0001419793

false

0001419793

2023-09-22

2023-09-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

Current Report

Pursuant To Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported: September

22, 2023

ORIGINCLEAR, INC.

(Name of registrant as specified in its charter)

| Nevada |

|

333-147980 |

|

26-0287664 |

| (State or other jurisdiction of |

|

(Commission File Number) |

|

(I.R.S. Employer |

| Incorporation or organization) |

|

|

|

Identification Number) |

|

13575 58th Street North, Suite 200

Clearwater, FL |

|

33760 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area

code: (727) 440-4603

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant

to Section 12(b) of the Act: None.

Indicate by check mark whether

the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b2 of the Securities Exchange Act of 1934 (§240.12b2 of this chapter).

Emerging growth company ☐

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material

Definitive Agreement

On September 22, 2023, Water On Demand, Inc. (“WODI”),

a subsidiary of OriginClear, Inc. (“OCLN”), merged with and into WODI Acquisitions, Inc., a wholly owned subsidiary of Progressive

Water Treatment, Inc. (“PWT”), a subsidiary of OCLN. As a result, WODI became a subsidiary of PWT.

In connection with the merger of WODI and PWT, WODI,

PWT and Fortune Rise Acquisition Corporation (“FRLA”) entered into an amendment to the non-binding Letter of Intent (“LOI”)

that was previously executed on January 5, 2023 to now designate PWT as the new target of the acquisition. Under the revised/amended LOI,

FRLA proposes to acquire all of the outstanding securities of PWT, based on certain material financial and business terms and conditions

being met. The LOI is not binding on the parties and is intended solely to guide good-faith negotiations toward definitive agreements.

| Item 7.01 |

Regulation FD Disclosure. |

On September 28, 2023, OCLN issued a press release

which announced the amendment of its previously-announced LOI and the assignment of the LOI to PWT as the parent company of WODI. As a

result, FRLA now proposes to acquire all of the outstanding securities of PWT, based on certain material financial and business terms

and conditions being met. A copy of the press release is attached hereto as Exhibit 99.1.

The furnishing of the press

release is not an admission as to the materiality of any information therein. The information contained in the press release is summary

information that is intended to be considered in the context of more complete information included in the Company’s filings with

the U.S. Securities and Exchange Commission (the “SEC”) and other public announcements that the Company has made and may make

from time to time by press release or otherwise. The Company undertakes no duty or obligation to update or revise the information contained

in this report, although it may do so from time to time as its management believes is appropriate. Any such updating may be made through

the filing of other reports or documents with the SEC, through press releases or through other public disclosures.

The information in this Item

7.01 of this Current Report on Form 8-K and the press release shall not be deemed “filed” for purposes of Section 18 of the

Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the

Securities Act of 1933, as amended. The information contained in this Item 7.01 and in the press release shall not be incorporated by

reference into any filing with the SEC made by the Company, whether made before or after the date hereof, regardless of any general incorporation

language in such filing.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

ORIGINCLEAR, INC. |

| |

|

| September 28, 2023 |

By: |

/s/ T. Riggs Eckelberry |

| |

|

Name: T. Riggs Eckelberry

Title: Chief Executive Officer

|

Exhibit 99.1

In Amended Letter

Of Intent, OriginClear’s Water On Demand and Fortune Rise Acquisition Corporation Nominate A New Target For Merger

Non-binding agreement sets basis for further negotiations.

Metuchen, NJ and Clearwater, FL – September

28, 2023 – Fortune Rise Acquisition Corporation (Nasdaq: FRLA) and OriginClear Inc. (OTC Other: OCLN), the Clean Water Innovation

Hub™, announce that FRLA and OriginClear subsidiary, Water On Demand Inc. (WODI), currently the sponsor of FRLA, have agreed to

nominate a new target for acquisition by FRLA. The new target is Progressive Water Treatment Inc., a Texas corporation (PWT). PWT recently

merged with WODI.

“Progressive Water Treatment is a target with

both a lengthy operating history and significantly increased revenue since 2021”, said Riggs Eckelberry, OriginClear CEO and Chairman

of Water On Demand. “We believe, and the Board of FRLA agrees, that the combination of Progressive Water Treatment with Water On

Demand and its Modular Water Systems business unit creates compelling value for the intended merger.”

Accordingly, the Letter of Intent (“LOI”)

executed January 5, 2023 with WODI has been amended to designate PWT as the new target of the acquisition. Under the revised/amended LOI,

FRLA proposes to acquire all the outstanding securities of PWT, based on certain material financial and business terms and conditions

being met. The LOI is not binding on the parties and is intended solely to guide good-faith negotiations toward definitive agreements.

The parties will work together in good faith with

their respective advisors to agree on a structure for the business combination that is most expedient to the consummation of the acquisition.

Pursuant to the LOI, it is proposed that FRLA will acquire 100% of the outstanding equity securities of PWT, including all shares of common

stock, preferred stock, outstanding options and warrants. In return, PWT equity holders will receive shares of common stock of FRLA and

any outstanding options and warrants will be assumed by FRLA in accordance with their terms.

Subject to meeting Nasdaq quantitative and qualitative

listing requirements, upon the closing of the business combination, the newly-combined entity anticipates trading publicly on Nasdaq under

a new trading symbol.

The precise structure of the business combination,

including the allocation of stock and/or cash consideration paid to the PWT equity holders, will be negotiated to meet the needs of all

parties including management of PWT and key equity holders.

About Fortune Rise Acquisition Corporation

FRLA is a blank check company incorporated in February

2021 as a Delaware corporation formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase,

reorganization or similar business combination with one or more businesses.

FRLA is a "shell company" as defined under

the Securities Exchange Act of 1934, as amended, because it has no operations and nominal assets consisting almost entirely of cash. FRLA

will not generate any operating revenues until after the completion of its initial business combination, at the earliest. To date, FRLA’s

efforts have been limited to organizational activities and activities related to its initial public offering as well as the search for

a prospective business combination target.

Advisors

EF Hutton, a division of Benchmark Investments, LLC

is acting as Capital Markets Advisor in the transaction.

About Progressive Water Treatment and Water on

Demand

Once a government monopoly, clean water is going private.

Local industries and communities are now treating and recycling their own water, helping to reduce the burden on municipal systems and

save on fast-rising water rates while also responding to the challenge of climate change. That’s good for business and good for

sustainability. Now, the innovative fintech, Water On Demand™, is enabling clean water to become an investable asset, open to main

street investors, with the potential for generational royalties. In 2023, OriginClear contributed its Modular Water Systems division to

give Water On Demand the downsized technology that businesses need for on-site water treatment and recycling. Later in 2023, OriginClear

contributed Progressive Water Treatment, a 25-year veteran engineered solutions subsidiary based in McKinney, Texas, adding the ability

to execute on larger and more prestigious installations. “OriginClear has retained a commanding percentage of the new combined company,”

said Riggs Eckelberry, OriginClear CEO. “Our longtime shareholders can confidently expect that the parent company will continue

to benefit greatly from any positive outcomes of this new, consolidated company, which due to its senior operating history, will adopt

the name of Progressive Water Treatment, Inc.”

About OriginClear

OriginClear® is the Clean Water Innovation Hub™,

dedicated to launching new ventures such as Water On Demand and Modular Water Systems™ – a leader in onsite, prefabricated

systems made with sophisticated materials that can last decades. Another OriginClear subsidiary acquired in 2015, Progressive Water Treatment,

was key to achieving a company-wide increase of 250% in revenues from 2021 to 2022, and has now merged with Water On Demand and Modular

Water Systems intended to create better enterprise value for a potential merger. Get live weekly updates every Thursday by signing up

at www.originclear.com/ceo.

For more information, visit the company’s website: https://www.originclear.com/

Follow us on Twitter

Follow us on LinkedIn

Like us on Facebook

Subscribe to us on YouTube

Signup for our Newsletter

No Offer or Solicitation

This communication does not constitute an offer to

sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of

securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under

the securities laws of any such jurisdiction.

Safe Harbor Statement

Matters discussed in this release contain forward-looking

statements. When used in this release, the words "anticipate," "believe," "estimate," "may," "intend,"

"expect," “plans” and similar expressions identify such forward-looking statements. Actual results, performance

or achievements could differ materially from those contemplated, expressed or implied by the forward-looking statements contained herein.

These forward-looking statements are based largely

on the expectations of FRLA and OriginClear and are subject to a number of risks and uncertainties. These include, but are not limited

to, risks and uncertainties associated with OriginClear’s history of losses and need to raise additional financing, the acceptance

of OriginClear’s products and technology in the marketplace, OriginClear’s ability to demonstrate the commercial viability

of its products and technology and its need to increase the size of our organization, and if or when OriginClear will receive and/or fulfill

its obligations under any purchaser orders. Further information on FRLA’s and OriginClear’s risk factors is contained in each

company’s respective quarterly and annual reports filed with the Securities and Exchange Commission. The Company undertakes no obligation

to revise or update publicly any forward-looking statements for any reason except as may be required under applicable law.

Media Contact

The Pontes Group

Lais Pontes Greene (954) 960-6083

lais@thepontesgroup.com

www.thepontesgroup.com

Investor Relations and Press Contact:

Devin Angus

Toll-free: 877-999-OOIL (6645) Ext. 3

International: +1-323-939-6645 Ext. 3

Fax: 323-315-2301

ir@OriginClear.com

www.OriginClear.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

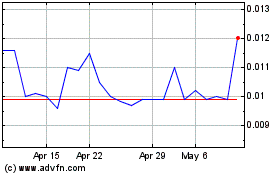

Originclear (PK) (USOTC:OCLN)

Historical Stock Chart

From Mar 2024 to Apr 2024

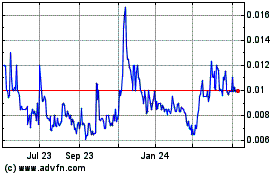

Originclear (PK) (USOTC:OCLN)

Historical Stock Chart

From Apr 2023 to Apr 2024