioritize the completion of regulatory processes to obtain FDA authorization for the commercialization

of DuraGraft in the United States and the development of a functional MATLOC device prototype and MAR-FG-001-based viable products. We

intend to maintain the Krillase assets for potential future development and commercialization or disposition. Any determination as to

these matters would be based on a number of factors. See “Management’s Discussion and Analysis of Financial Condition

and Results of Operations – Principal Factors Affecting Our Financial Performance” for a summary of factors that we may

consider in this respect.

There

is no assurance that any of our intellectual property assets will ever be developed and fully commercialized and generate significant

revenues or will ever attract significant interest from potential buyers or investors. See “Risk Factors – Risks Related

to Our Business – We may not be able to monetize intangible assets, which may result in the need to record an impairment charge.”

Recent Developments

For a description of certain

recent developments, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations –

Liquidity and Capital Resources – Recent Developments”.

Our Products and Technologies

DuraGraft™

Through our acquisition of the Somahlution Assets

in July 2020, we acquired key intellectual assets based on a patent-protected cytoprotective platform technology designed to reduce ischemic

injury to organs and tissues in grafting and transplantation surgeries. These assets include DuraGraft, a first-in-class, De Novo

granted and CE marked intra-operative vascular graft storage and flushing solution used during CABG surgeries.

DuraGraft is the first and only medical product

that has received authorization by the FDA for marketing for use as an intra-operative vascular conduit storage and flushing solution

used during CABG surgeries. DuraGraft is also the only product certified for marketing in Europe and other jurisdictions for this indication

as an endothelial damage inhibitor, or EDI. DuraGraft carries CE marking and is approved for marketing in 36 countries outside the

United States on three continents, including all countries in the European Union, or the EU, including Spain, Austria, Ireland, Germany,

and Italy, as well as countries outside the EU including the United Kingdom, or the UK, Turkey, Switzerland, Chile, and the Philippines.

DuraGraft is also the only patented product for this indication. The DuraGraft patent portfolio includes granted patents and pending

applications in over 30 countries throughout the world, including patents granted in the United States, Europe, Australia, India, Argentina,

South Africa, Mexico, and several Asian countries.

Cardiac care is a large

and growing industry. According to the U.S. Centers for Disease Control and Prevention, or CDC, the estimated average annual US cost

of coronary heart disease is $219 billion (Centers for Disease Control and Prevention, Office of Policy, Performance, and Evaluation,

“Health Topics – Heart Disease and Heart Attack.” POLARIS, August 17, 2021). According

to a market analysis report, the size of the CABG procedures market globally was approximately $10.2 billion as of 2022 (Rahul Gotadki,

Market Research Future, “Coronary Artery Bypass Graft Market Research Report Information By Type (Off-Pump, On-Pump, Minimally

Invasive Direct CABG, Endoscopic Vein Harvesting and Others), By Procedure (Single CABG Surgery, Double CABG Surgery, Triple CABG Surgery,

Quadruple CABG Surgery and Others), By End-User (Hospitals, Cardiology Clinics, Research Institutes and Others), and By Region (North

America, Europe, Asia-Pacific, And Rest Of The World) – Market Forecast Till 2030.”, July 2023). The same source reports

that this market is forecast to increase at a compound annual growth rate, or CAGR, of 8.20% between 2023 and 2030. Globally, it is estimated

that more than 1 million CABG procedures are performed worldwide each year (Gaudino, Mario, Weill Cornell Medicine, “Method Using

Artery for Coronary Artery Bypass Linked to Better Long-term Outcomes Than Using Vein,” July 14, 2020), with procedures performed

in the U.S. being a substantial percentage of the total global procedures performed. According to the American Heart Association,

CABG is the most common type of open-heart surgery in the United States with more than 500,000 surgeries performed each year

(The Society of Thoracic Surgeons, “Coronary Artery Bypass Grafting (CABG).” The Patient Guide to Heart, Lung, and

Esophageal Surgery, May 2019).

Having received FDA authorization for marketing

of DuraGraft, we are proceeding with our plans to commercialize DuraGraft in the United States and continue to generate

international revenue growth from sales of DuraGraft. In the U.S. marketplace, we intend

to employ a small direct sales force focusing on marketing and sales to hospital integrated networks. We have also begun the process

of developing the U.S. CABG market for DuraGraft with select clinical studies, the development of known opinion leaders, or KOLs, the

promotion of existing publications, and digital marketing. We

will also seek to develop and commercialize additional applications for the technology underlying DuraGraft.

Our DuraGraft commercialization

plan using its CE marking and existing distribution partners in select European and Asian countries resumed in the second quarter of

2022, with a targeted approach based on market access, existing KOLs, clinical data and revenue penetration. In

Europe and elsewhere, we will continue our DuraGraft marketing efforts relying on our DuraGraft CE marking and our distribution partners.

The CE marking signifies that DuraGraft may be sold in the EEA and that DuraGraft has been assessed as meeting safety, health, and environmental

protection requirements. We are currently working with local distributors of cardiovascular disease-related products, in accordance with

local regulatory requirements, to sell and increase the market share of DuraGraft in Spain, Austria, Switzerland, Germany, Chile, Turkey,

Italy, and the UK among others.

MATLOC®

In

December 2021, we acquired My Health Logic, its lab-on-chip technology platform and its in-development patient-centric, digital point-of-care

screening and diagnostic device, MATLOC.

The

excitement over microfluidics, also known as lab-on-a-chip technology, lies in its potential for producing revolutionary, timely, accessible,

and practical point-of-care devices; devices that are patient-centric (one-to-many, rather than doctor centric, one-to-one) and support

self-care and independence. Microfluidics is a technology for analyzing small volumes of fluids, with the potential to miniaturize complex

laboratory procedures onto a small microchip, hence the term “lab-on-chip”.

Marizyme’s

lab-on-chip technology is currently being developed for screening and diagnosis related to the three leading biomarkers for CKD, a disease

estimated to affect 37 million Americans (National Kidney Foundation, “Chronic kidney disease (CKD),” 2023) – or approximately

one out of every nine Americans. If left untreated, many patients will advance to end stage renal disease, or ESRD, often leading to

kidney transplant, renal failure, or dialysis. Since 90% of those with CKD do not know they have it (Centers for Disease Control and

Prevention, “Chronic Kidney Disease in the United States, 2023,” May 30, 2023), the risk of progression in the disease is

high and this creates massive burdens for CKD patients and healthcare systems (Webster AC, Nagler EV, Morton RL, Masson P. Chronic kidney

disease. Lancet. 2017, March 25;389(10075):1238-1252. doi: 10.1016/ S0140-6736(16)32064-5. Epub 2016 Nov 23). In 2018 Medicare alone

spent $130 billion on CKD and ESRD-related costs (United States Renal Data System (“USRDS”). 2020 USRDS annual data report:

epidemiology of kidney disease in the United States. National Institutes of Health, National Institute of Diabetes and Digestive and

Kidney Diseases, Bethesda, MD, 2020 (“2020 USRDS”), Volume 1 Chronic Kidney Disease; Chapter 6 Healthcare Expenditures for

Persons with CKD; Highlights; Bullet #1: “Medicare fee-for-service (FFS) spending for beneficiaries with CKD who did not have ESRD

exceeded $81 billion in 2018 and represented 22.3% of Medicare FFS spending (Tables 6.1 and 6.2).”; Volume 2; End Stage Renal Disease:

End Stage Renal Disease: Chapter 9 Healthcare Expenditures for Persons with ESRD; Highlights; Bullet #1: “Total Medicare-related

expenditures for beneficiaries with ESRD rose to $49.2B in 2018.”). With the increase of diabetics and hypertension cases in the

U.S., which make up roughly two-thirds of all CKD patients (USRDS 2020 ADR Reference Tables, Vol. 2—ESRD; Ref. Tables A Incidence;

Table A.4 Incident counts of reported ESRD patients, by age and primary diagnosis, 2016–2018 combined. Col. X, Row 38 (All patients)

382,398; Col. X, Row 33 (Diabetes) 179,706; Col. X, Row 34 (Hypertension) 110,807.] [Computed from: (Col. X shows all gender and race.)

All patients (Col. X, Row 38) = 382,398 / DM (Col. X, Row 33) 179,706; (179,706/382,398) = 47% (0.4699); HTN (Col. X, Row 34) 110,807

(110,807/382,398) = 29% (0.2897)), CKD related healthcare costs are expected to increase significantly. Compounding this development

is the fact that less than 50% of diabetic patients are annually screened or tested for kidney damage (Folkerts, K., Petruski-Ivleva,

N., Comerford, E., et al., “Adherence to Chronic Kidney Disease Screening Guidelines Among Patients With Type 2 Diabetes in a US

Administrative Claims Database,” Mayo Clinic Proceedings 2021;96(4):975-986) doi: https://doi.org/10.1016/j.mayocp.2020.07.037).

This creates an unmet need for point-of-care technologies that facilitate CKD screening and diagnosis, which further facilitates earlier

screening and diagnosis and detection to slow down or eliminate the CKD progression. By combining lab-on-chip technology with our MATLOC

device, it will be able to quantitatively read the two urine biomarkers, albumin and creatine, and a blood biomarker, eGFR, necessary

for effective CKD screening and diagnosis at point-of-care with results available instantly on a patient’s smartphone.

The

COVID-19 pandemic has massively accelerated the ongoing transformation in healthcare. Connected consumer electronic devices are enabling

24/7 home-based digital healthcare. We believe that consumers have the desire and are now becoming empowered to manage their own healthcare

and that they will seek to utilize our point-of-care MATLOC device.

With

our lab-on-chip technology and MATLOC device in development, we are striving to achieve earlier detection and slowing of the progression

of CKD, allowing patients and healthcare systems to reduce the enormous costs of kidney failure, transplant, and/or dialysis. After completing

the technology for CKD assessment, we plan to explore the commercial potential of other biomarkers for chronic diseases to be measured

at point-of-care.

We

anticipate that once we commence marketing and sales operations for DuraGraft in the U.S., we will be able to accelerate the development

of a functional MATLOC device prototype.

MAR-FG-001

In November 2021, we reinitiated the development

of MAR-FG-001, our fat grafting technology. MAR-FG-001 is a tumescent solution base for fat grafting procedures that may be used for

plastic and cosmetic surgeries. The Company intends to develop MAR-FG-001 for use during these and other fat grafting procedures.

Fat

grafting is a surgical process used in medical reconstructive and other plastic surgery procedures in which fat is transferred from one

area of the body to another (known as “autologous fat grafting” or simply “fat grafting”) to correct a defect,

replace injured tissue, or to make cosmetic enhancements.

Compared

to standard solutions, we believe that MAR-FG-001 could better protect adipose tissue from ischemic and oxidative injury and increase

adipocyte and stromal cell viability, which is key to improving retention of fat volume thereby improving patient outcomes following

fat grafting procedures.

The

global market for autologous fat grafting was estimated to be $699.96 million in 2021 and was projected to grow at a CAGR of 8.62% until

2028 (“Global Autologous Fat Grafting Market – Industry Trends and Forecast to 2028,” Data Bridge Market Research,

December 2020). Growing preference for the use of non-invasive aesthetic techniques in skin rejuvenation, more rapid recovery with lesser

allergic risks and reduced downtime compared to other procedures are some of the factors contributing to increasing demand. The adoption

rate for autologous fat grafting procedures in the United States was 2.2% of all augmentation and reconstruction procedures as of 2018,

suggesting significant potential for growth of adoption of these procedures (“Autologous Fat Grafting Market Analysis By Product

(Integrated Fat Transfer Systems, Aspiration and Harvesting Systems, Liposuction Systems, Fat Processing Systems, De-epithelialization

Devices), By Application & Region - Global Market Insights 2021 to 2031,” Fact.MR, March 2022). With approximately 22.4 million

plastic surgeries performed in the United States in 2020 (American Society of Plastic Surgeons, “Plastic Surgery Statistics Report

– 2020,” April 27, 2021), there is potential for widespread implementation of innovative fat grafting systems.

MAR-FG-001

is currently in development and not yet available for sale in any markets.

Our

Historical Performance

Our net loss was approximately $20.6

million and $6.9 million for the three months

ended June 30, 2023 and June 30, 2022, respectively, and was approximately $23.1 million and $13.0 million for the six months ended June

30, 2023 and June 30, 2022, respectively. For the fiscal years ended December 31, 2022 and 2021, our net loss was approximately $38.2

million and $11.0 million, respectively. We expect to incur expenses and operating losses over the next several years. Accordingly, we

will need additional financing to support our continuing operations. We will seek to fund our operations through public or private equity

offerings, debt financings, government or other third-party funding, collaborations and licensing arrangements. Adequate additional financing

may not be available to us on acceptable terms, or at all. Our failure to raise capital as and when needed would impact our going concern

status and would have a negative impact on our financial condition and our ability to pursue our business strategy and continue as a

going concern. We will need to generate significant revenues to achieve profitability, and we may never do so.

Our

Competitive Strength

We

believe that the following competitive strength will enable us to compete effectively:

| ● | Superior,

first-in-class vascular graft storage and flushing solution. DuraGraft is

the first and only medical product that has received authorization by the

FDA for marketing for use as an intra-operative vascular conduit storage and flushing solution

used during CABG surgeries. DuraGraft is also the only product certified for marketing

in Europe and other jurisdictions for this indication. |

Our

Growth Strategies

We

will strive to grow our business by pursuing the following key growth strategies:

| ● | Commercialize

DuraGraft. |

| ● | Develop

MATLOC technology and related products. |

| ● | Develop

MAR-FG-001 fat grafting technology and related products. |

| ● | Acquire

more life science assets. |

The

strategic plans described above will require capital. We will not receive any of the required capital in this offering except upon the

exercise of warrants held by the selling stockholders for issuance of the shares of common stock that are being registered for resale

by the registration statement of which this prospectus forms a part. There can be no assurances that we will be able to raise the capital

that we need to execute our plans or that capital, whether through securities offerings, either private or public, will be available

to us on acceptable terms, if at all. An inability to raise sufficient funds could cause us to scale back our development and growth

plans or discontinue them altogether.

COVID-19

Pandemic

The Company has been impacted

by the COVID-19 pandemic and related supply chain shortages and other economic conditions, and some of its earlier plans to diversify

and expand its operations were delayed as a result. Moreover, the impact of the COVID-19 pandemic on the Company’s

supply chain and its ability to produce DuraGraft inventory was a primary reason that we did not generate substantial revenue from sales

of DuraGraft during 2021 and 2022. The Company’s inventory production of DuraGraft returned to its pre-pandemic level at the end

of the second quarter of 2022, but lingering effects of the COVID-19 pandemic continued to depress demand for DuraGraft and cause revenues

from DuraGraft during the first and second quarters of 2023 to be minimal. There can be no assurance that future supply chain

disruptions and other effects of COVID-19 outbreaks will not adversely impact our revenues.

In

addition, the Company is dependent upon certain contract manufacturers and suppliers and their ability to reliably and efficiently fulfill

its orders is critical to the Company’s business success. The COVID-19 pandemic has impacted and may continue to impact certain

of the Company’s manufacturers and suppliers. As a result, the Company has faced and may continue to face delays or difficulty

sourcing certain products, which could negatively affect the Company’s business and financial results.

While it is not possible

at this time to estimate the total impact that COVID-19 could have on our business in the future, the continued spread of COVID-19

and variants of the virus, the rate of vaccinations regionally and globally and the measures taken by the government authorities, and

any future epidemic disease outbreaks, could: Disrupt the supply chain and the manufacture or shipment of products and supplies for use

by us in our research activities and by strategic partners for their distribution and sales activities; delay, limit or prevent us in

our research activities and strategic partners in their distribution and sales activities; impede our negotiations with strategic partners;

impede testing, monitoring, data collection and analysis and other related activities by us; interrupt or delay the operations of the

FDA or other regulatory authorities, which may impact review and approval timelines for initiation of clinical trials or marketing; or

impede the launch or commercialization of any approved products; any of which could delay our strategic partnership plans, increase our

operating costs, and have a material adverse effect on our business, financial condition and results of operations.

For

further discussion of the impact of the COVID-19 pandemic on our business, please see “Management’s Discussion and Analysis

of Financial Condition and Results of Operations”, and “Risk Factors –

Risks Related to Our Business – The COVID-19 pandemic has adversely impacted the Company’s supply chain and could materially

and adversely affect our ability to conduct clinical trials and engage with our third-party vendors and thereby have a material adverse

effect on our financial results.”

Implications

of Being a Smaller Reporting Company

We

are a “smaller reporting company” as defined in Rule 10(f)(1) of Regulation S-K. Smaller reporting companies may take advantage

of certain reduced disclosure obligations, including, among other things, providing only two years of audited financial statements. We

will remain a smaller reporting company until the last day of the fiscal year in which (1) the market value of our shares held by non-affiliates

equals or exceeds $250 million as of the prior June 30th, or (2) our annual revenues equaled or exceeded $100 million during such completed

fiscal year and the market value of our shares held by non-affiliates equals or exceeds $700 million as of the prior June 30th. Such

reduced disclosure and corporate governance obligations may make it more challenging for investors to analyze our results of operations

and financial prospects.

For

additional information, see “Risk Factors – Risks Related to This Offering and Ownership of Our Securities –

We are a ‘smaller reporting company’ within the meaning of the Exchange Act, and if we take advantage of certain exemptions

from disclosure requirements available to smaller reporting companies, this could make our securities less attractive to investors and

may make it more difficult to compare our performance with other public companies.” and “—As a ‘smaller

reporting company,’ we may at some time in the future choose to exempt our company from certain corporate governance requirements

that could have an adverse effect on our public stockholders.”

Corporate

Information

Our

principal executive office is located at 555 Heritage Drive, Suite 205, Jupiter, Florida 33458 and our telephone number is (561) 935-9955.

We maintain a website at www.marizyme.com. Information available on this website is not incorporated by reference in and is not deemed

a part of this prospectus or the registration statement of which this prospectus forms a part. Our filings with the SEC are available

for inspection through the SEC’s website at http://www.sec.gov.

The

Offering

| Common stock offered by the selling stockholders: |

|

This

prospectus relates to the offer and resale by the selling stockholders of up to 915,071,257 shares of common stock that may

be sold from time to time by the selling stockholders named in this prospectus, which includes: |

| |

|

|

|

|

| |

|

|

● |

13,971,324 shares of outstanding common stock held

by existing stockholders; |

| |

|

|

|

|

| |

|

|

● |

221,939,338

shares

of common stock issuable upon the conversion of the outstanding Convertible Notes, assuming

that all convertible debts and other liabilities under the Convertible Notes are converted

into shares of common stock, without regard to any applicable limitations or restrictions; |

| |

|

|

|

|

| |

|

|

● |

380,986,336

shares of common stock upon the exercise of the outstanding Class C Warrants,

without regard to any applicable limitations or restrictions; |

| |

|

|

|

|

| |

|

|

● |

66,159,434

shares

of common stock upon the conversion of the outstanding OID Convertible Notes, assuming that

the OID Convertible Notes are held until maturity and that all convertible debts and other

liabilities under the OID Convertible Notes are converted into shares of common

stock, without regard to any applicable limitations or restrictions; |

|

|

|

|

|

| |

|

|

● |

84,546,202

shares

of common stock upon the exercise of the outstanding Class E Warrants, without regard to

any applicable limitations or restrictions; |

| |

|

|

|

|

| |

|

|

● |

80,796,202

shares

of common stock upon the exercise of the outstanding Class F Warrants, without regard to

any applicable limitations or restrictions; and |

| |

|

|

|

|

| |

|

|

● |

66,672,421

shares of common

stock upon the exercise of the Placement Agent Warrants, without regard to any applicable

limitations or restrictions. |

| |

|

|

|

|

| Shares

of common stock outstanding at commencement of the offering(1): |

|

46,666,760

shares of common stock. |

| |

|

|

| Use of proceeds: |

|

We

will not receive any proceeds from the resales of shares of common stock by the selling stockholders. Assuming the full exercise

of the Class C Warrants, the Class E Warrants, the Class F Warrants, and the Placement Agent Warrants for cash, we will receive gross

proceeds of approximately $70.4 million. We plan to use the proceeds for working capital and general corporate purposes. See

“Use of Proceeds.” |

| |

|

|

| Risk factors: |

|

Investing

in our common stock involves a high degree of risk. As an investor, you should be able to bear a complete loss of your investment.

You should carefully consider the information set forth in the “Summary of Risk Factors” section beginning on

page 10 and “Risk Factors” section beginning on page 12 before deciding to invest in our common

stock. |

| |

|

|

| Trading market and symbol: |

|

Our common stock is quoted for trading on the OTCQB under the symbol “MRZM”. We have applied to list our common stock under the symbol “MRZM” on the Nasdaq Capital Market. There can be no guarantee that we will successfully list our common stock on the Nasdaq Capital Market. The registration of the selling stockholders’ resale of the Company’s common stock as described in this prospectus is not conditioned upon our successful listing on the Nasdaq Capital Market. |

| (1) |

The

number of shares of common stock outstanding is based on 46,666,760 shares outstanding as

of September 19, 2023, and excludes the following securities as of such

date: |

| |

● |

3,925,943 shares of common

stock that have been approved by our board of directors for issuance upon the exercise of vested and unvested options granted to

our officers, directors, employees and service providers at a weighted average exercise price of $1.33 per share pursuant to our

Amended and Restated 2021 Stock Incentive Plan (the “Stock Incentive Plan” or the “Plan”); |

| |

|

|

| |

● |

350,000 unissued restricted

shares of common stock subject to certain performance-based vesting terms and issuable to corporations controlled by our Chief Financial

Officer and Vice President of Finance under the Plan and that will be granted upon the vesting of such restricted shares under certain

side agreements with these corporations; |

| |

|

|

| |

● |

7,200,000 shares of common

stock reserved for issuance pursuant to the Plan, which is inclusive of the 3,925,943 shares issuable upon the exercise of vested

and unvested options that have been granted under the Plan and 350,000 unissued restricted shares of common stock subject to certain

performance-based vesting terms and that will be granted under the Plan upon the vesting of such restricted shares under the side

agreements referred to above; |

| |

|

|

| |

● |

221,939,338 shares of common

stock issuable upon conversion of outstanding Convertible Notes,

assuming that all convertible debts and other liabilities under the Convertible Notes

are converted into shares of common stock, and that all issuable shares of common

stock upon conversion in full of the Convertible Notes are issued, without regard to any

applicable limitations or restrictions; |

| |

|

|

| |

● |

380,986,336 shares of common

stock issuable upon full exercise of outstanding Class C Warrants at an exercise price of

$0.10 per share, without

regard to any applicable limitations or restrictions; |

| |

|

|

| |

● |

66,159,434

shares

of common stock issuable upon conversion of outstanding OID Convertible Notes, assuming that

the OID Convertible Notes are held until maturity, that all convertible debts and other

liabilities under the OID Convertible Notes are converted into shares of common

stock, and that all issuable shares of common stock upon conversion in full of the OID Convertible

Notes are issued, without regard to any applicable limitations or restrictions; |

| |

|

|

| |

● |

84,546,202

shares

of common stock issuable upon exercise of outstanding Class E Warrants at an exercise price

of $0.10 per share, without regard to any applicable limitations or restrictions; |

| |

|

|

| |

● |

80,796,202

shares

of common stock issuable upon exercise of outstanding Class F Warrants at an exercise price

of $0.20 per share, without regard to any applicable limitations or restrictions; |

| |

|

|

| |

● |

280,014

shares of common stock issuable upon exercise of outstanding Placement Agent Warrants at an exercise price of $1.375 per share (the

“2020 Placement Agent Warrants”), without regard to any applicable limitations or restrictions; |

| |

|

|

| |

● |

48,234,054 shares of common stock issuable upon exercise

of certain outstanding Placement Agent Warrants issued on July 25, 2023 and September 27, 2023 at an exercise price of $0.10 per

share (the “Replacement Placement Agent Warrants”),

without regard to any applicable limitations or restrictions; |

| |

|

|

| |

● |

11,694,656 shares

of common stock issuable upon exercise of certain Placement Agent Warrants issued on September 13, 2023 at an exercise price of $0.10

per share (collectively, the “OID Notes and Class E Placement Agent Warrants”, and together with the Class F Placement

Agent Warrants, the “OID Units Placement Agent Warrants”), without regard to any applicable limitations or restrictions; |

| |

|

|

| |

● |

6,463,697 shares

of common stock issuable upon exercise of Placement Agent Warrants issued on September 13, 2023 at an exercise price of $0.20 per

share (collectively, the “Class F Placement Agent Warrants”), without regard to any applicable limitations or restrictions; |

| |

|

|

| |

● |

577,796

shares of common stock issuable upon full exercise of other outstanding warrants at a weighted-average

exercise price of approximately $3.56 per share, without regard to any applicable

limitations or restrictions. |

In

addition, unless otherwise indicated, the information throughout this prospectus, including outstanding share amounts as of September

19, 2023, reflects and assumes no exercise or conversion of any of the securities listed above, and no issuance of any shares of

common stock pursuant to the Plan.

Summary

Financial Information

The

following tables summarize certain financial data regarding our business and should be read in conjunction with our financial statements

and related notes contained elsewhere in this prospectus and the information under “Management’s Discussion and Analysis

of Financial Condition and Results of Operations.”

Our

summary financial data as of and for the six months ended June 30, 2023 and 2022 are derived from the financial statements

included elsewhere in this prospectus. Our summary financial data as of and for the fiscal years ended December 31, 2022 and 2021 are

derived from our audited financial statements included elsewhere in this prospectus. All consolidated financial statements included in

this prospectus are prepared and presented in accordance with generally accepted accounting principles in the United States of America

(“GAAP”). The summary financial information is only a summary and should be read in conjunction with the historical financial

statements and related notes contained elsewhere herein. The consolidated financial statements contained elsewhere fully represent our

financial condition and operations; however, they are not indicative of our future performance.

| | |

Six

Months Ended

June 30, | | |

Year Ended December 31, | | |

Year Ended December 31, | |

| | |

2023 | | |

2022 | | |

2022 | | |

2021 | |

| Statements of Operations Data | |

(Unaudited) | | |

(Unaudited) | | |

| | |

| |

| Revenue | |

$ | 313,713 | | |

$ | 61,809 | | |

$ | 233,485 | | |

$ | 210,279 | |

| Total operating expenses | |

| 7,161,692 | | |

| 8,647,883 | | |

| 37,502,962 | | |

| 8,951,308 | |

| Total operating loss | |

| (6,936,865 | ) | |

| (8,597,099 | ) | |

| (37,323,796 | ) | |

| (8,821,383 | ) |

| Total other income (expense) | |

| (16,194,121 | ) | |

| (4,451,770 | ) | |

| (842,074 | ) | |

| (2,176,546 | ) |

| Net loss | |

$ | (23,130,986 | ) | |

$ | (13,048,869 | ) | |

$ | (38,165,870 | ) | |

$ | (10,997,929 | ) |

| Loss per share – basic and diluted | |

$ | (0.55 | ) | |

$ | (0.32 | ) | |

$ | (0.94 | ) | |

$ | (0.31 | ) |

| Weighted average number of shares of common stock – basic and diluted | |

| 41,979,194 | | |

| 40,728,740 | | |

| 40,727,092 | | |

| 36,041,613 | |

| | |

As of June

30, | | |

As of

December 31, | |

| | |

2023 | | |

2022 | | |

2021 | |

| Balance Sheet Data | |

(unaudited) | | |

| | |

| |

| Cash | |

$ | 205,226 | | |

$ | 510,865 | | |

$ | 4,072,339 | |

| Total current assets | |

| 1,058,577 | | |

| 1,955,303 | | |

| 4,401,818 | |

| Total assets | |

| 36,981,452 | | |

| 38,687,638 | | |

| 65,999,350 | |

| Total current liabilities | |

| 20,821,718 | | |

| 2,921,767 | | |

| 3,133,721 | |

| Total liabilities | |

| 29,711,796 | | |

| 21,265,653 | | |

| 18,309,018 | |

| Total stockholder’s equity | |

| 7,269,656 | | |

| 17,421,985 | | |

| 47,690,332 | |

| Total liabilities and stockholder’s equity | |

| 36,981,452 | | |

| 38,687,638 | | |

| 65,999,350 | |

Summary

of Risk Factors

An

investment in our securities involves a high degree of risk. You should carefully consider the risks summarized below. These risks are

discussed more fully in the “Risk Factors” section immediately following this Prospectus Summary. These risks include,

but are not limited to, the following:

Risks

Related to Our Business

| ● | We

have incurred losses since inception, and we anticipate that we will incur continued losses

for the foreseeable future. Moreover, our independent registered public accounting firm’s

report, contained herein, includes an explanatory paragraph that expresses substantial doubt

about our ability to continue as a going concern, indicating the possibility that we may

not be able to operate in the future. |

| ● | We

defaulted under the Convertible Notes and, as a result, the Convertible Note holders may

accelerate amounts owed under such Convertible Notes and seek to take possession the assets

securing our obligations. Our other indebtedness could also expose us to risks that could

adversely affect our business, financial condition and results of operations. |

| ● | Management

identified a material weakness in our internal controls, and failure to remediate it or any

future ineffectiveness of internal controls could have a material adverse effect on the Company’s

business and the price of its common stock. |

| ● | If

we continue to fail to comply with the rules under the Sarbanes-Oxley Act of 2002 related

to disclosure controls and procedures, or, if we discover additional material weaknesses

and other deficiencies in our internal control and accounting procedures, our securities’

prices could decline significantly and raising capital could be more difficult. |

| ● | Misconduct

of employees, subcontractors, agents and business partners could cause us to lose existing

contracts or customers and adversely affect our ability to obtain new contracts and customers

and could have a significant adverse impact on our business and reputation. |

| ● | We

have negative working capital. |

| ● | We

have a limited operational history. |

| ● | If

we fail to retain current members of our senior management, or to identify, attract, integrate

and retain additional key personnel, our business will be harmed. |

| ● | If

we do not generate sufficient cash flow from operations in the future, we may not be able

to fund our product development efforts and acquisitions or fulfill our future obligations. |

| ● | We

will require substantial additional funding which may not be available to us on acceptable

terms, or at all. Failing to raise the necessary additional capital could force us to delay,

reduce, eliminate or abandon growth initiatives, development or commercialization of our

technologies and products. |

| ● | We

may not be able to monetize intangible assets, which may result in the need to record an

impairment charge. |

| ● | Acquisitions

present many risks, and we may not realize the financial and strategic goals we anticipate

at the time of an acquisition. |

| ● | The

medical device market is highly competitive, and we may not be able to effectively compete

against other providers of medical devices, particularly those with greater resources. |

| ● | Our

future performance may depend on the success of products we have not yet developed or acquired. |

| ● | Our

products may never achieve market acceptance. |

| ● | We

may delay or terminate the development or acquisition of a product at any time if we believe

the perceived market or commercial opportunity does not justify further investment, which

could materially harm our business. |

| ● | Product

liability lawsuits against us could cause us to incur substantial liabilities and to limit

commercialization of any products that we may develop or acquire. |

| ● | We

may not be able to protect or enforce our intellectual property rights, which could impair

our competitive position. |

| ● | Confidentiality

agreements with employees and others may not adequately prevent disclosure of trade secrets

and other proprietary information and may not adequately protect our intellectual property. |

| ● | We

may be subject to intellectual property infringement claims by third parties which could

be costly to defend, divert management’s attention and resources, and may result in

liability. |

| ● | Competitors

may violate our intellectual property rights, and we may bring litigation to protect and

enforce our intellectual property rights, which may result in substantial expense and may

divert our attention from implementing our business strategy. |

| ● | We

may be dependent on third-party manufacturers since we will not initially directly

manufacture our products. |

| ● | We

currently have no marketing and sales organization and have limited experience as a company

in commercializing products, and we may need to invest significant resources to develop these

capabilities. If we are unable to establish marketing and sales capabilities in the United

States, we may not be able to generate substantial product revenue. |

| ● | The

COVID-19 pandemic has adversely impacted the Company’s supply chain and could materially

and adversely affect our ability to conduct clinical trials and engage with our third-party

vendors and thereby have a material adverse effect on our financial results. |

Risks

Related to Government Regulation

| ● | Only

one of our

products has been authorized for marketing in the United States, other

products may not be granted authorization, and any authorization may be subject

to significant limitations. |

| ● | Failure

to obtain regulatory approvals in foreign jurisdictions will prevent us from marketing our

products internationally. |

| ● | Even

if we receive regulatory approval for any product we may develop or acquire, we will be subject

to ongoing regulatory obligations and continued regulatory review, which may result in significant

additional expense and subject us to penalties if we fail to comply with applicable regulatory

requirements. |

| ● | Healthcare

reform measures could hinder or prevent our products’ commercial success. |

| ● | If

we fail to comply with healthcare regulations, we could face substantial penalties and our

business, operations and financial condition could be adversely affected. |

Risks

Related to This Offering and Ownership of Our Securities

| ● | Our

efforts to obtain and maintain a listing of our common stock on the Nasdaq Capital Market

may fail and may not prevent, or may cause, the decline of the value of your common stock. |

| ● | Substantial

future sales or issuances of our securities, or the perception in the public markets that

these sales or issuances may occur, may depress the price of our common stock. Also, future

issuances of our common stock or rights to purchase common stock could result in additional

dilution of the percentage ownership of our stockholders and could cause the prices of our

common stock to fall. |

RISK

FACTORS

An

investment in our common stock involves a high degree of risk. You should carefully consider the following risk factors, together with

the other information contained in this prospectus, before purchasing our common stock. We have listed below (not necessarily in order

of importance or probability of occurrence) what we believe to be the most significant risk factors applicable to us, but they do not

constitute all of the risks that may be applicable to us. Any of the following factors could harm our business, financial condition,

results of operations or prospects, and could result in a partial or complete loss of your investment. Some statements in this prospectus,

including statements in the following risk factors, constitute forward-looking statements. Please refer to the section titled “Cautionary

Note Regarding Forward-Looking Statements”.

Risks

Related to Our Business

We

have incurred losses since inception, and we anticipate that we will incur continued losses for the foreseeable future. Moreover, our

independent registered public accounting firm’s report, contained herein, includes an explanatory paragraph that expresses substantial

doubt about our ability to continue as a going concern, indicating the possibility that we may not be able to operate in the future.

As

of June 30, 2023, December 31, 2022 and December 31, 2021, the Company had an accumulated deficit of approximately $109.1

million, $86.0 million and $47.8 million, respectively, respectively. We expect to incur significant and increasing operating

losses for the next several years as we expand our acquisition efforts, continue clinical trials, acquire, or license technologies, advance

other medical devices into clinical development, complete clinical trials, seek regulatory approval and, if we receive FDA approval,

commercialize our products. Primarily because of our losses incurred to date, our expected continued future losses, and limited cash

balances, our independent registered public accounting firm has included in its report an explanatory paragraph expressing substantial

doubt about our ability to continue as a going concern. Our ability to continue as a going concern is contingent upon, among other factors,

the sale of the shares of common stock or obtaining alternate financing. We cannot provide any assurance that we will be able to raise

additional capital.

If

we are unable to secure additional capital, we may be required to curtail our research and development initiatives and take additional

measures to reduce costs in order to conserve our cash in amounts sufficient to sustain operations and meet our obligations. These measures

could cause significant delays in our clinical and regulatory efforts, which are critical to the realization of our business plan. The

accompanying financial statements do not include any adjustments that may be necessary should we be unable to continue as a going concern.

It is not possible for us to predict currently the potential success of our business. The revenue and income potential of our proposed

business and operations are currently unknown. If we cannot continue as a viable entity, you may lose some or all your investment in

our company.

We

defaulted under the Convertible Notes and, as a result, the Convertible Note holders may accelerate amounts owed under such Convertible

Notes and seek to take possession the assets securing our obligations. Our other indebtedness could also expose us to risks that could

adversely affect our business, financial condition and results of operations.

We

defaulted under the Convertible Notes due to a cross-default provision that was triggered by the non-repayment of principal under a promissory

note on May 7, 2023. Under the terms of the Convertible Notes, the aggregate amount that may be due is $22,193,934, or approximately

$5.7 million more than would otherwise have been due under the Convertible Notes. Under the unit purchase agreement entered into on May

27, 2021 with certain holders of several of the Convertible Notes, each of the Company’s subsidiaries entered into a guaranty to

guarantee the repayment of the Company’s obligations under the Convertible Notes, and the Company and its subsidiaries entered

into security agreements granting security interests in all of their respective assets for up to the dollar value owed under the respective

Convertible Notes. The respective Convertible Notes were issued for aggregate principal of approximately $1.2 million. Under each unit

purchase agreement entered into with respect to subsequent issuances of the Convertible Notes, the Company and its subsidiaries were

obligated to enter into similar security agreements and guaranties, but did not do so.

The

holders of the Convertible Notes have not exercised any remedies applicable to the Convertible Notes or given notice of any intention

to do so as of the date of this prospectus. If Univest Securities, LLC (“Univest”), as the appointed representative of the

Convertible Note holders, remains so appointed, no investor other than Univest may pursue any remedy with respect to the Convertible

Notes. However, if the amount owed due to the default is not repaid upon demand, the holders of the Convertible Notes may nonetheless

seek to remove Univest from this appointed position, take possession of some or all of the Company’s and its subsidiaries’

assets, force the Company and its subsidiaries into bankruptcy proceedings, or seek other legal remedies against the Company and its

subsidiaries. In such event, the Company’s business, operating results and financial condition may be materially adversely affected.

In

addition to the Convertible Notes, we have incurred indebtedness under the OID Convertible Notes in the aggregate principal amount of

$6,163,697. The OID Convertible Notes accrue interest at 10% and will mature on various dates from February 12, 2024 to May 30, 2024.

We have also incurred trade debts to various vendors. In the future, we may incur additional indebtedness.

Even

if the holders of the Convertible Notes do not pursue remedies in response to our default under the Convertible Notes, our indebtedness

could have significant negative consequences for our security holders, business, results of operations and financial condition by, among

other things:

| ● | increasing

our vulnerability to adverse economic and industry conditions; |

| ● | limiting

our ability to obtain additional financing; |

| ● | requiring

the dedication of a substantial portion of our cash flow from operations to service our indebtedness,

which will reduce the amount of cash available for other purposes; |

| ● | limiting

our flexibility to plan for, or react to, changes in our business; and |

| ● | placing

us at a possible competitive disadvantage with competitors that are less leveraged than us

or have better access to capital. |

Our

business may not generate sufficient funds, and we may otherwise be unable to maintain sufficient cash reserves to pay any indebtedness

that we may incur. The OID Convertible Notes contain restrictive covenants, including cross-default provisions, that are similar to the

Convertible Notes. In addition, any future indebtedness that we may incur may also contain financial and other restrictive covenants

that will limit our ability to operate our business, raise capital or make payments under our indebtedness. If we fail to comply with

such covenants or to make payments under any of our indebtedness when due, then we would be in default under that indebtedness, which

could, in turn, result in that indebtedness becoming immediately payable in full and cross-default or cross-acceleration under our other

indebtedness and other liabilities.

Management

has determined that disclosure controls and procedures and internal control over financial reporting were not effective, identified a

material weakness in our internal controls, and a failure to remediate it or any future ineffectiveness of internal controls could have

a material adverse effect on the Company’s business and the price of its securities.

As

previously reported in “Item 9A. Controls and Procedures” of the Company’s Annual Report on Form 10-K for the

fiscal year ended December 31, 2022, our management determined that our disclosure controls and procedures and internal control over

financial reporting, or ICFR, were not effective due to a material weakness in ICFR as of December 31, 2022, and as previously reported

in “Item 4. Controls and Procedures” of the Company’s Quarterly Report on Form 10-Q for the fiscal quarter ended

June 30, 2023, our management determined that our disclosure controls and procedures were not effective due to material weaknesses

in ICFR as of June 30, 2023.

A “material weakness” is a deficiency, or a combination of deficiencies, in ICFR, such

that there is a reasonable possibility that a material misstatement of the Company’s annual or interim financial statements will

not be prevented or detected on a timely basis. As previously reported, we have taken, and plan to continue to take, measures to remediate

the Company’s internal weaknesses in ICFR. However, the implementation of these measures may not address any control deficiencies

in our ICFR. Our failure to address any control deficiencies could result in inaccuracies in our financial statements and could also

impair our ability to comply with applicable financial reporting requirements and related regulatory filings on a timely basis. Moreover,

effective ICFR is important to prevent fraud. Failure to report its financial information on an accurate or timely basis may thereby

subject the Company to adverse regulatory consequences, including sanctions by the SEC or violations of applicable securities exchange

or quotation service listing rules. There could also be a negative reaction in the financial markets due to a loss of investor confidence

in the Company and the lack of timeliness or reliability of its financial statements. Confidence in the reliability of the Company’s

financial statements may suffer due to the Company’s reporting of a material weakness in its ICFR. This could materially adversely

affect the Company’s business, financial condition, results of operations and prospects and lead to a decline in the price of its

common stock.

If

we continue to fail to comply with the rules under the Sarbanes-Oxley Act of 2002 related to disclosure controls and procedures, or,

if we discover additional material weaknesses and other deficiencies in our internal control and accounting procedures, our securities’

prices could decline significantly and raising capital could be more difficult.

If

we continue to fail to comply with the rules under the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”) related to disclosure

controls and procedures, or, if we discover additional material weaknesses and other deficiencies in our internal control and accounting

procedures, the prices of our securities could decline significantly and raising capital could be more difficult. Moreover, effective