BAE Systems 1st Half Pretax Profit Rose; Demand Backlog to Boost Growth -- Update

July 29 2021 - 4:20AM

Dow Jones News

By Anthony O. Goriainoff

BAE Systems PLC said Thursday that pretax profit rose and

launched a buyback program, while noting that a demand backlog

should support the company's growth expectations in the coming

years.

The London-listed defense company said it was launching a

buyback program of up to 500 million pounds ($695.1 million) as it

reported a rise in pretax profit for the first half of the

year.

The buyback program was possible due to BAE's decision to

accelerate its U.K. deficit pension payments in 2020, coupled with

investment in the business and good operational performance driving

enhanced cash generation, it said.

The company said its pipeline of opportunities across all the

sectors where it operates remains strong. BAE is prominent in many

long-term defense programs for the U.S. armed forces, while several

European nations have continued to increase their defense budgets

as they move toward their 2% of GDP NATO commitments.

It added that in the U.K. it has seen renewed commitments to its

major long-term programs such as warship, submarine, and combat

aircraft design and build.

"Our geographic diversity positions us strongly in the

post-pandemic cycle where many of the countries in which we operate

have made plans to increase their spending to counter the

challenging threat environments," the company said.

BAE said that, for the six months ended June 30, pretax profit

was GBP1.15 billion compared with GBP689 million for the first half

of 2020.

Underlying earnings per share--the company's preferred metric,

which strips out exceptional and other one-off items--rose to 21.9

pence a share from 18.7 pence a share in the year-prior period.

The company's order intake in the period was GBP10.58 billion,

compared with GBP9.34 billion last year, while its backlog totaled

GBP44.6 billion.

Revenue for the period was GBP9.34 billion compared with GBP9.18

billion the year before.

The company said its Electronics Systems division performed

strongly and benefited from last year's acquisitions. It added that

the civil market operations which had been most affected by the

pandemic have stabilized, and that it was seeing a recovery in the

commercial Controls & Avionics Solutions and Power &

Propulsion Solutions businesses.

BAE said it expects group sales to grow in the 3% to 5% range

over 2021, based on a strong pound-to-dollar exchange rate.

"If these higher currency rates persist in line with the

first-half average rates, we expect reported sales to be at the

lower end of this guidance range," it said.

Write to Anthony O. Goriainoff at

anthony.orunagoriainoff@dowjones.com

(END) Dow Jones Newswires

July 29, 2021 04:12 ET (08:12 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

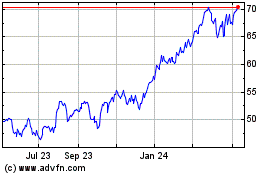

Bae Systems (PK) (USOTC:BAESY)

Historical Stock Chart

From Apr 2024 to May 2024

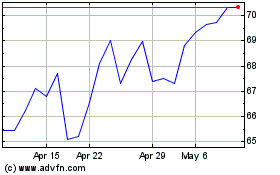

Bae Systems (PK) (USOTC:BAESY)

Historical Stock Chart

From May 2023 to May 2024