UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2023

Commission File Number: 001-38198

BEST Inc.

(Registrant’s name)

2nd

Floor, Block A, Huaxing Modern Industry Park

No. 18 Tangmiao Road, Xihu District, Hangzhou

Zhejiang Province 310013

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1) :¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7) :¨

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

BEST

Inc. |

| |

|

| |

By: |

/s/ Shao-Ning Johnny Chou |

| |

|

Name: Shao-Ning Johnny Chou |

| |

|

Title: Chairman and Chief Executive Officer |

Date: August 25, 2023

EXHIBIT INDEX

Exhibit 99.1

BEST

Inc. Announces Unaudited Second Quarter 2023 Financial Results

HANGZHOU, China,

August 24, 2023 -- BEST Inc. (NYSE: BEST) (“BEST” or the “Company”), a leading integrated smart supply

chain solutions and logistics services provider in China and Southeast Asia (“SEA”), today announced its unaudited financial

results for the second quarter ended June 30, 2023.

Johnny Chou, Founder,

Chairman and CEO of BEST, commented, “We outperformed in the second quarter by achieving both top-line growth and bottom-line improvements.

At the Group level, our gross margin turned positive to 4.2% for the quarter compared with negative 4.6% for the same period of last

year and we narrowed our net loss by 48.7% year over year. BEST Supply Chain Management achieved its second consecutive quarter of profitability

and reached a record high gross margin of 10.9% while BEST Freight delivered a non-GAAP profitability in the second quarter. Both business

lines generated positive operating cash flow for the quarter.”

“BEST Freight’s

growth momentum has quickly accelerated. Its second-quarter volume and revenue grew by 7.2% and 15.2% year over year, respectively, with

gross margin improving to 5.3%. We will continue to focus on service quality, operating efficiency, digital transformation and synergy

with BEST Supply Chain Management and we expect BEST Freight to be profitable in both the third and fourth quarters, with positive operating

cash flow for the year.”

“BEST Supply

Chain Management continued to benefit from the market’s increased demand for third-party integrated logistics service partners

with higher-level service offerings. With our capabilities in technology, we are becoming more efficient and are further differentiating

BEST across the market. In the second quarter, revenue from BEST Supply Chain Management increased by 6.7% and gross margin increased

by 2.7%, both year over year. We expect BEST Supply Chain Management to continue its profitability in the second half of the year and

generate positive operating cash flow in 2023.”

“For BEST

Global, as we continue to optimize our organization and integrated logistics service capabilities, we are improving our service quality

and network coverage, as well as expanding our reach in cross-border opportunities. In the second quarter, BEST Global’s total

volume for the cross-border business increased by approximately 54.1% quarter-over-quarter. Looking ahead, we expect Global’s parcel

volume to continue to increase and its operating margin and bottom-line to show steady improvements.”

“In summary,

we saw remarkable improvements across our business lines in the second quarter. Our primary focus remains on delivering best-in-class

service quality, digital transformation and synergies among our business units. With this focus, we can drive sustainable growth and

profitability in the near future.” concluded Mr. Chou.

Gloria Fan, BEST’s

Chief Financial Officer, added, “As we continue to benefit from our effective strategic refocusing plan to achieve cost reductions

and better operating efficiency, Group’s selling, general and administrative expenses in the second quarter decreased by 31.4%

year over year. Our balance of cash and cash equivalents, restricted cash, and short-term investments remained strong at RMB3.2 billion

at end of the second quarter. As we further strengthen our service capabilities, optimize our organizational structure and generate synergies

among our business lines, we can capture growth opportunities and create long-term value.”

FINANCIAL HIGHLIGHTS(1)

For the Second

Quarter Ended June 30, 2023:(2)

| ● | Revenue

was RMB2,137.7 million (US$294.8 million), compared to RMB1,931.0 million in the second

quarter of 2022. The increase was primarily due to increased revenue of BEST Freight and

BEST Supply Chain Management. |

| ● | Gross

profit was RMB88.8 million (US$12.2 million), compared to a gross loss of RMB89.3 million

in the second quarter of 2022. The increase was primarily due to further improvements in

operating efficiency for both Freight and Supply Chain Management. Gross profit margin

was 4.2%, compared to a gross loss margin of 4.6% in the second quarter of 2022. |

| ● | Net

Loss from continuing operations was RMB174.4 million (US$24.1 million), compared to RMB340.1

million in the second quarter of 2022. Non-GAAP net loss from continuing operations(3)(4)

was RMB161.2 million (US$22.2 million), compared to RMB320.2 million in the second

quarter of 2022. |

| ● | Diluted

loss per ADS(5) from continuing operations was RMB8.12 (US$1.12),

compared to a loss of RMB16.57 in the second quarter of 2022. Non-GAAP diluted loss per

ADS(3)(4) from continuing operations was RMB7.46 (US$1.03), compared

to a loss of RMB15.56 in the second quarter of 2022. |

(1) All numbers presented

have been rounded to the nearest integer, tenth, or hundredth, and year over year comparisons are based on figures before rounding.

(2)In December 2022, BEST sold its China express business,

the principal terms of which were previously announced. As a result, China express business has been deconsolidated from the Company

and its historical financial results are reflected in the Company’s consolidated financial statements as discontinued operations

accordingly. The financial information and non-GAAP financial information disclosed in this press release is presented on a continuing

operations basis, unless otherwise specifically stated.

(3)

Non-GAAP net income/loss represents net income/loss excluding share-based compensation expenses, amortization of intangible assets

resulting from business acquisitions, and fair value change of equity investments (if any).

(4)

See the sections entitled “Use of Non-GAAP Financial Measures” and “Reconciliations of Non-GAAP Measures to the

Nearest Comparable GAAP Measures” for more information about the non-GAAP measures referred to within this results announcement.

(5)

Diluted earnings/loss per ADS, is calculated by dividing net income/loss attributable to ordinary shareholders as adjusted for

the effect of dilutive ordinary equivalent shares, if any, by the weighted average number of ordinary and dilutive ordinary equivalent

shares expressed in ADS outstanding during the period.

| ● | EBITDA(6)

from continuing operations was negative RMB138.1 million (US$19.0 million),

compared to negative RMB290.3 million in the second quarter of 2022. Adjusted EBITDA(6) from

continuing operations was negative RMB124.9 million (US$17.2 million), compared to negative

RMB270.3 million in the second quarter of 2022. |

BEST Freight

– As the market was gradually recovering and Freight continued to improve its service quality, its volume increased by 7.2%

in the second quarter of 2023 year over year. BEST Freight’s non-GAAP net income of the quarter was RMB1.4 million, compared with

a non-GAAP net loss of RMB54.6 million in the same period of 2022, primarily due to increased volume, higher average selling price per

tonne and improved operating efficiency. As service quality remains the cornerstone of Freight’s service, its focus moving forward

will be on further improving its operating efficiency and ability to provide the key account customers with high-quality services. In

addition, Freight will continue to synergize with BEST Supply Chain Management to capitalize additional business opportunities.

BEST Supply

Chain Management – Driven by its superb service quality and enhanced digital transformation capabilities, BEST Supply Chain

Management continued its robust growth momentum in the second quarter. Its revenue increased by 6.7% while its distribution volume increased

by 52.5% both year over year. BEST Supply Chain Management’s gross margin hit a record high of 10.9%, which led to a net profit

of RMB9.4 million in the second quarter of 2023. Highlighting BEST Supply Chain Management as the solid foundation of our synergistic

logistics ecosystem, we will continue to invest in and improve BEST Supply Chain’s digital transformation capabilities and drive

synergies across our business lines.

BEST Global

– In the second quarter, BEST Global continued its recovery post COVID. BEST Global’s volume increased by 5.5% year over

year, while total volume of the cross-border business in the second quarter increased by approximately 54.1% quarter-over-quarter. BEST

Global also continued its efforts to further reduce costs and improve its operating efficiency as well as expand the coverage for small-

and medium-sized enterprises. As this momentum continues and incremental gains are made, the Company expects that BEST Global’s

volume will continue to grow, and its operating margin and bottom line will continue to improve in the second half of 2023.

Others –

The Company continued to wind down its Capital business line and expects to complete the wind-down by the end of 2023.

(6) EBITDA represents

net income/loss excluding depreciation, amortization, interest expense and income tax expense and minus interest income. Adjusted EBITDA

represents EBITDA excluding share-based compensation expenses and fair value change of equity investments (if any).

Key Operational Metrics

| | |

Three Months Ended | | |

% Change YOY | |

| | |

June 30, 2021 | | |

June 30, 2022 | | |

June 30, 2023 | | |

2022 vs 2021 | | |

2023 vs 2022 | |

| Freight Volume (Tonne in ‘000) | |

| 2,438 | | |

| 2,223 | | |

| 2,383 | | |

| (8.8 | %) | |

| 7.2 | % |

| Supply Chain Management volume (Tonne in ‘000) | |

| 310 | | |

| 400 | | |

| 610 | | |

| 29.0 | % | |

| 52.5 | % |

| Global Parcel Volume in SEA (in ‘000) | |

| 38,761 | | |

| 30,782 | | |

| 32,480 | | |

| (20.6 | %) | |

| 5.5 | % |

FINANCIAL RESULTS(7)

For the Second

Quarter Ended June 30, 2023:

Revenue

The following table

sets forth a breakdown of revenue by business segment for the periods indicated.

Table 1 –

Breakdown of Revenue by Business Segment

| | |

Three Months Ended | | |

| |

| | |

June 30, 2022 | | |

June 30, 2023 | | |

| |

| (In ‘000, except for %) | |

RMB | | |

% of

Revenue | | |

RMB | | |

US$ | | |

% of

Revenue | | |

% Change

YOY | |

| Total Freight | |

| 1,208,435 | | |

| 62.6 | % | |

| 1,392,625 | | |

| 192,052 | | |

| 65.2 | % | |

| 15.2 | % |

| Supply Chain Management | |

| 450,984 | | |

| 23.4 | % | |

| 481,206 | | |

| 66,361 | | |

| 22.5 | % | |

| 6.7 | % |

| Global | |

| 241,171 | | |

| 12.5 | % | |

| 239,381 | | |

| 33,012 | | |

| 11.2 | % | |

| (0.7 | )% |

| Others(8) | |

| 30,378 | | |

| 1.5 | % | |

| 24,463 | | |

| 3,374 | | |

| 1.1 | % | |

| (19.5 | )% |

| Total Revenue | |

| 1,930,968 | | |

| 100.0 | % | |

| 2,137,675 | | |

| 294,799 | | |

| 100.0 | % | |

| 10.7 | % |

| · | Freight

Service Revenue was RMB1,392.6 million (US$192.1 million) for the second quarter of 2023,

compared with RMB1,208.4 million in the same period last year. Freight service revenue increased

by 15.2% year over year, primarily resulting from increases in both freight volume and average

selling price per tonne. |

| · | Supply

Chain Management Service Revenue increased by 6.7% year over year to RMB481.2 million (US$66.4

million) for the second quarter of 2023, up from RMB451.0 million in the same period of last

year, primarily attributable to an expanded customer base and increased volume from existing

customers. |

(7)

All numbers

represented the financial results from continuing operations, unless otherwise stated.

(8)“Others”

Segment primarily represents Capital business unit.

| · | Global

Service Revenue decreased by 0.7% year over year to RMB239.4 million (US$33.0 million) for

the second quarter of 2023 from RMB241.2 million in the same period last year primarily due

to lower parcel volume in Thailand, which was partially offset by steady increases in parcel

volume in Vietnam and Malaysia. |

Cost of Revenue

The following table

sets forth a breakdown of cost of revenue by business segment for the periods indicated.

Table 2 –

Breakdown of Cost of Revenue by Business Segment

| | |

Three Months Ended | | |

| |

| | |

June 30, 2022 | | |

June 30, 2023 | | |

| |

| (In ‘000, except for %) | |

RMB | | |

% of

Revenue | | |

RMB | | |

US$ | | |

% of

Revenue | | |

% of Revenue

Change

YOY | |

| Freight | |

| (1,302,523 | ) | |

| 107.8 | % | |

| (1,319,356 | ) | |

| (181,948 | ) | |

| 94.7 | % | |

| (13.0 | ppt) |

| Supply Chain Management | |

| (413,910 | ) | |

| 91.8 | % | |

| (428,870 | ) | |

| (59,144 | ) | |

| 89.1 | % | |

| (2.7 | ppt) |

| Global | |

| (276,554 | ) | |

| 114.7 | % | |

| (287,726 | ) | |

| (39,679 | ) | |

| 120.2 | % | |

| 5.5 | ppt |

| Others | |

| (27,273 | ) | |

| 89.8 | % | |

| (12,911 | ) | |

| (1,781 | ) | |

| 52.8 | % | |

| (37.0 | ppt) |

| Total Cost of Revenue | |

| (2,020,260 | ) | |

| 104.6 | % | |

| (2,048,863 | ) | |

| (282,551 | ) | |

| 95.8 | % | |

| (8.8 | ppt) |

| · | Cost

of Revenue for Freight was RMB1,319.4 million (US$181.9 million), or 94.7% of revenue in

the second quarter of 2023. The 13.0 percentage point year-over-year decrease in cost of

revenue as a percentage of revenue was mainly due to higher volume and reduced unit cost. |

| · | Cost

of Revenue for Supply Chain Management was RMB428.9 million (US$59.1 million), or 89.1% of

revenue in the second quarter of 2023. The 2.7 percentage point year-over-year decrease in

cost of revenue as a percentage of revenue was primarily due to improved operating efficiency

and optimized customer structure. |

| · | Cost

of Revenue for Global was RMB287.7 million (US$39.7 million), or 120.2% of revenue in the

second quarter of 2023. The 5.5% year-over-year increase in cost of revenue as a percentage

of revenue was primarily due to lower parcel volume in Thailand. |

Gross Profit

was RMB88.8 million (US$12.2 million), compared to a gross loss of RMB89.3 million in the second quarter of 2022; Gross Margin

was positive 4.2%, compared to negative 4.6% in the second quarter of 2022.

Operating Expenses

Selling, General

and Administrative (“SG&A”) Expenses were RMB228.9 million (US$31.6 million), or 10.7% of revenue, in the second

quarter of 2023, compared to RMB333.8 million, or 17.3% of revenue, in the same period of 2022. SG&A expenses in the second quarter

decreased by 31.4% year over year due to reduced headcount and bad debt expense.

Research and

Development Expenses were RMB29.9 million (US$4.1 million) or 1.4% of revenue in the second quarter of 2023, compared to RMB42.1

million or 2.2% of revenue in the second quarter of 2022, primarily due to reduced headcount.

Share-based

Compensation (“SBC”) Expenses included in the cost and expense items above were RMB13.2 million (US$1.8 million) in the

second quarter of 2023, compared to RMB19.9 million in the same period of 2022. Of the total SBC expenses, RMB0.05 million (US$0.01 million)

was allocated to cost of revenue, RMB0.5 million (US$0.1 million) was allocated to selling expenses, RMB11.8 million (US$1.6 million)

was allocated to general and administrative expenses, and RMB0.8 million (US$0.1 million) was allocated to research and development expenses.

Net Loss

and Non-GAAP Net Loss from continuing operations

Net Loss from

continuing operations in the second quarter of 2023 was RMB174.4 million (US$24.1 million), compared to RMB340.1 million in the same

period of 2022. Excluding SBC expenses, non-GAAP net loss from continuing operations in the second quarter of 2023 was RMB161.2

million (US$22.2 million), compared to RMB320.2 million in the second quarter of 2022.

Diluted loss

per ADS and Non-GAAP diluted loss per ADS from continuing operations

Diluted loss

per ADS from continuing operations in the second quarter of 2023 was RMB8.12 (US$1.12), compared to a loss of RMB16.57 in the same

period of 2022. Excluding SBC expenses non-GAAP diluted loss per ADS from continuing operations in the second quarter of 2023

was RMB7.46 (US$1.03), compared to a loss of RMB15.56 in the second quarter of 2022. A reconciliation of non-GAAP diluted loss per ADS

to diluted loss per ADS is included at the end of this results announcement.

Adjusted

EBITDA and Adjusted EBITDA Margin from continuing operations

Adjusted EBITDA

from continuing operations in the second quarter of 2023 was negative RMB124.9 million (US$17.2 million), compared to negative RMB270.3

million in the same period of 2022. Adjusted EBITDA margin from continuing operations in the second quarter of 2023 was negative

5.8%, compared to negative 14.0% in the same period of 2022.

Cash and Cash Equivalents, Restricted

Cash and Short-term Investments

As of June 30,

2023, cash and cash equivalents, restricted cash and short-term investments were RMB3,177.5 million (US$438.2 million), compared to RMB4,413.0

million as of June 30, 2022. In 2022, the Company bought back approximately US$200 million (RMB1.4 billion) aggregate principal

amount of its existing Convertible Senior Notes due 2024.

Net Cash Used In Continuing Operating

Activities

Net cash used in

continuing operating activities in the second quarter of 2023 was RMB158.0 million (US$21.8 million), compared to RMB304.8 million of

net cash used in continuing operating activities in the same period of 2022. The decrease in net cash used in operating activities was

mainly due to the decreased net loss in the second quarter of 2023.

SHARES OUTSTANDING

As of August 11,

2023, the Company had approximately 397.6 million ordinary shares outstanding (9). Each American Depositary Share represents

twenty (20) Class A ordinary shares.

As previously announced, effective

from April 4, 2023, the Company has changed the ratio of its American Depositary Shares to its Class A ordinary shares, par

value US$0.01 per share, from the original ADS ratio of one (1) ADS to five (5) Class A ordinary share, to a new ADS ratio

of one (1) ADS to twenty (20) Class A ordinary shares.

FINANCIAL GUIDANCE

The Company confirms

its guidance for total revenue between RMB8.5 billion and RMB9.5 billion for the full year of 2023.

This forecast reflects

the Company’s current and preliminary view based on its current business situation and market conditions, which are subject to

change.

WEBCAST AND

CONFERENCE CALL INFORMATION

The Company will

hold a conference call at 9:00 pm U.S. Eastern Time on August 23, 2023 (9:00 am Beijing Time on August 24, 2023), to discuss

its financial results and operating performance for the second quarter of 2023.

Participants may

access the call by dialing the following numbers:

| United States |

: +1-888-317-6003 |

| Hong Kong |

: 800-963976 or +852-5808-1995 |

(9)

The total

number of shares outstanding excludes shares reserved for future issuances upon exercise

or vesting of awards granted under the Company’s share incentive plans.

| Mainland China |

: 4001-206115 |

| International |

: +1-412-317-6061 |

| Participant Elite Entry Number |

: 5464411 |

A replay of the

conference call will be accessible through August 31, 2023 by dialing the following numbers:

| United States |

: +1-877-344-7529 |

| International |

: +1-412-317-0088 |

| Replay Access Code |

: 9570777 |

Please visit the

Company's investor relations website to view the earnings release prior to the conference call. A live and archived webcast of the conference

call and a corporate presentation will be available at the same site.

ABOUT BEST INC.

BEST Inc. (NYSE:

BEST) is a leading integrated smart supply chain solutions and logistics services provider in China and Southeast Asia. Through its proprietary

technology platform and extensive networks, BEST offers a comprehensive set of logistics and value-added services, including freight

delivery, supply chain management and global logistics services. BEST’s mission is to empower business and enrich life by leveraging

technology and business model innovation to create a smarter, more efficient supply chain. For more information, please visit: http://www.best-inc.com/en/.

For investor and

media inquiries, please contact:

BEST Inc.

Investor relations

team

ir@best-inc.com

Piacente Financial

Communications

Helen Wu

Tel: +86-10-6508-0677

E-mail: best@tpg-ir.com

Piacente Financial Communications

Brandi Piacente

Tel: +1-212-481-2050

E-mail: best@tpg-ir.com

SAFE HARBOR

STATEMENT

This announcement

contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities

Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,”

“anticipates,” “future,” “intends,” “plans,” “believes,” “estimates”

and similar statements. Among other things, the business outlook and quotations from management in this announcement, as well as BEST's

strategic and operational plans, contain forward-looking statements. BEST may also make written or oral forward-looking statements in

its periodic reports to the U.S. Securities and Exchange Commission (the “SEC”), in its annual report to shareholders, in

press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements

that are not historical facts, including statements about BEST's beliefs and expectations, are forward-looking statements. Forward-looking

statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained

in any forward-looking statement, including but not limited to the following: BEST's goals and strategies; BEST's future business development,

results of operations and financial condition; BEST's ability to maintain and enhance its ecosystem; BEST's ability to compete effectively;

BEST's ability to continue to innovate, meet evolving market trends, adapt to changing customer demands and maintain its culture of innovation;

fluctuations in general economic and business conditions in China and other countries in which BEST operates, and assumptions underlying

or related to any of the foregoing. Further information regarding these and other risks is included in BEST's filings with the SEC. All

information provided in this press release and in the attachments is as of the date of this press release, and BEST does not undertake

any obligation to update any forward-looking statement, except as required under applicable law.

USE OF NON-GAAP

FINANCIAL MEASURES

In evaluating its

business, BEST considers and uses non-GAAP measures, such as non-GAAP net loss/income, non-GAAP net loss/income margin, adjusted EBITDA,

adjusted EBITDA margin, EBITDA, and non-GAAP Diluted earnings/loss per ADS, as supplemental measures in the evaluation of the Company’s

operating results and in the Company’s financial and operational decision-making. The Company believes these non-GAAP financial

measures that help identify underlying trends in the Company’s business that could otherwise be distorted by the effect of the

expenses and gains that the Company includes in loss from operations and net loss. The Company believes that these non-GAAP financial

measures provide useful information about its operating results, enhance the overall understanding of its past performance and future

prospects and allow for greater visibility with respect to key metrics used by the Company’s management in its financial and operational

decision-making. The presentation of these non-GAAP financial measures is not intended to be considered in isolation or as a substitute

for the financial information prepared and presented in accordance with U.S. GAAP. For more information on these non-GAAP financial measures,

please see the table captioned “Reconciliations of Non-GAAP Measures to the Nearest Comparable GAAP Measures” in the results

announcement.

The non-GAAP financial

measures are provided as additional information to help investors compare business trends among different reporting periods on a consistent

basis and to enhance investors' overall understanding of the Company's current financial performance and prospects for the future. These

non-GAAP financial measures should be considered in addition to results prepared in accordance with U.S. GAAP, but should not be considered

a substitute for, or superior to, U.S. GAAP results. In addition, the Company's calculation of the non-GAAP financial measures may be

different from the calculation used by other companies, and therefore comparability may be limited.

Summary of Unaudited

Condensed Consolidated Income Statements

(In Thousands)

| | |

|

Three Monmths Ended June 30, |

|

|

Six Months Ended June 30, | |

| | |

2022 | | |

2023 | | |

2022 | | |

2023 | |

| | |

RMB | | |

RMB | | |

US$ | | |

RMB | | |

RMB | | |

US$ | |

| Revenue | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Freight | |

| 1,208,435 | | |

| 1,392,625 | | |

| 192,052 | | |

| 2,301,249 | | |

| 2,444,498 | | |

| 337,112 | |

| Supply Chain Management | |

| 450,984 | | |

| 481,206 | | |

| 66,361 | | |

| 859,946 | | |

| 921,460 | | |

| 127,075 | |

| Global | |

| 241,171 | | |

| 239,381 | | |

| 33,012 | | |

| 509,880 | | |

| 436,409 | | |

| 60,184 | |

| Others | |

| 30,378 | | |

| 24,463 | | |

| 3,374 | | |

| 62,478 | | |

| 50,570 | | |

| 6,974 | |

| Total Revenue | |

| 1,930,968 | | |

| 2,137,675 | | |

| 294,799 | | |

| 3,733,553 | | |

| 3,852,937 | | |

| 531,344 | |

| Cost of Revenue | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Freight | |

| (1,302,523 | ) | |

| (1,319,356 | ) | |

| (181,948 | ) | |

| (2,472,837 | ) | |

| (2,373,991 | ) | |

| (327,388 | ) |

| Supply Chain Management | |

| (413,910 | ) | |

| (428,870 | ) | |

| (59,144 | ) | |

| (805,117 | ) | |

| (833,220 | ) | |

| (114,906 | ) |

| Global | |

| (276,554 | ) | |

| (287,726 | ) | |

| (39,679 | ) | |

| (562,232 | ) | |

| (536,930 | ) | |

| (74,046 | ) |

| Others | |

| (27,273 | ) | |

| (12,911 | ) | |

| (1,781 | ) | |

| (59,498 | ) | |

| (28,449 | ) | |

| (3,923 | ) |

| Total Cost of Revenue | |

| (2,020,260 | ) | |

| (2,048,863 | ) | |

| (282,551 | ) | |

| (3,899,684 | ) | |

| (3,772,590 | ) | |

| (520,264 | ) |

| Gross (Loss)/Profit | |

| (89,292 | ) | |

| 88,812 | | |

| 12,248 | | |

| (166,131 | ) | |

| 80,347 | | |

| 11,080 | |

| Selling Expenses | |

| (66,130 | ) | |

| (62,670 | ) | |

| (8,643 | ) | |

| (121,056 | ) | |

| (116,487 | ) | |

| (16,064 | ) |

| General and Administrative Expenses | |

| (267,632 | ) | |

| (166,199 | ) | |

| (22,920 | ) | |

| (467,686 | ) | |

| (360,089 | ) | |

| (49,659 | ) |

| Research and Development Expenses | |

| (42,127 | ) | |

| (29,928 | ) | |

| (4,127 | ) | |

| (75,302 | ) | |

| (58,625 | ) | |

| (8,085 | ) |

| Other operating income/(expense), net | |

| 116,975 | | |

| 476 | | |

| 66 | | |

| 119,615 | | |

| (890 | ) | |

| (123 | ) |

| Loss from Operations | |

| (348,206 | ) | |

| (169,509 | ) | |

| (23,376 | ) | |

| (710,560 | ) | |

| (455,744 | ) | |

| (62,850 | ) |

| Interest Income | |

| 25,554 | | |

| 26,001 | | |

| 3,586 | | |

| 41,172 | | |

| 47,679 | | |

| 6,575 | |

| Interest Expense | |

| (25,738 | ) | |

| (16,998 | ) | |

| (2,344 | ) | |

| (52,160 | ) | |

| (34,619 | ) | |

| (4,774 | ) |

| Foreign Exchange Loss | |

| (107,265 | ) | |

| (46,661 | ) | |

| (6,435 | ) | |

| (102,420 | ) | |

| (31,937 | ) | |

| (4,404 | ) |

| Other Income | |

| 19,426 | | |

| 5,243 | | |

| 723 | | |

| 21,108 | | |

| 10,467 | | |

| 1,443 | |

| Other Expense | |

| 20,422 | | |

| (3,065 | ) | |

| (423 | ) | |

| 20,042 | | |

| (3,716 | ) | |

| (512 | ) |

| Gain

on changes in the fair value of derivative assets/liabilities | |

| 75,757 | | |

| 30,765 | | |

| 4,243 | | |

| 63,088 | | |

| 36,157 | | |

| 4,986 | |

| Loss before Income Tax and Share of Net Loss of Equity Investees | |

| (340,050 | ) | |

| (174,224 | ) | |

| (24,027 | ) | |

| (719,730 | ) | |

| (431,713 | ) | |

| (59,536 | ) |

| Income Tax Expense | |

| (93 | ) | |

| (186 | ) | |

| (26 | ) | |

| (312 | ) | |

| (324 | ) | |

| (45 | ) |

| Loss before Share of Net loss of Equity Investees | |

| (340,143 | ) | |

| (174,410 | ) | |

| (24,052 | ) | |

| (720,042 | ) | |

| (432,037 | ) | |

| (59,581 | ) |

| Net Loss from continuing operations | |

| (340,143 | ) | |

| (174,410 | ) | |

| (24,052 | ) | |

| (720,042 | ) | |

| (432,037 | ) | |

| (59,581 | ) |

| Net income from discontinued operations | |

| 2,511 | | |

| 15,222 | | |

| 2,099 | | |

| 2,227 | | |

| 15,222 | | |

| 2,099 | |

| Net Loss | |

| (337,632 | ) | |

| (159,188 | ) | |

| (21,953 | ) | |

| (717,815 | ) | |

| (416,815 | ) | |

| (57,481 | ) |

| Net Loss from continuing operations attributable to non-controlling interests | |

| (8,929 | ) | |

| (13,801 | ) | |

| (1,903 | ) | |

| (16,949 | ) | |

| (27,229 | ) | |

| (3,755 | ) |

| Net Loss attributable to BEST Inc. | |

| (328,703 | ) | |

| (145,387 | ) | |

| (20,050 | ) | |

| (700,866 | ) | |

| (389,586 | ) | |

| (53,726 | ) |

Summary of Unaudited

Condensed Consolidated Balance Sheets

(In Thousands)

| | |

As of December 31,2022 | | |

As of June 30, 2023 | |

| | |

RMB | | |

RMB | | |

US$ | |

| Assets | |

| | |

| | |

| |

| Current Assets | |

| | | |

| | | |

| | |

| Cash and Cash Equivalents | |

| 533,481 | | |

| 1,228,532 | | |

| 169,422 | |

| Restricted Cash | |

| 399,337 | | |

| 250,002 | | |

| 34,477 | |

| Accounts and Notes Receivables | |

| 691,324 | | |

| 786,753 | | |

| 108,498 | |

| Inventories | |

| 16,480 | | |

| 12,093 | | |

| 1,668 | |

| Prepayments and Other Current Assets | |

| 777,842 | | |

| 686,845 | | |

| 94,720 | |

| Short-term Investments | |

| 725,043 | | |

| 108,883 | | |

| 15,016 | |

| Amounts Due from Related Parties | |

| 76,368 | | |

| 61,721 | | |

| 8,512 | |

| Lease Rental Receivables | |

| 43,067 | | |

| 55,815 | | |

| 7,697 | |

| Total Current Assets | |

| 3,262,942 | | |

| 3,190,644 | | |

| 440,010 | |

| Non-current Assets | |

| | | |

| | | |

| | |

| Property and Equipment, Net | |

| 784,732 | | |

| 735,465 | | |

| 101,425 | |

| Intangible Assets, Net | |

| 75,553 | | |

| 85,836 | | |

| 11,837 | |

| Long-term Investments | |

| 156,859 | | |

| 156,859 | | |

| 21,632 | |

| Goodwill | |

| 54,135 | | |

| 54,135 | | |

| 7,466 | |

| Non-current Deposits | |

| 50,767 | | |

| 69,712 | | |

| 9,614 | |

| Other Non-current Assets | |

| 75,666 | | |

| 91,474 | | |

| 12,615 | |

| Restricted Cash | |

| 1,545,605 | | |

| 1,590,047 | | |

| 219,278 | |

| Lease Rental Receivables | |

| 40,188 | | |

| 1,700 | | |

| 234 | |

| Operating Lease Right-of-use Assets | |

| 1,743,798 | | |

| 1,493,970 | | |

| 206,028 | |

| Total non-current Assets | |

| 4,527,303 | | |

| 4,279,198 | | |

| 590,128 | |

| Total Assets | |

| 7,790,245 | | |

| 7,469,842 | | |

| 1,030,138 | |

| Liabilities and Shareholders’ Equity | |

| | | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | | |

| | |

| Long-term borrowings-current | |

| 79,148 | | |

| 26,738 | | |

| 3,687 | |

| Convertible Senior Notes held by related parties | |

| 522,744 | | |

| 541,935 | | |

| 74,736 | |

| Convertible Senior Notes held by third parties | |

| 77 | | |

| 79 | | |

| 11 | |

| Short-term Bank Loans | |

| 183,270 | | |

| 492,203 | | |

| 67,878 | |

| Accounts and Notes Payable | |

| 1,430,004 | | |

| 1,528,489 | | |

| 210,788 | |

| Income Tax Payable | |

| 1,563 | | |

| 1,985 | | |

| 274 | |

| Customer Advances and Deposits and Deferred Revenue | |

| 277,737 | | |

| 293,294 | | |

| 40,447 | |

| Accrued Expenses and Other Liabilities | |

| 1,145,654 | | |

| 1,057,385 | | |

| 145,820 | |

| Financing Lease Liabilities | |

| 11,873 | | |

| 1,404 | | |

| 194 | |

| Operating Lease Liabilities | |

| 544,262 | | |

| 529,305 | | |

| 72,994 | |

| Amounts Due to Related Parties | |

| 1,315 | | |

| 1,812 | | |

| 250 | |

| Total Current Liabilities | |

| 4,197,647 | | |

| 4,474,629 | | |

| 617,080 | |

Summary of Unaudited

Condensed Consolidated Balance Sheets (Cont’d)

(In Thousands)

| | |

As of December 31, 2022 | | |

As of June 30, 2023 | |

| | |

RMB | | |

RMB | | |

US$ | |

| Non-current Liabilities | |

| | | |

| | | |

| | |

| Convertible senior notes held by related parties | |

| 522,744 | | |

| 541,935 | | |

| 74,736 | |

| Long-term borrowings | |

| 381 | | |

| - | | |

| - | |

| Operating Lease Liabilities | |

| 1,292,057 | | |

| 1,068,432 | | |

| 147,344 | |

| Financing Lease Liabilities | |

| 26,024 | | |

| 1,431 | | |

| 197 | |

| Other Non-current Liabilities | |

| 18,752 | | |

| 25,329 | | |

| 3,493 | |

| Long-term Bank Loans | |

| 928,894 | | |

| 967,880 | | |

| 133,477 | |

| Total Non-current Liabilities | |

| 2,788,852 | | |

| 2,605,007 | | |

| 359,247 | |

| Total Liabilities | |

| 6,986,499 | | |

| 7,079,636 | | |

| 976,327 | |

| Mezzanine Equity: | |

| | | |

| | | |

| | |

| Convertible Non-controlling Interests | |

| 191,865 | | |

| 191,865 | | |

| 26,459 | |

| Total mezzanine equity | |

| 191,865 | | |

| 191,865 | | |

| 26,459 | |

| Shareholders’ Equity | |

| | | |

| | | |

| | |

| Ordinary Shares | |

| 25,988 | | |

| 25,988 | | |

| 3,584 | |

| Treasury Shares | |

| - | | |

| (13,256 | ) | |

| (1,828 | ) |

| Additional Paid-In Capital | |

| 19,481,417 | | |

| 19,506,687 | | |

| 2,690,095 | |

| Accumulated Deficit | |

| (18,934,860 | ) | |

| (19,324,447 | ) | |

| (2,664,963 | ) |

| Accumulated Other Comprehensive Income | |

| 124,464 | | |

| 115,238 | | |

| 15,892 | |

| BEST Inc. Shareholders’ Equity | |

| 697,009 | | |

| 310,210 | | |

| 42,780 | |

| Non-controlling Interests | |

| (85,128 | ) | |

| (111,869 | ) | |

| (15,427 | ) |

| Total Shareholders’ Equity | |

| 611,881 | | |

| 198,341 | | |

| 27,352 | |

| Total Liabilities, Mezzanine Equity and Shareholders’ Equity | |

| 7,790,245 | | |

| 7,469,842 | | |

| 1,030,138 | |

Summary of Unaudited

Condensed Consolidated Statements of Cash Flows

(In

Thousands)

| | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| | |

2022 | | |

2023 | | |

2022 | | |

2023 | |

| | |

RMB | | |

RMB | | |

US$ | | |

RMB | | |

RMB | | |

US$ | |

| Net cash used in continuing operating activities | |

| (304,799 | ) | |

| (157,992 | ) | |

| (21,788 | ) | |

| (559,397 | ) | |

| (321,180 | ) | |

| (44,293 | ) |

| Net cash used in discontinued operating activities | |

| (8,759 | ) | |

| - | | |

| - | | |

| (58,257 | ) | |

| - | | |

| - | |

| Net cash used in operating activities | |

| (313,558 | ) | |

| (157,992 | ) | |

| (21,788 | ) | |

| (617,654 | ) | |

| (321,180 | ) | |

| (44,293 | ) |

| Net cash (used in)/generated from continuing investing activities | |

| (100,994 | ) | |

| (46,514 | ) | |

| (6,415 | ) | |

| (980,536 | ) | |

| 636,486 | | |

| 87,775 | |

| Net cash (used in)/generated from discontinued Investing activities | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Net cash generated from/(used in) investing activities | |

| (100,994 | ) | |

| (46,514 | ) | |

| (6,415 | ) | |

| (980,536 | ) | |

| 636,486 | | |

| 87,775 | |

| Net cash (used in)/generated from continuing financing activities | |

| (821,512 | ) | |

| 109,316 | | |

| 15,075 | | |

| (966,796 | ) | |

| 226,935 | | |

| 31,296 | |

| Net cash (used in)/generated from discontinued financing activities | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Net cash (used in)/generated from financing activities | |

| (821,512 | ) | |

| 109,316 | | |

| 15,075 | | |

| (966,796 | ) | |

| 226,935 | | |

| 31,296 | |

| Exchange Rate Effect on Cash and Cash Equivalents, and Restricted Cash | |

| 71,659 | | |

| 61,139 | | |

| 8,431 | | |

| 48,104 | | |

| 47,917 | | |

| 6,608 | |

| Net (decrease)/increase in Cash and Cash Equivalents, and Restricted Cash | |

| (1,164,405 | ) | |

| (34,051 | ) | |

| (4,696 | ) | |

| (2,516,882 | ) | |

| 590,158 | | |

| 81,387 | |

| Cash and Cash Equivalents, and Restricted Cash at Beginning of Period | |

| 3,963,671 | | |

| 3,102,633 | | |

| 427,873 | | |

| 5,316,148 | | |

| 2,478,423 | | |

| 341,790 | |

| Cash and Cash Equivalents, and Restricted Cash at End of Period | |

| 2,799,266 | | |

| 3,068,582 | | |

| 423,177 | | |

| 2,799,266 | | |

| 3,068,581 | | |

| 423,177 | |

| Less: Cash and Cash Equivalents, and Restricted Cash held for sales at end of the Period | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Cash and Cash Equivalents, and Restricted Cash from continuing operations at End of Period | |

| 2,799,266 | | |

| 3,068,582 | | |

| 423,177 | | |

| 2,799,266 | | |

| 3,068,581 | | |

| 423,177 | |

RECONCILIATIONS OF NON-GAAP MEASURES

TO THE NEAREST COMPARABLE GAAP MEASURES

For the Company’s

continuing operations, the table below sets forth a reconciliation of the Company’s net (loss)/income to EBITDA, adjusted EBITDA

and adjusted EBITDA margin for the periods indicated:

Table 3 –

Reconciliation of EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin

| | |

Three Months Ended June 30, 2023 | |

| (In RMB‘000) | |

Freight | | |

Supply Chain | | |

Global | | |

Others | | |

Unallocated(10) | | |

Total | |

| Net (Loss)/Income | |

| (369 | ) | |

| 9,363 | | |

| (113,099 | ) | |

| (11,002 | ) | |

| (59,303 | ) | |

| (174,410 | ) |

| Add | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Depreciation & Amortization | |

| 18,966 | | |

| 8,441 | | |

| 12,610 | | |

| 417 | | |

| 4,720 | | |

| 45,154 | |

| Interest Expense | |

| - | | |

| - | | |

| - | | |

| - | | |

| 16,998 | | |

| 16,998 | |

| Income Tax Expense | |

| 20 | | |

| 39 | | |

| - | | |

| 139 | | |

| (12 | ) | |

| 186 | |

| Subtract | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest Income | |

| - | | |

| - | | |

| - | | |

| - | | |

| (26,001 | ) | |

| (26,001 | ) |

| EBITDA | |

| 18,617 | | |

| 17,843 | | |

| (100,489 | ) | |

| (10,446 | ) | |

| (63,598 | ) | |

| (138,073 | ) |

| Add | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share-based Compensation Expenses | |

| 1,750 | | |

| 872 | | |

| 522 | | |

| 4 | | |

| 10,025 | | |

| 13,173 | |

| Adjusted EBITDA | |

| 20,367 | | |

| 18,715 | | |

| (99,967 | ) | |

| (10,442 | ) | |

| (53,573 | ) | |

| (124,900 | ) |

| Adjusted EBITDA Margin | |

| 1.5 | % | |

| 3.9 | % | |

| (41.8 | )% | |

| (42.7 | )% | |

| - | | |

| (5.8 | )% |

| | |

Three Months Ended June 30, 2022 | |

| (In RMB‘000) | |

Freight | | |

Supply Chain | | |

Global | | |

Others | | |

Unallocated | | |

Total | |

| Net Income/(Loss) | |

| (57,418 | ) | |

| 12,094 | | |

| (105,085 | ) | |

| (82,439 | ) | |

| (107,295 | ) | |

| (340,143 | ) |

| Add | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Depreciation & Amortization | |

| 20,188 | | |

| 9,416 | | |

| 5,977 | | |

| 6,706 | | |

| 7,315 | | |

| 49,602 | |

| Interest Expense | |

| - | | |

| - | | |

| - | | |

| - | | |

| 25,738 | | |

| 25,738 | |

| Income Tax Expense | |

| - | | |

| 45 | | |

| 12 | | |

| 24 | | |

| 12 | | |

| 93 | |

| Subtract | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest Income | |

| - | | |

| - | | |

| - | | |

| - | | |

| (25,554 | ) | |

| (25,554 | ) |

| EBITDA | |

| (37,230 | ) | |

| 21,555 | | |

| (99,096 | ) | |

| (75,709 | ) | |

| (99,784 | ) | |

| (290,264 | ) |

| Add | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share-based Compensation Expenses | |

| 2,777 | | |

| 1,686 | | |

| 1,415 | | |

| 128 | | |

| 13,934 | | |

| 19,940 | |

| Adjusted EBITDA | |

| (34,453 | ) | |

| 23,241 | | |

| (97,681 | ) | |

| (75,581 | ) | |

| (85,850 | ) | |

| (270,324 | ) |

| Adjusted EBITDA Margin | |

| (1.8 | )% | |

| 1.2 | % | |

| (5.1 | )% | |

| (3.9 | )% | |

| - | | |

| (14.0 | )% |

(10) Unallocated

expenses are primarily related to corporate administrative expenses and other miscellaneous items that are not allocated to individual

segments.

For the Company’s

continuing operations, the table below sets forth a reconciliation of the Company’s net (loss)/income to non-GAAP net Income/(loss),

non-GAAP net Income/(loss) margin for the periods indicated:

Table

4 – Reconciliation of Non-GAAP Net (Loss)/Income and Non-GAAP Net (Loss)/Income Margin

| | |

Three Months Ended June 30, 2023 | |

| (In RMB‘000) | |

Freight | | |

Supply Chain | | |

Global | | |

Others | | |

Unallocated | | |

Total | |

| Net (Loss)/Income | |

| (369 | ) | |

| 9,363 | | |

| (113,099 | ) | |

| (11,002 | ) | |

| (59,303 | ) | |

| (174,410 | ) |

| Add | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share-based Compensation Expenses | |

| 1,750 | | |

| 872 | | |

| 522 | | |

| 4 | | |

| 10,025 | | |

| 13,173 | |

| Non-GAAP Net (Loss)/Income | |

| 1,381 | | |

| 10,235 | | |

| (112,577 | ) | |

| (10,998 | ) | |

| (49,278 | ) | |

| (161,237 | ) |

| Non-GAAP Net (Loss)/Income Margin | |

| 0.1 | % | |

| 2.1 | % | |

| (47.0 | )% | |

| (45.0 | )% | |

| - | | |

| (7.5 | )% |

| | |

Three Months Ended June 30, 2022 | |

| (In RMB‘000) | |

Freight | | |

Supply Chain | | |

Global | | |

Others | | |

Unallocated | | |

Total | |

| Net Income/(Loss) | |

| (57,418 | ) | |

| 12,094 | | |

| (105,085 | ) | |

| (82,439 | ) | |

| (107,295 | ) | |

| (340,143 | ) |

| Add | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share-based Compensation Expenses | |

| 2,777 | | |

| 1,686 | | |

| 1,415 | | |

| 128 | | |

| 13,934 | | |

| 19,940 | |

| Non-GAAP Net Income/(Loss) | |

| (54,641 | ) | |

| 13,780 | | |

| (103,670 | ) | |

| (82,311 | ) | |

| (93,361 | ) | |

| (320,203 | ) |

| Non-GAAP Net Income/(Loss) Margin | |

| (2.8 | )% | |

| 0.7 | % | |

| (5.4 | )% | |

| (4.3 | )% | |

| - | | |

| (16.6 | )% |

For the Company’s

continuing operations, the table below sets forth a reconciliation of the Company’s diluted loss per ADS to Non-GAAP diluted loss

per ADS for the periods indicated:

Table 5 –

Reconciliation of diluted loss per ADS and Non-GAAP diluted loss per ADS

| | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| | |

2023 | | |

2023 | |

| (In ‘000) | |

RMB | | |

US$ | | |

RMB | | |

US$ | |

| Net Loss Attributable to Ordinary Shareholders | |

| (160,609 | ) | |

| (22,149 | ) | |

| (404,808 | ) | |

| (55,826 | ) |

| Add | |

| | | |

| | | |

| | | |

| | |

| Share-based Compensation Expenses | |

| 13,173 | | |

| 1,817 | | |

| 25,266 | | |

| 3,484 | |

| Non-GAAP Net Loss Attributable to Ordinary Shareholders | |

| (147,436 | ) | |

| (20,332 | ) | |

| (379,542 | ) | |

| (52,341 | ) |

| Weighted Average Diluted Ordinary Shares Outstanding During the Quarter | |

| | | |

| | | |

| | | |

| | |

| Diluted | |

| 395,518,481 | | |

| 395,518,481 | | |

| 394,952,425 | | |

| 394,952,425 | |

| Diluted (Non-GAAP) | |

| 395,518,481 | | |

| 395,518,481 | | |

| 394,952,425 | | |

| 394,952,425 | |

| Diluted loss per ordinary share | |

| (0.41 | ) | |

| (0.06 | ) | |

| (1.02 | ) | |

| (0.14 | ) |

| Add | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP adjustment to net loss per ordinary share | |

| 0.04 | | |

| 0.01 | | |

| 0.06 | | |

| 0.01 | |

| Non-GAAP diluted loss per ordinary share | |

| (0.37 | ) | |

| (0.05 | ) | |

| (0.96 | ) | |

| (0.13 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Diluted loss per ADS | |

| (8.12 | ) | |

| (1.12 | ) | |

| (20.50 | ) | |

| (2.83 | ) |

| Add | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP adjustment to net loss per ADS | |

| 0.66 | | |

| 0.09 | | |

| 1.28 | | |

| 0.18 | |

| Non-GAAP diluted loss per ADS | |

| (7.46 | ) | |

| (1.03 | ) | |

| (19.22 | ) | |

| (2.65 | ) |

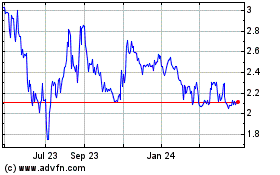

BEST (NYSE:BEST)

Historical Stock Chart

From Mar 2024 to Apr 2024

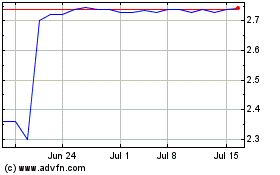

BEST (NYSE:BEST)

Historical Stock Chart

From Apr 2023 to Apr 2024