Bitcoin transaction fee record: User pays $500,000 due to error

One individual made a costly mistake, paying nearly $500,000 (20

bitcoins) in fees to transfer just $200 worth of bitcoin

(COIN:BTCUSD). This transaction, which took place on September

10th, sets the record for the highest transaction fee in

Bitcoin. The transaction caught the attention of Casa’s CTO,

Jameson Lopp, who suggested that it could be flawed

software. The amount went to the F2Pool mining pool, which

offered a three-day deadline for the sender to claim the amount

before distributing it to its miners.

Stellar Lumens (XLM) awaits key announcement

The market is buzzing with expectations as Stellar Lumens

(COIN:XLMUSD) prepares for a long-awaited announcement from the

Stellar organization on September 12th. After teasers from

Stellar on X (formerly Twitter) counting down the days until the

big announcement, rumors are circulating about a possible

integration with Apple Pay. Meanwhile, the price of XLM

fluctuated, rising 11.95% for the week.

India moves towards cryptocurrency regulation based on global

guidelines

Based on joint recommendations from the International Monetary

Fund (IMF) and the Financial Stability Board (FSB), India is

drafting a regulatory framework for cryptocurrencies that could

become law within months. According to Cointelegraph, Crebaco

CEO Sidharth Sogani reported that the Indian legislative strategy

focuses on five main points, with an emphasis on global

collaboration. These include advanced KYC procedures, audit

disclosure, uniform tax policy, bank-like status for cryptocurrency

exchanges, and mandatory compliance positions for crypto

companies.

BIS and UAE launch tech challenge for sustainable finance

The Bank for International Settlements (BIS), in partnership

with the United Arab Emirates, presented an initiative to promote

sustainable financial solutions using technologies such as

blockchain, AI and the Internet of Things. Named COP28 UAE

TechSprint, the initiative challenges developers to address gaps in

data verification in the sector. BIS highlights the need to

apply these technologies to improve transparency and verification

in green finance. Proposals are accepted until October 6, with

winners being revealed at COP28 in December.

El Salvador expands Bitcoin education in schools

Two years after the legalization of bitcoin (COIN:BTCUSD) in El

Salvador, the Ministry of Education launched a pilot program with

the goal of introducing bitcoin education in all schools in the

country by 2024. With support from the My First Bitcoin and Bitcoin

Beach, the program will train 150 teachers, who will disseminate

learning about cryptocurrency to students. Since its founding,

My First Bitcoin has educated more than 25,000 students and created

the “Bitcoin Diploma,” a 10-week course. This course, now in

its 5th edition, influenced El Salvador’s official curriculum on

the topic.

Bankman-Fried defense alleges insufficient internet access in

prison to prepare for trial

The legal team of Sam Bankman-Fried, founder of FTX, requested

his pre-trial release citing internet access difficulties at the

correctional facility. The defense claims that these

limitations make it difficult to review millions of pages of

documents related to the case. Furthermore, although a

specific time for using a laptop was promised, in practice, this

time was not fully granted. Judge Lewis Kaplan refused a

previous request for release, while the Justice Department says the

current access is adequate for his defense. Bankrupt FTX’s

assets total around $7 billion, including significant amounts in

Solana (COIN:SOLUSD) and Bitcoin (COIN:BTCUSD), according to recent

court documents. The document also reports 38 condominiums,

penthouses and other properties in the Bahamas with an estimated

value of around $200 million. Before declaring bankruptcy in

November 2022, FTX made billion-dollar payments to top executives

such as Sam Bankman-Fried.

Coinbase predicts crypto block’s growing influence in 2024 US

elections, faces challenges in Indian expansion

Brian Armstrong, leader of Coinbase (NASDAQ:COIN), suggests that

the 2024 US elections will feel the influence of the cryptocurrency

voting bloc, a force that many politicians may be

underestimating. While highlighting that regulations on the

sector are evolving globally, he notes the growing interest of

American politicians in the topic. Furthermore, Armstrong

addressed the concept of “flatcoins”, an evolution of stablecoins,

which could maintain their value over time, aligned with indicators

such as the CPI. Elsewhere, Coinbase faces hurdles as it tries

to expand its services in India. While the company sent emails

informing it of stopping services for some Indian users after

September 25, it clarified that only accounts that do not meet the

updated standards will be affected. Despite investing in local

exchanges, Coinbase had difficulties establishing its presence

in the country, facing resistance from regulatory

authorities. Recently, there was an interruption of services

due to pressure from the Indian central bank, the Reserve Bank of

India.

Ripple offsets losses and moves forward with Fortress acquisition

after security incident

Ripple, a major crypto payments company, covered the losses of

blockchain startup Fortress Trust’s customers following a security

breach related to a third-party vendor. This move was an

essential part of Ripple’s acquisition of Fortress, which was

already under discussion but gained momentum after the

incident. Despite the security issues, there were no losses of

funds. The acquisition will allow Ripple to expand its

regulatory reach and incorporate Fortress’ services into its own

payment technology.

Hackers exploit Buterin’s account and steal $691,000 in crypto

assets

Hackers accessed the account of Vitalik Buterin, founder of

Ethereum (COIN:ETHUSD), and embezzled more than US$691,000, much of

it in NFTs, through a phishing link. Although the origin of

the attack is unclear, analyst ZachXBT does not rule out a

potential “SIM swap”. Buterin, with almost 5 million followers

on the platform, could have been the target of an internal

scheme. Such an attack adds to other recent ones in the

cryptosphere, including a hack on the Terra blockchain website.

Hacker sentenced to lose millions in Bitcoin and sports car

Ahmad Wagaafe Hared of Tucson, Arizona, was ordered by a federal

judge to turn over about $5.2 million in Bitcoin and a 2017 BMW i8

to the U.S. government after being found guilty of stealing

cryptocurrencies from executives in northern California in 2016.

Hared and his associates used a SIM swapping technique to gain

access to victims’ accounts. The region is known for hosting

cryptocurrency organizations such as Coinbase

(NASDAQ:COIN). Additional details of the case remain

confidential, and others involved in similar schemes were also

recently convicted.

Maple Finance: Adjusting strategies amid crypto crashes

During the market peak of 2021, Maple Finance saw a golden

opportunity by teaming up with the acclaimed Alameda Research to

provide a lending product for institutions. However, when the

crypto industry suffered declines in 2022, Maple had to

readjust. Sid Powell, the company’s CEO, recognizes that the

emphasis was on great returns, neglecting risks. The

Orthogonal fiasco highlighted flaws in risk management in the DeFi

sector. In response, Maple expanded its scope to include

real-world assets such as a liquidity pool for accounts receivable

and tokenized securities, diversifying its portfolio and moving

away from the volatility of cryptocurrencies. “We want to

abstract away as much of the complexity of encryption as

possible. My vision for the future is that we could launch a

family office and say we have a credit and loan product with lower

rates than the average Ares or Apollo credit fund”, said

Powell.

Leadership changes at Celsius after financial crisis

Steve Kokinos, former CEO of Algorand, was named as a possible

CEO of the company that will take over Celsius

operations. Celsius, which has faced financial and regulatory

problems, is seeking restructuring after declaring bankruptcy last

year. Kokinos will be part of a nine-member board, six chosen

by Celsius’ creditor committee and two by Fahrenheit

Holdings. Fahrenheit was the consortium that proposed

acquiring Celsius’ assets in May. Kokinos, who left Algorand

in 2022, is also a co-owner of Fahrenheit. The newly formed

board features figures such as Michael Arrington of Arrington

Capital; Asher Genoot, leader of Bitcoin Corp in the

US; Frederick Arnold, responsible for the assets of the now

dissolved Lehman Brothers; Elizabeth LaPuma, formerly at UBS

(NYSE:UBS) and current chair of the audit committee at WeWork

(NYSE:WE); and Emmanuel Aidoo, former Credit Suisse

banker. In addition to them, Scott Duffy and Thomas DiFiore,

leaders of the Celsius committee, will also join the board,

representing the company’s creditors.

Challenges of cryptocurrency custody and the need for regulation

The collapse of Prime Trust, a cryptocurrency custody company,

highlights the risks of self-custody in the sector, said Diogo

Monica, CEO of Anchorage Digital. According to him, Prime

Trust’s failure was not technological, but rather an “integration

failure”, pointing to the company’s lack of technical

expertise. This slip-up caused millions in assets to become

inaccessible. Monica suggests that traditional financial rules

could benefit cryptocurrency custody. He calls for more

regulatory clarity as Anchorage Digital grows, attracting

institutions looking for secure digital asset storage.

Seamless Protocol: Innovation in undercollateralized loans on DeFi

network

DeFi developers, including Seashell, RNG Labs, and Loreum Labs,

in collaboration with consultants from Ampleforth and Uniswap, have

introduced the Seamless Protocol on the layer 2 network. This

protocol, a variation of Aave v3, allows smart contracts to

implement pre-defined lending strategies. The idea is to simulate

single-purpose loans, where liquidity can only be used for a

specific purpose. The initiative departs from traditional

reputation scoring systems, emphasizing trust in code over humans

in the DeFi space. “Many borrowers already know the purpose of

the additional liquidity they seek, so Integrated Financing

Strategies simply connect these steps. Since lending strategies are

on-chain in smart contracts, liquidity providers have complete

visibility into how funds are used“, explained the

protocol.

Fireblocks launches non-custodial wallet service for fintechs and

corporate customers

Fireblocks, a leading cryptocurrency custody company, is now

offering a non-custodial wallet service to its extensive list of

clients such as Revolut and Nubank (NYSE:NU). This initiative

seeks to allow users to have full control over their assets, a

growing demand following bankruptcies of cryptocurrency

companies. The change frees fintechs from being custodians and

makes it easier for users to access services such as decentralized

finance (DeFi) and Web3 applications, said Michael Shaulov, CEO of

Fireblocks. He also highlighted that the Fireblocks solution

allows wallet recovery, ensuring security and

convenience. “What was previously difficult for large

licensed institutions or large corporations can be incorporated

into the wallet experience when companies don’t have all these

regulatory and custody limitations”.

Bitgamo will expand presence in Europe with 75 cryptocurrency ATMs

Luxembourg-based cryptocurrency exchange Bitgamo has revealed

plans to launch 75 cryptocurrency ATMs across Europe in 2024,

promising to offer the most competitive rates. Gaining

prominence globally, Bitgamo recently responded to customers’

desire to convert crypto into traditional currency without the need

for KYC and offered superior rates of up to 10% for assets such as

Bitcoin (COIN:BTCUSD) and Ethereum (COIN:ETHUSD). Gabriel

Weber, Communications Director, stated that the company is ready

for this expansion, ensuring that cashiers offer the best

rates.

Animoca Brands raises $20 Million to advance Mocaverse platform

Animoca Brands, which specializes in gaming and Web3, completed

a $20 million funding round on September 11 to boost the Mocaverse

platform. This project aims to be the backbone of the identity

and rewards system for Web3 entertainment and culture. Led by

Yat Siu, the initiative will focus on creating a digital identity,

Moca ID, via non-transferable NFT tokens, allowing users to

establish reputation and accumulate points. CMCC Global, a

renowned blockchain investor, led the financing with other

important names in the sector.

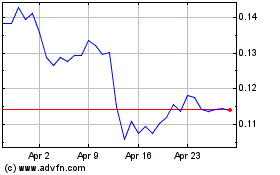

Stellar Lumens (COIN:XLMUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Stellar Lumens (COIN:XLMUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024