American Express (NYSE:AXP): RBC Capital upgrades to outperform

from sector perform. PT up 1.5% to $200.

Avalonbay Communities (NYSE:AVB): BMO Capital Markets downgrades

to outperform from market perform. PT down 2.3% to $210.

Biogen Inc (NASDAQ:BIIB): Morgan Stanley maintains an

overweight/attractive rating with a target price raised from $363

to $381.

Canadian National Railway (NYSE:CNI): Wolfe Research maintains

its outperform rating with a raised target price of $143.

Capital One (NYSE:COF): RBC Capital maintains its sector perform

rating with a reduced target price of $113.

Csx Corp (NASDAQ:CSX): Wolfe Research maintains its outperform

rating with a target price raised from $38 to $42.

Discover Financial Services (NYSE:DFS): RBC Capital maintains

its outperform rating with a reduced target price of $120.

Eli Lilly (NYSE:LLY): Berenberg maintains a buy recommendation

with a target price raised from $500 to $600.

Essex Property (NYSE:ESS): BMO Capital Markets downgrades to

underperform from market perform. PT up 2.2% to $235.

Fox Corp (NASDAQ:FOX): Rosenblatt Securities Inc. maintains a

neutral recommendation with a target price raised from $33 to

$34.

Johnson & Johnson (NYSE:JNJ): Guggenheim maintains a neutral

recommendation with a reduced target price of $169.

Keysight Tech (NYSE:KEYS): Goldman Sachs upgrades its

recommendation from neutral to buy, with a target price increase

from $146 to $164.

Lowe’s (NYSE:LOW): Bernstein upgrades its recommendation from

market perform to outperform and raises the target price from $252

to $282.

Lululemon (NASDAQ:LULU): Bernstein upgrades its recommendation

from underperform to market perform. The target price is raised

from $328 to $366.

Mid American Apartment Communities (NYSE:MAA): BMO Capital

Markets maintains its market perform recommendation with a reduced

target price of $158.

Norfolk Southern (NYSE:NSC): Wolfe Research maintains its

outperform rating on the stock with a revised target price of USD

265, up from the previous target of $255.

Oracle Corp (NYSE:ORCL): Barclays upgrades its recommendation

from equalweight to overweight and raises its target price from

$126 to $150.

Spotify (NYSE:SPOT): Canaccord Genuity maintains a buy

recommendation with a target price raised from $170 to $180.

Synchrony Finance (NYSE:SYF): RBC Capital downgrades to sector

perform from outperform. PT reduced from $41 to $37.

Don’t Trade Without Seeing

The Orderbook

U.S. stock futures started the holiday-shortened week with

marginal declines, retracing some of the strong gains from the

previous week.

As of 06:35 ET (10:35 GMT), the Dow Jones Futures contract

remained mostly unchanged, while S&P 500 Futures edged 5

points, or 0.1%, lower, and Nasdaq 100 Futures dropped 35 points,

or 0.2%.

Last week, Wall Street’s major indices performed well, with the

Dow Jones Industrial Average gaining 1.4%, the Nasdaq Composite

rising 3.3%, and the S&P 500 climbing 2.5%, marking their best

weekly performances since July.

Global data signals economic weakness. However, investor

sentiment has become more fragile as U.S. investors returned from

their long weekend to evidence of a global economic slowdown.

In August, Chinese services sector activity expanded at a

slower-than-expected pace, as indicated by the Caixin services

purchasing managers’ index, which showed its weakest reading in

eight months.

Similar negative news came out of Europe, with data revealing

that the decline in eurozone business activity accelerated faster

than initially estimated last month, leading the bloc’s dominant

services industry to contract.

HCOB’s Composite Purchasing Managers’ Index, a reliable gauge of

overall economic health, dropped to its lowest level since November

2020.

Goldman lowers odds of U.S. recession Later in the session,

factory orders for July are expected to show a 2.5% decline, but

the U.S. economy is still considered a global hopeful.

Goldman Sachs has become more confident that the U.S. economy

will avoid a significant contraction in the near term. The

investment bank reduced the probability of a U.S. recession in the

next 12 months from 20% to 15%, citing positive inflation data and

last week’s labor market report. Goldman highlighted Fed Chair

Jerome Powell’s cautious approach to future rate decisions as an

indicator that a September rate hike is less likely.

Throughout the week, investors will hear from several Fed

speakers, beginning with Dallas Fed President Lorie Logan on

Wednesday.

Tuesday’s Wall Street

Highlights: Goldman Sachs, Airbnb, Tesla, Novo Nordisk, and

more

Disney and Charter dispute in the spotlight: In corporate news,

attention is likely to be on the entertainment sector, as Walt

Disney (NYSE:DIS) encouraged Spectrum cable service customers of

Charter Communications (NASDAQ:CHTR) to consider switching to a

live television option from Hulu. This comes as the media companies

remain at odds over a new distribution deal. Disney expressed hope

for an agreement to restore access to Disney-owned channels that

have been blacked out on Charter’s service since Thursday.

Crude oil drops on weak Chinese economic data: Oil prices

declined on Tuesday due to weak Chinese services activity data,

which indicated further challenges for the world’s second-largest

economy and the largest crude importer.

Despite these losses, expectations that major OPEC+ members

Saudi Arabia and Russia will agree to extend their output cuts this

week have limited the decline, potentially leading to a tighter

market.

As of 06:40 ET, U.S. crude futures traded 0.4% lower at $85.22 a

barrel, close to levels last seen in November, while the Brent

contract fell 0.8% to $88.31, near its highest level since late

January.

Furthermore, gold futures dipped 0.5% to $1,957.55 per ounce,

and the EUR/USD currency pair traded 0.4% lower at 1.0746.

US Options Trader

Live Realtime Streaming: US Options (OPRA), NYSE, NASDAQ, AMEX

prices + Dow Jones and S&P indices – and our innovative Options

Tools, featuring Live Options Flow.

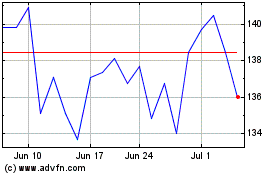

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Mar 2024 to Apr 2024

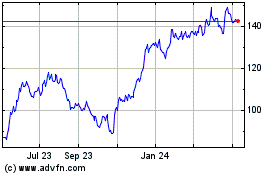

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Apr 2023 to Apr 2024