UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a party other than the Registrant ☐

Check

the Appropriate Box:

| ☐ |

|

Preliminary

Proxy Statement |

| ☐ |

|

Confidential,

for Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

| ☒ |

|

Definitive

Proxy Statement |

| ☐ |

|

Definitive

Additional Materials |

| ☐ |

|

Soliciting

Material Pursuant to §240.14a-12 |

THE

GLIMPSE GROUP, INC.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement if other than the Registrant)

Payment

of filing fee (Check the appropriate box):

| ☒ |

|

No

fee required. |

| |

|

|

| ☐ |

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| |

|

|

| |

|

(1) |

|

Title

of each class of securities to which transaction applies: |

| |

|

|

|

|

| |

|

(2) |

|

Aggregate

number of securities to which transaction applies: |

| |

|

|

|

|

| |

|

(3) |

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined): |

| |

|

|

|

|

| |

|

(4) |

|

Proposed

maximum aggregate value of transaction: |

| |

|

|

|

|

| |

|

(5) |

|

Total

fee paid: |

| |

|

|

|

|

| |

|

|

|

|

| ☐ |

|

Fee

paid previously with preliminary materials. |

| |

|

|

| ☐ |

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing. |

| |

|

|

| |

|

(1) |

|

Amount

Previously Paid: |

| |

|

|

|

|

| |

|

(2) |

|

Form,

Schedule or Registration Statement No.: |

| |

|

|

|

|

| |

|

(3) |

|

Filing

Party: |

| |

|

|

|

|

| |

|

(4) |

|

Date

Filed: |

| |

|

|

|

|

THE

GLIMPSE GROUP, INC.

15

West 38th St., 12th Fl

New

York, NY 10018

Notice

of Annual Meeting of Stockholders

| Date:

|

|

December

15, 2023 |

| Time:

|

|

9:30

a.m. EST |

| Location: |

|

15

West 38th St., 4th Fl

New

York, NY 10018 |

| Record

Date: |

|

October

10, 2023 |

Proposals:

| |

1. |

Re-elect

seven directors to the Board of Directors (the “Board”) of The Glimpse Group, Inc. (the “Company”) to serve

on a classified board until their respective class term has run and their successors are duly elected and qualified or until their

earlier resignation or removal; |

| |

|

|

| |

2. |

To

hold an advisory vote on executive compensation (the “Say-on-Pay Proposal”); and |

| |

|

|

| |

3. |

Ratify

the appointment of Hoberman & Lesser CPA’s, LLP (“Hoberman”) as the independent registered public accounting

firm of the Company for the fiscal year ending June 30, 2024. |

THE

BOARD RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE NOMINEES TO SERVE AS DIRECTORS IN THEIR DESIGNATED BOARD CLASSES SET FORTH

IN PROPOSAL NO. 1, AND “FOR” PROPOSALS NO. 2, AND NO. 3.

Holders

of record of the Company’s common stock at the close of business on October 13, 2023 (the “Record Date”) will be entitled

to notice of, and to vote at the 2023 annual meeting of stockholders of the Company (the “Meeting”) and any adjournment or

postponement thereof. Each share of common stock entitles the holder thereof to one vote.

Your

vote is important, regardless of the number of shares you own. Even if you plan to attend the Meeting in person, it is strongly recommended

that you complete the enclosed proxy card before the meeting date, to ensure that your shares will be represented at the Meeting if you

are unable to attend.

A

complete list of stockholders of record entitled to vote at the Meeting will be available for 10 days before the Meeting at the principal

executive office of the Company for inspection by stockholders during ordinary business hours for any purpose germane to the Meeting.

This

notice and the enclosed proxy statement are first being mailed to stockholders on or about October 31,2023.

You

are urged to review carefully the information contained in the enclosed proxy statement prior to deciding how to vote your shares.

| |

|

By

Order of the Board, |

| |

|

|

|

| Date: |

October

31, 2023 |

By: |

/s/

Lyron Bentovim |

| |

|

Name: |

Lyron

Bentovim |

| |

|

Title: |

Chief

Executive Officer

(Principal

Executive Officer) |

IF

YOU RETURN YOUR PROXY CARD WITHOUT AN INDICATION OF HOW YOU WISH TO VOTE, YOUR SHARES WILL BE VOTED “FOR” ALL OF THE PROPOSALS

LISTED ABOVE.

Important

Notice Regarding the Availability of Proxy Materials

for

the 2023 Annual Meeting of Stockholders to be held at 9:30 a.m. EST on

The

Notice of the Annual Meeting of Stockholders, this proxy statement, and our Annual Report on Form 10-K for the period ended June 30,

2023 (the “Annual Report”) are available at https://ir.theglimpsegroup.com/filings/.

TABLE

OF CONTENTS

QUESTIONS

AND ANSWERS ABOUT THESE PROXY MATERIALS

Why

am I receiving this proxy statement?

In

this proxy statement, we refer to The Glimpse Group, Inc. as the “Company,” “we,” “us,” or “our.”

This

proxy statement describes the proposals on which our Board would like you, as a stockholder, to vote at the Meeting, which will take

place on December 15, 2023 at 9:30 a.m., EST, at 15 West 38th St., 4th Fl, New York, NY 10018.

Stockholders

are being asked to consider and vote upon proposals to (i) re-elect nine directors to the Board to serve on a classified board until

their respective class term has run and their successors are duly elected and qualified or until their earlier resignation or removal,

(ii) provide an advisory vote on executive compensation (the “Say-on-Pay Proposal”); and (iii) ratify the appointment of

Hoberman & Lesser CPA’s, LLP (“Hoberman”) as our independent registered public accounting firm for the fiscal year

ending June 30, 2024.

This

proxy statement also gives you information on the proposals so that you can make an informed decision. You should read it carefully.

Your vote is important. You are encouraged to submit your proxy card as soon as possible after carefully reviewing this proxy statement.

Who

can vote at the Meeting?

Stockholders

who owned shares of our common stock on the Record Date may attend and vote at the Meeting. There were 16,619,905 shares of common stock

outstanding on the Record Date . All shares of common stock shall have one vote per share. Information about the stockholdings

of our directors, executive officers, and significant stockholders is contained in the section entitled “Security Ownership of

Certain Beneficial Owners and Management” beginning on page 20 of this proxy statement.

What

is the proxy card?

The

card enables you to appoint each of Lyron Bentovim and Maydan Rothblum, each acting alone, as your representative at the Meeting. By

completing and returning the proxy card, you are authorizing this person to vote your shares at the Meeting in accordance with your instructions

on the proxy card. This way, your shares will be voted whether or not you attend the Meeting. Even if you plan to attend the Meeting,

it is strongly recommended to complete and return your proxy card before the Meeting date just in case your plans change. If a proposal

comes up for vote at the Meeting that is not on the proxy card, the proxy will vote your shares, under your proxy, according to his best

judgment.

How

does the Board recommend that I vote?

Our

Board unanimously recommends that stockholders vote “FOR” each of the nominees to serve as directors in their designated

Board classes set forth in proposal No. 1, and “FOR” proposals No. 2 and No.3.

What

is the difference between holding shares as a stockholder of record and as a beneficial owner?

Certain

of our stockholders hold their shares in an account at a brokerage firm, bank, or other nominee holder, rather than holding share certificates

in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Stockholder

of Record/Registered Stockholders

If,

on the Record Date, your shares were registered directly in your name with our transfer agent, ClearTrust, LLC, you are a “stockholder

of record” who may vote at the Meeting, and we are sending these proxy materials directly to you. As the stockholder of record,

you have the right to direct the voting of your shares by returning the enclosed proxy card to us or to vote in person at the Meeting.

Whether or not you plan to attend the Meeting, please complete, date, and sign the enclosed proxy card to ensure that your vote is counted.

Beneficial

Owner

If,

on the Record Date, your shares were held in an account at a brokerage firm or at a bank or other nominee holder, you are considered

the beneficial owner of shares held “in street name,” and these proxy materials are being forwarded to you by your broker

or nominee who is considered the stockholder of record for purposes of voting at the Meeting. As the beneficial owner, you have the right

to direct your broker on how to vote your shares and to attend the Meeting. However, since you are not the stockholder of record, you

may not vote these shares in person at the Meeting unless you receive a valid proxy from your brokerage firm, bank, or other nominee

holder. To obtain a valid proxy, you must make a special request of your brokerage firm, bank, or other nominee holder. If you do not

make this request, you can still vote by using the voting instruction card enclosed with this proxy statement; however, you will not

be able to vote in person at the Meeting.

What

are broker non-votes?

Broker

non-votes are shares held by brokers that do not have discretionary authority to vote on the matter and have not received voting instructions

from their clients. Brokers holding shares of record for customers generally are not entitled to vote on “non-routine” matters,

unless they receive voting instructions from their customers. The proposed ratification of the appointment of Hoberman as the Company’s

independent registered public accounting firm for the fiscal year ending June 30, 2024 is considered a “routine” matter.

Accordingly, brokers are entitled to vote uninstructed shares only with respect to the ratification of the appointment of Hoberman as

our independent registered public accounting firm.

If

my bank, broker or other nominee holds my shares in “street name,” will such party vote my shares for me?

For

all “non-routine” matters, not without your direction. Your broker, bank or other nominee will be permitted to vote your

shares on any “non-routine” proposal only if you instruct your broker, bank or other nominee on how to vote. Under applicable

stock exchange rules, brokers, banks or other nominees have the discretion to vote your shares on routine matters if you fail to instruct

your broker, bank or other nominee on how to vote your shares with respect to such matters. The proposals to be voted upon by our stockholders

described in this proxy statement, except for the ratification of the appointment of our independent registered public accounting firm,

are “non-routine” matters, and brokers, banks and other nominees therefore cannot vote on these proposals without your instructions.

The proposed ratification of the appointment of Hoberman as the Company’s independent registered public accounting firm for the

fiscal year ending June 30, 2024 is considered a “routine” matter. Accordingly, brokers, banks and other nominees are entitled

to vote uninstructed shares only with respect to the ratification of the appointment of Hoberman as our independent registered public

accounting firm. Therefore, it is important that you instruct your broker, bank or nominee on how you wish to vote your shares.

How

do I vote my shares if I hold my shares in “street name” through a bank, broker or other nominee?

If

you hold your shares as a beneficial owner through a bank, broker or other nominee, you should have received instructions on how to vote

your shares from your broker, bank or other nominee. Please follow their instructions carefully. You must provide voting instructions

to your bank, broker or other nominee by the deadline provided in the materials you receive from your bank, broker or other nominee to

ensure your shares are voted in the way you would like at the Meeting.

How

do I vote?

If

you were a stockholder of record of the Company’s common stock on the Record Date, you may vote in person at the Meeting or by

submitting a proxy. Each share of common stock that you own in your name entitles you to one vote, in each case, on the applicable proposals.

| |

(1) |

You

may submit your proxy by mail. You may submit your proxy by mail by completing, signing, and dating your proxy card and returning

it in the enclosed, postage-paid, and addressed envelope. If we receive your proxy card prior to the Meeting and if you mark your

voting instructions on the proxy card, your shares will be voted: |

| |

● |

as

you instruct, and |

| |

|

|

| |

● |

according

to the best judgment of the proxies if a proposal comes up for a vote at the Meeting that is not on the proxy card. |

We

encourage you to examine your proxy card closely to make sure you are voting all of your shares in the Company.

Mark,

sign, and date your proxy card and return it in the postage-paid envelope we have provided or return it to Broadridge, Inc.

If

you return a signed card, but do not provide voting instructions, your shares will be voted:

| |

● |

FOR

each nominees to serve as directors in their designated Board classes; |

| |

|

|

| |

● |

FOR

passing an advisory vote on executive compensation; and |

| |

|

|

| |

● |

FOR

the selection of Hoberman as our independent registered public accounting firm for the fiscal year ending June 30, 2024. |

| |

|

|

| |

● |

According

to the best judgment of Maydan Rothblum, the Company’s Chief Financial Officer and Chief Operating Officer, if a proposal comes

up for a vote at the Meeting that is not on the proxy card. |

| |

(2) |

You

may vote in person at the Meeting. We will pass out written ballots to any stockholder of record who wants to vote at the Meeting. |

| |

|

|

| |

(3) |

You

may vote online. You may use the website www.proxyvote.com to transmit your voting instructions and for electronic delivery

of information up until 11:59 p.m., EST, December 14, 2023. Have your proxy card in hand when you access the website and follow the

instructions to obtain your records and to create an electronic voting instruction form. |

| |

|

|

| |

(4)

|

You

may vote via mail. Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return

it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. |

| |

|

|

| |

(5) |

You

may vote via fax. You may fax your signed voting card to +1-800-690-6903. |

What

happens if I abstain?

If

you abstain, whether by proxy or in person at the Meeting, or if you instruct your broker, bank or other nominee to abstain your abstention

will not be counted for or against the proposals, but will be counted as “present” at the Meeting in determining whether

or not a quorum exists.

If

I plan on attending the Meeting, should I return my proxy card?

Yes.

Whether or not you plan to attend the Meeting, after carefully reading and considering the information contained in this proxy statement,

please complete and sign your proxy card, and then return the proxy card in the pre-addressed, postage-paid envelope provided herewith

as soon as possible, so your shares may be represented at the Meeting.

May

I change my mind after I return my proxy?

Yes.

You may revoke your proxy and change your vote at any time before the polls close at the Meeting. You may do this by:

| |

● |

sending

a written notice to the Secretary of the Company at the Company’s executive offices stating that you would like to revoke your

proxy of a particular date; |

| |

|

|

| |

● |

signing

another proxy card with a later date and returning it to the Secretary before the polls close at the Meeting; or |

| |

|

|

| |

● |

attending

the Meeting and voting in person. |

What

does it mean if I receive more than one proxy card?

You

may have multiple accounts at the transfer agent and/or with brokerage firms. Please sign and return all proxy cards to ensure that all

of your shares are voted.

What

happens if I do not indicate how to vote my proxy?

Signed

and dated proxies received by the Company without an indication of how the stockholder desires to vote on a proposal will be voted in

favor of each director and proposal presented to the stockholders.

Will

my shares be voted if I do not sign and return my proxy card?

If

you do not sign and return your proxy card, your shares will not be voted unless you vote in person at the Meeting.

What

vote is required to re-elect the director nominees as directors of the Company?

The

re-election of each nominee for director requires the affirmative vote of a majority of the voting power of the shares of capital stock

of the Company present in person or represented by proxy at the Meeting and voting thereon, and where a separate vote by class is required,

a majority of the voting power of the shares of that class present in person or represented by proxy at the Meeting and voting thereon.

How

many votes are required to approve the executive compensation?

The

proposal to approve executive compensation requires the affirmative vote of a majority of the votes cast at the Meeting by the holders

of shares of common stock entitled to vote.

How

many votes are required to appoint Hoberman as the Company’s independent registered public accounting firm for fiscal year ending

June 30, 2024?

The

proposal to appoint Hoberman to serve as our independent registered public accounting firm for the fiscal year ending June 30, 2024 requires

the affirmative vote of a majority of the voting power of the shares of capital stock of the Company present in person or represented

by proxy at the Meeting and voting thereon, and where a separate vote by class is required, a majority of the voting power of the shares

of that class present in person or represented by proxy at the Meeting and voting thereon.

Is

my vote kept confidential?

Proxies,

ballots, and voting tabulations identifying stockholders are kept confidential and will not be disclosed, except as may be necessary

to meet legal requirements.

Where

do I find the voting results of the Meeting?

We

will announce voting results at the Meeting and also file a Current Report on Form 8-K with the U.S. Securities and Exchange Commission

(the “SEC”) reporting the voting results.

Who

can help answer my questions?

You

can contact the Company’s CFO & COO, Maydan Rothblum, at (917) 292-2685 or via email maydan@theglimpsegroup.com or by sending

a letter to the offices of the Company at 15 West 38th St., 12th Fl, New York, NY 10018, with any questions about proposals described

in this proxy statement or how to execute your vote.

GENERAL

INFORMATION ABOUT THE MEETING AND VOTING

We

are furnishing this proxy statement to you, as a stockholder of The Glimpse Group, Inc., as part of the solicitation of proxies by our

Board for use at the Meeting to be held on December 15, 2022, and any adjournment or postponement thereof. This proxy statement is first

being furnished to stockholders on or about October 31, 2022. This proxy statement provides you with information you need to know to

be able to vote or instruct your proxy how to vote at the Meeting.

| Date,

Time, and Place of the Meeting |

|

The

Meeting will be held on December 15, 2023, at 9:30 a.m., EST, at 15 West 38th St., 4th Fl, New York, NY 10018, or such other date,

time, and place to which the Meeting may be adjourned or postponed. |

| |

|

|

| Purpose

of the Meeting |

|

At

the Meeting, the Company will ask stockholders to consider and vote upon the following proposals: |

| |

1. |

Re-elect

seven directors to the Board to serve on a classified board until their respective class term has run and their successors are duly

elected and qualified or until their earlier resignation or removal; |

| |

2. |

To

hold an advisory vote on executive compensation; and |

| |

|

|

| |

3. |

Ratify

the appointment of Hoberman as the independent registered public accounting firm of the Company for the fiscal year ending June 30,

2024. |

| Record

Date and Voting Power |

|

Our

Board fixed the close of business on October 13, 2023, as the record date for the determination of the outstanding shares of common

stock entitled to notice of, and to vote on, the matters presented at the Meeting. As of the Record Date, there were 16,619,905 shares

of common stock outstanding. Each share of common stock entitles the holder thereof to one vote. |

| Quorum

and Required Vote |

|

A

quorum of stockholders is necessary to hold a valid meeting. A quorum will be present at

the meeting if the holders of one-third (33 1/3%) of the voting power of the outstanding

shares of capital stock of the Company entitled to vote at the Meeting is represented in

person or by proxy. Abstentions and broker non-votes (i.e., shares held by brokers on behalf

of their customers, which may not be voted on certain matters because the brokers have not

received specific voting instructions from their customers with respect to such matters)

will be counted solely for the purpose of determining whether a quorum is present at the

Meeting.

Proposal

No. 1 (re-election of nine directors) requires the affirmative vote of a majority of the voting power of the shares of capital stock

of the Company present in person or represented by proxy at the Meeting and voting thereon, and where a separate vote by class is

required, a majority of the voting power of the shares of that class present in person or represented by proxy at the meeting and

voting thereon. Abstentions and broker non-votes will have no effect on the re-election of directors; and

|

| |

|

Proposal

No. 2 (ratification of Say-on-Pay Proposal) requires the affirmative vote of a majority of

the voting power of the shares of capital stock of the Company present in person or represented

by proxy at the Meeting and voting thereon, and where a separate vote by class is required,

a majority of the voting power of the shares of that class present in person or represented

by proxy at the meeting and voting thereon. Abstentions and broker non-votes will have no

direct effect on the outcome of this proposal.

Proposal

No. 3 (ratification of appointment of Hoberman to serve as our independent registered public

accounting firm for fiscal year ending June 30, 2023) requires the affirmative vote of a

majority of the voting power of the shares of capital stock of the Company present in person

or represented by proxy at the Meeting and voting thereon, and where a separate vote by class

is required, a majority of the voting power of the shares of that class present in person

or represented by proxy at the meeting and voting thereon. |

| |

|

|

| Revocability

of Proxies |

|

Any

proxy may be revoked by the person giving it at any time before it is voted. A proxy may be revoked by (A) sending to our Secretary,

at The Glimpse Group, Inc., 15 West 38th St., 12th Fl, New York, NY 10018, either (i) a written notice of revocation bearing a date

later than the date of such proxy or (ii) a subsequent proxy relating to the same shares, or (B) by attending the Meeting and voting

in person. |

| |

|

|

| Proxy

Solicitation Costs |

|

The

cost of preparing, assembling, printing, and mailing this proxy statement and the accompanying form of proxy, and the cost of soliciting

proxies relating to the Meeting, will be borne by the Company. If any additional solicitation of the holders of our outstanding shares

of common stock is deemed necessary, we (through our directors and officers) anticipate making such solicitation directly. The solicitation

of proxies by mail may be supplemented by telephone, telegram, and personal solicitation by officers, directors, and other employees

of the Company, but no additional compensation will be paid to such individuals. |

| No

Right of Appraisal |

|

None

of Nevada law, our Certificate of Incorporation, or our Bylaws provides for appraisal or other similar rights for dissenting stockholders

in connection with any of the proposals to be voted upon at the Meeting. Accordingly, our stockholders will have no right to dissent

on any of the proposals presented at the Meeting. |

| |

|

|

| Who

Can Answer Your Questions about Voting Your Shares |

|

You

can contact the Company’s CFO & COO, Maydan Rothblum, at (917) 292-2685 or via email maydan@theglimpsegroup.com or by sending

a letter to the offices of the Company at 15 West 38th St., 12th Fl, New York, NY 10018, with any questions about proposals described

in this proxy statement or how to execute your vote. |

| |

|

|

| Principal

Offices |

|

The

principal executive offices of our Company are located at 15 West 38th St., 12th Fl, New York, NY 10018. The Company’s telephone

number is (917) 292-2685. |

PROPOSAL

NO. 1 — RE-ELECTION OF DIRECTORS

Our

Board is composed of nine members. In accordance with our articles of incorporation and in connection with this year’s Meeting,

our Board is implementing a classified board of directors consisting of three classes with three directors per class, each serving staggered

three-year terms, all of whom have been nominated by the Nominating and Corporate Governance Committee of our Board (the “Nominating

Committee”) and approved by our Board to stand for re-election as directors of the Company. Unless such authority is withheld,

proxies will be voted for the re-election of the persons named below, each of whom has been designated as a nominee. If, for any reason,

any nominee/director becomes unavailable for re-election, the proxies will be voted for such substitute nominee(s) as the Board may propose.

At

this year’s Meeting, all director nominees will stand for re-election to one of three classes with staggered three-year terms.

Going forward, only one class of directors will be elected at each annual meeting of stockholders, with the other classes continuing

for the remainder of their respective three-year terms. In connection with the year’s Meeting, our current directors were divided

among three classes as follows:

| ● | The

proposed Class I directors will be Ian Charles and Jeff Meisner, and their terms will continue

until the 2024 annual meeting; |

| ● | The

proposed Class II directors will be Maydan Rothblum, Jeff Enslin and Alexander Ruckdaeschel,

and their terms will continue until the 2025 annual meeting; |

| ● | The

proposed Class III directors will be Lem Amen and Lyron Bentovim and their terms will continue

until the 2026 annual meeting. |

Each

director’s term will continue until the expiration of their respective class term and until the election and qualifications of

their successor, or their earlier death, resignation or removal. This classification of our board of directors may have the effect of

delaying or preventing changes in control of our company.

We

believe that the collective skills, experiences, and qualifications of our directors provide our Board with the expertise and experience

necessary to advance the interests of our stockholders. While the Nominating Committee of our Board does not have any specific, minimum

qualifications that must be met by each of our directors, the Nominating Committee uses a variety of criteria to evaluate the qualifications

and skills necessary for each member of the Board. In addition to the individual attributes of each of our current directors described

below, we believe that our directors should have the highest professional and personal ethics and values, consistent with our longstanding

values and standards. They should have broad experience at the policy-making level in business, exhibit commitment to enhancing stockholder

value, and have sufficient time to carry out their duties and to provide insight and practical wisdom based on their past experiences.

The

director nominees recommended by the Board are as follows:

the

board recommends the RE-election of these nominees to serve as directors in these Board

classes:

| Name |

|

Class |

|

Age |

|

Position |

| Executive

Officers |

|

|

|

|

|

|

| Lyron

Bentovim |

|

III |

|

54 |

|

President,

Chief Executive Officer and Chairman of the Board |

| Maydan

Rothblum |

|

II |

|

50 |

|

Chief

Operating Officer, Chief Financial Officer, Secretary, Treasurer, and Director |

| Jeff

Meisner |

|

I |

|

62 |

|

Chief

Revenue Officer and Director |

| Non-Executive

Directors |

|

|

|

|

|

|

| Ian

Charles |

|

I |

|

55 |

|

Independent

Director and Chair of Audit Committee |

| Jeff

Enslin |

|

II |

|

57 |

|

Independent

Director and Chair of Governance Committee |

| Lemuel

Amen |

|

III

|

|

57 |

|

Independent

Director and Chair of Strategy Committee |

| Alexander

Ruckdaeschel |

|

II |

|

51 |

|

Independent

Director and Chair of Compensation Committee |

Nominee

Information

Lyron

Bentovim has been President and Chief Executive Officer since he co-founded the Company in 2016. From July 2014 to August 2015,

Mr. Bentovim was Chief Operating Officer and Chief Financial Officer of Top Image Systems, a Nasdaq-listed company. From March 2013 to

July 2014, Mr. Bentovim served as Chief Operating Officer and Chief Financial Officer of NIT Health and Chief Operating Officer and Chief

Financial Officer and Managing Director at Cabrillo Advisors. From August 2009 until July 2012, Mr. Bentovim served as the Chief Operating

Officer and Chief Financial Officer of Sunrise Telecom, Inc. a Nasdaq-listed company. Prior to Sunrise Telecom, Inc., from January 2002

to July 2009, Mr. Bentovim was a Portfolio Manager for Skiritai Capital LLC, an investment advisor. Prior to Skiritai Capital LLC, Mr.

Bentovim served as the President, Chief Operating Officer and co-founder of WebBrix, Inc. Mr. Bentovim serves on the board of directors

of Manhattan Bridge Capital, a Nasdaq-listed company, and has served on the board of directors of the following publicly traded companies:

Blue Sphere, RTW Inc., Ault, Inc., Top Image Systems Ltd., Three-Five Systems Inc., Sunrise Telecom Inc., and Argonaut Technologies Inc.

Additionally, Mr. Bentovim was a Senior Engagement Manager with strategy consultancies USWeb/CKS, Mitchell Madison Group LLC and McKinsey

& Company Inc. Mr. Bentovim has an MBA from Yale School of Management and a law degree from the Hebrew University, Israel.

Maydan

Rothblum has been Chief Operating Officer and Chief Financial Officer since he co-founded the Company in 2016 and a member of

our board of directors since July 2021. From 2004 to 2016, Mr. Rothblum served as the co-founder, Managing Director and Chief Operating

Officer of Sigma Capital Partners, a middle-market private equity firm focused on making negotiated investments directly onto the balance

sheets of, primarily, small-to-mid sized publicly traded technology companies. In addition to his role as principal investor, Mr. Rothblum

oversaw the fund’s portfolio, managed the fund’s day-to-day operations and financial reporting. Prior to working at Sigma

Capital Partners, Mr. Rothblum held positions at Apax Partners, a global private equity fund, and Booz, Allen & Hamilton, a global

strategic consultancy. Additionally, Mr. Rothblum served as an Engineer for the Israel Defense Forces. Mr. Rothblum holds an MBA from

Columbia Business School and a BS in Industrial Engineering and Management from the Technion - Israel Institute of Technology.

Jeff

Meisner has been Chief Revenue Officer and a member of our board of directors since February 2022. Mr. Meisner is the General

Manager of Sector 5 Digital, LLC a wholly owned subsidiary of the Company. From 2014 to 2022, Mr. Meisner was the CEO of S5D, an immersive

technology company focused on creating innovative Virtual Reality, Augmented Reality, and other digital experiences, which was acquired

by the Company, as described above. From 2001 to 2019, Mr. Meisner was Chief Executive Officer and founder of Skyline Sector 5, an experiential

marketing company focused on the trade show and event industry. Prior to 2001, Mr. Meisner held various business development, operations

and executive roles for a number of technology companies. Additionally, Mr. Meisner currently serves on the Board of Directors of Cristo

Rey Fort Worth, a non-profit college preparatory high school for economically disadvantaged youth. Mr. Meisner holds a BASc. in Electrical

Engineering from The University of Waterloo in Ontario, Canada.

Ian

Charles has served as a member of our board of directors since January 2022 and as the Chair of the Company’s Audit Committee

since January 2022. Mr. Charles has approximately 25 years of executive leadership experience in technology, public markets, mergers

and acquisitions, and multinational operations. Since 2022, Mr. Charles has served as the Chief Financial Officer of Filevine, a provider

of legal SaaS solutions. From 2019 to 2021, Mr. Charles served as the Chief Financial Officer of Scoop Technologies, Inc., a workplace

management software provider. From 2014 to 2019, Mr. Charles served as the Chief Financial Officer of Planful (formerly Host Analytics),

a financial planning and analysis platform that provides financial planning, consolidation, reporting and analytics.

Jeff

Enslin has served as a member our board of directors since July 2018 and as the Chair of the Company’s Governance Committee

since January 2022. Mr. Enslin was previously the Chair of the Company’s Audit Committee from 2018 to 2021. From 1995 to 2018,

Mr. Enslin was a senior partner and senior portfolio manager at Caxton Associates LP, a macro-focused hedge fund. Mr. Enslin is the founder

and managing member of Perimetre Capital LLC since 2018, where he actively manages a wide portfolio of early stage technology investments.

Mr. Enslin has served on the Investment Committees at Lehigh University (2010 to 2019) and the Peddie School (2010 to present, Advisory

Trustee). Mr. Enslin is an active mentor at both Creative Destruction Labs and Endless Frontier Labs. Mr. Enslin received his MBA in

finance and international business from New York University’s Stern School of Business and his B.S. in Finance from Lehigh University.

Lemuel

Amen has served as a member of our board of directors since May 2021 and as the Chair of the Company’s Strategy Committee

since January 2022. Mr. Amen is the Founder and Chairman of Altius Manufacturing Group, LLC, an equity growth management firm, and has

held senior executive positions and led global business units for Electronic Data Systems (EDS) and 3M. Mr. Amen has served on the board

of directors for a privately held technology firm, AbeTech Inc., since 2009, and on the board of advisors of a privately held industrial

firm, Diversified Chemical Technology, Inc., since 2018. Additionally, Mr. Amen is an experienced board governance professional serving

high-growth technology, industrial services, and application software firms. Prior board governance service positions include: Chairman

of the board of directors for Viking Engineering and Development Inc. (2011 to 2017); board director and operating committee member for

Bauer Welding & Metal Fabricators, Inc. (2013 to 2016); and board President and lead director for HighJump Software, Inc. (2005 to

2008). Mr. Amen served as Chairman for the Federal Reserve Bank of Minneapolis, Ninth District Advisory Council from 2012 to 2015. Additional

governance and board director service post includes: University of Michigan – Dearborn, College of Business, Board of Advisors

(2019 to present); State of Minnesota Governor’s Workforce Development Council (2016 to 2019); Ordway Center for the Performing

Arts (2015 to 2018); Junior Achievement Worldwide Inc., Global Board of Directors (2003 to 2008); and Northwestern University, McCormick

School of Engineering & Computer Science, Industrial Advisory Board (2000 to 2006). Mr. Amen earned his M.S. in Civil and Environmental

Engineering from Northwestern University, and his B.S. in Mechanical Engineering at California State University-Northridge.

Alexander

Ruckdaeschel has served as a member of our board of directors since July 2021 and as the Chair of the Company’s Compensation

Committee since January 2022. Mr. Ruckdaeschel has worked in the financial industry for over 20 years in the U.S. and Europe as a co-founder,

partner and senior executive. Since 2012 and until recently, he served on the board of directors of Vuzix, a Nasdaq listed company and

a leading supplier of smart glasses and AR technology products and services and was the Chairman of Vuzix’s compensation committee.

Mr. Ruckdaeschel co-founded Herakles Capital Management and AMK Capital Advisors in 2008. He was also a partner with Alpha Plus Advisors

and Nanostart AG, where he was the head of their U.S. group. Mr. Ruckdaeschel has significant experience in startup operations as the

manager of DAC Nanotech-Fund and Biotech-Fund, and sits on several boards. Following service in the German military, Mr. Ruckdaeschel

was a research assistant at Dunmore Management focusing on intrinsic value and identifying firms that were undervalued and had global

scale potential.

Corporate

Governance Practices and Policies

Board

and Committee Independence

The

Board determines whether each of our directors is considered independent. For a director to be considered independent, the director must

meet the bright-line independence standards under the Nasdaq listing standards. The Board must also affirmatively determine that, in

its opinion, each director has no relationship that would interfere with the directors’ exercise of independent judgment in carrying

out the director’s responsibilities. In addition to the Nasdaq listing standards, the Board will consider all relevant facts and

circumstances in determining whether a director is independent. There are no family relationships among any of our directors and executive

officers. The Board has determined that the following nominees satisfy the independence requirements of Nasdaq: Ian

Charles, Jeff Enslin, Lemuel Amen and Alexander Ruckdaeschel.

Board

Committees and Meetings

The

Board held five meetings during fiscal year 2023. No director attended fewer than 75% of the aggregate number of all meetings

of the Board and committees on which he or she served during fiscal year 2023. The Company expects the directors to attend the Meeting

either in person or by conference call.

Board

Committees

The

Board has created four standing committees: an Audit Committee, a Compensation Committee, Strategy Committee and a Nominating and Corporate

Governance Committee. The Board has adopted a formal, written charter for each of the committees under which each committee operates.

The charters can be found in the Corporate Governance section of the Investor Relations tab on the Company’s website at https://ir.theglimpsegroup.com/corpgov/.

As a matter of routine corporate governance, each committee intends to review its charter and practices on an annual basis to determine

whether its charter and practices are consistent with listing standards of Nasdaq.

Committee

Composition

| Director |

|

Audit

Committee |

|

Compensation

Committee |

|

Nominating

Committee |

|

Strategy

Committee |

| Sharon

Rawlings* |

|

|

|

(1) |

|

|

|

|

| Ian

Charles |

|

(1)

(2) |

|

|

|

(1) |

|

|

| Jeff

Enslin |

|

(1)

|

|

(1) |

|

(1)

(2) |

|

(1) |

| Lemuel

Amen** |

|

(1) |

|

|

|

|

|

(1)

(2) |

| Alexander

Ruckdaeschel |

|

|

|

(1)

(2) |

|

(1) |

|

(1) |

| (1) |

Committee

member. |

| |

|

| (2) |

Committee

chair. |

*

Mrs. Rawlings has notified the Board that she will not be seeking re-election at the Annual Meeting and will continue to serve until

the expiration of her term.

**

Mr. Amen, upon Mrs. Rawlings departure, will assume a position on the compensation committee upon re-election.

Audit

Committee

Upon

re-election, Ian Charles, Lemuel Amen, and Jeff Enslin will be members of our Audit Committee of the Board (the “Audit Committee”)

for fiscal year 2024, where Ian Charles shall continue to serve as the chairman. All members of our Audit Committee satisfy the independence

standards promulgated by the SEC and by Nasdaq as such standards apply specifically to members of Audit Committees.

The

primary purpose of our audit committee is to provide assistance to the board of directors in fulfilling its oversight responsibility

to the shareholders and others relating to (1) the integrity of the Company’s financial statements, (2) the effectiveness of the

Company’s internal control over financial reporting, (3) the Company’s compliance with legal and regulatory requirements,

and (4) the independent auditor’s qualifications and independence. Specific responsibilities of our audit committee include:

| |

● |

Reviewing

and reassessing the charter at least annually and obtaining the approval of the board of directors; |

| |

|

|

| |

● |

Reviewing

and discussing quarterly and annual audited financial statements; |

| |

|

|

| |

● |

Discussing

the Company’s policies on risk assessment and risk management; |

| |

|

|

| |

● |

Discussing

with the independent auditor the overall scope and plans for their audit, including the adequacy of staffing and budget or compensation;

and |

| |

|

|

| |

● |

Reviewing

and approving related party transactions; |

Our

Audit Committee previously operated under a written charter, adopted by our board of directors on November 21, 2018. On April 14, 2021,

the Board approved the adoption of our Amended and Restated Audit Committee Charter. Our Audit Committee now operates under the Amended

and Restated Audit Committee Charter. Our Audit Committee will review and reassess the adequacy of the written charter on an annual basis.

The

Audit Committee held four meetings in fiscal year 2023.

Compensation

Committee

Upon

re-election, Alexander Ruckdaeschel Lemuel Amen and Jeff Enslin will be members of our Compensation Committee of the Board (the

“Compensation Committee”) and Mr. Alexander Ruckdaeschel shall serve as the chairman. The Board has affirmatively

determined that each member of the Compensation Committee meets the additional independence criteria applicable to compensation

committee members under Nasdaq and SEC rules.

The

primary purpose of our compensation committee is to discharge the responsibilities of our board of directors with respect to all forms

of compensation for the Company’s executive officers and to administer the Company’s equity incentive plan for employees.

Specific responsibilities of our compensation committee include:

| |

● |

Reviewing

and overseeing the Company’s overall compensation philosophy, and overseeing the development and implementation of compensation

programs aligned with the Company’s business strategy; |

| |

|

|

| |

● |

Determining

the form and amount of compensation to be paid or awarded to the Chief Executive Officer (“CEO”) and all other executive

officers of the Company; |

| |

|

|

| |

● |

Annually

reviewing and approving all matters related to CEO compensation; |

| |

|

|

| |

● |

Reviewing,

adopting, amending, and terminating incentive compensation and equity plans, severance agreements, profit sharing plans, bonus plans,

change-of-control protections, and any other compensatory arrangements for our executive officers and other senior management; and |

| |

|

|

| |

● |

Reviewing

and establishing general policies relating to compensation and benefits of our employees, including our overall compensation philosophy. |

Our

Compensation Committee previously operated under a written charter, adopted by our board of directors on November 21, 2018. On April

14, 2021, the Board approved the adoption of our Amended and Restated Compensation Committee Charter. Our Compensation Committee now

operates under the Amended and Restated Compensation Committee Charter. Our Compensation Committee will review and reassess the adequacy

of the written charter on an annual basis.

The

Compensation Committee held eight meetings in fiscal year 2023.

Nominating

and Corporate Governance Committee

Upon

re-election, Jeff Enslin, Alexander Ruckdaeschel and Ian Charles will be the members of our Nominating Committee, where Mr. Jeff Enslin

shall serve as the chairman. he Nominating and Corporate Governance Committee’s responsibilities include:

| |

● |

identifying

individuals qualified to become board members; |

| |

|

|

| |

● |

recommending

to our board of directors the persons to be nominated for election or appointed as directors and to each board committee; |

| |

|

|

| |

● |

reviewing

and recommending to our board of directors corporate governance principles, procedures and practices, and reviewing and recommending

to our board of directors proposed changes to our corporate governance principles, procedures and practices from time to time; and |

| |

|

|

| |

● |

reviewing

and making recommendations to our board of directors with respect to the composition, size and needs of our board of directors. |

Our

Nominating and Corporate Governance Committee operates under a written charter, adopted by our board of directors on April 14, 2021.

Our Nominating and Corporate Governance Committee will review and reassess the adequacy of the written charter on an annual basis.

The

Nominating and Corporate Governance Committee held two meetings in fiscal year 2023.

Strategy

Committee

Upon

re-election, Lem Amen, Alexander Ruckdaeschel, Jeff Enslin and Lyron Bentovim will be the members of our Strategy Committee, where Mr.

Lem Amen shall serve as the chairman. The Strategy Committee’s responsibilities include:

| |

● |

identifying

strategic trends within the Company and industry |

| |

|

|

| |

● |

analyzing

the potential strategic impact of various financial, operational, technological and M&A alternatives |

| |

|

|

| |

● |

reviewing

and making recommendations to our board of directors with respect to the Company’s strategic directions |

The

Strategy Committee held four meetings in fiscal year 2023.

The

table below provides certain highlights of the diversity characteristics of our directors:

Board

Diversity Matrix (As of October 13, 2023)

Total

Number of Directors - 9

| | |

Female | | |

Male | | |

Non-Binary | | |

Did

Not

Disclose

Gender | |

| Part I: Gender Identity | |

| | |

| | |

| | |

| |

| Directors | |

1 | | |

8 | | |

| | |

| |

| | |

| | |

| | |

| | |

| |

| Part II: Demographic Background | |

| | |

| | |

| | |

| |

| African American or Black | |

| | |

1 | | |

| | |

| |

| Alaskan Native or Native American | |

| | |

| | |

| | |

| |

| Asian | |

| | |

| | |

| | |

| |

| Hispanic or Latinx | |

| | |

| | |

| | |

| |

| Native Hawaiian or Pacific Islander | |

| | |

| | |

| | |

| |

| White | |

1* | | |

7* | | |

| | |

| |

| Two or More Races or Ethnicities | |

| | |

| | |

| | |

| |

| LGBTQ+ | |

| | |

| | |

| | |

| |

| Did Not Disclose Demographic Background | |

| | |

| | |

| | |

| |

*

The diversity matrix set forth herein is expected to change after the results of the 2023 annual meeting and is only representative of

the Board’s make up as of October 13, 2023.

Board

Role in Risk Oversight

Our

Audit Committee is primarily responsible for overseeing our risk management processes on behalf of the Board, including with respect

to cybersecurity risks. The Audit Committee receives reports from management on at least a quarterly basis regarding management’s

assessment of risks to the Company.

In

addition, the Audit Committee reports regularly to our Board, which also monitors our risk profile. The Audit Committee and the Board

focus on the most significant risks we face and our general risk management strategies, while our management team coordinates responses

to day-to-day risks.

Code

of Conduct and Ethics

We

have adopted a code of conduct and ethics (the “Code of Ethics”) applicable to our directors, officers, and employees in

accordance with applicable federal securities laws and Nasdaq rules. The Code of Ethics is publicly available in the Corporate Governance

section of the Investor Relations tab on the Company’s website at https://ir.theglimpsegroup.com/corpgov/. We intend to post

any amendments to or waivers from the Code of Ethics that apply to our principal executive officer, principal financial officer, and

principal accounting officer, or persons performing similar functions, on our website.

Family

Relationships

There

are no family relationships between or among the director nominees or other executive officers of the Company.

Legal

Proceedings Involving Officers and Directors

To

the knowledge of the Company after reasonable inquiry, no director nominee or executive officers during the past 10 years, or any promoter

who was a promoter at any time during the past five fiscal years, has (1) been subject to a petition under the Federal bankruptcy laws

or any state insolvency law was filed by or against, or a receiver, fiscal agent, or similar officer was appointed by a court for the

business or property of such person, or any partnership in which he was a general partner at or within two years before the time of such

filing, or any corporation or business association of which he was an executive officer at or within two years before the time of such

filing; (2) been convicted in a criminal proceeding or is a named subject of a pending criminal proceeding (excluding traffic violations

and other minor offenses); (3) been the subject of any order, judgment, or decree, not subsequently reversed, suspended or vacated, of

any court of competent jurisdiction, permanently or temporarily enjoining him from, or otherwise limiting, the following activities:

(i) acting as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage

transaction merchant, any other person regulated by the Commodity Futures Trading Commission, or an associated person of any of the foregoing,

or as an investment adviser, underwriter, broker or dealer in securities, or as an affiliated person, director or employee of any investment

company, bank, savings, and loan association or insurance company, or engaging in or continuing any conduct or practice in connection

with such activity; (ii) engaging in any type of business practice; or (iii) engaging in any activity in connection with the purchase

or sale of any security or commodity or in connection with any violation of Federal or State securities laws or Federal commodities laws;

(4) been the subject of any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any Federal or State authority

barring, suspending or otherwise limiting for more than 60 days the right of such person to engage in any activity described in paragraph

(3)(i) of this section, or to be associated with persons engaged in any such activity; (5) been found by a court of competent jurisdiction

in a civil action or by the SEC to have violated any Federal or State securities law, and the judgment in such civil action or finding

by the SEC has not been subsequently reversed, suspended, or vacated; (6) been found by a court of competent jurisdiction in a civil

action or by the Commodity Futures Trading Commission to have violated any Federal commodities law, and the judgment in such civil action

or finding by the Commodity Futures Trading Commission has not been subsequently reversed, suspended or vacated; (7) been the subject

of, or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended

or vacated, relating to an alleged violation of: (i) any Federal or State securities or commodities law or regulation; or (ii) any law

or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction,

order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition

order; or (iii) any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or (8) been the

subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization

(as defined in Section 3(a)(26) of the Securities Exchange Act of 1934, as amended, or the “Exchange Act” (15 U.S.C. 78c(a)(26)),

any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29)), or any equivalent exchange,

association, entity, or organization that has disciplinary authority over its members or persons associated with a member.

There

are no material pending legal proceedings to which any of the individuals listed above is party adverse to the Company or any of its

subsidiaries or has a material interest adverse to the Company or any of its subsidiaries.

Stockholder

Communications with the Board

We

have not implemented a formal policy or procedure by which our stockholders can communicate directly with our Board. Nevertheless, every

effort will be made to ensure that the views of stockholders are heard by the Board, and that appropriate responses are provided to stockholders

in a timely manner. During the upcoming year, our Board will continue to monitor whether it would be appropriate to adopt such a process.

Director

Compensation

Because

we are still in the development stage, our directors do not receive any cash compensation other than reimbursement for expenses incurred

during the performance of their duties or their separate duties as officers of the Company.

The

following table sets forth information concerning equity-based compensation for the fiscal year ending June 30, 2023 of our directors

serving at such time who are not also named executive officers.

| Name | |

Fiscal Year | | |

Fees

Earned ($) | | |

Option

Options (1) | | |

Stock

Awards ($) | | |

All

Other Compensation ($) | | |

Total ($) | |

| Sharon Rowlands | |

| 2023 | | |

| | | |

$ | 100,000 | | |

| | | |

| | | |

$ | 100,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Jeffrey Enslin | |

| 2023 | | |

| | | |

$ | 100,000 | | |

| | | |

| | | |

$ | 100,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Lemuel Amen | |

| 2023 | | |

| | | |

$ | 100,000 | | |

| | | |

| | | |

$ | 100,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Alexander Ruckdaeschel | |

| 2023 | | |

| | | |

$ | 100,000 | | |

| | | |

| | | |

$ | 100,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Ian Charles | |

| 2023 | | |

| | | |

$ | 100,000 | | |

| | | |

| | | |

$ | 100,000 | |

| (1) |

The

amounts disclosed represent the approximate aggregate grant date fair value of stock options granted to our named directors during

Fiscal Year 2023 under the 2016 The Glimpse Group Incentive Plan. The assumptions used to compute the fair value are disclosed in

Note 10 to our audited financial statements for Fiscal Year 2023. Such grant date fair values do not take into account any estimated

forfeitures related to service-vesting conditions. These amounts do not reflect the actual economic value that will be realized by

the named director upon the vesting of the stock options, the exercise of the stock options, or the sale of common stock acquired

under such stock options. |

Executive

Officers

Our

current executive officers are as follows:

| Name |

|

Age |

|

Position |

| Executive

Officers |

|

|

|

|

| Lyron

Bentovim |

|

54 |

|

President,

Chief Executive Officer and Chairman of the Board |

| Maydan

Rothblum |

|

50 |

|

Chief

Operating Officer, Chief Financial Officer, Secretary, Treasurer, and Director |

| D.J.

Smith |

|

47 |

|

Chief

Creative Officer and Director |

| Jeff

Meisner |

|

62 |

|

Chief

Revenue Officer and Director |

| Tyler

Gates |

|

36 |

|

Chief

Futurist Officer and Board Observer |

Lyron

Bentovim has been President and Chief Executive Officer since he co-founded the Company in 2016. From July 2014 to August 2015,

Mr. Bentovim was Chief Operating Officer and Chief Financial Officer of Top Image Systems, a Nasdaq-listed company. From March 2013 to

July 2014, Mr. Bentovim served as Chief Operating Officer and Chief Financial Officer of NIT Health and Chief Operating Officer and Chief

Financial Officer and Managing Director at Cabrillo Advisors. From August 2009 until July 2012, Mr. Bentovim served as the Chief Operating

Officer and Chief Financial Officer of Sunrise Telecom, Inc. a Nasdaq-listed company. Prior to Sunrise Telecom, Inc., from January 2002

to July 2009, Mr. Bentovim was a Portfolio Manager for Skiritai Capital LLC, an investment advisor. Prior to Skiritai Capital LLC, Mr.

Bentovim served as the President, Chief Operating Officer and co-founder of WebBrix, Inc. Mr. Bentovim serves on the board of directors

of Manhattan Bridge Capital, a Nasdaq-listed company, and has served on the board of directors of the following publicly traded companies:

Blue Sphere, RTW Inc., Ault, Inc., Top Image Systems Ltd., Three-Five Systems Inc., Sunrise Telecom Inc., and Argonaut Technologies Inc.

Additionally, Mr. Bentovim was a Senior Engagement Manager with strategy consultancies USWeb/CKS, Mitchell Madison Group LLC and McKinsey

& Company Inc. Mr. Bentovim has an MBA from Yale School of Management and a law degree from the Hebrew University, Israel.

Maydan

Rothblum has been Chief Operating Officer and Chief Financial Officer since he co-founded the Company in 2016 and a member of

our board of directors since July 2021. From 2004 to 2016, Mr. Rothblum served as the co-founder, Managing Director and Chief Operating

Officer of Sigma Capital Partners, a middle-market private equity firm focused on making negotiated investments directly onto the balance

sheets of, primarily, small-to-mid sized publicly traded technology companies. In addition to his role as principal investor, Mr. Rothblum

oversaw the fund’s portfolio, managed the fund’s day-to-day operations and financial reporting. Prior to working at Sigma

Capital Partners, Mr. Rothblum held positions at Apax Partners, a global private equity fund, and Booz, Allen & Hamilton, a global

strategic consultancy. Additionally, Mr. Rothblum served as an Engineer for the Israel Defense Forces. Mr. Rothblum holds an MBA from

Columbia Business School and a BS in Industrial Engineering and Management from the Technion - Israel Institute of Technology.

D.J.

Smith has been the Chief Creative Officer since he co-founded the company in 2016. Since June 2016, Mr. Smith has served as the

co-founder and Organizer of NYVR Meetup. Prior to co-founding the Company, Mr. Smith served as the Senior Project Manager at Avison Young,

where he managed construction and real estate development projects. From April 2016 to August 2020, Mr. Smith was the Founder of VRTech

Consulting LLC, which provided consulting for real estate development projects and virtual reality. Mr. Smith holds a B.S. in Civil Engineering

from Pennsylvania State University.

Jeff

Meisner has been Chief Revenue Officer and a member of our board of directors since February 2022. Mr. Meisner is the General

Manager of Sector 5 Digital, LLC a wholly owned subsidiary of the Company. From 2014 to 2022, Mr. Meisner was the CEO of S5D, an immersive

technology company focused on creating innovative Virtual Reality, Augmented Reality, and other digital experiences, which was acquired

by the Company, as described above. From 2001 to 2019, Mr. Meisner was Chief Executive Officer and founder of Skyline Sector 5, an experiential

marketing company focused on the trade show and event industry. Prior to 2001, Mr. Meisner held various business development, operations

and executive roles for a number of technology companies. Additionally, Mr. Meisner currently serves on the Board of Directors of Cristo

Rey Fort Worth, a non-profit college preparatory high school for economically disadvantaged youth. Mr. Meisner holds a BASc. in Electrical

Engineering from The University of Waterloo in Ontario, Canada.

Tyler

Gates, as of August 1, 2022, is the General Manager of Brightline Interactive, LLC (BLI), a wholly owned subsidiary of the Company

and serves as the Company’s Chief Futurist Officer and as a non-voting Board Observer of the board of directors. Prior to the closing

of the BLI acquisition, Mr. Gates was the Chief Executive Officer of BLI, and has been with BLI in several executive leadership roles

since 2012. BLI focuses on interactive, spatial and immersive VR & AR technology solutions for training, simulation and brand experiences.

Additionally, Mr. Gates has been the President of the VR/AR Association (VRARA) DC’s Chapter since its inception in 2017 and is

the Host of VRARA’s Everything VR/AR Podcast. VRARA is a global industry association for VR/AR/MR with local chapters in major

cities around the world. Mr. Gates holds a BA Degree in Corporate Communications and Interpersonal Psychology from Lenoir-Rhyne University.

Executive

Compensation

The

following is a summary of the compensation we paid for each of the last three years ended June 30, 2023 and 2022, respectively, to our

Executive Officers.

| Name

and Principal Position | |

Fiscal

Year | | |

Salary | | |

Bonus | | |

Stock

Awards ($)

** | | |

Option

Award | | |

Non-Equity Incentive Plan Compensation

($) | | |

Non-Qualified Deferred Compensation Earnings ($) | | |

All

Other Compensation ($) | | |

Total | |

| Lyron Bentovim | |

| 2023 | | |

$ | 231,875 | | |

$ | - | | |

| 51,255 | | |

$ | 460,810 | | |

| - | | |

| - | | |

| 331 | | |

$ | 744,271 | |

| President & CEO | |

| 2022 | | |

$ | 257,500 | | |

$ | 100,000 | | |

| - | | |

$ | - | | |

| - | | |

| - | | |

| 8,417 | | |

$ | 365,917 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Maydan Rothblum | |

| 2023 | | |

$ | 211,500 | | |

$ | - | | |

| 36,360 | | |

$ | 293,243 | | |

| - | | |

| - | | |

| 4,622 | | |

$ | 545,724 | |

| CFO & COO | |

| 2022 | | |

$ | 227,500 | | |

$ | 75,000 | | |

| - | | |

$ | - | | |

| - | | |

| - | | |

| 1,175 | | |

$ | 303,675 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| David J Smith CCO | |

| 2023 | | |

| 189,000 | | |

$ | - | | |

| - | | |

$ | 101,418 | | |

| - | | |

| - | | |

| 1,120 | | |

$ | 291,538 | |

| | |

| 2022 | | |

$ | 205,000 | | |

$ | 40,000 | | |

| - | | |

$ | - | | |

| - | | |

| - | | |

| 1,188 | | |

$ | 246,187 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Jeff Meisner | |

| 2023 | | |

$ | 198,000 | | |

$ | - | | |

| 34,042 | | |

$ | - | | |

| - | | |

| - | | |

| 4,602 | | |

$ | 236,644 | |

| CRO* | |

| 2022 | | |

$ | 91,667 | | |

$ | - | | |

| - | | |

$ | - | | |

| - | | |

| - | | |

| - | | |

$ | 91,667 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| * Partial from February 1, 2022 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Tyler Gates | |

| 2023 | | |

$ | 175,583 | | |

$ | - | | |

| - | | |

$ | 18,058 | | |

| - | | |

| - | | |

| 3,601 | | |

$ | 197,242 | |

| Chief Futurist Officer* | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| * Partial from August 1, 2022 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

*Represents

stock-based compensation in lieu of reduced cash salary

Pay

vs. Performance Comparison

The

following table sets forth information concerning the compensation of our principal executive officer, or “PEO,” and, on

an average basis, the compensation of our other named executive officers, or “NEOs,” for each of the fiscal years ending

June 30, 2023 and 2022, as such compensation relates to our financial performance for each such fiscal year.

| Year | | |

Summary compensation

Table Total for CEO (1) | | |

Compensation Actually

Paid to CEO (2) | | |

Average Summary

Compensation Table Total for Non-PEO NEOs(3) | | |

Compensation Actually

Paid to Non-PEO NEOs(4) | | |

Value

of Initial Fixed 100$ Investment Based on(5)

Total Shareholder Return | | |

Net Income (Loss) | |

| (a) | | |

(b) | | |

(c) | | |

(d) | | |

(e) | | |

(f) | | |

(g) | |

| | 2023 | | |

$ | 744,271 | | |

$ | 326,327 | | |

$ | 317,787 | | |

$ | 232,298 | | |

$ | 50.86 | | |

$ | (28,563,283.00 | ) |

| | 2022 | | |

$ | 365,917 | | |

$ | 366,228 | | |

$ | 213,843 | | |

$ | 214,006 | | |

$ | 56.86 | | |

$ | (5,966,287.00 | ) |

| (1) | The

dollar amounts reported are the amounts of total compensation reported for our CEO, Lyron

Bentovim, in the Summary Compensation Table for fiscal years 2023 and 2022. |

| (2) | The

dollar amounts reported represent the amount of “compensation actually paid”,

as computed in accordance with SEC rules. The dollar amounts reported are the amounts of

total compensation reported for Mr. Bentovim during the applicable year, but also include

(i) the year-end value of equity awards granted during the reported year, (ii) the change

in the value of equity awards that were unvested at the end of the prior year, measured through

the date the awards vested, or through the end of the reported fiscal year, and (iii) value

of equity awards issued and vested during the reported fiscal year. See Table below for further

information. |

| (3) | The

dollar amounts reported are the average of the total compensation reported for our NEOs,

other than our CEO, in the Summary Compensation Table for fiscal years 2023 and 2022. |

| (4) | The

dollar amounts reported represent the average amount of “compensation actually paid”,

as computed in accordance with SEC rules, for our NEOs, other than our CEO. The dollar amounts

reported are the average of the total compensation reported for our NEOs, other than our

CEO in the Summary Compensation Table for fiscal years 2023 and 2022, but also include (i)

the year-end value of equity awards granted during the reported year, (ii) the change in

the value of equity awards that were unvested at the end of the prior year, measured through

the date the awards vested, or through the end of the reported fiscal year, and (iii) value

of equity awards issued and vested during the reported fiscal year. |

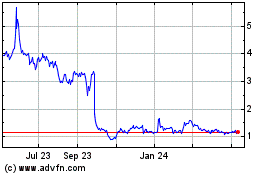

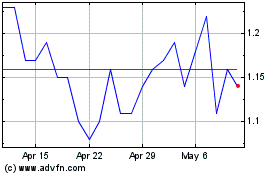

| (5) | Reflects

the cumulative shareholder return over the relevant fiscal year, computed in accordance with

SEC rules, assuming an investment of $100 in our common shares at a price per share equal

to the closing price of our common stock on the last trading day before the commencement

of the earliest applicable fiscal year (June 30, 2021) and the measurement end point of the

closing price of our common stock on the last trading day in the applicable fiscal year.

For FY 2023, the closing price of our common stock on June 30, 2022 was $3.98 and the closing

price of our common stock on June 30, 2023 was $3.56. For FY 2022, the closing price of our

common stock on July 1, 2021 (IPO price) was $7.00 and the closing price of our common stock

on June 30, 2022 was $3.98. |

Relationship

between Pay versus Performance

Our

“total shareholder return,” as set forth in the above table, during the two-year period ended June 30, 2023 decreased by

49% compared to a decrease in “compensation actually paid” to our CEO from $366,228 in FY 2022 to $326,327 in FY 2023 and

an increase in average “compensation actually paid” to our non-CEO NEOs from $214,006 in FY 2022 to $232,298 in FY 2023.

In addition, our net loss increased by 379%, from net loss of approximately $5.97 million in FY 2022 to a net loss of approximately $28.5

million in FY 2023 compared to the aforementioned changes in “compensation actually paid” to our CEO and non-CEO NEOs.

Employment

Agreements

Lyron

Bentovim

On

May 13, 2021, we entered into an executive employment agreement with Mr. Lyron Bentovim. Mr. Bentovim is one of our co-founders and has

been the Company’s President and Chief Executive Officer since its inception. Mr. Bentovim’s employment agreement shall continue

until terminated by either the Company or Mr. Bentovim. Pursuant to Mr. Bentovim’s employment agreement, as of the Company’s

IPO on July 1, 2021, he received an annual base cash salary of $250,000, amended to $265,000 as of January 1, 2022. In addition, Mr.

Bentovim will be eligible to receive performance bonuses as determined by the Compensation Committee.

Maydan

Rothblum

On

May 13, 2021, we entered into an executive employment agreement with Mr. Maydan Rothblum. Mr. Rothblum is one of our co-founders and

has been the Company’s Chief Financial Officer and Chief Operating Officer since its inception. Mr. Rothblum’s employment