US Index Futures rose slightly premarket on Wednesday on

anticipation of corporate earnings, a day after the Dow Jones hit

its longest streak of gains since 2021.

By 6:52 AM, Dow Jones (DOWI:DJI) futures were up 38 points,

or 0.11%. S&P 500 futures were up 0.03%, while Nasdaq-100

futures were up 0.12%. The 10-year Treasury yield is at

3.752%.

European shares were higher, boosted by Kering shares after

changes in the luxury group’s top management. Furthermore, the

London market stabilized after data revealed a faster-than-expected

deceleration in British inflation. The British consumer price

index changed by 0.1% in June in the monthly comparison, with

market consensus expecting 0.40%. On an annual basis, the data

changed by 7.9% in June, against a market consensus of 8.20%.

On Wednesday’s American economic agenda, the Department of

Commerce will release data on housing construction starting in June

at 8:30 am. Economists polled by Dow Jones forecast a 9.3%

drop in new home construction from the previous month, following a

sharp 21.7% increase. Consensus estimates call for a 0.7% drop

in building permits in June, compared with the 5.2% gain recorded

the previous month. Crude Oil Inventories data for the week to

7/14 will be released at 10:30 AM. In addition, the US

government is going to hold this Wednesday, at 1 pm, the auction of

20-year Treasuries, whose objective is to finance public

expenses.

In commodities markets, West Texas Intermediate crude for August

is up 0.09% at $75.82 a barrel. Brent crude for September is

up 0.38% near $79.93 a barrel. Iron ore futures traded in

Dalian, China, fell 0.60%, at US$115.38 per tonne, once again in

the face of the cooling of the Chinese economy and in anticipation

of stimuli in the country.

At Tuesday’s close, the Dow jumped 366.58 points or 1.06% to

34,951.93 points. The S&P 500 rose 32.19 points or 0.71%

to 4,554.98 points. The Nasdaq Composite advanced 108.69

points or 0.76% to 14,353.64 points. The positive day was

driven by favorable results from Bank of America (NYSE:BAC) and

Morgan Stanley (NYSE:MS). However, economic activity data

disappointed, with retail sales and industrial production below

expectations. The market is now pricing in just one more

interest rate hike by the Fed. In Europe, there was a positive

day in the markets after members of the ECB suggested the

possibility of a pause in interest rate increases.

On the front of Wednesday’s corporate results, due before the

start of trading, earnings from Goldman Sachs (NYSE:GS), ASML

(NASDAQ:ASML), Halliburton (NYSE:HAL), US Bancorp (NYSE:USB) ,

Nasdaq (NASDAQ:NDAQ), Baker Hughes (NASDAQ:BKR), M&T Bank

(NYSE:MTB), among others. After the market close, among the

most highly anticipated reports are Tesla (NASDAQ:TSLA), Netflix

(NASDAQ:NFLX), United Airlines (NASDAQ:UAL), IBM (NYSE:IBM) and Las

Vegas Sands (NYSE:LVS) .

Wall Street Corporate Highlights for Today

Microsoft (NASDAQ:MSFT) – Microsoft stock

closed at a record high on Tuesday after announcing pricing for the

new Microsoft 365 service, which adds AI to the Office

suite. Copilot will cost $30 more per month, increasing

recurring revenue. The service is already being tested by

customers such as Goodyear (NASDAQ:GT)

and General Motors (NYSE:GM).

Alphabet (NASDAQ:GOOGL) – Google is

starting a pilot program restricting some employees’ internet

access to reduce the risk of cyberattacks. The measure aims to

protect data and prevent security incidents. The company seeks

to harden its internal systems against malicious threats.

Meta Platforms (NASDAQ:META) – Meta

announced the commercial launch of its open source AI model, Llama,

in partnership with Microsoft. Called Llama 2, the model will

be distributed through Microsoft’s Azure cloud service and will be

available for direct download and through other

providers. Meta hopes Llama will offer a free alternative to

the proprietary models sold by OpenAI and Google, threatening its

dominance in the generative AI software market.

Teladoc (NYSE:TDOC), Microsoft (NASDAQ:MSFT)

– Teladoc Health is expanding its partnership with Microsoft to

leverage the company’s artificial intelligence services to automate

clinical documentation on its telehealth platform. This

integration will help ease the workload of healthcare professionals

during virtual appointments. The use of AI has been actively

discussed in the healthcare industry as a way to deal with

administrative burden and staff shortages.

Twilio (NYSE:TWLO) – ARK funds continued

to acquire Twilio shares on Tuesday, bringing a total of $11.4

million in new purchases. The Fintech ETF added 18,099 shares,

the Innovation ETF acquired 146,801 shares and the Next Generation

Internet ETF added 26,620 shares, based on the closing price of the

share and corresponding to the dollar amount purchased on

Monday. Twilio represents more than 0.1% of the three

funds.

Tesla (NASDAQ:TSLA) – Tesla has applied

for approval to make changes to its factory near Berlin, with a

view to expanding it to become the largest car factory in

Europe. The company plans to double capacity to 1 million cars

a year and 100 gigawatt hours of battery production. In other

news, the US National Highway Traffic Safety Administration (NHTSA)

is conducting a special investigation into a fatal accident

involving a 2018 Tesla Model 3 that is suspected to have had

advanced driver assistance systems. The accident occurred in

South Lake Tahoe, California on July 5, resulting in two

fatalities.

United Airlines (NASDAQ:UAL) – United

Airlines pilots are turning down captain promotions due to

unpredictable schedules and poor quality of life. The

resulting shortage of captains could reduce the flights available

to travelers, impacting the company’s operation. Airlines are

facing challenges in attracting pilots to positions of greater

responsibility.

American Airlines (NASDAQ:AAL) – Pilots’

ratification of American Airlines’ new contract is in jeopardy as

United Airlines raised the benchmark with its own deal, according

to American’s pilots union. The union is seeking contract

improvements to meet industry standards and avoid falling behind

other airlines.

Altice USA (NYSE:ATUS) – Armando Pereira,

co-founder and former CEO of telecom group Altice, will appear

before a judge in Portugal as part of an investigation into

corruption. Altice tries to isolate the events, stating that

they are isolated to Portugal and individuals without executive

functions. Pereira no longer has a formal role, but his

influence on the group is profound. Altice faces significant

debt due to aggressive acquisitions. Altice USA’s purchasing

director was also placed on leave.

AT&T (NYSE:T) – AT&T has said it

will not immediately remove the lead cables from Lake Tahoe pending

further review, according to its court filing. The company

defended itself against the Wall Street Journal reports, arguing

that the cables represent only a small part of its network.

Rio Tinto (NYSE:RIO) – Rio Tinto has

reported production issues at its operations, citing concerns about

a global economic slowdown. However, the company expects its

iron ore production to be at the upper end of expectations for the

year. The fall in iron ore prices due to China’s real estate

sector may improve with the Chinese government’s momentum

policies. Rio also lowered its expectations for refined copper

production and faced challenges at its iron ore operations in

Canada.

Yum Brands (NYSE:YUM) – Taco Bell, owned

by Yum Brands, has successfully attempted to trademark the phrase

“Taco Tuesday” from competitor Taco John’s. Taco Bell argued

that the phrase was commonplace and that Taco John’s had wrongfully

monopolized it. Taco John’s has abandoned the mark and Taco

Bell is also seeking to cancel a separate trademark relating to the

expression. Taco Bell said it wanted to “clear” the phrase for

use by restaurants across the country.

Chipotle Mexican Grill (NYSE:CMG) – With

the opening of the first franchised restaurants in Kuwait and Dubai

next year, Chipotle is expanding its international

presence. Analysts see this as a good sign for the company’s

value, enabling opportunities for faster growth, although the focus

remains on the domestic business.

Constellation Brands (NYSE:STZ) –

Constellation Brands has agreed to appoint two new independent

directors and share confidential information with Elliott

Investment Management. The agreement aims to facilitate

collaboration and recognizes Constellation’s growth potential.

Pfizer (NYSE:PFE) – Pfizer and Flagship

Pioneering plan to invest $100 million to develop up to 10 new

drugs in areas including internal medicine, oncology, infectious

diseases and immunology. The companies will collaborate in the

discovery and development process, with Pfizer providing funding

and an option to purchase the drugs.

Goldman Sachs (NYSE:GS) – The Goldman

Sachs board expressed support for CEO David Solomon in his focus on

Wall Street’s core businesses and asset management. Despite

rising skepticism, the board is confident in Solomon’s ability to

revive the bank’s stock. The expected arrival of Tom Montag

also indicates internal support for Solomon’s recovery

plans. Though Goldman’s shares have fallen this year, the bank

remains one of the top mergers and acquisitions advisors

globally.

Bank of America (NYSE:BAC) – New York’s

pension authority asked Bank of America’s board to recover

executive pay after the bank agreed to pay a $250 million

fine. The city controller demanded transparency on payment

recovery and internal reporting.

Morgan

Stanley (NYSE:MS), Mitsubishi UFJ

Financial Group (NYSE:MUFG) – Mitsubishi UFJ

Financial Group and Morgan Stanley announced an expansion of their

15-year alliance, combining some operations in their Japanese

brokerage joint ventures. The collaboration will include

equity research, sales and execution services, as well as

reorganizing the equity underwriting business. The two

companies will also collaborate on foreign exchange

trading. The partnership builds on MUFG’s $9 billion

investment in Morgan Stanley in 2008.

Morgan Stanley (NYSE:MS) – Morgan Stanley is

moving more than 200 technology developers from mainland China to

Hong Kong and Singapore in response to the country’s restrictions

on accessing data stored on land. The bank’s remaining team is

building an autonomous system in China to comply with local

regulations. These changes reflect multinationals’ growing

caution about data security in China. In other news, Morgan

Stanley’s expense reduction efforts resulted in termination costs

of $308 million in the second quarter, after eliminating about

3,000 jobs. The investment bank has faced spending pressures,

and similar cuts have occurred at other Wall Street investment

banks. Compensation expenses also increased in the period.

Grab Holdings (NASDAQ:GRAB) – GXS Bank,

Grab Holdings’ new digital bank, has increased the deposit limit on

its Singapore savings account from S$5,000 to S$75,000. This

indicates that the Monetary Authority of Singapore has raised the

limit previously imposed on the company. This change is an

advantage for GXS Bank to compete with traditional

banks. Other Grab-backed digital banks are also pushing for

higher deposit limits.

Blackstone (NYSE:BX) – Blackstone Group LP

will invest $150 million in Astaris Capital Management, a firm

specializing in event-driven investing in Europe. The

investment will be split between Astaris’ existing hedge fund and a

new pool of capital. Blackstone is making the investment

through its Strategic Alliance Fund IV.

Yellow Corp (NASDAQ:YELL) – The

International Brotherhood of Teamsters issued a strike notice

Tuesday, citing Yellow Corp’s failure to make a crucial payment to

health and pension funds. The union warned that benefits could

be suspended if payment is not made, while analysts predict

negative impacts for Yellow and opportunities for competing

companies such as Old Dominion Freight

Line (NASDAQ:ODFL) and ArcBest

Corp (NASDAQ:ARCB).

Cracker Barrel (NASDAQ:CBRL) – Investors

in Cracker Barrel Old Country Store Inc. reacted positively on

Tuesday following the announcement of a leadership change. CEO

Sandra Cochran will step down after 12 years, to be succeeded by

Julie Felss Masino starting in November. The leadership

transition comes after a period in which the company faced

challenges related to financial results and marketing actions.

Earnings

ASML (NASDAQ:ASML) – ASML is up 0.4% in

premarket trading on Wednesday after it posted higher revenue and

profit in the second quarter, but warned of future economic

uncertainties. The company raised its 2023 outlook, driven by

strong demand for its lithography machines. However, the CEO

highlighted macroeconomic uncertainties and possible US export

restrictions to China. The company reported net profit of 1.9

billion euros, against 1.82 billion euros expected, and expects net

sales in the third quarter of this year to be between 6.5 billion

euros and 7 billion euros.

Interactive Brokers (NASDAQ:IBKR) –

Interactive Brokers reported second-quarter results that were below

expectations. According to Refinitiv, the brokerage reported

adjusted earnings of $1.32 per share, below the average estimate of

$1.40 per share.

Carvana (NYSE:CVNA) – The online auto

retailer took a 7.7% drop in premarket trading on Wednesday after

it announced it will delay reporting its second-quarter results to

the previously scheduled August 3 for today.

Omnicom Group (NYSE:OMC) – The global

marketing company reported second-quarter revenue of $3.61 billion,

missing forecasts of $3.67 billion, according to FactSet consensus

estimates. Omnicom slightly beat earnings expectations, with

adjusted earnings of $1.81 per share, compared to consensus

estimates of $1.80 per share.

JB Hunt (NASDAQ:JBHT) – JB Hunt Transport

Services reported second-quarter earnings of $1.81 per share, along

with revenue of $3.13 billion. Analyst expectations polled by

Refinitiv were for earnings per share of $1.92 on revenue of $3.31

billion.

Western Alliance Bancorporation (NYSE:WAL)

– Western Alliance reported earnings of $1.96 per share, below the

consensus estimate of $1.98 per share, according to

Refinitiv. However, revenue for the quarter reached $669

million, beating the forecast of $652 million. The bank also

reported an increase in deposits during the quarter.

United Community Banks

Inc (NASDAQ:UCBI) – United Community Banks

reported lower-than-expected second-quarter

results. Competition for new customers has increased costs,

while higher interest rates have made borrowing more

difficult. Still, the bank recorded an increase in loans and

deposits. Management cited price competition from deposits as

a challenge.

Morgan Stanley (NYSE:MS) – Morgan Stanley

beat second-quarter earnings estimates, driven by growth in the

wealth management business. Net income for the wealth

management unit reached a record $6.7 billion. CEO James

Gorman expressed optimism about the economic environment and

stressed that the choice of successor will not be based solely on

the performance of business units.

BNY Mellon (NYSE:BK) – Bank of New York

Mellon Corp beat second-quarter earnings expectations, boosted by

Federal Reserve tightening policies. Net interest income

increased 33%, while adjusted earnings per share beat analysts’

average estimate. The bank has also seen an increase in assets

under custody or administration.

Charles Schwab (NYSE:SCHW) – Charles

Schwab reported a smaller-than-expected decline in second-quarter

profit, driven by rising asset management fees. While interest

income declined, the company saw an increase in fund inflows,

building confidence in a future recovery. Adjusted earnings

per share beat analyst estimates.

Lockheed Martin (NYSE:LMT) – Lockheed

Martin raised its full-year sales and profit outlook due to demand

for military equipment driven by geopolitical uncertainty. The

company reported second-quarter net income of $6.63 per share,

above Wall Street estimates of $6.45 per share, according to

Refinitiv data. Quarterly net sales increased 8.1% to $16.69

billion, beating expectations of $15.92 billion.

Market view

Joby Aviation (NYSE:JOBY) – JP Morgan

downgraded shares of electric air taxi maker Joby Aviation from

“Neutral” to “Underweight”. However, the price target was

raised from $5 to $6. As a result, the stock fell 8.8% in

Wednesday’s premarket trade to hit $9.17.

Citigroup (NYSE:C) – Citigroup has been

upgraded from “Hold” to “Buy” by Odeon Capital.

UnitedHealth

Group (NYSE:UNH) – UnitedHealth rose

3.3% on Tuesday after the healthcare provider was upgraded to

“Outperform” from “Market Perform” by Bernstein.

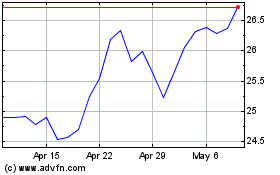

United Communty Banks (NASDAQ:UCBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

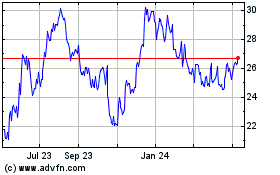

United Communty Banks (NASDAQ:UCBI)

Historical Stock Chart

From Apr 2023 to Apr 2024