0001715611false00017156112023-07-212023-07-21iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

July 21, 2023

Date of Report (Date of earliest event reported)

BODY AND MIND INC. |

(Exact name of registrant as specified in its charter) |

Nevada | | 000-55940 | | 98-1319227 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

750 – 1095 West Pender Street Vancouver, British Columbia, Canada | | V6E 2M6 |

(Address of principal executive offices) | | (Zip Code) |

(800) 361-6312

Registrant’s telephone number, including area code

Not applicable.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol (s) | Name of each exchange on which registered |

N/A | N/A | N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (Section 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Section 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

__________

SECTION 1 – REGISTRANT’S BUSINESS AND OPERATIONS

Item 1.01 Entry into a Material Definitive Agreement

On July 21, 2023, Body and Mind Inc.’s (the “Company” or “BaM”) wholly owned subsidiary, DEP Nevada, Inc. (“DEP”), which currently holds, beneficially and of record, all of the issued and outstanding interests and other ownership, equity or profit interests (the “Interests”) in NMG OH 1, LLC (“NMG OH”), entered into an equity purchase agreement (the “EPA”) with FarmaceuticalRX, LLC (the “Purchaser”) to sell the Interests to the Purchaser for an initial purchase price (the “Initial Purchase Price”) of (i) a cash amount (the “Cash Amount”) equal to (A) US$7,975,000.00, minus (B) the aggregate amount of the Estimated Closing Indebtedness (as defined in the EPA), minus (C) the aggregate amount of the Estimated Transaction Expenses (as defined in the EPA), plus (D) the Estimated Closing Cash (as defined in the EPA), (E)(1) minus the amount, if any, by which the Target Net Working Capital (as defined in the EPA) exceeds the Estimated Closing Net Working Capital (as defined in the EPA) or (2) plus the amount, if any, by which the Estimated Closing Net Working Capital exceeds the Target Net Working Capital; (F) plus the deposit of US$250,000 (the “Deposit”), which Deposit has been paid by the Purchaser to DEP. The Initial Purchaser Price, as such sum may be adjusted in accordance with Section 2.3 and Section 8.8 of the EPA is referred to in the EPA as the “Final Purchase Price”. An amount equal to the Escrow Amount (as defined in the EPA) of US$100,000 from the Final Purchase Price shall be held in escrow and released to DEP on the fifth day of the twelfth month after Closing (as defined in the EPA) unless there are any indemnification claims pending until such time as the claim is resolved.

DEP shall receive a payment of US$2,500,000 (each, a “Bonus Payment”) for each additional dispensary license granted to NMG OH by the State of Ohio Board of Pharmacy or other regulatory body, in accordance with the terms of the EPA. Additional dispensary licenses that will receive the Bonus Payment shall specifically exclude an adult use license issued for the License (as defined in the EPA) and current lease location.

Closing of the of the EPA (“Closing”) is subject to certain closing conditions, including, but not limited to, (i) state approval from the State of Ohio Board of Pharmacy or of any other department or agency of the State of Ohio that are required in connection with the acquisition of the Interests and the effect of the transactions contemplated by the EPA on the Licenses (as defined in the EPA) (the “State Approval”), (ii) landlord consent to the assignment of the existing lease including a valid purchase option to Purchaser, and (iii) consent of all debt lenders to the Issuer to release NMG OH from any security agreements or other agreements in connection with any applicable respective loan agreements. The Closing shall occur on the first day of the month following State Approval and satisfaction or waiver of all other closing conditions (the “Closing Date”).

Within 365 days of the Closing Date, the Purchaser shall deliver to DEP a Purchaser Adjustment Statement (as defined in the EPA) setting forth the (i) Closing Net Working Capital (as defined in the EPA), (ii) the Closing Indebtedness ( as defined in the EPA), (iii) the Closing Transaction Expenses (as defined in the EPA), (iv) the Closing Cash (as defined in the EPA), and (v) the resulting adjustment to the Cash Amount, if any, determined in accordance with Section 2.3(f) of the EPA. Based on the Accepted Adjustment Statement (as defined in the EPA), the parties shall determine if the Final Purchaser Price shall be adjusted upwards or downwards.

The Purchaser and DEP entered into a side letter agreement contemporaneously with the EPA (the “Side Agreement”) to set forth the terms of their mutual understanding relating to operations and certain business decisions of NMG OH during the period, starting at the signing of the EPA and up to and including the Closing Date of the EPA, which shall be the first day of the month following State Approval and as defined in the EPA (the “Pre-Takeover Period”) with respect to scope of business agreement, management fee and expenses, ownership and control, limited trade license, regulatory matters, and miscellaneous matters, all as more specifically set out in the Side Agreement.

The Company along with its subsidiaries, DEP Nevada, Inc. and the other guarantors, Nevada Medical Group, LLC, NMG OH 1, LLC, NMG OH P1, LLC, NMG Long Beach, LLC, NMG MI C1, Inc., NMG MI P1, Inc., NMG MI 1, Inc., NMG CA C1, LLC, NMG CA P1, LLC, NMG CA 1, LLC and NMG Cathedral City, LLC (each, a “Guarantor” and collectively, the “Guarantors”) previously entered into a loan agreement (the “Loan Agreement”) with FG Agency Lending, LLC (the “Agent”) and Bomind Holdings LLC (together with its successors and assigns, the “Lender”), dated July 19, 2021, as amended on November 30, 2021, on June 14, 2022, on December 12, 2022 and on December 16, 2022.

The Company, DEP, NMG OH, the Agent and the Lender entered into a consent agreement (the “Consent Agreement”) The Agent has presented a Consent Agreement (the “Consent Agreement”), wherein the Agent consented to the transaction contemplated in the EPA, including the sales of the Interests, has agreed to the provision of a UCC-3 Termination Statement and any applicable releases of all Liens (as defined in the EPA) on the assets and property of NMG OH to DEP and the Purchaser, provided certain conditions precedent and conditions subsequent are satisfied. The conditions subsequent of the Consent Agreement require DEP or any other Loan Party to cause the Agent to receive repayment upon the date or dates any funds are owed and/or paid to DEP or any other Loan Party (as defined in the Loan Agreement) pursuant to the EPA (any such date, a “Sale Payment Date”), in the amount of such proceeds (including the Deposit (as defined in the EPA), which shall be repaid to the Agent on the first Sale Payment Date after the effective date), which such repayment shall in each case be: (i) subject to the Exit Fee (as defined in the Loan Agreement), and (ii) applied to the principal balance at the premium rate of 105% so long as the final Sale Payment Date is on or before December 31, 2023, and at the premium rate of 107% any time thereafter. To the extent the Obligations (as defined in the Loan Agreement) are not repaid in full in cash on the Closing Date, the Loan Agreement shall remain in full force and effect, without any further modification thereto.

The foregoing descriptions of the EPA, the Side Agreement and the Consent Agreement do not purport to be complete and are qualified in their entirety by the EPA, the Side Agreement and the Consent Agreement, which are filed as Exhibits 10.1, 10.2 and 10.3 hereto, respectively, and are incorporated by reference herein.

SECTION 9 – FINANCIAL STATEMENTS AND EXHIBITS

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

Exhibit | | Description |

| | |

10.1 | | Equity Purchase Agreement by and among FarmaceuticalRX, LLC, NMG OH 1, LLC and DEP Nevada, Inc., dated July 21, 2023 |

| | |

10.2 | | Agreement by and among FarmaceuticalRX, LLC and DEP Nevada, Inc., dated July 21, 2023 |

| | |

10.3 | | Consent Agreement by and among Body and Mind Inc., DEP Nevada, Inc., NMG OH 1, LLC, FG Agency Lending LLC and Bomind Holdings LLC, dated July 21, 2023 |

| | |

104 | | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the inline XBRL document) |

__________

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| BODY AND MIND INC. | |

DATE: July 26, 2023 | By: | /s/ Michael Mills | |

| | Michael Mills | |

| | President, CEO and Director | |

__________

nullnullnull

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

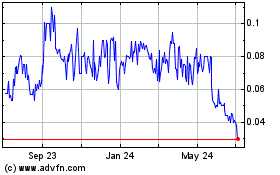

Body and Mind (QB) (USOTC:BMMJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

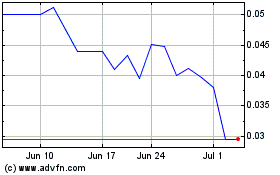

Body and Mind (QB) (USOTC:BMMJ)

Historical Stock Chart

From Apr 2023 to Apr 2024