false

0000810509

0000810509

2023-07-24

2023-07-24

0000810509

navb:CommonStockCustomMember

2023-07-24

2023-07-24

0000810509

navb:PreferredStockPurchaseRightsCustomMember

2023-07-24

2023-07-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): July 24, 2023

|

NAVIDEA BIOPHARMACEUTICALS, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Delaware

|

001-35076

|

31-1080091

|

|

(State or other jurisdiction

|

(Commission

|

(IRS Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

4995 Bradenton Avenue, Suite 240, Dublin, Ohio

|

43017

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Registrant's telephone number, including area code

|

(614) 793-7500

|

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of exchange on which registered

|

|

Common Stock

|

NAVB

|

NYSE American

|

|

Preferred Stock Purchase Rights

|

N/A

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On July 24, 2023, Joseph W. Meyer, Director, Finance and Accounting, Principal Financial Officer and Principal Accounting Officer of Navidea Biopharmaceuticals, Inc. (the “Company”), informed the Company of his resignation. Mr. Meyer’s last day of employment with the Company will be August 11, 2023.

On July 26, 2023 the Board of Directors (the “Board”) of the Company appointed Craig Dais, age 57, as the Company’s Chief Financial Officer, effective upon his start date of July 28, 2023. Mr. Dais will also serve as the Company’s Principal Financial Officer and Principal Accounting Officer, effective August 12, 2023 or if earlier upon Mr. Meyer’s departure from the Company.

Mr. Dais joins the Company from Colorado Pain Care, LLC, where he served as Chief Financial Officer from 2020 to 2023, and from Ascent CFO Solutions, where he served as a fractional Chief Financial Officer from 2018 to 2020. From 2012 to 2018, Mr. Dais served as Chief Financial Officer at Duffy Crane & Hauling. Mr. Dais began his career in public accounting with KPMG Peat Marwick and earned a B.S. in Accounting (Minor in Business) from the Metropolitan State University of Denver.

There are no arrangements or understandings between Mr. Dais and any other persons pursuant to which Mr. Dais was appointed as the Company’s Chief Financial Officer. Mr. Dais has no family relationships that require disclosure pursuant to Item 401(d) of Regulation S-K and has not been involved in any transactions that require disclosure pursuant to Item 404(a) of Regulation S-K.

In connection with Mr. Dais’ appointment as Chief Financial Officer, the Board approved the terms of an offer letter, which the Company entered into with Mr. Dais on July 26, 2023, setting forth the terms of his employment and compensation. Pursuant to the offer letter, Mr. Dais will receive a base salary of $200,000 per year. His annual cash bonus target will be 20% of his annual base salary and his annual stock option target will be 150,000 stock options, in each case based on achieving certain Company objectives. Mr. Dais’ employment with the Company will be on an at-will basis.

The foregoing summary of the offer letter is subject to, and qualified in its entirety by, the full text of the offer letter, a copy of which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

| Item 5.07 |

Submission of Matters to a Vote of Security Holders. |

The Company held a Special Meeting of Stockholders on July 27, 2023. As of the close of business on July 3, 2023, the record date for the Special Meeting, there were 96,399,385 shares of Common Stock and 84,199 shares of Series K Preferred Stock outstanding and entitled to vote. Each proposal submitted to a vote, the voting power of the shares, the required voted for each proposal, and the quorum requirement are described in detail in the Company’s definitive proxy statement filed with the Securities and Exchange Commission on July 3, 2023.

The proposals submitted to a vote of stockholders at the Special Meeting and the final voting results are as follows:

1. To approve, for the primary purpose of maintaining the Company’s listing on NYSE American, an amendment to our Amended and Restated Certificate of Incorporation, as amended, to effect, on or prior to the one-year anniversary of the date of the Special Meeting, a reverse split of the our common stock at a ratio between 1-for-20 and 1-for-50, with such ratio and the implementation and timing of such reverse stock split to be determined in the discretion of our Board of Directors (the “Reverse Stock Split Proposal”). The Reverse Stock Split Proposal was approved by votes as follows:

| For |

Against |

Abstain |

| 47,907,056,197 |

16,512,206,711 |

349,038,690 |

There were no broker non-votes on the Reverse Stock Split Proposal.

2. To approve, for purposes of facilitating the raising of equity to fund the Company’s working capital needs, maintaining the Company’s listing on NYSE American, and complying with Section 713(a) and Section 713(b) of the NYSE American Company Guide, the issuance of more than 19.99% of our outstanding shares of common stock to our Vice Chairman, John K. Scott, Jr. upon conversion of our Series J convertible preferred stock, which issuance will also result in a “change of control” of our company under the NYSE American listing rules (the “Preferred Stock Conversion and Change of Control Proposal”). The Preferred Stock Conversion and Change of Control Proposal was approved by votes as follows:

| For |

Against |

Abstain |

| 39,987,334 |

15,937,845 |

337,284 |

There were 8,441,135 broker non-votes on the Preferred Stock Conversion and Change of Control Proposal.

The results reported above are final voting results. No other matters were considered or voted upon at the Special Meeting.

On July 27, 2023, the Company issued a press release announcing the appointment of Mr. Dais as Chief Financial Officer. A copy of the Company’s press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

|

Exhibit

|

|

|

Number

|

Exhibit Description

|

| |

|

|

10.1

|

|

|

99.1

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Navidea Biopharmaceuticals, Inc.

|

| |

|

|

| |

|

|

|

Date: July 28, 2023

|

By:

|

/s/ Joseph W. Meyer

|

| |

|

Joseph W. Meyer

Director, Finance and Accounting

(Principal Financial Officer)

|

Exhibit 10.1

July 26, 2023

Mr. Craig Dais

Dear Craig,

I am pleased to offer you the position of Chief Financial Officer for Navidea Biopharmaceuticals, Inc. (the "Company"). As the Chief Financial Officer, you will be responsible for tracking cash flow, analyzing strengths/weaknesses in the Company's finances and overseeing all aspects of its financial success. You will report directly to the Chief Medical Officer.

Duties and Responsibilities

| |

●

|

Recruit Hire and Retain Industry Leading Talent for the Company

|

| |

●

|

Directs the preparation of all financial statements, including income statements, balance sheets, shareholder reports, tax returns, and governmental agency reports.

|

| |

●

|

Company sales and profit projections to actual figures and budgeted expenses to actual expenses; makes or oversees any necessary adjustments to future projections and budgets.

|

| |

●

|

Reviews planning process and suggests improvements to current methods.

|

| |

●

|

Analyzes operations to identify areas in need of reorganization, downsizing, or elimination.

|

| |

●

|

Works with the CMO and other executives to coordinate planning and establish priorities for the planning process.

|

| |

●

|

Studies long-range economic trends and projects their impact on future growth in sales and market share.

|

| |

●

|

Identifies opportunities for expansion into new product areas.

|

| |

●

|

Oversees investment of funds and works with investment bankers to raise additional capital required for expansion.

|

| |

●

|

Provide Key Vendor Relationship Support

|

| |

●

|

Manage and Support designated NAVB associates

|

| |

●

|

Attend/Support NAVB Weekly Team Meetings facilitated by G2G Ventures

|

| |

●

|

Support Investor discussions

|

| |

●

|

Other duties as assigned

|

Annual Compensation Details

Annual Salary: $200,000

Annual Cash Bonus Target: 20% of Annual Salary - Based upon achieving Company Plan

Annual Stock Option Target: 150,000 Company Stock Options to be awarded annually - Based upon achieving Company Plan (2023 stock option award (if achieved) will not be pro-rate for start date)

Access to Company Medical, Dental and Vision benefits within 30 days of start date

Paid Vacation: 4 weeks per year

CPA/CPE: License and renewal reimbursement up to $1,000 per year

Start Date: July 28, 2023

Your employment, like that of all other employees of the Company, will be "at will." This means that either you or the Company may terminate the employment relationship, at any time, with or without cause.

Should these terms be acceptable to you, please sign and return this agreement within 3 business days of receipt. We appreciate your contributions to the Company and look forward to continuing to work with you.

Sincerely,

Signed and accepted by:

| /s/Craig A. Dais |

|

Craig A. Dais |

| |

|

|

| |

|

July 26,2023 |

| |

|

Date |

Exhibit 99.1

Press Release

Navidea Biopharmaceuticals, Inc. Hires Craig A. Dais, CPA as Chief Financial Officer

Following the Company’s Fix, Fund, Propel approach, Mr. Dais’s hire strengthens financial expertise, leadership, and oversight, along with continuing Navidea’s focus on advancing innovative technology to market.

DUBLIN, Ohio, July 27, 2023 (BUSINESS WIRE) -- Navidea Biopharmaceuticals, Inc. (NYSE American: NAVB) (“Navidea” or the “Company”), a company focused on the development of precision immunodiagnostic agents and immunotherapeutics, today announced the hiring of Craig A. Dais, CPA in the position of Chief Financial Officer (CFO), reporting directly to the Company’s Chief Medical Officer. Mr. Dais’s hiring aligns with the Company’s stated objectives and its Fix, Fund, Propel approach to advancing innovative technology to market.

Financial Expertise, Leadership, and Oversight

Craig A. Dais’s hiring in the role of CFO, strengthens the Company’s financial expertise and oversight, supported by G2G Ventures as Executive Consultants, with demonstrated expertise in accounting, financial modeling, capital development, and strong growth-oriented leadership within private and publicly-held organizations. In his role, he is responsible for overseeing all aspects of Navidea’s financial success, including the preparation of all financial statements, reporting and analysis, the active management of the Company’s cash flows, and the development of expert teams responsible for managing and tracking financial activities.

“Craig is an active and experienced accounting and finance leader with the ability to see both the details and the big picture,” said Michael Blue, M.D., FACEP, Navidea’s Chief Medical Officer. “He is a self-motivated leader with expertise in developing strong teams that can help the Company grow by providing insights, reporting, and financial acumen. His financial leadership will help bring Navidea's technology and assets to the forefront.”

Mr. Dais continues an impactful career as financial executive, leader, and Certified Public Accountant, having served in various roles of increasing responsibility over 30 years. His recent experience includes serving as Chief Financial Officer at Colorado Pain Care, LLC, (Fractional) Chief Financial Officer at Ascent CFO Solutions, Chief Financial Officer at Duffy Crane & Hauling, Vice President of Finance at Pendum LLC and other leadership positions with public and private organizations. Craig began his career in finance with KPMG Peat Marwick. Mr. Dais earned a Bachelor of Science in Accounting, along with a Minor in Business, from Metropolitan State University of Denver, and is (inactive status) a Certified Public Accountant.

“I am thrilled to have the opportunity to join Navidea’s team as Chief Financial Officer, and eager to get started,” said Mr. Dais. “I believe my experience and career has led me to this role, and I believe Navidea’s transformative technology can improve lives around the world. My goal is to get to work using my experience to make that happen.”

About Navidea

Navidea Biopharmaceuticals, Inc. (NYSE American: NAVB) is a biopharmaceutical company focused on the development of precision immunodiagnostic agents and immunotherapeutics. Navidea is developing multiple precision-targeted products based on its Manocept platform to enhance patient care by identifying the sites and pathways of disease and enable better diagnostic accuracy, clinical decision-making, and targeted treatment. Navidea’s Manocept platform is predicated on the ability to specifically target the CD206 mannose receptor expressed on activated macrophages. The Manocept platform serves as the molecular backbone of Tc99m tilmanocept, the first product developed and commercialized by Navidea based on the platform. Navidea’s strategy is to deliver superior growth and shareholder return by bringing to market novel products and advancing the Company’s pipeline through global partnering and commercialization efforts. For more information, visit www.navidea.com.

About G2G Ventures

G2G Ventures is a Colorado-based private equity firm focused on empowering organizations to reach their full potential through investment and consulting services. Specializing in creating long-term partnerships with trusted investors and established businesses, G2G Ventures draws on strong internal balance sheet liquidity, augmented by trusted investor capital, to craft bespoke capital solutions which include private equity investment, venture capital participation, and mezzanine debt options. Beyond financial investment, G2G Ventures provides accretive consulting services to help clarify strategic goals and key performance indicators (KPIs), evolve financial processes, and enhance operational effectiveness. To learn more about how G2G Ventures is a growth partner for enduring business, connect with our team.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends affecting the financial condition of our business. Forward-looking statements include our expectations regarding pending litigation and other matters. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including, among other things: our history of operating losses and uncertainty of future profitability; the final outcome of any pending litigation; our ability to successfully complete research and further development of our drug candidates; the timing, cost and uncertainty of obtaining regulatory approvals of our drug candidates; our ability to successfully commercialize our drug candidates; dependence on royalties and grant revenue; our ability to implement our growth strategy; anticipated trends in our business; our limited product line and distribution channels; advances in technologies and development of new competitive products; our ability to comply with the NYSE American continued listing standards; our ability to maintain effective internal control over financial reporting; the impact of the current coronavirus pandemic; and other risk factors detailed in our most recent Annual Report on Form 10-K and other SEC filings. You are urged to carefully review and consider the disclosures found in our SEC filings, which are available at http://www.sec.gov or at http://ir.navidea.com.

Investors are urged to consider statements that include the words “will,” “may,” “could,” “should,” “plan,” “continue,” “designed,” “goal,” “forecast,” “future,” “believe,” “intend,” “expect,” “anticipate,” “estimate,” “project,” and similar expressions, as well as the negatives of those words or other comparable words, to be uncertain forward-looking statements.

You are cautioned not to place undue reliance on any forward-looking statements, any of which could turn out to be incorrect. We undertake no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future events or otherwise after the date of this report. In light of these risks and uncertainties, the forward-looking events and circumstances discussed in this report may not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements.

Investor Relations Contact

Navidea Biopharmaceuticals, Inc.

G2G Ventures - Executive Consultant

Theodore Gerbick

Chief Marketing Officer

tgerbick@g2g.ventures

v3.23.2

Document And Entity Information

|

Jul. 24, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

NAVIDEA BIOPHARMACEUTICALS, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jul. 24, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-35076

|

| Entity, Tax Identification Number |

31-1080091

|

| Entity, Address, Address Line One |

4995 Bradenton Avenue, Suite 240

|

| Entity, Address, City or Town |

Dublin

|

| Entity, Address, State or Province |

OH

|

| Entity, Address, Postal Zip Code |

43017

|

| City Area Code |

614

|

| Local Phone Number |

793-7500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000810509

|

| CommonStock Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

NAVB

|

| Security Exchange Name |

NYSE

|

| PreferredStockPurchaseRights Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock Purchase Rights

|

| Trading Symbol |

N/A

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=navb_CommonStockCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=navb_PreferredStockPurchaseRightsCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

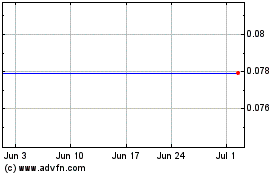

Navidea Biopharmaceuticals (AMEX:NAVB)

Historical Stock Chart

From Mar 2024 to Apr 2024

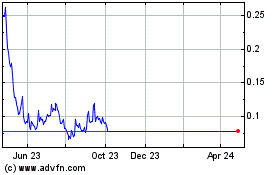

Navidea Biopharmaceuticals (AMEX:NAVB)

Historical Stock Chart

From Apr 2023 to Apr 2024