0001259429

false

0001259429

2023-08-22

2023-08-22

0001259429

OXSQ:CommonStockParValue0.01PerShareMember

2023-08-22

2023-08-22

0001259429

OXSQ:Sec6.50NotesDue2024Member

2023-08-22

2023-08-22

0001259429

OXSQ:Sec6.25NotesDue2026Member

2023-08-22

2023-08-22

0001259429

OXSQ:Sec5.50NotesDue2028Member

2023-08-22

2023-08-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported):

August 22, 2023

OXFORD SQUARE CAPITAL CORP.

(Exact

name of Registrant as specified in its charter)

| Maryland |

|

814-00638 |

|

20-0188736 |

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

Number)

|

|

(I.R.S.

Employer

Identification

No.) |

8 Sound Shore Drive, Suite 255

Greenwich,

CT 06830

(Address

of principal executive offices)

Registrant’s

telephone number, including area code: (203) 983-5275

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange

on

Which Registered |

| Common stock, par value $0.01 per share |

|

OXSQ |

|

NASDAQ

Global Select Market LLC |

| 6.50% Notes due 2024 |

|

OXSQL |

|

NASDAQ

Global Select Market LLC |

| 6.25% Notes due 2026 |

|

OXSQZ |

|

NASDAQ

Global Select Market LLC |

| 5.50% Notes due 2028 |

|

OXSQG |

|

NASDAQ

Global Select Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

☐

Emerging growth company

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01.

Entry into a Material Definitive Agreement

On

August 22, 2023, Oxford Square Capital Corp. (the “Company”) entered into an amendment no. 1 (the

“Amendment”) to that certain equity distribution agreement, dated August 1, 2019 (as amended, the “Equity

Distribution Agreement”), by and among the Company, Oxford Square Management, LLC, Oxford Funds, LLC and Ladenburg Thalmann & Co. Inc., as the sales agent. The Amendment, among other items, allows for sales pursuant to the Equity Distribution Agreement

to continue under the Company’s currently effective shelf registration statement.

The

Offering is being made pursuant to the Company’s effective shelf registration statement on

Form N-2 (Registration No. 333-265533) filed with the Securities and Exchange Commission, as supplemented by a

prospectus supplement dated August 22, 2023. This Current Report on Form 8-K shall not constitute an offer to sell or a

solicitation of an offer to buy any securities, nor shall there be any sale of these securities in any state or jurisdiction in

which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any

such state or other jurisdiction.

The

description above is only a summary of the material provisions of the Amendment and is qualified in its entirety by reference to the

full text of the Amendment, which is attached hereto as Exhibit 1.1 and is incorporated herein by reference.

On

August 22, 2023, Dechert LLP delivered its legality opinion with respect to the shares of the Company’s common stock to be sold

pursuant to the Equity Distribution Agreement, which is attached hereto as Exhibit 5.1.

Item 9.01.

Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| Date: August 23, 2023 |

Oxford Square Capital Corp. |

| |

|

|

| |

By: |

/s/ Saul B. Rosenthal |

| |

|

Saul B. Rosenthal |

| |

|

President |

Exhibit

1.1

OXFORD

SQUARE CAPITAL CORP.

(a

Maryland corporation)

AMENDMENT

NO. 1 TO

EQUITY

DISTRIBUTION AGREEMENT

August

22, 2023

Ladenburg

Thalmann & Co. Inc.

640

Fifth Avenue 4th Floor

New

York, New York 10019

Ladies

and Gentlemen:

This

Amendment No. 1, dated August 22, 2023 (the “Amendment”), is to the Equity Distribution Agreement, dated August

1, 2019 (the “Equity Distribution Agreement”), by and among Oxford Square Capital Corp., a Maryland corporation

(the “Company”), Oxford Square Management, LLC, a limited liability company organized under the laws of the

State of Delaware (the “Adviser”), Oxford Funds, LLC, a limited liability company organized under the laws of

Delaware (the “Administrator”) and Ladenburg Thalmann & Co. Inc. (“Ladenburg”).

WHEREAS,

the Company, the Adviser, the Administrator and Ladenburg desire to amend the Equity Distribution Agreement to modify the definition

of certain defined terms in the Equity Distribution Agreement and used therein and to make certain other changes to the Equity Distribution

Agreement with effect on and after the date hereof.

NOW

THEREFORE, in consideration of the mutual promises contained in this Amendment and other good and valuable consideration, the receipt

and sufficiency of which are hereby acknowledged, the parties to this Amendment, intending to be legally bound, hereby amend the Equity

Distribution Agreement and agree as follows:

1.

Effective on the date hereof, all references to the “Registration Statement” in the Equity Distribution

Agreement shall refer to the Company’s registration statement on Form N-2 and the second paragraph of Section 1 of the Equity

Distribution Agreement is amended and restated as follows:

The

Company has filed, in accordance with the provisions of the Securities Act of 1933, as amended, and the rules and regulations thereunder

(collectively, the “Securities Act”), with the Commission a registration statement on Form N-2 (File No. 333-265533),

including a base prospectus, relating to the Common Shares, including the Shares to be issued from time to time by the Company. The Company

has prepared a prospectus supplement specifically relating to the Shares (the “Prospectus Supplement”) to the base

prospectus included as part of such registration statement. Except where the context otherwise requires, such registration statement,

as amended when it became effective, including all documents filed as part thereof, or incorporated or deemed incorporated by reference

therein, and including any information contained in a Prospectus (as defined below) subsequently filed with the Commission pursuant to

Rule 424 under the Securities Act or deemed to be a part of such registration statement pursuant to Rule 430B of the Securities Act,

is herein called the “Registration Statement.” The base prospectus included in the Registration Statement, as it may

be supplemented by the Prospectus Supplement, in the form in which such prospectus and/or Prospectus Supplement have most recently been

filed by the Company with the Commission pursuant to Rule 424 under the Securities Act, relating to the Shares, including documents incorporated

or deemed to be incorporated therein by reference, is herein called the “Prospectus.” Any reference to the base prospectus,

the Prospectus Supplement or the Prospectus shall be deemed to refer to and include any post-effective amendment to the Registration

Statement and any prospectus supplement relating to the Shares filed with the Commission pursuant to Rule 424, in each case after the

date of the base prospectus, the Prospectus Supplement or the Prospectus, as the case may be. For purposes of this Agreement, all references

to the Registration Statement, the Prospectus or to any amendment or supplement thereto shall be deemed to include any copy filed with

the Commission pursuant to EDGAR.

2.

Effective as of the date hereof, the first and second paragraphs of Section 2 of the Equity Distribution Agreement are

amended and restated as follows:

Each

time that the Company wishes to issue and sell the Shares hereunder (each, a “Placement”), it will notify Ladenburg

orally or by email notice (or other method mutually agreed to in writing by the parties) (a “Placement Notice”) containing

the parameters in accordance with which it desires the Shares to be sold, which shall at a minimum include the number of Shares to be

issued and sold (the “Placement Securities”), the time period during which sales are requested to be made, any limitation

on the number of Shares that may be sold in any one day and any minimum price below which sales may not be made (which minimum price

shall not be less than the Company’s most recently determined net asset value per share). The Placement Notice shall originate

from any of the individuals from the Company set forth on Exhibit A, and shall be directed to one of the individuals from Ladenburg

set forth on Exhibit A, as such Exhibit A may be amended from time to time.

If

Ladenburg wishes to accept such proposed terms included in the Placement Notice (which it may decline to do for any reason in its sole

discretion) or, following discussion with the Company, wishes to accept amended terms, Ladenburg will, prior to 4:30 p.m. (New York City

Time) on the Business Day following the Business Day on which such Placement Notice is delivered to Ladenburg, issue to the Company a

notice orally or by email (or other method mutually agreed to in writing by the parties) addressed to (or oral notice directed to) one

or more of the individuals from the Company and Ladenburg set forth on Exhibit A setting forth the terms that Ladenburg is willing

to accept. Where the terms provided in the Placement Notice are amended as provided for in the immediately preceding sentence, such terms

will not be binding on the Company or Ladenburg until the Company delivers to Ladenburg an acceptance orally or by email (or other method

mutually agreed to in writing by the parties) of all of the terms of such Placement Notice, as amended (the “Acceptance”),

which email shall be addressed to (or oral confirmation directed to) one or more of the individuals from the Company and Ladenburg set

forth on Exhibit A. The Placement Notice (as amended by the corresponding Acceptance, if applicable) shall be effective upon receipt

by the Company of Ladenburg’s acceptance of the terms of the Placement Notice or upon receipt by Ladenburg of the Company’s

Acceptance, as the case may be, unless and until (i) the entire amount of the Placement Securities has been sold, (ii) the Company or

Ladenburg terminates the Placement Notice in accordance with Section 4 below, (iii) the Company issues a subsequent Placement Notice

with parameters superseding those on the earlier dated Placement Notice, (iv) this Agreement has been terminated under the provisions

of Section 14 or (v) either party shall have suspended the sale of the Placement Securities in accordance with Section 4 below. The amount

of any commission, discount or other compensation to be paid by the Company to Ladenburg in connection with the sale of the Placement

Securities shall be calculated in accordance with the terms set forth in Exhibit B. It is expressly acknowledged and agreed that

neither the Company nor Ladenburg will have any obligation whatsoever with respect to a Placement or any Placement Securities unless

and until the Company delivers a Placement Notice to Ladenburg and either (i) Ladenburg accepts the terms of such Placement Notice or

(ii) where the terms of such Placement Notice are amended, the Company accepts such amended terms by means of an Acceptance pursuant

to the terms set forth above, and then only upon the terms specified in the Placement Notice (as amended by the corresponding Acceptance,

if applicable) and herein. In the event of a conflict between the terms of this Agreement and the terms of a Placement Notice (as amended

by the corresponding Acceptance, if applicable), the terms of the Placement Notice (as amended by the corresponding Acceptance, if applicable)

will control.

3.

Effective as of the date hereof, Section 5(c) of the Equity Distribution Agreement is amended and restated as follows:

The

Company has been duly incorporated and is validly existing in good standing as a corporation under the laws of the State of Maryland.

The Company has full power and authority to own its property and to conduct its business as described in the Prospectus and enter into

this Agreement, and is in good standing and is duly qualified to transact business in each jurisdiction in which the conduct of its business

or its ownership or leasing of property requires such qualification, except to the extent that the failure to be so qualified or be in

good standing would not have a material adverse effect on the condition, financial or otherwise, or on the earnings, business, operations,

prospects or property of the Company (a “Company Material Adverse Effect”). The Company has no consolidated subsidiaries

other than the entity set forth on Exhibit E hereto (the “Subsidiary”), as such Exhibit E may be amended

from time to time.

4.

Effective as of the date hereof, Section 5(f) of the Equity Distribution Agreement is amended and restated as follows:

None

of (1) the execution and delivery by the Company of, and the performance by the Company of its obligations under, this Agreement and

each Company Agreement, or (2) the issuance and sale of the Shares as contemplated by this Agreement conflicts with or will conflict

with, result in, or constitute a violation, breach of, default under, (x) the articles of incorporation of the Company, as amended to

date (the “Charter”) or the fourth amended and restated bylaws of the Company, as amended to date (the “Bylaws”)

(y) any agreement, indenture, note, bond, license, lease or other instrument or obligation binding upon the Company or the Subsidiary

that is material to the Company or the Subsidiary taken as a whole, or (z) any law, rule or regulation applicable to the Company or the

Subsidiary or any judgment, order or decree of any governmental body, agency or court having jurisdiction over the Company or the Subsidiary,

whether foreign or domestic; except, with respect to clauses (y) or (z), any contravention which would have neither (i) a Company Material

Adverse Effect or (ii) a material adverse effect on the consummation of the transactions contemplated by this Agreement; provided, that

no representation or warranty is made with respect to compliance with the laws of any jurisdiction outside of the United States in connection

with the offer or sale of the Shares in such jurisdiction by Ladenburg.

5.

Effective as of the date hereof, Section 8(b) of the Equity Distribution Agreement is amended and restated as follows:

Filings. Except

as may be mutually agreed by the Company and Ladenburg, the Company and Ladenburg agree that no sales of Shares shall take place, and

the Company shall not request the sale of any Shares that would be sold, and Ladenburg shall not be obligated to sell, (i) with respect

to the Company’s quarterly filings on Form 10-Q, during any period commencing upon the 30th day following

the end of each fiscal quarter and ending on the date on which the Company files with the Commission updated financial and other information

as of the end of the Company’s most recent quarterly period (the “10-Q Filing”), (ii) with respect to the Company’s

annual report filings on Form 10-K, during any period commencing upon the 50th day following the end of the Company’s

fiscal year, and ending on the date on which the Company files with the Commission updated audited financial information and other information

as of the end of the Company’s most recent fiscal year (the “10-K Filing”) and (iii) with respect to the Company’s

current reports on Form 8-K that are “filed” with the Commission and not “furnished,” during any period commencing

on the date of the event causing the filing of the Form 8-K and ending on the date on which the Company files with the Commission such

Form 8-K (the “8-K Filing”). To the extent the Company releases its earnings for its most recent quarterly period

or fiscal year, as applicable (an “Earnings Release”) before it files with the Commission its quarterly report on

Form 10-Q for such quarterly period or annual report on Form 10-K for such fiscal year, then Ladenburg and the Company agree that

no sales of Shares shall take place for the period beginning on the date of the Earnings Release and ending on the date of the filing

of a prospectus supplement under Rule 424 under the Securities Act related to the Shares that includes such updated financial information

or that such information is otherwise incorporated into the Registration Statement. Notwithstanding the foregoing, without the prior

written consent of each of the Company and Ladenburg, no sales of Common Shares shall take place, and the Company shall not request the

sale of any Shares that would be sold, and Ladenburg shall not be obligated to sell, during any period in which the Company is in possession

of material non-public information.

6.

Effective as of the date hereof, Section 8(q) of the Equity Distribution Agreement is amended and restated as follows:

Company

Legal Opinions. On or prior to the date that the first Shares are sold pursuant to the terms of this Agreement, each time Common

Shares are delivered to Ladenburg as principal on a Settlement Date and within three (3) Trading Days of each Representation Date with

respect to which the Company is obligated to deliver a certificate in the form attached hereto as Exhibit D for which no waiver

is applicable, the Company shall cause to be furnished to Ladenburg written opinions of Dechert LLP (“Company Counsel”),

or other counsel satisfactory to Ladenburg, in form and substance reasonably satisfactory to Ladenburg and its counsel, dated the date

that the opinion is required to be delivered to relate to the Registration Statement and the Prospectus (including any documents which

were or are subsequently incorporated by reference therein) as then amended or supplemented; provided, however, that in

lieu of such opinions for subsequent Representation Dates, any such counsel may furnish Ladenburg with a letter (a “Reliance

Letter”) to the effect that Ladenburg may rely on a prior opinion delivered under this Section 8(q) to the same extent as if

it were dated the date of such letter (except that statements in such prior opinion shall be deemed to relate to the Registration Statement

and the Prospectus (including any documents which were or are subsequently incorporated by reference therein, if any) as amended or supplemented

at such Representation Date).

7.

Effective as of the date hereof, Section 15 of the Equity Distribution Agreement is amended and restated as follows:

Notices. Except

as otherwise provided in this Agreement, all notices and other communications hereunder shall be in writing and sent (a) by telecopy

to any person who has provided its telecopy number in its notice instructions, if the sender on the same day sends a confirming copy

of such notice by an internationally recognized overnight delivery service (charges prepaid), (b) by registered or certified mail with

return receipt requested (postage prepaid), (c) by an internationally recognized overnight delivery service (charges prepaid) or (d)

by e-mail, provided, that, in the case of this clause (d), upon written request of any holder to receive paper copies of such notices

or communications, the Company will promptly send such paper copies to such holder. Notices to Ladenburg shall be directed to Ladenburg

Thalmann & Co. Inc., 640 Fifth Avenue, 4th Floor, New York, NY 10019, skaplan@ladenburg.com and jcaliva@ladenburg.com,

with a copy to Blank Rome LLP, 1271 Avenue of the Americas, New York, NY 10020; if sent to the Company, the Adviser or the Administrator,

will be mailed, directed to or sent to them at 8 Sound Shore Drive, Suite 255, Greenwich, CT 06830, srosenthal@oxfordfunds.com, with

a copy to Dechert LLP, 1900 K Street NW, Washington, DC 20006.

8.

Effective as of the date hereof, Exhibit E of the Equity Distribution Agreement is amended and restated as

follows:

None.

Except

as set forth above, no other amendments to the Equity Distribution Agreement are intended by the parties hereto, are made, or shall be

deemed to be made, pursuant to this Amendment, and all provisions of the Equity Distribution Agreement, including all exhibits thereto,

unaffected by this Amendment shall remain in full force and effect.

Each

capitalized term used but not defined herein shall have the meaning ascribed to such term in the Equity Distribution Agreement.

This

Amendment may be executed in one or more counterparts, each of which shall be deemed an original but all of which together will constitute

one and the same instrument.

[Signature

Page Follows.]

If

the foregoing is in accordance with your understanding of our agreement, please so indicate in the space provided below for that purpose,

whereupon this letter shall constitute a binding agreement among the Company, the Adviser, the Administrator and Ladenburg.

| |

Very

truly yours, |

| |

|

| |

OXFORD

SQUARE CAPITAL CORP. |

| |

|

| |

By: |

/s/

Jonathan H. Cohen |

| |

Name: |

Jonathan

H. Cohen |

| |

Title: |

Chief

Executive Officer |

| |

|

| |

OXFORD

SQUARE MANAGEMENT, LLC |

| |

|

|

| |

By: |

/s/

Jonathan H. Cohen |

| |

Name: |

Jonathan

H. Cohen |

| |

Title: |

Chief

Executive Officer |

| |

|

| |

OXFORD

FUNDS, LLC |

| |

|

| |

By: |

/s/

Jonathan H. Cohen |

| |

Name: |

Jonathan H. Cohen

|

| |

Title: |

Managing Member |

CONFIRMED

AND ACCEPTED, as of

the

date first above written:

LADENBURG

THALMANN & CO. INC.

| By: |

/s/

Jeffrey Caliva |

|

| Name: |

Jeffrey Caliva |

|

| Title: |

Managing Director |

|

[Signature page to Amendment

No. 1 to Equity Distribution Agreement]

6

Exhibit 5.1

|

|

1900 K Street, NW

Washington, DC 20006-1110

+1 202 261 3300 Main

+1 202 261 3333 Fax

www.dechert.com |

| |

|

August 23, 2023

Oxford Square Capital Corp.

8 Sound Shore Drive, Suite 255

Greenwich, Connecticut 06830

| |

Re: |

Oxford Square Capital Corp. |

Ladies and Gentlemen:

We have acted as counsel to Oxford Square Capital

Corp., a Maryland corporation (the “Company”), in connection with the preparation and filing of a Registration Statement

on Form N-2 (the “Registration Statement”), as originally declared effective on September 26, 2022, by the U.S. Securities

and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the “Securities Act”),

and the prospectus supplement, dated August 22, 2023 (the “Prospectus Supplement” and, together with the base prospectus,

dated as of September 26, 2022, included in the Registration Statement, the “Prospectus”) in connection with the proposed

issuance by the Company of shares of common stock, par value $0.01 per share (the “Common Stock”), of the Company with

an aggregate offering price of up to $150,000,000 (the “Shares”), filed with the Commission pursuant to Rule 424 and

Rule 430B under the Securities Act.

This opinion letter is being furnished to the

Company in accordance with the requirements of Item 25 of Form N-2 under the Securities Act, and no opinion is expressed herein as to

any matter other than as to the legality of the Shares.

In rendering the opinions expressed below, we

have examined and relied on originals or copies, certified or otherwise identified to our satisfaction, of such documents, corporate records

and other instruments, agreements, certificates and receipts of public officials, certificates of officers or other representatives of

the Company and others, and such other documents as we have deemed necessary or appropriate as a basis for the opinions set forth below,

including the following documents:

| |

(i) |

the Registration Statement; |

| |

(ii) |

the Articles of Incorporation of the Company, as amended by the Articles of Amendment thereto, certified as of a recent date by the State Department of Assessments and Taxation of the State of Maryland (“SDAT”); |

| |

(iii) |

the Fourth Amended and Restated Bylaws of the Company, certified as of a recent date by the Secretary of the Company; |

| |

(iv) |

a form of certificate evidencing the Common Stock; |

|

August 23, 2023

Page 2 |

| |

(v) |

the equity distribution agreement by and among the Company, Oxford Square Management, LLC, Oxford Funds, LLC and Ladenburg Thalmann & Co. Inc., dated as of August 1, 2019 (the “Equity Distribution Agreement”), as amended pursuant to Amendment No. 1 to the Equity Distribution Agreement, dated as of August 22, 2023 (the “Amendment”, and collectively with the Equity Distribution Agreement, the “Distribution Agreement”); |

| |

(vi) |

a certificate from SDAT as to the existence and good standing of the Company dated as of a recent date (the “Certificate of Good Standing”); and |

| |

(vii) |

resolutions of the board of directors of the Company (the “Board of Directors”), or a duly authorized committee thereof, relating to, among other things, the authorization and approval of (a) the preparation and filing of the Registration Statement and Prospectus, (b) preparation and execution of the Distribution Agreement, and (c) the authorization, issuance, offer and sale of the Shares pursuant to the Prospectus. |

As to the facts upon which this opinion is based,

we have relied, to the extent we deem proper, upon certificates of public officials and certificates and written statements of agents,

officers, directors and representatives of the Company.

In our examination, we have assumed the genuineness

of all signatures, the authenticity of all documents submitted to us as original documents and the conformity to original documents of

all documents submitted to us as copies. In addition, we have assumed (i) the legal capacity of all natural persons, (ii) the legal power

and authority of all persons signing on behalf of the parties to such documents, and (iii) that the Certificate of Good Standing remains

accurate and the Registration Statement remains effective at the time of the issuance and sale of the Shares.

On the basis of the foregoing and subject to the

assumptions, qualifications and limitations set forth in this letter, we are of the opinion that when (i) the Amendment has been duly

executed and delivered by the parties thereto and (ii) the Shares are (a) duly issued and sold in connection with the offering against

receipt by the Company of payment therefor at a price per Share not less than the par value per share of the Common Stock as contemplated

by the Registration Statement and the Prospectus and in accordance with the terms of the Distribution Agreement, and (b) if applicable,

countersigned by the transfer agent, the Shares will be validly issued, fully paid and nonassessable.

We express no opinion as to the validity, legally

binding effect or enforceability of any provision in any agreement or instrument that (i) requires or relates to payment of any interest

at a rate or in an amount which a court may determine in the circumstances under applicable law to be commercially unreasonable or a penalty

or forfeiture or (ii) relates to governing law and submission by the parties to the jurisdiction of one or more particular courts.

The opinions expressed herein are limited to the

Maryland General Corporation Law and we do not express any opinion herein concerning any other law. We express no opinion as to the effect

on the matters covered by this letter of the laws of any other jurisdiction.

We assume no obligation to advise you of any changes

in the foregoing subsequent to the date of this opinion.

We hereby consent to the filing of this opinion

letter as an exhibit to the Registration Statement and to the reference to this firm under the caption “Legal Matters” in

the Prospectus which forms a part of the Registration Statement. In giving such consent, we do not thereby admit that we are in the category

of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission thereunder.

Very truly yours,

/s/ Dechert LLP

v3.23.2

Cover

|

Aug. 22, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 22, 2023

|

| Entity File Number |

814-00638

|

| Entity Registrant Name |

OXFORD SQUARE CAPITAL CORP.

|

| Entity Central Index Key |

0001259429

|

| Entity Tax Identification Number |

20-0188736

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

8 Sound Shore Drive

|

| Entity Address, Address Line Two |

Suite 255

|

| Entity Address, City or Town |

Greenwich,

|

| Entity Address, State or Province |

CT

|

| Entity Address, Postal Zip Code |

06830

|

| City Area Code |

203

|

| Local Phone Number |

983-5275

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common stock, par value $0.01 per share |

|

| Title of 12(b) Security |

Common stock, par value $0.01 per share

|

| Trading Symbol |

OXSQ

|

| Security Exchange Name |

NASDAQ

|

| 6.50% Notes due 2024 |

|

| Title of 12(b) Security |

6.50% Notes due 2024

|

| Trading Symbol |

OXSQL

|

| Security Exchange Name |

NASDAQ

|

| 6.25% Notes due 2026 |

|

| Title of 12(b) Security |

6.25% Notes due 2026

|

| Trading Symbol |

OXSQZ

|

| Security Exchange Name |

NASDAQ

|

| 5.50% Notes due 2028 |

|

| Title of 12(b) Security |

5.50% Notes due 2028

|

| Trading Symbol |

OXSQG

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=OXSQ_CommonStockParValue0.01PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=OXSQ_Sec6.50NotesDue2024Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=OXSQ_Sec6.25NotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=OXSQ_Sec5.50NotesDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

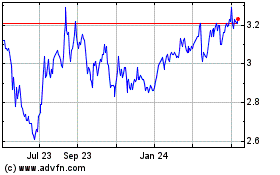

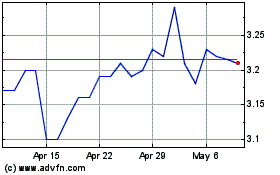

Oxford Square Capital (NASDAQ:OXSQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Oxford Square Capital (NASDAQ:OXSQ)

Historical Stock Chart

From Apr 2023 to Apr 2024