0000895447

false

0000895447

2023-09-21

2023-09-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 25, 2023 (September 21, 2023)

SHOE CARNIVAL, INC.

(Exact name

of Registrant as Specified in Its Charter)

| Indiana |

0-21360 |

35-1736614 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

| |

|

|

7500 East Columbia Street

Evansville, Indiana |

|

47715 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (812) 867-4034

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions

A.2. below):

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

|

SCVL |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02 Departure of Directors or

Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On September 25, 2023, Shoe Carnival, Inc. (the “Company”)

announced that the Company and Erik Gast, the Company’s Executive Vice President, Chief Financial Officer and Treasurer, mutually

agreed that Mr. Gast would leave the Company to pursue other opportunities, effective as of September 25, 2023. Mr. Gast

and the Company had discussed having the Chief Financial Officer position, which is currently based in the Company’s Fort Mill,

South Carolina office, spend substantially more time working from the Company’s Evansville, Indiana headquarters, and Mr. Gast

was not supportive of this change. Mr. Gast’s departure was not related to any disagreement between Mr. Gast and the Company

relating to the Company’s financial reporting or condition, operations, policies or practices.

On September 22, 2023, the Board of Directors of the Company appointed

Patrick C. Edwards to serve as the Company’s Senior Vice President, Chief Financial Officer, Secretary and Treasurer, effective

as of September 25, 2023, to succeed Mr. Gast. Mr. Edwards was also designated as the Company’s principal financial

officer, effective as of September 25, 2023, and will continue to serve as the Company’s principal accounting officer. Mr. Edwards,

age 51, has served as the Company’s Vice President, Chief Accounting Officer and Corporate Controller since March 2021. He

has also served as the Company’s Secretary since June 2021 and was the Company’s Assistant Secretary from December 2019

to June 2021. From October 2019 to March 2021, Mr. Edwards served as the Company’s Vice President and Corporate

Controller. Prior to joining the Company, Mr. Edwards was Vice President of Accounting for CenterPoint Energy, Inc. from February 2019

to August 2019 following its acquisition of Vectren Corporation (“Vectren”). For Vectren, Mr. Edwards held various

leadership roles in the accounting, audit and finance functions from February 2001 through February 2019, including Vice President

and Treasurer from April 2017 to February 2019 and Vice President of Corporate Audit from August 2013 to April 2017.

Prior to joining Vectren, Mr. Edwards worked in public accounting. Mr. Edwards is a Certified Public Accountant.

On September 22, 2023, the

Compensation Committee of the Board of Directors approved an increase in Mr. Edwards’ annual base salary to $366,000 in connection

with his promotion. No other changes were made to Mr. Edwards’ compensation.

There are no family relationships

between Mr. Edwards and any director or executive officer of the Company, and he has no direct or indirect material interest in any

transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K. Further, there are no arrangements or understandings

between Mr. Edwards and any other person pursuant to which he was selected to become the Senior Vice President, Chief Financial Officer,

Secretary and Treasurer of the Company.

Mutual Separation Agreement with Mr. Gast

In connection with his departure, Mr. Gast and the Company entered

into a Mutual Separation Agreement, dated September 21, 2023 (the “Agreement”). Pursuant to the terms of the Agreement,

Mr. Gast will receive (i) a one-time lump sum payment of $566,000, payable within 30 days after the effective date of the Agreement;

and (ii) monthly payments equal to his monthly COBRA premium, which payments will be made for

the shorter of 18 months or the date Mr. Gast becomes eligible for group health insurance coverage benefits with a new employer.

Mr. Gast will remain eligible to receive reimbursement of certain relocation expenses in connection with relocating his residence

to the Fort Mill, South Carolina area up to a maximum reimbursement of $100,000, which includes any amounts already reimbursed to him,

plus an amount equal to any additional out-of-pocket federal, state and local income taxes incurred in connection with such reimbursement.

Mr. Gast will also forfeit all of the unvested restricted stock units and performance stock units that were granted to him under

the Company’s 2017 Equity Incentive Plan.

Mr. Gast also agreed to a general release

of claims against the Company and reaffirmed his post-employment non-competition, non-disclosure, non-disparagement and related restrictive

covenants and obligations under his Employment and Noncompetition Agreement dated March 14, 2023.

The

foregoing description of the Agreement is intended only as a summary and is qualified in its entirety by reference to the full text of

the Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

The following information shall not be deemed “filed” for

the purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the liabilities

of that Section, nor shall it be incorporated by reference into any registration statement or other document pursuant to the Securities

Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

A copy of the press release issued by the Company on September 25,

2023, announcing Mr. Gast’s departure and the appointment of Mr. Edwards as the new Senior Vice President, Chief Financial

Officer, Secretary and Treasurer of the Company, is furnished as Exhibit 99.1, and the information set forth therein is incorporated

herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

SHOE CARNIVAL, INC. |

| |

|

(Registrant) |

| |

|

|

| Date: |

September 25, 2023 |

By: |

/s/ Mark J. Worden |

| |

|

Mark J. Worden |

| |

|

President and Chief Executive Officer |

EXHIBIT 10.1

MUTUAL SEPARATION AGREEMENT

This MUTUAL SEPARATION AGREEMENT

(this “Agreement”) is entered into by and between SHOE CARNIVAL, INC. (the “Company”) and ERIK

GAST (“Gast”) (Gast and the Company will sometimes be collectively referred to as the “Parties”

and individually as a “Party”).

Recitals

A. Gast

has been employed with the Company pursuant to that Employment and Non-Competition Agreement dated March 14, 2023, between Gast and

the Company (the “Employment Agreement”).

B. Gast

and the Company have mutually decided and agreed to terminate their employment relationship in accordance with the terms and conditions

set forth in this Agreement.

Agreement

In consideration of the termination

of the employment relationship, and the covenants, promises and obligations set forth herein, the Company and Gast agree as follows:

Section 1. Separation

of Employment. The Parties agree that Gast’s employment with the Company and Gast’s

position as Executive Vice President and Chief Financial Officer will terminate or has terminated by mutual agreement effective September 25,

2023 (the “Employment Separation Date”). The Company will pay Gast his earned, unpaid base salary through the Employment

Separation Date (such earned, unpaid salary hereinafter referred to as the “Final Wages”) on the Company’s next

regular payroll date after the Employment Separation Date. Gast acknowledges that, except for the Final Wages, the Company has paid Gast

all wages and other compensation to which Gast is entitled in connection with his employment with the Company and that, except as provided

in this Agreement, Gast is not entitled to any additional compensation, including, without limitation, salary, commissions, wages, bonuses,

or vacation pay from the Company. Except for any applicable COBRA rights or as otherwise may be expressly provided in any applicable

employee benefit plans, Gast’s eligibility to participate in, and/or Gast’s receipt of, all employee benefits terminated

as of the Employment Separation Date. Consistent with the Company’s expense reimbursement policies, the Company will reimburse

Gast for any unreimbursed business expenses that Gast reasonably has incurred in connection with his employment with the Company up to

the Employment Separation Date provided that Gast submits such expenses together with such receipts and other documentation as required

by the Company’s expense reimbursement policies within thirty (30) days after the Employment Separation Date. The Company’s

obligation to pay the Final Wages and the unreimbursed business expenses is not contingent on Gast entering into this Agreement, and

the Company will pay Gast the Final Wages and the unreimbursed business expenses regardless of whether Gast enters into this Agreement.

Section 2. Severance

Benefits. Contingent on this Agreement becoming effective (as described in Section 8

below) and Gast’s compliance with this Agreement and his post-employment obligations and covenants under Section 5 and

Section 6 of the Employment

Agreement, the Company will pay or provide

Gast with the following severance benefits (collectively, the

“Severance Benefits”) (which Gast acknowledges he would not be entitled to receive if he did not enter

into this Agreement):

(a) The

Company will pay Gast a lump sum severance payment in the gross amount of Five Hundred Sixty-Six Thousand Dollars ($566,000) (the “Severance

Payment”), payable within thirty (30) days after this Agreement becomes effective. The Severance Payment shall be subject to

all applicable payroll tax withholdings.

(b) During

the eighteen (18) month period immediately following the Employment Separation Date, the Company will pay Gast up to eighteen (18) special

monthly severance payments, each in the gross amount equal to the COBRA Premium Rate (as defined below) (each a “Special Monthly

Payment”); provided, however, if Gast becomes eligible for group health insurance coverage benefits with a new employer during

the 18-month period immediately following the Employment Separation Date, the Company’s obligation to pay, and Gast’s right

to receive, any additional Special Monthly Payments shall immediately cease. Gast agrees to notify the Company immediately in writing

if he becomes eligible for group health insurance coverage benefits with a new employer during the 18-month period immediately following

the Employment Separation Date. Gast may use the Special Monthly Payments for any purpose. The Special Monthly Payments shall be subject

to all applicable payroll tax withholdings. For purposes of the Agreement, the “Cobra Premium Rate” means the monthly

amount charged, as of the Employment Separation Date, for COBRA continuation coverage under the Company’s group medical and dental

plans for the coverage options and coverage levels applicable to Gast and his covered dependents as of the Employment Separation Date.

(c) In

accordance with Section 3.7 of the Employment Agreement Gast shall remain eligible to receive reimbursement of certain reasonable

relocation expenses in connection with relocating his residence to the Fort Mill, South Carolina area, including customary closing costs

in connection with the sale of Gast’s current home, house hunting trips and temporary housing expenses, subject to the terms and

conditions of the Company’s relocation policies, as in effect from time to time. Relocation expenses shall be subject to a maximum

reimbursement of One Hundred Thousand Dollars ($100,000) of relocation expenses in the aggregate, including any relocation expenses that

have already been reimbursed to Gast. A relocation expense must be incurred and submitted for reimbursement by no later than December 31,

2023 to be eligible for reimbursement. The Company shall also pay Gast such amounts as are necessary to compensate him for any additional

out-of-pocket federal, state and local income taxes incurred by Gast with respect to any compensation attributed to Gast for the reimbursements

provided under Section 3.7 of the Employment Agreement.

Section 3. Compliance

with Code Section 409A. The intent of the Parties hereto is that payments and benefits under

this Agreement satisfy, to the greatest extent possible, the exemptions from the application of Section 409A of the Internal Revenue

Code of 1986, as amended, and the Treasury Regulations issued thereunder (collectively “Code Section 409A”) (including

without limitation the exemptions for short-term deferrals and separation pay due to involuntary separation from service), and, accordingly,

to the maximum extent permitted, this Agreement shall be interpreted and be administered in a manner consistent with such intent. To the

extent payment and benefits under this Agreement are not so exempt, this Agreement (and

any

definitions hereunder) shall be interpreted and be administered to be in compliance with Code Section 409A. Nevertheless, the

tax treatment of the benefits provided under the Agreement is not warranted or guaranteed. Neither the Company nor its officers,

directors, managers, employees, attorneys or advisers shall be held liable for any taxes, interest, penalties or other monetary

amounts owed by Gast as a result of the application of Code Section 409A. Any payments described in this Agreement that are due

within the “short-term deferral period” (as defined in Code Section 409A) will not be treated as deferred

compensation unless applicable law requires otherwise. If any amount to be paid or benefit to be provided to Gast pursuant to this

Agreement constitutes deferred compensation subject to Code Section 409A, such payment or benefit shall be construed as a

separate identified payment for purposes of Code Section 409A. Notwithstanding anything to the contrary in this Agreement, to

the extent that any payments to be made in connection with Gast’s separation from service would result in the imposition of

any individual excise tax and late interest charges imposed under Code Section 409A, the payment will instead be made on the

first business day after the earlier of: (a) the date that is six (6) months following such separation from service; and

(b) the date of Gast’s death.

Section 4. Acknowledgment

of Forfeiture of Unvested RSU’s and PSU’s. As of immediately prior to the Employment

Separation Date, Gast held Thirty-One Thousand Two Hundred Eighty-Six (31,286) unvested Restricted Stock Units granted on or about April 24,

2023 pursuant to the Company’s 2017 Equity Incentive Plan (the “Unvested RSU’s”) and Nine Thousand Four

Hundred Thirty (9,430) Performance Stock Units at the target level of performance granted on or about April 24, 2023 pursuant to

the Company’s 2017 Equity Incentive Plan (the “Unvested PSU’s”). Gast and the Company acknowledge and

agree that the Unvested RSU’s and Unvested PSU’s were immediately forfeited and became void effective as of the Employment

Separation Date.

Section 5. Reaffirmation

of, and Compliance with, Post-Employment Covenants and Obligations under Employment Agreement.

Gast hereby acknowledges and reaffirms his post-employment non-competition, non-disclosure, non-disparagement and other restrictive covenants

and obligations under Section 5 and Section 6 of the Employment Agreement. If Gast breaches, or threatens to breach, this Agreement

or any of the covenants or provisions set forth in Section 5 and Section 6 of the Employment Agreement, then in such event

the Company shall have the right immediately and permanently to discontinue payment and provision of any of the Severance Benefits set

forth in Section 2 of this Agreement. Gast acknowledges and agrees that such remedy is in addition to, and not in lieu of,

any and all other legal and/or equitable remedies that may be available to the Company in connection with Gast’s breach or threatened

breach of this Agreement or the covenants or provisions of Section 5 or Section 6 of the Employment Agreement.

Section 6. Amendment

of Section 6.4.1 of Employment Agreement. The Company and Gast agree that the definition

of “Competing Business” in Section 6.4.1 of the Employment Agreement is hereby amended and restated as follows: “6.4.1

“Competing Business” means any of the following entities (which You acknowledge are direct competitors of the Company)

and each of their respective subsidiaries and successors: (a) Payless; (b) Caleres, Inc.; (c) Designer Brands Inc.;

(d) Rack Room; (e) Kohls Corporation; (f) Shoe Department; (g) Shoe City; (h) Shoe Pavilion, Inc.; (i) JD

Sports Fashion plc; (j) Finish Line, Inc.; (k) Belk; (l) Off Broadway Shoe Warehouse; (m) Foot Locker Retail, Inc.;

(n) Nike, Inc.;

(o) Adidas AG; (p) Puma SE; (q) Crocs, Inc.; (r) Skechers USA, Inc.; and/or (s) New

Balance Athletics, Inc.”

Section 7. General

Release of Claims. To the fullest extent permitted by applicable laws, Gast hereby generally,

irrevocably and unconditionally releases and forever discharges and covenants not to sue the Company and all of its parents, subsidiaries

and affiliated entities and all of its and their current and/or former employees, officers, members, shareholders, owners, directors,

representatives, agents, insurers, attorneys, employee benefit plans and their fiduciaries and administrators, and all persons acting

by, through, or under or in concert with any of them, both individually and in their representative capacities (collectively, including

without limitation the Company, the “Company Released Parties”), from any and all complaints, claims, demands, liabilities,

damages, obligations, injuries, actions or rights of action of any nature whatsoever, (including without limitation claims for damages,

attorneys’ fees, interest and costs), whether known or unknown, disclosed or undisclosed, administrative or judicial, suspected

or unsuspected, that exist in whole or in part as of the date Gast signs this Agreement, including, but not limited to, any claims based

upon, arising out of or in any manner connected with Gast’s employment with the Company, the termination of Gast’s employment

with the Company, the Employment Agreement and/or any acts, omissions or events occurring on or before the date Gast signs this Agreement.

Without limiting the generality of the foregoing, Gast acknowledges and agrees that the foregoing release/covenant not to sue is to be

construed as broadly as possible and includes, but is not limited to, and constitutes a complete waiver of, any and all possible claims

Gast has or may have against the Company Released Parties under or with respect to the Age Discrimination in Employment Act of 1967,

as amended (including the Older Workers Benefit Protection Act), 29 U.S.C. § 621 et seq., the Civil Rights

Act of 1964 and 1991, as amended, 29 U.S.C. § 2000(e), the Americans With Disabilities Act of 1990, as amended, 42 U.S.C. § 12,101

et seq., the Employee Retirement Income Security Act of 1974, as amended, 29 U.S.C. § 1001 et seq.,

the Family and Medical Leave Act, as amended, 29 U.S.C. § 2601 et seq., the National Labor Relations Act, 29 U.S.C. §151

et seq., the Worker Adjustment and Retraining Notification Act, 29 U.S.C. § 2101 et seq., the Occupational Safety and Health

Act, 29 U.S.C. § 651 et seq., the Indiana Civil Rights Law, and all other federal, state and local laws and statutes, all

wrongful discharge or other state law claims and all contract claims or other theories of recovery as of the date Gast signs this Agreement;

provided, however, Gast is not releasing or waiving (a) any claims or rights under this Agreement; (b) any vested rights under

any employee benefit plan, (c) any rights or claims that cannot be waived by applicable law, or (d) any claim that may arise

after the date Gast signs this Agreement. Gast has been advised by the Company that this Agreement does not prohibit Gast from (x) filing

an administrative charge or complaint with a governmental agency, such as the United States Equal Employment Opportunity Commission (“EEOC”),

relating to Gast’s employment with the Company; or (y) participating in any investigation by the EEOC or other governmental

agency; provided, however, Gast acknowledges and agrees that by this Agreement he is waiving and releasing, to the fullest extent permitted

by law, any and all entitlement to any form of personal relief arising from such charge or complaint or any legal action relating to

such charge or complaint. If the EEOC, any other administrative agency or any other person brings a complaint, charge or legal action

on Gast’s behalf against any of the Company Released Parties based on any acts, events or omissions occurring on or before the

date Gast signs this Agreement, Gast hereby waives any rights to, and will not accept, any remedy obtained through the efforts of such

agency or person.

Section 8. ADEA

Advisements. Gast acknowledges : (a) the Company has advised Gast that by entering into

this Agreement, Gast is waiving and releasing, among other claims, all claims against the Company Released Parties under the Age Discrimination

in Employment Act of 1967, as amended (including the Older Workers Benefit Protection Act), 29 U.S.C. § 621 et seq.,

as of the date Gast signs this Agreement; (b) the Company has advised Gast to consult with an attorney prior to signing this Agreement;

(c) the Company has advised Gast that he has up to twenty-one (21) days to consider and accept this Agreement by signing and returning

this Agreement to the Company; (d) the Company has advised Gast that for a period of seven (7) days following Gast’s

signing of this Agreement, Gast may revoke this Agreement by written notice to the Company; and (e) this Agreement will not become

binding and enforceable until the seven-day revocation period has expired without Gast having exercised his right of revocation.

Section 9. Cooperation

and Transition Assistance. Gast agrees that for a period of six (6) months after the Employment

Separation Date, he will, without any additional remuneration other than the Severance Benefits, cooperate with the Company in any work

transition issues, including, without limitation, making himself reasonably available by phone and/or email, if requested, to answer

questions or otherwise provide information concerning business transition issues or other business matters involving the Company; provided,

however, the foregoing cooperation obligation shall not preclude Gast from obtaining other full-time employment or in any way interfere

unreasonably with any such other employment. Gast further agrees and covenants that if, at any time, the Company desires Gast to provide

any information or testimony relating to any judicial, administrative or other proceeding involving the Company, Gast will cooperate

in making himself reasonably available for such purposes and will provide truthful information and/or testimony. The Company agrees to

reimburse Gast for all necessary and reasonable out-of-pocket expenses he incurs in connection with such matters. Should Gast be served

with a subpoena in any legal proceeding relating to the Company, Gast agrees immediately to notify the Company of the subpoena and provide

it with a copy of the subpoena, unless prohibited by applicable law.

Section 10. No

Actions Commenced. Gast represents and warrants that, as of the date of signing this Agreement:

(a) Gast has not filed or submitted any complaint, charge or action of any kind in any forum, judicial, administrative or otherwise,

against any of the Company Released Parties which complaint, charge or action is currently pending against any of the Company Released

Parties with the EEOC, any other federal, state or local governmental agency, or any judicial body; (b) Gast has no known workplace

injuries or occupational diseases; and (c) Gast has not sold, assigned or transferred to any other person or entity any claim, action,

right or cause of action that Gast has or may have against any of the Company Released Parties or that is the subject of the general

release of claims set forth in Section 7 of this Agreement.

Section 11. Disclosure

and Other Rights. Nothing in this Agreement or any other agreement to which Gast is subject

shall be construed to prevent, restrict, or impede Gast from: (a) exercising protected rights to the extent that such rights cannot

be waived by agreement; (b) complying with any applicable law or regulation or a valid order of a court of competent jurisdiction;

(c) reporting possible violations of law or regulation to any governmental agency; (d) filing an administrative charge with

or participating in any government agency investigation or proceeding (although Gast waives the right to recover monetary damages in

any

charge,

complaint or lawsuit filed by a government agency or anyone else); (e) disclosing or discussing conduct Gast reasonably

believes to be illegal harassment, illegal discrimination, illegal retaliation, wage and hour violations, or sexual assault, that is

recognized as illegal under state, federal, or common law, or that is recognized as against the clear mandate of public policy,

occurring in the workplace, at work-related events coordinated by or through the Company, between employees, or between the Company

and any employee, whether on or off the work premises; or (f) making any other disclosure or engaging in any other activity

that is protected by applicable law.

Section 12. Return

of Company Property. Gast represents and covenants (a) that Gast has returned, or will immediately

return, to the Company all property belonging to the Company, including, but not limited to, keys, access cards, credit cards, files,

computer and accessories, equipment, computer disks or files, documents, electronic data in any storage medium, and/or any such other

Company property in Gast’s possession or custody or under Gast’s control (including, without limitation, any applicable security

keys and passwords for any the Company’s devices or accounts), and (b) that Gast has not retained, and will not retain, copies

(hard copy or electronic) of any the Company’s files, documents or electronic data, or any abstracts or summaries of such information.

Section 13. Non-Disparagement

of Gast. During the three (3) year period immediately after the Employment Separation Date,

the Covered Company Representatives will not make or publish any public statement that disparages Gast or injures Gast’s reputation;

provided, however, that nothing in this Section 13 is intended to prohibit: (a) any Covered Company Representative from

making any disclosures as may be required or compelled by law or legal process; (b) any Covered Company Representative from making

any disclosures or providing any information to any government or law enforcement agencies or bodies; (c) any Covered Company Representative

from making any truthful statement in connection with the enforcement of or defense of any action, claim or cause of action relating to

this Agreement or Your employment with the Company; or (d) any Covered Company Representative from making any statements, comments

or disclosures within the Company or any affiliate of the Company, including, without limitation, making or publishing any statement,

comment or disclosures to any employee, representative or agent of the Company or any affiliate of the Company; or (e) any Covered

Company Representative from making any disclosures as part of its public filings under the federal securities laws. For purposes of this

Agreement, “Covered Company Representative” means any member of the Company’s Board of the Directors, the Company’s

Chief Executive Officer, the Company’s Chief Financial Officer, or any other executive officer of the Company holding the position

of Executive Vice President or higher.

Section 14. No

Admission. This Agreement and the actions taken pursuant to this Agreement do not constitute

an admission by either Party of any wrongdoing or liability, and each Party expressly denies any wrongdoing or liability.

Section 15. No

Other Severance Benefits. Gast acknowledges that, except as expressly provided in this Agreement,

Gast is not entitled to any other severance payments or other benefits under any other agreement, plan or program that may be maintained

by the Company, and Gast hereby waives any and all rights Gast may have under any such agreements, plans or programs.

Section 16. Entire

Agreement; Modification. This Agreement and the Employment Agreement constitute the entire

agreement of the Parties with respect to the subject matter addressed herein and supersedes any prior agreements, understandings or

representations, oral or written, with respect to the subject matter addressed in this Agreement; provided, however, this Agreement

does not affect or supersede Gast’s continuing obligations and covenants under the Employment Agreement that survive the

termination of Gast’s employment, including, without limitation, Gast obligations under Section 5 and Section 6 of

the Employment Agreement. Gast acknowledges and agrees that he does not have any continuing rights under the Employment Agreement.

This Agreement may not be amended, supplemented, or modified except by a written agreement signed by both Gast and a duly authorized

officer of the Company.

Section 17. Severability.

If any provision or portion of this Agreement is determined by a court of competent jurisdiction

to be unenforceable or invalid for any reason, such unenforceability or invalidity shall not affect the enforceability or invalidity

of the remainder of this Agreement. Should any covenant or provision of this Agreement be determined by a court of competent jurisdiction

to be unenforceable or invalid for any reason, such covenant or provision shall be enforced to the maximum extent permitted by applicable

law.

Section 18. Governing

Law; Venue. To the extent not preempted by federal law, the provisions of this Agreement shall

be construed and enforced in accordance with the laws of the State of Indiana, notwithstanding any state’s choice-of-law or conflicts-of-law

rules to the contrary. The Company and Gast agree that any legal action arising out of or relating to this Agreement shall be commenced

and maintained exclusively before any appropriate state court of record in Vanderburgh County, Indiana, or in the United States

District Court for the Southern District of Indiana, Evansville Division. Further, the Company and Gast hereby consent and submit to

the personal jurisdiction and venue of any appropriate state court of record in Vanderburgh County, Indiana, or in the United States

District Court for the Southern District of Indiana, Evansville Division, and waive any right to challenge or otherwise object to personal

jurisdiction or venue (including, without limitation, any objection based on inconvenient forum grounds) in any action commenced or maintained

in such courts located in Vanderburgh County, Indiana, or in the United States District Court for the Southern District of Indiana,

Evansville Division; provided, however, the foregoing shall not affect any applicable right a Party may have to remove a legal action

to federal court.

Section 19. Jury

Trial Waiver. EACH PARTY HEREBY WAIVES ITS RIGHT TO A JURY TRIAL OF ANY CLAIM OR CAUSE OF ACTION

ARISING OUT OF OR RELATING TO THIS AGREEMENT.

Section 20. Construction.

This Agreement is the result of negotiations between the Parties. This Agreement shall be interpreted

without any presumption or inference

based upon or against the Party causing this Agreement to be prepared. The language of this Agreement

shall in all cases be construed as a whole, according to its fair meaning, and not strictly for or against any Party.

Section 21. Counterparts.

This Agreement may be executed in one or more counterparts (or upon separate signature pages bound

together into one or more counterparts), all of which taken together shall constitute but one agreement. Signatures transmitted by facsimile

or other electronic means (including, without limitation, pdf format or any electronic signature complying with the U.S. ESIGN Act of

2000, e.g., www.docusign.com) are acceptable the same as original signatures for execution of this Agreement.

Section 22. Acknowledgment. Gast

acknowledges that he has been given ample time to consider this Agreement, he has had the opportunity to consult with his own

attorney or other advisors concerning this Agreement if he so chooses, and he is knowingly and voluntarily entering into this

Agreement intending to be legally bound.

[Remainder of page intentionally left blank;

signature page follows.]

[Signature page for Mutual Separation Agreement]

IN WITNESS WHEREOF, the Company

and Gast have executed this Mutual Separation Agreement on the date(s) indicated below.

| GAST |

|

COMPANY |

| |

|

|

| |

|

SHOE CARNIVAL, INC. |

| |

|

|

| /s/

Erik Gast |

|

By: |

/s/ Mark J. Worden |

| Erik Gast |

|

|

| |

|

Title: |

President &

Chief Executive Officer |

| |

|

|

| Date: |

September 21,

2023 |

|

Date: |

September 22,

2023 |

EXHIBIT 99.1

SHOE CARNIVAL ANNOUNCES APPOINTMENT OF PATRICK EDWARDS AS CHIEF

FINANCIAL OFFICER

Edwards, currently a Shoe Carnival

executive officer, has served as the Company’s Chief Accounting Officer and Secretary since 2021

Edwards brings nearly 30 years

of strategic experience in finance, accounting, risk management and governance to the role

Evansville, Indiana, September 25, 2023 - Shoe Carnival, Inc.

(Nasdaq: SCVL) (the “Company”), a leading retailer of footwear and accessories for the family, announced today that Patrick

Edwards has been named the Company’s Senior Vice President, Chief Financial Officer, Secretary and Treasurer, effective today.

Mr. Edwards, currently a Shoe Carnival executive officer, has

served as the Company’s Chief Accounting Officer and Secretary since 2021 and has served as Vice President and Controller since

he joined the Company in 2019. Mr. Edwards has been instrumental in the Company’s successful growth and financial strategies

during that time.

Prior to joining Shoe Carnival, Mr. Edwards served in increasing

roles of responsibility in finance and accounting during his 18-year career with Vectren Corporation, a publicly traded utility holding

company, including serving as vice president and treasurer and vice president of corporate audit. Early in his career, Mr. Edwards

worked in public accounting for PricewaterhouseCoopers LLP. Mr. Edwards holds a bachelor’s degree in accounting from Southern

Methodist University and is a Certified Public Accountant.

Mr. Edwards is active in the community, serving as treasurer of

Junior Achievement of Southwestern Indiana and is a former treasurer of Youth First, Inc. He is also a member of the board of directors

of the Boys and Girls Club of Evansville and is a member of the University of Southern Indiana Accounting Circle.

The Company also announced today that the Company and Erik Gast, the

Company’s Executive Vice President, Chief Financial Officer and Treasurer, mutually agreed that Mr. Gast would leave the Company,

effective today, to pursue other opportunities.

Mark Worden, Shoe Carnival’s President and Chief Executive Officer,

commented, “Patrick has been a significant contributor to our success since joining Shoe Carnival in 2019. I am very pleased that

he has agreed to expand his role and I am confident that he will continue to add incredible value as we move forward in executing our

strategy to grow the business and drive shareholder value.”

Mr. Worden further commented, “I would also like to thank

Erik for his contributions and wish him all the best in his future endeavors.”

About Shoe Carnival

Shoe Carnival, Inc. is one of the nation’s largest family

footwear retailers, offering a broad assortment of dress, casual and athletic footwear for men, women and children with emphasis on national

name brands. As of September 25, 2023, the Company operates 400 stores in 35 states and Puerto Rico under its Shoe Carnival and Shoe

Station banners and offers shopping at www.shoecarnival.com and www.shoestation.com. Headquartered in Evansville, IN, Shoe Carnival, Inc.

trades on The Nasdaq Stock Market LLC under the symbol SCVL. Press releases and annual reports are available on the Company's website

at www.shoecarnival.com.

Contact Information

Steve R. Alexander

Shoe Carnival Investor Relations

(812) 867-4034

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

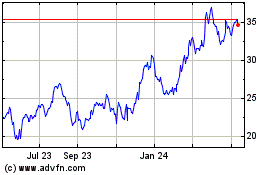

Shoe Carnival (NASDAQ:SCVL)

Historical Stock Chart

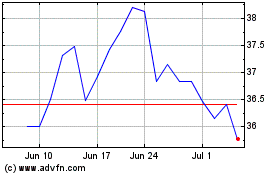

From Mar 2024 to Apr 2024

Shoe Carnival (NASDAQ:SCVL)

Historical Stock Chart

From Apr 2023 to Apr 2024