Statement of Beneficial Ownership (sc 13d)

May 13 2022 - 5:04PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No.)*

|

|

|

(Name of Issuer) |

|

BSQUARE CORPORATION |

|

|

|

(Title of Class of Securities)

Common Stock, no par value |

|

|

|

(CUSIP Number)

11776U300 |

|

|

|

(Name, Address and Telephone Number of Person Authorized to

Receive Notices and Communications)

Richard A Karp

c/o TicTran Corp

849 Independence Ave Ste B

Mountain View CA 94043

(650)396-8156 |

|

|

|

(Date of Event which Requires Filing of this Statement)

May 6, 2022 |

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

CUSIP No. 11776U300

|

1. |

Names of Reporting Persons.

I.R.S. Identification Nos. of above persons (entities only).

Richard A Karp |

|

2. |

Check the Appropriate Box if a Member of a Group (See Instructions)

(a)

(b) |

|

3. |

SEC Use Only

|

|

4. |

Source of Funds (See Instructions)

PF |

|

5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

|

|

6. |

Citizenship or Place of Organization

USA |

|

Number of

Shares Bene-

ficially by

Owned by Each

Reporting

Person With |

7. |

Sole Voting Power

5,101 |

|

8. |

Shared Voting Power

900,000 |

|

9. |

Sole Dispositive Power

5,101 |

|

10. |

Shared Dispositive Power

900,000 |

|

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

905,501 |

|

12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (see instructions)

|

|

13. |

Percent of Class Represented by Amount in Row (11)

6.8% |

|

14. |

Type of Reporting Person (See Instructions)

IN, OO |

CUSIP No. 11776U300

|

1. |

Names of Reporting Persons.

I.R.S. Identification Nos. of above persons (entities only).

Richard A Karp Trust |

|

2. |

Check the Appropriate Box if a Member of a Group (See Instructions)

(a)

(b) |

|

3. |

SEC Use Only

|

|

4. |

Source of Funds (See Instructions)

PF, WC |

|

5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

|

|

6. |

Citizenship or Place of Organization

USA |

|

Number of

Shares Bene-

ficially by

Owned by Each

Reporting

Person With |

7. |

Sole Voting Power

0 |

|

8. |

Shared Voting Power

900,000 |

|

9. |

Sole Dispositive Power

0 |

|

10. |

Shared Dispositive Power

900,000 |

|

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

905,101 |

|

12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (see instructions)

|

|

13. |

Percent of Class Represented by Amount in Row (11)

6.8% |

|

14. |

Type of Reporting Person (See Instructions)

IN, OO |

CUSIP No. 11776U300

|

1. |

Names of Reporting Persons.

I.R.S. Identification Nos. of above persons (entities only).

Richard A Karp Trust for Michael D Karp |

|

2. |

Check the Appropriate Box if a Member of a Group (See Instructions)

(a)

(b) |

|

3. |

SEC Use Only

|

|

4. |

Source of Funds (See Instructions)

PF,WC |

|

5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

|

|

6. |

Citizenship or Place of Organization

USA |

|

Number of

Shares Bene-

ficially by

Owned by Each

Reporting

Person With |

7. |

Sole Voting Power

0 |

|

8. |

Shared Voting Power

180,000 |

|

9. |

Sole Dispositive Power

0 |

|

10. |

Shared Dispositive Power

180,000 |

|

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

905,101 |

|

12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (see instructions)

|

|

13. |

Percent of Class Represented by Amount in Row (11)

6.8% |

|

14. |

Type of Reporting Person (See Instructions)

IN, OO |

CUSIP No. 11776U300

|

1. |

Names of Reporting Persons.

I.R.S. Identification Nos. of above persons (entities only).

Richard A Karp trust for John L Karp |

|

2. |

Check the Appropriate Box if a Member of a Group (See Instructions)

(a)

(b) |

|

3. |

SEC Use Only

|

|

4. |

Source of Funds (See Instructions)

PF,WC |

|

5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

|

|

6. |

Citizenship or Place of Organization

USA |

|

Number of

Shares Bene-

ficially by

Owned by Each

Reporting

Person With |

7. |

Sole Voting Power

0 |

|

8. |

Shared Voting Power

180,000 |

|

9. |

Sole Dispositive Power

0 |

|

10. |

Shared Dispositive Power

180,000 |

|

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

905,101 |

|

12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (see instructions)

|

|

13. |

Percent of Class Represented by Amount in Row (11)

6.8% |

|

14. |

Type of Reporting Person (See Instructions)

IN, OO |

CUSIP No. 11776U300

|

1. |

Names of Reporting Persons.

I.R.S. Identification Nos. of above persons (entities only).

Richard A Karp Grandchildren’s trust |

|

2. |

Check the Appropriate Box if a Member of a Group (See Instructions)

(a)

(b) |

|

3. |

SEC Use Only

|

|

4. |

Source of Funds (See Instructions)

PF,WC |

|

5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

|

|

6. |

Citizenship or Place of Organization

USA |

|

Number of

Shares Bene-

ficially by

Owned by Each

Reporting

Person With |

7. |

Sole Voting Power

0 |

|

8. |

Shared Voting Power

40,000 |

|

9. |

Sole Dispositive Power

0 |

|

10. |

Shared Dispositive Power

40,000 |

|

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

905,101 |

|

12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (see instructions)

|

|

13. |

Percent of Class Represented by Amount in Row (11)

6.8% |

|

14. |

Type of Reporting Person (See Instructions)

IN, OO |

CUSIP No. 11776U300

|

1. |

Names of Reporting Persons.

I.R.S. Identification Nos. of above persons (entities only).

Richard A Karp Charitable Foundation |

|

2. |

Check the Appropriate Box if a Member of a Group (See Instructions)

(a)

(b) |

|

3. |

SEC Use Only

|

|

4. |

Source of Funds (See Instructions)

WC |

|

5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

|

|

6. |

Citizenship or Place of Organization

USA |

|

Number of

Shares Bene-

ficially by

Owned by Each

Reporting

Person With |

7. |

Sole Voting Power

0 |

|

8. |

Shared Voting Power

100,000 |

|

9. |

Sole Dispositive Power

0 |

|

10. |

Shared Dispositive Power

100,000 |

|

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

905,101 |

|

12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (see instructions)

|

|

13. |

Percent of Class Represented by Amount in Row (11)

6.8% |

|

14. |

Type of Reporting Person (See Instructions)

IN, OO |

Item 4. Purpose of Transaction

The reporting persons purchased the reported shares based on the reporting persons’ belief that the shares, when purchased, were undervalued and represented an attractive investment opportunity. Depending upon overall market conditions, other investment opportunities available to the reporting persons, and the availability of shares at prices that would make the purchase or sale of shares desirable, the reporting persons may endeavor to increase or decrease their position in the Issuer (Bsquare Corporation) through, among other things, the purchase or sale of shares on the open market or in private transactions or otherwise, on such terms and at such times as the reporting persons deem advisable.

In January, 2022, Richard A Karp delivered a letter to the Issuer, nominating a slate of highly qualified director candidates, including Richard A Karp, Michael D Karp, and Sean Kelly, for election to the board at the Issuer’s 2022 annual meeting of stockholders.

Richard A Karp and Sean Kelly have engaged, and may continue to engage, in discussions with management and the board of the Issuer regarding board representation and the composition of the Issuer’s board, generally.

Signature

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

May 13, 2022 |

|

Date |

|

|

|

/s/ Richard A Karp |

|

Signature |

|

|

|

Richard A Karp as an individual, and as trustee of the Richard A Karp trust, Richard A Karp trust for Michael D Karp, Richard A Karp trust for John D Karp, Richard A Karp grandchildren’s trust, and the Richard A Karp charitable foundation. |

|

Name/Title |

BSQUARE (NASDAQ:BSQR)

Historical Stock Chart

From Aug 2024 to Sep 2024

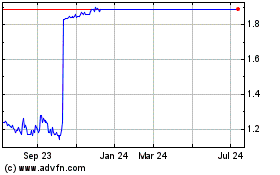

BSQUARE (NASDAQ:BSQR)

Historical Stock Chart

From Sep 2023 to Sep 2024