FitLife Brands to Acquire Substantially All of the Assets of MusclePharm Corporation

September 27 2023 - 4:45PM

FitLife Brands, Inc. (“FitLife” or the “Company”) (Nasdaq: FTLF), a

provider of innovative and proprietary nutritional supplements and

wellness products, today announced that the US Bankruptcy Court for

the District of Nevada has approved FitLife’s acquisition of

substantially all of the assets of MusclePharm Corporation under

Section 363 of the US Bankruptcy Code.

Highlights of the transaction are as

follows:

- The all-cash transaction, with no shares being issued by

FitLife, is expected to be highly accretive to existing

shareholders once all transaction-related costs (anticipated to be

approximately $500,000) have been expensed.

- The purchase price of $18.5 million, which is subject to

customary adjustments, will be funded using cash on hand and the

proceeds of a new committed $10 million term loan issued by First

Citizens Bank with a rate of SOFR+275.

- The transaction is expected to close as soon as practicable,

but no later than October 16, 2023.

- Through the asset purchase transaction, the Company is

acquiring substantially all of the assets and assuming none of the

liabilities of MusclePharm (other than de minimus cure costs

relating to certain assumed contracts).

MusclePharm is an iconic sports nutrition brand with strong

domestic and international appeal. The brand, which was

launched approximately 15 years ago, grew quickly with the support

of brand ambassadors such as Tiger Woods and Arnold

Schwarzenegger. Despite MusclePharm’s financial distress in

recent years and ultimate bankruptcy filing, the brand’s consumer

following remains strong, as evidenced by the continued engagement

of its 564,000 Instagram followers.

According to monthly operating reports filed with the Bankruptcy

Court, MusclePharm has been generating approximately $1.2-1.5

million in monthly revenue at gross margins between 25-30% during

bankruptcy. FitLife intends to return the brand to growth and

enhance the brand’s profitability through a focus on online sales

direct to the end consumer and expanded wholesale distribution.

Online Sales Direct to the End Consumer

Historically, MusclePharm has focused almost exclusively on

wholesale distribution as opposed to selling directly to the end

consumer. Presently, FitLife estimates that third parties are

selling approximately $5 million annually of MusclePharm’s products

on Amazon.com despite limited availability of the products.

After current third-party resellers have exhausted their inventory,

FitLife intends to fully internalize this revenue stream and drive

further online revenue growth for the MusclePharm products.

As is the case with FitLife’s other brands, online sales of

MusclePharm products are anticipated to generate substantially

higher gross margins than those achieved through wholesale

distribution.

Expanded Wholesale Distribution

Prior to bankruptcy, MusclePharm’s products enjoyed strong

distribution with major domestic retailers including Costco,

Walmart, GNC, Vitamin Shoppe, and others. Distribution

through most of these retail partners was adversely impacted by

MusclePharm’s financial distress and ultimate bankruptcy

filing. FitLife intends to work with MusclePharm’s previous

retail partners to restore distribution of the company’s products

in the domestic wholesale channel.

Additionally, MusclePharm has a strong international following,

and international sales have been a substantial portion of the

company’s revenue during bankruptcy. FitLife intends to

strengthen relationships with existing international wholesale

partners and expand international distribution with new

international wholesale partners.

Dayton Judd, FitLife’s Chairman and CEO, commented, “We are very

excited to welcome MusclePharm to the FitLife family of

brands. We expect MusclePharm to drive continued revenue and

earnings growth for our Company. Although we will always

opportunistically evaluate potential additional M&A

transactions, after closing the MusclePharm transaction we expect

to focus primarily on integrating and growing our recently acquired

brands and reducing leverage through EBITDA growth and debt

reduction.”

About FitLife BrandsFitLife Brands is a

developer and marketer of innovative and proprietary nutritional

supplements and wellness products for health-conscious consumers.

FitLife markets over 240 different products primarily online,

but also through domestic and international GNC franchise locations

as well as through more than 17,000 additional domestic retail

locations. FitLife is headquartered in Omaha, Nebraska.

For more information, please visit our website at

www.fitlifebrands.com.

Forward-Looking StatementsStatements in this

press release that are not strictly historical are

“forward-looking” statements within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. These statements

involve substantial risks, uncertainties and assumptions, including

statements related to the Company and MusclePharm and our

acquisition of MusclePharm’s assets that could cause actual results

to differ materially from those expressed or implied by such

statements. Forward-looking statements in this communication

include, among other things, statements about the potential

benefits of our acquisition of MusclePharm’s assets, our possible

or assumed business strategies, potential growth opportunities, and

potential market opportunities. Risks and uncertainties include,

among other things, risks related to our ability to successfully

integrate MusclePharm’s assets; our ability to implement our plans,

forecasts and other expectations with respect to MusclePharm’s

business; our ability to realize the anticipated benefits of the

acquisition of MusclePharm, including the possibility that the

expected benefits from the acquisition will not be realized or will

not be realized within the expected time period; disruption from

the acquisition of MusclePharm making it more difficult to maintain

business and operational relationships; the outcome of any

challenges to the Company’s acquisition of MusclePharm or legal

proceedings related to the transaction or otherwise; the negative

effects of the announcement or the consummation of the acquisition

of MusclePharm on the market price of our common stock or on our

operating results; significant transaction costs; attracting new

customers and maintaining and expanding MusclePharm’s existing

customer base. Additional risks and uncertainties that could affect

our financial results are included in the section titled “Risk

Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” in our Annual Report on Form

10-K for the year ended December 31, 2022 and other filings that we

make from time to time with the Securities and Exchange Commission

(‘SEC’) which, once filed, are available on the SEC’s website at

www.sec.gov. In addition, any forward-looking statements contained

in this communication are based on assumptions that we believe to

be reasonable as of this date. Except as required by law, we assume

no obligation to update these forward-looking statements, or to

update the reasons if actual results differ materially from those

anticipated in the forward-looking statements.

investor@fitlifebrands.com

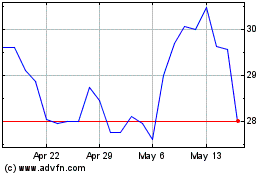

FitLife Brands (NASDAQ:FTLF)

Historical Stock Chart

From Mar 2024 to Apr 2024

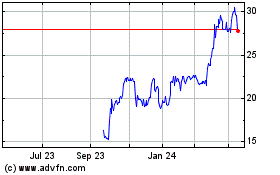

FitLife Brands (NASDAQ:FTLF)

Historical Stock Chart

From Apr 2023 to Apr 2024