Current Report Filing (8-k)

March 10 2022 - 6:10AM

Edgar (US Regulatory)

GROUP 1 AUTOMOTIVE INC false 0001031203 0001031203 2022-03-09 2022-03-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 10, 2022 (March 9, 2022)

Group 1 Automotive, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

| Delaware |

|

1-13461 |

|

76-0506313 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

| |

|

|

|

|

| 800 Gessner, Suite 500 Houston, Texas 77024 |

|

|

|

77024 |

| (Address of Principal Executive Offices) |

|

|

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (713) 647-5700

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

|

GPI |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities

Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company. ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 |

Entry into a Material Definitive Agreement. |

Effective March 9, 2022 (the “Closing Date”), Group 1 Automotive, Inc. (the “Company”) entered into an amended and restated five-year revolving syndicated credit arrangement with 21 financial institutions, including 6 manufacturer-affiliated finance companies (the “Credit Facility”). The Credit Facility consists of two tranches: one for U.S. vehicle inventory floorplan financing (the “Floorplan Line”) and another for working capital and general corporate purposes, including acquisitions (the “Acquisition Line”). As of the Closing Date, the aggregate maximum borrowing commitment of the two tranches equals $2.0 billion. The Floorplan Line provides a maximum borrowing commitment of $1.651 billion as of the Closing Date, of which a maximum of $151.0 million can be re-designated as additional Acquisition Line borrowing commitment. The Acquisition Line provides a maximum borrowing commitment of $349.0 million as of the Closing Date, which may be increased by $151.0 million of re-designated Floorplan Line commitments for a maximum borrowing commitment of $500.0 million, or 25 percent of the total Credit Facility. Unused Acquisition Line commitments may be reallocated to the Floorplan Line at the Company’s request. A maximum of $150.0 million of the Acquisition Line can be borrowed in either Euros or Pounds Sterling. The aggregate maximum borrowing commitment can be increased to a maximum of $2.4 billion, if one or more existing lenders agree to increase their commitments, or if the Administrative Agent approves the admission of one or more financial institutions as additional lenders. The Acquisition Line bears interest at the Secured Overnight Financing Rate (“SOFR”) (including a 10 basis point spread adjustment) plus a margin that ranges from 100 to 200 basis points, depending on our leverage ratio. The Floorplan Line bears interest at a rate equal to SOFR (including a 10 basis point spread adjustment) plus 110 basis points (for new vehicle inventory) and 140 basis points (for used vehicle inventory). All of our U.S. dealership-owning subsidiaries are co-borrowers under our Credit Facility and as such, they are liable on a joint and several basis for obligations under the Credit Facility, with certain exceptions. Our Credit Facility contains a number of significant covenants that, among other things, restrict our ability to dispose of assets, incur additional indebtedness, create liens on assets, make investments and engage in mergers or consolidations. We are also required to comply with specified financial tests and ratios defined in the Credit Facility, such as the Fixed-Charge Coverage Ratio and the Total Adjusted Leverage Ratio. The Credit Facility also contains typical Events of Default (as defined in the Credit Facility) for both the Floor Plan Line and the Acquisition Line, including change of control, non-payment of obligations and cross-defaults to certain of our other material indebtedness. Upon the occurrence of an Event of Default, we could be required to immediately repay all or certain portions of the amount outstanding under the Credit Facility. Our obligations under the Credit Facility are secured by essentially all of our personal property (other than equity interests in dealership-owning subsidiaries) including all motor vehicle inventory and proceeds from the disposition of dealership-owning subsidiaries.

Our Ford and Lincoln dealerships will continue to obtain new vehicle floor plan financing from Ford Motor Credit Company. The description of the Credit Facility set forth above does not purport to be complete and is qualified in its entirety by reference to the provisions of the Credit Facility, which is filed hereto as Exhibit 10.1 and is incorporated herein by reference.

| Item 2.03 |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The information provided in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

| Item 7.01 |

Regulation FD Disclosure. |

On March 9, 2022 the Company issued a press release announcing that it had completed a $2.0 billion five-year revolving syndicated credit facility that will expire in March 2027.

The information, including the press release, furnished under this Item 7.01 shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be deemed incorporated by reference into any other filing by the Company under the Exchange Act or the Securities Act of 1933, as amended, except as otherwise expressly stated in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits. The following exhibits are filed herewith:

Exhibit Index

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Group 1 Automotive, Inc. |

|

|

|

|

| Date: March 10, 2022 |

|

|

|

By: |

|

/s/ Daniel McHenry |

|

|

|

|

Name: |

|

Daniel McHenry |

|

|

|

|

Title: |

|

Chief Financial Officer |

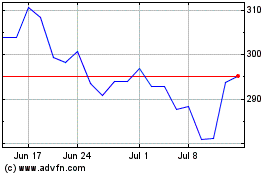

Group 1 Automotive (NYSE:GPI)

Historical Stock Chart

From Aug 2024 to Sep 2024

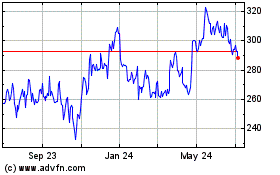

Group 1 Automotive (NYSE:GPI)

Historical Stock Chart

From Sep 2023 to Sep 2024