First Citizens BancShares Shares Leap Premarket on Silicon Valley Deal

March 27 2023 - 7:09AM

Dow Jones News

By Colin Kellaher

Shares of First Citizens BancShares Inc. surged 20% in premarket

trading Monday after the bank holding company said it would acquire

a large chunk of the failed Silicon Valley Bank in a deal that

roughly doubles its assets.

The Raleigh, N.C., company said it is assuming Silicon Valley

assets of $110 billion and deposits of $56 billion from the Federal

Deposit Insurance Corp., which took control of the bank earlier

this month.

The FDIC said the deal includes the purchase of about $72

billion of Silicon Valley loans at a discount of $16.5 billion.

First Citizens said Silicon Valley's 17 branches will begin

operating Monday as Silicon Valley Bank, a division of First

Citizens Bank.

First Citizens, which reported total assets of around $109

billion at the end of 2022, said its assets now top $219

billion.

First Citizens shares, which closed Friday at $582.55, were

recently up 20% to $700 in premarket trading.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

March 27, 2023 06:54 ET (10:54 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

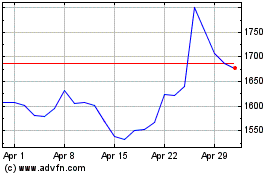

First Citizens BancShares (NASDAQ:FCNCA)

Historical Stock Chart

From Aug 2024 to Sep 2024

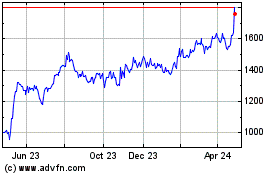

First Citizens BancShares (NASDAQ:FCNCA)

Historical Stock Chart

From Sep 2023 to Sep 2024