United Community Banks, Inc. (NASDAQ: UCBI) (United) today

announced that net income for the 2023 first quarter was $62.3

million and pre-tax, pre-provision income was $101.9 million.

Diluted earnings per share of $0.52 for the quarter represented an

increase of $0.09 or 21%, from the first quarter a year ago and a

decrease of $0.22 or 30% from the fourth quarter of 2022. On an

operating basis, United’s diluted earnings per share of $0.58 was

up 16% from the year-ago quarter. The primary drivers of the

increased earnings per share year-over-year were increased interest

rates and organic loan growth. The linked-quarter decrease in

earnings per share was primarily driven by higher deposit and

borrowed funds interest cost as well as changes in deposit

composition toward more expensive time deposits during the quarter.

United’s return on assets was 0.95%, or 1.06% on an operating

basis. Return on equity was 7.3% and return on tangible common

equity was 11.6%. On a pre-tax, pre-provision basis, operating

return on assets was 1.71% for the quarter. At quarter end,

tangible common equity to tangible assets was 8.2%, up 29 basis

points from the fourth quarter of 2022.

Chairman and CEO Lynn Harton stated, “This was

another solid quarter for United. Deposit growth reflected the

strength of our customer franchise, and our loan growth was within

our stated target range of mid to high single digits. While our net

interest margin did contract from the previous quarter due to

higher deposit costs, we continued to generate strong returns and

strengthen our balance sheet.” Harton continued, “On the strategic

front, we continue to expand the company into exciting growth

markets that we know and where we can partner with organizations

that align with our values and culture. We are very glad to welcome

Progress officially into the United team, adding to our growth

opportunities in Alabama and the Florida Panhandle. Our recently

announced partnership with First National Bank of South Miami will

also bring great opportunities and a talented team to the company.

I couldn’t be more excited to welcome them to our team.”

United’s net interest margin decreased by 15

basis points to 3.61% from the fourth quarter. The average yield on

United’s interest-earning assets was up 44 basis points to 4.76%,

but its cost of deposits increased by 61 basis points to 1.10%,

leading to the reduction in the net interest margin. Net

charge-offs were $7.1 million or 0.17% of average loans during the

quarter, flat compared to the fourth quarter of 2022, and NPAs were

28 basis points relative to total assets, up 10 basis points from

the previous quarter.

Mr. Harton concluded, “We continue to believe

that 2023 will be a great year for United, despite the uncertainty

in the economic environment. We remain focused on being a great

partner for our clients and communities; growing our business and

being prepared to manage through any challenges that lie ahead. We

continue to strengthen our teams, recruiting great bankers and

adding new locations, most recently in Atlanta and Charleston,

South Carolina. Consistent with building for our future, we also

recently announced a refresh of our brand with a new logo to be

rolled out to our markets through 2024. While the brand will

present itself as more modern and forward-looking, it also

continues to symbolize our commitment to service and to community

that has been our focus for more than 70 years.”

First Quarter 2023 Financial

Highlights:

- Net income of $62.3 million and

pre-tax, pre-provision income of $101.9 million

- EPS increased by 21% compared to

first quarter 2022 on a GAAP basis and 16% on an operating basis;

compared to fourth quarter 2022, EPS decreased 30% on a GAAP basis

and 23% on an operating basis

- Return on assets of 0.95%, or 1.06%

on an operating basis

- Pre-tax, pre-provision return on

assets of 1.71% on an operating basis

- Return on common equity of 7.3%

- Return on tangible common equity of

11.6% on an operating basis

- A provision for credit losses of

$21.8 million, which decreased the allowance for loan losses to

1.03% of loans from 1.04% in the fourth quarter. The first quarter

provision included $10.4 million to establish an initial allowance

on loans acquired in the Progress transaction.

- Loan production of $1.4 billion,

resulting in organic loan growth, excluding acquired Progress

balances, of 8% annualized for the quarter

- Customer deposits were up $525

million, or 10% annualized, excluding acquired Progress

balances

- Total deposits

are estimated to be 76% insured or collateralized

- Net interest

margin of 3.61% was down 15 basis points from the fourth quarter

due to increased deposit costs

- Mortgage closings of $225 million

compared to $462 million a year ago; mortgage rate locks of $335

million compared to $757 million a year ago

- Noninterest income was down $3.1

million on a linked quarter basis, primarily driven by lower

positive marks on certain equity and limited partnership

investments, lower services charges and fees and securities losses,

partially offset by higher mortgage fees

- Noninterest expenses increased by

$22.5 million compared to the fourth quarter on a GAAP basis and by

$15.3 million on an operating basis, mostly due to closing the

Progress acquisition on January 3, 2023

- Efficiency ratio of 57.2%, or 53.7%

on an operating basis

- Net charge-offs

of $7.1 million, or 17 basis points as a percent of average loans,

flat from the net charge-offs level experienced in the fourth

quarter

- Nonperforming assets of 0.28% of

total assets, up 10 basis points compared to December 31, 2022

- Quarterly common shareholder

dividend of $0.23 per share declared during the quarter, an

increase of 10% year-over-year

- We completed the acquisition of

Progress Financial Corporation and its banking subsidiary Progress

Bank and Trust with $1.8 billion in assets on January 3, 2023;

financial returns are expected to be within our desired

thresholds

Conference Call

United will hold a conference call on Wednesday,

April 19, 2023, at 11 a.m. ET to discuss the contents of this press

release and to share business highlights for the quarter.

Participants can pre-register for the conference call by navigating

to

https://dpregister.com/sreg/10177198/f8dc6d5780.

Those without internet access or unable to pre-register may dial in

by calling 1-866-777-2509. Participants are encouraged to dial in

15 minutes prior to the call start time. The conference call also

will be webcast and can be accessed by selecting “Events and

Presentations” under “News and Events” within the Investor

Relations section of the company's website, www.ucbi.com.

| UNITED

COMMUNITY BANKS, INC. |

|

|

|

|

|

|

| Selected

Financial Information |

|

|

|

|

|

|

|

(in thousands, except per share data) |

|

|

|

|

|

|

|

|

|

|

2023 |

|

|

|

2022 |

|

|

First Quarter

2023 - 2022

Change |

| |

|

First Quarter |

|

Fourth Quarter |

|

Third Quarter |

|

Second Quarter |

|

First Quarter |

|

| INCOME

SUMMARY |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest revenue |

|

$ |

279,487 |

|

|

$ |

240,831 |

|

|

$ |

213,887 |

|

|

$ |

187,378 |

|

|

$ |

171,059 |

|

|

|

| Interest expense |

|

|

68,017 |

|

|

|

30,943 |

|

|

|

14,113 |

|

|

|

8,475 |

|

|

|

7,267 |

|

|

|

|

Net interest revenue |

|

|

211,470 |

|

|

|

209,888 |

|

|

|

199,774 |

|

|

|

178,903 |

|

|

|

163,792 |

|

|

29 |

% |

| Provision for credit

losses |

|

|

21,783 |

|

|

|

19,831 |

|

|

|

15,392 |

|

|

|

5,604 |

|

|

|

23,086 |

|

|

|

| Noninterest income |

|

|

30,209 |

|

|

|

33,354 |

|

|

|

31,922 |

|

|

|

33,458 |

|

|

|

38,973 |

|

|

(22 |

) |

|

Total revenue |

|

|

219,896 |

|

|

|

223,411 |

|

|

|

216,304 |

|

|

|

206,757 |

|

|

|

179,679 |

|

|

22 |

|

| Noninterest expenses |

|

|

139,805 |

|

|

|

117,329 |

|

|

|

112,755 |

|

|

|

120,790 |

|

|

|

119,275 |

|

|

17 |

|

|

Income before income tax expense |

|

|

80,091 |

|

|

|

106,082 |

|

|

|

103,549 |

|

|

|

85,967 |

|

|

|

60,404 |

|

|

33 |

|

| Income tax expense |

|

|

17,791 |

|

|

|

24,632 |

|

|

|

22,388 |

|

|

|

19,125 |

|

|

|

12,385 |

|

|

44 |

|

|

Net income |

|

|

62,300 |

|

|

|

81,450 |

|

|

|

81,161 |

|

|

|

66,842 |

|

|

|

48,019 |

|

|

30 |

|

| Merger-related and other

charges |

|

|

8,631 |

|

|

|

1,470 |

|

|

|

1,746 |

|

|

|

7,143 |

|

|

|

9,016 |

|

|

|

| Income tax benefit of

merger-related and other charges |

|

|

(1,955 |

) |

|

|

(323 |

) |

|

|

(385 |

) |

|

|

(1,575 |

) |

|

|

(1,963 |

) |

|

|

|

Net income - operating (1) |

|

$ |

68,976 |

|

|

$ |

82,597 |

|

|

$ |

82,522 |

|

|

$ |

72,410 |

|

|

$ |

55,072 |

|

|

25 |

|

|

Pre-tax pre-provision income

(5) |

|

$ |

101,874 |

|

|

$ |

125,913 |

|

|

$ |

118,941 |

|

|

$ |

91,571 |

|

|

$ |

83,490 |

|

|

22 |

|

| PERFORMANCE

MEASURES |

|

|

|

|

|

|

|

|

|

|

|

|

| Per common

share: |

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted net income - GAAP |

|

$ |

0.52 |

|

|

$ |

0.74 |

|

|

$ |

0.74 |

|

|

$ |

0.61 |

|

|

$ |

0.43 |

|

|

21 |

|

| Diluted net income - operating

(1) |

|

|

0.58 |

|

|

|

0.75 |

|

|

|

0.75 |

|

|

|

0.66 |

|

|

|

0.50 |

|

|

16 |

|

| Cash dividends declared |

|

|

0.23 |

|

|

|

0.22 |

|

|

|

0.22 |

|

|

|

0.21 |

|

|

|

0.21 |

|

|

10 |

|

| Book value |

|

|

25.76 |

|

|

|

24.38 |

|

|

|

23.78 |

|

|

|

23.96 |

|

|

|

24.38 |

|

|

6 |

|

| Tangible book value (3) |

|

|

17.59 |

|

|

|

17.13 |

|

|

|

16.52 |

|

|

|

16.68 |

|

|

|

17.08 |

|

|

3 |

|

| Key performance

ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

| Return on common equity - GAAP

(2)(4) |

|

|

7.34 |

% |

|

|

10.86 |

% |

|

|

11.02 |

% |

|

|

9.31 |

% |

|

|

6.80 |

% |

|

|

| Return on common equity -

operating (1)(2)(4) |

|

|

8.15 |

|

|

|

11.01 |

|

|

|

11.21 |

|

|

|

10.10 |

|

|

|

7.83 |

|

|

|

|

Return on tangible common equity - operating (1)(2)(3)(4) |

|

|

11.63 |

|

|

|

15.20 |

|

|

|

15.60 |

|

|

|

14.20 |

|

|

|

11.00 |

|

|

|

| Return on assets - GAAP

(4) |

|

|

0.95 |

|

|

|

1.33 |

|

|

|

1.32 |

|

|

|

1.08 |

|

|

|

0.78 |

|

|

|

| Return on assets - operating

(1)(4) |

|

|

1.06 |

|

|

|

1.35 |

|

|

|

1.34 |

|

|

|

1.17 |

|

|

|

0.89 |

|

|

|

| Return on assets - pre-tax

pre-provision (4)(5) |

|

|

1.58 |

|

|

|

2.07 |

|

|

|

1.94 |

|

|

|

1.49 |

|

|

|

1.37 |

|

|

|

| Return on assets - pre-tax

pre-provision, excluding merger- related and other charges

(1)(4)(5) |

|

|

1.71 |

|

|

|

2.09 |

|

|

|

1.97 |

|

|

|

1.60 |

|

|

|

1.52 |

|

|

|

| Net interest margin (fully

taxable equivalent) (4) |

|

|

3.61 |

|

|

|

3.76 |

|

|

|

3.57 |

|

|

|

3.19 |

|

|

|

2.97 |

|

|

|

| Efficiency ratio - GAAP |

|

|

57.20 |

|

|

|

47.95 |

|

|

|

48.41 |

|

|

|

56.58 |

|

|

|

57.43 |

|

|

|

| Efficiency ratio - operating

(1) |

|

|

53.67 |

|

|

|

47.35 |

|

|

|

47.66 |

|

|

|

53.23 |

|

|

|

53.09 |

|

|

|

| Equity to total assets |

|

|

11.90 |

|

|

|

11.25 |

|

|

|

11.12 |

|

|

|

10.95 |

|

|

|

11.06 |

|

|

|

| Tangible common equity to

tangible assets (3) |

|

|

8.17 |

|

|

|

7.88 |

|

|

|

7.70 |

|

|

|

7.59 |

|

|

|

7.72 |

|

|

|

| ASSET

QUALITY |

|

|

|

|

|

|

|

|

|

|

|

|

| Nonperforming assets

("NPAs") |

|

$ |

73,403 |

|

|

$ |

44,281 |

|

|

$ |

35,511 |

|

|

$ |

34,428 |

|

|

$ |

40,816 |

|

|

80 |

|

| Allowance for credit losses -

loans |

|

|

176,534 |

|

|

|

159,357 |

|

|

|

148,502 |

|

|

|

136,925 |

|

|

|

132,805 |

|

|

33 |

|

| Allowance for credit losses -

total |

|

|

197,923 |

|

|

|

180,520 |

|

|

|

167,300 |

|

|

|

153,042 |

|

|

|

146,369 |

|

|

35 |

|

| Net charge-offs

(recoveries) |

|

|

7,084 |

|

|

|

6,611 |

|

|

|

1,134 |

|

|

|

(1,069 |

) |

|

|

2,978 |

|

|

|

| Allowance for credit losses -

loans to loans |

|

|

1.03 |

% |

|

|

1.04 |

% |

|

|

1.00 |

% |

|

|

0.94 |

% |

|

|

0.93 |

% |

|

|

| Allowance for credit losses -

total to loans |

|

|

1.16 |

|

|

|

1.18 |

|

|

|

1.12 |

|

|

|

1.05 |

|

|

|

1.02 |

|

|

|

| Net charge-offs to average

loans (4) |

|

|

0.17 |

|

|

|

0.17 |

|

|

|

0.03 |

|

|

|

(0.03 |

) |

|

|

0.08 |

|

|

|

| NPAs to total assets |

|

|

0.28 |

|

|

|

0.18 |

|

|

|

0.15 |

|

|

|

0.14 |

|

|

|

0.17 |

|

|

|

| AT PERIOD END ($ in

millions) |

|

|

|

|

|

|

|

|

|

|

|

|

| Loans |

|

$ |

17,125 |

|

|

$ |

15,335 |

|

|

$ |

14,882 |

|

|

$ |

14,541 |

|

|

$ |

14,316 |

|

|

20 |

|

| Investment securities |

|

|

5,915 |

|

|

|

6,228 |

|

|

|

6,539 |

|

|

|

6,683 |

|

|

|

6,410 |

|

|

(8 |

) |

| Total assets |

|

|

25,872 |

|

|

|

24,009 |

|

|

|

23,688 |

|

|

|

24,213 |

|

|

|

24,374 |

|

|

6 |

|

| Deposits |

|

|

22,005 |

|

|

|

19,877 |

|

|

|

20,321 |

|

|

|

20,873 |

|

|

|

21,056 |

|

|

5 |

|

| Shareholders’ equity |

|

|

3,078 |

|

|

|

2,701 |

|

|

|

2,635 |

|

|

|

2,651 |

|

|

|

2,695 |

|

|

14 |

|

| Common shares outstanding

(thousands) |

|

|

115,152 |

|

|

|

106,223 |

|

|

|

106,163 |

|

|

|

106,034 |

|

|

|

106,025 |

|

|

9 |

|

(1) Excludes merger-related and other charges.

(2) Net income less preferred stock dividends, divided by average

realized common equity, which excludes accumulated other

comprehensive income (loss). (3) Excludes effect of acquisition

related intangibles and associated amortization. (4) Annualized.

(5) Excludes income tax expense and provision for credit

losses.

| UNITED

COMMUNITY BANKS,

INC. |

|

|

|

|

| Non-GAAP

Performance Measures Reconciliation |

| Selected

Financial

Information |

|

|

|

|

|

(in thousands, except per share

data) |

|

|

|

|

|

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

FirstQuarter |

|

Fourth Quarter |

|

Third Quarter |

|

Second Quarter |

|

First Quarter |

| |

|

|

|

|

|

|

|

|

|

|

| Noninterest expense

reconciliation |

|

|

|

|

|

|

|

|

|

|

|

Noninterest expenses (GAAP) |

|

$ |

139,805 |

|

|

$ |

117,329 |

|

|

$ |

112,755 |

|

|

$ |

120,790 |

|

|

$ |

119,275 |

|

| Merger-related and other

charges |

|

|

(8,631 |

) |

|

|

(1,470 |

) |

|

|

(1,746 |

) |

|

|

(7,143 |

) |

|

|

(9,016 |

) |

|

Noninterest expenses - operating |

|

$ |

131,174 |

|

|

$ |

115,859 |

|

|

$ |

111,009 |

|

|

$ |

113,647 |

|

|

$ |

110,259 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Net income

reconciliation |

|

|

|

|

|

|

|

|

|

|

| Net income (GAAP) |

|

$ |

62,300 |

|

|

$ |

81,450 |

|

|

$ |

81,161 |

|

|

$ |

66,842 |

|

|

$ |

48,019 |

|

| Merger-related and other

charges |

|

|

8,631 |

|

|

|

1,470 |

|

|

|

1,746 |

|

|

|

7,143 |

|

|

|

9,016 |

|

| Income tax benefit of

merger-related and other charges |

|

|

(1,955 |

) |

|

|

(323 |

) |

|

|

(385 |

) |

|

|

(1,575 |

) |

|

|

(1,963 |

) |

|

Net income - operating |

|

$ |

68,976 |

|

|

$ |

82,597 |

|

|

$ |

82,522 |

|

|

$ |

72,410 |

|

|

$ |

55,072 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Net income to pre-tax

pre-provision income reconciliation |

|

|

|

|

|

|

|

|

|

|

| Net income (GAAP) |

|

$ |

62,300 |

|

|

$ |

81,450 |

|

|

$ |

81,161 |

|

|

$ |

66,842 |

|

|

$ |

48,019 |

|

| Income tax expense |

|

|

17,791 |

|

|

|

24,632 |

|

|

|

22,388 |

|

|

|

19,125 |

|

|

|

12,385 |

|

| Provision for credit

losses |

|

|

21,783 |

|

|

|

19,831 |

|

|

|

15,392 |

|

|

|

5,604 |

|

|

|

23,086 |

|

|

Pre-tax pre-provision income |

|

$ |

101,874 |

|

|

$ |

125,913 |

|

|

$ |

118,941 |

|

|

$ |

91,571 |

|

|

$ |

83,490 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Diluted income per

common share reconciliation |

|

|

|

|

|

|

|

|

|

|

| Diluted income per common

share (GAAP) |

|

$ |

0.52 |

|

|

$ |

0.74 |

|

|

$ |

0.74 |

|

|

$ |

0.61 |

|

|

$ |

0.43 |

|

| Merger-related and other

charges, net of tax |

|

|

0.06 |

|

|

|

0.01 |

|

|

|

0.01 |

|

|

|

0.05 |

|

|

|

0.07 |

|

|

Diluted income per common share - operating |

|

$ |

0.58 |

|

|

$ |

0.75 |

|

|

$ |

0.75 |

|

|

$ |

0.66 |

|

|

$ |

0.50 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Book value per common

share reconciliation |

|

|

|

|

|

|

|

|

|

|

| Book value per common share

(GAAP) |

|

$ |

25.76 |

|

|

$ |

24.38 |

|

|

$ |

23.78 |

|

|

$ |

23.96 |

|

|

$ |

24.38 |

|

| Effect of goodwill and other

intangibles |

|

|

(8.17 |

) |

|

|

(7.25 |

) |

|

|

(7.26 |

) |

|

|

(7.28 |

) |

|

|

(7.30 |

) |

|

Tangible book value per common share |

|

$ |

17.59 |

|

|

$ |

17.13 |

|

|

$ |

16.52 |

|

|

$ |

16.68 |

|

|

$ |

17.08 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Return on tangible

common equity reconciliation |

|

|

|

|

|

|

|

|

|

|

| Return on common equity

(GAAP) |

|

|

7.34 |

% |

|

|

10.86 |

% |

|

|

11.02 |

% |

|

|

9.31 |

% |

|

|

6.80 |

% |

| Merger-related and other

charges, net of tax |

|

|

0.81 |

|

|

|

0.15 |

|

|

|

0.19 |

|

|

|

0.79 |

|

|

|

1.03 |

|

| Return on common equity -

operating |

|

|

8.15 |

|

|

|

11.01 |

|

|

|

11.21 |

|

|

|

10.10 |

|

|

|

7.83 |

|

| Effect of goodwill and other

intangibles |

|

|

3.48 |

|

|

|

4.19 |

|

|

|

4.39 |

|

|

|

4.10 |

|

|

|

3.17 |

|

|

Return on tangible common equity - operating |

|

|

11.63 |

% |

|

|

15.20 |

% |

|

|

15.60 |

% |

|

|

14.20 |

% |

|

|

11.00 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| Return on assets

reconciliation |

|

|

|

|

|

|

|

|

|

|

| Return on assets (GAAP) |

|

|

0.95 |

% |

|

|

1.33 |

% |

|

|

1.32 |

% |

|

|

1.08 |

% |

|

|

0.78 |

% |

| Merger-related and other

charges, net of tax |

|

|

0.11 |

|

|

|

0.02 |

|

|

|

0.02 |

|

|

|

0.09 |

|

|

|

0.11 |

|

|

Return on assets - operating |

|

|

1.06 |

% |

|

|

1.35 |

% |

|

|

1.34 |

% |

|

|

1.17 |

% |

|

|

0.89 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| Return on assets to

return on assets- pre-tax pre-provision

reconciliation |

|

|

|

|

|

|

|

|

|

|

| Return on assets (GAAP) |

|

|

0.95 |

% |

|

|

1.33 |

% |

|

|

1.32 |

% |

|

|

1.08 |

% |

|

|

0.78 |

% |

| Income tax expense |

|

|

0.29 |

|

|

|

0.41 |

|

|

|

0.37 |

|

|

|

0.32 |

|

|

|

0.20 |

|

| (Release of) provision for

credit losses |

|

|

0.34 |

|

|

|

0.33 |

|

|

|

0.25 |

|

|

|

0.09 |

|

|

|

0.39 |

|

|

Return on assets - pre-tax, pre-provision |

|

|

1.58 |

|

|

|

2.07 |

|

|

|

1.94 |

|

|

|

1.49 |

|

|

|

1.37 |

|

| Merger-related and other

charges |

|

|

0.13 |

|

|

|

0.02 |

|

|

|

0.03 |

|

|

|

0.11 |

|

|

|

0.15 |

|

|

Return on assets - pre-tax pre-provision, excluding merger-related

and other charges |

|

|

1.71 |

% |

|

|

2.09 |

% |

|

|

1.97 |

% |

|

|

1.60 |

% |

|

|

1.52 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| Efficiency ratio

reconciliation |

|

|

|

|

|

|

|

|

|

|

| Efficiency ratio (GAAP) |

|

|

57.20 |

% |

|

|

47.95 |

% |

|

|

48.41 |

% |

|

|

56.58 |

% |

|

|

57.43 |

% |

| Merger-related and other

charges |

|

|

(3.53 |

) |

|

|

(0.60 |

) |

|

|

(0.75 |

) |

|

|

(3.35 |

) |

|

|

(4.34 |

) |

|

Efficiency ratio - operating |

|

|

53.67 |

% |

|

|

47.35 |

% |

|

|

47.66 |

% |

|

|

53.23 |

% |

|

|

53.09 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| Tangible common equity

to tangible assets reconciliation |

|

|

|

|

|

|

|

|

|

|

| Equity to total assets

(GAAP) |

|

|

11.90 |

% |

|

|

11.25 |

% |

|

|

11.12 |

% |

|

|

10.95 |

% |

|

|

11.06 |

% |

| Effect of goodwill and other

intangibles |

|

|

(3.36 |

) |

|

|

(2.97 |

) |

|

|

(3.01 |

) |

|

|

(2.96 |

) |

|

|

(2.94 |

) |

| Effect of preferred

equity |

|

|

(0.37 |

) |

|

|

(0.40 |

) |

|

|

(0.41 |

) |

|

|

(0.40 |

) |

|

|

(0.40 |

) |

|

Tangible common equity to tangible assets |

|

|

8.17 |

% |

|

|

7.88 |

% |

|

|

7.70 |

% |

|

|

7.59 |

% |

|

|

7.72 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| UNITED

COMMUNITY BANKS,

INC. |

|

|

|

|

|

|

| Financial

Highlights |

|

|

|

|

|

Loan Portfolio Composition at

Period-End |

|

|

|

|

|

|

|

2023 |

|

|

2022 |

|

Linked Quarter Change |

|

Year over Year Change |

| (in millions) |

First Quarter |

|

Fourth Quarter |

|

Third Quarter |

|

Second Quarter |

|

First Quarter |

|

|

| LOANS BY

CATEGORY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owner occupied commercial RE |

$ |

3,141 |

|

$ |

2,735 |

|

$ |

2,700 |

|

$ |

2,681 |

|

$ |

2,638 |

|

$ |

406 |

|

|

$ |

503 |

|

| Income producing commercial

RE |

|

3,611 |

|

|

3,262 |

|

|

3,299 |

|

|

3,273 |

|

|

3,328 |

|

|

349 |

|

|

|

283 |

|

| Commercial &

industrial |

|

2,442 |

|

|

2,252 |

|

|

2,238 |

|

|

2,253 |

|

|

2,336 |

|

|

190 |

|

|

|

106 |

|

| Commercial construction |

|

1,806 |

|

|

1,598 |

|

|

1,514 |

|

|

1,514 |

|

|

1,482 |

|

|

208 |

|

|

|

324 |

|

| Equipment financing |

|

1,447 |

|

|

1,374 |

|

|

1,281 |

|

|

1,211 |

|

|

1,148 |

|

|

73 |

|

|

|

299 |

|

|

Total commercial |

|

12,447 |

|

|

11,221 |

|

|

11,032 |

|

|

10,932 |

|

|

10,932 |

|

|

1,226 |

|

|

|

1,515 |

|

| Residential mortgage |

|

2,756 |

|

|

2,355 |

|

|

2,149 |

|

|

1,997 |

|

|

1,826 |

|

|

401 |

|

|

|

930 |

|

| Home equity lines of

credit |

|

930 |

|

|

850 |

|

|

832 |

|

|

801 |

|

|

778 |

|

|

80 |

|

|

|

152 |

|

| Residential construction |

|

492 |

|

|

443 |

|

|

423 |

|

|

381 |

|

|

368 |

|

|

49 |

|

|

|

124 |

|

| Manufactured housing |

|

326 |

|

|

317 |

|

|

301 |

|

|

287 |

|

|

269 |

|

|

9 |

|

|

|

57 |

|

| Consumer |

|

174 |

|

|

149 |

|

|

145 |

|

|

143 |

|

|

143 |

|

|

25 |

|

|

|

31 |

|

|

Total loans |

$ |

17,125 |

|

$ |

15,335 |

|

$ |

14,882 |

|

$ |

14,541 |

|

$ |

14,316 |

|

$ |

1,790 |

|

|

$ |

2,809 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| LOANS BY

MARKET |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Georgia |

$ |

4,177 |

|

$ |

4,051 |

|

$ |

4,003 |

|

$ |

3,960 |

|

$ |

3,879 |

|

$ |

126 |

|

|

$ |

298 |

|

| South Carolina |

|

2,672 |

|

|

2,587 |

|

|

2,516 |

|

|

2,377 |

|

|

2,323 |

|

|

85 |

|

|

|

349 |

|

| North Carolina |

|

2,257 |

|

|

2,186 |

|

|

2,117 |

|

|

2,006 |

|

|

1,879 |

|

|

71 |

|

|

|

378 |

|

| Tennessee |

|

2,458 |

|

|

2,507 |

|

|

2,536 |

|

|

2,621 |

|

|

2,661 |

|

|

(49 |

) |

|

|

(203 |

) |

| Florida |

|

1,745 |

|

|

1,308 |

|

|

1,259 |

|

|

1,235 |

|

|

1,208 |

|

|

437 |

|

|

|

537 |

|

| Alabama |

|

1,029 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1,029 |

|

|

|

1,029 |

|

| Commercial Banking

Solutions |

|

2,787 |

|

|

2,696 |

|

|

2,451 |

|

|

2,342 |

|

|

2,366 |

|

|

91 |

|

|

|

421 |

|

|

Total loans |

$ |

17,125 |

|

$ |

15,335 |

|

$ |

14,882 |

|

$ |

14,541 |

|

$ |

14,316 |

|

$ |

1,790 |

|

|

$ |

2,809 |

|

| UNITED

COMMUNITY BANKS, INC. |

|

|

|

| Financial

Highlights |

|

|

|

| Credit

Quality |

|

|

|

| (in

thousands) |

|

|

|

|

|

|

|

2023 |

|

|

2022 |

|

| |

|

First Quarter |

|

Fourth Quarter |

|

Third Quarter |

|

| NONACCRUAL

LOANS |

|

|

|

|

|

|

|

|

Owner occupied RE |

|

$ |

1,000 |

|

$ |

523 |

|

$ |

877 |

|

| Income producing RE |

|

|

10,603 |

|

|

3,885 |

|

|

2,663 |

|

| Commercial &

industrial |

|

|

33,276 |

|

|

14,470 |

|

|

11,108 |

|

| Commercial construction |

|

|

475 |

|

|

133 |

|

|

150 |

|

| Equipment financing |

|

|

5,044 |

|

|

5,438 |

|

|

3,198 |

|

| Total commercial |

|

|

50,398 |

|

|

24,449 |

|

|

17,996 |

|

| Residential mortgage |

|

|

11,280 |

|

|

10,919 |

|

|

10,424 |

|

| Home equity lines of

credit |

|

|

2,377 |

|

|

1,888 |

|

|

1,151 |

|

| Residential construction |

|

|

143 |

|

|

405 |

|

|

104 |

|

| Manufactured housing |

|

|

8,542 |

|

|

6,518 |

|

|

4,187 |

|

| Consumer |

|

|

55 |

|

|

53 |

|

|

17 |

|

|

Total nonaccrual loans held for investment |

|

|

72,795 |

|

|

44,232 |

|

|

33,879 |

|

| Nonaccrual loans held for

sale |

|

|

— |

|

|

— |

|

|

316 |

|

| OREO and repossessed

assets |

|

|

608 |

|

|

49 |

|

|

1,316 |

|

|

Total NPAs |

|

$ |

73,403 |

|

$ |

44,281 |

|

$ |

35,511 |

|

| |

|

|

2023 |

|

|

|

2022 |

|

| |

|

First Quarter |

|

Fourth Quarter |

|

Third Quarter |

| (in thousands) |

|

Net Charge-Offs |

|

Net Charge-Offs to Average Loans

(1) |

|

Net Charge-Offs |

|

Net Charge-Offs to Average Loans

(1) |

|

Net Charge-Offs |

|

Net Charge-Offs to Average Loans

(1) |

| NET CHARGE-OFFS

(RECOVERIES) BY CATEGORY |

|

|

|

|

|

|

|

|

|

|

|

|

| Owner occupied RE |

|

$ |

90 |

|

|

0.01 |

% |

|

$ |

(130 |

) |

|

(0.02 |

)% |

|

$ |

(90 |

) |

|

(0.01 |

)% |

|

Income producing RE |

|

|

2,306 |

|

|

0.26 |

|

|

|

(113 |

) |

|

(0.01 |

) |

|

|

176 |

|

|

0.02 |

|

| Commercial &

industrial |

|

|

225 |

|

|

0.04 |

|

|

|

4,577 |

|

|

0.81 |

|

|

|

(744 |

) |

|

(0.13 |

) |

| Commercial construction |

|

|

(37 |

) |

|

(0.01 |

) |

|

|

(77 |

) |

|

(0.02 |

) |

|

|

10 |

|

|

— |

|

| Equipment financing |

|

|

3,375 |

|

|

0.93 |

|

|

|

1,658 |

|

|

0.50 |

|

|

|

1,121 |

|

|

0.36 |

|

|

Total commercial |

|

|

5,959 |

|

|

0.20 |

|

|

|

5,915 |

|

|

0.21 |

|

|

|

473 |

|

|

0.02 |

|

| Residential mortgage |

|

|

(87 |

) |

|

(0.01 |

) |

|

|

(33 |

) |

|

(0.01 |

) |

|

|

(66 |

) |

|

(0.01 |

) |

| Home equity lines of

credit |

|

|

33 |

|

|

0.01 |

|

|

|

(89 |

) |

|

(0.04 |

) |

|

|

(102 |

) |

|

(0.05 |

) |

| Residential construction |

|

|

(15 |

) |

|

(0.01 |

) |

|

|

(23 |

) |

|

(0.02 |

) |

|

|

(109 |

) |

|

(0.11 |

) |

| Manufactured housing |

|

|

628 |

|

|

0.76 |

|

|

|

246 |

|

|

0.32 |

|

|

|

220 |

|

|

0.30 |

|

| Consumer |

|

|

566 |

|

|

1.37 |

|

|

|

595 |

|

|

1.61 |

|

|

|

718 |

|

|

1.98 |

|

|

Total |

|

$ |

7,084 |

|

|

0.17 |

|

|

$ |

6,611 |

|

|

0.17 |

|

|

$ |

1,134 |

|

|

0.03 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| (1) Annualized. |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

UNITED COMMUNITY BANKS, INC. Consolidated

Balance Sheets (Unaudited) |

|

|

|

|

| (in

thousands, except share and per share data) |

|

March 31, 2023 |

|

December 31,2022 |

| ASSETS |

|

|

|

|

|

Cash and due from banks |

|

$ |

275,962 |

|

|

$ |

195,771 |

|

|

Interest-bearing deposits in banks |

|

|

501,719 |

|

|

|

316,082 |

|

|

Federal funds and other short-term investments |

|

|

— |

|

|

|

135,000 |

|

|

Cash and cash equivalents |

|

|

777,681 |

|

|

|

646,853 |

|

|

Debt securities available-for-sale |

|

|

3,331,139 |

|

|

|

3,614,333 |

|

|

Debt securities held-to-maturity (fair value $2,206,874 and

$2,191,073, respectively) |

|

|

2,584,081 |

|

|

|

2,613,648 |

|

|

Loans held for sale |

|

|

20,390 |

|

|

|

13,600 |

|

|

Loans and leases held for investment |

|

|

17,124,703 |

|

|

|

15,334,627 |

|

|

Less allowance for credit losses - loans and leases |

|

|

(176,534 |

) |

|

|

(159,357 |

) |

|

Loans and leases, net |

|

|

16,948,169 |

|

|

|

15,175,270 |

|

|

Premises and equipment, net |

|

|

336,617 |

|

|

|

298,456 |

|

|

Bank owned life insurance |

|

|

341,285 |

|

|

|

299,297 |

|

|

Goodwill and other intangible assets, net |

|

|

961,244 |

|

|

|

779,248 |

|

|

Other assets |

|

|

571,244 |

|

|

|

568,179 |

|

|

Total assets |

|

$ |

25,871,850 |

|

|

$ |

24,008,884 |

|

| LIABILITIES AND

SHAREHOLDERS' EQUITY |

|

|

|

|

| Liabilities: |

|

|

|

|

|

Deposits: |

|

|

|

|

|

Noninterest-bearing demand |

|

$ |

7,540,265 |

|

|

$ |

7,643,081 |

|

|

NOW and interest-bearing demand |

|

|

4,769,663 |

|

|

|

4,350,878 |

|

|

Money market |

|

|

5,140,902 |

|

|

|

4,510,680 |

|

|

Savings |

|

|

1,362,520 |

|

|

|

1,456,337 |

|

|

Time |

|

|

2,703,568 |

|

|

|

1,781,482 |

|

|

Brokered |

|

|

487,756 |

|

|

|

134,049 |

|

|

Total deposits |

|

|

22,004,674 |

|

|

|

19,876,507 |

|

|

Short-term borrowings |

|

|

7,219 |

|

|

|

158,933 |

|

|

Federal Home Loan Bank advances |

|

|

30,000 |

|

|

|

550,000 |

|

|

Long-term debt |

|

|

324,729 |

|

|

|

324,663 |

|

|

Accrued expenses and other liabilities |

|

|

427,105 |

|

|

|

398,107 |

|

|

Total liabilities |

|

|

22,793,727 |

|

|

|

21,308,210 |

|

| Shareholders' equity: |

|

|

|

|

|

Preferred stock; $1 par value; 10,000,000 shares authorized;

4,000 shares Series I issued and outstanding, $25,000

per share liquidation preference |

|

|

96,422 |

|

|

|

96,422 |

|

|

Common stock, $1 par value; 200,000,000 shares authorized,

115,151,566 and 106,222,758 shares issued and outstanding,

respectively |

|

|

115,152 |

|

|

|

106,223 |

|

|

Common stock issuable; 579,835 and 607,128 shares,

respectively |

|

|

11,977 |

|

|

|

12,307 |

|

|

Capital surplus |

|

|

2,606,403 |

|

|

|

2,306,366 |

|

|

Retained earnings |

|

|

542,606 |

|

|

|

508,844 |

|

|

Accumulated other comprehensive loss |

|

|

(294,437 |

) |

|

|

(329,488 |

) |

|

Total shareholders' equity |

|

|

3,078,123 |

|

|

|

2,700,674 |

|

|

Total liabilities and shareholders' equity |

|

$ |

25,871,850 |

|

|

$ |

24,008,884 |

|

| |

|

|

| UNITED COMMUNITY

BANKS, INC. Consolidated Statements of

Income (Unaudited) |

|

|

|

|

|

Three Months EndedMarch 31, |

|

(in thousands, except per share data) |

|

|

2023 |

|

|

|

2022 |

|

|

Interest revenue: |

|

|

|

|

|

Loans, including fees |

|

$ |

236,431 |

|

|

$ |

146,741 |

|

|

Investment securities, including tax exempt of $2,110 and $2,655,

respectively |

|

|

39,986 |

|

|

|

23,665 |

|

|

Deposits in banks and short-term investments |

|

|

3,070 |

|

|

|

653 |

|

|

Total interest revenue |

|

|

279,487 |

|

|

|

171,059 |

|

| |

|

|

|

|

| Interest

expense: |

|

|

|

|

|

Deposits: |

|

|

|

|

|

NOW and interest-bearing demand |

|

|

17,599 |

|

|

|

1,469 |

|

|

Money market |

|

|

25,066 |

|

|

|

1,012 |

|

|

Savings |

|

|

538 |

|

|

|

72 |

|

|

Time |

|

|

14,658 |

|

|

|

578 |

|

|

Deposits |

|

|

57,861 |

|

|

|

3,131 |

|

|

Short-term borrowings |

|

|

1,148 |

|

|

|

— |

|

|

Federal Home Loan Bank advances |

|

|

5,112 |

|

|

|

— |

|

|

Long-term debt |

|

|

3,896 |

|

|

|

4,136 |

|

|

Total interest expense |

|

|

68,017 |

|

|

|

7,267 |

|

|

Net interest revenue |

|

|

211,470 |

|

|

|

163,792 |

|

|

Provision for credit losses |

|

|

21,783 |

|

|

|

23,086 |

|

|

Net interest revenue after provision for credit losses |

|

|

189,687 |

|

|

|

140,706 |

|

| |

|

|

|

|

| Noninterest

income: |

|

|

|

|

|

Service charges and fees |

|

|

8,699 |

|

|

|

9,070 |

|

|

Mortgage loan gains and other related fees |

|

|

4,521 |

|

|

|

16,152 |

|

|

Wealth management fees |

|

|

5,724 |

|

|

|

5,895 |

|

|

Gains from sales of other loans, net |

|

|

1,916 |

|

|

|

3,198 |

|

|

Lending and loan servicing fees |

|

|

4,016 |

|

|

|

2,986 |

|

|

Securities losses, net |

|

|

(1,644 |

) |

|

|

(3,734 |

) |

|

Other |

|

|

6,977 |

|

|

|

5,406 |

|

|

Total noninterest income |

|

|

30,209 |

|

|

|

38,973 |

|

|

Total revenue |

|

|

219,896 |

|

|

|

179,679 |

|

| |

|

|

|

|

| Noninterest

expenses: |

|

|

|

|

|

Salaries and employee benefits |

|

|

78,698 |

|

|

|

71,006 |

|

|

Communications and equipment |

|

|

10,008 |

|

|

|

9,248 |

|

|

Occupancy |

|

|

9,889 |

|

|

|

9,378 |

|

|

Advertising and public relations |

|

|

2,349 |

|

|

|

1,488 |

|

|

Postage, printing and supplies |

|

|

2,537 |

|

|

|

2,119 |

|

|

Professional fees |

|

|

6,072 |

|

|

|

4,447 |

|

|

Lending and loan servicing expense |

|

|

2,319 |

|

|

|

2,366 |

|

|

Outside services - electronic banking |

|

|

3,425 |

|

|

|

2,523 |

|

|

FDIC assessments and other regulatory charges |

|

|

4,001 |

|

|

|

2,173 |

|

|

Amortization of intangibles |

|

|

3,528 |

|

|

|

1,793 |

|

|

Merger-related and other charges |

|

|

8,631 |

|

|

|

9,016 |

|

|

Other |

|

|

8,348 |

|

|

|

3,718 |

|

|

Total noninterest expenses |

|

|

139,805 |

|

|

|

119,275 |

|

|

Income before income taxes |

|

|

80,091 |

|

|

|

60,404 |

|

|

Income tax expense |

|

|

17,791 |

|

|

|

12,385 |

|

|

Net income |

|

|

62,300 |

|

|

|

48,019 |

|

| Preferred stock dividends |

|

|

1,719 |

|

|

|

1,719 |

|

| Earnings allocated to

participating securities |

|

|

339 |

|

|

|

238 |

|

|

Net income available to common shareholders |

|

$ |

60,242 |

|

|

$ |

46,062 |

|

| |

|

|

|

|

| Net income per common

share: |

|

|

|

|

|

Basic |

|

$ |

0.52 |

|

|

$ |

0.43 |

|

|

Diluted |

|

|

0.52 |

|

|

|

0.43 |

|

| Weighted average common shares

outstanding: |

|

|

|

|

|

Basic |

|

|

115,451 |

|

|

|

106,550 |

|

|

Diluted |

|

|

115,715 |

|

|

|

106,677 |

|

|

|

|

|

|

|

|

|

|

|

|

Average Consolidated Balance Sheets and Net Interest

Analysis For the Three Months Ended March 31, |

|

|

|

|

| |

|

|

2023 |

|

|

|

2022 |

|

|

(dollars in thousands, fully taxable equivalent

(FTE)) |

|

Average Balance |

|

Interest |

|

Average Rate |

|

Average Balance |

|

Interest |

|

Average Rate |

| Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-earning assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans, net of unearned income (FTE) (1)(2) |

|

$ |

16,897,372 |

|

|

$ |

236,530 |

|

5.68 |

% |

|

$ |

14,234,026 |

|

|

$ |

146,637 |

|

4.18 |

% |

|

Taxable securities (3) |

|

|

6,059,323 |

|

|

|

37,876 |

|

2.50 |

|

|

|

5,848,976 |

|

|

|

21,010 |

|

1.44 |

|

|

Tax-exempt securities (FTE) (1)(3) |

|

|

422,583 |

|

|

|

2,834 |

|

2.68 |

|

|

|

510,954 |

|

|

|

3,566 |

|

2.79 |

|

|

Federal funds sold and other interest-earning assets |

|

|

472,325 |

|

|

|

3,352 |

|

2.88 |

|

|

|

1,910,411 |

|

|

|

1,020 |

|

0.22 |

|

|

Total interest-earning assets (FTE) |

|

|

23,851,603 |

|

|

|

280,592 |

|

4.76 |

|

|

|

22,504,367 |

|

|

|

172,233 |

|

3.10 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest-earning

assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowance for credit losses |

|

|

(167,584 |

) |

|

|

|

|

|

|

(113,254 |

) |

|

|

|

|

|

Cash and due from banks |

|

|

271,210 |

|

|

|

|

|

|

|

166,005 |

|

|

|

|

|

|

Premises and equipment |

|

|

329,135 |

|

|

|

|

|

|

|

277,216 |

|

|

|

|

|

|

Other assets (3) |

|

|

1,484,936 |

|

|

|

|

|

|

|

1,369,301 |

|

|

|

|

|

|

Total assets |

|

$ |

25,769,300 |

|

|

|

|

|

|

$ |

24,203,635 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and

Shareholders' Equity: |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing

liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing deposits: |

|

|

|

|

|

|

|

|

|

|

|

|

|

NOW and interest-bearing demand |

|

$ |

4,499,907 |

|

|

|

17,599 |

|

1.59 |

|

|

$ |

4,667,098 |

|

|

|

1,469 |

|

0.13 |

|

|

Money market |

|

|

5,223,267 |

|

|

|

25,066 |

|

1.95 |

|

|

|

5,110,817 |

|

|

|

1,012 |

|

0.08 |

|

|

Savings |

|

|

1,416,931 |

|

|

|

538 |

|

0.15 |

|

|

|

1,436,881 |

|

|

|

72 |

|

0.02 |

|

|

Time |

|

|

2,348,588 |

|

|

|

12,313 |

|

2.13 |

|

|

|

1,758,895 |

|

|

|

534 |

|

0.12 |

|

|

Brokered time deposits |

|

|

208,215 |

|

|

|

2,345 |

|

4.57 |

|

|

|

79,092 |

|

|

|

44 |

|

0.23 |

|

|

Total interest-bearing deposits |

|

|

13,696,908 |

|

|

|

57,861 |

|

1.71 |

|

|

|

13,052,783 |

|

|

|

3,131 |

|

0.10 |

|

|

Federal funds purchased and other borrowings |

|

|

107,955 |

|

|

|

1,148 |

|

4.31 |

|

|

|

611 |

|

|

|

— |

|

— |

|

|

Federal Home Loan Bank advances |

|

|

453,056 |

|

|

|

5,112 |

|

4.58 |

|

|

|

— |

|

|

|

— |

|

— |

|

|

Long-term debt |

|

|

324,701 |

|

|

|

3,896 |

|

4.87 |

|

|

|

318,995 |

|

|

|

4,136 |

|

5.26 |

|

|

Total borrowed funds |

|

|

885,712 |

|

|

|

10,156 |

|

4.65 |

|

|

|

319,606 |

|

|

|

4,136 |

|

5.25 |

|

|

Total interest-bearing liabilities |

|

|

14,582,620 |

|

|

|

68,017 |

|

1.89 |

|

|

|

13,372,389 |

|

|

|

7,267 |

|

0.22 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest-bearing

liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest-bearing deposits |

|

|

7,697,844 |

|

|

|

|

|

|

|

7,666,635 |

|

|

|

|

|

|

Other liabilities |

|

|

357,367 |

|

|

|

|

|

|

|

378,327 |

|

|

|

|

|

|

Total liabilities |

|

|

22,637,831 |

|

|

|

|

|

|

|

21,417,351 |

|

|

|

|

|

| Shareholders' equity |

|

|

3,131,469 |

|

|

|

|

|

|

|

2,786,284 |

|

|

|

|

|

|

Total liabilities and shareholders' equity |

|

$ |

25,769,300 |

|

|

|

|

|

|

$ |

24,203,635 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest revenue

(FTE) |

|

|

|

$ |

212,575 |

|

|

|

|

|

$ |

164,966 |

|

|

| Net interest-rate spread

(FTE) |

|

|

|

|

|

2.87 |

% |

|

|

|

|

|

2.88 |

% |

| Net interest margin (FTE)

(4) |

|

|

|

|

|

3.61 |

% |

|

|

|

|

|

2.97 |

% |

|

(1) |

Interest revenue on tax-exempt securities and loans has been

increased to reflect comparable interest on taxable securities and

loans. The rate used was 26%, reflecting the statutory federal

income tax rate and the federal tax adjusted state income tax

rate. |

|

(2) |

Included in the average balance of loans outstanding are loans on

which the accrual of interest has been discontinued and loans that

are held for sale. |

|

(3) |

Unrealized gains and losses on securities, including those related

to the transfer from AFS to HTM, have been reclassified to other

assets. Pretax unrealized losses of $419 million in 2023 and $81.2

million in 2022 are included in other assets for purposes of this

presentation. |

|

(4) |

Net interest margin is taxable equivalent net interest revenue

divided by average interest-earning assets. |

About United Community Banks, Inc.

United Community Banks, Inc. (NASDAQ: UCBI) is a

top 100 U.S. financial institution with $25.9 billion in assets,

and through its subsidiaries, provides a full range of banking,

wealth management and mortgage services. UCBI is the financial

holding company for United Community Bank (“United Community”)

which has 207 offices across Alabama, Florida, Georgia, North

Carolina, South Carolina, and Tennessee, as well as a national SBA

lending franchise and a national equipment lending subsidiary.

United Community is committed to improving the financial health and

well-being of its customers and ultimately the communities it

serves. Among other awards, United Community is a nine-time winner

of the J.D. Power award that ranked the bank #1 in customer

satisfaction with consumer banking in the Southeast and was

recognized in 2023 by Forbes as one of the World’s Best Banks and

one of America’s Best Banks. The bank is also a multi-award

recipient of the Greenwich Excellence Awards, including the 2022

awards for Small Business Banking-Likelihood to Recommend (South)

and Overall Satisfaction (South), and was named one of the "Best

Banks to Work For" by American Banker in 2022 for the sixth

consecutive year. Additional information about United can be found

at www.ucbi.com.

Non-GAAP Financial Measures

This press release, including the accompanying

financial statement tables, contains financial information

determined by methods other than in accordance with generally

accepted accounting principles, or GAAP. This financial information

includes certain operating performance measures, which exclude

merger-related and other charges that are not considered part of

recurring operations, such as “operating net income,” “pre-tax,

pre-provision income,” “operating net income per diluted common

share,” “operating earnings per share,” “tangible book value per

common share,” “operating return on common equity,” “operating

return on tangible common equity,” “operating return on assets,”

“return on assets - pre-tax, pre-provision, excluding

merger-related and other charges,” “return on assets - pre-tax,

pre-provision,” “operating efficiency ratio,” and “tangible common

equity to tangible assets.” These non-GAAP measures are included

because United believes they may provide useful supplemental

information for evaluating United’s underlying performance trends.

These measures should be viewed in addition to, and not as an

alternative to or substitute for, measures determined in accordance

with GAAP, and are not necessarily comparable to non-GAAP measures

that may be presented by other companies. To the extent applicable,

reconciliations of these non-GAAP measures to the most directly

comparable measures as reported in accordance with GAAP are

included with the accompanying financial statement tables.

Caution About Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. In general, forward-looking statements usually

may be identified through use of words such as “may,” “believe,”

“expect,” “anticipate,” “intend,” “will,” “should,” “plan,”

“estimate,” “predict,” “continue” and “potential,” or the negative

of these terms or other comparable terminology, and include

statements related to the expected financial returns of the

acquisition of First Miami Bancorp, Inc. (“FMIA”). Forward-looking

statements are not historical facts and represent management’s

beliefs, based upon information available at the time the

statements are made, with regard to the matters addressed; they are

not guarantees of future performance. Actual results may prove

to be materially different from the results expressed or

implied by the forward-looking statements. Forward-looking

statements are subject to numerous assumptions, risks and

uncertainties that change over time and could cause actual results

or financial condition to differ materially from those expressed in

or implied by such statements.

Factors that could cause or contribute to such

differences include, but are not limited to (1) the risk that the

cost savings and any revenue synergies from the FMIA acquisition

may not be realized or take longer than anticipated to be realized,

(2) disruption of customer, supplier, employee or other business

partner relationships as a result of the FMIA acquisition, (3) the

possibility that the costs, fees, expenses and charges related to

the acquisition of FMIA may be greater than anticipated, (4)

reputational risk and the reaction of the companies’ customers,

suppliers, employees or other business partners to the acquisition

of FMIA, (5) the risks relating to the integration of FMIA’s

operations into the operations of United, including the risk that

such integration will be materially delayed or will be more costly

or difficult than expected, (6) the risks associated with United’s

pursuit of future acquisitions, (7) the risk of expansion into new

geographic or product markets, (8) the dilution caused by

United’s issuance of additional shares of its common stock in the

FMIA acquisition, and (9) general competitive, economic, political

and market conditions. Further information regarding additional

factors which could affect the forward-looking statements contained

in this press release can be found in the cautionary language

included under the headings “Cautionary Note Regarding

Forward-Looking Statements” and “Risk Factors” in United’s Annual

Report on Form 10-K for the year ended December 31, 2022, and other

documents subsequently filed by United with the United States

Securities and Exchange Commission (“SEC”).

Many of these factors are beyond United’s

ability to control or predict. If one or more events related to

these or other risks or uncertainties materialize, or if the

underlying assumptions prove to be incorrect, actual results may

differ materially from the forward-looking statements. Accordingly,

shareholders and investors should not place undue reliance on any

such forward-looking statements. Any forward-looking statement

speaks only as of the date of this communication, and United

undertakes no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as required by law. New risks and

uncertainties may emerge from time to time, and it is not possible

for United to predict their occurrence or how they will affect

United or FMIA.

United qualifies all forward-looking statements

by these cautionary statements.

For more information:

Jefferson HarralsonChief Financial Officer(864)

240-6208Jefferson_Harralson@ucbi.com

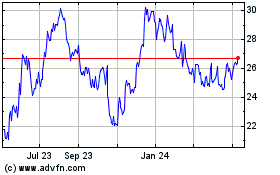

United Communty Banks (NASDAQ:UCBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

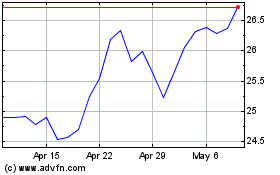

United Communty Banks (NASDAQ:UCBI)

Historical Stock Chart

From Apr 2023 to Apr 2024