0001770236

false

0001770236

2023-09-26

2023-09-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

| Date of Report (Date of earliest event reported): |

September 26, 2023 |

Moving iMage Technologies, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

001-40511 |

85-1836381 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

17760 Newhope Street, Fountain Valley, CA 92075

(Address, including

zip code, of principal executive offices)

| Registrant’s telephone number, including area code |

(714) 751-7998 |

N/A

(Former name or

former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Trading Symbol |

Name of Each Exchange on Which Registered |

| Common Stock, $0.00001 par value |

MITQ |

NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

| Item 2.02 |

Results of Operations and Financial Condition. |

On September 26, 2023, Moving iMage Technologies, Inc.

(the “Company”) issued a press release reporting certain financial results for the fiscal year ended June 30, 2023.

A copy of the press is attached hereto as Exhibit 99.1 and the information therein is incorporated herein by reference.

The

information reported under this Item 7.01 in this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, shall

not be deemed filed for purposes of Section 18 of the Exchange Act of 1934, as amended (the “Exchange Act”)

or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities

Act of 1933, as amended (the “Securities Act”), or the Exchange Act, regardless of any general incorporation language in such

filing.

| Item 7.01 |

Regulation FD Disclosure. |

The information under Item 2.02 above is incorporated herein by reference.

The information reported under this Item 7.01 in this Current Report

on Form 8-K, including Exhibit 99.1 and 99.2 attached hereto, shall not be deemed filed for purposes of Section 18 of the

Exchange Act or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under

the Securities Act or the Exchange Act, regardless of any general incorporation language in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Moving iMage Technologies, Inc. |

| |

|

|

| Date: September 26, 2023 |

|

|

| |

|

|

| |

By: |

/s/ William F. Greene |

| |

Name: |

William F. Greene |

| |

Title: |

Chief Financial Officer |

Exhibit

99.1

Moving

iMage Technologies Announces Fourth Quarter and Full-Year Fiscal 2023 Results

Fountain

Valley, CA – September 26, 2023: Moving iMage Technologies, Inc. (NYSE AMERICAN: MITQ), (“MiT”), a leading technology

and services company for cinema, Esports, stadiums, arenas and other out-of-home entertainment venues, today announced results for its

fourth quarter and full-year ended June 30, 2023.

“We

completed a solid year with double-digit revenue growth, higher gross margin and reduced non-GAAP losses,” said Phil Rafnson, chairman

and chief executive officer. “Fiscal 2023 was a transition year for MiT. As the box office increased sharply, we saw the beginning

of a new, multi-year technology upgrade cycle, and cinema owners continued investing in new FF&E projects. Additionally, we made

meaningful progress in our strategy to transform our business with higher margin, recurring revenue technology offerings that have the

potential to meaningfully accelerate revenue growth and profits over the medium to longer term.

“Additionally,

our fiscal 2023 results would have been even better had we not seen approximately $3.4 million in pushouts in our legacy FF&E projects

business during the second half of fiscal 2023. Pushouts are not uncommon in this part of our business, and this lumpiness is a big reason

we are developing new technology offerings with recurring revenue streams. We also had roughly $1 million, or $0.09 per share, in non-recurring,

non-cash year-end accounting write-downs in the quarter that negatively impacted our GAAP operating and net losses.”

Fourth

Quarter Fiscal 2023 Highlights (versus Fiscal 2Q22)

| · | Revenue

of $5.8 million compared to $5.6 million; |

| · | Gross

Profit of $1.4 million compared to $1.5 million, and Gross Margin of 24.2%; |

| · | GAAP

Operating Loss of ($1.4) million compared to ($0.5) million; |

| o | GAAP

Operating loss in fiscal 2023 included ($1.0 million) in non-cash accounting write-downs; |

| · | GAAP

Net Loss and Loss per Share of ($1.3) million and ($0.12) compared to ($0.7) million and

($0.07), respectively; |

| · | Non-GAAP

Net Loss and Loss per Share of ($0.2) million and ($0.02) compared to ($0.7) million and

($0.06), respectively. |

Fiscal

Year 2023 Highlights (versus Fiscal 2Q22)

| · | Revenue

of $20.2 million compared to $18.4 million; |

| · | Gross

Profit of $5.3 million compared to $4.5 million, Gross Margin expanded by 200 basis points

to 26.3%; |

| · | GAAP

Operating Loss of ($2.0) million compared to ($1.8) million; |

| o | GAAP

Operating loss in fiscal 2023 included ($1.0 million) in non-cash accounting write-downs; |

| · | GAAP

Net Loss and Loss per Share of ($1.8) million and ($0.17) compared to ($1.3) million and

($0.13), respectively; |

| · | Non-GAAP

Net Loss and Loss per Share of ($0.7) million and ($0.07) compared to Non-GAAP Net Loss and

Loss per Share of ($1.5) million and ($0.14), respectively. |

Select

Financial Metrics: FY23 versus FY22 as of 6/30/2023*

| (in

millions, except for Loss per Share and percentages) | |

4Q23 | |

4Q22 | |

Change | |

FY23 | |

FY22 | |

Change | |

| Total

Revenue | |

$ | 5.8 | |

$ | 5.6 | |

2.6 | % |

$ | 20.2 | |

$ | 18.4 | |

10.1 | % |

| Gross

Profit | |

$ | 1.4 | |

$ | 1.5 | |

-5.4 | % |

$ | 5.3 | |

$ | 4.5 | |

19.0 | % |

| Gross

Margin | |

| 24.2 | % |

| 26.2 | % |

| |

| 26.3 | % |

| 24.3 | % |

| |

| Operating

Loss | |

$ | (1.4 | ) |

$ | (0.5 | ) |

200.7 | % |

$ | (2.0 | ) |

$ | (1.8 | ) |

-12.1 | % |

| Operating

Margin | |

| -23.5 | % |

| -8.0 | % |

| |

| -9.8 | % |

| -9.6 | % |

| |

| GAAP

Net Loss | |

$ | (1.3 | ) |

$ | (0.7 | ) |

nm | |

$ | (1.8 | ) |

$ | (1.3 | ) |

-33.7 | % |

| GAAP Loss Per Share | |

$ | (0.12 | ) |

$ | (0.07 | ) |

nm | |

$ | (0.17 | ) |

$ | (0.13 | ) |

-30.4 | % |

| Non-GAAP

Net Loss | |

$ | (0.2 | ) |

$ | (0.7 | ) |

65.4 | % |

$ | (0.7 | ) |

$ | (1.5 | ) |

53.6 | % |

| Non-GAAP Loss Per Share | |

$ | (0.02 | ) |

$ | (0.06 | ) |

65.9 | % |

$ | (0.07 | ) |

$ | (0.14 | ) |

54.2 | % |

nm

= not measurable/meaningful; *may not add up due to rounding

Fiscal

2024 Commentary

“Given

the lumpy nature of our legacy business, we are approaching fiscal 2024 guidance cautiously by targeting low double-digit revenue growth

from our legacy businesses while continuing to move towards break-even on a non-GAAP basis. That said, we do see multiple upside opportunities

from our newer initiatives, which aren’t included in our current guidance. These include an ADA compliance product refresh at a

large national circuit, recording any sales of LEA Professional products, order growth in Esports above the modest fiscal 2023 levels,

National Amusements rolling out CineQC to its international locations, initial sales of MiTranslator and other international sales. As

you can see, we have significant opportunities to accelerate growth, and we plan to provide updates as initiatives start moving forward,”

concluded Rafnson.

Earnings

Conference Call and Webcast Information

Management

will host a conference call and audio webcast to review the Company’s results and forward expectations at 10:00 a.m Eastern Time.

Dial-in

and Webcast Information

Date/Time:

Tuesday, September 26, 2023, 10:00 a.m. ET

Toll-Free: 1-877-407-4018

Toll/International: 1-201-689-8471

Call

me™: Participants can use Guest dial-in #s above and be answered by an operator OR click the Call

me™ Link for instant telephone access to the event. Call me™

link will be made active 15 minutes prior to scheduled start time.

Webcast:

https://viavid.webcasts.com/starthere.jsp?ei=1635216&tp_key=7431f4e981

Telephone

Replay

Replay Dial-In: 1-844-512-2921 or 1-412-317-6671

Replay Expiration: Thursday, November 9, 2023 at 11:59 p.m. ET

Access ID: 13741344

Telephone Replays will be made available approximately 3 hours after conference end time.

About

Moving iMage Technologies

Moving

iMage Technologies is a leading manufacturer and integrator of purpose-built technology solutions and equipment to support a wide variety

of entertainment applications, with a focus on motion picture exhibitions, sports venues and eSports. MiT offers a wide range of products

and services, including custom engineering, systems design, integration and installation, enterprise software solution, digital cinema,

A/V integration, as well as customized solutions for emerging entertainment technology. MiT’s Caddy Products division designs and

sells proprietary cup-holder and other seating-based products and lighting systems for theaters and stadiums. For more information,

visit www.movingimagetech.com.

Forward-Looking

Statements

All

statements above that are not purely about historical facts, including, but not limited to, those in which we use the words “believe,”

“anticipate,” “expect,” “plan,” “intend,” “estimate,” “target”

and similar expressions, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. While

these forward-looking statements represent our current judgment of what may happen in the future, actual results may differ materially

from the results expressed or implied by these statements due to numerous important factors. Our filings with the SEC provide detailed

information on such statements and risks and should be consulted along with this release. To the extent permitted under applicable law,

we assume no obligation to update any forward-looking statements.

Contact:

Brian

Siegel, IRC, MBA

Senior

Managing Director, Hayden IR

(346)

396-8696

Brian@haydenir.com

MOVING

IMAGE TECHNOLOGIES, INC.

CONSOLIDATED

BALANCE SHEETS

(in

thousands)

| | |

June 30, | |

| | |

2023 | | |

2022 | |

| Assets | |

| | | |

| | |

| Current Assets: | |

| | | |

| | |

| Cash | |

$ | 6,616 | | |

$ | 2,340 | |

| Marketable securities - current | |

| — | | |

| 4,363 | |

| Accounts receivable, net | |

| 905 | | |

| 1,762 | |

| Inventories, net | |

| 4,419 | | |

| 4,033 | |

| Prepaid expenses and other | |

| 451 | | |

| 864 | |

| Total Current Assets | |

| 12,391 | | |

| 13,362 | |

| Long-Term Assets: | |

| | | |

| | |

| Marketable securities – long-term | |

| — | | |

| 325 | |

| Right-of-use asset | |

| 415 | | |

| — | |

| Property and equipment, net | |

| 28 | | |

| 22 | |

| Intangibles, net | |

| 480 | | |

| 839 | |

| Goodwill | |

| — | | |

| 287 | |

| Other assets | |

| 16 | | |

| 16 | |

| Total Long-Term Assets | |

| 939 | | |

| 1,489 | |

| Total Assets | |

$ | 13,330 | | |

$ | 14,851 | |

| | |

| | | |

| | |

| Liabilities And Stockholders’ Equity | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 1,507 | | |

$ | 1,583 | |

| Accrued expenses | |

| 618 | | |

| 655 | |

| Customer deposits | |

| 3,169 | | |

| 3,158 | |

| Lease liability–current | |

| 280 | | |

| — | |

| Unearned warranty revenue | |

| 26 | | |

| 18 | |

| Total Current Liabilities | |

| 5,600 | | |

| 5,414 | |

| | |

| | | |

| | |

| Long-Term Liabilities: | |

| | | |

| | |

| Lease liability–non-current | |

| 151 | | |

| — | |

| Deferred rent | |

| — | | |

| 22 | |

| Total Long-Term Liabilities | |

| 151 | | |

| 22 | |

| Total Liabilities | |

| 5,751 | | |

| 5,436 | |

| Stockholders’ Equity | |

| | | |

| | |

| Common stock, $0.00001 par value, 100,000,000 shares authorized, 10,685,778 and 10,828,398 shares issued and outstanding at June 30, 2023 and 2022, respectively | |

| — | | |

| — | |

| Additional paid-in capital | |

| 12,462 | | |

| 12,500 | |

| Accumulated deficit | |

| (4,883 | ) | |

| (3,085 | ) |

| Total Stockholders’ Equity | |

| 7,579 | | |

| 9,415 | |

| Total Liabilities and Stockholders’ Equity | |

$ | 13,330 | | |

$ | 14,851 | |

MOVING

IMAGE TECHNOLOGIES, INC.

CONSOLIDATED

STATEMENTS

OF OPERATIONS

(in

thousands except share and per share amounts)

| | |

Year Ended | | |

Year Ended | |

| | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2022 | |

| Net sales | |

$ | 20,207 | | |

$ | 18,351 | |

| Cost of goods sold | |

| 14,897 | | |

| 13,890 | |

| Gross profit | |

| 5,310 | | |

| 4,461 | |

| | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | |

| Research and development | |

| 261 | | |

| 238 | |

| Selling and marketing | |

| 2,630 | | |

| 2,389 | |

| General and administrative | |

| 3,440 | | |

| 3,596 | |

| Impairment of long-term assets | |

| 954 | | |

| — | |

| Total operating expenses | |

| 7,285 | | |

| 6,223 | |

| Operating loss | |

| (1,975 | ) | |

| (1,762 | ) |

| Other expenses (income) | |

| | | |

| | |

| Unrealized loss on marketable securities | |

| — | | |

| 242 | |

| Realized (gain)/loss on marketable securities | |

| (38 | ) | |

| 6 | |

| PPP loan forgiveness | |

| — | | |

| (705 | ) |

| Interest expense and other income, net | |

| (139 | ) | |

| 40 | |

| Total other expense (income) | |

| (177 | ) | |

| (417 | ) |

| Net loss | |

$ | (1,798 | ) | |

$ | (1,345 | ) |

| | |

| | | |

| | |

| Weighted average shares outstanding: basic and diluted (Note 5) | |

| 10,922,710 | | |

| 10,577,994 | |

| Net loss per common share basic and diluted | |

$ | (0.16 | ) | |

$ | (0.13 | ) |

MOVING

IMAGE TECHNOLOGIES, INC.

CONSOLIDATED

STATEMENTS

OF CASH FLOWS

(in

thousands)

| | |

Year Ended | | |

Year Ended | |

| | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2022 | |

| Cash flows from operating activities: | |

| | | |

| | |

| | |

| | | |

| | |

| Net loss | |

$ | (1,798 | ) | |

$ | (1,345 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| PPP loan forgiveness | |

| — | | |

| (705 | ) |

| Provision for doubtful accounts | |

| 389 | | |

| (218 | ) |

| Depreciation expense | |

| 9 | | |

| 19 | |

| Amortization expense | |

| 96 | | |

| 96 | |

| Impairment expense | |

| 550 | | |

| — | |

| ROU amortization | |

| 244 | | |

| (3 | ) |

| Stock option compensation expense | |

| 146 | | |

| 245 | |

| Unrealized loss on investments | |

| — | | |

| 242 | |

| Realized (gain) loss on investments | |

| (38 | ) | |

| 6 | |

| Changes in operating assets and liabilities | |

| | | |

| | |

| Accounts receivable | |

| 868 | | |

| (1,090 | ) |

| Inventories, net | |

| (386 | ) | |

| (2,499 | ) |

| Prepaid expenses and other | |

| 413 | | |

| 348 | |

| Accounts payable | |

| (76 | ) | |

| (328 | ) |

| Accrued expenses | |

| 83 | | |

| 42 | |

| Unearned warranty revenue | |

| 8 | | |

| (16 | ) |

| Customer deposits | |

| 11 | | |

| 1,819 | |

| Advances on notes receivable | |

| (250 | ) | |

| — | |

| Net cash used in operating activities | |

| 269 | | |

| (3,387 | ) |

| Cash flows from investing activities | |

| | | |

| | |

| Sales of marketable securities | |

| 12,395 | | |

| 641 | |

| Purchases of marketable securities | |

| (7,669 | ) | |

| (5,577 | ) |

| Purchases of property and equipment | |

| (15 | ) | |

| (20 | ) |

| | |

| (400 | ) | |

| — | |

| Net cash provided by (used in) investing activities | |

| 4,311 | | |

| (4,956 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities | |

| | | |

| | |

| Net proceeds from initial public offering | |

| — | | |

| 11,244 | |

| Payments on notes payable | |

| — | | |

| (1,241 | ) |

| Payments on line of credit | |

| — | | |

| (590 | ) |

| Stock Buyback | |

| (304 | ) | |

| — | |

| Net cash provided by (used in) financing activities | |

| (304 | ) | |

| 9,413 | |

| | |

| | | |

| | |

| Net increase in cash | |

| 4,276 | | |

| 1,070 | |

| Cash, beginning of the year | |

| 2,340 | | |

| 1,270 | |

| Cash, end of the year | |

$ | 6,616 | | |

$ | 2,340 | |

RECONCILIATION

OF NON-GAAP ITEMS

(in

millions except for per share numbers)

| | |

4Q23 | | |

4Q22 | | |

FY23 | | |

FY22 | |

| GAAP Net Loss | |

$ | (1.3 | ) | |

$ | (0.7 | ) | |

$ | (1.8 | ) | |

$ | (1.3 | ) |

| Add back: | |

| | | |

| | | |

| | | |

| | |

| Impairments of Goodwill and Intangibles | |

$ | 0.6 | | |

$ | - | | |

$ | 0.6 | | |

$ | - | |

| SNDBX Note Write-off | |

$ | 0.4 | | |

$ | - | | |

$ | 0.4 | | |

$ | - | |

| Other Income/Expense | |

$ | - | | |

$ | (0.2 | ) | |

$ | - | | |

$ | 0.1 | |

| PPP Loan Forgiveness Gain | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | (0.7 | ) |

| Stock Compensation Expense | |

$ | 0.1 | | |

$ | 0.2 | | |

$ | 0.1 | | |

$ | 0.4 | |

| | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP Net Loss | |

$ | (0.2 | ) | |

$ | (0.7 | ) | |

$ | (0.7 | ) | |

$ | (1.5 | ) |

| Non-GAAP Loss Per Share | |

$ | (0.02 | ) | |

$ | (0.06 | ) | |

$ | (0.07 | ) | |

$ | (0.14 | ) |

| Shares Outstanding | |

| 10.9 | | |

| 10.8 | | |

| 10.6 | | |

| 10.9 | |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

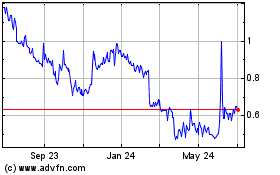

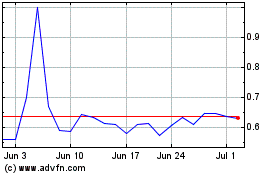

Moving iMage Technologies (AMEX:MITQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Moving iMage Technologies (AMEX:MITQ)

Historical Stock Chart

From Apr 2023 to Apr 2024