Stem Shares Hit 52-Week Low After Plan to Offer $175 Million of Notes in Private Offering

March 29 2023 - 11:08AM

Dow Jones News

By Chris Wack

Stem Inc. shares were down 17% at $5.22 after the company said

it intends to offer $175 million in green convertible senior notes

due 2030 in a private offering.

The stock hit its 52-week low of $4.67 earlier in the session,

and is down 55% in the past 12 months.

In connection with the offering, Stem expects to grant the

initial purchasers of the notes an option to buy--for settlement

within a 13-day period from, and including, the date when the notes

are first issued--up to an additional $35 million of the notes

under the same terms and conditions.

When issued, the notes will be senior, unsecured obligations of

Stem. They will accrue interest payable semi-annually in arrears

and will mature on April 1, 2030, unless earlier repurchased,

redeemed or converted in accordance with their terms prior to such

date.

Stem intends to use the net proceeds of the offering to purchase

and surrender for cancellation a portion of Stem's 0.50% Green

Convertible Senior Notes due 2028 in privately negotiated

transactions concurrently with the pricing of the offering and for

general corporate purposes.

Write to Chris Wack at chris.wack@wsj.com

(END) Dow Jones Newswires

March 29, 2023 10:53 ET (14:53 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

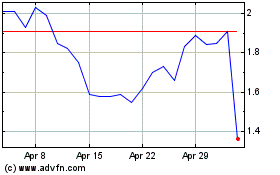

Stem (NYSE:STEM)

Historical Stock Chart

From Aug 2024 to Sep 2024

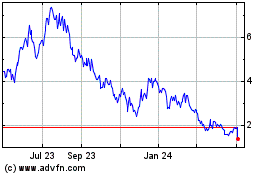

Stem (NYSE:STEM)

Historical Stock Chart

From Sep 2023 to Sep 2024