Keep An Eye Out: Pre-Market Movers And Recommendations

October 05 2023 - 9:25AM

IH Market News

ANALYST RECOMMENDATIONS:

Advanced Micro Device: Baird maintains its

outperform rating and reduces the target price from $170 to

$125.

Amphenol: BNP Paribas Exane maintains its

outperform recommendation with a target price of $93.

Best Buy: Truist Securities maintains its hold

recommendation with a price target reduced from $80 to $74.

Centerpoint: KeyBanc Capital Markets upgrades

to overweight from sector weight with a target price of $29.

CMS Energy: KeyBanc Capital Markets upgrades to

overweight from sector weight with a target price of $57.

Dollar General: Truist Securities maintains its

hold recommendation with a price target reduced from $142 to

$117.

Dollar Tree: Truist Securities maintains its

buy recommendation and reduces the target price from $160 to

$128.

DTE Energy: KeyBanc Capital Markets upgrades to

overweight from sector weight with a target price of $106.

Entergy Corp: KeyBanc Capital Markets upgrades

to overweight from sector weight with a target price of $97.

Fortive Corp: BNP Paribas Exane maintains its

outperform recommendation with a target price of $91.

Genuine Parts: Truist Securities maintains its

buy recommendation with a price target reduced from $191 to

$172.

The Home Depot: Truist Securities maintains its

buy recommendation with a price target reduced from $372 to

$341.

Idexx: Piper Sandler & Co maintains its

overweight recommendation and reduces the target price from $600 to

$520.

Lowe’s: Truist Securities maintains its buy

recommendation with a price target reduced from $256 to $235.

Nextera Energy: KeyBanc Capital Markets

downgrades to sector weight from overweight.

O’Reilly Automot: Citi upgrades to buy from

neutral with a price target raised from $983 to $1040. Truist

Securities maintains its buy recommendation with a price target

raised from $1065 to $1068.

Target: Truist Securities maintains its hold

recommendation with a price target reduced from $133 to $116.

Tractor Supply: Citi downgrades to neutral from

buy with a price target reduced from $250 to $207. Truist

Securities maintains its buy recommendation and reduces the target

price from $257 to $235.

Zoetis: Piper Sandler & Co maintains its

overweight recommendation with a price target reduced from $220 to

$210.

Don’t Trade Without Seeing

The Orderbook

PRE-MARKET

U.S. futures fell Thursday, handing back some of the

previous session’s strong gains ahead of the release of more

important labor data.

Here are some of the biggest premarket U.S. stock

movers today:

Constellation Brands (NYSE:STZ) stock

unchanged despite the drinks giant raising its annual profit target

after topping sales expectations for the second quarter. The stock

has gained around 8% this year to date.

ConAgra Foods (NYSE:CAG) stock fell 1.2%

after the packaged food maker reported slowing demand for its

products, even as it swung to a profit in the first quarter on the

back of multiple rounds of price hikes.

Clorox (NYSE:CLX) stock fell 3.9% after

the maker of cleaning products said it expects to post a

first-quarter loss after a cyberattack in August caused product

outages and disrupted supplies and operations.

Polestar (NASDAQ:PSNY) stock rose 3.4%

after the EV manufacturer announced it delivered 13,000 vehicles in

the third quarter, and was on course for 60,000-70,000 for the

year.

Rivian (NASDAQ:RIVN) stock fell 9.2% after

the EV maker announced plans to sell convertible green bonds worth

$1.5 billion, maturing in October 2030.

Blackberry (TSX:BB) stock rose 3.1% after

the technology company announced it will separate its Internet of

Things and cybersecurity business units and target a subsidiary

initial public offering for the IoT business next fiscal year.

Exxon (NYSE:XOM) stock fell 1.2% after the

oil giant said it would deliver a third-quarter operating profit

between $8.3 billion and $11.4 billion, below the year ago’s record

earnings but up from its second quarter.

Nvidia (NASDAQ:NVDA) stock rose 0.8% after

Evercore ISI called the semiconductor a “top play” as the earnings

season approaches. It has an ‘overweight’ rating on the stock, and

sees plenty of upside.

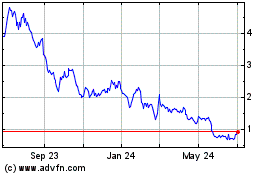

Polestar Automotive Hold... (NASDAQ:PSNY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Polestar Automotive Hold... (NASDAQ:PSNY)

Historical Stock Chart

From Apr 2023 to Apr 2024