Trump Social-Media SPAC's Shares Jump After SEC Settlement

July 21 2023 - 7:37AM

Dow Jones News

By Dean Seal

Shares of Digital World Acquisition Corp., the special-purpose

acquisition company aiming to merge with Donald Trump's media

company, are trading higher after the company resolved a regulatory

investigation with an $18 million fine.

The stock is up 20% at $16.15 in premarket trading. At

Thursday's close, shares were down 11% since the start of the year

and had fallen 59% over the past 12 months.

The U.S. Securities and Exchange Commission said late Thursday

that DWAC will pay the fine if it completes a combination with

Trump Media & Technology Group.

The agency had alleged that DWAC misled investors who

participated in its $287 million initial public offering in 2021.

The blank-check company told investors that it didn't have

discussions with a merger target prior to raising money, but its

officers had extensive merger discussions with Trump's company, the

SEC said.

DWAC first disclosed the likely settlement in early July, though

the SEC hadn't approved the deal yet.

The settlement clears one hurdle for DWAC's merger with Trump

Media & Technology, which will become publicly traded if the

SPAC tie-up is closed. The two parties have until September to

complete the combination.

If the deal doesn't close in time, DWAC will have to return the

millions it raised to investors. If it does so by January 2025, the

SEC will waive its penalty.

Write to Dean Seal at dean.seal@wsj.com

(END) Dow Jones Newswires

July 21, 2023 07:22 ET (11:22 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

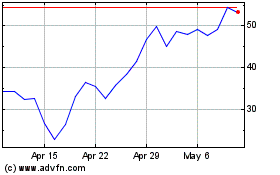

Trump Media and Technology (NASDAQ:DJT)

Historical Stock Chart

From Mar 2024 to Apr 2024

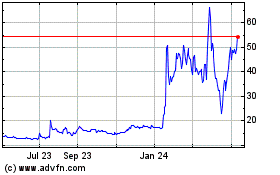

Trump Media and Technology (NASDAQ:DJT)

Historical Stock Chart

From Apr 2023 to Apr 2024