Gap Inc. (NYSE: GPS), a portfolio of purpose-led, billion-dollar

lifestyle brands including Old Navy, Gap, Banana Republic, and

Athleta, and the largest specialty apparel company in the U.S.,

today reported fiscal 2022 financial results for its first quarter

ended April 30, 2022.

“Our Q1 results and updated fiscal 2022 outlook primarily

reflect industry-wide headwinds as well as challenges at Old Navy

that are impacting our near-term performance. While we are

disappointed to deliver results below expectations, we are

confident in our ability to navigate the headwinds and re-stabilize

the Old Navy business in order to deliver continued progress on our

long-term strategy,” said Sonia Syngal, CEO, Gap Inc. “We believe

that we can navigate this period of acute disruption and build an

even more resilient and agile company. We remain anchored by our

belief in our iconic purpose-led brands – Old Navy, Gap, Banana

Republic, and Athleta – and are focused on making continued

progress against our Power Plan strategy and getting back on track

toward delivering growth, margin expansion, and value for our

shareholders over the long term.”

First Quarter Fiscal 2022 - Financial

Results

- Net sales of $3.5 billion, down 13% compared to last year.

- Net sales growth in the first quarter fiscal 2022 was

negatively impacted by an estimated 5 percentage points related to

lapping the benefit of stimulus last year and approximately 3

percentage points from divestitures, store closures, and the

transition of the company’s European business to a partnership

model.

- Comparable sales were down 14% year-over-year.

- Online sales declined 17% compared to last year and represented

39% of total net sales.

- Store sales declined 10% compared to last year. The company

ended the quarter with 3,414 store locations in over 40 countries,

of which 2,825 were company operated.

- Gross margin was 31.5%, 930 basis points lower than last

year.

- Merchandise margins were down 760 basis points versus last year

and included approximately $170 million, or 480 basis points, of

incremental transitory air freight costs. Higher discounting at Old

Navy and inflationary commodity price increases partially offset by

the benefit of lower discounting at Banana Republic drove the

remaining decline of approximately 280 basis points.

- Rent, Occupancy and Depreciation deleveraged 170 basis points

versus last year primarily due to lower sales volume in the

quarter.

- Operating loss was $197 million in the quarter; operating

margin of negative 5.7%.

- Net loss of $162 million; diluted loss per share of $0.44.

First Quarter Fiscal 2022 – Balance

Sheet and Cash Flow Highlights

- Ended the quarter with cash and cash equivalents of $845

million.

- Net cash from operating activities was negative $362 million.

Free cash flow,1 defined as net cash from operating activities less

purchases of property and equipment, was negative $590

million.

- Ending inventory was up 34% year-over-year to $3.2

billion.

- Capital expenditures were $228 million.

- Share repurchases were $54 million, representing 3.7 million

shares.

- Paid first quarter dividend of $0.15 per share, totaling $56

million.

- Board of Directors approved second quarter fiscal 2022 dividend

of $0.15 per share.

1

Additional information regarding

free cash flow, a non-GAAP financial measure, is provided at the

end of this press release along with a reconciliation of this

measure from the most directly comparable GAAP financial measure

for the applicable period.

First Quarter Fiscal 2022 – Brand

Results

Old Navy:

- Net sales of $1.8 billion, down 19% compared to last year.

Sales in the quarter were negatively impacted by size and

assortment imbalances, ongoing inventory delays, and product

acceptance issues in some key categories.

- Comparable sales were down 22%.

Gap:

- Net sales of $791 million, down 11% compared to last year. The

brand was slightly impacted by slowed demand stemming from

inflationary pressures impacting the lower-income consumer as well

as continued inventory lateness to last year. Growth at Gap Brand

was also negatively impacted by the COVID-related forced lockdowns

and slowed overall demand in China.

- Global and North America comparable sales were both down

11%.

Banana Republic:

- Net sales of $482 million, up 24% compared to last year. The

brand is realizing the benefits of last year’s relaunch which is

resonating with consumers particularly in light of the near-term

shift into occasion and work-based categories.

- Comparable sales were up 27%.

Athleta:

- Net sales of $360 million, up 4% compared to last year. The

brand continues to make progress in driving awareness and

establishing authority in the women’s active and wellness

category.

- Comparable sales were down 7%.

Fiscal Year 2022 Outlook

“We are revising our fiscal 2022 outlook to reflect the impact

of certain factors impacting our near-term performance, including

execution challenges at Old Navy, an uncertain macro consumer

environment, inflationary cost headwinds, and a slowdown in China

that is impacting Gap Brand,” said Katrina O’Connell, Executive

Vice President and Chief Financial Officer, Gap Inc. “We expect our

performance to improve modestly in the back half of the year and

accelerate as we enter fiscal 2023. We believe that our long-term

strategy is the right one and we are taking steps to position our

brands, platform and people to capitalize on the significant

opportunities ahead.”

- The company now expects fiscal 2022 revenue to decline in the

low to mid-single digit range versus last year.

- Gross margin is expected to be in the range of 36.5% to

37.5%.

- Reported operating margin is expected to be in the range of

1.8%-2.8% with adjusted operating margin2 in the range of 1.5% to

2.5%.

- Reported diluted earnings per share is expected to be in the

range of $0.40 to $0.70.

- Adjusted diluted earnings per share,2 excluding a net benefit

expected from international initiatives, is expected to be in the

range of $0.30 to $0.60.

- Net interest expense of approximately $80 million.

- Effective tax rate of approximately 27%.

- Capital expenditures of approximately $700 million.

- The company continues to expect to open about 30 to 40 stores

each for Old Navy and Athleta in fiscal year 2022. As part of its

350-store closure plan, the company expects to close about 50 Gap

and Banana Republic stores in North America during the year.

2

Additional information regarding

expected 2022 adjusted operating margin and adjusted diluted

earnings per share, both of which are non-GAAP financial measures,

is provided at the end of this press release along with a

reconciliation of these measures from the most directly comparable

GAAP financial measures for the applicable period.

Webcast and Conference Call Information Cammeron

McLaughlin, Head of Investor Relations at Gap Inc., will host a

summary of the company’s first quarter fiscal 2022 results during a

conference call and webcast from approximately 2:00 p.m. to 3:00

p.m. Pacific Time today. Ms. McLaughlin will be joined by Chief

Executive Officer Sonia Syngal and Chief Financial Officer Katrina

O’Connell.

To access the conference call, please pre-register using this

link. Registrants will receive confirmation with dial-in

details.

A live webcast of the event can be accessed using this link. A

replay will also be made available at investors.gapinc.com.

Non-GAAP Disclosure This press release includes financial

measures that have not been calculated in accordance with U.S.

generally accepted accounting principles (GAAP) and are therefore

referred to as non-GAAP financial measures. The non-GAAP measures

described below are intended to provide investors with additional

useful information about the company’s financial performance, to

enhance the overall understanding of its past performance and

future prospects and to allow for greater transparency with respect

to important metrics used by management for financial and operating

decision-making. The company presents these non-GAAP financial

measures to assist investors in seeing its financial performance

from management's view and because it believes they provide an

additional tool for investors to use in computing the company's

core financial performance over multiple periods with other

companies in its industry. Additional information regarding the

intended use of each non-GAAP measure included in this press

release is provided in the tables to this press release.

The non-GAAP measures included in this press release are free

cash flow, expected 2022 adjusted operating margin, and expected

2022 adjusted diluted earnings per share. These non-GAAP measures

exclude the impact of certain items that are set forth in the

tables to this press release.

The non-GAAP measures used by the company should not be

considered as a substitute for, or superior to, measures of

financial performance prepared in accordance with GAAP and may not

be the same as similarly titled measures used by other companies

due to possible differences in method and in items or events being

adjusted. The company urges investors to review the reconciliation

of these non-GAAP financial measures to the most directly

comparable GAAP financial measures included in the tables to this

press release below, and not to rely on any single financial

measure to evaluate its business. The non-GAAP financial measures

used by the company have limitations in their usefulness to

investors because they have no standardized meaning prescribed by

GAAP and are not prepared under any comprehensive set of accounting

rules or principles.

Forward-Looking Statements This press release and related

conference call and webcast contain forward-looking statements

within the “safe harbor” provisions of the Private Securities

Litigation Reform Act of 1995. All statements other than those that

are purely historical are forward-looking statements. Words such as

“expect,” “anticipate,” “believe,” “estimate,” “intend,” “plan,”

“project,” and similar expressions also identify forward-looking

statements. Forward-looking statements include statements regarding

the following: navigating disruption and building a resilient and

agile company; executing against our Power Plan strategy and

delivering growth, margin expansion and long-term shareholder

value; our performance in fiscal 2022 and fiscal 2023; positioning

our brands, platform and people to capitalize on future

opportunities; revenue growth in fiscal 2022 and year-over-year

revenue growth in the second half of fiscal 2022; gross margin in

fiscal 2022 and in the first and second halves of fiscal 2022;

reported and adjusted operating margin in fiscal 2022; reported and

adjusted earnings per share in fiscal 2022; the impact of

international initiatives on adjusted earnings per share in fiscal

2022; net interest expense in fiscal 2022; effective tax rate in

fiscal 2022; capital expenditures in fiscal 2022; store openings

and closings in fiscal 2022 and completing the North American fleet

rationalization; our ability to navigate industry-wide headwinds

and restabilize Old Navy and the timing thereof; the impact of

challenges at Old Navy on earnings per share in fiscal 2022; the

impacts of inflation, fuel costs and hourly labor headwinds on our

fiscal 2022 outlook; consumer demand in fiscal 2022; pressured

sales in the short-term from excess inventory at Old Navy;

refocusing on Old Navy’s value equation; capturing consumers in an

inflationary environment; improving Old Navy’s assortment in fall

and holiday; maintaining Old Navy’s leadership in denim, active and

fleece categories; Old Navy’s strong stock position for back to

school; optimizing Old Navy’s in-store and online size ranges;

price parity across all women’s styles at Old Navy; optimizing

replenishment, monitoring demand and refining extended size

offerings at Old Navy; availability of core women’s sizes at Old

Navy in the fall; updating Old Navy’s marketing mix and messaging;

engaging customers through our new credit card program with

Barclays; the strength and long-term value of Old Navy’s core

assets; Old Navy’s Price ON-Lock initiative; multi-year tailwinds

for Athleta; Athleta’s revenue CAGR over the long-term; Athleta’s

positioning to capitalize on current consumer trends; Athleta’s

assortment mix in fiscal 2022; igniting brand relevance and driving

category and channel diversification at Gap; expanding Gap across

wholesale and marketplaces in fiscal 2022; Banana Republic’s

positioning to capitalize on current consumer trends; air freight

expense in fiscal 2022, the second quarter of fiscal 2022 the

second half of fiscal 2022; the impact of lockdowns in China on our

fiscal 2022 outlook; the impacts of inflation, higher discounting

at Old Navy, ROD deleverage and fuel costs on our fiscal 2022 gross

margin; improvements in promotional levels at Old Navy in the

second half of fiscal 2022; ROD deleverage in fiscal 2022; SG&A

deleverage in fiscal 2022; reducing discretionary spending and

managing expenses in fiscal 2022; the sale of our UK Distribution

Center; the transition of our Old Navy Mexico business; and our

dividend and share repurchase programs.

Because these forward-looking statements involve risks and

uncertainties, there are important factors that could cause our

actual results to differ materially from those in the

forward-looking statements. These factors include, without

limitation, the following risks, any of which could have an adverse

effect on our financial condition, results of operations, and

reputation: the overall global economic and geopolitical

environment, consumer spending patterns and risks associated with

the COVID-19 pandemic; the risk that our estimates regarding

consumer demand are inaccurate, or that economic conditions

including delayed shipments and other global supply chain

challenges worsen beyond what we currently estimate; the risk that

we may be unable to mitigate the impact of global supply chain

disruptions on our business and operations and maintain inventory

commensurate with consumer demand; the risk that inflation

continues to rise, which could increase our expenses and negatively

impact consumer demand; the risk that we may be unable to manage

our inventory effectively and the resulting impact on our gross

margins and sales; the risk that global supply chain delays will

result in receiving inventory after the applicable selling season

and lead to significant impairment charges; the risk that we or our

franchisees may be unsuccessful in gauging apparel trends and

changing consumer preferences or responding with sufficient lead

time; the risk that we fail to maintain, enhance and protect our

brand image and reputation; the risk that increased public focus on

our ESG initiatives or our inability to meet our stated ESG goals

could affect our brand image and reputation; the highly competitive

nature of our business in the United States and internationally;

engaging in or seeking to engage in strategic transactions that are

subject to various risks and uncertainties; the risk that our

investments in customer, digital, and omni-channel shopping

initiatives may not deliver the results we anticipate; the risk

that we fail to manage key executive succession and retention and

to continue to attract qualified personnel; the risks to our

business, including our costs and global supply chain, associated

with global sourcing and manufacturing; the risks to our reputation

or operations associated with importing merchandise from foreign

countries, including failure of our vendors to adhere to our Code

of Vendor Conduct; the risk of data or other security breaches or

vulnerabilities that may result in increased costs, violations of

law, significant legal and financial exposure, and a loss of

confidence in our security measures; the risk that failures of, or

updates or changes to, our IT systems may disrupt our operations;

the risk that our efforts to expand internationally may not be

successful; the risk that our franchisees and licensees could

impair the value of our brands; the risk that trade matters could

increase the cost or reduce the supply of apparel available to us;

the risk of foreign currency exchange rate fluctuations; the risk

that comparable sales and margins will experience fluctuations;

natural disasters, public health crises (similar to and including

the ongoing COVID-19 pandemic), political crises (such as the

ongoing conflict between Russia and Ukraine), negative global

climate patterns, or other catastrophic events; the risk that we or

our franchisees may be unsuccessful in identifying, negotiating,

and securing new store locations and renewing, modifying, or

terminating leases for existing store locations effectively; the

risk that we will not be successful in defending various

proceedings, lawsuits, disputes, and claims; our failure to comply

with applicable laws and regulations and changes in the regulatory

or administrative landscape; reductions in income and cash flow

from our credit card arrangement related to our private label and

co-branded credit cards and our new credit card arrangement; the

risk that our level of indebtedness may impact our ability to

operate and expand our business; the risk that we and our

subsidiaries may be unable to meet our obligations under our

indebtedness agreements; the risk that changes in our credit

profile or deterioration in market conditions may limit our access

to the capital markets; the risk that the adoption of new

accounting pronouncements will impact future results; the risk that

we do not repurchase some or all of the shares we anticipate

purchasing pursuant to our repurchase program; and the risk that

additional information may arise during our close process or as a

result of subsequent events that would require us to make

adjustments to our financial information.

Additional information regarding factors that could cause

results to differ can be found in our Annual Report on Form 10-K

filed with the Securities and Exchange Commission on March 15,

2022, as well as our subsequent filings with the Securities and

Exchange Commission.

These forward-looking statements are based on information as of

May 26, 2022. We assume no obligation to publicly update or revise

our forward-looking statements even if experience or future changes

make it clear that any projected results expressed or implied

therein will not be realized.

About Gap Inc. Gap Inc., a collection of purpose-led

lifestyle brands, is the largest American specialty apparel company

offering clothing, accessories, and personal care products for men,

women, and children under the Old Navy, Gap, Banana Republic, and

Athleta brands. The company uses omni-channel capabilities to

bridge the digital world and physical stores to further enhance its

shopping experience. Gap Inc. is guided by its purpose, Inclusive,

by Design, and takes pride in creating products and experiences its

customers love while doing right by its employees, communities, and

planet. Gap Inc. products are available for purchase worldwide

through company-operated stores, franchise stores, and e-commerce

sites. Fiscal year 2021 net sales were $16.7 billion. For more

information, please visit www.gapinc.com.

The Gap, Inc. CONDENSED CONSOLIDATED BALANCE

SHEETS UNAUDITED ($ in millions)

April 30, 2022

May 1, 2021

ASSETS Current assets: Cash and cash equivalents

$

845

$

2,066

Short-term investments

-

475

Merchandise inventory

3,169

2,370

Other current assets

991

1,091

Total current assets

5,005

6,002

Property and equipment, net

2,791

2,839

Operating lease assets

3,587

4,060

Other long-term assets

874

703

Total assets

$

12,257

$

13,604

LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities:

Accounts payable

$

1,599

$

1,530

Accrued expenses and other current liabilities

1,127

1,294

Current portion of operating lease liabilities

717

798

Income taxes payable

29

16

Total current liabilities

3,472

3,638

Long-term liabilities: Revolving credit facility

350

-

Long-term debt

1,485

2,218

Long-term operating lease liabilities

3,921

4,449

Other long-term liabilities

575

493

Total long-term liabilities

6,331

7,160

Total stockholders' equity

2,454

2,806

Total liabilities and stockholders' equity

$

12,257

$

13,604

The Gap, Inc. CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS UNAUDITED 13 Weeks Ended ($

and shares in millions except per share amounts) April 30,

2022 May 1, 2021 Net sales

$

3,477

$

3,991

Cost of goods sold and occupancy expenses

2,381

2,361

Gross profit

1,096

1,630

Operating expenses

1,293

1,390

Operating income (loss)

(197

)

240

Interest, net

19

53

Income (loss) before income taxes

(216

)

187

Income taxes

(54

)

21

Net income (loss)

$

(162

)

$

166

Weighted-average number of shares - basic

370

376

Weighted-average number of shares - diluted

370

385

Earnings (loss) per share - basic

$

(0.44

)

$

0.44

Earnings (loss) per share - diluted

$

(0.44

)

$

0.43

The Gap, Inc. CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS UNAUDITED

13 Weeks Ended

($ in millions)

April 30, 2022 (a)

May 1, 2021 (a)

Cash flows from operating activities: Net income (loss)

$

(162

)

$

166

Depreciation and amortization

130

120

Loss on divestiture activity

-

56

Change in merchandise inventory

(166

)

69

Change in accounts payable

(336

)

(205

)

Change in accrued expenses and other current liabilities

(236

)

40

Change in income taxes payable, net of receivables and other

tax-related items

369

(18

)

Other, net

39

112

Net cash provided by (used for) operating activities

(362

)

340

Cash flows from investing activities: Purchases of property

and equipment

(228

)

(124

)

Purchases of short-term investments

-

(298

)

Proceeds from sales and maturities of short-term investments

-

233

Proceeds from divestiture activity

-

28

Net proceeds from sale of building

333

-

Net cash provided by (used for) investing activities

105

(161

)

Cash flows from financing activities: Proceeds from

revolving credit facility

350

-

Proceeds from issuances under share-based compensation plans

7

25

Withholding tax payments related to vesting of stock units

(14

)

(32

)

Repurchases of common stock

(54

)

-

Cash dividends paid

(56

)

(91

)

Net cash provided by (used for) financing activities

233

(98

)

Effect of foreign exchange rate fluctuations on cash, cash

equivalents, and restricted cash

(7

)

(1

)

Net increase (decrease) in cash, cash equivalents, and restricted

cash

(31

)

80

Cash, cash equivalents, and restricted cash at beginning of period

902

2,016

Cash, cash equivalents, and restricted cash at end of period

$

871

$

2,096

____________________

(a)

For the thirteen weeks ended

April 30, 2022 and May 1, 2021, total cash, cash equivalents, and

restricted cash includes $26 million and $30 million, respectively,

of restricted cash primarily recorded in other long-term assets on

the Condensed Consolidated Balance Sheets.

The Gap, Inc. NON-GAAP FINANCIAL MEASURES

UNAUDITED

FREE CASH FLOW

Free cash flow is a non-GAAP financial measure. We believe free

cash flow is an important metric because it represents a measure of

how much cash a company has available for discretionary and

non-discretionary items after the deduction of capital

expenditures. We require regular capital expenditures including

technology improvements to automate processes, engage with

customers, and optimize our supply chain in addition to building

and maintaining stores. We use this metric internally, as we

believe our sustained ability to generate free cash flow is an

important driver of value creation. However, this non-GAAP

financial measure is not intended to supersede or replace our GAAP

results.

13 Weeks Ended

($ in millions)

April 30, 2022

May 1, 2021

Net cash provided by (used for) operating activities

$

(362

)

$

340

Less: Purchases of property and equipment

(228

)

(124

)

Free cash flow

$

(590

)

$

216

The Gap, Inc. NON-GAAP FINANCIAL MEASURES

UNAUDITED

ADJUSTED STATEMENT OF OPERATIONS METRICS FOR THE FIRST

QUARTER OF FISCAL YEAR 2021

The following adjusted statement of operations metrics are

non-GAAP financial measures. These measures are provided to enhance

visibility into the Company's underlying results for the period

excluding the impact of a loss on divestiture activity incurred

during the first quarter of fiscal 2021. Management believes that

excluding certain items from statement of operations metrics that

are not part of the Company's core operations provides additional

information to investors to facilitate the comparison of results

against past and future years. However, these non-GAAP financial

measures are not intended to supersede or replace the GAAP

measures.

($ in millions)13 Weeks Ended May 1, 2021

OperatingExpenses OperatingExpenses as a% of Net

Sales OperatingIncome OperatingIncome as a %of Net

Sales IncomeTaxes NetIncome Earnings perShare

-Diluted GAAP metrics, as reported

$

1,390

34.8

%

$

240

6.0

%

$

21

$

166

$

0.43

Adjustments for: Loss on divestiture activity (a)

(56

)

(1.4

)%

56

1.4

%

36

20

0.05

Non-GAAP metrics

$

1,334

33.4

%

$

296

7.4

%

$

57

$

186

$

0.48

____________________ (a) Represents the impact of the loss on

divestiture activity that occurred during the first quarter of

fiscal 2021 related to the Janie and Jack and Intermix brands.

The Gap, Inc. NON-GAAP FINANCIAL MEASURES

UNAUDITED

EXPECTED ADJUSTED EARNINGS PER SHARE FOR FISCAL YEAR

2022

Expected adjusted diluted earnings per share is a non-GAAP

financial measure. Expected adjusted diluted earnings per share for

fiscal year 2022 is provided to enhance visibility into the

Company's expected underlying results for the period excluding the

estimated impact of strategic changes to our operating model in

Mexico and the sale of the Company's U.K. distribution center. This

non-GAAP financial measure is not intended to supersede or replace

the GAAP measure.

52 Weeks EndingJanuary 28, 2023 Low End High

End Expected earnings per share - diluted

$

0.40

$

0.70

Add: Estimated impact of strategic actions (a)

0.09

0.09

Less: Estimated gain on sale of building (b)

(0.19

)

(0.19

)

Expected adjusted earnings per share - diluted

$

0.30

$

0.60

____________________

(a)

Represents the estimated earnings

per share impact, calculated net of tax at the expected effective

tax rate, of estimated net costs related to strategic changes to

our operating model in Mexico.

(b)

Represents the estimated earnings

per share impact, calculated net of tax at the expected effective

tax rate, of an expected gain on the sale of our U.K. distribution

center.

The Gap, Inc. NET SALES RESULTS

UNAUDITED The following table details the Company’s

first quarter fiscal year 2022 and 2021 net sales (unaudited):

($ in millions) Old NavyGlobal Gap

Global BananaRepublic Global AthletaGlobal

Other (2) Total 13 Weeks Ended April 30, 2022

U.S. (1)

$

1,673

$

497

$

416

$

344

$

3

$

2,933

Canada

147

64

43

9

-

263

Europe

1

54

1

2

-

58

Asia

-

141

16

-

-

157

Other regions

20

35

6

5

-

66

Total

$

1,841

$

791

$

482

$

360

$

3

$

3,477

($ in millions) Old NavyGlobal Gap

Global BananaRepublic Global AthletaGlobal

Other (3) Total 13 Weeks Ended May 1, 2021

U.S. (1)

$

2,099

$

556

$

333

$

347

$

89

$

3,424

Canada

159

68

34

-

-

261

Europe

-

69

3

-

-

72

Asia

1

163

16

-

-

180

Other regions

21

30

3

-

-

54

Total

$

2,280

$

886

$

389

$

347

$

89

$

3,991

____________________

(1)

U.S. includes the United States

and Puerto Rico.

(2)

Primarily consists of net sales

from revenue generating strategic initiatives.

(3)

Primarily consists of net sales

for the Intermix brand, which was divested on May 21, 2021. Also

includes net sales for the Janie and Jack brand through April 7,

2021.

The Gap, Inc. REAL ESTATE Store count,

openings, closings, and square footage for our stores are as

follows:

January 29, 2022

13 Weeks Ended April 30,

2022

April 30, 2022

Number of

Number of Stores

Number of Stores

Number of

Square Footage

Store Locations

Opened

Closed

Store Locations

(in millions)

Old Navy North America

1,252

9

3

1,258

20.2

Gap North America

520

1

9

512

5.4

Gap Asia

329

3

4

328

2.7

Gap Europe (1)

11

-

-

-

-

Banana Republic North America

446

1

2

445

3.7

Banana Republic Asia

50

1

-

51

0.2

Athleta North America

227

6

2

231

1.0

Company-operated stores total

2,835

21

20

2,825

33.2

Franchise (1)

564

23

9

589

N/A

Total

3,399

44

29

3,414

33.2

____________________

(1)

The 11 Gap Italy stores that were

transitioned to OVS S.p.A. during the period are not included as

store closures or openings for Company-operated and Franchise store

activity. The ending balance for Gap Europe excludes these stores

and the ending balance for Franchise includes these stores.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220526005214/en/

Investor Relations Contact: Emily Gacka (415) 427-1972

Investor_relations@gap.com Media Relations Contact: Megan

Foote (415) 832-1989 Press@gap.com

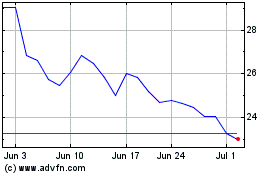

Gap (NYSE:GPS)

Historical Stock Chart

From Aug 2024 to Sep 2024

Gap (NYSE:GPS)

Historical Stock Chart

From Sep 2023 to Sep 2024