Form 8-K - Current report

September 14 2023 - 4:56PM

Edgar (US Regulatory)

0000928054FALSE00009280542023-09-142023-09-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

September 14, 2023

Date of Report (Date of earliest event reported)

Flotek Industries, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-13270 | 90-0023731 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

5775 N. Sam Houston Parkway W., Suite 400

Houston, TX 77086

(Address of principal executive office and zip code)

(713) 849-9911

(Registrant’s telephone number, including area code)

(Not Applicable)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of Exchange on which registered |

| Common Stock, $0.0001 par value | FTK | NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

On September 14, 2023, Flotek Industries, Inc. (the “Company”) issued a press release announcing that it projects achieving a financial milestone in the third quarter of 2023 and that its Board of Directors (the “Board”) has approved a 1-for-6 reverse split of the Company’s common stock. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information furnished pursuant to Item 7.01 of this Current Report on Form 8-K and in Exhibit 99.1 hereto shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), is not subject to the liabilities of that section and is not deemed incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as otherwise expressly stated in such filing.

Item 8.01 Other Events.

On August 29, 2023, the Company changed the address of its principal executive offices from 8846 N. Sam Houston Parkway W. Houston, TX, 77064 to the new, and current, address of 5775 N. Sam Houston Parkway W., Suite 400, Houston, TX 77086. The Company’s telephone number is unchanged: (713) 849-9911.

Item 9.01 Financial Statements and Exhibits

| | | | | | | | | | | |

Exhibit Number | | Description |

99.1 | | | |

104 | | | Cover Page Interactive Data File (formatted as Inline XBRL). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| FLOTEK INDUSTRIES, INC. |

| Date: September 14, 2023 | /s/ Bond Clement |

| Name: | Bond Clement |

| Title: | Chief Financial Officer |

Flotek Industries, Inc. 5775 N. Sam Houston Pkwy W., Suite 400 Houston, Texas 77086 (713)-849-9911 www.flotekind.com FOR IMMEDIATE RELEASE Flotek Projects Achieving Financial Milestone in Third Quarter and Announces 1-for-6 Reverse Stock Split HOUSTON, September 14, 2023 - Flotek Industries, Inc. (“Flotek” or the “Company”) (NYSE: FTK) today announced it expects to report positive adjusted EBITDA(1) for the quarter ending September 30, 2023, accelerating its previous estimate of achieving this financial metric before year-end. Reaching positive adjusted EBITDA(1) builds upon the Company’s improvement in its financial results over the last several quarters, highlighted by revenues and gross profit during the first half of 2023 increasing by approximately $56 million and $9 million, respectively, as compared to the first half of 2022. The Company expects that its third quarter 2023 adjusted EBITDA(1) will reflect the ninth consecutive quarter of improvement. The Company also announced that its Board of Directors has approved a 1-for-6 reverse split of Flotek’s common stock, par value $0.0001 per share (the “Reverse Stock Split”). The Reverse Stock Split will become effective after market close on September 25, 2023 (the “Effective Date”), and the shares of common stock are expected to begin trading on the split-adjusted basis under the Company's existing trading symbol, "FTK," when the market opens on September 26, 2023. The new CUSIP number following the Reverse Stock Split will be 343389409. Ryan Ezell, Chief Executive Officer, stated, “Our results through the first half of 2023, combined with our confidence in reaching positive adjusted EBITDA(1) for the third quarter, clearly indicate continued improvement in all aspects of our business. Revenues, gross profit and adjusted EBITDA(1) during the first half of 2023 have increased significantly as compared to the first half of last year, while our balance sheet has improved through the conversion of debt to equity as well as the entry into an Asset Based Loan to enhance liquidity. We expect this strong financial momentum to continue into 2024.” On the Effective Date, the total number of shares of common stock held by each stockholder of the Company will be converted automatically into the number of shares of common stock equal to (i) the number of issued and outstanding shares of common stock held by each such stockholder immediately prior to the Reverse Stock Split, divided by (ii) 6, with such resulting number of shares rounded up to the nearest whole share. The Company will issue one whole share of the post-Reverse Stock Split common stock to any stockholder who otherwise would have received a fractional share as a result of the Reverse Stock Split. As a result, no fractional (1) A non-GAAP financial measure. See our previously issued reconciliation of Non-GAAP items to the most comparable GAAP measures in connection with our second quarter 2023 earnings release. We are unable to reconcile this forward-looking non- GAAP financial measure to the most directly comparable GAAP financial measure without unreasonable efforts, as we are unable to predict with a reasonable degree of certainty the impact of certain items that would be expected to impact the GAAP financial measure, including, among other items, the future amortization of our contract assets, certain stock-based compensation costs and the impact of the revaluation of certain liabilities, which is based upon our future stock price. These items do not impact the non-GAAP financial measure.

shares will be issued in connection with the Reverse Stock Split and no cash or other consideration will be paid in connection with any fractional shares that would otherwise have resulted from the Reverse Stock Split. The Reverse Stock Split has no effect on the par value or on the number of authorized shares of common stock or preferred stock. Immediately after the Reverse Stock Split, each stockholder's percentage ownership interest in the Company and proportional voting power will remain unchanged, except for minor changes and adjustments that will result from the treatment of fractional shares. The rights and privileges of the holders of shares of common stock will be substantially unaffected by the Reverse Stock Split. The Company anticipates that the effect of the Reverse Stock Split will be sufficient to regain compliance with the New York Stock Exchange’s continued listing standards, however, there can be no assurance that the Reverse Stock Split will have that effect, initially or in the future, or that it will enable the Company to maintain the listing of its common stock on the New York Stock Exchange. Stockholders who are holding their shares in electronic form at brokerage firms do not need to take any action, as the effect of the Reverse Stock Split will automatically be reflected in their brokerage accounts. Stockholders holding paper certificates may (but are not required to) send the certificates to the Company's transfer agent and registrar, Equiniti. Equiniti will issue a new stock certificate reflecting the Reverse Stock Split to each requesting stockholder. About Flotek Industries, Inc. Flotek Industries, Inc. is an advanced technology-driven, green chemical and data analytics company providing unique and innovative completion solutions that have a proven, positive impact on sustainability and reducing the overall environmental impact of energy on air, land, water and people. Flotek has an intellectual property portfolio of over 170 patents and a global presence in more than 15 countries throughout North America, Latin America, the Middle East and North Africa. Flotek has established collaborative partnerships focused on sustainable and optimized chemistry and data solutions which improve well performance and allow its customers to generate higher returns on invested capital. Flotek is based in Houston, Texas and its common shares are traded on the New York Stock Exchange under the ticker symbol “FTK”. For additional information, please visit www.flotekind.com. Forward -Looking Statements Certain statements set forth in this press release constitute forward-looking statements (within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934) regarding Flotek Industries, Inc.’s business, financial condition, results of operations and prospects. Words such as will, continue, expects, anticipates, projects, intends, plans, believes, seeks, estimates and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this press release. Although forward-looking statements in this press release reflect the good faith judgment of management, such statements can only be based on facts and factors currently known to management. Consequently, forward-looking

statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking statements. Investor contact: Bond Clement Chief Financial Officer E: ir@flotekind.com P: (713) 726-5322

v3.23.2

Cover

|

Sep. 14, 2023 |

| Entity Addresses |

|

| Document Type |

8-K

|

| Document Period End Date |

Sep. 14, 2023

|

| Entity Registrant Name |

Flotek Industries, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-13270

|

| Entity Tax Identification Number |

90-0023731

|

| Entity Address, Address Line One |

5775 N. Sam Houston Parkway W.

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77086

|

| City Area Code |

(713)

|

| Local Phone Number |

849-9911

|

| Soliciting Material |

false

|

| Written Communications |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value

|

| Trading Symbol |

FTK

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000928054

|

| Amendment Flag |

false

|

| Entity Address, Address Line Two |

Suite 400

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

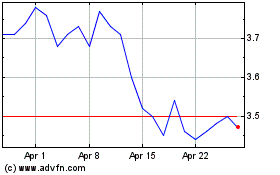

Flotek Industries (NYSE:FTK)

Historical Stock Chart

From Mar 2024 to Apr 2024

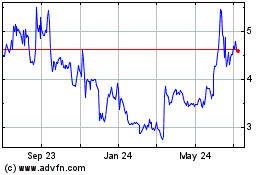

Flotek Industries (NYSE:FTK)

Historical Stock Chart

From Apr 2023 to Apr 2024