0001309082false00013090822023-08-012023-08-01iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 19345

Date of Report (Date of earliest event reported): August 1, 2023

Camber Energy, Inc. |

(Exact name of registrant as specified in its charter) |

Nevada | | 001-32508 | | 20-2660243 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification Number) |

15915 Katy Freeway Suite 450, Houston, Texas | | 77094 |

(Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code: (281) 404-4387

Not applicable.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☒ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock | CEI | NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.01 Completion of Acquisition or Disposition of Assets.

On August 1, 2023, Viking Merger Sub, Inc. (“Merger Sub”), a Nevada corporation and wholly owned subsidiary of Camber Energy, Inc., a Nevada corporation (“Camber”), completed the previously-announced merger (“the Merger”) with and into Viking Energy Group, Inc., a Nevada corporation (“Viking”), with Viking surviving the Merger as a wholly-owned subsidiary of Camber. The Merger was effectuated pursuant to that certain Amended and Restated Agreement and Plan of Merger, dated February 15, 2021, as amended on April 18, 2023, by and between Camber and Viking (collectively, the “Merger Agreement”).

Upon the terms and subject to the conditions set forth in the Merger Agreement, at the effective time on August 1, 2023 as set forth in the Certificate of Merger duly filed with the Nevada Secretary of State (the “Effective Time”), each share: (i) of common stock, par value $0.001 per share, of Viking (the “Viking Common Stock”) issued and outstanding immediately prior to the Effective Time, other than shares owned by Camber, Viking and Merger Sub, was converted into the right to receive one share of common stock of Camber (the “Camber Common Stock”); (ii) of Series C Preferred Stock of Viking (the “Viking Series C Preferred Stock”) issued and outstanding immediately prior to the Effective Time was converted into the right to receive one share of Series A Convertible Preferred Stock of Camber (the “New Camber Series A Preferred Stock”) and (iii) of Series E Convertible Preferred Stock of Viking (the “Viking Series E Preferred Stock,” and, together with the Viking Series C Preferred Stock, the “Viking Preferred Stock”) issued and outstanding immediately prior to the Effective Time was converted into the right to receive one share of Series H Preferred Stock of Camber (the “New Camber Series H Preferred Stock,” and, together with the New Camber Series A Preferred Stock, the “New Camber Preferred”).

Pursuant to the Certificate of Designations for the New Camber Series A Preferred Stock, dated as of August 1, 2023 (the “Series A COD”), each share of New Camber Series A Preferred Stock is convertible into 890 shares of Camber Common Stock (subject to a beneficial ownership limitation preventing conversion into Camber Common Stock if the holder would be deemed to beneficially own more than 9.99% of Camber Common Stock), is treated equally with Camber Common Stock with respect to dividends and liquidation, and only has voting rights with respect to voting: (a) on a proposal to increase or reduce Camber’s share capital; (b) on a resolution to approve the terms of a buy-back agreement; (c) on a proposal to wind up Camber; (d) on a proposal for the disposal of all or substantially all of Camber’s property, business and undertaking; (f) during the winding-up of Camber; and/or (g) with respect to a proposed merger or consolidation in which Camber is a party or a subsidiary of Camber is a party.

Pursuant to the Certificate of Designations for the New Camber Series H Preferred Stock, dated as of August 1, 2023 (the “Series H COD”), each share of New Camber Series H Preferred Stock has a face value of $10,000 per share, is convertible into a certain number of shares of Camber Common Stock, with the conversion ratio based upon achievement of certain milestones by Viking’s subsidiary, Viking Protection Systems, LLC (provided the holder has not elected to receive the applicable portion of the purchase price in cash pursuant to that certain Purchase Agreement, dated as of February 9, 2022, by and between Viking and Jedda Holdings, LLC), is subject to a beneficial ownership limitation of 4.99% of Camber Common Stock (but may be increased up to a maximum of 9.99% at the sole election of a holder by the provision of at least 61 days’ advance written notice) and has voting rights equal to one vote per share of Camber Series H Preferred Stock held on a non-cumulative basis.

Holders of Viking Common Stock and Viking Preferred Stock had any fractional shares of Camber Common Stock or New Camber Preferred after the Merger rounded up to the nearest whole share.

At the Effective Time, each then outstanding option or warrant to purchase Viking Common Stock (a “Viking Option”), to the extent unvested, automatically became fully vested and was converted automatically into an option or warrant (an “Adjusted Option”) to purchase, on substantially the same terms and conditions as were applicable to such Viking Option immediately prior to the Effective Time, except that (i) instead of being exercisable into Viking Common Stock, such Adjusted Option is exercisable into Camber Common Stock, and (ii) all references to the “Company” in the Viking Option agreements are references to Camber in the Adjusted Option agreements.

At the Effective Time, each promissory note issued by Viking that is convertible into Viking Common Stock (a “Viking Convertible Note”) that, as of immediately prior to the Effective Time, is outstanding and unconverted, was converted into a promissory note convertible into Camber Common Stock (an “Adjusted Convertible Note”) having substantially the same terms and conditions as applied to the corresponding Viking Convertible Note as of immediately prior to the Effective Time (including, for the avoidance of doubt, any extended post-termination conversion period that applies following consummation of the Merger), except that (i) instead of being convertible into Viking Common Stock, such Adjusted Convertible Note is convertible into Camber Common Stock, and (ii) all references to the “Company” in the Viking Convertible Note agreements are references to Camber in the Adjusted Convertible Note agreements.

In connection with the Merger, Camber issued approximately 49,290,152 shares of Camber Common Stock, which represents approximately 59.99% of the outstanding Camber Common Stock after giving effect to such issuance. In addition, Camber reserved for issuance approximately 88,647,137 additional shares of Camber Common Stock in connection with the potential (1) conversion of the New Camber Series A Preferred Stock, (2) conversion of the New Camber Series H Preferred Stock, (3) exercise of the Adjusted Options and (4) conversion of the Adjusted Convertible Notes.

The foregoing description of the Merger Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Merger Agreement, which is attached hereto as Exhibit 2.1 and is incorporated herein by reference.

Item 3.03 Material Modification to Rights of Security Holders.

In connection with the closing of the Merger, on August 1, 2023, Camber filed each of the Series A COD and the Series H COD with the Nevada Secretary of State. The following and foregoing description of the Series A COD and the Series H COD does not purport to be complete and is qualified in its entirety by reference to the full text of the Series A COD and the Series H COD, which are attached hereto as Exhibits 3.1 and 3.2, respectively, and are incorporated herein by reference.

Certificate of Designation for New Camber Series A Preferred Stock

The Series A COD designated up to 28,092 shares of the authorized but unissued shares of its preferred stock as New Camber Series A Preferred Stock. The following is a summary of the principal terms of the New Camber Series A Preferred Stock.

Dividends

The holders of the New Camber Series A Preferred Stock (the “Series A Holders”) are entitled to receive, and Camber shall pay, dividends on shares of the New Camber Series A Preferred Stock equal to the amount of the dividend or distribution per share of Camber Common Stock payable at such time multiplied by the number of shares of Camber Common Stock the shares of New Camber Series A Preferred Stock held by such Holder are convertible into.

Voting Rights

Except as required by applicable law the Series A Holders have no right to vote on any matters, questions or proceedings of Camber except: (a) on a proposal to increase or reduce Camber’s share capital; (b) on a resolution to approve the terms of a buy-back agreement; (c) on a proposal to wind up Camber; (d) on a proposal for the disposal of all or substantially all of Camber’s property, business and undertaking; (f) during the winding-up of Camber; and/or (g) with respect to a proposed merger or consolidation in which Camber is a party or a subsidiary of Camber is a party.

Each share of New Camber Series A Preferred Stock entitles the holder thereof to 890 votes on all matters Series A Holders have the right to vote. Series A Holders will vote together as one class.

Liquidation

Upon any liquidation, dissolution or winding-up of Camber, whether voluntary or involuntary (a “Liquidation”), Series A Holders will be entitled to receive out of the assets of Camber, whether such assets are capital or surplus, for each share of New Camber Series A Preferred Stock the same amount that a holder of Camber Common Stock would receive if the New Camber Series A Preferred Stock were fully converted to Camber Common Stock, which amounts shall be paid pari passu with all holders of Camber Common Stock. A Fundamental Transaction, as defined in the Series A COD, shall not be treated as a Liquidation.

Conversion

Each share of New Camber Series A Preferred Stock is convertible, at the option of the Holder thereof, at any time after the date of issuance of such share, at the office of Camber or any transfer agent for such stock, into eight hundred and ninety (890) shares of fully paid and non-assessable Camber Common Stock (the “Series A Conversion Rate”). The Series A Conversion Rate is subject to a beneficial ownership limitation as set forth in Section 6(b) of the Series A COD.

Certain Adjustments

If Camber, at any time while the New Camber Series A Preferred Stock is outstanding, issues stock splits, effects a recapitalization of the Camber Common Stock, makes a subsequent rights offerings, or makes any dividend or other distribution of its assets, then the Series A Holders can adjust the Series A Conversion Rate of the New Camber Series A Preferred Stock to account for such transaction.

Certificate of Designation for New Camber Series H Preferred Stock

The Series H COD designated up to 2,075 shares of the authorized but unissued shares of its preferred stock as New Camber Series H Preferred Stock. The following is a summary of the principal terms of the New Camber Series H Preferred Stock.

Voting Rights

Except as required by applicable law, holders of the New Camber Series H Preferred Stock (“Series H Holders”) have voting rights equal to one vote per share of New Camber Series H Preferred Stock held on a non-cumulative basis.

Conversion

Each share of New Camber Series H Preferred Stock is convertible into a number of shares of Camber Common Stock as set forth in Section 5(a) of the Series H COD (the “Series H Conversion Rate”). The Series H Conversion Rate is subject to the beneficial ownership limitation as set forth in Section 5(b) of the Series H COD.

Item 8.01 Other Events.

On August 1, 2023, Camber published a press release announcing the closing of the Merger. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(a) | Financial Statements of Business Acquired. |

The audited consolidated balance sheets of Viking as of December 31, 2022 and 2021, the related audited consolidated statements of operations and comprehensive income (loss), stockholders equity, and cash flows for each of the years ended December 31, 2022 and 2021, and the notes related thereto, are incorporated by reference into this Item 9.01(a) from Viking’s Annual Report on Form 10-K for the year ended December 31, 2022 filed with the Securities and Exchange Commission (“SEC”) on March 24, 2023.

(b) | Pro Forma Financial Information. |

The unaudited pro forma combined statements of operations for the year ended December 31, 2022 and for the three months ended March 31, 2023, are presented as if the Merger had been completed on January 1, 2023. The unaudited pro forma combined balance sheet is presented as if the Merger had been completed on January 1, 2023. The pro forma financial statements, and the related notes thereto, required to be filed under this Item 9.01(b) were previously filed in Camber’s Form S-4/A filed with the SEC on June 8, 2023 under the caption “Unaudited Pro Forma Combined Financial Information,” which is incorporated by reference into this Item 9.01(b).

(d) Exhibits.

Exhibit No. | | Description of Exhibit |

2.1 | | First Amendment, dated as of April 18, 2023, to Amended and Restated Agreement and Plan of Merger, by and between Camber Energy, Inc. and Viking Energy Group, Inc., dated as of February 15, 2021 (incorporated by reference to Exhibit 2.1 to our Current Report on Form 8-K filed on April 19, 2023) |

| | |

3.1 | | Certificate of Designation of Series A Convertible Preferred Stock, dated August 1, 2023 |

| | |

3.2 | | Certificate of Designation of Series H Convertible Preferred Stock, dated August 1, 2023 |

| | |

99.1 | | Press Release dated August 1, 2023 |

| | |

104 | | Cover Page Interactive Data File (embedded within Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Camber Energy, Inc. | |

| | | |

Date: August 1, 2023 | By: | /s/ James Doris | |

| Name: | James Doris | |

| Title: | President & CEO | |

nullnullnull

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

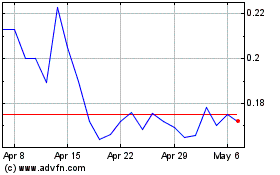

Camber Energy (AMEX:CEI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Camber Energy (AMEX:CEI)

Historical Stock Chart

From Apr 2023 to Apr 2024