Current Report Filing (8-k)

June 06 2022 - 4:36PM

Edgar (US Regulatory)

AMARIN CORP PLCUK 00-0000000 2 false 0000897448 0000897448 2022-06-01 2022-06-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 1, 2022

Amarin Corporation plc

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| England and Wales |

|

000-21392 |

|

Not applicable |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

| 77 Sir John Rogerson’s Quay, Block C, Grand Canal Docklands, Dublin 2, Ireland |

|

Not applicable |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: +353 (0) 1 6699 020

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| American Depositary Shares (ADS(s)), each ADS representing the right to receive one (1) Ordinary Share of Amarin Corporation plc |

|

AMRN |

|

NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.05 |

Costs Associated with Exit or Disposal Activities. |

On June 6, 2022, Amarin Corporation plc (“Amarin” or the “Company”) announced that it was implementing a new cost reduction plan (the “CRP”), resulting in a reduction of Amarin’s U.S. commercial team by approximately 65% of current levels, which represents a reduction of the total Amarin employee base by over 40% from current levels. Management, with the oversight and guidance of the Amarin board of directors, determined to implement the CRP following a review of Amarin’s business in light of the continued uncertainties and challenges in the U.S. business given generic competition levels for VASCEPA® (icosapent ethyl), and in order to better position Amarin to invest in European launches, research and development (including a fixed dose combination) and its global expansion plans.

Amarin estimates that it will incur approximately $10.0 million in charges related to the CRP, substantially all of which are cash expenditures for one-time termination benefits and associated costs. Amarin expects to record the charges in the second quarter of 2022 and to make substantially all of the related payments by the end of 2022.

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On June 1, 2022, Michael W. Kalb, Amarin’s Senior Vice President and Chief Financial Officer (and principal accounting officer) notified Amarin that he would be resigning from the Company, and on June 6, 2022, Amarin announced the appointment of Tom Reilly as Amarin’s new Senior Vice President and Chief Financial Officer (and principal accounting officer) (the “CFO”) as successor to Mr. Kalb, effective June 20, 2022 (or such earlier date as may be agreed with the Company, the “CFO Appointment Date”). Mr. Kalb is leaving the Company to pursue other interests after transitioning the role to Mr. Reilly.

Mr. Reilly, age 50, has more than 20 years of experience in building and leading finance and administration teams at life sciences companies both in the United States and globally. Most recently Mr. Reilly served as chief financial officer for Cara Therapeutics, Inc. (“Cara”), where he was responsible for leading all aspects of the Cara’s financial operations and planning. Prior to Cara, Mr. Reilly served as head of finance of the Allergan General Medicines business. Prior to joining Allergan, Mr. Reilly spent 14 years with Novartis where he served in roles of increasing responsibility, including finance head for Novartis’ Oncology Development unit, as chief financial officer for Novartis Pharma Austria and financial controller for Novartis USA’s Pharmaceutical Division. He earned his bachelor’s degree in finance from Manhattan College, an M.B.A in accounting from Seton Hall University and is a certified public accountant.

In connection with his appointment as Amarin’s CFO, Mr. Reilly entered into an offer letter with Amarin, which provides that Mr. Reilly’s initial annual base salary shall be $525,000, and his annual bonus potential shall initially be up to 50% of his annual base salary (including on a non-prorated basis for 2022), based upon the achievement of certain individual and Company objectives to be set by Amarin (with any bonus payment to be entirely at the discretion of the Amarin board of directors). Mr. Reilly is also entitled to a special, one-time sign-on cash bonus of $100,000, payable on July 31, 2022.

In addition, subject to approval by the Amarin board of directors, Mr. Reilly will be awarded:

| |

• |

|

a stock option award exercisable for up to 100,000 ordinary shares of Amarin, to vest, subject to Mr. Reilly’s continued service to Amarin, over four years, with 25% to vest on the first anniversary of the date of the CFO Appointment Date and the balance to vest ratably over the next 12 calendar quarters thereafter; such options to have an exercise price equal to the closing price of Amarin’s American Depository Shares on the NASDAQ Capital Market on the date of grant; |

| |

• |

|

an award of 100,000 time-based restricted stock units, to become vested, subject to Mr. Reilly’s continued service to Amarin, in three equal annual installments, with the first installment vesting on the first anniversary of the CFO Appointment Date (and becoming fully vested on the third anniversary of the CFO Appointment Date); and |

| |

• |

|

an award of 100,000 performance-based restricted stock units to vest, subject to Mr. Reilly’s continued service to Amarin through the applicable vesting date, upon the achievement of certain performance-based milestones. |

Mr. Reilly will be eligible for severance pay and benefits under terms and conditions of the Company’s Executive Severance and Change of Control Plan described in the Company’s proxy statement for its 2022 annual general meeting of shareholders.

It is expected that Mr. Reilly will enter into a deed of indemnification with Amarin in substantially the same form as Amarin’s other executive officers, and Mr. Reilly will be entitled to participate in the same employee benefits and insurance programs generally made available to the Company’s full-time U.S. employees.

There are no other arrangements or understandings between Mr. Reilly and any other person pursuant to which Mr. Reilly was appointed to the positions described in this Current Report on Form 8-K, and Mr. Reilly is not a party to any transaction that would require disclosure under Item 404(a) of Regulation S-K.

| Item 7.01 |

Regulation FD Disclosure |

On June 6, 2022, Amarin issued two press releases, one outlining the CRP, a copy of which is furnished herewith as Exhibit 99.1, and the other outlining the resignation of Mr. Kalb and the appointment of Mr. Reilly as CFO, a copy of which is furnished herewith as Exhibit 99.2.

The information in this Item 7.01, including Exhibits 99.1 and 99.2 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Forward-looking statement

This Current Report on Form 8-K contains forward-looking statements, which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other securities laws. Any statements contained herein which do not describe historical facts, including, among others, statements about Amarin’s CFO transition and statement about the CRP, including anticipated cost savings and uses thereof, estimates of charges related to the CRP and the expected timing of such charges. These forward-looking statements are not promises or guarantees and involve substantial risks and uncertainties. In particular, the charges associated with the CRP may be higher than expected and Amarin may not realize the expected benefits of such CRP, including expected reduced operating expenses and the ability to fund its European launches and global expansion. In addition, as a result of the reduction in force with the CRP, which primarily affects Amarin’s U.S. commercial team, Amarin’s ability to maintain and grow revenue from sales of Vascepa in the current indication may be materially adversely affected.

Among the factors that could cause actual results to differ materially from those described or projected herein include uncertainties associated generally with administrative decisions and the bases for such decisions. A further list and description of these risks, uncertainties and other risks associated with an investment in Amarin can be found in Amarin’s filings with the U.S. Securities and Exchange Commission, including its most recent Quarterly Report on Form 10-Q. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| Date: June 6, 2022 |

|

|

|

Amarin Corporation plc |

|

|

|

|

|

|

|

|

By: |

|

/s/ Karim Mikhail |

|

|

|

|

|

|

Karim Mikhail |

|

|

|

|

|

|

President and Chief Executive Officer |

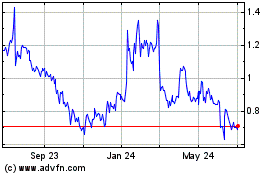

Amarin (NASDAQ:AMRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

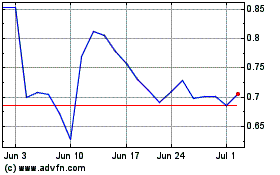

Amarin (NASDAQ:AMRN)

Historical Stock Chart

From Apr 2023 to Apr 2024