false

0001589061

0001589061

2023-09-05

2023-09-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 5, 2023

GYRODYNE, LLC

(Exact name of Registrant as Specified in its Charter)

|

New York

|

001-37547

|

46-3838291

|

|

(State or other jurisdiction

|

(Commission File

|

(I.R.S. Employer

|

|

of incorporation)

|

Number)

|

Identification No.)

|

ONE FLOWERFIELD

SUITE 24

ST. JAMES, New York 11780

(Address of principal executive

offices) (Zip Code)

(631) 584-5400

Registrant’s telephone number,

including area code

N/A

(Former name or former address, if changed since last report.)

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Shares of Limited

Liability Company Interests

|

GYRO

|

Nasdaq Capital Market

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Amendment No. 5 to Retention Bonus Plan

Effective September 5, 2023, the Board of Directors (the “Board”) of Gyrodyne, LLC, a New York limited liability company (the “Company”), approved Amendment No. 5 (“Amendment No. 5”) to the Company’s Retention Bonus Plan (the “Bonus Plan”). Amendment No. 5 is intended to create better alignment of interests between the Bonus Plan participants and all shareholders, and results from an extended period of shareholder engagement (the “Shareholder Outreach Campaign”) and receipt of shareholder feedback regarding the Company’s incentive compensation program.

The primary features of Amendment No. 5 are as follows:

| |

●

|

Waiver of plan benefits by directors: Director participants have agreed to waive all Bonus Plan benefits in exchange for an equivalent value of shares issuable under the Stock Plan (defined and described below), subject to shareholder approval. If the Stock Plan is approved by the shareholders, all benefits so waived by the director participants will be deemed void and not reallocated to any other participants in the Bonus Plan.

|

| |

●

|

$1,137,108 forfeited by retired directors returned to the Company: Prior to Amendment No. 5, the Bonus Plan provided that Bonus Plan benefits forfeited by retired director participants would be re-allocated among the remaining director participants pro rata. Nevertheless, under Amendment No. 5, such forfeited Bonus Plan benefits in the estimated amount of $1,137,108 have been removed from the pool and returned to the Company, irrespective of whether or not the shareholders approve the Stock Plan.

|

| |

●

|

Bonus rate: Bonus rate on property sale proceeds are modified as follows:

|

| |

●

|

For employees: 4.12% on up to $50,985,000 of net proceeds (net of commissions); 6.72% for incremental net sales above $50,985,000.

|

| |

●

|

For directors (assuming shareholders do not approve the Stock Plan): 5.30% of net proceeds (net of commissions).

|

| |

●

|

Delayed vesting: An employee participant will only vest in plan benefits triggered by property sales if he or she remains continuously employed through both the date of closing and the date of the Board’s irrevocable determination of a shareholder distribution; if employment terminates by death, disability or voluntary termination following substantial reduction in compensation (assuming no “cause” grounds for involuntary termination), however, the employee participant remains entitled to benefits only with respect to any property sales occurring within three years and yielding an internal rate of return of at least 4%.

|

| |

●

|

Benefits generally not payable until shareholders paid: Benefits not payable until liquidating cash distributions are paid to shareholders, except that employee participants will receive early payments if the cumulative amounts credited to the bonus pool bookkeeping account for employee participants equals or exceeds $500,000.

|

| |

●

|

Early sale incentive: If any property is sold on or before June 30, 2024, the bonus pool for employee participants will be funded with additional 1% of net sale price.

|

| |

●

|

Removal of price floor: Price floor hurdle for the sale of properties has been removed for all participants to eliminate the perception of any perverse incentive to avoid particular property sales that may not exceed the floor but which otherwise may be in the best interests of shareholders.

|

The foregoing description of Amendment No. 5 does not purport to be complete and is qualified in its entirety by reference to Amendment No. 5, which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Restricted Stock Award Plan

Also effective September 5, 2023, and as a result of the feedback received during the Shareholder Outreach Campaign, including the suggestion that the directors should be incentivized in a compensation plan separate from that of the employees and that directors’ interests would better align with those of the shareholders through a stock plan rather than the Bonus Plan, the Board approved, and proposed for shareholder approval, the Gyrodyne, LLC Restricted Stock Award Plan for director participants in the Bonus Plan.

Under the Stock Plan, the Company will issue to the former director participants in the Bonus Plan, in exchange for the waiver and forfeiture of their Bonus Plan benefits, an aggregate of 91,628 Gyrodyne shares, effective immediately upon shareholder approval of the Stock Plan, subject to vesting.

The value of the director participants’ Bonus Plan benefits was estimated to be $2,558,493. However, the director participants have agreed to reduce such benefits by $579,328 from $2,558,493 to $1,979,165, a 22.6% reduction in benefits. Under the Stock Plan, such reduced dollar value will convert to shares at the rate of $21.60 per share, or 91,628 shares in the aggregate. The 91,628 shares issuable under the Stock Plan was determined based upon the Company’s net assets in liquidation of $30,309,439 (or $20.44 per share) as of March 31, 2023, increased by (i) the $1,137,108 in bonuses forfeited by two retired directors ($0.77 per share), and (ii) the $579,328 in reduced benefits ($0.39 per share) to the director participants, to arrive at a pro forma net assets in liquidation of $32,025,875 or $21.60 per share. For perspective, the market price for the Company’s shares was $10.70 per share as of September 1, 2023. The 91,628 shares issuable under the Stock Plan would represent approximately 5.8% of the outstanding Gyrodyne shares after giving effect to such Stock Plan shares. Following the issuance of the 91,628 shares, no further shares or other awards may be issued under the Stock Plan.

If the shareholders do not approve the Stock Plan at the Company’s 2023 annual shareholders meeting, the director participants in the Bonus Plan will remain participants in the Bonus Plan, subject to changes in the Bonus Plan set forth in Amendment No. 5 which are described above.

The primary features of the Stock Plan are as follows:

| |

●

|

Effective Date: If approved by the Company’s shareholders, the Stock Plan will be effective on the date of such shareholder approval and the grants set forth in Exhibit A thereto will be effective immediately upon shareholder approval of the Stock Plan. Shareholders are being asked to approve the Stock Plan at the Annual Meeting.

|

| |

●

|

Purpose: The purpose of the Stock Plan is to incentivize the current director participants in the Bonus Plan to exchange their interests in the Bonus Plan for shares in the Company issuable under the Stock Plan, which will allow for compensation plan separation between directors and employees and better alignment of interests between director participants and shareholders.

|

| |

●

|

Eligibility: Directors of the Company who were participants in the Bonus Plan are eligible to receive grants under the Stock Plan. As of the date of this proxy statement, the eligible directors are Paul Lamb, Ronald Macklin, Nader Salour and Richard Smith. All such individuals have agreed to exchange their Bonus Plan benefits for shares under the Stock Plan, subject to shareholder approval of the Stock Plan. Jan Loeb was not a participant in the Bonus Plan and will not be eligible to participate in the Stock Plan.

|

| |

●

|

Maximum Shares Available: The total number of shares authorized for issuance under the Stock Plan is 91,628 shares, or approximately 5.8% of the common shares outstanding at the Record Date after giving effect to the issuance of the Stock Plan shares.

|

| |

●

|

Administration: Pursuant to the terms of the Stock Plan, the Stock Plan will be administered and interpreted by a committee which will consist of either (i) the Board, or (ii) the President and at least two other directors appointed by the Board. The committee will have full power and authority to administer and interpret the Stock Plan, to make factual determinations and to adopt or amend such rules, regulations, agreements and instruments for implementing the Stock Plan and for the conduct of its business as it deems necessary or advisable, to waive requirements relating to formalities or other matters that do not modify the substance of rights of participants or constitute a material amendment of the Stock Plan, to correct any defect or supply any omission of the Stock Plan or any grant document and to reconcile any inconsistencies in the Stock Plan or any grant document.

|

| |

●

|

Restricted Stock: Incentives under the Stock Plan will consist of grants of restricted stock. No shares issued under the Stock Plan, or any interest therein, will be transferrable by a participant, whether voluntarily or involuntarily, unless and until a liquidating distribution is made to the shareholders, except by will or by the laws of descent or distribution, and may not be subject to any voluntary or involuntary pledge, assignment, alienation, attachment, or similar encumbrance or transfer. All shares issued in connection with a grant will be subject to the terms, conditions, and restrictions set forth in the Company’s articles of organization, amended and restated limited liability company agreement, or other governing documents of the Company, as amended.

|

| |

●

|

Vesting: Vesting of shares issued under the Stock Plan occurs (i) in equal one-third tranches on each of the first three anniversaries of the grant date, and (ii) at such time as a liquidating distribution is made to the shareholders of the Company, subject to acceleration upon a liquidating distribution. Unvested Stock Plan shares will be forfeited by a participant if such participant is no longer serving on the Board at or prior to such time that liquidating distributions are paid to the shareholders other than as a result of death, disability or failure to be reelected.

|

| |

●

|

Amendments: The Board may amend, suspend or terminate the Stock Plan at any time, in its discretion, except that shareholder approval is required for any amendment that increases the number of shares available for grant, accelerates vesting or results in a material increase in benefits or a change in eligibility requirements.

|

| |

●

|

Section 409A: Section 409A of the Internal Revenue Code applies to compensation that individuals earn in one year but that is not paid until a future year, referred to as non-qualified deferred compensation. Because the shares issuable under the Stock Plan will be deemed to be issued in the same year in which they are earned, the Stock Plan and the shares issuable thereunder are not subject to Section 409A.

|

The foregoing description of the Stock Plan does not purport to be complete and is qualified in its entirety by reference to the Stock Plan, which is attached hereto as Exhibit 10.2 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit No.

|

|

Description

|

|

10.1

|

|

|

|

10.2

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

GYRODYNE, LLC

|

|

| |

|

|

|

|

|

|

|

|

|

Date:September 11, 2023

|

By:

|

/s/ Gary Fitlin

|

|

|

|

Name:

|

Gary Fitlin

|

|

|

|

Title:

|

President, Chief Executive Officer, Chief Financial

Officer and Treasurer

|

|

Exhibit 10.1

Exhibit 10.1

Amendment No. 5 to Retention Bonus Plan

AMENDMENT NUMBER 5

TO THE

GYRODYNE LLC RETENTION BONUS PLAN

WHEREAS, Gyrodyne Company of America, Inc. (“Gyrodyne Company”) established the Gyrodyne Company of America, Inc. Retention Bonus Plan (the “Retention Bonus Plan” or the “Plan”), effective as of May 30, 2014, the date it was approved by the Board of Directors of Gyrodyne Company; and

WHEREAS, Gyrodyne LLC (“Gyrodyne” or the “Company”), is the surviving entity in the merger of Gyrodyne Company and Gyrodyne Special Distribution, LLC (“GSD”) with and into Gyrodyne (the “Merger”), effective August 31, 2015; and

WHEREAS, the Retention Bonus Plan was last amended by Amendment Number 4, effective as of May 6, 2022; and

WHEREAS, no Amendments may be made to the Plan that would reduce any benefits to which any Employee Participants are entitled, as a result of Amendment Number 4; and

WHEREAS, no Participants in the Plan, including active employees and members of the Board of Directors of Gyrodyne (the “Board”), are currently vested in any benefits under the Plan; and

WHEREAS, the Board has determined, after a shareholder engagement process in which it received input from shareholders regarding incentive compensation, that it is in the best interest of the Company to amend the Plan further to achieve better alignment between Plan participants and shareholders; and

WHEREAS, to better motivate the participants in the Plan to sell all remaining properties, the “Aggregate Floor” that must be attained on the sale of Company properties for any amounts to be credited to the Bonus Pool under the Plan should be eliminated; and

WHEREAS, elimination of the “Aggregate Floor” shall increase the potential for benefits being paid to participants; and

WHEREAS, Gyrodyne also wishes to generally delay the payment of any benefits until after the sale of most properties occur, and liquidating cash distributions are paid to Shareholders, to have participants in the Plan and shareholders aligned on the corporate objectives and to receive benefits at the same time (except for certain required distributions for employee participants in the Plan (the “Employee Participants”)); and

WHEREAS, all participants in the Plan have approved the changes set forth in this Amendment; and

WHEREAS, the provisions of this Amendment shall not apply to any participants in the Plan who are board members (the “Board Participants”), unless the shareholders of Gyrodyne don’t approve the provisions of a Gyrodyne LLC Restricted Stock Award (“RSA”) Plan on terms and conditions that are acceptable to the Board, including the conversion of potential retention bonus payments to Board Participants into shares of restricted stock under such terms that are also acceptable to the Board; and

WHEREAS, Gyrodyne retained the authority, under Section 9.5 of the Plan, to periodically amend the Plan, subject to the provisions of Amendment Number 4.

NOW, THEREFORE, effective as of September 6, 2023, the Plan shall be amended as follows:

|

1.

|

Bonus Pool. Section 2.8, regarding the definition of the "Bonus Pool," shall be amended in its entirety to read as follows:

|

| |

2.8

|

“Bonus Pool” means the amount of funds that shall be transferred to a separate bookkeeping account held by the Company, to be allocated and paid to Employee Participants in accordance with Article V and a separate bookkeeping account for Board Participants, if any (or, to the extent applicable, former Participants in accordance with Article IV). The separate Bonus Pools shall remain assets of the Company and shall serve as a funding mechanism for the payments of amounts ultimately determined to be due to Employee and/or Board Participants under the Plan.

|

|

2.

|

Exclusion of Board Members. Members of the Board who currently participate in the Plan have agreed to waive all benefits under the Plan, which were not vested, and in lieu thereof to accept participation in a separate restricted stock award plan (the “RSA Plan”). Accordingly, participating Board members shall relinquish all rights to any benefits under the Retention Bonus Plan, subject to and conditioned upon approval of the RSA Plan by Shareholders and conversion of retention bonus payments into units of restricted stock on a basis acceptable to the Board at the 2023 Annual Meeting of the Company. The substitution of awards under the RSA Plan for benefits under the Retention Bonus Plan doesn’t result in any substitution of benefits under Section 409A of the Internal Revenue Code (the “Code”) since, as addressed below, the Retention Bonus Plan isn’t subject to Section 409A of the Code.

|

|

3.

|

Forfeiture of Benefits. Upon the approval of an acceptable RSA Plan, and conversion of rights under this Retention Bonus Plan to awards under the RSA Plan, and waiver of participation of Board members in this Plan, all allocations made to any Board members under Section 5.2 of the Plan, including benefits forfeited by previous participating Board members and subject to allocation under Section 5.5, shall be void and non-effective. Benefits forfeited by Board members shall not, with the consent of all Participants, be allocated to any Employee Participants in the Plan as might otherwise occur under Section 5.5 of the Plan, due to the lack of any remaining Board members participating in the Plan, but rather shall cease to be part of any Bonus Pool under the Plan.

|

| |

If the RSA Plan isn’t approved, the benefits previously forfeited by any Board members under the Retention Bonus Plan shall nevertheless be forfeited and shall not be available for reallocation to either Board Participants or Employee Participants.

|

|

4.

|

Vesting. Article IV, Vesting, shall be amended in its entirety to read as follows:

|

|

|

“A Participant shall only be entitled to receive Bonus Payments pursuant to this Plan to the extent that he/she has been continuously employed by, or providing services for, the Company through both (i) the date of a Closing regarding any Property (as defined under the Plan), and (ii) the date of an irrevocable action by the Board providing for a cash distribution of the proceeds of a sale of a Property to be made to Shareholders of the Company. For purposes of clarity, after Board members no longer participate in the Plan, Board members shall decide when to distribute cash associated with the proceeds of a sale of a Property to Shareholders and, at such time as such Shareholder distributions occur, remaining Employee Participants in the Plan shall be entitled to a payment of benefits to the extent credited to the Bonus Pool as of such date (with the exception of the minimum distributions provided in Section 5.2 below for accumulated Bonus Pool proceeds equal or exceeding $500,000).

|

|

|

For the avoidance of doubt, any Participant who is granted any such discretionary Bonus Payment shall remain unvested in such amount until such time as the Board takes irrevocable action to provide for a cash distribution of the proceeds of a sale of a Property to Shareholders of the Company (or as determined under the $500,000 rule in Section 5.2), and any such bonus payments shall be required to be paid no later than the end of the calendar year in which the Board so acts (or, if later, within 2½ months after the date such irrevocable action is taken by the Board or the $500,000 threshold is attained), to ensure that the Retention Bonus Plan remains exempt from Section 409A of the Code.

|

|

|

In the event of death or Disability of a Participant, a voluntary termination following a substantial reduction in compensation (deemed to be an involuntary termination), assuming such a Participant has not engaged in conduct that would constitute Cause, such a Participant shall be entitled to a future benefit to be paid in accordance with the provisions of the Plan only if the following requirements are satisfied:

|

| |

a.

|

A Property is sold within a period of 3 years following the date of a Participant’s separation from service with Gyrodyne or the Board for any of the above reasons, and if a liquidating distribution of the associated proceeds is declared; and

|

| |

b.

|

The Property is sold with an Internal Rate of Return (“IRR”) equal to at least 4% of the value of the property as determined under the annual appraisals obtained effective as of each December 31 (the “Valuation Date”), and measured from the earlier of the December 31 Valuation Date preceding the date of death, or Disability, or the Participant’s separation from service or separation from the Board, up until a contract of sale is executed (but not yet closed).

|

|

|

Article IV, Vesting, shall also be amended to delete the last paragraph of Article IV, relating to the Aggregate Floor.”

|

|

5.

|

Section 5.1 of the Plan is amended in its entirety to read as follows:

|

| |

“5.1

|

Funding of the Bonus Pool. Upon the Closing of each Property sale, funds shall be irrevocably transferred to a Bonus Pool account for the benefit of the Participants, as follows:

|

a. The Employee Participant portion of the Bonus Pool shall be funded with 4.12% of the Net Selling Price (and not the Adjusted Appraised Value of each Property (as provided in Amendment Number 2 to address land and development costs)), up to an aggregate Net Selling Price (not the Adjusted Appraised Value of a Property) of $50,985,000. The Employee Participant bonus rate shall increase to 6.72% for incremental aggregate Net Sales over $50,985,000. In no event shall the Employee Participant portion of the Bonus Pool be adversely impacted by any forfeiture of Board interests under the Retention Bonus Plan.

b. In the event the sale of any Property is completed on or before June 30, 2024, the Bonus Pool for Employee Participants (but not any Participating Board Members) shall be credited with an additional 1% of Net Sales Price.

c. The Director portion of the Bonus Pool shall be funded with 5.30% of the Net Selling Price.

d. For purposes of this Amendment, “Net Sales,” “Net Sales Price,” “Net Selling Price,” or terms to similar effect shall mean the Gross Sales Price for any Property or group of Properties, as reduced only by any commissions payable to effectuate the sale of any Property.

e. For the avoidance of doubt, in the event the Shareholders reject the RSA Plan, the Board Members shall remain in the Retention Bonus Plan, under the same provisions as shall apply to all Employee Participants (except as expressly provided in the Plan as hereby amended).

In the event the sale of any Property is contingent upon future installment or earnout payments, such amounts shall be treated as proceeds upon payment to the Company, and the applicable percentage thereof shall be immediately credited to the Bonus Pool and paid to Participants pursuant to Section 5.2 upon receipt by the Company. The Bonus Pool shall be subject to Section 9.6.

f. For clarity, there is no floor on the calculation of amounts credited to the Bonus Pool or determining the timing of any payments of amounts credited to the Bonus Pool, and land and development costs are not taken into account in the calculation of amounts credited to the Bonus Pool.”

|

6.

|

Payment of Benefits. Section 5.2, Payment of Benefits shall be replaced in total with the following:

|

|

|

“After funds are transferred to the Bonus Pool under Section 5.1, Bonus Payments shall be paid to all Employee Participants, at the same time that liquidating distributions are being paid to Shareholders following the sale of properties, so long as such Employee Participants have remained in-service through the date a liquidating distribution is declared and the Board has taken action to declare distributions to Employee Participants, as provided in Article IV above, as further indicated in the revised Exhibit A. Any amounts payable to a Participant upon payment to the Company following a Closing, as an installment or earnout payment, shall similarly be paid within sixty (60) days after the receipt of the Company of such funds. Notwithstanding any provisions in the Plan to the contrary, whenever the cumulative amounts transferred to the Bonus Pool bookkeeping account for Employee Participants equals or exceed $500,000, there shall automatically be a payment of benefits to Employee Participants, whether or not a liquidating distribution is declared to be paid by the Board, and in the event all properties have been sold (other than properties that might be transferred without compensation), a final Bonus Pool payment shall be made, regardless of the amount in the Employee Bonus Pool. All payments shall be made in a lump sum cash payment, within sixty (60) days after the date the Employee Participants become entitled to payment hereunder, such as upon determination by the Board that liquidating distributions shall be made to Shareholders or when the aggregate amounts credited to the Employee Participant Bonus Pool hit the above trigger payment amounts.

|

|

|

For clarity, if the RSA Plan is not approved and Director Participants remain in the Plan, Bonus Payments shall be paid to Director Participants at the same time that liquidating distributions are being paid to Shareholders. All payments shall be made in a lump sum cash payment, within sixty (60) days after the date the Director Participants become entitled to payment.”

|

|

7.

|

Forfeiture of Payment. Section 5.4 of the Plan shall also be replaced in total, as follows:

|

|

|

“Except as provided in Article IV, if any Employee Participant terminates employment prior to the date that actual payments are declared under the Plan, such a Participant shall forfeit the payment of any bonus payments. Further, except as provided in Article IV, if any Director Participant terminates service prior to the date that actual payments are declared under the Plan, such a Participant shall forfeit the payment of any bonus payments. This forfeiture provision exists in recognition of the goals of the Plan, which is to retain all Participants until the sale of Properties occurs and liquidating cash distributions are paid to Shareholders of the Company.”

|

|

8.

|

Restriction on Bonus Payments. Section 5.6 that added an Aggregate Floor to the Plan shall be repealed.

|

|

9.

|

Void Provisions. To the extent any provisions of the Plan contradict the provisions of this Amendment Number 5, they shall be null and void.

|

|

10.

|

Revised Exhibit A. Participating members of the Board already have a “specific percentage” of the Retention Bonus Pool allocated to each Director on an individual basis until it becomes void upon approval of an acceptable RSA Plan. Attached is a revised Exhibit A providing for specific employee bonus percentages for Employee Participants that shall apply for any sales on or after September 6, 2023, subject to the Plan and this Amendment.

|

|

11.

|

No Approval of the RSA Plan. For the avoidance of doubt, in the event the RSA Plan isn’t approved by the Shareholders of the Company at the 2023 annual meeting, the Board members participating in the Retention Bonus Plan shall remain in the Retention Bonus Plan, with aggregation of Properties and with distributions only made when Shareholders receive distributions.

|

|

12.

|

Defined Terms. Capitalized terms not specifically defined in this Amendment Number 5 shall have the meanings set forth in the Plan.

|

|

13.

|

Remaining Provisions. The remaining provisions of the Plan shall continue in full force and effect, unless and until further modified in accordance with the terms of the Plan.

|

|

14.

|

Not Subject to Section 409A. Notwithstanding any provisions of the Plan or any Amendments to the contrary, no employees are vested in any benefits under the Retention Bonus Plan and, all benefits are generally paid upon vesting. Therefore, the Retention Bonus Plan continues to not be subject to Section 409A of the Code. Notwithstanding any provisions in the Plan to the contrary, in the event the Plan becomes subject to Section 409A, the Company shall be responsible for the payment of any excise taxes payable by any Participants in the Plan, with a gross up for any related taxes. Any such payment or gross up payment will be made by the Company at a time and in a manner as to cause such payment or gross up payment to qualify as paid at a specified time or on a fixed schedule of payments within the meaning of Treas. Reg. § 1.409A-3(i)(1)(iv)-(v).

|

IN WITNESS WHEREOF, this Amendment Number 5 to the Gyrodyne LLC Retention Bonus Plan is executed effective as of September 6, 2023.

September 6, 2023

EXHIBIT A

GYRODYNE, LLC

RETENTION BONUS PLAN

EMPLOYEE BONUS PERCENTAGES –

IF THE RSA PLAN IS APPROVED

|

Board Members/Employees

|

Bonus Pool Percentage

|

|

Board Members

|

0% (previously 65%)

|

|

Subtotal

|

0.00%

|

| |

|

|

Employees

|

|

|

Gary Fitlin

|

44.211% (previously 15.474%)

|

|

Peter Pitsiokos

|

39.789% (previously 13.926%)

|

|

Officer Discretionary Amount

|

5.000% (previously 1.75%)

|

|

Patricia Lara

|

2.143% (previously 0.75%)

|

|

Dawn Ibraham

|

8.857% (previously 3.10%)

|

|

Subtotal

|

100% (previously 35.000%)

|

| |

|

| |

|

| |

|

|

Total

|

100.00%

|

September 6, 2023

EXHIBIT A

GYRODYNE, LLC

RETENTION BONUS PLAN

BOARD OF DIRECTORS – EMPLOYEE BONUS PERCENTAGES -

IF RSA PLAN IS REJECTED

|

Board Members/Employees

|

Bonus Pool Percentage1

|

|

Board Members

|

|

|

Paul Lamb, Chairman

|

18.75%

|

|

Richard Smith

|

12.50%

|

|

Ronald Macklin

|

12.50%

|

|

Nader Salour

|

12.50%

|

| |

|

|

Subtotal

|

56.25%

|

| |

|

| |

|

|

Employees

|

|

|

Gary Fitlin

|

19.3425%

|

|

Peter Pitsiokos

|

17.4075%

|

|

Patricia Lara

|

0.9375%

|

|

Dawn Ibraham

|

3.875%

|

|

Officer Discretionary Amount

|

2.1875%

|

| |

|

|

Subtotal

|

43.75%

|

| |

|

|

Total

|

100.00%

|

|

1.

|

The Board Pool does not get a 1% premium for selling any real estate on or before June 30, 2024, whereas the Employee Pool does.

|

September 6, 2023

Exhibit 10.2

Exhibit 10.2

Restricted Stock Award Plan

GYRODYNE, LLC

RESTRICTED STOCK AWARD PLAN

Effective as of October 12, 2023

Contingent Upon Shareholder Approval

The purpose of the Gyrodyne, LLC Restricted Stock Award Plan (the “RSA” or the “Plan”) is to provide current members of the Board of Directors of Gyrodyne, LLC, a New York limited liability company (“Gyrodyne” or the “Company”), who previously participated in the Gyrodyne, LLC Amended and Restated Retention Bonus Plan (the “Retention Bonus Plan”), with additional incentives to achieve the goals of the Company in lieu of participation in the Retention Bonus Plan. The Company believes that the Plan shall cause the participants to continue to contribute to the goals of the Company, thereby benefiting the Shareholders of the Company.

Wherever the following terms are used in this Plan they shall have the meanings specified below, unless the context clearly indicates to the contrary:

1.1 “Beneficiary” means the spouse of a Participant if a Participant is legally married at the time of death, or the estate for an unmarried Participant. No other designation of any Beneficiaries shall be permitted.

1.2 “Board” means the Company’s Board of Directors.

1.3 “Code” means the U.S. Internal Revenue Code of 1986, as amended, and any regulations issued thereunder.

1.4 “Disability” means a Participant is disabled under the long-term disability insurance policy maintained by the Company, or is determined to be disabled for purposes of social security benefits if a Participant is not covered by any Gyrodyne Long-Term Disability (“LTD”) Policy.

1.5 “ERISA” means the Employee Retirement Income Security Act of 1974, as periodically amended.

1.6 “Participants” mean Directors of Gyrodyne who receive RSAs under this RSA Plan.

1.7 “Restricted Stock Awards” or “RSAs” mean Awards consisting of common shares representing limited liability company interests in Gyrodyne, LLC.

1.8 “Shares,” “Stock,” “Company Stock,” “Restricted Stock” or similar terms refer to common shares representing limited liability company interests in Gyrodyne, LLC that are available for Restricted Stock Awards, or have been awarded as RSAs, under this Plan.

1.9 “Vesting Date” means the day on which a “liquidating distribution” occurs for Shareholders following or attributable to the sale of any properties owned by the Company. Additional terms and conditions regarding vesting of Grants are set forth in Section 6.1.

|

Article 2.

|

Administration

|

2.1 The Committee. The Plan shall be administered and interpreted by a Committee (the “Committee”), which shall consist of: (i) either the Board of Directors of the Company (the “Board”); or (ii) the President and at least two other directors appointed by the Board. If the Board does not appoint a Committee to administer all or any portion of the Plan, then the Board shall be the Committee.

2.2 Action by the Committee. A majority of the Committee shall constitute a quorum thereof, and the actions of a majority of the Committee at a meeting at which a quorum is present, or actions unanimously approved in writing by all members of the Committee, shall be actions of the Committee.

2.3 Delegation. The Committee may appoint one of its members to be chairman and any person, whether or not a member of the Committee, to be its secretary or agent. Furthermore, the Committee may delegate any ministerial duties in connection with the Plan to one or more officers of the Company.

2.4 Interpretation of Plan. The Committee shall have full power and authority to administer and interpret the Plan, to make factual determinations and to adopt or amend such rules, regulations, agreements and instruments for implementing the Plan and for the conduct of its business as it deems necessary or advisable, to waive requirements relating to formalities or other matters that do not modify the substance of rights of Participants or constitute a material amendment of the Plan, to correct any defect or supply any omission of the Plan or any Grant Document/Agreement (as defined in Section 3.2) and to reconcile any inconsistencies in the Plan or any Grant Document/Agreement. The Committee’s interpretations of the Plan and all determinations made or actions taken by the Committee pursuant to the powers vested in it hereunder shall be conclusive and binding on all persons having any interests in the Plan or in any awards granted hereunder. All powers of the Committee shall be exercised in its sole discretion, in the best interest of the Company and in keeping with the objectives of the Plan and need not be uniform as to similarly situated individuals.

2.5 No Liability. No member of the Committee shall be liable for any act or omission (whether or not negligent) taken or omitted in good faith, or for the good faith exercise of any authority or discretion granted in the Plan to the Committee, or for any act or omission of any other member of the Committee.

2.6 Costs. All costs incurred in connection with the administration and operation of the Plan shall be paid by the Company. Except for the express obligations of the Company under the Plan and under Grants (as defined in Section 3.1) in accordance with the provisions of the Plan, the Company shall have no liability with respect to any Grant, or to any Participant, including, but not limited to, any tax liability, capital losses, or other costs or losses incurred by any Participant.

3.1 Type of Grants. Incentives under the Plan shall consist of grants of Restricted Stock Awards (collectively referred to as “Grants”).

3.2 Grant Documents/Agreements. All Grants shall be subject to the terms and conditions set forth herein and to those other terms and conditions consistent with the Plan as the Committee deems appropriate. Each Grant shall be evidenced by a written instrument (the “Grant Document/Agreement”), which may include but shall not be limited to this Plan document and any related exhibits or attachments, specifying the number of shares of Company Stock to which it relates and containing such other terms and conditions as the Committee shall approve that are not inconsistent with the Plan. Grants under a particular section of the Plan need not be uniform as among the Participants. The Committee shall have the authority to waive any condition of an outstanding Grant or amend an outstanding Grant, provided that an amendment of an existing Grant may not be made without the consent of the Participant if such amendment would have an adverse effect on the rights of the Participant.

3.3 Grants. Immediately upon approval of this Plan by the equity holders of the Company, Grants of restricted shares shall be made to the Participants in the amounts set forth on Exhibit A to this Plan. (See Exh-A-RSA- 8-25-23) All Shares available under the Plan are to be granted to the participants identified in Exhibit A, effective upon approval of the Shareholders of the Company at the 2023 Annual Meeting of the Company (such approval date the “Grant Date”).

3.4 Adjustments in Certain Events. In the event of a corporate event or transaction (including, but not limited to, a change in the equity interests of the Company or the capitalization of the Company) such as a merger, consolidation, reorganization, recapitalization, separation, equity dividend, share split, reverse share split, split up, spin-off, or other distribution of equity or property of the Company, combination or exchange of Shares, dividend in kind, extraordinary cash dividend or other changes in capital structure or distribution (other than normal cash dividends or distributions) to shareholders of the Company, or any similar corporate event defined under Section 424(a) of the Code, then the Committee shall make such equitable changes or adjustments as it deems appropriate and, in such manner as it may deem equitable, to the number and kind of Shares, or other securities or consideration, issued or issuable in respect of outstanding Grants, as further provided in Section 12.5.

|

Article 4.

|

Shares Subject to the Plan

|

4.1 Shares. The Committee shall be authorized to issue or transfer under this Plan such number of common shares representing limited liability company interests of the Company, as identified in Exhibit A. No additional Grants may be made under this Plan following the Grants set forth in Exhibit A. The Company Stock may be authorized but unissued shares of Company Stock or shares reacquired by the Company from time to time.

|

Article 5.

|

Eligibility for Participation

|

5.1 Eligible Participants. All Board Members of the Company who were active participants in the Retention Bonus Plan on the date immediately preceding the date this Plan was approved by the equity holders of the Company (the “Participants”) shall be eligible to participate in the Plan, as identified in Exhibit A.

6.1 Restricted Stock. Grants shall be such terms as the Committee deems appropriate. The following provisions are applicable to all Grants:

a. Shares of Company Stock issued pursuant to Grants shall be issued in exchange for the waiver by each Participant of his benefits under the Company’s Retention Bonus Plan but without any additional cash consideration.

b. A Grantee receiving shares of Company Stock under this Plan shall receive a written notice of award from the Committee, specifying the number of shares subject to, and the date of issuance of, the award, which shall be deemed the “Grant Agreement” for purposes of Section 3.2.

c. All Shares granted to all participants shall not be vested upon grant. However, for the avoidance of doubt, Participants shall not forfeit any grants if they are not re-elected to the Board or in the event of death or disability. In the event of resignation from the Board, a Participant shall not forfeit the following percentage of Shares awarded to the Participant, depending on the Participant’s period of service on the Board from and after the Grant Date:

|

Years of Service

After Grant Date

|

|

Nonforfeitable

Percentage

|

|

Less than 1

|

|

|

0% |

| 1 but less than 2 |

|

|

33 - 1/3% |

| 2 but less than 3 |

|

|

66 - 2/3% |

|

3 or more

|

|

|

100% |

For clarity, upon completion of one or more years of service as described above, the applicable percentage of Shares shall not be forfeitable due to failure of continued service, but the Shares shall not be vested or transferrable unless and until a liquidating distribution is made to the Shareholders of the Company. Shares issued or issuable hereunder may not be sold and/or otherwise transferred, except in the event of death, until the Vesting Date. Upon the Vesting Date, all Shares awarded under this Plan will become fully vested and transferrable, to the extent not previously forfeited.

d. Each certificate for a share issued under a Grant, if any, shall contain a legend giving appropriate notice of the restrictions in the Grant.

e. Upon issuance by the Company, the Grantee shall have the right to vote shares subject to the Grant and to receive any dividends or other distributions paid on such shares.

f. All shares of Company Stock issued in connection with a Grant shall be subject to the terms, conditions, and restrictions set forth in the articles of organization, limited liability company agreement, or other governing documents of the Company, as amended, as well as any shareholders agreement, buy-sell agreement, or other similar agreements, as may be applicable.

g. No shares of Company Stock issued in connection with a Grant, or any interest therein, shall be transferrable by the Participant, whether voluntarily or involuntarily, except by will or by the laws of descent or distribution, prior to the Vesting Date. Furthermore, shares of Company Stock issued in connection with a Grant shall not be subject to any voluntary or involuntary pledge, assignment, alienation, attachment, or similar encumbrance or transfer.

|

Article 7.

|

Amendment and Termination of the Plan

|

7.1 Amendment. The Board may amend, suspend or terminate the Plan at any time, in its discretion, subject to any required shareholder approval or any shareholder approval which the Board deems advisable for any reason, such as for the purpose of obtaining or retaining any statutory or regulatory benefits under tax, securities or other laws or satisfying any stock listing requirement. For the avoidance of doubt, shareholder approval is required for any amendment to the Plan that (i) increases the number of Shares available (other than any adjustment as provided by Section 12.5, (ii) accelerates the vesting or granting of Shares, or (iii) results in a material increase in benefits or a change in eligibility requirements.

7. Termination of Plan. The Plan shall continue until terminated by the Board upon the agreement of all participants and/or their heirs. Once approved by the Shareholders, The Plan cannot be terminated by unilateral action of the Shareholders.

7.3 Termination and Amendment of Outstanding Grants. A termination, suspension or amendment of the Plan that occurs after a Grant is made shall not materially impair the right of a Participant unless the Participant consents. The termination of the Plan shall not impair the power and authority of the Committee with respect to an outstanding Grant. Whether or not the Plan has terminated, an outstanding Grant may be amended by agreement of the Company and the Participant consistent with the Plan.

|

Article 8.

|

Funding of the Plan

|

8.1 Unfunded Plan. This Plan shall be unfunded for purposes of the Code and Title I of ERISA, and no assets shall be set aside for the payment of benefits under the Plan.

|

Article 10.

|

Withholding of Taxes

|

10.1 Right to Withhold. A Participant receiving Grant hereunder shall be required to pay to the Company the amount of any such taxes, if any, which the Company is required to withhold with respect to such Grants or the vesting of such Grants, or the Company shall have the right to deduct from other wages paid to an employee by the Company, or to deduct from any Board fees, the amount of any withholding due with respect to such Grants.

10.2 Withholding Rules and Procedures. The Committee is authorized to adopt rules, regulations or procedures related to tax withholding, including provision for the satisfaction of a tax withholding obligation, by the retention of shares of Company Stock to which the Participant would otherwise be entitled pursuant to a Grant or by the Participant’s delivery of previously owned shares of Company Stock or other property.

|

Article 11.

|

Requirements for Issuance of Shares

|

11.1 Compliance with Law. The obligations of the Company to offer, sell, issue, deliver or transfer Company Stock under the Plan shall be subject to all applicable laws, regulations, rules and approvals, including, but not by way of limitation, the effectiveness of any registration statement under applicable securities laws if deemed necessary or appropriate by the Company. The Company’s obligation to offer, sell, issue, deliver or transfer its shares under the Plan is further subject to the approval of any governmental authority required in connection therewith and is further subject to the Company receiving, should it determine to do so, the advice of its counsel that all applicable laws and regulations have been complied with. Certificates for shares of Company Stock issued hereunder, if any, shall be legended as the Committee shall deem appropriate.

11.2 Share Certificates. Certificates representing shares of Company Stock issued under the Plan shall be subject to such stop-transfer orders and other restrictions as may be applicable under such laws, regulations and other obligations of the Company, including any requirement that a legend or legends be placed thereon.

11.3 No Fractional Shares. No fractional shares of Company Stock shall be issued or delivered pursuant to the Plan or any Grant, and no payments shall be made for any fractional shares for which any rights thereto shall be forfeited.

|

Article 12.

|

Miscellaneous

|

12.1 Divorce. In the event a Participant gets divorced prior to the vesting of any Award, whether or not any portion of the Shares shall be allocated to the spouse, in the event they become vested in the future, shall depend upon the receipt of documentation satisfactory to the Committee, that may allocate any future vested Stock to any former spouse.

12.2 Section 83(b) Elections. Participants shall have the right to make any election under Section 83(b) of the Code with regard to any unvested Shares granted under any Grant Agreement.

12.3 No Listing and No Registration of Shares. All Shares of the Company are publicly traded. However, the issuance of a Grant Agreement under this Plan is not intended to be an offer and/or sale of Shares to Participants. To the extent it is determined to be an offer and/or sale, the Company shall take all action necessary to comply with the securities laws, including registering Shares with the Securities and Exchange Commission on a Form S-8 or alternative form or complying with an appropriate exemption from such registration.

12.4 Insider Trading Policies. After Shares are transferred to a Participant, Shares may only be traded in the open windows for anyone considered to be an “insider” for purposes of any U.S. or other security rules.

12.5 Adjustments. In case the Company shall: (i) declare a dividend or dividends on Company Stock payable in shares of Company Stock; (ii) subdivide its outstanding common shares; (iii) combine its outstanding common shares into a smaller number of common shares; (iv) issue any equity securities by reclassification of its common shares (including any such reclassification in connection with a consolidation or merger in which the Company is the continuing entity); or (v) any other similar corporation transaction, the number of shares of Company Stock authorized under the Plan shall be adjusted proportionately. Similarly, in any such event, the Committee may make such adjustments in the number of shares of Company Stock subject to any Grants, as it deems equitable. Each Participant shall be notified of any such adjustment and any such adjustment, or the failure to make such adjustment, shall be binding on the Participant. For the avoidance of doubt, Participants shall be treated in a comparable manner as other common shareholders of the Company in the event of future corporate transactions, including the possibility of dilution in the event of a rights offering or other new issuance of equity securities.

12.6 Forfeiture of Shares. No future Board members shall receive any Grants under this Plan. In the event that any shares of Company Stock under the Plan are forfeited, such Grants shall lapse and not be available for the making of new Awards by the Committee under the Plan.

12. Compliance with Legal and Other Requirements. The Company may, to the extent deemed necessary or advisable by the Committee, postpone the issuance or delivery of any Grant until completion of any required actions under any federal or state law, rule or regulation, or compliance with any other obligation of the Company, as the Committee may consider appropriate, and may require any Participant to make such representations, furnish such information and comply with or be subject to such other conditions as it may consider appropriate in connection with the issuance of any Grant or the payment of benefits in compliance with applicable laws, rules, and regulations or other obligations.

12.8 Limits on Transferability: Beneficiaries. No Grant under the Plan shall be assignable or transferable by the Participant thereof, except by will or by the laws of descent and distribution, unless the Committee shall elect to permit such an assignment or transfer in its sole discretion.

12.9 Type of Program. This Plan is a restricted stock award plan, which subjects Company Stock granted under any Grant Agreement to a substantial risk of forfeiture until after a legally binding right arises.

12.10 Section 409A. The Plan is not subject to Section 409A of the Code. However, to the extent necessary, the Plan may be amended in any manner to comply with Section 409A, if such action is deemed to be necessary in the future.

12.11 Notices. All notices to Participants shall be made to their residence or at work. All notices and other communications hereunder shall be in writing and shall be given and shall be deemed to have been duly given if delivered in person, by cable, telegram, telex or facsimile transmission or email, to the parties as follows:

Chief Financial Officer

Gyrodyne LLC

One Flowerfield, Suite 24

St. James, NY 11780-1551

or to such other address as any party may have furnished to the other in writing in accordance herewith, except that notices of change of address shall only be effective upon receipt.

12.12 Expenses. All expenses incurred in administering the Plan shall be paid by the Company.

12.13 Severability. If any of the provisions of this Plan or any Grant Agreement is held to be invalid, illegal or unenforceable (whether in whole or in part), such provision shall be deemed modified to the extent, but only to the extent, of such invalidity, illegality or unenforceability, and the remaining provisions shall not be affected thereby; provided, that, if any of such provisions is finally held to be invalid, illegal, or unenforceable because it exceeds the maximum scope determined to be acceptable to permit such provision to be enforceable, such provision shall be deemed to be modified to the minimum extent necessary to modify such scope in order to make such provision enforceable hereunder.

Furthermore, in the event that any one or more provisions of the Plan or any Grant Agreement, or any action taken pursuant to the Plan or such Award Agreement, should, for any reason, be unenforceable or invalid in any respect under the laws of the United States, any state of the United States or any other government, such unenforceability or invalidity shall not affect any other provision of the Plan or of such or any other Grant Agreement, but in such particular jurisdiction and instance the Plan and the affected Grant Agreement shall be construed as if such unenforceable or invalid provision had not been contained therein or as if the action in question had not been taken thereunder.

12.14 Entire Agreement. The Plan and any Grant documents contain the entire agreement of the parties with respect to the subject matter thereof and supersede all prior agreements, promises, covenants, arrangements, communications, representations and warranties between them, whether written or oral with respect to the subject matter thereof.

12.15 Gender and Number. The masculine gender, where appearing herein, shall be deemed to include the feminine gender, and the singular shall be deemed to include the plural, unless the context clearly indicates to the contrary.

12.16 Captions. The captions at the head of a paragraph of this Plan are designed for convenience of reference only and are not to be resorted to for the purpose of interpreting any provisions of this Plan.

12.17 Plan Controlling. In the event of a conflict between the terms of this Plan and the terms of any Grant Agreement, the terms of this Plan shall govern.

12.18 Binding Agreement. The provisions of this Plan shall be binding upon the Participant and the Company and their successors, assigns, heirs, executors and beneficiaries.

12.19 Governing Laws. The Plan shall be governed and construed in accordance with the laws of the State of New York, except to the extent preempted by Federal law.

| Date: |

|

|

BY: |

|

| |

|

|

|

|

| Date: |

|

|

BY: |

|

| |

|

|

|

|

| Date: |

|

|

BY: |

|

September 5, 2023

EXHIBIT A

GYRODYNE, LLC

RESTRICTED STOCK AWARD (“RSA”) PLAN

|

BOARD MEMBERS/

EMPLOYEES

|

SHARES OF RESTRICTED

STOCK (“RSAs”)

|

|

Paul Lamb, Chairman

|

30,542

|

|

Richard Smith

|

20,362

|

|

Ronald Macklin

|

20,362

|

|

Nader Salour

|

20,362

|

| |

|

|

TOTAL

|

91,628

|

|

1.

|

The total shares being granted is 91,628.

|

|

2.

|

This number was determined as follows:

|

|

|

$1,979,165 ÷ $21.60 NAV = 91,628.

|

|

3.

|

The $1,979,165 value in the above formula represents the projected current value of the bonus pool allocable to the above Board members under the Retention Bonus Plan of $2,558,493, less an amount equal to $579,328 that is being voluntarily forfeited (subject to and conditioned upon approval of the RSA Plan), which results in $1,979,165 remaining in the bonus pool that is being given up in exchange for restricted stock awards under the RSA Plan.

|

|

4.

|

The $21.60 NAV value in the above formula represents the estimated adjusted net asset value per share of the Company determined for grant purposes under the RSA Plan.

|

September 5, 2023

v3.23.2

Document And Entity Information

|

Sep. 05, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

GYRODYNE, LLC

|

| Document, Type |

8-K

|

| Document, Period End Date |

Sep. 05, 2023

|

| Entity, Incorporation, State or Country Code |

NY

|

| Entity, File Number |

001-37547

|

| Entity, Tax Identification Number |

46-3838291

|

| Entity, Address, Address Line One |

ONE FLOWERFIELD

|

| Entity, Address, Address Line Two |

SUITE 24

|

| Entity, Address, City or Town |

ST. JAMES

|

| Entity, Address, State or Province |

NY

|

| Entity, Address, Postal Zip Code |

11780

|

| City Area Code |

631

|

| Local Phone Number |

584-5400

|

| Title of 12(b) Security |

Common Shares

|

| Trading Symbol |

GYRO

|

| Security Exchange Name |

NASDAQ

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001589061

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

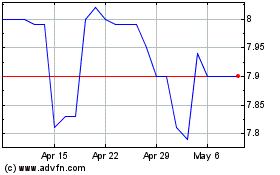

Gyrodyne (NASDAQ:GYRO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gyrodyne (NASDAQ:GYRO)

Historical Stock Chart

From Apr 2023 to Apr 2024