0001593549

FY

true

Amendment No: 3

NV

0001593549

FY

2022

0001593549

2022-01-01

2022-12-31

0001593549

2022-06-30

0001593549

2022-12-31

0001593549

2021-12-31

0001593549

us-gaap:SeriesAPreferredStockMember

2022-12-31

0001593549

us-gaap:SeriesAPreferredStockMember

2021-12-31

0001593549

us-gaap:SeriesCPreferredStockMember

2022-12-31

0001593549

us-gaap:SeriesCPreferredStockMember

2021-12-31

0001593549

us-gaap:SeriesDPreferredStockMember

2022-12-31

0001593549

us-gaap:SeriesDPreferredStockMember

2021-12-31

0001593549

us-gaap:SeriesAPreferredStockMember

2023-03-31

0001593549

2021-01-01

2021-12-31

0001593549

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2020-12-31

0001593549

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2020-12-31

0001593549

us-gaap:PreferredStockMember

us-gaap:SeriesDPreferredStockMember

2020-12-31

0001593549

us-gaap:CommonStockMember

2020-12-31

0001593549

us-gaap:AdditionalPaidInCapitalMember

2020-12-31

0001593549

us-gaap:RetainedEarningsMember

2020-12-31

0001593549

2020-12-31

0001593549

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2021-12-31

0001593549

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2021-12-31

0001593549

us-gaap:PreferredStockMember

us-gaap:SeriesDPreferredStockMember

2021-12-31

0001593549

us-gaap:CommonStockMember

2021-12-31

0001593549

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001593549

us-gaap:RetainedEarningsMember

2021-12-31

0001593549

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2021-01-01

2021-12-31

0001593549

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2021-01-01

2021-12-31

0001593549

us-gaap:PreferredStockMember

us-gaap:SeriesDPreferredStockMember

2021-01-01

2021-12-31

0001593549

us-gaap:CommonStockMember

2021-01-01

2021-12-31

0001593549

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-12-31

0001593549

us-gaap:RetainedEarningsMember

2021-01-01

2021-12-31

0001593549

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2022-01-01

2022-12-31

0001593549

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2022-01-01

2022-12-31

0001593549

us-gaap:PreferredStockMember

us-gaap:SeriesDPreferredStockMember

2022-01-01

2022-12-31

0001593549

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001593549

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0001593549

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0001593549

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2022-12-31

0001593549

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2022-12-31

0001593549

us-gaap:PreferredStockMember

us-gaap:SeriesDPreferredStockMember

2022-12-31

0001593549

us-gaap:CommonStockMember

2022-12-31

0001593549

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001593549

us-gaap:RetainedEarningsMember

2022-12-31

0001593549

NUGN:SeriesAAndCertainSeriesCPreferredStockMember

NUGN:MsHoffmanMember

2022-03-14

2022-03-14

0001593549

us-gaap:PreferredClassAMember

NUGN:MrStybrMember

2022-03-14

0001593549

srt:ScenarioPreviouslyReportedMember

2022-01-01

2022-12-31

0001593549

srt:RestatementAdjustmentMember

2022-01-01

2022-12-31

0001593549

srt:ScenarioPreviouslyReportedMember

2021-01-01

2021-12-31

0001593549

srt:RestatementAdjustmentMember

2021-01-01

2021-12-31

0001593549

srt:ScenarioPreviouslyReportedMember

2021-12-31

0001593549

srt:RestatementAdjustmentMember

2021-12-31

0001593549

srt:ScenarioPreviouslyReportedMember

2020-12-31

0001593549

srt:RestatementAdjustmentMember

2020-12-31

0001593549

srt:ScenarioPreviouslyReportedMember

2022-12-31

0001593549

srt:RestatementAdjustmentMember

2022-12-31

0001593549

2022-09-06

0001593549

us-gaap:SeriesAPreferredStockMember

2022-01-01

2022-12-31

0001593549

NUGN:PromissoryNoteMember

2020-01-26

2020-01-26

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

2022-01-01

2022-12-31

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

2021-01-01

2021-12-31

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

2020-01-01

2020-12-31

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

NUGN:RevenuesMember

2022-01-01

2022-12-31

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

NUGN:RevenuesMember

2021-01-01

2021-12-31

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

NUGN:RevenuesMember

2020-01-01

2020-12-31

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

NUGN:SalesDiscountsMember

2022-01-01

2022-12-31

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

NUGN:SalesDiscountsMember

2021-01-01

2021-12-31

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

NUGN:SalesDiscountsMember

2020-01-01

2020-12-31

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

NUGN:MerchandiseAccountFeesMember

2022-01-01

2022-12-31

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

NUGN:MerchandiseAccountFeesMember

2021-01-01

2021-12-31

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

NUGN:MerchandiseAccountFeesMember

2020-01-01

2020-12-31

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

NUGN:ProfessionalFeesRTSMember

2022-01-01

2022-12-31

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

NUGN:ProfessionalFeesRTSMember

2021-01-01

2021-12-31

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

NUGN:ProfessionalFeesRTSMember

2020-01-01

2020-12-31

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

NUGN:AmortizationRTSMember

2022-01-01

2022-12-31

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

NUGN:AmortizationRTSMember

2021-01-01

2021-12-31

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

NUGN:AmortizationRTSMember

2020-01-01

2020-12-31

0001593549

NUGN:MoviesMember

2022-12-31

0001593549

NUGN:ManagedRealEstateProjectsMember

2022-01-01

2022-12-31

0001593549

NUGN:ManagedRealEstateProjectsMember

2022-12-31

0001593549

NUGN:DevelopmentProjectsMember

2022-01-01

2022-12-31

0001593549

us-gaap:RealEstateMember

2022-01-01

2022-12-31

0001593549

NUGN:DevelopmentProjectMember

2022-01-01

2022-12-31

0001593549

us-gaap:RealEstateInvestmentMember

2020-03-10

0001593549

us-gaap:RealEstateInvestmentMember

2021-10-07

0001593549

us-gaap:RealEstateInvestmentMember

2022-09-06

0001593549

us-gaap:RealEstateInvestmentMember

2022-12-31

0001593549

NUGN:DevlopmentProjectResiDukeMember

2020-07-09

0001593549

NUGN:DevelopmentProjectResiDukeMember

2021-03-09

0001593549

us-gaap:RealEstateMember

2021-09-09

0001593549

NUGN:DevlopmentProjectsMember

2022-12-31

0001593549

NUGN:MovieProjectMember

2022-01-01

2022-12-31

0001593549

NUGN:MovieProjectMember

srt:MinimumMember

2022-01-01

2022-12-31

0001593549

NUGN:MovieProjectMember

srt:MaximumMember

2022-01-01

2022-12-31

0001593549

NUGN:MovieDevelopmentProjectsMember

2022-01-01

2022-12-31

0001593549

NUGN:AAndImachineLearningprogramEliseeMember

2022-01-01

2022-12-31

0001593549

NUGN:AAndImachineLearningprogramEliseeMember

NUGN:TwoThousandAndTwentyThreeMember

2022-01-01

2022-12-31

0001593549

NUGN:ScriptCarnivalKillersMember

2020-08-25

0001593549

NUGN:ScriptWritersCarnivalMember

2020-09-10

0001593549

NUGN:ScriptWritersCarnivalMember

2021-08-24

0001593549

NUGN:ProducerFeesMember

2021-11-11

0001593549

NUGN:RunningWildWorksMember

2022-03-05

0001593549

NUGN:RunningWildWorksMember

2022-05-04

0001593549

NUGN:RunningWildWorksOneMember

2022-05-04

0001593549

NUGN:RunningWildWorksTwoMember

2022-05-04

0001593549

NUGN:CarnivalKillersWorksMember

2022-07-18

0001593549

NUGN:KidsMovie1Member

2022-07-18

0001593549

NUGN:KidsMovie1ScriptMember

2022-09-14

0001593549

NUGN:MovieXScriptMember

2022-09-14

0001593549

NUGN:ProducersWorksMovieBRMember

2022-09-14

0001593549

NUGN:MovieXScriptWritersMember

2022-09-14

0001593549

NUGN:TVSeriesMember

2022-09-25

0001593549

NUGN:ProducerWorksScriptMember

2022-10-13

0001593549

NUGN:MovieXScriptWritersMember

2022-10-19

0001593549

NUGN:ProducerWorkMovieBRMember

2022-10-11

0001593549

NUGN:R.U.ROBOTS.R.O.SavageMember

2022-11-28

0001593549

NUGN:DirectorWorkMovieBRMember

2022-12-09

0001593549

NUGN:DirectorWorkMovieBRMember

2022-12-23

0001593549

NUGN:KidsMovie1ScriptMember

2022-12-29

0001593549

NUGN:EliseeSystemDevelopmentMember

2020-01-10

0001593549

NUGN:EliseeSystemDevelopmentMember

2020-03-25

0001593549

NUGN:EliseeSystemDevelopmentMember

2020-06-30

0001593549

NUGN:EliseeSystemDevelopmentMember

2020-09-30

0001593549

NUGN:EliseeSystemDevelopmentMember

2020-12-31

0001593549

NUGN:DatabaseOfStockForAnalysis2QMember

2021-06-30

0001593549

NUGN:DEBITPAYMENTTOICONICLABSPLCRef1368435Member

2021-06-30

0001593549

NUGN:DatabaseOfStockForAnalysis3QMember

2021-11-25

0001593549

NUGN:EliseeSystemDevelopmentMember

2021-12-31

0001593549

NUGN:AAndImachineLearningprogramEliseeMember

2021-06-30

0001593549

NUGN:AAndImachineLearningprogramEliseeMember

2021-09-30

0001593549

NUGN:AAndImachineLearningprogramEliseeMember

2021-12-31

0001593549

NUGN:AAndImachineLearningprogramEliseeMember

2022-03-31

0001593549

NUGN:AAndImachineLearningprogramEliseeMember

2022-06-30

0001593549

NUGN:AAndImachineLearningprogramEliseeMember

2022-09-30

0001593549

NUGN:AAndImachineLearningprogramEliseeMember

2022-12-31

0001593549

NUGN:AIMachineLearningProgramMember

2022-12-31

0001593549

us-gaap:SubsequentEventMember

2023-04-20

2023-04-20

0001593549

us-gaap:SubsequentEventMember

NUGN:AssignmentAndPurchaseAgreementMember

2023-05-25

2023-05-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K/A-3

(Mark

One)

| ☒ |

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the fiscal year ended December 31, 2022

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the transition period from __________ to __________

Commission

file number: 000-56457

LIVENTO

GROUP, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

46-3999052 |

State

or other jurisdiction of

incorporation

or organization |

|

(I.R.S.

Employer

Identification

No.) |

| |

|

|

17

State Street

New

York, New

York |

|

10004 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (980)432-8241

Securities

registered pursuant to Section 12(b) of the Securities Exchange Act of 1934: None.

Securities

registered pursuant to Section 12(g) of the Securities Exchange Act of 1934:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of principal U.S. market on which traded |

| Common

stock, par value $0.0001 |

|

NUGN |

|

OTCPINK |

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes

☐ No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes

☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

Yes

☒ No ☐

Indicate

by check mark whether the registrant is a large-accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or emerging growth company. See the definitions of “large-accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large-accelerated

filer |

☐ |

|

Accelerated

filer |

☐ |

| |

|

|

|

|

| Non-accelerated

filer |

☒ |

|

Smaller

reporting company |

☒ |

| |

|

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. Yes ☐ No ☒

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No

☒

The

aggregate market value of the registrant’s voting common stock held by non-affiliates of the registrant was $14,301,080

as of the last business day of the fiscal

quarter ended December 31, 2022, based on the closing price $0.0630per share for the common stock on such date as traded on the OTCPINK.

As

of December 31, 2022, the registrant had 227,001,268

shares of its common stock, par value

$0.0001 per share, outstanding.

DOCUMENTS

INCORPORATED BY REFERENCE

None

TABLE

OF CONTENTS

FORWARD-LOOKING

STATEMENTS

There

are statements in this registration statement that are not historical facts. These “forward-looking statements” can be identified

by the use of terminology such as “believe,” “hope,” “may,” “anticipate,” “should,”

“intend,” “plan,” “will,” “expect,” “estimate,” “project,” “positioned,”

“strategy” and similar expressions. You should be aware that these forward-looking statements are subject to risks and uncertainties

beyond our control. To discuss these risks, you should read this entire registration statement carefully, especially the risks discussed

under the “Risk Factors” section. Although management believes that the assumptions underlying the forward-looking statements

included in this report are reasonable, they do not guarantee our future performance, and actual results could differ from those contemplated

by these forward-looking statements. The assumptions used for purposes of the forward-looking statements specified in the following information

represent estimates of future events and are subject to uncertainty as to possible changes in economic, legislative, industry, and other

circumstances. As a result, the identification and interpretation of data and additional information and their use in developing and

selecting assumptions from and among reasonable alternatives require the exercise of judgment. To the extent that the assumed events

do not occur, the outcome may vary substantially from anticipated or projected results. Accordingly, no opinion is expressed on the achievability

of those forward-looking statements. In light of these risks and uncertainties, there can be no assurance that the results and events

contemplated by the forward-looking statements contained in this report will transpire. You are cautioned not to place undue reliance

on these forward-looking statements, which speak only as of their dates. We do not undertake any obligation to update or revise any forward-looking

statements.

PART

I

Item

1. Business.

Prior

Operations

ORGANIZATIONAL

HISTORY

We

were incorporated in the State of Nevada on October 30, 2013, under the name “Bling Marketing, Inc.”. Until December 29,

2014, we were a wholesaler of jewelry, principally earrings, rings, and pendants (“BMI Business”). We recognized a minimal

amount of sales from operations before the three months ending June 30, 2014, and were accordingly classified as a shell company. During

the three-month ended June 30, 2014, we began working with several distributors to sell our jewelry products to retail outlets and, as

a result, recognized sales revenue of $22,025 during the said period. On September 11, 2014, we filed a Current Report on Form 8-K indicating

that we were no longer a shell company as defined by Rule12b-2 of the Exchange Act in light of our operations through the quarter that

ended June 30, 2014.

On

December 26, 2014, we entered into an Agreement and Plan of Merger (“Nugene Merger Agreement”) with NuGene Inc., a California

corporation (“NuGene”). On December 29, 2014 (the “Closing Date”), we filed a certificate of merger in the State

of California whereby our subsidiary, NG Acquisition Inc. (“Acquisition Sub”), merged with NuGene. As a result, NuGene, the

surviving entity, became our wholly owned subsidiary. The transaction under the Nugene Merger Agreement was deemed to be a reverse merger,

whereby the Company (the legal acquirer) is considered the accounting acquiree and NuGene is considered the accounting acquirer, and

NuGene (the legal acquiree) is considered the accounting acquirer. The assets, liabilities, and operations of the acquired entity, NuGene,

were brought forward at their book value, and no goodwill was recognized.

In

connection with the NuGene Merger Agreement, we entered into a Business Transfer and Indemnity Agreement dated December 29, 2014 (the

“Indemnity Agreement”) with our former Chief Executive Officer and Director, Dena Kurland providing for:

| |

1. |

The

transfer of our jewelry business operations existing on the date of the Indemnity Agreement (the “BMI Business”); |

| |

2. |

The

assumption by Ms. Kurland of all liabilities of our Company and the indemnification by Ms. Kurland holding our Company harmless for

any and all liabilities arising at or before the date of the Indemnity Agreement; |

| |

3. |

The

payment by NuGene to Ms. Kurland of $350,000 in cash; and |

| |

4. |

The

surrender by Ms. Kurland of 15,000,000 shares (before giving effect to the Stock Split discussed below) (the “Indemnity Shares”)

of our Company’s common stock representing 95% of the then outstanding common stock (all of which shares have been deemed cancelled

by the Company). |

Pursuant

to the terms of the Nugene Merger Agreement, 26,052,760 shares of Company common stock and 1,917,720 Company a newly designated Series

A Preferred Stock were issued to the former NuGene shareholders. The Series A Preferred Stock was: (i) initially convertible into common

stock at a ratio of one to one, (ii) as long as there were a minimum of 900,000 shares of Series A Preferred Stock outstanding, the holders

of the Series A Preferred Stock had the right to elect a majority of the board of directors and (iii) the holders of the Series A Preferred

Stock, generally voting as a class with the holders of common stock, had for each share of Series A Preferred Stock three times the number

of votes permitted to each share of common stock.

On

December 26, 2014, our board of directors approved a 15.04 to one stock split (“Stock Split”) in the form of a stock dividend

to holders of our common stock as of that date. To affect that board action, each recipient of the stock dividend would receive 14.04

additional shares of common stock for every share of common stock held.

On

December 29, 2014, we completed the sale of 2,000,000 shares of our common stock to 18 purchasers (“Stock Placement”) for

proceeds totaling $2,000,000, including (a) $1,625,000 of cash and (b) automatic conversion of promissory notes in the principal amount

of $375,000.

NuGene

was incorporated in California in December 2006 and formed and funded by our founders, Ali Kharazmi and Mohammed Kharazmi, M.D. The initial

focus of NuGene was to develop and market customized skin care products. As part of that focus, NuGene sought to leverage the working

relationships developed by our founders with the plastic surgery community. NuGene directed significant time and resources on developing

anti-aging and scar treatment/reduction products.

In

2007 Nugene continued to focus on “age-defying” products utilizing peptide complexes (see further description below)

and nano-encapsulation for absorption into the skin (see additional description below). We introduced a limited product line under

the NuGene name and co-branded the products with an affiliated entity, Genetic Institute of Anti-Aging, Inc. (“GIAA”), which

the Kharazmi owned. We utilized the services of a Korean-based contract manufacturer to supply our products. This product line (the “GIAA

Line”) was based on peptides and did not utilize stem cells. We had very modest sales in 2007, with our sole customer GIAA, a related

party.

In

2008 we stopped production of the GIAA Line, and sales were limited to selling the remaining inventory through medical offices and GIAA.

With the GIAA Line discontinued, we spent the remainder of 2008 considering different formulations and methodologies for improved anti-aging

products.

In

2009 and 2010, we had limited activity and minimal sales. Our sales were mainly overseas and limited to the remaining inventory of the

GIAA Line. We continued to explore how we might advance our formulations and methodologies. We expended funds on research and development,

carried out mainly by scientists engaged by the Company.

In

2011 our founders decided to use adult adipose human stem cells (undifferentiated cells found throughout the body that multiply by cell

division to replenish dying cells and regenerate tissues) as the foundation of the formulation for its products. In 2011 the Company

developed a proprietary process to extract human adult stem cells from fat cells that the Company then used in its customized NuGene

line explicitly made for those client(s). Throughout 2011 we continued to provide autologous, or mature, fat-derived stem cells for use

in clinical procedures utilizing this technology. Through this process, the Company refined its ability to culture adult human stem cells

to render human-conditioned stem cell media at a proprietary concentration, a primary ingredient in the NuGene line of cosmeceuticals.

The Company believes that this proprietary concentration, combined with our unique formulations, will provide NuGene with a significant

competitive advantage.

In

2012 we completed our initial line of cosmeceutical products based on these adipose-derived stem cells. We branded this advanced skincare

line solely under the NuGene name (the “NuGene Line”). We eliminated the unpleasant odor associated with stem cells by adding

a fragrance with a very low incidence of allergic reaction. The packaging of this new product line bears no resemblance to the prior

GIAA Line. We also manufactured the NuGene Line ourselves at a small laboratory facility that we leased from an affiliated entity owned

by one of our founders.

Throughout

2013 we continued to expand the product offerings of the NuGene Line. The Company focused its stem cell work on surgical and orthopedic

regeneration. These services were delivered to one client, which was an affiliated entity. Sales of the NuGene Line were limited as we

were in an initial rollout and branding phase.

During

2014, we focused our efforts on transitioning to a cosmeceutical skincare business for mass distribution. With this transition and expanded

attention to our consumer products, we sought to develop our marketing plan and distribution channels. By the end of 2014, we had wholesalers

distributing products from the NuGene Line to medical offices and medical spas throughout the United States. December 31, 2014, we had

about 50 locations selling our products. In addition to the NuGene Line, we generated revenues from an affiliate, Advanced Surgical Partners

(“ASP”), which is also owned by our CEO and Chairman of the Board, Messrs. Ali and Mohammed Kharazmi, respectively. Revenues

generated from ASP resulted from NuGene providing Plasma Rich Platelet and Stem Cell injections for orthopedic and plastic surgery procedures

to ASP. We provided these products and services to ASP as we transitioned into commercializing our cosmeceutical product lines. We expect

further to minimize these product sales and services to ASP in early 2015.

Our

target customers primarily consisted of middle-aged men and women concerned with their aging skin and hair loss. Although our distributors

were primarily west of the Mississippi River, our products were sold throughout the United States.

By

2017, our cosmeceutical skincare business had been discontinued as we could not obtain financing for operations on reasonable terms and

became inactive. Our corporate charter was revoked in Nevada.

On January 26, 2020, Emergent, LLC

(“Emergent”), a Nevada LLC controlled by Milan I Hoffman, was appointed the custodian of the Company and proceeded to

revive the Company’s existence and resolve its outstanding indebtedness. This was completed as to all indebtedness except for

one convertible rate promissory note of $120,000. In March, 2022, Ms. Hoffman sold her Series A Preferred stock in the Company and

certain shares of Series C Preferred Stock to Livento Group, LLC, a limited liability company formed by Mr. Stybr in 2020, for

$200,000. Also in March 2022, Mr. Stybr, agreed to contribute Livento Group, LLC to the Company in exchange for a transfer to him of

the Series A Preferred Stock which gave Mr. Stybr voting control of the Company. Mr. Stybr was the sole member and manager of

Livento Group LLC prior to such transfer. The Series C Preferred Stock purchased by Livento Group, LLC was cancelled shortly after

it was acquired by Livento. Following such cancellation, Livento Group LLC, and Mr. Stybr, owned/controlled 100 shares of Series A

Preferred Stock of the Company, which has 51% voting rights. As a result of these transactions our current operations

are the operations of Livento Group, LLC.

Livento

Group operations started in 2017 as the internal team spearheaded the development of financial management software based on artificial

intelligence for investment entities. This software currently provides several clients with data processing and analytical services in

the investment management sector. Management believes that this segment of our operations will provide meaningful revenue, but we can

give no assurance that this will happen. The product is best described as an automated system that can analyze large quantities of data,

focusing on selected parameters and predicting short-term future behavior within a specific portfolio of selected assets. The software

chooses assets with the highest potential based on a set of specifications and properties, predicting short-term future behavior within

a particular portfolio.

In

2020 the Company acquired land for a residential real estate development project, amounting to 4 million USD, with a completion target

of late 2022. The property is being developed into 16 residential condominiums in a suburb of Prague in the Czech Republic, and all of

the condominium units have signed purchase agreements totaling 12 million. The development cost was approximately 3 million USD. Accordingly,

the gross profits from this project (not counting carrying costs) will be about 5 million USD. The Company had one more real estate project

in the planning phase but planned to sell it and not develop the property further. The Company invested in a residential project total

amount of around 825,000 USD and is currently looking for a buyer. We have had discussions with three potential buyers and expect to

finalize a contract of sale by the end of 2022 but can give no assurances that this will occur or that any sale of this project will

prove profitable. We do not have any further plans to engage in additional real estate development projects.

Present

Operations

The

Company formed BOXO Productions, Inc., a Delaware corporation (“BOXO”), on June 17, 2022 as a wholly owned subsidiary. BOXO

previously operated as a division of Livento that operated since 2020, where we meet with top film and movie producers. BOXO’s

business model is strongly oriented toward the growing demand for content to fill cinemas after COVID19 and the expansion of online content

distributors. BOXO Productions will hold all assets related to Company’s business in movies in the future and currently doesn’t

employ any personnel. In most of its projects, BOXO is not primarily dependent on the movie’s success, as a distributor pays it

before the film is finalized and receives a share of the revenue from cinemas’ box office and home sales. BOXO plans to produce

up to 6 movies and 12 television productions during 2022. BOXO also intends to participate in other films based on management’s

assessment of their potential success in cinemas already in the post-production phase. BOXO will focus on negotiating distribution agreements

that provide for its sharing in the box office sales of these movies. Scripts are chosen by BOXO’s production team, which regularly

receives offers from authors commonly involved in the film industry. BOXO may acquire movie or television rights in various stages of

development. Less frequently, BOXO receives offers for participating in a project’s post-production phase. BOXO finances movies

via internal resources, loans, and investors depending on the project’s state of development and the Company’s cash position.

During

2022 BOXO started production of three movies, Carnival of Killers, Wash Me in the River and Running Wild. These projects received an

initial investment from Livento of USD 400,000 each. Two of these projects, Carnival of Killers and Running Wild are expected to enter

the development stage of production competed in the summer of 2023 and filming and postproduction should end during 4Q 2024. The movie

Wash Me in the River was released in Q4 of 2022.

We

are in early stages of producing other movies that will be announced during Q1 or Q2 of 2023 once all the relevant agreements are finalized.

The

team has been involved either as producers, executive producers, or agents over the years on the following movies, which have been aired

both in theaters and streaming services such as Netflix, Prime Video, Paramount, and Disney Plus:

| |

● |

The

Misfits; a 2021 Action/Thriller featuring Pierce Brosnan |

| |

● |

Packaging

of Ironman movie |

| |

● |

Black

Swan; a 2010 Drama/Thriller featuring Natalie Portman, Mila Kunis, Winona Ryder, and Vincent Cassel |

| |

● |

Extremely

Wicked, Shockingly Evil and Vile; a 2019 Crime/Drama featuring John Malkovich and Zac Efron |

| |

● |

Marley

& Me; a 2008 Comedy/Drama featuring Jennifer Aniston and Owen Wilson |

| |

● |

The

Last Full Measure; a 2019 War/Drama featuring Samuel L. Jackson and Ed Harris |

| |

● |

Worth;

a 2020 Drama featuring Michael Keaton and Stanley Tucci Jr. |

| |

● |

American

Traitor: The Trial of Axis Sally; a 2021 Drama that features Al Pacino |

| |

● |

Best

Sellers; a 2021 Drama/Comedy featuring Michael Caine and Cary Elwes |

Currently,

the Company’s primary focus is the activities of BOXO Productions. As previously mentioned, new movies and television productions

are started monthly, with the target being six movies this year. The Company will use the proceeds of the condominium sales to fund the

activity and operations of BOXO.

The

BOXO team is comprised of three consultants that have been in the production business for last 20 – 30 years and has experience

with large productions as the above-mentioned examples. They have together worked on approximately 300 movie projects over the years.

While the terms of our financings vary from movie to movie, we generally form a limited liability company and serve as its managing

member. Our cash investment, in addition to performing the tasks typical of a producer, is generally from $300,000 to $700,000. The rest

of the costs of the movie are provided by investors. We typically retain a 20 % interest in cash flow, although each movie will be done

on differing terms reflecting market conditions and investors’ assessments of the risk involved.

The

Company does not plan to continue in its real estate activities, is finalizing its current projects, and will not pursue new opportunities

in this segment. The last remaining project, Thunder, was a proposed 52-unit condominium apartment building in Prague. We had an option

to purchase the parcel for the construction of the project but allowed the option to lapse. The parcel remains available and the project

now which consists of budget, architectural drawings, and project plans. We will endeavor to sell the project hopefully during 2023 but

can give no assurance that we will be successful in those efforts. Any buyer needs to secure the land and hire construction company to

build the project. Any proceeds from the sale of this project will be added to our general working capital.

Trends

in the Our Markets

Management

believes that the entertainment industry is experiencing structural changes. COVID19 changed the movie distribution business and offered

new business models and potential growth to participants who provide apps and streaming content directly to consumers through the Internet.

Based on management’s analysis of recent market statistics and trends, we believe these models have become dominant trends in this

market segment.

Management

also believes that these trends will continue and that there is a large market for BOXO’s films and television productions. The

movie production market has expanded significantly in the last two years and is likely to continue growing significantly in the coming

years. Management has observed that online streaming platforms continually require new content, and an increased number of connected

devices will likely result in more customers using these services. In the next few years, many developed and emerging nations will add

new customers to the network.

The

Company has internally developed software called “Elisee” that can capture large amounts of data and create predictive behavior

based on client inputs that assist the client in establishing its investment portfolio. Successfully building an equity portfolio is

not simple since one must consider the future of particular industries and the companies within them. Retail investors and Family Offices

lack complex historical data, and this is where Elisee excels. This data has been acquired from Dow Jones and other public sources and

dissected and analyzed. We believe in diversification but place more emphasis on those industries and companies with a more promising

outlook based on guidance from Elisee. Management believes each potential customer’s financial situation and investment needs are

unique. We see the constant shift of the world’s financial markets, real estate prices, CPI data, and effective portfolio management

as the key to success.

Elisee,

our software product, uses algorithms that read market data and neurological network abilities to determine the best path forward and

make ongoing corrections over time. The main idea is based on reducing risk by investing in several assets. Investors should approach

assets individually and carefully assemble them into their portfolios. When creating an optimal portfolio, Elisee constantly measures

two factors. The first factor is a parameter expressing potential profitability, and the second parameter represents risk. It is necessary

to consider the riskiness of the individual assets in the portfolio, their mutual covariance, or their mutual correlation to calculate

the risk of the entire portfolio. Covariance expresses the extent to which two investment instruments move in the same direction at a

specific time.

Our

competitors are other A.I. database and algorithm programming companies delivering services to clients like banks and asset managers.

Elisee is diversification tool.

|

|

The investor could create his portfolio from all the points in the picture.

But only points E, N, and J form an admissible set suitable for the investor. This set is also bounded by the efficient frontier,

characterized by the rational investor choosing only those portfolios that offer the maximum expected return for the specified amount

of risk. And at the same time, he chooses a portfolio that provides him the minimum risk for the given amount of expected return.

If the investor chooses point E, he can no longer create a better mix of stocks in his portfolio. If an investor establishes a portfolio

from any combination lying on the efficient frontier, it will be the best possible portfolio combination in the given situation. |

We

identified this as a unique opportunity to support several companies with different needs and to aid them in their asset selection process.

We developed our system that can read large amounts of data and run portfolio analyses on these assets, providing improved portfolio

management and performance.

The

system’s development commenced in early 2018, and the first version took one year of development and testing with various basic

data sets. Currently, Livento has a team of three analysts who focus on the maintenance and further development of the system. We are

continually developing and improving our software, making it more robust, stable, and capable of supporting an increased number of asset

classes.

Key

summary of points:

| |

● |

Elisee

was developed and tested over four years. |

| |

● |

Elisee

has had a successful and profitable track record for three years. |

| |

● |

Elisee

can process 1 TB of data in 1 hour. |

| |

● |

Elisee

uses neurological network algorithms to determine and analyze large data portions. |

Marketing

Strategy

Our

marketing strategy comprises the following components; social media (Twitter, LinkedIn, FB, etc.), PR and video communications, and a

personal approach. The strategy differs based on the product offered. They may be described as follows:

Social

media:

We can rapidly, quickly, and reliantly inform all stakeholders about necessary and relevant news. We use promotional

posts to gain company followers.

PR

and video communications:

A

professional IR agency was hired to write our PR communications, arrange interviews with Management, write articles, and introduce them

via different channels to the media. Video interviews and conference attendance are also planned for more prominent investors’

involvement.

Personal

approach:

Our

software uses a direct and personal approach via different marketing channels, including social networks, industry liaisons, and articles

in specialized magazines.

Employees

We

currently have eleven employees and consultants. Three of our employees are specialized in Elisee development, three are engaged in Financial

Management, and two are involved in administrative positions. The remaining employees are engaged in various management positions. We

anticipate hiring additional employees or consultants over the next three months to support the growth of BOXO. None of our employees

are covered by a collective bargaining agreement.

Competition

BOXO

competes with other production companies focused on movies and online streaming platforms. Our main market advantage is direct contact

via the producer team to top Hollywood icons, including well-known producers, directors, actors, and distribution companies that pay

BOXO before the film is finalized.

The

competition to our software is other software products performing similar functions. We differentiate ourselves in specializing and providing

a proven track record in several specific market segments, where we can offer predictive behavior of assets with and without our decision-making

process.

In

all aspects of our business, we face competition from companies with more significant resources than we have, but we have gradually and

consistently grown despite this.

We

currently occupy space within serviced office suites in New York City and Prague in the Czech Republic. Since our employees and

consultants work virtually, we believe this arrangement is adequate for us and allows us to operate at a very low cost. In the

future, if we require more office space, we will acquire appropriate quarters within which to operate.

Item

1A. Risk Factors.

Not

applicable because we are a smaller reporting company.

Item

1B. Unresolved Staff Comments.

Not

applicable because we are a smaller reporting company.

Item

2. Properties.

We

currently occupy space within serviced office suites in New York City and Prague in the Czech Republic. Since our employees and consultants

work virtually, we believe this arrangement is adequate for us and allows us to operate at a very low cost. In the future, if we require

more office space, we will acquire appropriate quarters within which to operate.

Item

3. Legal Proceedings.

There

is no material pending legal proceedings to which the Company is a party or as to which any of its property is subject, and no such proceedings

are known to the Company to be threatened or contemplated against it.

Item

4. Mine Safety Disclosures.

Not

applicable.

PART

II

Item

5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

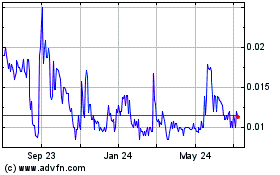

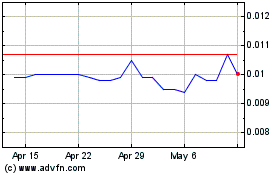

Our

Common Stock is included on the Pink Sheets under the Symbol NUGN and is currently quoted at $0.065 with active trading. There are approximately

69 holders of record of our common stock. Other holders have their stock deposited at brokers and their shares are in street name.

We

have not paid any cash dividends to date, but should the company’s needs allow it, the Board of Directors intends to declare dividends

from future earnings.

We

have not authorized the issuance of securities under retirement, pension, profit sharing, stock option, or other equity compensation

plans.

The

reported closing price was $0.057 on May 25, 2023 .

| Period |

|

High |

|

|

Low |

|

| January

1, 2023 |

- |

March

31, 2023 |

|

|

.107 |

|

|

|

.046 |

|

| October 1, 2022 |

- |

December 31, 2022 |

|

|

.120 |

|

|

|

.050 |

|

| July 1, 2022 |

- |

September 30, 2022 |

|

|

.198 |

|

|

|

.027 |

|

| April 1, 2022 |

- |

June 30, 2022 |

|

|

.200 |

|

|

|

.014 |

|

| January 1, 2022 |

- |

March 31, 2022 |

|

|

.065 |

|

|

|

.004 |

|

| October 1, 2021 |

- |

December 31, 2021 |

|

|

.048 |

|

|

|

.007 |

|

| July 1, 2021 |

- |

September 30, 2021 |

|

|

.045 |

|

|

|

.005 |

|

| April 1, 2021 |

- |

June 30, 2021 |

|

|

.023 |

|

|

|

.004 |

|

| January 1, 2021 |

- |

March 31, 2021 |

|

|

.018 |

|

|

|

.003 |

|

| October 1, 2020 |

- |

December 31, 2020 |

|

|

.008 |

|

|

|

.002 |

|

| July 1, 2020 |

- |

September 30, 2020 |

|

|

.019 |

|

|

|

.003 |

|

| April 1, 2020 |

- |

June 30, 2020 |

|

|

.037 |

|

|

|

.001 |

|

| January 1, 2020 |

- |

March 31, 2020 |

|

|

.003 |

|

|

|

.001 |

|

Dividends

Holders

of our common stock are entitled to receive dividends if, as and when declared by the Board of Directors out of funds legally available

therefore. We have never declared or paid any dividends on our common stock. We intend to retain any future earnings for use in the operation

and expansion of our business. Consequently, we do not anticipate paying any cash dividends on our common stock to our stockholders for

the foreseeable future.

Item

6. Selected Financial Data.

Not

applicable because we are a smaller reporting company.

Item

7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The

following discussion and analysis of financial condition and results of operations should be read in conjunction with our consolidated

financial statements and related notes included elsewhere in this report. The information and financial data discussed below is only

a summary and should be read in conjunction with the historical financial statements and related notes contained elsewhere in this 10-K.

The financial statements contained elsewhere in this 10-K fully represent the Company’s financial condition and operations; however,

they are not indicative of the Company’s future performance. Although management believes that the assumptions made and expectations

reflected in the forward-looking statements are reasonable, there is no assurance that the underlying assumptions will, in fact, prove

to be correct or that actual results will not be different from expectations expressed in this 10-K.

Management’s

Discussion and Analysis of Financial Condition and Results of Operation.

Overview

We

primarily engage in developing BOXO projects development where our business model consists of financing new movies or engaging in a stage

before starting distribution. BOXO is paid once the distributor company comes into the project; thus, Livento can turn around the investment

equity quickly.

AI

product has current revenues from our clients in the form of fees for our services, and we invest part of these back into the product’s

continuous upgrade. We provide our clients with analytical services where we use our software to deliver them requested portfolio setting,

and we charge an initial data analysis fee if the client uses the results of our software regularly; we charge fees based on the size

of assets he has under management and type of additional services he requires. We divide our prices based on the number of data sets

that need to be analyzed.

BOXO

production revenues will be reflected further this year as the first projects enter a revenue stage. BOXO projects are currently in differing

stages of production.

Our

current real estate project is in a revenue production phase as apartments are becoming subject to purchase contracts and sell.

Recent

Developments

In

Q1 2022, while the Convid-19 pandemic appeared to be ending, management decided to acquire Livento. We believe this strategy has secured

investors and attention for BOXO’s efforts.

New

movies are lined up every two weeks, and our producer team chooses the one with the highest added value for shareholders regarding current

cash flow and potential movie effects.

Our

AI product continues in normal development, where our internal team is providing services to several investment houses for portfolio

optimization.

During

end of 2022 we finalized the sale of the first part of our real estate project for amount $2,1 million which sales will continue during

Q1 2023.

Critical

Accounting Policies

Critical

accounting policies are defined as those that are reflective of significant judgments, estimates, and uncertainties and potentially result

in materially different results under different assumptions and conditions. We believe the following are our critical accounting policies:

Basis

of Presentation and Principles of Consolidation

These

consolidated financial statements and related notes are presented by accounting principles generally accepted in the United States and

are expressed in US dollars.

The

basis of accounting differs in certain material aspects from that used for preparing the books of the Subsidiaries, which are prepared

by the accounting principles and relevant financial regulations applicable to limited liabilities enterprises established in their domicile.

The accompanying consolidated financial statements reflect necessary adjustments not recorded in the books of the Subsidiaries to present

them in conformity with U.S. GAAP.

The

consolidated financial statement comprises the financial statement of Livento Group Inc. (The Company) and the subsidiaries Livento Group

LLC and BOXO Production Inc as of December 31, 2022.

Subsidiary

- The Group consolidated financial statements include the assets, liabilities, equity, revenue, expenses and cash flows of the Company.

A subsidiary is an entity over which the Company has control. The Company controls an entity when the Company has power over the entity,

is exposed to, or has rights to, variable returns from its involvement with the entity and has the ability to affect those returns through

its power over the entity. Assessment of control is based on the substance of the relationship between the Company and the entity and

includes consideration of both existing voting rights and, if applicable, potential voting rights that are currently exercisable and

convertible. The operating results of subsidiaries acquired are included in the consolidated financial statements from month when control

is acquired (typically the acquisition date). The operating results of subsidiaries that are divested during the period are included

up to the date control ceased (typically the disposition date) and any difference between the fair value of the consideration received

and the carrying value of a divested subsidiary is recognized in the consolidated income statements. Accounting policies of subsidiaries

have been aligned with those of the Company where necessary.

Functional

and presentation currency

The

accompanying consolidated financial statements are presented in the United States dollar (“USD”), the Company’s reporting

currency.

Related

parties

The

Company adopted ASC 850, Related Party Disclosures, to identify related parties and disclose related party transactions.

A

related party is generally defined as (i) any person that holds 10% or more of the Company’s securities and their immediate families,

(ii) the Company’s management, (iii) someone that directly or indirectly controls, is controlled by or is under common control

with the Company, or (iv) anyone who can significantly influence the financial and operating decisions of the Company. A transaction

is considered a related party transaction when resources or obligations are transferred between related parties. Related parties may

be individuals or corporate entities.

Revenue

Recognition

The

Company adopted ASC 606 requires using a new five-step model to recognize revenue from customer contracts. The five-step model requires

entities to exercise judgment when considering the terms of contracts, which includes (1) identifying the contracts or agreements with

a customer, (2) identifying our performance obligations in the contract or agreement, (3) determining the transaction price, (4) allocating

the transaction price to the separate performance obligations, and (5) recognizing revenue as each performance obligation is satisfied.

The Company only applies the five-step model to contracts when it is probable that the Company will collect the consideration it is entitled

to in exchange for the services it transfers to its clients. The Company has concluded that the new guidance did not require any change

to its revenue recognition processes.

The

Company recognizes software service fees over time as performance obligations are satisfied over the life of the service, usually, with

an average duration of one year. Payments received in advance from customers are recorded as “Deferred revenues.” Such advance

payments received are non-refundable after the thirty days refund period.

The

cost of revenue consists primarily of the outsourced information technology support service, internal employees, consultants, service

charges for cloud computing, and related expenses, which are directly attributable to the revenues.

| S/N |

|

Type

of services |

|

Nature,

Timing of satisfaction of performance obligation and significant payment terms |

|

Revenue

Recognition |

| 1 |

|

Income

from Elissee Software |

|

Elisee

involves in the business of analysis of data sets for DJIA and DAX indexes. The contracts for Elisee are generally for 12 months.

The billing for Elisee is quarterly with 60 days collection period. |

|

Revenue

is recognized by the company not only when delivery note and invoice has been signed and

confirmed by the customer, but at the end of each quarter over the 12 months period after

service has been delivered to the customers.

When

the company expects to be entitled to breakage (forfeiture of substandard services), the company recognizes the expected amount of

breakage in proportion to the services provided versus the total expected network services to be provided. Any unexpected amounts

of breakage are recognized when the unused value of network services expire |

| |

|

|

|

|

|

|

| 2 |

|

Management

service income |

|

The

company rendered Management services to (Retinvest-AB, Thun Development Services and others)

contains real estate development services mainly, but not limited to: |

|

The

company recognize revenue when the services have been provided |

| |

|

|

|

|

|

|

| |

|

|

|

- |

budgeting |

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

- |

contract check and preparation |

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

- |

project works |

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

- |

reporting and control of works |

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

- |

analysis of available land opportunities acquisitions |

|

|

Going

Concern

The

Company’s financial statements, as of December 31, 2022, are prepared using generally accepted accounting principles in the United

States of America applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal

course of business.

The

Company has tried to establish an ongoing and stable source of revenues and cash flows sufficient to cover its operating costs and allow

it to continue as a going concern. The Company has accumulated a net loss of $487,158 as of December 31, 2022. The cash balances as of

December 31, 2022, were $24,159. These factors, among others, support the ability of the Company to continue to fulfill its targets.

However,

management cannot assure that the Company will accomplish any of its plans. These financial statements do not include any adjustments

related to the recoverability and classification of assets or the amounts and classification of liabilities that might be necessary should

the Company be unable to continue as a going concern.

Readers

should not place undue reliance on these forward-looking statements, which are based on management’s current expectations and projections

about future events, are not guarantees of future performance, are subject to risks, uncertainties and assumptions (including those described

below), and apply only as of the date of this filing. Our actual results, performance or achievements could differ materially from the

results expressed in, or implied by, these forward-looking statements. Factors which could cause or contribute to such differences include,

but are not limited to, the risks discussed in prior filings, in press releases and in other communications to shareholders issued by

us from time to time which attempt to advise interested parties of the risks and factors which may affect our business. We undertake

no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or

otherwise.

Managements’

Discussion of the year ended December 31 2020

During

2020, Livento Group LLC operated as development platform for its artificial intelligence software Elisee and real estate projects where

as well revenue of $750,267 was invoiced for consulting and management services. We are providing strategical, project and administration

services to several projects in Europe. Another $820,030 in revenues was share in real estate projects sales totaling revenues for 2020

to $1,570,297.

Costs

were incurred mainly as professional fees in amount of $316,000 for people providing Elisee development and real estate projects consulting.

Other costs was $88,000 for computer and server rent that was used for development of several projects in IT sector, one of them was

as well Elisee. We are accounting for $267,000 as costs of goods sold that covered professional fees related to revenues.

Our

long-term assets consisted of Elisee in amount of $3,320,030, real estate projects in amount of $236,700 and $5,045,789 and a movie project

in amount $1,580,600.

Managements’

Discussion of the year ended December 31 2021

In

2021, Livento Group LLC moved more forward as well in movie projects and started to shift its position from real estate towards movies.

We continued to develop Elisee platform for new clients in USA and our real estate projects started to being realized and developed.

Our revenue consists from $525,000 invoiced for Elisee and $1,315,866 for real estate management.

Due

to high growth of the company, our professional fees increased in line with our revenues to $574,009 and Elisee and other IT focused

projects development took $334,500 for server and IT rent. We are accounting for $714,589 as costs of goods sold for Elisee and $345,000

for professional fees linked to consulting revenues. We as well officially had our first office that was in cost of $87,100.

Company

ended in net loss of $214,879 that was caused mainly by amortization of Elisee software that we started fully used and sell in 2021.

Without amortization, the financial result of the company would be profit of $499,710 which would be decrease compared to year 2020 but

Company invested lot of revenues into movie projects and as well Elisee development in expectation of future revenue coming from these

investments.

Our

long term assets consisted of Elisee in amount of $5,032,230, real estate projects in amount of $2,757,700 and $9,171,659 and movie projects

in amount $3,715,600.

Managements’

discussion of the periods ended 2022

Livento

Group was acquired by Nugene International, Inc., which subsequently changed its name to Livento Group, Inc. We had revenue of $1,966,202

during year 2022. These came from sales of Elisee and our management services to real estate projects. Elisee sales accounted for $ 1,066,000

and $900,202 for real estate projects and management services.

Our

costs of goods sold consist of Amortization of Intangible Assets in amount of $1,677,410, Professional fees of key professionals and

consulting fee that is related to generation of income from the Elisee in amount of $393,879. Most of the revenue for the quarter that

ended December 31, 2022, was derived from software fees. Management believes that the increased revenues are related to our expanded

staffing. The main reason is the hiring of new investment representative people and intermediary consultants that support gaining new

clients. Our expenses were $482,347, mainly professional fees, contracted labor, cloud fees, servers, and legal expenses. We sold first

part of our real estate project with $100,000 profit and we seek to continue in this trend as real estate sales attitude is getting better

in European residential market in first quarter 2023.

Professional

fees increased during this period as we hired services to develop Elisee and more people in administration regarding the process of getting

change don’t with NuGene International, Inc. Compared to the previous period, we took larger office space to accommodate more people’s

needs. All of the above resulted in a net operation loss of $487,158.

Because

of inflation, increased costs of construction, and smaller profit margins, we are transferring our focus to BOXO and Elisee. BOXO is

undertaking more projects and requires more investment than we can generate, and demand for Elisee is increasing due to current market

volatility. We believe the capital generated from the disposal of our real estate properties will provide the required cash for these

operations.

Assets

| Name

of the intangible asset |

|

A&I

machine learning program |

| What

the intangible assets is to be used for |

|

Contains

algorithms and code to analyze large portions of data within closed portfolio of items in order to set their best performing distribution

within the portfolio. |

| Duration

for the construction / completion of the intangible assets |

|

Development

started in 2018 and continues to present time. Company has several consultants and pays data and servers to upgrade and finalize

the system. |

| Expectation

of revenue generation from the asset |

|

The

asset currently generates app USD 1,5 million per year and we expect from 2023 to produce USD 2,5 million as we are able to offer

upgraded version to more clients. |

| Expected

useful life of the assets upon completion |

|

Based

on the recommendation from the system developers and technological changes the company policy is to amortize A & I Learning Program

for 3 years. The company will conduct an annual impairment test to reassess our assumptions on the estimated useful life. |

| Amortization |

|

The

company amortizes the asset at 33.33% per annum using the straight method. |

| Amount

expended on research. |

|

Research

expenses are currently USD 5,032,230 including initial acquisition of the asset and continues investments into data, consultants

and servers. These expenses don’t include general costs, marketing and other indirect costs occurred during the time. |

Development

Projects

| Name

of the asset |

|

Real

Estate Development Projects |

| what

the assets is to be used for |

|

It

contains project plans, budgets, permits and zoning rights for large project in Europe, Czech Republic. |

| Duration

for the construction / completion of the assets |

|

We

are hiring consultants that are proceeding the works on the asset and we expect completing in 1Q 2023. |

| Expectation

of revenue generation from the acquisition of the asset |

|

Asset

will be sold to third party for highest bid, we expect to sell for app USD 3 million. Our sell process already started, we entertain

several developers that are interested in the project acquisition. |

| Expected

useful life of the assets upon completion |

|

It’s

a project, will be valid for 10 years after completion. |

| Amount

expended on research |

|

The

cost to produce this asset is currently USD 2,757,700 and contains works of people and acquisition of initial project. |

Managed

Real Estate Projects

| Name

of the asset |

|

Managed

Real Estate Projects |

| what

the assets is to be used for |

|

Asset

with name “Tundra’ that is expressly large residential project we acquired as a company and we are finalizing project

works to sell this project in 1Q 2023. |

| Duration

for the construction / completion of the intangible assets |

|

We

are hiring consultants that are proceeding the works on the asset and we expect completing in 2Q / 2023. |

| Expectation

of revenue generation from the acquisition of the asset |

|

Asset

will be sold to third party for highest bid, we expect to sell for app USD 9 million. Our sell process already started, we entertain

several developers that are interested in the project acquisition. |

| Expected

useful life of the assets upon completion |

|

It’s

a project, will be valid for 10 years after completion. |

| Amount

expended on research. |

|

The

cost to produce this asset is currently $ 9,171,659 and contains our efforts as well as and the acquisition of initial project. We

already sold $2,000,000 with $100,000 profit so actual value is $7,171,659 |

Movie

projects

| Name

of the intangible asset |

|

Movie

Projects |

| what

the intangible assets is to be used for |

|

We

invest into movie development projects and this asset class contains intellectual rights to books, movies, scripts. We further develop

the asset via developing complete movie script that is further offered to large distribution studios in entertainment industry that

will sell the project so BOXO can produce the asset to full movie. Assets as well can be separately sold if there is buyer with interest. |

| Duration

for the construction / completion of the intangible assets |

|

Each

movie asset needs 15-18 months to reach completion. |

| Expectation

of revenue generation from the acquisition of the asset |

|

Asset

once pre-sold to distributor receives 40% margin revenue and once in cinemas and /or online streamers, BOXO receives revenue share

in share of 15-25%. |

| Expected

useful life of the assets upon completion |

|

Movie

asset package has expected value for 15 years. |

| How

the assets is to be amortized |

|

Pursuant

to ASC 926-20-35, Livento Group, Inc amortizes capitalized movies cost when a movie is released,

and it begins to recognize revenue from the film. These costs for an individual film are

amortized and participation costs are accrued to direct operating expenses in the proportion

that current year’s revenues bear to management’s estimates of the ultimate revenue

at the beginning of the current year expected to be recognized from the exploitation, exhibition,

or sale of such film. Ultimate revenue includes estimates over a period not to exceed ten

years following the date of initial release of the motion picture.

Pursuant

to ASC 926-20-50-2, Livento Group costs to produce this asset is currently $ 10,086,617 and contains works of people, licenses, and

acquisition of initial project. |

| Amount

expended on research |

|

The

cost to produce this asset is currently $ 10,086,617 and contains works of people, licenses and acquisition of initial project. |

COVID-19

outbreak

In

March 2020, the World Health Organization declared coronavirus COVID-19 a global pandemic. The COVID-19 pandemic has negatively impacted

the global economy, workforce, and customers and created significant volatility and disruption of financial markets. It has also disrupted

the normal operations of many businesses, including ours. This outbreak could decrease spending, adversely affect demand for our services

and harm our company and the results of operations. It is not possible for us to predict the duration or magnitude of the adverse consequences

of the outbreak and its effects on our business or the results of operations at this time.

Liquidity

and Capital Resources.

Liquidity

is the ability of a company to generate funds to support its current and future operations, satisfy its obligations, and otherwise operate

on an ongoing basis.

We

had $24,159 cash on hand on December 31, 2022. This is adequate for our planned operations through the end of 2022. In addition, we anticipate

approximately $2,150,000 in revenue from second sale process of our real estate assets to be received during 1Q 2023 and other receivables

for Elisee and our management services in the amount of $489,910. To build the BOXO brand fully, the Company intends to rely on increased

net income and cash inflow in the coming year. In addition, we also plan to receive additional investments for our business through private

equity sales. However, we can give no assurance that we will realize the goals.

Our

receivables are mainly due from clients using Elisee software as the clients were experiencing high market volatility and delayed several

payments. The situation is resolving and management anticipates that all delayed payments should be done received during Q1 2023.

Our

billing for Elisee is generally quarterly, with payment up to 60 days, thus creating a need for working capital.

Our

contracts for Elisee are generally 24 months, providing stable revenue and cash flow. We are engaged in the production of three movies,

where the first one should provide revenue during 1Q of 2023 and the others near the end of 2023. Our movie industry investments appear

on our balance sheet as these are not costs but direct investments as we acquire intellectual property in target movie companies. Each

movie is produced in separate company so risk of failure is mitigated for Livento as a holding company.

Our

debt is mainly operational liabilities, including one $61,400 loan and payments for rent, professional fees, and marketing. We will pay

these outstanding amounts as they come due and our receivables come in the company. The Loan is to be repaid in 1Q 2023, and we believe

our cash flow will be sufficient to pay it.

We

have not entered into any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our

financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures, or

capital resources and would be considered material to investors.

Off-Balance

Sheet Arrangements

We

have no off-balance sheet arrangements, as defined in Item 303(a)(4)(ii) of Regulation S-K, obligations under any guaranteed contracts

or contingent obligations. We also have no other commitments, other than the costs of being a public company that will increase our operating

costs or cash requirements in the future.

Seasonality

Management

does not believe that our current business segment is seasonal to any material extent.

Securities

Authorized for Issuance under Equity Compensation Plans

We

do not have in effect any compensation plans under which our equity securities are authorized for issuance.

Unregistered

Sales of Equity Securities

During

the years ended December 31, 2021 and December 31, 2022, we issued the following unregistered equity securities:

| Date of Transaction | |

Transaction type (e.g., new issuance, cancellation,

shares returned to treasury) | |

Number of Shares Issued (or cancelled) | |

Class of Securities | |

Individual/ Entity Shares were issued to (entities

must have individual with voting / investment control disclosed). | |

Reason for share issuance (e.g., for cash

or debt conversion)-OR-Nature of Services Provided | |

Restricted or Unrestricted as of this filing. | |

Exemption or Registration Type. |

| | |

| |

| |

| |

| |

| |

| |

|

| 04/05/2021 | |

New | |

| 700

000 000 | | |

Common | |

Milan Hoffman | |

Services | |

Restricted | |

| 144 | |

| 04/20/2021 | |

Cancelled | |

| -

2 328 000 | | |